Moscow, 01/28/2021, 05:36:34, editorial office PRONEDRA.RU, author Ekaterina Litvinchik.

The budget classification code, or BCC, is used when preparing documentation that determines the purpose of payment orders. In 2021, there have been significant changes to the KBK. They are observed after implementation by virtue of an order developed by the Ministry of Finance. It appears in the documentation register under number 210 n, and was signed on November 29, 2021. This document makes adjustments to previously approved standards that have been in effect in the country since July 1, 2013.

Who pays and when

According to Art. 143 of the Tax Code of the Russian Federation, taxpayers for this type of fee are legal entities and individual entrepreneurs, but it is believed that ultimately it is paid by the buyer. The fact is that value added tax is indirect. With its help, the state seeks to receive part of the premium that the manufacturer or seller sets on the price of the product at each stage of production or sales. The tax is calculated by the manufacturer and the seller, but it is included in the cost of the product; in addition, the entrepreneur deducts the input VAT already paid when purchasing goods for production. Thus, the buyer is the source of the collection, but in the legislative act - in the Tax Code - individuals are not mentioned as VAT payers; they do not calculate or transfer it.

This financial commitment is of great importance for the budget and not only in terms of revenue. The state, by introducing a value added tax, ensures the contribution of funds to the budget earlier than the final sale of products, which increases the efficiency of the obligation and its collection.

IMPORTANT!

From 01/01/2019, VAT has been increased from 18% to 20%.

What to do if there is an error in the VAT KBK?

The company may indicate an erroneous BCC in the declaration or payment order. In the first case, an error is unlikely, since most companies generate the declaration in a special accounting program, which itself enters the correct BCC. The main thing is to remind the programmer before each reporting period that the program needs to be updated. In addition, the company must submit a VAT return only according to the TKS - the report will not be sent to the tax office if the code data is incorrect.

But it is much easier to make a mistake in a payment order. If the BCC in the payment order is incorrect, the transferred funds may end up either in the budget of a different level or in unclear payments. This oversight can be corrected by writing a statement to the tax office to clarify the payment details. Based on this application, the tax office will accept the tax for crediting, and as of the day of payment. That is, penalties (if the inspectors managed to accrue them) will be canceled.

How to fill out a sample application for clarification of payment details, look in the article “Sample application for clarification of tax payment (error in KBK).”

What if you didn’t notice that the tax went to the wrong KBK and you didn’t submit an application to the inspectorate? Then, after the deadline for paying the tax, the inspectors will decide that you have not fulfilled your obligation to the budget. And they will impose fines and penalties. They can be challenged, guided by arbitration practice and clause 3 of Art. 45 of the Tax Code of the Russian Federation, since the company still transferred money to the budget, albeit to the wrong address.

Arbitration practice in this case is on the side of the taxpayer: regardless of whether the company correctly indicated the BCC in the payment order, the payment to the budget took place, which means that the company fulfilled its obligations to the budget. If you have a dispute with inspectors about this, rely, for example, on the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13, the determination of the Supreme Arbitration Court of the Russian Federation dated June 10, 2010 No. VAS-4111/10, etc.

The Ministry of Finance and the Federal Tax Service also recognize that errors in the BCC are not grounds for recognizing the obligation to pay tax as unfulfilled (see letters from the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145, dated July 17, 2013 No. 03-02- 07/2/27977 and dated March 29, 2012 No. 03-02-08/31, Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/ [email protected] ).

About whether the error in the KBK is critical,

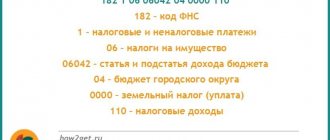

The value of BCC for the main VAT liability

Budget classification codes are established uniformly for legal entities and individual entrepreneurs; the values do not depend on the status of the taxpayer and the legal form.

In 2021, the BCC values for this tax are the same as in 2021. The data for the main obligation is given below.

| Purpose of payment | KBK indicator |

| Value added tax on goods, as well as works and services sold on the territory of the Russian Federation | 182 1 0300 110 |

| Tax on goods, works, services from Belarus and Kazakhstan | 182 1 0400 110 |

| Tax on goods, works, services from abroad | 153 1 0400 110 |

Features and nuances of BCC for VAT payment

This tax is the main “filler” of the Russian treasury, so entrepreneurs should be especially careful when paying it. It is paid from the sale of goods and/or services, as well as from imported goods sold in Russia. It must also be paid when transferring goods for one’s own needs, if this is not reflected in the tax return. It is also relevant when importing goods.

There were very serious changes to the payment of value added tax a couple of years ago, so for 2021, legislators touched on this tax only in passing to give entrepreneurs the opportunity to adapt.

Calculation and payment procedure

VAT is a tax that requires quarterly declaration and payment. It is calculated based on the results of each quarter: the difference in the tax base and deductions is multiplied by the tax rate. Thus, the budget receives these tax payments four times a year.

If legal deductions exceed the revenue portion of the VAT, then the budget will compensate for the missing share: the amount will be counted toward future payments or to pay off any arrears. In the absence of arrears, the law allows the amount of compensation to be transferred to the bank account of the entrepreneur.

The tax base is considered to be the main characteristic of the goods or services being sold - their value on the day of shipment of the goods or transfer of the service or the day of their payment (the date of the event that occurred earlier).

There are some nuances regarding VAT tax rates:

- same rate - same base;

— if transactions are subject to VAT at different rates, then their base is also calculated separately;

— the cost is always calculated in national currency, revenue from imports is converted into rubles at the current exchange rate.

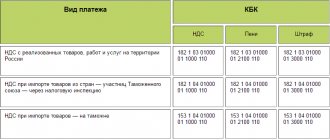

For penalties and fines

The CBC “VAT Penalties” in 2021 are also similar to those used in 2021. The table shows the current indicators of BCC when paying VAT.

| Type of collection | KBK VAT, penalties | Fines |

| Value added tax on goods, as well as works and services sold on the territory of the Russian Federation | 182 1 0300 110 | 182 1 0300 110 |

| Value added tax on goods imported into the Russian Federation from Belarus and Kazakhstan | 182 1 0400 110 | 182 1 0400 110 |

| Value added tax on goods imported into the territory of the Russian Federation (the payment administrator in this case is the Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 |

If the payment deadline is missed, VAT penalties will apply; BCC 2021 will be required when filling out a payment order for the transfer of penalties on your own initiative or at the request of the tax authority.

KBK "VAT fine" 2021 for legal entities is required when drawing up a payment document for payment of a fine, which is assigned for untimely or improper fulfillment of a financial obligation (for example, in case of incomplete payment of the established fee).

This might also be useful:

- Details for paying insurance premiums in 2021

- New BCCs for pension contributions 2021

- New BCCs for medical contributions for 2021

- KBK for transport tax 2021

- KBC for insurance premiums for 2021

- KBK for payment of trade tax in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

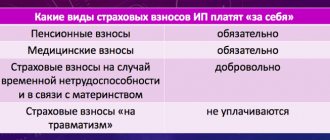

For tax agents

Tax agents for VAT are, in accordance with Art. 161 Tax Code of the Russian Federation:

- tenants of property from government agencies and local governments;

- purchasers of goods, work and services from foreign organizations operating in the Russian market, which themselves are not registered as taxpayers in the Russian Federation;

- buyers of state property, with the exception of individual entrepreneurs;

- bodies, companies and individual entrepreneurs authorized to sell confiscated property, etc.;

- from 01.10.2011 - buyers of property and (or) property rights of debtors declared bankrupt (with the exception of individuals who do not have the status of individual entrepreneurs);

- registered as taxpayers (organizations and individual entrepreneurs) carrying out business activities using agency agreements, commission agreements or agency agreements, and making settlements under them with foreign persons who are not registered with the tax authorities as taxpayers.

The tax agent indicates its status in field 101, which is designated by the code “02”.

| Status | BCF value |

| Tax agent | 182 1 0300 110 |

Self-calculation of penalties

Perhaps you are faced with the problem of calculating and paying penalties, and you need to correctly calculate the amount. Let's use the following scheme:

- We determine the amount of the penalty. This is an indicator of the amount owed.

- We determine the days overdue from debt repayment.

- We look at the Central Bank refinancing rate. This indicator is indicated on the Central Bank website.

- We calculate using the formula - P = Week * St. Ref. / 300 - Pr ,

Where:

- P – the amount to be paid for the penalty itself;

- Art. ref. — refinancing rate in effect at the time the penalty is issued;

- Pr - number of overdue days.

You can also use a calculator to calculate penalties or obtain data on the accrual of penalties from regulatory authorities.

When independently calculating penalties, the taxpayer must take into account the next day, that is, the day of seizure.

The correct calculation of penalties can be considered using an example.

Let's say a certain organization Vympel LLC filed a tax return. It indicated the amount that was not paid to the tax authority on time. As a result, a penalty was charged:

| VAT amount | VAT paid | Arrears | Payment deadline | Number of days | Calculation | Sum |

| 840,200 | 500,260 | 840,200— 500,260 = 339, | .01.2016 | 12 | 339, rub. * 11% / 300 * 12 days | 1,495 |

| 880,730 | 319,400 | 880,730— 319,400 = 481,33 | .02.2016 | 14 | 481.33 * 11% / 300 * 14 days | 2,47 |

| 720,610 | 649,80 | 720,61— 649,8 = ,81 | .03.2016 | 19 | .81 rub. * 11% / 300 * 19 days | 0,49 |

As a result, the amount of the penalty amounted to 4.461 rubles; we sum up all the columns (1.495+2.476+0.49)

The day the penalty is paid is considered the day the document is processed and funds are credited to the account of the organization that assigned these penalties.

The tax authority will collect penalties corresponding to the unpaid VAT tax unconditionally. For this purpose, government services, such as the bailiff department, will be involved.

In tax inspectorates, programs for calculating penalties are set to automatic mode. To keep abreast of all calculations, you need to constantly take certificates and statements in order to pay the accrued amounts on time.

How to fill out a payment form

Budget classification codes are indicated in field 104; they are the same for the entire country. When filling out the payment form, it is necessary to take into account that the details are indicated by the tax office to which the payer is assigned in accordance with his location. The registration rules are specified in the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 and Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended.

When filling out, you must also correctly indicate:

- payer status (check in the article “What is the payer status in a payment order and how to fill it out”);

- payment amount (integer);

- quarter for which payment is made (in the form “KV.01.2019”).

Filling out a payment order for VAT in 2021

To transfer the main VAT payment (penalty or fine) to the budget, you must correctly indicate the details in the payment order. First of all, you must correctly indicate your taxpayer status in field 101:

- 01 - legal entity;

- 02 - tax agents;

- 06 - import tax;

- 09 - IP.

The tax amount (field 6) is indicated in round rubles without kopecks. The type of transaction (field 18) for VAT payment is filled in with code “01”, and the order of payment (field 21) with code “5”. The BCC corresponding to the type of operation (see table above) is indicated in field 104. In field 105, OKTMO is entered, indicating the payer’s affiliation with a specific municipal entity. The meaning of OKTMO can be found on the Federal Tax Service website.

The basis for payment (field 106) is indicated as “TP” - current payment. And in the adjacent 107 field the period for which the tax is paid is entered. In the case of VAT, this will be the corresponding quarter, for example, “KV.01.2021”. Below is an example of a VAT payment for the 1st quarter of 2021.