When creating an LLC, the company is registered with the tax office, after the registration process with the tax office it is necessary to register with the Social Insurance Fund - FSS, in Moscow registration with the FSS funds is carried out automatically, there is no need to independently go to the funds and register, the tax office after the registration process carries out electronic data exchange, and you register. Until recently, funds sent registration notices to the legal address, which contained assigned numbers. At the moment, the funds have practically stopped sending mail notifications, because... Most companies do not have the ability to seize mail from legal addresses, and the service has become irrelevant. A notice from the fund is not a constituent document, but only informs you about the assigned number in the Social Insurance Fund, which will be required for the generation and submission of quarterly reports.

What is the FSS subordination code and its decoding

This is a number that is automatically assigned to the policyholder by the Social Insurance Fund upon registration.

This number shows in which territorial body of the Fund the organization or individual entrepreneur is registered. Get a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs

The subordination code consists of five characters:

- the sequence of numbers from the first to the fourth indicates a branch of the Fund;

- the fifth digit refers to the policyholder and is called the “registration reason symbol.” Separate divisions are assigned 2, individuals 3. These values are given in paragraph 19 of the procedure approved by Order of the Ministry of Labor dated April 29, 2016 No. 202n. There is no separate symbol for legal entities. In practice they are always assigned 1.

Let's give an example. Let's say the company and individual entrepreneur are registered in the city of Moscow. Then the first two digits of the subordination code for them are 77 (denote the Moscow regional branch of the FSS). If they are registered in branch No. 18 of the capital branch, then the third and fourth digits are 18 (indicate the branch number). The full number for the organization is 77181, for the entrepreneur - 77183.

By INN IP

IP details - what they include, where you can find them

To understand how to find out which department of the Social Insurance Fund an individual entrepreneur belongs to, you need to turn to online services. They will allow you to receive and view the entrepreneur’s unique code. There are many portals that allow you to carry out this process.

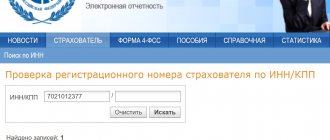

FSS resource

Any Russian employee of an enterprise can use it to find out information about their employer. The information will reveal additional information about the entrepreneur, as well as his social security number.

To do this you need to follow the link. There will be several tabs on the main page of the portal, but you need to pay attention to the empty search bar. It is in this that you need to enter the TIN number of the subject of interest and receive the subordination code in the FSS for the individual entrepreneur. This process may take some time, but most often the information appears within a few seconds.

Checking the registration number according to the FSS

Service Contour Focus

You will first need to register on the website, and then check the private entrepreneur.

The portal is paid, but every applicant has the opportunity to use it free of charge for a short period of time. To do this you need to follow the link. The system will bring the applicant to the main page. To use the demo version, you do not need to register, just click on the “Try for free” icon. This method is relevant for those who require such information once. For permanent use you will need to obtain full access and register.

Checking through "Contour Focus"

Screen@Astral service is paid

There is no demo version in it. Therefore, this option is suitable for those who regularly need to check information about the organization.

To do this, you need to follow the link and register. After authorization, you need to click on the “Checking companies and individual entrepreneurs” tab, then top up your account, gain access and use the portal. The service will provide a complete report on the company, not only FSS numbers, but also about the financial position of the enterprise: statements, income, issue documents and level of reliability.

Checking via Skin@Astral

Unirate24

This is another paid resource that provides comprehensive information about the subject. It also allows for a full check of counterparties that are officially registered with the tax service. Here the system offers to pay separately for any issue depending on what paper the applicant requires. To use the service, you need to follow the link, then register, top up your account and receive a business certificate of any format with extended data.

Checking through the Unirate24 service

Federal Tax Service

It provides information for free, but, like other services, it requires registration. To do this, you will need to follow the link and then visit your personal account. After registration, the applicant enters the required tab “Individual Entrepreneurs” or “Legal Entities”. It is also possible to find out the data through the tax service. To do this, the system will require you to enter the TIN number or the name of the organization.

Receiving data through the Federal Tax Service

Note! Without a unique code, no enterprise can function properly. Illegal business activities are prosecuted by law.

Extract from the Federal Tax Service

Documents for registration

Before registering with the Social Insurance Fund as an individual entrepreneur, you must collect a package of documents. It includes:

- Application in the prescribed form.

- A copy of a document to confirm your identity (passport).

- TIN.

- Registration certificate of individual entrepreneur.

- Certificate from the Unified State Register of Individual Entrepreneurs.

- A copy of the employee’s work record book or employment agreement.

- A copy of the author's order contract or civil law agreement, if they provide for the payment of premiums for injury insurance.

All documents from the list must be certified. When submitting in electronic format, this is done using an electronic digital signature. When submitting in person, a fund employee checks all copies with the originals. For applications in the presence of labor and civil law agreements, different forms are used.

What is policyholder registration number

Electronic signature and encryption procedure are mandatory conditions for electronic interaction between taxpayers and regulatory authorities. It turns out that if you need to send a package of forms to the FSS, you need to know all the codes exactly. An error in one number will mean that the reporting was not submitted or was submitted with errors. Basic data is the own registration number of the reporting organization or individual entrepreneur and their identification code of subordination in the social insurance authorities.

Results

You can find out the registration number in the FSS by TIN of a company or individual entrepreneur in literally a couple of minutes using a special service on the FSS website. If an entrepreneur runs a business as an individual entrepreneur, then he needs to keep in mind that by default, information about him is not registered by the FSS and may not be in the department’s online database.

Find out also how to determine the FSS subordination code by registration number.

For the amount of fines for failure to submit reports to the Social Insurance Fund, see this article.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

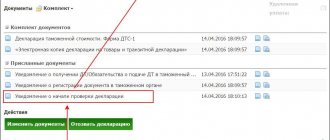

Delivery confirmation

- How to confirm receipt

- Confirmation of receipt of the notice must be sent by the date in the “Confirmation Deadline” column. If the fund does not receive confirmation after this date, it will send notice by registered mail.

To confirm receipt: • Hover your mouse over the line with the notification • Click “Confirm receipt”.To view the text of the notification: • Hover your mouse over the line with the notification • Click on the “Download” link • Select where to save the file on your device

Purpose of the service

In the process of registering a legal entity, the tax authority undertakes to inform other government bodies about the fact of the emergence of a new business entity. In particular, the tax inspectorate notifies the Pension Fund of the Russian Federation about the registration of a legal entity and requests a registration number for subsequent entry into the Unified State Register of Legal Entities.

If a legal entity needs to obtain a certificate of registration from the Pension Fund before entering this data into the Unified State Register of Legal Entities, then it will have to visit the Pension Fund, and this is always time-consuming.

It is much easier and more convenient to use the service provided by the Federal Tax Service of the Russian Federation on the website nalog.ru. Our page will guide you to this service.

Additional data for individual entrepreneurs

Individual entrepreneurs, having gone through the official registration procedure, also receive a subordination code. Along with this, they are assigned a registration number. It will remain unchanged for 2021. This value is mandatory in the reporting process.

The first four digits included in the registration number indicate the Social Insurance Fund in which the company was registered. The next six digits are the serial number of the individual entrepreneur. The code of his subordination always ends with the number 3. If it is some other number, you must make a second application to the Federal Insurance Service.

The formation of an individual entrepreneur's accounting file takes place on the basis of documentation received by the department. At the same time, the FSS stores it in electronic format. If an individual entrepreneur plans to change his place of residence, he will also have to change the code in the new place. To do this, you will need to submit an application to the local FSS office.

Along with this, the changes will also affect the subordination code . If an entrepreneur dismisses all employed employees, he will receive the right to deregistration, since there will be no need to make insurance contributions. To solve this problem, you will also need to submit an application, which is completed in a free form. After this, the deregistration procedure will take no more than 14 days.

Sometimes in the documentation used in the reporting process, there is a special field to indicate the code. It contains 4 cells. There is a space before the fifth. In this situation, regardless of location, all five digits without a space are required.

Who is required to receive a registration number

The legislation identifies two cases when it is required to obtain a registration number in the Social Insurance Fund for an individual entrepreneur:

- if an individual entrepreneur hired employees and formalized the employment relationship by drawing up an agreement, becoming their employer;

- when concluding a civil agreement, one of the points of which is the need to pay contributions.

The legislator does not make it a mandatory condition to obtain a registration number in the Social Insurance Fund for an individual entrepreneur working without the use of hired labor. The procedure for submitting documents will be voluntary if the entrepreneur wishes to insure himself in case of loss of ability to work.

For the first category of persons, it is required to obtain a registration number in the Social Insurance Fund for individual entrepreneurs in two forms at once - an insured against occupational diseases and accidents and an insured for temporary disability or maternity. (Federal Law No. 125-FZ and Federal Law No. 255-FZ). The second case, when obtaining a number is mandatory, provides for the emergence of an “insured/insured person” relationship exclusively in the event of an injury or occupational disease.

On video: Contributions to the Social Insurance Fund for employees for LLCs and individual entrepreneurs

Insurance premiums for employees

As soon as the entrepreneur hires his first employee, he must register with the social insurance fund and the Social Insurance Fund for individual entrepreneurs will generate a unique policyholder number. Payments and reporting will be initialized based on this indicator in the future.

We recommend you study! Follow the link:

What is a registration number in the Pension Fund for individual entrepreneurs and how to find it out by TIN

As an employer, an entrepreneur does not have preferences over organizations. Individual entrepreneurs pay contributions to the Social Insurance Fund at rates identical to those of legal entities - 2.9%.

The principle of contributions is as follows:

- The individual entrepreneur makes monthly contributions to the fund for employees;

- in case of illness, the employee receives money in an amount depending on the length of service;

- the entrepreneur reports to the fund about the money given to the employee;

- The Social Insurance Fund compensates the employer for his costs of paying for the certificate of incapacity for work.

An identical mechanism works when issuing maternity benefits, funds issued as part of child care, etc.

The rate for calculating insurance premiums for injuries is 2.9%.

Accrued contributions must be transferred by the 15th day of the following month following the payroll period. Late payment of fees will result in penalties. In addition to this obligation, the individual entrepreneur must carefully keep records of insurance premiums and report every quarter on the fees accrued and contributed to the Social Insurance Fund.

Enterprises with up to 25 employees can submit reports both on paper and electronically. Above this limit, reporting is submitted only via telecommunication channels.

What does the FSS subordination code give?

You need to know it in order to fill out the following documents correctly.

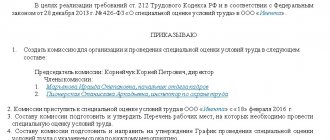

1. Calculation according to form 4-FSS (approved by order of the FSS of Russia dated September 26, 2016 No. 381). The code is placed on the title page and all subsequent pages. The corresponding field is located next to the cells intended for the policyholder's registration number.

Fill out and submit 4‑FSS online for free using the current form

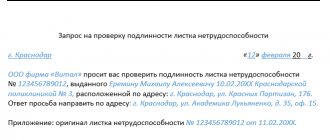

2. Sick leave (form approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n). The subordination code is indicated in the section that the employer fills out. The required field is located after the cells reserved for the registration number. For more information on how to fill out and pay for sick leave, see: “Payment of sick leave in 2021” and “Disease codes on sick leave with decoding.”

Create electronic registers and submit them to the Social Insurance Fund via the Internet

Judgment

Judges of three instances made a decision in favor of the policyholder, and the fine issued by the FSS was recognized as unfounded. The judges relied on order No. 19 of the Federal Insurance Service of the Russian Federation dated February 12, 2010, which describes the technology for processing policyholder reports in the system.

Namely, the order states that the report cannot be accepted by the system under the following conditions:

- The sent file has an incorrect name format or size

- the file does not meet the conditions for the formation and use of an electronic digital signature

- The digital signature certificate has expired

- the report is certified by an electronic signature of a person who does not have the authority to do so

- the file does not meet the document structure requirements

The judges emphasized that the report was provided on time and also passed all stages of the system’s internal control. The organization did not receive a negative protocol stating that the report file for some parameters could not be accepted by the system. In the presented 4-FSS calculation, the TIN, OGRN and legal address were indicated, which means the fund had the opportunity to correctly identify the policyholder . An incorrectly specified registration number cannot be the reason why the report is considered not submitted to the FSS authorities.

New codes of subordination to the FSS in 2021

Most often, during the existence of a company or individual entrepreneur, the subordination code does not change. This is due to the fact that the code of the FSS branch and the symbol of the reason for registration remain the same as when registering.

But occasionally changes do occur. They are related to changes in the territorial bodies of the Fund.

At the beginning of 2021, the branches of the St. Petersburg regional branch of the FSS were reorganized. Since April, the following codes have been in effect for city districts:

- Central, Krasnoselsky, Petrodvortsovy - 7804;

- Petrogradsky, Moscow, Kolpinsky -7807;

- Admiralteysky, Kronstadt, Primorsky - 7812;

- Kalininsky, Frunzensky, Krasnogvardeysky - 7815;

- Vyborgsky, Kirovsky, Kurortny - 7829;

- Vasileostrovsky, Nevsky, Pushkinsky -7830.

ATTENTION. Even if the subordination code changes, the policyholder's registration number remains the same. In calculations using Form 4-FSS and on sick leave, the new code and the previous number should be entered.

What is FSS

The abbreviation FSS denotes the social insurance fund, which is included in the category of non-budgetary organizations. This structure was created to provide compulsory insurance to Russian citizens. The work of the fund is regulated by the relevant law (Resolution of the Government of the Russian Federation No. 101, as amended on December 29, 2018) and the budget code.

This type of insurance applies to employees of companies where there is a risk of injury as a result of professional activities. Every month, employers transfer a certain percentage of the accrued salary fund to the Social Insurance Fund. These payments are accumulated by the fund and, if necessary, are used to pay compensation in cases established by law:

- In case of temporary loss of performance.

- Upon pregnancy and early medical registration.

- At the birth of a child and caring for him up to a certain age.

- For sanatorium and resort services for company employees and their children.

- When workers receive guaranteed funeral services.

For workers, all this means insurance in case of developing an occupational disease or being injured at work. The employer gets the opportunity to reduce the number of illnesses and accidents, including through the purchase of protective equipment.

An individual entrepreneur can voluntarily pay contributions in the event of temporary disability or maternity. In 2021, the amount of payments is 3,925.44 rubles. Fixed payments are not made during the suspension of activities. This applies to caring for a child, a disabled person, an elderly person, conscription for military service, and staying outside the country as the spouse of a diplomat or military personnel.

Important! By refusing to transfer insurance contributions, the employer deprives employees of the payments they are entitled to and violates the law.

It is impossible to find out the FSS number using the TIN: what is the reason?

This usually happens in two cases:

- the procedure for registering a payer with the Social Insurance Fund and assigning a number to it in this department has not yet been completed or the database is being updated (but such cases are observed extremely rarely and are not systematic);

You can find out how and when policyholders register with the Social Insurance Fund in ConsultantPlus. Trial access to the legal system is provided free of charge.

- if an entrepreneur conducts business as an individual entrepreneur and initially does not have employees.

The fact is that an individual entrepreneur is required to have a FSS number only if he:

- is an employer (subclause 3, clause 1, article 2.3 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ).

- wishes to receive benefits for temporary disability and maternity (in this case, registering a relationship with the Social Insurance Fund voluntarily).

At the same time, according to Art. 6 of Law No. 125-FZ of July 24, 1998, when hired employees appear, the entrepreneur must register with the Social Insurance Fund within 30 days from the date of concluding at least 1 employment contract or civil contract with the hired employee (if it specifies accident insurance and occupational diseases).

Once an individual entrepreneur is registered with the FSS, he will be able to find out his number assigned by the department at any time using his TIN via the Internet.

In the Ready-made solution from ConsultantPlus, you can find out how to issue a certificate of no debt for injuries. Study the material by getting trial access to the K+ system for free.