Payment

Accounting policy of an enterprise: general requirements for registration Accounting policy is drawn up according to the rules established by law

2018 has brought new changes in accounting and will be active. Chief accountants need to be

Starting from the new year, the limits for switching to a simplified system have been changed. Based on Art. 2

Advance payment is an advance payment for goods. That is, the contract has already been concluded, part of the money has been transferred to the seller

Despite the fact that the legal status of an entrepreneur is characterized by a simplified registration and accounting procedure,

The real estate taxation system has changed frequently recently because the authorities are in

Reporting to the Federal Tax Service We always hasten to deal with tax reports first, so

Issuance and receipt For many simplified tax system “income minus expenses”, a loan can be

22 29 2 9 16 23 30 3 10 17 24 31 4 11

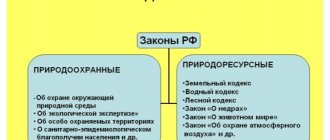

The environmental tax is not presented in the Tax Code as a separate type of payment to the budget. He