2018 has brought new changes in accounting and will be active. Chief accountants need to be attentive to all the subtleties of the transition to new standards. You should pay special attention to the correctness of record keeping in the information base and put all matters in order. Otherwise, errors and inaccuracies are fraught with fines and inspections.

In April 2015, the Russian Ministry of Finance approved a program for the development of federal accounting standards for public sector organizations (Order No. 64n dated April 10, 2015).

According to the program, ten standards must be in effect from January 1, 2021. However, the entry into force of three of them was planned to be postponed from 2021 to 2021: the Russian Ministry of Finance prepared a draft order to introduce appropriate changes to the program.

On October 31, 2021, the Russian Ministry of Finance issued Order No. 170n “On approval of the program for the development of federal accounting standards for public sector organizations for 2017-2019.” and on invalidation of orders of the Ministry of Finance of Russia dated April 10, 2015 No. 64n “On approval of the program for the development of federal accounting standards for public sector organizations” and November 25, 2016 No. 218n “On amendments to the order of the Ministry of Finance of Russia dated April 10, 2015 No. 64n “On” approval of the program for the development of federal accounting standards for public sector organizations."

The standards come into force in stages from January 1, 2021. The final transition to use is planned for 2021. At the same time, changes will be made to the current instructions for accounting and reporting, forms of primary accounting documents and registers.

Currently, five standards have been approved and registered with the Russian Ministry of Justice:

- “Conceptual foundations of accounting and reporting of public sector organizations” (Order of the Ministry of Finance of Russia dated December 31, 2016 No. 256n);

- “Fixed assets” (Order of the Ministry of Finance of Russia dated December 31, 2016 No. 257n);

- “Rent” (Order of the Ministry of Finance of Russia dated December 31, 2016 No. 258n);

- “Impairment of assets” (Order of the Ministry of Finance of Russia dated December 31, 2016 No. 259n);

- “Presentation of accounting (financial) statements” (Order of the Ministry of Finance of Russia dated December 31, 2016 No. 260n).

Drafts of other standards are posted on the website of the Ministry of Finance of Russia in the section “Accounting and accounting (financial) reporting of the public sector”, subsection “Financial reporting standards for the public sector”.

As noted, changes in accounting will be introduced gradually, from 2021 to 2021. 29 new standards are expected . Innovations entail a number of significant changes. Their goal is to increase the efficiency of government agencies.

The name of the standard, “Conceptual Framework for Accounting and Reporting for Public Sector Organizations,” speaks for itself. This is a basic document that defines uniform requirements for accounting and reporting in public sector organizations:

- basic rules (methods) of accounting;

- accounting objects, general rules for their recognition (derecognition), valuation (monetary measurement) and valuation methods;

- general rules for the formation of information disclosed in accounting (financial) statements, their qualitative characteristics;

- basic principles (assumptions) of reporting preparation;

- basic requirements for inventory of assets and liabilities.

Public sector organizations must apply the standard when maintaining accounting (budget) records from January 1, 2021. To prepare reports, the provisions of the standard must be followed starting with the 2021 reporting. Reporting for 2017 is presented according to the old rules.

The provisions of the standard are applied simultaneously with other approved standards, as well as regulatory legal acts that govern accounting (budget) accounting and reporting.

To understand the essence of the upcoming changes, the study of standards must begin with the conceptual foundations. Let's analyze the provisions of the document. What are fundamentally new approaches to data generation?

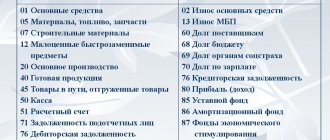

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 101)

Let's look at the main changes in account 101 00 000 “Fixed Assets”:

1. New wiring has appeared. When fixed assets are transferred for financial lease (gratuitous perpetual use) by the lessor (lender), the disposal of fixed assets classified as non-operating (financial) environment objects is reflected in the following entries:

| DEBIT account 0 401 10 172 “Income from transactions with assets” of the corresponding analytical accounting accounts: |

| 0 104 00 000 “Depreciation” |

| 0 114 00 000 “Impairment of non-financial assets” |

| CREDIT of the corresponding analytical accounting accounts account 0 101 00 000 “Fixed assets” |

2. A new group 00 “Fixed assets – property in concession” and analytical accounting accounts were introduced:

| Analytical accounting account | Account names |

| 0 101 91 000 | “Residential premises = property in concession” |

| 0 101 92 000 | “Non-residential premises (buildings and structures) – property in concession” |

| 0 101 94 000 | “Machinery and equipment – concession property” |

| 0 101 95 000 | “Vehicles – concession property” |

| 0 101 97 000 | “Biological resources – property in concession” |

| 0 101 98 000 | “Other fixed assets – property in concession” |

3. The group of accounting accounts 0 101 40 000 “Fixed assets – leased items” and analytical accounts for it (0 101 (41 – 48) 000) are excluded.

4. The following accounts have been excluded:

| Analytical accounting account | Account name |

| 0 101 18 000 | “Other fixed assets – real estate of the institution” |

| 0 101 21 000 | “Residential premises are particularly valuable movable property of an institution” |

| 0 101 23 000 | “Structures are especially valuable movable property of an institution” |

| 0 101 31 000 | “Residential premises – other movable property of the institution” |

| 0 101 43 000 | “Structures – leased items” |

5. Certain account names have been changed:

| Account name in the old version | Name of the account in the new edition |

| 0 101 26 000 “Industrial and business equipment - especially valuable movable property of the institution” | 0 101 26 000 “Industrial and economic equipment - especially valuable movable property of the institution” |

| 0 101 27 000 “The library collection is a particularly valuable movable property of the institution” | 0 101 27 000 “Biological resources are particularly valuable movable property of the institution” |

| 0 101 33 000 “Structures – other movable property of the institution” | 0 101 33 000 “Investment real estate” – other movable property of the institution |

| 0 101 36 000 “Industrial and business equipment - other movable property of the institution” | 0 101 36 000 “Industrial and economic inventory - other movable property of the institution” |

| 0 101 37 000 “Library collection – other movable property of the institution” | 0 101 37 000 “Biological resources – other movable property of the institution” |

Primary and accounting documents

Order 52n regulates the forms of primary documentation and accounting registers to reflect the economic facts of the institution’s activities. The document is valid for all types of government institutions (Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n).

Open instruction 52n on budget accounting with changes in 2021

The document states:

- list of forms of primary documents and accounting journals;

- unified documentation forms;

- methodological recommendations for filling out forms.

Let us note that institutions have the right to independently develop (modify, change or create) other forms of primary and accounting documentation that take into account the specific features of the organization’s activities. Such norms are enshrined in Law No. 402-FZ. But such decisions are coordinated with higher-level RBS. Order 52n is not mandatory.

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 102)

On account 102 00 000, as in the old version of the Instructions, intangible assets are taken into account. But the changes affected this account too - analytical accounting accounts 0 102 40 000 “Intangible assets - leased items” were excluded.

That is, currently only 2 accounts are used to generate information about the presence of business transactions and intangible assets: (click to expand)

| Analytical accounting account | Account name |

| 0 102 20 000 | “Intangible assets are especially valuable movable property of an institution” |

| 0 102 30 000 | “Intangible assets - other movable property of an institution” |

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 103)

Non-productive assets are subject to accounting in account 103 00 000. After making adjustments to the Instructions, the following groups of accounts are now used to account for non-productive assets:

| Account group | Name |

| 0 103 10 000 | Non-productive assets – real estate of the institution |

| 0 103 30 000 | Non-productive assets – other movable property |

| 0 103 90 000 | Non-productive assets – as part of the grantor’s property |

Previously used analytical accounting accounts belong to the 1st group. New accounts have been introduced for groups 30 and 90:

| Check | Name |

| 0 103 32 000 | Subsoil resources – other movable property of the institution |

| 0 103 33 000 | Other non-produced assets – other movable property of the institution |

| 0 103 91 000 | Land is part of the grantor's property |

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 104)

Account 104 00 000 “Depreciation” for accounting for depreciation charges has been adjusted to a significant extent:

1. Accounts excluded:

| Analytical accounting account | Name |

| 0 104 18 000 | Depreciation of other fixed assets – real estate of the institution |

| 0 104 21 000 | Depreciation of residential premises – especially valuable movable property of an institution |

| 0 104 23 000 | Depreciation of structures - especially valuable movable property of the institution |

| 0 104 31 000 | Depreciation of residential premises - other movable property of the institution |

| 0 104 43 000 | Depreciation of structures – leased items |

2. The name of the accounting group for account 0 104 40 000 has changed. Now the name is “Depreciation of rights to use assets”, previously it was “Depreciation of leased items”.

3. A new accounting group for account 0 104 40 000 “Depreciation of property in concession” was introduced.

4. New budget accounting entries have appeared:

| Operation | DEBIT | CREDIT |

| Termination of the right to use assets upon early termination of the agreement under which operating lease items were taken into account (disposal of an accounting item) must be reflected in the amount of accumulated depreciation of the right to use assets. | ... corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use assets” | ... corresponding analytical accounting accounts account 0 111 40 000 “Rights to use non-financial assets” |

| Termination of the right to use an asset (subject to full execution of the contract) (disposal of an accounting object) must be reflected in the amount of the book value of the right to use the assets. | ... corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use assets” | ... corresponding analytical accounting accounts account 0 111 40 000 “Rights to use non-financial assets” |

What to do with “old” fixed assets from 01/01/2018?

The procedure for accounting for fixed assets that were recognized as such before 01/01/2018 and meet the criteria for assets does not change from the new year. The transitional provisions of the Fixed Assets Standard do not apply to such fixed assets. That is, there is no need to organize real estate accounting at cadastral value for fixed assets recorded before 01/01/2018.

At the same time, some of the objects previously accounted for as part of fixed assets may no longer satisfy the concept of “asset”. What to do with such basic funds, the Methodological Instructions do not give an answer.

The concept of “asset” is disclosed in the Standard “Conceptual Framework...”. An asset is property, including cash and non-cash funds, owned by the accounting entity and (or) in its use, controlled by it as a result of the facts of economic life that have occurred, from which useful potential or economic benefits are expected.

Fixed assets that do not meet this definition are not subject to balance sheet accounting.

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 106)

Account 106 00 000 “Investments in non-financial assets” has also undergone some changes: (click to expand)

- Added account 0 106 33 000 “Investments in non-produced assets - other movable property of the institution.”

- The account group 0 106 90 000 “Investments in the property of the grantor” and analytical accounts for it were introduced: 0 106 91 000 “Investments in fixed assets in the concession” and 0 106 93 000 “Investments in non-produced assets in the concession”.

- Count group 40 has been renamed. Instead of the old name “Investments in leased objects” the name “Investments in financial lease objects” is now used.

For this reason, the following analytical accounting accounts were excluded:

| Check | Name |

| 0 106 41 000 | Investments in fixed assets – leased items |

| 0 106 42 000 | Investments in intangible assets – leased items |

| 0 106 44 000 | Investments in inventories – leased items |

Documents useful in the work of an accountant

In addition to key accounting instructions, accountants use other regulations. For example, Order No. 173n regulates the procedure for generating information and the rules for exchanging this information with FC bodies to maintain a register of contracts concluded as a result of procurement.

But the procedure for returning funds to the federal budget of the state is established in instruction 152n on budget accounting in 2021.

on budget accounting

Instruction 174n as amended for 2021 - changes in the chart of accounts (account 0 111 00 000)

On the analytical accounting accounts of account 0 111 00 000 “Rights to use assets”, the following operating lease objects are recorded:

| Analytical accounting account | Name |

| 0 111 41 000 | Rights to use residential premises |

| 0 111 42 000 | Rights to use non-residential premises (buildings and structures) |

| 0 111 44 000 | Rights to use machinery and equipment |

| 0 111 45 000 | Rights to use vehicles |

| 0 111 46 000 | Rights to use industrial and household equipment |

| 0 111 47 000 | Rights to use biological resources |

| 0 111 48 000 | Rights to use other fixed assets |

| 0 111 49 000 | Rights to use non-produced assets |

Registration of transactions to reflect the rights to use assets:

| Operation | DEBIT | CREDIT |

| Recognition of an operating lease accounting object as a lessee (property user) | ... corresponding analytical accounting accounts account 0 111 40 000 “Rights to use non-financial assets” | Accounts 0 302 24 730 “Increase in accounts payable for settlements of rent for the use of property”; 0 302 29 730 “Increase in accounts payable for payments of rent for the use of land plots and other isolated natural objects” |

| Receipt of non-financial assets related to the objects of accounting for operating leases on preferential terms for free-term use in accordance with the agreement, reflected by the institution (user) of non-financial assets in the amount of the fair value of lease payments. | ... corresponding analytical accounting accounts account 0 111 40 000 “Rights to use non-financial assets” | … account 0 401 40 182 “Deferred income from gratuitous right of use” |

| Termination of the right to use an asset (if the contract is fully executed) (disposal of an accounting object) in the amount of the book value of the right to use the asset | ... corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use assets” | ... corresponding analytical accounting accounts account 0 111 40 000 “Right to use non-financial assets” |

| Termination of the right to use an asset upon early termination of the agreement under which operating lease accounting items were taken into account (disposal of an accounting item) | The “red reversal” method in the amount of the residual value of the right to use the asset: DEBIT of the corresponding analytical accounts of account 0 111 40 000 “Rights to use non-financial assets” | CREDIT accounts 0 302 24 730 “Increase in accounts payable for settlements of rent for the use of property”, 0 302 29 730 “Increase in accounts payable for payments of rent for the use of land plots and other isolated natural objects”, 0 401 40 182 “Future income from gratuitous right of use.” |

| In the amount of accumulated depreciation of the right to use the asset: DEBIT of the corresponding analytical accounting accounts, account 0 104 40 000 “Depreciation of the right to use assets” | CREDIT to the corresponding analytical accounting accounts account 0 111 40 000 “Rights to use non-financial assets” |

Instruction 174n as amended for 2021 - changes in the chart of accounts (account 0 114 00 000)

Let's consider which groups of accounts and analytical accounting accounts are used to generate, in monetary terms, information about accrued losses from impairment of fixed assets, intangible assets, non-produced assets and business transactions that reflect changes in impairment losses, in accordance with the objects of accounting and the content of the business transaction:

| Account group | Analytical accounts |

| 0 114 10 000 “Depreciation of the institution’s real estate” | 0 114 11 000 “Depreciation of residential premises - real estate of the institution” 0 114 12 000 “Depreciation of non-residential premises (buildings and structures) - real estate of institutions” 0 114 13 000 “Impairment of investment real estate - real estate of institutions” 0 114 15 000 “Depreciation of vehicles - real estate of institutions” |

| 0 114 20 000 “Depreciation of particularly valuable movable property of the institution” | 0 114 22 000 “Depreciation of non-residential premises (buildings and structures) - especially valuable movable property of institutions” 0 114 24 000 “Depreciation of machinery and equipment - especially valuable movable property of institutions” 0 114 25 000 “Depreciation of vehicles - especially valuable movable property of institutions” 0 114 26 000 “Depreciation of production and economic inventory - especially valuable movable property of institutions” 0 114 27 000 “Depreciation of biological resources - especially valuable movable property of institutions” 0 114 28 000 “Depreciation of other fixed assets – especially valuable movable property of institutions” 0 114 29 000 “Depreciation of intangible assets - especially valuable property of institutions” |

| 0 114 30 000 “Depreciation of other movable property of the institution” | 0 114 32 000 “Depreciation of non-residential premises (buildings and structures) - other movable property of institutions” 0 114 33 000 “Impairment of investment real estate – other movable property of institutions” 0 114 34 000 “Depreciation of machinery and equipment – other movable property of institutions” 0 114 35 000 “Depreciation of vehicles – other movable property of institutions” 0 114 36 000 “Depreciation of production and economic inventory - other movable property of institutions” 0 114 37 000 “Depreciation of biological resources - other movable property of institutions” 0 114 38 000 “Depreciation of other fixed assets – other movable property of institutions” 0 114 39 000 “Depreciation of intangible assets – other movable property of institutions” |

| 0 114 60 000 “Impairment of non-productive assets” | 0 114 61 000 “Depreciation of land - non-productive assets” 0 114 62 000 “Impairment of subsoil resources – non-productive assets” 0 114 63 000 “Impairment of other non-productive assets - non-productive assets” |

For the listed accounts, transactions will be reflected in the following entries:

| Operation | DEBIT | CREDIT |

| Accrual of losses from impairment of fixed assets, intangible assets and non-productive assets | 0 401 20 274 “Losses from impairment of assets” | Analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” |

| Taking into account amounts of losses from impairment of non-financial assets upon receipt of fixed assets, intangible assets, and non-productive assets | When transferring between the head office and separate divisions (branches): DEBIT of analytical accounting accounts account 0 304 04 000 “Internal departmental settlements” | CREDIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” |

| If received free of charge: DEBIT account 0 401 10 189 “Other income” | CREDIT to analytical accounting accounts 0 114 00 000 “Impairment of non-financial assets” | |

| When internally moving accounting objects when they are classified (excluded) into (from) the category of especially valuable movable property: DEBIT account 0 401 10 172 “Income from transactions with assets” | CREDIT of analytical accounting accounts of account 0 114 00 000 “Impairment of non-financial assets” (with simultaneous reflection in DEBIT of the corresponding analytical accounting accounts of account 0 114 00 000 “Impairment of non-financial assets” and CREDIT of account 0 401 10 172 “Income from transactions with assets”). | |

| Write-off of accumulated losses from impairment of non-financial assets for caused fixed assets, intangible assets, non-productive assets | When transferring fixed assets, intangible assets, non-productive assets within the framework of settlements between the head office, separate divisions (branches), reflected on the basis of primary documents drawn up by the transferring and receiving parties, and notification in form 0504805: DEBIT of analytical accounting accounts 0 114 00 000 “Impairment non-financial assets" | CREDIT of analytical accounting accounts 0 304 04 000 “Internal departmental settlements” |

| When transferring accounting objects to a government body, state (municipal) institution, reflected on the basis of primary documents drawn up by the transferring and receiving parties, and notification in form 0504805: DEBIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” | CREDIT account 0 401 20 241 “Expenses for gratuitous transfers to state and municipal organizations” | |

| When transferring fixed assets upon their sale on the basis of a decision of the permanent commission on receipt and disposal of assets, on the gratuitous transfer of fixed assets, intangible assets, adopted in accordance with the laws of the Russian Federation (in relation to organizations other than international financial organizations, supranational organizations and foreign governments , individuals), incl. when a budgetary institution creates other organizations, as well as the disposal of fixed assets, intangible assets in accordance with the decision made to write them off, when transferring fixed assets into non-operating (financial lease): DEBIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” | CREDIT of analytical accounting accounts account 0 101 00 000 “Fixed assets”, accounts 0 102 00 000 “Intangible assets” |

Results

State and municipal institutions draw up a working PS on the basis of those already approved by law. In 2020-2021, it is necessary to make appropriate changes to the working PS and account coding, as well as transfer balances at the beginning of the year to the changed accounts.

Sources:

- Federal Law of January 12, 1996 No. 7-FZ

- Order of the Ministry of Finance of Russia dated 06.06.2019 No. 85n

- Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 205 00)

Account 205 00 000 “Calculations for income” reflects calculations for the income of a budgetary institution and transactions with them. Let's look at the changes:

1. New budget accounting entries have appeared:

| Operation | DEBIT | CREDIT |

| Accrual of income from rental property of a budget institution transferred under operating lease to tenants on the basis of agreements with them | 2,205 21,560 “Increase in accounts receivable for operating lease income” | 2 401 40 121 “Deferred income from operating leases” |

| Accrual of income from the rental of property of a budgetary institution transferred under a non-operating (financial) lease to tenants under an agreement | 2,205 22,560 “Increase in accounts receivable for income from finance leases” | 2 401 40 122 “Deferred income from finance leases” |

| Income from reimbursement to the lessor of expenses for the maintenance of the property transferred by him for use (upon the fact of corresponding requirements to the lessee) | 0 205 35 560 “Increase in accounts receivable for income from contingent rental payments” | 0 401 10 135 “Income from conditional rental payments” |

| Debt for unused balances of subsidies for other purposes in terms of balances, the need for which is not confirmed by the founder | 5,205 83,560 “Increase in accounts receivable for settlements of subsidies for other purposes” | 5 303 05 730 “Increase in accounts payable for other payments to the budget” |

| Debt for unused balances of subsidies for the purpose of budget investments in terms of balances, the need for which is not confirmed by the founder | 6,205 84,560 “Increase in accounts receivable for settlements of subsidies for capital investments” | 6 303 05 730 “Increase in accounts payable for other payments to the budget” |

2. New accounts have been introduced:

| Check | Name |

| 0 205 22 000 | Calculations of income from finance leases |

| 0 205 23 000 | Calculations of income from payments for the use of natural resources |

| 0 205 24 000 | Calculations of income from interest on deposits, cash balances |

| 0 205 25 000 | Calculations of interest income on loans provided |

| 0 205 26 000 | Calculations of interest income on other financial instruments |

| 0 205 27 000 | Calculations of income from dividends from investment objects |

| 0 205 28 000 | Calculations of income from the granting of non-exclusive rights to the results of intellectual activity and means of individualization |

| 0 205 29 000 | Calculations for other income from property |

| 0 205 32 000 | Calculations of income from the provision of services (work) under the compulsory health insurance program |

| 0 205 33 000 | Calculations of income from fees for providing information from government sources (register) |

| 0 205 35 000 | Calculations for contingent lease payments |

| 0 205 83 000 | Calculations for subsidies for other purposes |

| 0 205 84 000 | Calculations for subsidies for capital investments |

| 0 205 89 000 | Calculations for other income |

3. Account names have been changed:

| Check | Name in the old edition | Name in the new edition |

| 205 21 | Calculations of income from operating leases | Settlements with payers of property income |

| 205 31 | Calculations of income from the provision of paid services (works) | Settlements with payers of income from the provision of paid work and services |

| 205 81 | Settlements with payers of other income | Settlements with payers of other income |

4. Account group 40 “Calculations for forced seizure amounts” has been excluded.

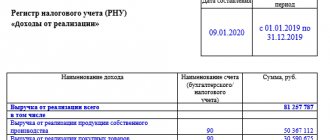

KBK income tax 2021

Depending on the legal status of a business entity, it is subject to the rule provided for by law that a certain percentage of the income received is paid to the treasury. If we are talking about individual entrepreneurship, then tax law obliges individual entrepreneurs to transfer income tax to the treasury. However, when it comes to legal entities, the obligation to calculate income tax is established. In the article, we will consider what income tax represents in 2021, the rate that is relevant for this year, and also how settlements with the budget for this tax are carried out.

The content of the article

Income tax 2018

In accordance with the current Chapter 25 of tax law (income tax of the Tax Code of the Russian Federation 2018), payers of income tax are companies that have the status of a legal entity and apply a general tax regime in their activities.

Payers of this tax are all legal entities, as well as foreign companies that operate through representative offices or simply receive income from sources located in our country.

The object subject to this tax is the profit received by the company, which is defined as the difference between income received and expenses.

Many disputes between entrepreneurs and tax authorities arise when expenses incurred are included in the calculation, a significant amount of which reduces the amount of the tax payment. The fact is that the company’s expenses must meet certain criteria, such as economic feasibility and feasibility, and also be confirmed by correctly executed primary documentation containing all the required details.

Income tax for 2021 - the rate effective for the current year - will be discussed later.

How to calculate income tax

Income tax rate 2018

Despite the current year being marked by many tax changes, the 2021 income tax form (rate) remains unchanged at 20%. The link to the fixed rate is given in Art. 284 Tax Code of the Russian Federation.

The payment amount received by the tax authorities is subject to distribution between the federal and regional budgets. At the same time, 17% is credited to the treasury of the subject of the federation and only 3% finances the state as a whole.

Income tax: KBK 2018

In order for the tax payment to reach the treasury as intended, the payment order for payment must indicate the budget classification code or BCC. It should be noted that the values of these codes are constantly being adjusted, as a result of which filling out a payment order must be preceded by checking the relevance of the code used.

We present the BCC of income tax in 2021 in the form of a table:

Based on the table presented above, tax authorities have provided codes not only for paying the tax amount, but also for possible penalties for income tax (KBK 2018) and penalties.

Income tax 2021: changes

The current financial year involves many tax changes. Some of them also affected the procedure for calculating income tax for 2018. The most significant of them were:

| p/p | Income tax 2021: changes |

| 1 | Payers of this tax have the right to use investment tax deductions in relation to their activities that affect the accounting procedure for fixed assets; |

| 2 | The procedure for creating reserves for doubtful debts has been changed. This year the following rules apply: in the process of directly creating a fund, the existing counter-debt of the counterparty must be taken into account. In this connection, only the difference between receivables and payables is classified as doubtful. In 2018, tax officials clarified that receivables should be reduced only for debts with the maximum overdue; |

| 3 | The list of possible costs for research development has been expanded; |

| 4 | The procedure for using the increasing coefficient in the process of accelerated depreciation has been adjusted. In particular, a ban was introduced on the use of a coefficient of more than 2 units in relation to OSs with high energy efficiency. And the coefficient is more than 3 units in relation to water supply facilities. |

As for the changed income tax rate for 2021, its size remains at 20%.

Income tax payment 2021 sample

Correct formation of a payment order is the key to timely receipt of tax payments to the budget. In this regard, special attention should be paid to reflecting all mandatory details. Income tax (payment details for 2018) is presented below as an example.

Income tax - sample payment order 2021 - can be downloaded from the link:

(Sample) Income tax – payment order

Companies can generate a payment document either in the accounting program or Client Bank they are using, or using the service presented on the website of the Federal Tax Service. The advantage of using the latter is the automatic application of the current BCC.

The income tax payment 2021 (filling sample) was presented above.

Income tax deadlines: reporting 2018

The need to transfer income tax to the treasury in 2021 also requires taxpayers to generate tax reports.

The income tax return is a unified document approved by tax order No. ММВ-7-3/572 dated October 19, 2016.

In accordance with the requirements of tax legislation, payers have the opportunity to independently determine which reporting period for a given tax will be applied: a month or a quarter.

If the reporting period is a month, the completed tax report must be submitted monthly, but no later than the 28th day of the month following the end of the reporting period. For example, reporting for February 2021 should be done by March 28, 2018.

In the case where the reporting period is a quarter, the tax report will need to be submitted to the inspectorate no later than the 28th day of the month following the end of the quarter. For example, a declaration for the 1st quarter of 2021 must be sent before 04/28/18.

Thus, generating corporate income tax reporting for 2021 is the direct responsibility of taxpayers.

Income tax payment deadlines 2018

Payment of income tax for 2021 is a mandatory component of the relationship between the state and the company in relation to this budget payment. As discussed above, organizations have the opportunity to independently determine the appropriate reporting period. Depending on their choice, the deadline for transferring the tax to the treasury will also vary.

The payment deadlines will correspond to the period for submitting the tax report, that is, for both quarterly and monthly payments, the 28th is the regulatory date.

Income tax in a budgetary institution 2018

In some cases, income tax is payable by public sector institutions. This situation occurs if the company also carries out commercial activities. Accordingly, in relation to this type of income, the regulations prescribed in Chapter 25 of the Tax Code of the Russian Federation are applicable.

LawCount.ru

lawcount.ru

Instruction 174n as amended for 2021 - changes in the chart of accounts (account 206 00)

In KOSGU, new sub-items were added to account 206 00 000 “Settlements for issued advances”, and therefore new accounts are being introduced:

| Check | Sub-article KOSGU |

| 0 206 96 000 “Calculations for advances for payment of other expenses” | 296 (from January 1, 2021) |

| 0 206 27 000 “Calculations for insurance advances” | 227 (from January 1, 2021) |

| 0 206 28 000 “Calculations for advances for services, work for the purpose of capital investments” | 228 (from January 1, 2021) |

| 0 206 29 000 “Calculations for advance payments for rent for the use of land plots and other isolated natural objects” | 229 (from January 1, 2021) |

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 208)

Important!

From January 1, 2021, subarticle 291 “Taxes, duties and fees” of KOSGU must reflect the costs of paying taxes (which can be included in expenses), government duties and fees, and various payments to budgets of all levels. Account 208 91 000 is now called “Settlements with accountable persons for payment of duties and fees”.

New analytical accounting accounts have also been introduced into account 208 00 000:

| Check | Sub-article KOSGU |

| From January 1, 2021 | |

| 0 208 93 000 “Settlements with accountable persons for payment of fines for violation of the terms of contracts (agreements)” | 293 |

| 0 208 95 000 “Settlements with accountable persons for payment of other economic sanctions” | 295 |

| 0 208 96 000 “Settlements with accountable persons for payment of other expenses” | 296 |

| From January 1, 2021 | |

| 0 208 27 000 “Settlements with accountable persons for payment of insurance” | 227 |

| 0 208 28 000 “Settlements with accountable persons for payment for services and work for capital investment purposes” | 228 |

| 0 208 29 000 “Settlements with accountable persons for payment of rent for the use of land plots and other isolated natural objects” | 229 |

Memo on current changes

IMPORTANT!

For all types of government institutions, separate regulations are provided that regulate the features of the formation of a unified chart of accounts for a specific type.

Thus, for public sector employees, a unified chart of accounts is approved by Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

Open instruction 174n on budget accounting with changes for 2021

Instruction 174n with changes for 2021 - changes in the chart of accounts (account 209)

An accountant, when making calculations on the amounts of damage caused to a budgetary institution and other income on account 209 00 000, will have to take into account the innovations:

1. Settlements for other income are reflected in account 209 89 000 (not in account 209 83 000).

2. The name of the group of accounts 209 40 has changed - now it is “Calculations for fines, penalties, penalties, damages” (not “Calculations for forced seizure amounts”).

3. New accounts have been introduced:

| Check | Name |

| 0 209 34 000 | Cost compensation calculations |

| 0 209 41 000 | Calculations of income from penalties for violation of the terms of contracts (agreements) |

| 0 209 43 000 | Calculations of income from insurance claims |

| 0 209 44 000 | Calculations of income from compensation for property damage (except for insurance premiums) |

| 0 209 45 000 | Calculations of income from other amounts of forced seizure |

Answers to common questions about what is instruction 174n with changes for 2021

Question #1:

At what time should the lessee (user of the property) recognize the object of accounting for an operating lease by debiting account 0 111 40 000 and crediting accounts 0 302 24 730 or 0 302 29 730?

Answer:

It is necessary to recognize the accounting object of an operating lease on the date of classification of the lease accounting object in the amount of lease payments for the entire period of use of the property provided for in the lease agreement.

Question #2:

What is the reason for the introduction of new analytical accounting accounts in accounts 208 00 000 and 206 00 000, according to Instruction 174n?

Answer:

These innovations are associated with the presence of new subarticles of KOSGU.