State duty is a payment that is charged for receiving any government service. Deregistration of an individual entrepreneur from tax registration is one of such services. The state fee for closing an individual entrepreneur in 2021 is only 160 rubles, but in some cases it may not be paid at all.

How to close an individual entrepreneur correctly

In accordance with the provisions of the law, in order to liquidate the individual entrepreneur in 2021, the businessman completes the package with the following papers:

- an application for termination of commercial activities, drawn up in form P26001, provided for by the classification;

- a receipt confirming payment of the state fee;

- passports, SNILS certificates and TIN of the applicant.

To close an individual entrepreneur, an entrepreneur applies to the government agency that registers enterprises - the tax department.

Additionally, issues related to:

- contributions to the Pension Fund;

- repayment of budget debt to government bodies;

- additional commercial services.

When paying the state duty, you are required to provide information about the payer's details. The individual entrepreneur is liquidated within five days, excluding weekends, from the date of submission of documentation to the tax department. If the papers are submitted and the issues that arise are resolved, the applicant is given a document confirming the provision of the necessary information and the liquidation of the individual entrepreneur.

A preliminary request is submitted to the Pension Fund regarding the repayment of debt before the final cessation of the enterprise. If an individual entrepreneur has a debt to social services, the entrepreneur may be subject to a large fine, and the tax office will refuse to liquidate the enterprise.

Common mistakes of individual entrepreneurs

Due to the mistakes of the entrepreneur, the process of liquidation of the individual entrepreneur may be delayed. The most common of them is entering incorrect information into the payment receipt. For example, it may be an incorrect TIN. Or some fields of the receipt may not be filled in at all. The second common mistake is incorrectly specified passport data. Sometimes, over the course of his many years of activity, an individual entrepreneur changes his passport and indicates the series and number of the old passport.

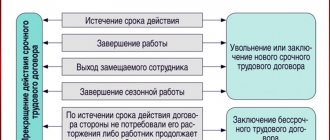

Dismissal of employees

Incorrect payment of fees and penalties: an accountant or the entrepreneur himself may incorrectly calculate the fines and tax payments to be paid. Then the FL will think that everything has been paid, but the tax office will find inconsistencies and the problem will remain unresolved.

Also, an entrepreneur may forget about writing the dismissal of his employees. Or he formalizes his dismissal, but debts (vacation pay, compensation, dismissal pay) remain.

Note! The law obliges employers who dismiss employees due to liquidation or downsizing to pay them a lump sum salary for 3 months in advance. It is assumed that employees dismissed through no fault of their own will have to find a new job within 3 months.

Sending documents by mail

If an entrepreneur cannot go to the tax office in person, the documentation is sent by mail. The papers are sent by registered mail with a mandatory description of the contents of the package.

In case of incomplete set or discrepancy of the submitted papers, the paid state duty is not refunded. The fee will have to be paid again. To avoid misunderstandings and additional financial expenses, you need to resolve all issues related to closing the enterprise in a timely manner, and collect documentation according to the list provided by law.

Where can I get a current form to fill out?

The receipt form can be obtained from the tax office at the registration address of the individual entrepreneur or LLC or downloaded from the official portal of the department.

To pay, you need to know the details of the Federal Tax Service where the company is registered. They must be clarified so that the payment goes through correctly and reaches the correct recipient.

Articles:

I closed the IP in 2021, what next?

What fines can the tax office send after the closure of an individual entrepreneur and why?

What details need to be included in the form?

- Please indicate your payment type;

- Reason for payment;

- Your passport details;

- IP INN number;

- Details of the Federal Tax Service, where payments will be sent;

- Date of payment;

- Sum.

KBK state fees at closing.

This is a necessary and important detail - the budget classification code. Without this indication, your payment will not be accepted. This year, in order to close an individual entrepreneur, you need to enter the following code: 182 1 08 07010 01 1000 110.

Receipt for closing an individual entrepreneur

The receipt form for payment of the state duty for closing an individual entrepreneur is filled out indicating:

- Full name and registration address;

- TIN code;

- bank with the applicant’s account number and details of the financial organization;

- details of the payment recipient, including account number, KBK, INN, KPP and OKTMO.

The receipt for closing an individual entrepreneur in 2021 consists of two parts, one of which is issued to the payer, the second remains in the bank where the operation was carried out. Each half indicates the date of payment and signature of the payer.

The paid receipt is attached to the set of papers submitted to the branch of the Federal Tax Service.

Hotline for citizen consultations: 8-800-350-57-94

Payment through a Sberbank branch

One of the easiest ways to pay the state fee for closing an individual entrepreneur is to visit a Sberbank branch. It is important for the payer to correctly indicate his data and information about the recipient.

The tax service details included in the state duty payment receipt are individual for each department branch. An entrepreneur can check the data by calling the Federal Tax Service. If an error is made when specifying the details, the payment will have to be made again.

The entrepreneur must prove his identity by presenting his passport. If you have any questions about filling out the receipt, a representative of the financial institution will help. For a form filled out by a bank employee, you will need to pay an additional 20 rubles, which is confirmed by a separate check.

Payment through Sberbank online

Another convenient option for paying state fees for terminating activities is to contact the Sberbank online service. Payment is also possible through the official website of Sberbank.

To pay the state fee, you will need:

- Login to the site or application.

- Go to the tab with payments and transfers.

- In the name of the recipient structure, indicate the name of the tax department branch.

- Provide passport details and other information about the payer.

- Select the type of state duty.

If funds are transferred by non-cash method, the printed receipt must be certified at the branch of the financial institution.

The document is recognized as valid if it has the employee’s signature and the bank’s seal.

This you need to know: How to pay a debt to bailiffs through Sberbank-Online

Payment via MFC

Services for paying the state fee for closing an individual entrepreneur are provided by a network of MFCs opened in Moscow and other cities of the Russian Federation. Pre-registration on the official website will help you avoid wasting time in queues.

On the appointed date and time, you must go to the MFC with your passport and TIN. An employee of the center will perform the operation to pay the state duty. The procedure will take no more than ten minutes.

Documents can be sent to the MFC by mail if the entrepreneur does not have enough time to visit the authorities.

Is it necessary to pay?

State duty is a fixed target contribution. It is established by Russian legislation and is subject to mandatory payment to the budget upon liquidation of an individual entrepreneur, if the documents necessary for closing the business are “paper”. You can save on paying the fee by submitting electronic versions of documents for registering the liquidation of a business.

Since 2021, amendments to the registration legislation have come into force: if documents are sent electronically, through multifunctional centers and notaries, then you will not have to pay a state fee. However, to receive this preference, an individual entrepreneur must have an electronic digital signature. With its help, a businessman is identified, and documents regarding him are sent electronically.

When filing documents as standard, the fee is paid at a bank branch or online. In 2021, the amount of state duty for state registration of business closure is 160 rubles .

From September 1, 2021, the Federal Tax Service of Russia will be able to forcibly close an individual entrepreneur if:

- his last report was received more than 15 months ago or during this period he did not purchase a patent;

- The individual entrepreneur is on the list of debtors for taxes and fees.

After the tax authorities initiate the forced closure of a business, it will be possible to start doing business again after three years. Therefore, if a business is stalling, it is better to voluntarily deregister.

Liquidation of individual entrepreneurs through State Services

To pay the required state fee for closing an individual entrepreneur through State Services, you will need to first register on the resource. Having passed identification on the portal, the businessman creates a personal account, after logging in to which you will need:

- Click on the button to add an organization and indicate its affiliation with an individual entrepreneur.

- On the list.

- Select the electronic form for performing the operation and enter personal information.

- Attach the necessary documents.

- Send a request for registration to the Federal Tax Service.

If everything is done correctly, a confirmation of the closure of the enterprise will be sent to the applicant by e-mail within the five working days provided for by law.

Other actions

The list of other operations that need to be performed after closing is purely individual and depends on the nature and conditions of the work.

The most common actions are:

- Close all bank accounts of the entrepreneur. This must be done after all mandatory payments to government agencies have been made. There is no need to notify the tax service about account closure.

- Terminate all contracts that were concluded for the entrepreneur - for the supply of materials, provision of various services (Internet, telephony, garbage removal, etc.), etc.

- Deregister cash registers - if you used online cash registers, you can deregister them by submitting electronic applications through your personal account on the Federal Tax Service portal. You also need to terminate the contract for servicing cash register equipment.

- Destroy the seal - if it was used by the entrepreneur.

Attention: even if the business is closed, it is necessary to store the entire archive of documents for another four years from the date of this action.

Cashless payment via the Internet

Online payment of the state duty for terminating the activities of an individual entrepreneur is carried out through the tax service portal.

Procedure:

- Log in to the official portal of the tax department.

- Select the section on payment of state duty.

- Place a dot opposite the line “due to termination of activity” with the amount of 160 rubles.

- Enter your full name, residential address and Taxpayer Identification Number - the last condition is mandatory if the fee is paid by transfer.

- After checking the entered data, the payment button is pressed.

- Select the method of transferring funds - by bank transfer.

- Click on the icon of Sberbank or other financial organization.

- Generate a receipt and make a payment by clicking the appropriate confirmation.

A payer who closes an individual entrepreneur and ceases business activities will receive a message on his mobile phone containing a special code. After entering this number, the payment will be processed.

An alternative option is to choose cash payment. In this case, an electronic form of receipt is generated, which should be printed and paid at any financial institution. In this case, you will not have to fill out the form. The businessman will only have to sign in the appropriate boxes, and the remaining information will be filled in automatically.

When choosing a financial organization through which funds are transferred to pay the state fee for closing an individual entrepreneur, the entrepreneur checks the icon of the desired structure.

Introduction

A working entrepreneur must pay taxes one way or another, even if he does not earn anything. This is a rather unpleasant practice, so you won’t be able to “fall asleep” by putting zeros in the declaration. The best option for a private owner who has decided to close (even if he has thoughts about continuing work in a few months) is to liquidate the individual entrepreneur with the payment of all existing debts.

It’s easy to close an individual entrepreneur even on your own

Let's take a look at how much the closing process will cost. There are several options:

- Independent trip to the territorial tax service.

- Contacting intermediaries who will carry out the closing procedure.

- Send the necessary closure papers via mail.

- Create an application through the government services portal.

Attention: despite the fact that there are a lot of advertisements on the Internet about closing individual entrepreneurs, it is better to do it yourself. Firstly, it will not take much time, secondly, you will not overpay, and thirdly, you will make sure that the individual entrepreneur is really closed.

You should contact intermediaries only if you do not want to waste time on this and communicate with officials. Let's take a closer look at how this works.