Returning funds to a current account is a situation that may arise in a number of cases:

- Payment for low-quality goods.

- Violation of delivery deadlines.

- Incorrect crediting of money to the current account.

- Accidental debiting of funds from the account.

In all of the above cases, a refund to the bank account is required. Moreover, each of the options requires a separate approach from individual entrepreneurs or companies (primarily from the standpoint of reporting and paying taxes).

Grounds for returning erroneously transferred funds.

If an error is made in the transfer of funds, then in accordance with the regulations of the legislation of the Russian Federation, the payer is given the right to return the amounts paid.

Thus, if an incorrect transfer is made to another legal entity, in reality there are no contractual obligations between the payer and the recipient. Relying on Article 1102 of the Civil Code of Russia, the second party is obliged to return funds acquired unjustifiably to the sender. Moreover, if the return is delayed, the first party may demand compensation in the form of interest for the use of its funds. What is stipulated by Article 1107 of the Civil Code of the Russian Federation. Therefore, both parties have reasons and interests in the speedy return of the transferred amounts.

It is worth noting that funds transferred by mistake to a non-existent organization will be automatically returned by the bank within 5 business days. If this does not happen, a clarifying letter to the bank will be required.

Errors in details can be made when entering them manually. Experienced accountants use electronic copying when filling out payment documents or automated financial accounting tools (1C Enterprise, Internet Banking and others). In them, you can select the counterparty from the list or just enter the TIN. Most fields of the payment order will be filled in automatically.

Most often, inaccuracies occur when specifying the payment amount. Because in each specific case it is individual and, as a rule, is entered manually. Under such circumstances, there is a risk of overpayment under the contract. However, there is no need to worry.

The amount received in excess of the contract is also equivalent to funds acquired unjustifiably. And evasion of return entails liability on the basis of Article 395 of the Civil Code of the Russian Federation. Since the fact of unlawful retention and use of funds is recorded.

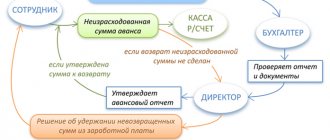

What are reportable amounts?

Employers give employees money to meet the needs of the organization: purchasing office supplies, paying suppliers, purchasing gasoline for the fleet. Such payments are called accountable payments. Their use must be reported within the prescribed period, and the unspent balance must be returned.

The procedure for issuing money for reporting is regulated by Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. They are issued in one of two ways:

- cash from the organization's cash desk;

- transfer to a corporate card or personal account of an employee (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728).

This raises the question: if it is possible to give money to an employee by bank transfer, then is it possible to return the accountable funds to the organization’s account? Let's figure it out.

Refund methods.

If the error was discovered immediately, the funds will be returned quickly. Due to the fact that the bank takes time to carry out operations, payments do not go through instantly. As a rule, a timely contact with the bank with a request to revoke a payment order solves the problem that has arisen.

But how can you return erroneously transferred funds if several days have already passed? There are two ways to resolve the issue:

1. Voluntary.

The emphasis here is on the agreement between the two parties. If the counterparty is respectable and interested in further cooperation, then it will promptly respond to a letter about the return of erroneously transferred funds. As a rule, organizations respond adequately to such incidents and treat mistakes made with understanding. At the same time, no one needs extra paperwork.

2. Judicial.

If the recipient independently refuses to return the erroneously transferred funds, then the sender can only resolve the matter in court. Only a statement of claim to the court with reasonable evidence of the current situation will help resolve the dispute.

Judicial practice has various examples of final results, both in favor of the injured party and vice versa. Therefore, it is better to entrust the process of paperwork and case management to qualified lawyers. This will significantly increase the chances of a positive resolution of the issue.

When to draw up the KM-3 act

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued. This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months . After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2021.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

Filling out the table in KM-3

The KM-3 act, as a rule, is filled out by hand, but there is no reference to the fact that it cannot be completed using a computer. In any case, the document must be certified by the signatures of the commission, otherwise the audit may determine it as incorrectly drawn up.

Data can be reduced - this is especially true for positions in column 6.

Letter requesting the return of erroneously transferred funds.

It is not enough for any organization to make an oral request or demand to take any action, especially of a financial nature. Typically, a formal letter from another legal entity is required, which states the nature of the problem and specific details of the circumstances.

The structure of letters of this kind is not strictly specified. They are issued in free form. However, it is better to use the organization’s form indicating the details. Often, to effect a refund, it is necessary to reconcile mutual settlements.

Below are letters for the return of erroneously transferred funds:

Refund of erroneously transferred funds letter sample.

Compilation deadlines

The Civil Code of the Russian Federation does not contain any mention of the maximum time limit for sending an appeal with a demand for the return of unjustifiably received amounts of money. Based on the general statute of limitations, an application to a person who has unjustifiably enriched himself can be filed within three years from the moment the organization learned or should have learned about the excessive payments made.

However, it is considered in good faith to notify the counterparty within a reasonable time after identifying an accounting error. In civil law, this period usually does not exceed 7-10 days.

Purpose of payment for the return of erroneously transferred funds.

In turn, the opposite situations arise. When erroneously transferred funds or an overpayment are received into the organization’s current account. In this case, you will need to check the counterparty, payments and the correctness of the amounts. If a decision is made to revert, it is important to fill out payment documents correctly. To ensure that these amounts do not appear in the reporting as income or expenses, the purpose of the payment for the return of funds must indicate the basis and the action being performed.

For example, the following formulations are suitable:

Refund of excessively transferred funds according to letter No. 37/1/19 dated 04/04/2019, according to invoice No. 4935 dated 03/18/2019.

Or

Refund of erroneously transferred funds according to letter No. 37/1/19 dated 04/04/2019, according to invoice No. 4935 dated 03/18/2019.

payment order can be found below:

Sample payment order for the return of erroneously transferred funds.

Summary

Failure to fulfill the obligation to return amounts is misappropriation of someone else's funds. To receive money back, the buyer must write a claim to the retail outlet and, at the store’s request, present a cash receipt or payment document.

If your money went to another account due to a bank error, immediately contact the credit institution and try to cancel the transaction.

Sources

- https://ppt.ru/forms/postavschik/vozvrat-tovara

- https://assistentus.ru/forma/pismo-ob-izlishne-perechislennyh-denezhnyh-sredstvah/

- https://obrazec-dogovora.ru/pismo/pismo-o-vozvrate-denezhnyh-sredstv-obrazec.html

- https://PravPotreb.com/vozvrat/denezhnyh-sredstv-pismo-obrazets.html

- https://dedadi.ru/obrazcy-dokumentov/pismo-pro-vozvrat-deneg.html

- https://glavny-yurist.ru/pretenziya-na-vozvrat-denezhnyh-sredstv.html

- https://assistentus.ru/forma/km-3-akt-o-vozvrate-denezhnyh-summ/

- https://assistentus.ru/forma/pismo-o-vozvrate-deneg-na-raschetnyj-schet/

- https://glavny-yurist.ru/zayavlenie-na-vozvrat-deneg-za-tovar.html

- https://pravoved.ru/journal/vozvrat-oshibochno-perechislennyh-denezhnyh-sredstv/

Reflection of transactions in accounting

Let's consider the procedure for recording transactions in accounting accounts on the part of all participants in the transaction:

| № | Situation | Provider | Buyer |

| 1 | Excessive advance payment | Dt 51 Kt 62 - advance payment received; Dt 51 Kt 76/2 - excess amount received. | Dt 60 Kt 51 - prepayment transferred; Dt 76/2 Kt 51 - excessively transferred amount. |

| 2 | Incorrect enumeration | Dt 51 Kt 76/2 - erroneously received amount. | Dt 76/2 Kt 51 - erroneously transferred amount. |

| 3 | Termination or change of contract terms | Dt 51 Kt 62 - prepayment received. | Dt 60 Kt 51 - advance payment is transferred. |

When erroneous payments are returned, reverse accounting entries are made.

Nuances of accounting under the simplified tax system

Often, the supplier has disagreements with the tax authorities about the taxation of excess revenue. The fact is that the tax base is formed upon payment, i.e., at the time the money is received, income arises.

In case of erroneous or excessive transfer of payments, the amounts received are not taken into account when generating taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Until the circumstances are clarified, these funds do not fall under the definition of income from sales or non-operating income (Articles 249, 250 of the Tax Code of the Russian Federation).

The above does not apply to advances returned due to termination or change in the terms of the contract. At the time of receipt of the prepayment, the taxpayer has an obligation to increase income. When collecting advances received from buyers for the refunded amount, the income of the period in which the funds were returned is reduced (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).