Advance payment is an advance payment for goods. That is, the contract has already been concluded, part of the money has been transferred to the seller in advance, and the rest will be transferred after the delivery of the goods.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Do I have to pay VAT on advances received from buyers?

The procedure for determining the VAT rate on an advance payment

When receiving an advance, the VAT rate is determined by calculation. Depending on the basic rate for goods, works, and services produced, it can be calculated as 18/118 or 10/110.

Example 1.

An advance was received against the supplier of goods taxed at a rate of 10%. The advance amount is 200 thousand rubles, it is necessary to calculate VAT.

VAT in this case will be

200 000,00 * 10 / 110 = 18 181,82

Example 2.

An advance payment was received for services taxed at a rate of 18%. The advance amount is 177 thousand rubles, it is necessary to calculate VAT.

VAT in this case will be

177 000,00 * 18 / 118 = 27 000,00

VAT deduction from prepayment

On the date of shipment of goods, against the advance payment received, the amount of VAT calculated on the advance payment received from the buyer can be deducted (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

Advance VAT is deductible only in the quarter of shipment of goods. It is impossible to transfer the deduction to the next tax period (letters of the Ministry of Finance of Russia dated July 21, 2015 No. 03-07-11/41908, dated October 17, 2017 No. 03-07-11/67480). The amount of advance VAT deduction depends on the tax rate that is applied when shipping goods as an advance payment (clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the cost of goods shipped, including VAT, is equal to or greater than the amount of the advance received previously, a deduction is declared in the amount of the VAT calculated earlier upon receipt of the advance (letter of the Ministry of Finance dated 05/07/2018 No. 03-07-11/30585). If the amount of the advance payment exceeds the cost of goods shipped against this advance, including VAT, then the deduction can only be claimed in the amount of VAT on the cost of shipment.

Example

Gratis LLC received an advance from the buyer in the amount of RUB 354,000. (including VAT RUB 54,000). The following month, the company shipped goods worth RUB 236,000 to the buyer. (including VAT RUB 36,000).

On the date of shipment, the company has the right to deduct VAT from a previously received advance in the amount of 36,000 rubles.

Peculiarities of determining VAT on an advance payment if the advance payment and shipment belong to the same tax period.

Despite the fact that it seems logical in this case to calculate VAT only once, from shipment, regulatory authorities insist otherwise.

According to the regulatory authorities, VAT must be charged first on the advance received, then on the sale. And accordingly, issue two invoices - for the advance received and for the sale.

Then, when filling out the purchase ledger, you must record the VAT on the advance payment as a tax deduction.

The VAT Declaration must reflect both cases of VAT calculation - both from the advance received and from the sale, as well as the VAT deduction.

Courts often take the opposite point of view and believe that there is no need to charge VAT on advances received if both the advance and the sale fall within the same tax period.

Table 1 shows the documents for each case.

Table 1.

| No. | VAT on the advance, if the advance and sale are in the same tax period | Document |

| 1 | VAT is charged, an invoice needs to be issued | Letter from the Ministry of Finance of the Russian Federation dated 10/12/2011 No. 03-07-14/99, Letters from the Federal Tax Service of the Russian Federation dated July 20, 2011 No. ED-4-3/11684, dated March 10, 2011 No. KE-4-3/3790, dated 02/15/2011 No. KE-3-3/ [email protected] , Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 06/28/2012 No. A32-13441/2010. |

| 2 | There is no need to charge VAT | Determination of the Supreme Arbitration Court of the Russian Federation dated September 19, 2008 No. 11691/08, Resolutions: FAS of the North Caucasus District dated May 25, 2012 No. A32-16839/2011, FAS Volga District dated September 7, 2011 No. A57-14658/2010 |

VAT deduction in non-standard situations

In practice, the taxpayer-seller of goods can calculate the amount of VAT on the advance payment using the calculated rate of 18/118. And shipment against the advance received can be made at two rates: 10 and 18%. How much VAT should be deducted during the shipment period? And how to avoid senseless tax losses?

Example

On July 15, 2021, Gratis LLC received an advance from the buyer in the amount of RUB 236,000. Since the company did not have information on VAT rates for goods planned for shipment against the advance received, VAT of 36,000 rubles was calculated on the advance amount.

The advance amounts and VAT were reflected by Gratis LLC in the tax return for the second quarter of 2021. The tax has been paid in full to the budget.

On September 15, 2021, Gratis LLC shipped goods to the buyer. The cost of shipped goods is 236,000 rubles, including VAT 10% - 4,000 rubles, 18% - 29,288 rubles. The total amount of VAT charged to the buyer upon shipment of goods is RUB 33,288.

In the example considered, the amount of VAT calculated on the advance received exceeds the amount of VAT that can be deducted upon shipment, guided by the norm of clause 6 of Art. 172 of the Tax Code of the Russian Federation. It turns out that the taxpayer overpaid VAT when receiving an advance from the buyer, although the amount of shipment, including VAT, is equal to the amount of the advance received earlier.

The Supreme Court, in Ruling No. 310-KG18-11870 dated August 21, 2018, called the difference resulting under similar circumstances an overpaid tax. The taxpayer’s dispute with the tax authority concerned the amount of tax deduction from a previously received advance. The taxpayer deducted all advance VAT.

However, the inspector did not agree with this calculation. And he allowed us to deduct only the amount of VAT in the amount of tax calculated on the cost of shipped goods.

Consequently, the company will have to file an updated VAT return for the period in which the advance payment was received. As a result, the company will have an overpayment of taxes, which can be returned or offset according to the rules of Art. 78 Tax Code of the Russian Federation.

Features of issuing an invoice when receiving an advance

Upon receipt of the invoice, the seller must issue an invoice for the advance received.

The procedure for issuing an invoice for an advance payment is defined in Decree of the Government of the Russian Federation of December 26, 2011 N 1137.

The period for issuing such an invoice is 5 calendar days, because the same as when issuing a regular invoice.

The invoice is issued in two copies, one of which is transferred to the buyer.

For an advance invoice, it is important to indicate in line 5 the details of the payment document for the advance received.

When indicating the names of goods, works, services, you can use their generic name, which allows you to identify goods, works, services.

Filling out the columns begins with column 7, which indicates the estimated rate of 10/110 or 18/118 (

Emerging nuances ↑

VAT is a rather “ambiguous” tax, and when calculating it, even experienced accountants have many questions.

How not to pay?

Many taxpayers are concerned with the question of how to avoid paying this VAT? This tax is not paid by those organizations and individual entrepreneurs that apply preferential tax regimes.

In this case, they do not have the right to issue invoices and accept VAT deductions on shipped and purchased goods, works or services.

It is also possible not to pay VAT, on the basis of Art. 145 of the Tax Code of the Russian Federation, becoming a participant in a research project.

With long-term continuous supplies

If an agreement has been concluded between counterparties for the implementation of long-term continuous supplies of goods, provision of services or performance of work, then the seller has the right to issue an invoice simultaneously with the receipt of payments for payment for the goods.

This must be done no later than the 5th day of the next month in which the goods were shipped or any contractual services were provided.

This is stated in the Letter of the Ministry of Finance dated July 18, 2005 N 03-04-11/166 “On the deduction of VAT for long-term supplies of goods.”

VAT adjustment

If the prepayment received previously must be returned, then the adjustment is made in the amount in which the tax was calculated. Let's assume the money was transferred in 2021, and it needs to be returned in January 2021. In this case, the VAT adjustment is carried out if an adjustment invoice is provided. The amount will be equal to the already accrued VAT at the rate of 18%.

When an advance payment is made in 2021, but the shipment is made only in 2021, the remaining VAT liability is accrued on the day the goods are delivered. If there are several shipments in parts, then VAT is accounted for in accordance with the tax requirements in force at the time. When, in the case of the next shipment, VAT obligations exceed the listed prepayments, the remaining ones are registered as tax obligations. In the same way, the calculation is carried out if the goods are delivered in 2021.

If the amount of the prepayment exceeds the full cost of delivery, then the amount of previously accrued tax exceeds the obligations for the transaction as a whole. In this case, the resulting excess tax is not subject to deduction. If the goods were shipped last year, and the cost was adjusted in 2021, then this is carried out using an adjustment invoice based on the rate established on the date of shipment (in our case, 18%).

Based on advances received, VAT recovery is carried out by the buyer. Restoration is performed in the following cases:

- When a batch of goods has been delivered for which an advance payment has already been made.

- When the deal was canceled and the advance was returned.

Receiving an additional payment of 2% VAT in 1C: Accounting 8 edition 3.0

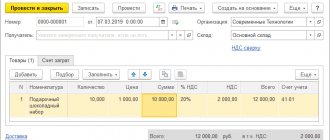

To perform operation 3.1 “Receiving additional VAT payment from the buyer” based on the document Invoice to the buyer

(Fig. 1) a document is created

Receipt to the current account

with the transaction type

Payment from the buyer

.

Indicators of the document Receipt to the current account

are filled in automatically based on the information in the

Buyer Invoice

.

In addition, in the document Receipt to current account

must be indicated (Fig. 9):

- in the fields According to document No.

and

from

– the number and date of the buyer’s payment order; - in the Amount

– the actual amount of the additional VAT payment received.

If, by agreement of the parties, the buyer makes an additional payment of VAT in the amount of 2% until December 31, 2018 inclusive, then such additional payment is considered as an additional payment for the cost on which VAT must be calculated at the rate of 18/118 (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4 -3/ [email protected] ).

Therefore, in the document Receipt to the current account

the VAT rate of 18% is indicated and the VAT amount is automatically calculated in the amount of 457.63 rubles. (RUB 3,000.00 x 18/118).

Rice. 9

As a result of posting the document Receipt to the current account

An accounting entry will be generated (Fig. 10):

- on the debit of account 51 and the credit of account 62.02 - for the amount of funds received by the seller from the buyer as an additional payment of 2% VAT.

Rice. 10

When receiving additional VAT payment, the seller can issue an adjustment invoice for the difference between the indicators of the invoice drawn up upon receipt of advance payment in the amount of 18/118, and the indicators after changing the cost of goods (work, services), property rights using a tax rate of 18/118 (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3/ [email protected] ).

An adjustment invoice for the received amount of VAT surcharge (operations 3.2 “Drawing up an invoice for the amount of VAT surcharge”, 3.3 “Calculation of VAT on the received VAT surcharge”) in the program is generated on the basis of the document Receipt to the current account

Click the

Create based on

(Fig. 9).

In the new document Invoice issued

(Fig. 11) basic information will be filled in automatically according to the base document:

- in the from

– the date of preparation of the invoice, which by default is set to the same date as the date of generation of the document

Receipt to the current account

; - in the Counterparty

,

Payment document No.

and

from fields

– the relevant information from the base document.

In addition, the following will be automatically entered:

- in the Transaction type code

– value 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ); - Compiled

switch is set to

On paper

, if there is no valid agreement on the exchange of electronic invoices, or

In electronic form

, if such an agreement has been concluded; - The Issued (transferred to the counterparty)

checkbox indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted; - The Manager

and

Chief Accountant

fields are data from the “Responsible Persons” information register.

If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory Individuals

.

Since an adjustment invoice is issued for the amount of additional VAT payment, it is necessary in the Invoice Type

replace the default value

For advance

with the new value

Adjustment for advance

.

In the modified tabular part of the document, it is necessary to indicate in the column To the invoice

details of the invoice for the advance payment (Fig. 4), for which an adjustment invoice is drawn up.

After this, the cost indicators of the tabular section will be automatically filled in, both “before the change” and “after the change”.

Rice. eleven

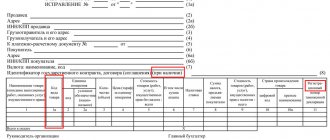

Click the Print document button. Invoice issued

(Fig. 11) you can go to view the form of the adjustment invoice and then print it in two copies (Fig. 12).

In accordance with Example No. 2, given in the appendix to the letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] , the adjustment invoice for the amount of additional VAT payment received in 2021 indicates:

- in column 7 of line A (before the change) – tax rate 18/118;

- in column 7 of line B (after the change) – tax rate 18/118;

- in column 8 of line A (before the change) - the amount of VAT in the amount of 27,000.00 rubles, calculated from the amount of advance payment received (177,000.00 rubles x 18/118);

- in column 8 of line B (after the change) - the amount of VAT in the amount of 27,457.63 rubles, which is the result of adding the amount of VAT calculated from the received advance payment (177,000.00 rubles x 18/118), and the amount of VAT calculated from the received amount of additional VAT payment (RUB 3,000.00 x 18/118);

- in column 8 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change), amounting to 457.63 rubles. (RUB 27,457.63 - RUB 27,000.00);

- in column 9 of line A (before the change) - the amount of advance payment received in the amount of RUB 177,000.00;

- in column 9 of line A (after the change) - the amount of advance payment received in the amount of RUB 177,000.00. and VAT surcharge in the amount of RUB 3,000.00;

- in column 9 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change) in the amount of 3,000.00 rubles, corresponding to the amount of the additional payment received.

Rice. 12

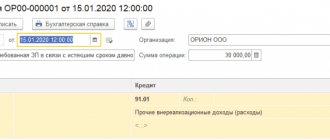

As a result of posting the document Adjustment Invoice issued

An accounting entry is generated (Fig. 13):

- on the debit of account 76.AB and the credit of account 68.02 - for the amount of VAT calculated from the received surcharge amount in the amount of 457.63 rubles. (RUB 3,000.00 x 18/118).

Rice. 13

Based on the document Adjustment invoice issued

an entry is made in the information register “Invoice Log” to store the necessary information about the issued adjustment invoice (Fig. 14).

Rice. 14

Document Adjustment invoice issued

is registered in the accumulation register “VAT Sales” (Fig. 15).

Rice. 15

Based on the entries in the “VAT Sales” register, a sales book is generated for the fourth quarter of 2021 (Section Sales - VAT subsection

) (Fig. 16).

Rice. 16

The amount of VAT accrued from the additional payment received is also reflected in line 070 of section 3 of the VAT tax return for the fourth quarter of 2018 (approved by order of the Ministry of Finance of Russia dated October 15, 2009 No. 104n) (section Reports

– subsection

1C-Reporting

– hyperlink

Regulated reports

).

About contracts moving into 2021.

Questions may arise in the opposite situation: when shipment under previously (before 01/01/2019) concluded long-term contracts, including the transfer of advance payments, is carried out in 2021.

A kind of instruction on the actions of taxpayers during the transition period was prepared by the main tax department of the country in Letter dated October 23, 2018 No. SD-4-3 / [email protected] It follows from the letter that, regardless of whether adjustments are made to the terms of such agreements, shipment of them in 2021 must be accompanied by VAT at a rate of 20%. Therefore, no amendments to the agreement regarding the VAT rate are required.

The Ministry of Finance also issued a number of letters on this topic (dated November 27, 2018 No. 03-07-11/85574, dated October 16, 2018 No. 03-07-14/74188, dated August 6, 2018 No. 03-07-05/55290). In Letter No. 03‑07‑11/64576 dated 09/10/2018, for example, department specialists spoke out regarding lease agreements: when calculating VAT on the cost of rent, the VAT rate is determined based on the period in which the services were provided. Thus, when preparing the “primary” and issuing invoices for rent amounts for December 2021, a rate of 18% is used, for January 2021 - a rate of 20%. The date of conclusion of the contract does not matter.

VAT on prepayment in case of a change in tax regime

There are also situations in which there is no need to charge VAT if an advance payment is received. These include the following:

- The company is exempt from paying VAT, in accordance with current legislation.

- The company operates in a special mode.

- The recipient of the advance payment produces products for the purpose of sale outside the Russian Federation.

- Goods are exempt from VAT or subject to a zero VAT rate.

- The production period for the goods for which advance payment has been received is more than 6 months.

If an individual entrepreneur worked for OSNO and received an advance, and then switched to the simplified tax system, then the procedure for reflecting VAT will be as follows. Based on the fact that in most cases, when applying the simplified tax system, there is no need to pay VAT, upon completion of the transaction, VAT obligations do not arise. But a previously taken into account advance cannot be deducted either.

In the case of the opposite situation, when an individual entrepreneur switched from the simplified tax system to OSNO, in case of receiving an advance payment and after delivery of goods and full payment, he will have to pay VAT in the full amount.

- applies exemption from VAT (Article 145 of the Tax Code of the Russian Federation);

- sells goods that are subject to VAT at the export rate of 0% (clause 1 of Article 164 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated October 15, 2012 No. 03-07-08/293);

- sells goods for which the duration of the production cycle is more than 6 months (clause 13 of article 167 of the Tax Code of the Russian Federation). The list of such goods is approved by the Government of the Russian Federation (List, approved by Government Resolution No. 468 of July 28, 2006). In this case, the seller-manufacturer must have a document confirming the cycle duration, issued by the Ministry of Industry and Trade of Russia;

- sells goods that are not subject to VAT (Article 149 of the Tax Code of the Russian Federation). Then VAT will not have to be charged when shipping the goods;

- the place of sale of goods for which an advance was received is not the territory of the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation). In such a situation, there is no object of VAT taxation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

No. 3: New export rules have been introduced

Accompanying documents

From October 1, 2021, for goods exported outside the EAEU, there will be no need to submit copies of transport, shipping and/or other documents with customs marks of the place of departure confirming the export of goods outside of Russia. The Federal Tax Service can receive data on the export of goods directly from customs – in electronic form.

However, if customs does not provide these data or they contradict the information declared by the taxpayer himself, then the Federal Tax Service may request copies of transport, shipping and other documents confirming the export of goods. The taxpayer is given 30 calendar days from the date of receipt of the inspection request to submit such documents. Reason: Federal Law of August 3, 2018 No. 302-FZ

If the company ships goods to the EAEU countries, such documents also do not need to be submitted together with the VAT return. But provided that the company has submitted an electronic list of applications for the import of goods and payment of indirect taxes (tax authorities have the right to request them, but selectively).

Export contract

For goods sold for export from October 1, 2021, an export contract to confirm the zero VAT rate can be submitted to the Federal Tax Service only once.

If in the future it is also needed to confirm the export rate, the VAT payer will be able to send a notification drawn up in any form to the inspectorate instead. This notification will need to be sent to the inspectorate along with a VAT return, which reflects the export transactions related to the previously submitted contract.

Confirmation of the zero rate for Russian companies

Until October 1, 2021, when selling goods abroad, Russian companies could not confirm the zero VAT rate if the foreign buyer was a Russian organization. Tax authorities, in this case, demanded payment of VAT in the usual manner - as for domestic sales. Moreover, the fact that the goods crossed the Russian border in this case did not matter to the inspectors, since in order to confirm the export rate, a contract with a foreign one is now needed.

For goods that will be sold for export starting from October 1, 2018, it will be possible to confirm the zero VAT rate even if there is a contract with a Russian organization. According to its terms, the goods must be supplied to a separate division of the company (branch, representative office of a Russian company).

Situations are different.

In Letter No. SD-4-3/ [email protected] the Federal Tax Service clarified other situations related to the calculation of VAT during the transition period. Let's go over them.

The cost of the product shipped before 01/01/2019 has been changed from 01/01/2019. In this case, the tax rate that was in effect on the date of shipment (transfer) is applied, and therefore in column 7 of the CSF (based on clause 3 of Article 168 of the Tax Code of the Russian Federation) it is drawn up no later than five calendar days counting from the date of drawing up the documents specified in clause. 10, Article 172 of the Tax Code of the Russian Federation) reflects the same tax rate as in column 7 of the invoice to which the CSF was drawn up (see also Letter of the Ministry of Finance of the Russian Federation dated October 22, 2018 No. 03-07-09/75650).

Corrected invoice for product shipped before 01/01/2019. According to clause 7 of the Rules for filling out an invoice[5], corrections to invoices are made by the seller by drawing up new copies of invoices in accordance with this document. In the new copy, changes to the indicators (number and date) reflected in line 1 of the previous invoice are not allowed, and line 1a is filled in, where the serial number of the correction and the date of the correction are indicated.

In this regard, if corrections are made to the invoice issued for shipment before 01/01/2019, column 7 of the corrected invoice reflects the tax rate in effect on the date of shipment of the goods and reflected in column 7 of the invoice issued upon shipment .

After 01/01/2019, the return of low-quality goods shipped before 01/01/2019 was made. During the transition to an increased rate, the Federal Tax Service allowed the CSF to be issued for returns of goods in 2021, which will ensure the application of the same VAT rate at which these goods were shipped in 2021. Moreover, it is recommended for the seller to issue a CSF in any case, be it the return of goods accepted or not accepted for registration, whether it is returned by a “traditional” buyer or a special regime buyer.

By the way, the seller transfers one copy of the CSF to the buyer, a VAT payer, to restore the tax accepted for deduction. If the buyer is not a taxpayer or is exempt from fulfilling taxpayer obligations related to the calculation and payment of tax, then when he returns from 01/01/2019 goods shipped (transferred) to him before 01/01/2019, the seller registers an adjustment document in the purchase book containing the total ( summary) data on return transactions completed during a calendar month (quarter), regardless of the cash register readings.

The buyer (if he has accepted the VAT amounts presented to him for deduction), in turn, restores the tax on the basis of the CSF received from the seller, regardless of the period of shipment of the goods, that is, until 01/01/2019 or from the specified date.

VAT is calculated by tax agents. Some of them apply the VAT rate during the transition period in the same way as VAT payers. These tax agents include:

- organizations (IP) purchasing scrap metal and raw animal skins from VAT payers (clause 8 of Article 161 of the Tax Code of the Russian Federation);

- organizations (IP) participating in settlements on the basis of a commission agreement, commission or agency agreement, when goods are sold in Russia by foreign persons who are not registered for tax purposes in the Russian Federation (clause 5 of Article 161);

- Russian railway carriers who, from October 1, 2018, provide services for the provision of rolling stock and containers under an agency agreement, commission agreement or agency agreement (clause 5.1 of Article 161);

- organizations (IP) selling confiscated property, ownerless valuables and other property mentioned in paragraph 4 of Art. 161.

Another group of tax agents calculates VAT during the transition period in a special way:

- organizations (IP) purchasing from a foreign seller who is not registered with the Russian tax authorities, goods, work or services, the place of sale of which is recognized as the territory of the Russian Federation (clause 4, clause 1, article 148, clauses 1, 2, article 161 Tax Code of the Russian Federation);

- tenants and buyers of state, municipal property or property of constituent entities of the Russian Federation specified in clause 3 of Art. 161 Tax Code of the Russian Federation.

These persons determine the VAT base on the earlier of two dates - the date of payment for shipment or the date of transfer of the advance payment.

The Federal Tax Service emphasized: in the case where the advance was paid before December 31, 2018 inclusive, and the product was shipped already in 2021, the “advance” VAT must be calculated at the rate of 18/118. In the future, the tax is not recalculated (clause 2.1 of Letter No. SD-4-3/ [email protected] ).

In the opposite situation (the product was shipped in 2021 and paid for in 2019), it is also allowed to use a rate of 18/118, despite the fact that the date for determining the tax base falls on 2019. This is explained by the fact that the 20% rate, according to the rules established by Federal Law No. 303-FZ, applies to products shipped starting from 01/01/2019.

"Google Tax" during the transition period. The Federal Tax Service also spoke out regarding the calculation of the so-called Google tax during the transition period (clause 2.2 of the letter). In a nutshell[6]: if payment for services in electronic form is received in 2021, a foreign organization (remember, from 01/01/2019 it itself pays VAT to the budget - clause 3 of Article 174.2 of the Tax Code of the Russian Federation) will calculate VAT using settlement rate:

- 15.25% – when services are provided up to December 31, 2018 inclusive;

- 16.67% – when services are provided starting from 01/01/2019.

If a foreign organization received an advance in 2021 or earlier for services that will be provided in 2021, it should not calculate VAT, since on the date of transfer of the advance the buyer (organization or individual entrepreneur), being a tax agent, calculated VAT himself (clause 9 Article 174.2 of the Tax Code of the Russian Federation).