Payment

Who must submit reports in form 6-NDFL Tax legislation in part 6-NDFL instructions for

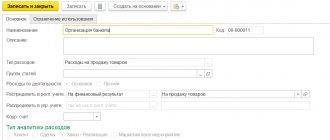

Concept and types of trade Trade is a separate branch of the economy associated with the process of transfer of inventories

Business lawyer > Accounting > Accounting and reporting > How to fill out a Report

Home — Articles Calculation and payment of tax payments are the most important responsibility of any business entity

In the interests of business, various meetings are held with investors, potential clients, creditors and other entities

An invoice is a document intended for tax accounting. Based on the received invoice, accounting and

In accordance with Article 136 of the current Labor Code of the Russian Federation, the organization must make calculations according to

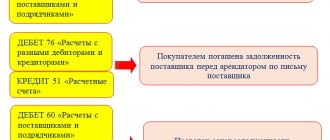

How does legislation affect the nuances of accounting for payments to a third party? In order of production

A unit of equity participation in a company can be with or without par value.

Classification of payers In accordance with Art. 19 of the Tax Code, taxpayers are individuals and