Payment

Is there a tax on currency transactions in the Russian Federation Directly conducting transactions with currency, cash

Types of securities In accounting for the purposes of revaluation, securities are divided into: financial investments,

In this article we will look at how a desk audit of 3-NDFL is carried out, its timing, and also how to find out

All car owners who purchase vehicles are aware of the Tax Code of the Russian Federation, according to which owners

Accounting books for individual entrepreneurs: new forms Instructions were approved by the Ministry of Taxes Resolution dated January 30, 2019 N 5

In times of crisis, organizations quite often need to sell receivables. More often

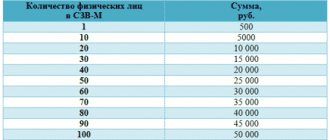

Composition and deadlines for submitting reports to the Pension Fund from 2021 Organizations and individual entrepreneurs,

For a whole year now, organizations and entrepreneurs have been transferring insurance premiums to the Federal Tax Service for new BCCs.

The provisions of Law No. 402-FZ of December 6, 2011 “On Accounting” separate the concepts of drawing up and approving an annual

Who must submit reports in form 6-NDFL Tax legislation in part 6-NDFL instructions for