How does legislation affect the nuances of accounting for payments to a third party?

The order of accounting entries made when paying for third parties may be influenced by legal regulations.

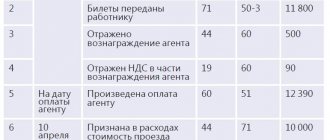

The law does not prohibit a company or individual entrepreneur from paying off the obligations of third parties. The subtleties of this procedure are described in Art. 313 Civil Code of the Russian Federation. But there is a limitation for such an operation - the presence in the law or agreement between the parties of a clause on the mandatory fulfillment of obligations personally by the participants in the transaction. If such a condition exists, additional entries in the accounting of counterparties will not be needed - all transfers under the agreement will occur without the participation of third parties.

Although no one prohibits a third party from financially supporting the debtor. This person can transfer money to pay off the debt, for example, as part of a loan agreement. In this case, settlements between the debtor and the third party will be made within the framework of the loan agreement using the accounting entries inherent in this type of agreement.

Find out what transactions are used when recording loans in accounting from this material.

We will describe below what transactions are made when paying for a third party.

How to reflect payment to a supplier through third party posting

Although no one prohibits a third party from financially supporting the debtor. This person can transfer money to pay off the debt, for example, as part of a loan agreement.

In this case, settlements between the debtor and the third party will be made within the framework of the loan agreement using the accounting entries inherent in this type of agreement.

Find out what transactions are used when recording loans in accounting.

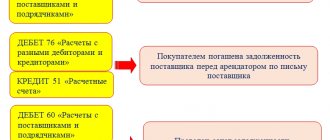

We will describe below what transactions are made when paying for a third party. Repayment of a debt for a third party affects the accounting of the payer, debtor and creditor in most cases:

- payment accounts (50, 51, 55).

- expense accounts (44, 26, 91, etc.);

- settlement accounts (60,62, 76, etc.)

Let's look at the transactions when paying to a third party at the request of the supplier using an example.

What postings should be used to reflect payment for services for a third party?

Organization A notifies organization B that the fulfillment of the obligation to pay for the services provided by it has been entrusted to a third party (company B).

Since Company B does not have a contractual relationship with Organization B, the accounting records of Company B reflect settlements directly with the supplier (Organization A). The amount of the prepayment transferred to the creditor of organization A is counted towards payment for purchased goods, which is reflected by an internal entry in account 60: in the debit of subaccount 60-1 and the credit of subaccount 60-2. operations

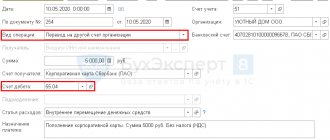

Payment of a debt to a third party on behalf of a supplier in 1C: Enterprise Accounting 8 edition 3.0

In the form that opens, fill in the type of transaction, in our case it will be “Payment to the supplier,” the date, select the recipient of the payment (according to the letter from the supplier), fill in the bank account, amount, contract number and cash flow item.

Now let’s create SALT for account 60 and see the loan debt to Monolit LLC. Next, you need to offset the debt between Sozvezdie LLC and Monolit LLC so that mutual settlements with each of the counterparties are closed.

To do this, fill out the “Debt Adjustment” document.

Payment for third party posting

: Debit 60.01 Credit 60.02 - receivables and payables were offset Fig. 3 Debt adjustment The example discussed in this article can be found on the ITS website (www.its.1c.ru): 1.

Click the Accounting section and select General taxation system. Important

Version 2.

This opens the Directory of Business Transactions. Version 2. 2. Click on the section Calculations and obligations, then open the section Supplier and contractors / The article is called “Payment to a third party at the request of the supplier” (article address: https://www.its.1c.ru/db/hoosn#content :226:2).

The third party has a debt to the Buyer equal to the amount of the Buyer's obligation to the Supplier. On behalf of the Buyer, the Third Party shall pay the amount corresponding to its receivables directly to the Supplier.

Payment for other wiring arrangement

Through the competition, we have created an inspiring collection of business stories told by people who are turning small start-ups into successful companies.

Their experience and advice will be useful to anyone who is thinking about starting their own business.

To start, you need some prerequisites: an idea, some money and, most importantly, the desire to start Magazine Ask your question ← Return Similar questions Show more questions... Don't have a suitable question?

— Ask your question. Articles on this topic Nothing found. And the addressee of the letter, that is, the paying organization, should receive its original. So, the main document for making payment for another legal entity is a letter, a sample of which is presented in the following image.

Reflection in the tax accounting of the payer The company has paid the obligations of its counterparty, and now this operation must be reflected in the accounting. First, let's consider whether this will have any tax consequences for the payer.

Payment for goods by a third party

Therefore, if the third party’s obligation to you was: - payment (prepayment) for goods (work, services), then you need to recognize the proceeds from their sale as income; - repayment of the loan and payment of interest on it, then you must recognize the amount of interest in income; 2) goods (work, services) purchased from the seller are considered paid for (clause

If in payment of a debt of a third party to you, then the posting will be as follows: Dt 60 Kt 62 (58, 78) - Payment was received for shipped goods (work, services) or the loan was returned and interest was paid on it If in payment of an advance payment by a third party , then the postings will be as follows: Dt 60 Kt 62-advance – Advance received Dt 62-advance Kt 68 – VAT calculated on the advance received If a third party issues a loan to you, then the posting will be as follows:

Repayment of debt by a third party: legal features, accounting in “1C: Accounting 8”

So, the obligation under the contract, including those related to payment for goods (work, services), can be fulfilled not only by the debtor himself, but also by a third party who is not a party to the relevant transaction.

This possibility exists if it does not follow from the law, contract or the very essence of the obligation that the debtor is obliged to fulfill it personally () It is important to remember that the debtor, by involving a third party in the fulfillment of the obligation, does not leave the relationship with the creditor, but remains responsible to him for non-fulfillment or improper execution of a contract, for example, for timely payment for goods delivered to him ().

In turn, the creditor is obliged to accept the performance offered for the debtor by a third party ().

Based on these two characteristics, the model of legal relations under consideration should be distinguished from translation

Payment to the supplier by a third party transaction

A standard debt assignment agreement is drawn up taking into account the following information:

- Information about the signatories, their details;

- Amount of debt (full or partial assignment of obligations, information on assignment of fines, penalties, etc.);

- The procedure and timing of debt repayment (one-time satisfaction of obligations or a phased payment schedule).

One of the main documents attached to the agreement is the act of reconciliation of mutual settlements between the delegate and the creditor. This act confirms the existence and amount of obligations on a certain date, as well as the recognition of debt by both parties. When concluding an agreement to replace a debtor, it is mandatory to preserve the form in which the original agreement was concluded.

If the agreement was notarized or registered, then the assignment of the debt must be formalized in compliance with the same conditions. The procedure for transferring debt is reflected in the accounting records of each of the parties that signed the relevant agreement, namely the delegate, the delegate and the creditor.

Payment for another organization

313 of the Civil Code of the Russian Federation, unless the contract strictly stipulates that the debtor must personally fulfill the obligations.

The conditions for the participation of a third party must be documented.

For this:

- The debtor sends a letter to the third party in which he describes the relevant contractual obligations.

- The buyer sends a notice to the creditor indicating information about the third party who is subject to contractual obligations;

All letters can be formatted in any form in accordance with the rules of a business letter, which details the details of the parties and complete information on calculations.

The presence of written notifications allows you to avoid tax claims, since VAT and income tax have already been accrued and only the debt is paid.

How to make a debt adjustment when transferring debt, writing off debt and when offsetting advances in the 1C 8.3 program, read our article.

Transfer of money to a creditor at the request of a supplier: example of postings from the payer and debtor

How should transactions reflect payment for a third party? Repayment of a debt for a third party affects the accounting of the payer, debtor and creditor in most cases:

- settlement accounts (60,62, 76, etc.)

- expense accounts (44, 26, 91, etc.);

- payment accounts (50, 51, 55).

Let's look at the transactions when paying to a third party at the request of the supplier using an example.

Panther LLC sold a batch of goods worth 350,000 rubles. (cost of goods - 286,000 rubles) to PJSC Jaguar. At the same time, Panther LLC owed IP Zavgorodniy P.N. the same amount for renting production premises. Panther LLC appealed to the management of Jaguar PJSC with a request to transfer the debt for the supplied goods directly to the bank account of its lessor to pay off the rent arrears.

How Panther LLC will reflect this operation in its accounting is shown in the figure below (to simplify the example, we assume that VAT is not involved in the calculations):

Such postings are used when paying for a supplier to a third party in the accounting of the supplier himself. What transactions are required to be made by the payer when paying for a third party, see below:

In creditor accounting, the entries will be even simpler. Based on the debtor's notification and a bank statement about the amount received from a third party, he will cover the debtor's debt. No additional wiring is required.

Find out below what documentary support for such operations will be required.

Find out what transactions are reflected in transactions under a receivables transfer agreement (assignment) in this article.

Payment of an invoice by a third party posting in 1s 8 3

Here, on the “Advances to supplier (accounts receivable)” tab, click on the “Fill in” and “Fill in advances for mutual settlements” button. There will be a debt of Cactus LLC to Veda LLC, attributed to advances.

On the second tab “Debt to a third party (accounts payable)” we do the same; the debt of Veda LLC to Tonus LLC will be reflected here. After posting the document, the following posting will be generated: Dt 60.01 Kt 60.

02 and the debt of Cactus LLC and to Tonus LLC will be closed.

Payment for the counterparty by posting letter

is reflected as follows. A payment order is drawn up, which indicates the details of the third party and on the basis of which the payment is made (additional agreement or letter).

Payment for organization by letter of posting

19704 There are cases when the supplier asks to repay the debt for the purchased product or service not to his current account, but to transfer payment of the debt to a third party.

In such a situation, the supplier draws up an additional agreement to the contract or sends the buyer a letter indicating the details of the payee. Let's consider a simple example of reflecting a similar situation in the 1C program: Enterprise Accounting 8 edition 3.0.

Read about the latest changes in this section.

- New BCCs for insurance premiums and simplification were approved

- The rules for filling out field 101 in a payment order have changed.

- Insurance premiums were transferred to the tax authorities.

- New reporting has appeared - calculation of insurance premiums, SZV-STAZH and others.

- In a new way, it is now necessary to confirm the type of activity in the Social Insurance Fund.

- I want to be aware of all changes

Lyubov Kotova answers,

Head of the Department of Legal Regulation of Insurance Premiums of the Department of Tax and Customs Policy of the Ministry of Finance of Russia

“Now on the title page of the calculation there are fields “Code according to OKVED”, “Number of working disabled people”, “Number of workers engaged in work with harmful and dangerous factors.” Previously, you indicated this data in section II.

Then check this with your counterparty. In general, it is better to include such a condition in the contract. If payment for goods or an advance payment will be made by a third company, the buyer is obliged to notify the supplier about this. Otherwise, it is possible that this organization will declare that the funds were transferred by mistake and demand payment of interest on this amount.

If the buyer has confirmed that he has entrusted payment to another organization, then the money credited to the current account should be considered an advance under the supply agreement. Therefore, calculate VAT on these amounts.

And issue an invoice. In this document, provide the details of the payment order.

But on line 6 of the invoice you need to indicate the name of your buyer, and not the name of the company that transferred the advance payment to you.

Let's look at this situation from the buyer's perspective. The buyer must issue a written instruction to the third organization to pay for the goods.

Important

According to the document, a posting will be generated: Dt 60.02 Kt 51, that is, the payment amount will go to the advances issued.

If we open the balance sheet for account 60, we will see our debt to Tonus LLC (on credit) and the debt of Cactus LLC to us (debit).

Now we need to offset these debts. To do this, use the “Debt Adjustment” document, located on the “Purchases and Sales” tab in the “Settlements with counterparties” section.

Select the type of operation “Advance offset” and click on the “Create” button.

In the header of the document we indicate that the advance payment to the supplier must be offset against the debt of our organization to a third party. In the supplier (debtor) column we indicate Kaktus LLC, since this company owes us due to the advance payment. In the third party (creditor) column we indicate Tonus LLC.

Let's go to the tabular part of the document.

CJSC "Alpha";

Debit 41 Credit 60

– 1,000,000 rub. – purchased furniture was accepted for accounting;

Debit 19 Credit 60

– 180,000 rub. – VAT presented by the seller is reflected;

Debit 68 subaccount “VAT calculations” Credit 19

– 180,000 rub. – VAT presented by the seller is accepted for deduction;

Debit 76 subaccount “Settlements with third parties” Credit 51

– 590,000 rub. – the remaining debt was transferred to the account of Alfa CJSC;

Debit 60 Credit 76 subaccount “Settlements with third parties”

– 1,180,000 rub. – the debt to the supplier is offset.

Taxation

. As for income tax, there is nothing unusual here: the organization simply reflects the costs of purchasing goods. This follows from paragraph 1 of Article 253 of the Tax Code of the Russian Federation.

VAT

.

Source: https://yurist-don.ru/oplata-scheta-tretim-litsom-provodki-v-1s-8-3/

What documents will justify postings for payment of a third party's debt?

Payment of a debt for a third party, like any business transaction, must be reflected in the records of all parties involved in the debt repayment procedure. In order for the entries made in accounting to be justified, supporting documents are needed.

It should be noted that the possibility of paying a debt by a third party may be initially provided for in the contract. However, this alone is not enough to reasonably reflect the transaction in accounting.

In general, we can name several supporting documents in this situation:

- A letter from the debtor to the payer with a request to repay the debt to the creditor using the specified details.

A sample letter regarding payment to a third party was prepared by ConsultantPlus experts. Get trial access to the system for free and proceed to the sample.

2. Agreement - order for payment.

It is advisable to issue this document to confirm the debt repayment transaction. It is usually required by tax inspectors during audits. Although the law does not require the mandatory execution of such an agreement when paying a third party’s debt.

- A copy of the payment order confirming the payment made.

A copy of the payment slip with the bank’s mark on the execution of the payment will serve as proof of repayment of the debt and confirm not only the date and amount of the payment, but also the actual payer and recipient of the money.

The payment order must correctly formulate the purpose of the payment - it must be stated that the money is being transferred to pay off a debt for another person. You will need to list the details of the debtor that will allow you to easily identify him (name, tax identification number, etc.).

Otherwise, the amount received by the creditor may be considered unjust enrichment and will have to be returned.

An example of the wording of the purpose of payment when paying for a third party was given by ConsultantPlus experts. Get trial access to K+ for free.

When you need to issue an invoice for the amount of unreasonable compensation, find out here.

- Notification to the creditor about the payment made and an act of reconciliation of mutual settlements with him.

With these documents, the company whose debt was paid by a third party will confirm the validity of recording the fact of repayment of accounts payable.

We will explain in the next section what entries need to be made in accounting when paying tax debts for third parties.

Transfer of salary to a third party: registration procedure, posting – Employee Rights

Payment for a third party - postings - understanding the nuances of accounting for this business transaction is important both for the payer of someone else's debt, and for the debtor and creditor.

In what cases does the law prohibit paying other people's debts, and when there are no obstacles to this? What accounting accounts are involved in this? What documents are used to support accounting entries? You will find the answers in our material.

- How does legislation affect the nuances of accounting for payments to a third party?

- Transfer of money to a creditor at the request of a supplier: example of postings from the payer and debtor

- What documents will justify postings for payment of a third party's debt?

- Tax payments for a third party: postings from the debtor

- Transactions with the payer when paying off someone else's tax debts

- Results

How does legislation affect the nuances of accounting for payments to a third party?

The order of accounting entries made when paying for third parties may be influenced by legal regulations.

The law does not prohibit a company or individual entrepreneur from paying off the obligations of third parties. The subtleties of this procedure are described in Art. 313 Civil Code of the Russian Federation.

But there is a limitation for such an operation - the presence in the law or agreement between the parties of a clause on the mandatory fulfillment of obligations personally by the participants in the transaction.

If such a condition exists, additional entries in the accounting of counterparties will not be needed - all transfers under the agreement will occur without the participation of third parties.

Although no one prohibits a third party from financially supporting the debtor. This person can transfer money to pay off the debt, for example, as part of a loan agreement. In this case, settlements between the debtor and the third party will be made within the framework of the loan agreement using the accounting entries inherent in this type of agreement.

Find out what transactions are used when recording loans in accounting from this material.

We will describe below what transactions are made when paying for a third party.

Transfer of money to a creditor at the request of a supplier: example of postings from the payer and debtor

How should transactions reflect payment for a third party? Repayment of a debt for a third party affects the accounting of the payer, debtor and creditor in most cases:

- settlement accounts (60,62, 76, etc.)

- expense accounts (44, 26, 91, etc.);

- payment accounts (50, 51, 55).

Let's look at the transactions when paying to a third party at the request of the supplier using an example.

Panther LLC sold a batch of goods worth 350,000 rubles. (cost of goods - 286,000 rubles) to PJSC Jaguar. At the same time, Panther LLC owes the debt to IP Zavgorodniy P.N.

the same amount for renting industrial premises.

Panther LLC appealed to the management of Jaguar PJSC with a request to transfer the debt for the supplied goods directly to the bank account of its lessor to pay off the rent arrears.

How Panther LLC will reflect this operation in its accounting is shown in the figure below (to simplify the example, we assume that VAT is not involved in the calculations):

In creditor accounting, the entries will be even simpler. Based on the debtor's notification and a bank statement about the amount received from a third party, he will cover the debtor's debt. No additional wiring is required.

Find out below what documentary support for such operations will be required.

Find out what transactions are reflected in transactions under a receivables transfer agreement (assignment) in this article.

What documents will justify postings for payment of a third party's debt?

Payment of a debt for a third party, like any business transaction, must be reflected in the records of all parties involved in the debt repayment procedure. In order for the entries made in accounting to be justified, supporting documents are needed.

It should be noted that the possibility of paying a debt by a third party may be initially provided for in the contract. However, this alone is not enough to reasonably reflect the transaction in accounting.

In general, we can name several supporting documents in this situation:

- A letter from the debtor to the payer with a request to repay the debt to the creditor using the specified details.

- An agreement is an order for payment.

It is advisable to issue this document to confirm the debt repayment transaction. It is usually required by tax inspectors during audits. Although the law does not require the mandatory execution of such an agreement when paying a third party’s debt.

- A copy of the payment order confirming the payment made.

A copy of the payment slip with the bank’s mark on the execution of the payment will serve as proof of repayment of the debt and confirm not only the date and amount of the payment, but also the actual payer and recipient of the money.

The payment order must correctly formulate the purpose of the payment - it must be stated that the money is being transferred to pay off a debt for another person. You will need to list the details of the debtor that will allow you to easily identify him (name, tax identification number, etc.).

Otherwise, the amount received by the creditor may be considered unjust enrichment and will have to be returned.

When you need to issue an invoice for the amount of unreasonable compensation, find out here.

- Notification to the creditor about the payment made and an act of reconciliation of mutual settlements with him.

With these documents, the company whose debt was paid by a third party will confirm the validity of recording the fact of repayment of accounts payable.

We will explain in the next section what entries need to be made in accounting when paying tax debts for third parties.

Tax payments for a third party: postings from the debtor

No other payment requires strict adherence to payment deadlines, like the group of tax payments (taxes, fees, insurance premiums). If in most cases it is possible to agree with the counterparty on the postponement of deadlines or to achieve payment in installments, with tax payments the situation is much more complicated. For late tax payments, the taxpayer suffers in all areas:

- Financially - forced to pay penalties and fines for any delay in tax payments (including if there is a delay of 1 day).

- Reputational - thanks to the Transparent Business service, information about unpaid taxes, fees and contributions by the taxpayer is not closed. Interested parties, when assessing a potential partner, if such information is available, may decide the issue of a potential partnership not in his favor.

When and what information tax authorities plan to disclose using the Transparent Business service, please follow the link.

- In the main business activity - if the company plans to participate in competitions to obtain profitable orders. Among the mandatory criteria for selecting applicants for execution of an order may be the requirement that there are no unpaid taxes and fees.

As a result, the issue of timely payment of tax payments is always acute for most taxpayers. And the possibility of repayment of such amounts by third parties becomes particularly relevant. Moreover, from 2021 such an opportunity is directly provided for in Art. 45 of the Tax Code of the Russian Federation.

The following entries are made in the accounting records of the taxpayer for whom tax payments are being made:

Find out what documents tax authorities recommend drawing up in such cases from these publications:

Transactions with the payer when paying off someone else's tax debts

In the previous section, we dealt with the transactions made by the taxpayer when a third party pays off his tax debt. What entries does the payer need to make in such a situation in his accounting?

The posting diagram in the payer's accounting is shown in the figure below:

There is a limitation when paying tax amounts for a debtor - you can only pay off a tax debt for a third party with money. It will not be possible to direct your own tax overpayment for these purposes. Tax legislation does not provide for such a method of repaying tax debts for a third party (letter of the Ministry of Finance of Russia dated June 18, 2018 No. 03-02-07/1/41421).

Is it possible to pay for a third party tax debts that arose before 2021 - the moment from which the law stipulated the possibility of paying taxes and insurance premiums for third parties? Tax authorities do not object and recognize such payments as legitimate.

We discuss here what arguments allow you to pay past tax debts for third parties.

Results

The fact of payment for a third party by posting is reflected in the accounting of both the payer, the creditor, and the debtor. The payer first reflects the transfer of money to the creditor for the debtor at his request, and then carries out offsets (if he himself owed money to the supplier).

If there was no debt initially, it closes the resulting debt upon receipt of money or other assets from the supplier (debtor).

The debtor and creditor use accounting accounts in this operation, depending on the type of debt and other accounting and legislative nuances.

All transactions on accounting accounts must be supported by documents, so it is important to formalize agreements in writing and create a complete package of papers (payment orders, letters, contracts, etc.).

Subscribe to our accounting channel Yandex.Zen

Subscribe

Source:

Transferring salary to a bank card in 2021: postings

The Constitution of the Russian Federation grants citizens of the Russian Federation the right to work

The Labor Code of the Russian Federation regulates the employer’s obligation to pay wages

https://www..com/watch?v=ytadvertise

The Civil Code of the Russian Federation, Part 1, reflects the issues of concluding an agreement

Source: https://zlatschool38.ru/otbor-soiskatelej/perechislenie-zarplaty-tretemu-litsu-poryadok-oformleniya-provodki.html

Tax payments for a third party: postings from the debtor

No other payment requires strict adherence to payment deadlines, like the group of tax payments (taxes, fees, insurance premiums). If in most cases it is possible to agree with the counterparty on the postponement of deadlines or to achieve payment in installments, with tax payments the situation is much more complicated. For late tax payments, the taxpayer suffers in all areas:

- Financially - forced to pay penalties and fines for any delay in tax payments (including if there is a delay of 1 day).

- Reputational - thanks to the Transparent Business service, information about unpaid taxes, fees and contributions by the taxpayer is not closed. Interested parties, when assessing a potential partner, if such information is available, may decide the issue of a potential partnership not in his favor.

- In the main business activity - if the company plans to participate in competitions to obtain profitable orders. Among the mandatory criteria for selecting applicants for execution of an order may be the requirement that there are no unpaid taxes and fees.

As a result, the issue of timely payment of tax payments is always acute for most taxpayers. And the possibility of repayment of such amounts by third parties becomes particularly relevant. Moreover, from 2021 such an opportunity is directly provided for in Art. 45 of the Tax Code of the Russian Federation.

The following entries are made in the accounting records of the taxpayer for whom tax payments are being made:

Find out what documents tax authorities recommend drawing up in such cases from these publications:

- “Paying taxes for a third party - why does the Federal Tax Service ask to conclude an agreement?”;

- “The Federal Tax Service has developed rules for issuing payment slips when paying taxes for third parties”.

Payment for other wiring arrangement

Contents The company's supplier requested that payment for a shipment of goods be transferred not to his bank account, but to his lessor.

LLC "B". In this case, the letter should indicate what debt (under what agreement) LLC “S” will pay the third party, and also on the basis of what agreement the third party receives this money.

He explains this by saying that he must pay off his rent arrears, but currently has no available funds. Can a company in such a situation make payment for another legal entity? Yes, today there is nothing unusual in such a request. After all, the law allows business entities to pay their obligations not only directly.

It is quite acceptable that another organization transfers funds on behalf of the debtor.

Legal basis The right of the debtor to transfer the obligation to pay for it to a third party is provided for by the Civil Code. This is stated in Article 313. Close Every year the SKB Kontur company holds a competition for entrepreneurs “I am a Businessman”, hundreds of businessmen from different cities of Russia take part in it - from Kaliningrad to Vladivostok.

Transactions with the payer when paying off someone else's tax debts

In the previous section, we dealt with the transactions made by the taxpayer when a third party pays off his tax debt. What entries does the payer need to make in such a situation in his accounting?

The posting diagram in the payer's accounting is shown in the figure below:

There is a limitation when paying tax amounts for a debtor - you can only pay off a tax debt for a third party with money. It will not be possible to direct your own tax overpayment for these purposes. Tax legislation does not provide for such a method of repaying tax debts for a third party (letter of the Ministry of Finance of Russia dated June 18, 2018 No. 03-02-07/1/41421).

Is it possible to pay for a third party tax debts that arose before 2021 - the moment from which the law stipulated the possibility of paying taxes and insurance premiums for third parties? Tax authorities do not object and recognize such payments as legitimate.

We discuss here what arguments allow you to pay past tax debts for third parties.

Reflection in accounting when paying by a third party.

Natalya Andreevna! Help me understand the following situation: LLC “A” is renting premises from LLC “B”. A security deposit is required under the lease agreement.

At the time the relationship arose, LLC “A” did not have enough funds to pay the security deposit. The founder of LLC "A" finds LLC "C", which, referring to the lease agreement between LLC "A" and LLC "B", transfers a security deposit to the account of LLC "B". That is, payment has been made from a 3rd party. How to formalize it correctly this situation in the accounting department of LLC "A"? what documents, postings. Thank you in advance Your personal expert answers In this situation, LLC “A” should send a letter to LLC “C” with a request to transfer the debt under the supply agreement to a third party, i.e.

Results

The fact of payment for a third party by posting is reflected in the accounting of both the payer, the creditor, and the debtor. The payer first reflects the transfer of money to the creditor for the debtor at his request, and then carries out offsets (if he himself owed money to the supplier). If there was no debt initially, it closes the resulting debt upon receipt of money or other assets from the supplier (debtor). The debtor and creditor use accounting accounts in this operation, depending on the type of debt and other accounting and legislative nuances.

All transactions on accounting accounts must be supported by documents, so it is important to formalize agreements in writing and create a complete package of papers (payment orders, letters, contracts, etc.).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for acquiring transactions in 1C 8.3 Accounting 3.0

Increasingly, payments received from customers are made electronically and by bank cards. There are also frequent situations when buyers purchase goods on credit.

In this article we will look at:

- how to reflect revenues from sales on payment cards and bank loans in 1C 8.3;

- what accounting entries are generated for acquiring in retail trade;

- How to close account 57 in 1C 8.3.

Acquiring settings in 1C

To be able to reflect transactions on payment cards (bank loans):

- set up an acquiring agreement with a bank or other credit institution:

Transactions on payment cards and bank loans in 1C 8.3

The processing of payment by payment card and bank loan depends on the moment at which the payment occurred.

If you are reflecting an advance payment (for example, when purchasing in an online store) or receiving retail revenue from NTT on payment cards, use the Payment card transaction in the Bank and cash desk - Cash desk - Payment card transactions section.

In this case the Operation Type according to the following principle:

- Payment from the buyer - upon receipt of an advance (even from a retail buyer);

- Retail revenue - capitalization of revenue from NTT.

If payment is made at the time of purchase, indicate it on the Non-cash payments the Retail Sales Report document (section Sales – Retail Sales – Retail Sales Reports).

In each of the proposed methods, you need to configure the Payment type :

- Payment method : Payment card - payment is made by bank cards;

- Bank loan - the purchase was purchased on credit;

- Own gift certificate and third-party gift certificate - the purchase was paid for with a certificate or gift card;

As a rule, payment by payment card does not arrive immediately to the organization’s current account, but after 1-3 days, so it is accounted for in account 57.03 “Sales by payment cards.”

- Settlement account - 57.03 “Sales by payment cards”;

- Bank commission - the amount of the bank's commission, minus which payment will be received from the buyer to the account: Fixed amount - a fixed percentage of the commission;

- Depends on the transaction amount - set the amount interval and the commission amount for each interval.

Let's look step by step at how to formalize these two situations in 1C using examples.

Prepayment in the online store

The organization sells goods through an online store. Accounting is carried out without using account 42 “Trade margin”.

On July 16, payment was received from the buyer for the goods using a payment card through the website. For payments by plastic cards, an acquiring agreement has been concluded with PJSC VTB. The bank commission is 2% of the payment amount.

July 17 product Curtain set “VERDI” (1 piece) price 5,900 rub. (including VAT 18%) is shipped to the buyer.

Buyer payment via online store

Receipt of an advance payment from the buyer using a payment card is documented in the document Transaction on a payment card, transaction type Payment from the buyer in the section Bank and cash desk - Cash desk - Transactions on payment cards.

Please indicate:

- Counterparty is the buyer who paid for the purchase with a payment card. If the payment came from an individual, the type of counterparty - Individual .

- Payment type —setting up an acquiring agreement with a bank, selected from the Payment Types directory :

- Payment amount - the amount of payment by bank card.

In the tabular section, fill out the payment breakdown, where you can indicate the order and invoice that the online store generates.

Postings

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

Crediting payment from the paying agent to the current account

When the bank credits customers' payments via payment cards to the current account, complete the document Receipt to current account transaction type Receipts from sales on payment cards and bank loans based on the document Payment card transaction by clicking the Create button based on – Receipt to current account .

The document will be filled in automatically.

Check:

- Payer is the bank with which the acquiring agreement is concluded.

- Amount - the amount that the bank credited to the account according to the statement. This is the amount of payment from buyers minus the amount of remuneration from the acquiring bank.

- Settlement account - 57.03 “Sales by payment cards.”

- The amount of services is the acquiring bank's remuneration for transferring payment.

- Cost account - 91.02 “Other expenses”.

- Other income and expenses - Expenses for banking services , selected from the directory Other income and expenses with the Type of article - Expenses for banking services .

Postings

Checking settlements on account 57.03

After the payment has been received into the organization’s account, there should be no balance on account 57.03. Account Analysis report in the Reports - Standard Reports - Account Analysis section.

The absence of a final balance on account 57.03 shows that the buyer’s payment was received in full minus the bank’s remuneration amounts. There is no debt to the bank.

Sales of goods

Document the sale of goods with the document Sales (act, invoice) transaction type Goods (invoice) in the Sales – Sales – Sales (acts, invoices) section.

Please indicate:

- Warehouse - retail outlet, selected from the Warehouses , type Retail store ;

- Account for settlements with the counterparty - 62.01 “Settlements with buyers and customers”.

- Account for accounting of settlements for advances - 62.02 “Settlements for advances received.”

In the tabular section, enter the goods sold from the Nomenclature .

Postings

Payment through a terminal in a retail store

The organization retails goods through an automated point of sale (ATP). Accounting is carried out without using account 42 “Trade margin”.

To receive payments via plastic cards, an acquiring agreement was concluded with VTB PJSC. The bank commission is 2% of the payment amount.

On June 11, the following goods were sold for a total amount of 88,500 rubles:

- Roller blind “BLACKOUT FIBER” – 10 pcs. at a price of 4,130 rubles.

- Thread curtains “Africa”—20 pcs. at a price of RUB 2,360.

Payment for goods was made by payment card.

On June 12, the payment made by payment card was credited to the bank account.

Retail sales of goods

Fill out a detailed report on goods sold using the document Retail Sales Report, transaction type Retail in the Sales – Retail Sales – Retail Sales Reports section.

Please indicate:

- Warehouse is a retail outlet, selected from the Warehouses , type Retail store .

On the Products , fill in the products sold from the Nomenclature .

On the Non-cash payments , indicate all types of non-cash payments (payment card, electronic means, etc.):

- Payment type - setting up an acquiring agreement with the bank, selected from the Payment Types .

- Amount — the amount of non-cash payment.

Next, we will consider accounting entries in 1C when paying through the terminal.

Postings

Crediting payment by payment card to the current account

When the bank credits customers' payments via payment cards to the current account, document the document Receipt to the current account, transaction type Receipts from sales on payment cards and bank loans in the section Bank and Cash - Bank - Bank statements - Receipt.

Please indicate:

- Payer is the bank with which the acquiring agreement is concluded.

- Amount - the amount that the bank credited to the account according to the statement. This is the amount of payment from buyers minus the amount of remuneration from the acquiring bank.

- Settlement account - 57.03 “Sales by payment cards.”

- The amount of services is the acquiring bank's remuneration for transferring payment.

- Cost account - 91.02 “Other expenses”.

- Other income and expenses - Expenses for banking services , selected from the directory Other income and expenses with the Type of article - Expenses for banking services .

Postings

Acquiring: postings in accounting under the simplified tax system in 1C 8.3

The organization entered into an acquiring agreement with VTB PJSC to receive payments from customers using plastic cards. The bank commission is 2% of the payment amount.

On June 28, payment made by payment card in the amount of RUB 15,600. arrived in the bank account.

Income under the simplified tax system is reflected in KUDiR at the moment payment is received from the buyer to the organization’s account, i.e. when entering the document Receipt to the current account, the transaction type is Receipts from sales on payment cards and bank loans in the section Bank and Cash – Bank – Bank statements – Receipt.

Postings

Reflection in KUDiR

Acquiring: accounting entries when combining simplified taxation system and UTII in 1C 8.3

If the retail store is located on UTII, then when selling, select the appropriate income account 90.01.2.

Thus, when payment is received, the program will reflect the income according to UTII. Let's consider the postings of the document Receipt to the current account type of operation Receipts from sales on payment cards and bank loans .

Postings

Reflection in KUDiR

Test yourself! Take the test:

See also:

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Source: https://BuhExpert8.ru/obuchenie-1s/1s-buhgalteriya-8-3/uchet-ekvajringovyh-operatsij-v-1s-8-3-buhgalteriya-3-0.html

Payment of debt by a third party in 1s 8.3 accounting

Previously, the tax service considered this option unacceptable - the taxpayer was obliged to pay his taxes independently.

We issue a payment order, based on it you can create a bank statement with the type debit from the current account - payment to the supplier.

Here the recipient of the payment is indicated, in our example, Kaktus LLC, the agreement (you can simply indicate the main agreement, since we do not have an agreement with Kaktus LLC), the cash flow item and the amount.

The operation will not entail any other tax consequences.

Payment for goods by a third party

Question How to take into account payment for goods (works, services) by a third party? Answer Accounting for the debtor - buyer of goods (works, services) In case of OSN, payment for goods (works, services) purchased by you does not affect income tax and VAT, regardless of who transfers the money to the seller - you yourself or a third party.

There is one exception - if the money transferred by a third party to your seller is counted towards the advance payment that the third party must pay you for the supply of goods (work, services) subject to VAT. In this case, it is necessary (clause 2, clause 1, art.

167, paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, clause 2 of the Federal Tax Service Letter of 02/28/2006 N MM-6-03/ [email protected] ): - calculate VAT on the advance amount equal to the amount transferred by a third party to your seller; - within 5 calendar days from the date of transfer of money by a third party, draw up an advance invoice in two copies, one of which is registered in the sales book, and the second is transferred to a third party.

Taxes

In this case, Ivanov receives income from organization A, which owes him. Therefore, organization B will be the tax agent. After all, according to Art. 226 of the Tax Code, a tax agent is recognized as an organization from which or as a result of relations with which an individual received income. Ivanov did not receive any income from Organization B. The “author” of the income remained organization A, on whose instructions the money was transferred. Therefore, B should not withhold the amount of personal income tax when paying.

But organization A cannot keep the money, since it does not pay it.

Right

In the situation under consideration, organization B “closes” the debt to the legal entity. But in fact, the settlement occurs between organization B and individual Ivanov. The Civil Code allows the fulfillment of an obligation by a third party in cases where, according to law or contract, the debtor is not obliged to fulfill the obligation personally. In this case, the creditor is obliged to accept the performance offered for the debtor by a third party (clause 1 of Article 313 of the Civil Code of the Russian Federation). Therefore, there is no change of persons in the obligation that arose between organizations A and B.

It turns out that when calculating B and Ivanov, two obligations are closed at once: the obligation that arose between organizations B and A, and the obligation between company A and Ivanov. That is, in fact, the relationship between Ivanov and organization B is based on an obligation that arose between two legal entities. Therefore, when issuing money to Ivanov, a reference must be made in the documents to the fact that the execution is in favor of organization A.

But the limit on cash payments between legal entities does not apply in this case. After all, the settlement occurs not between organizations, but between a legal entity and an individual. Let us remind you that currently for cash payments between legal entities the maximum amount for one transaction is set in the amount of 60 thousand rubles. (Instruction of the Central Bank of Russia dated November 14, 2001 N 1050-U).

M.A. Shcherbakova

Expert "UNP"

How is debt payment carried out by a third party?

The debtor may entrust the fulfillment of contractual obligations to a third party, in accordance with Art. 313 of the Civil Code of the Russian Federation, unless the contract strictly stipulates that the debtor must personally fulfill the obligations.

The conditions for the participation of a third party must be documented. For this:

- The buyer sends a notice to the creditor indicating information about the third party who is subject to contractual obligations;

- The debtor sends a letter to the third party in which he describes the relevant contractual obligations.

All letters can be formatted in any form in accordance with the rules of a business letter, which details the details of the parties and complete information on calculations. The presence of written notifications allows you to avoid tax claims, since VAT and income tax have already been accrued and only the debt is paid.

How to make a debt adjustment when transferring debt, writing off debt and when offsetting advances in the 1C 8.3 program, read our article.