Accounting for penalties in accounting

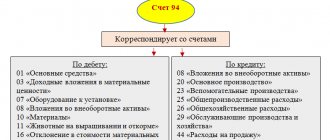

In accordance with the Chart of Accounts (), the amounts of tax penalties due are reflected in the debit of account 99 “Profits and losses” in correspondence with the account for accounting settlements with the tax budget.

Therefore, if an organization was assessed penalties on taxes, then the accounting entry will be as follows:

Debit account 99 - Credit account 68 “Calculations for taxes and fees”

Moreover, since analytical accounting for account 68 is carried out by type of tax, the credit of this account indicates the type of tax for which penalties were accrued.

So, when calculating penalties for value added tax, the posting will be as follows:

Debit account 99 - Credit account 68, sub-account “VAT”

Accordingly, the transfer of the amount of accrued penalties will be reflected in the accounting entry:

Debit account 68, sub-account “VAT” - Credit account 51, etc.

And when calculating penalties for tax under the simplified tax system, the accounting entry, accordingly, will be:

Debit of account 99 - Credit of account 68, subaccount “USN”

When calculating penalties on contributions, accounting entries will also consist of a debit to account 99, but for a loan you need to indicate account 69 “Calculations for social insurance and security”

Results

State duty - posting this payment in accounting has numerous features. The state duty can be attributed to expenses for core activities, other expenses or to an increase in the value of the asset.

When writing off state duty, postings are made using expense accounts in correspondence with the account. 68, to which the corresponding sub-account is opened. The fee for carrying out legally significant actions charged by private notaries is not a state duty, therefore, when carrying out such business transactions in accounting, invoice. 68 is not used.

Penalties under contracts

When calculating penalties in accounting, the entries may be different if we are not talking about a violation of tax laws, but about non-fulfillment of the terms of business agreements concluded between counterparties.

After all, sanctions for violation of the terms of the contract (fine, penalty, penalty, etc.) are other income or expenses, depending on whether these amounts are due for accrual or payment (clause 7 PBU 9/99, clause 11 PBU 10 /99). Therefore, in the entries for calculating penalties for late payments under the contract, it will not be account 99, but account 91 “Other income and expenses” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Thus, for the penalties due for late payment under the posting agreement, the debtor will have the following:

Debit of account 91 “Other income and expenses”, sub-account “Other expenses” - Credit of account 76 “Settlements with various debtors and creditors”, sub-account “Settlements on claims”

And, for example, for penalties due to the lessor under a leasing agreement, the following entry must be reflected:

Debit of account 76 - Credit of account 91, subaccount “Other income”

In accordance with clause 4 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99), expenses, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into: - expenses for ordinary activities; - other expenses. Expenses for ordinary activities are expenses associated, in particular, with the manufacture and sale of products, the acquisition and sale of goods, the performance of work, and the provision of services (clause 5 of PBU 10/99). Expenses other than expenses for ordinary activities are considered other. Expenses in the form of rent can be taken into account by the organization both as part of expenses for ordinary activities, and as part of other expenses, depending on the use of the leased property. In the situation under consideration, the organization will have to incur expenses that represent the repayment of debt in the form of overdue rent based on a court decision. In this regard, these expenses in the form of payment of the principal amount must be reflected as part of other expenses using account 91 “Other income and expenses” in correspondence with account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims”. According to clause 12 and clause 14.2 of PBU 10/99, compensation for losses caused by the organization is accepted for accounting in amounts awarded by the court or recognized by the organization. Moreover, in accordance with clause 18 of PBU 10/99, expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity). Therefore, the necessary accounting entries must be reflected on the date the court decision entered into legal force:

— 1,393,203.52 rub. — an expense is recognized in the form of overdue rent. As the debt is repaid, the following entry will need to be made in the accounting records:

— 100,000 rub. — the amount was transferred (partially) to pay off the debt.

Accounting for state duty

Legal expenses in the form of state fees, incurred by the plaintiff and subject to recovery by decision of the arbitration court from the defendant, on the date of entry into force of the court decision are attributed by the plaintiff to other income and are reflected by an entry on the credit of account 91 in correspondence with the debit of account 76 “Settlements with various debtors and creditors "(clause 7 of PBU 9/99 “Income of the organization”). Accordingly, in the accounting of the defendant, the amounts of compensation for legal costs paid to the plaintiff are classified as other expenses and are reflected in the accounting also on the date the court decision enters into force. The entries to reflect the amount of the refunded state duty will be similar to the entries made in the accounting to reflect the recognition of expenses in the form of overdue rent: Debit 91, subaccount “Other expenses” Credit 76, subaccount “Settlements on claims” - 26,932.04 rubles. - an expense is recognized in the form of a state duty, subject to recovery by court decision. On the date of debt repayment, the following entry will need to be made in accounting: Debit 76, subaccount “Settlements of claims” Credit 51 - 26,932.04 rubles. — the amount of state duty is transferred.

How is the amount of a penalty for violation of contractual obligations paid to the counterparty on the basis of a court decision reflected in the organization’s accounting?

The organization's counterparty filed a claim for payment of a penalty in the amount of 300,000 rubles. for violation of contractual obligations. The organization did not recognize the claim, citing the refusal by the fact that the violation of the terms of the contract occurred for reasons beyond the control of the organization. The counterparty filed a corresponding claim in court. According to experts, the court will decide to collect from the organization at least 280,000 rubles. up to 320,000 rub. (equally likely). The court made a decision to recover 300,000 rubles from the organization in favor of the counterparty. Based on a court decision that has entered into legal force, the funds to be collected are transferred to the counterparty. For the purposes of tax accounting of income and expenses, the organization uses the accrual method.

Composition of expenses in bankruptcy

The insolvency procedure is carried out under the supervision of the Arbitration Court. The body determines the stage of the procedure and the manager conducting financial control of the operations. Covering expenses is carried out at the expense of the debtor and is not compensated by third parties. Expenses subject to judicial approval include:

- Manager's remuneration.

- Payment for current activities in the form of postal, office, and transportation expenses.

- Amounts required for publication of notifications about the start of the procedure in the Bulletin.

- Funds spent on holding public auctions of the debtor's property.

- Payments for the services of appraisers, auditors, experts and others.

When determining the amount of expenses, the validity of the expenses, reasonable amount and proportionality to the result are taken into account.

Accounting

Fines, penalties, penalties for violation of the terms of contracts are recognized as other expenses of the organization and are accepted for accounting in amounts awarded by the court or recognized by the organization (clauses 11, 14.2 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance Russia dated 05/06/1999 N 33n). In the situation under consideration, the organization voluntarily did not recognize the claim, and therefore the counterparty filed a corresponding claim in court. If there is legal proceedings against the organization (including the collection of funds from the organization), an assessment is made of the likelihood of a court decision not in favor of the organization. If such a probability is considered high and the amount to be recovered can be reliably estimated (based on the amounts that can be recovered from the organization by court decision), the organization recognizes an estimated liability. This follows from paragraphs 4, 5 of the Accounting Regulations “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n. The estimated liability is recognized in the accounting records of the organization in the amount reflecting the most reliable monetary estimate of the expenses necessary to settle this liability (clause 15 of PBU 8/2010). In this case, according to experts, the amount to be recovered will be (with equal probability) from 280,000 rubles. up to 320,000 rub. Consequently, the amount of the estimated liability is determined on the basis of paragraphs. “b” clause 17 of PBU 8/2010 as the arithmetic average of these amounts, i.e. will be 300,000 rubles. For accounting purposes, the estimated liability in relation to the amount of the penalty payable by court decision is recognized as another expense and is reflected in the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”, and the credit of account 96 “Reserves for future expenses” " This follows from the provisions of clause 8 of PBU 8/2010, clause 11 of PBU 10/99, as well as the Instructions for the application of the Chart of Accounts for accounting and financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n. To record calculations for payable penalties, account 76 “Settlements with various debtors and creditors” can be used (a separate sub-account “Settlements for payment of penalties for violation of contractual obligations”) (Instructions for using the Chart of Accounts). On the date the court decision enters into legal force, the organization’s accounting in accordance with clause 21 of PBU 8/2010 reflects the occurrence of accounts payable in the amount subject to recovery by court decision and the write-off of a previously recognized estimated liability. In this case, an entry is made in the debit of account 96 in correspondence with the credit of account 76 (Instructions for using the Chart of Accounts). The accounting entry for payment of the amount of the penalty to the counterparty is shown in the following table of entries.

To what account should payments to bailiffs be attributed?

» » In this article, lawyer Alexey Knyazev answers the popular question: “?”.

Question: The organization pays an enforcement fee to the bailiff service. Where to include this amount in accounting and whether or not this amount reduces the taxable base for income tax. Thank you. Answer: According to Art. 112 of the Federal Law of 02.10.2007 N 229-FZ “On Enforcement Proceedings”, the enforcement fee is a monetary penalty imposed on the debtor in the event of his failure to fulfill the executive document within the time limit established for the voluntary execution of the executive document, as well as in the event of his failure to comply with the executive document, subject to immediate execution, within 24 hours from the receipt of a copy of the bailiff's decision to initiate enforcement proceedings.

The performance fee is credited to the federal budget. The enforcement fee is set at 7% of the amount to be collected or the value of the property being recovered, but not less than five hundred rubles from a debtor-citizen and five thousand rubles from a debtor-organization.

In case of non-execution of an enforcement document of a non-property nature, the enforcement fee from the debtor-citizen is established in the amount of five hundred rubles, from the debtor-organization - five thousand rubles. Clause 3 of the Constitutional Court of the Russian Federation of July 30, 2001 N 13-P explains that the enforcement fee is not included in the list of taxes and fees that are established, amended or canceled by the Tax Code of the Russian Federation (clause

clauses 3 and 5 art. 3 of the Tax Code of the Russian Federation), and, therefore, it does not apply to fees in the sense of Art.

57 of the Constitution of the Russian Federation. It is also not a state duty.

The amount, calculated at 7% of the funds collected under the writ of execution, refers, in fact, to coercive measures in connection with non-compliance with the legal requirements of the state.

This measure is a punitive sanction, that is, imposing on the debtor the obligation to make a certain additional payment as a measure of his public legal liability arising in connection with an offense committed by him in the process of enforcement proceedings.

Debt collection through court (postings)

› › › Often, enterprises providing services for the supply of goods or performance of services cannot work on prepayment with all of their clients. And therefore they are faced with malicious debtors among them. When all attempts to resolve this situation have been exhausted, the company's management has no choice but to go to court to collect the debt.

Let's consider a situation where the court made a decision in favor of the creditor and, in addition to the debt, ordered the debtor to return legal costs and imposed a penalty.

To begin with, the acquired fine or the amount of interest for late payment is included in income. In paragraph 3 of Art. 250 of the Tax Code of the Russian Federation spells out in detail about these funds. Accounting will classify these amounts as other income.

Only the fine specified in the court decision is taken into account, since it has the opportunity to reduce the requested penalty if it considers that the requested penalty is too high. The tax base for income tax will be increased by the state duty, which will be compensated. Because the defendant will return it in full.

When the claim was submitted, this amount was written off as expenses.

Debt collection through the court - a procedure providing for the forced return of debt - is carried out through judicial proceedings and enforcement proceedings. As for the amount of debt, the goods were sent but not paid, therefore, the proceeds have already been reflected.

The accrual method implies that it does not matter at what time the firm receives the cash. The same rules come into force if the company has carried out work or provided services. To accept expenses for accounting, it is necessary to obtain a court order that will confirm the expenses (PBU 10/99 clause.

14.2). The court ruling is considered legal as soon as it enters into force.

The state duty is taken into account on the account. 68, legal costs on the subaccount “Settlements for claims” account.

Application of PBU 18/02

When expenses are recognized in accounting in the form of the amount of an estimated liability arising in connection with a legal proceeding, a deductible temporary difference (DTD) and a corresponding deferred tax asset (DTA) arise in the organization's accounting. On the date of recognition of the expense in tax accounting in the form of an amount subject to recovery from the organization by court decision, the above-mentioned VVR and ONA are repaid. This follows from paragraphs 11, 14, 17 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n, taking into account the explanations given in Interpretation R82 “ Temporary differences in income tax” (approved by the Accounting Methodological Center on October 15, 2008).

| Amount, rub. | Primary document | |||

| When recognizing an estimated liability in accounting | ||||

| An estimated liability to pay a penalty to the counterparty has been recognized | Accounting certificate-calculation | |||

| SHE is reflected | Accounting certificate-calculation | |||

| On the date of entry into force of the court decision | ||||

| Reflects the amount payable to the counterparty by court decision | A court decision that has entered into legal force Accounting information | |||

| ONA extinguished | Accounting information | |||

| On the date of payment of penalties to the counterparty | ||||

| The amount recovered by court decision was transferred to the counterparty | Bank account statement | |||

M.S. Radkova Consulting and Analytical Center for Accounting and Taxation

The accrual of penalties under a contract - we will consider postings for such transactions below - is a fairly common procedure in commercial relations. The procedure for accounting for such penalties depends on many factors: the organizational and legal status of the party to the agreement, the type of agreement, the taxation system - we will study them in more detail.

What is a penalty as an accounting object?

A penalty is a penalty determined by law or contract for failure to fulfill obligations by one party to the agreement to the other (others). From an accounting point of view, it is legitimate to consider a penalty:

- other income of the receiving party (clause 7 of PBU 9/99);

- other expenses of the obligated party (clause 11 of PBU 10/99).

Penalties as income are reflected in accounting in the reporting period in which the title documents on the basis of which the penalty was formed appeared. Such a document could be, for example, a court decision or a bilateral act of the parties to the agreement (clause 16 of PBU 9/99). The penalty as income or expense must be reflected in the balance sheet before the actual settlements of the parties (clause 76 of the regulations by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

The main accounting account for generating entries for penalties is 76. Let's study how it and its subaccounts are used to reflect transactions related to the payment of a penalty by a business entity (or its receipt of corresponding income from a counterparty).

Are funds written off from seized accounts legally?

If you don’t agree with the debt, it needs to be challenged in court; the bailiff does his job, which is prescribed to him by his job responsibilities, but unlike others, he does it very quickly.

Apparently, the debt is to the bank, which informed it that you have accounts with a credit institution. Moreover, there are probably not such a large number of banks in your region. November 15, 2021, 15:13 0 0 Anastasia client, city.

Divnogorsk Thank you for your answer! Those. first they wrote off the money, and then the decision arrived by mail.

Shouldn't they have notified me of the initiation of enforcement proceedings and given me a 5-day period for voluntary compliance with the requirements from the moment of receipt of this resolution?

How are fines (penalties) paid by the obligated party to the contract reflected in accounting?

The party to the contract, which is obliged to compensate the counterparty for losses by paying a penalty, will generate the following entries:

- Dt 91.2 Kt 76 (the penalty was recognized on the basis of a title document);

- Dt 76 Kt 51 (the penalty is transferred within the time limits specified by law or contract).

If the penalty is paid to an individual in cash, this will be reflected by the posting: Dt 76 Kt 50.

In cases provided for by law, when making settlements with an individual, not only the penalties paid - fines (penalties) are reflected in the accounting records, but also the taxes and contributions accrued on them.

So, if the recipient of the penalty is an individual who is not registered as an individual entrepreneur, then the following correspondence may additionally be drawn up:

- When the penalty arose within the framework of legal relations under an agreement, payments under which are subject to insurance premiums (for example, under a civil process agreement for the performance of work by an individual):

- Dt 76 Kt 68 (personal income tax charged for a penalty);

- Dt 68 Kt 51 (NDFL paid);

- Dt 91.2 Kt 69 (contributions are calculated for the amount of the penalty - pension and medical, in accordance with subparagraph 1, paragraph 1, article 420 of the Tax Code of the Russian Federation);

- Dt 69 Kt 51 (dues paid).

- When the penalty arose within the framework of other legal relations:

- Dt 76 Kt 68 (personal income tax charged);

- Dt 68 Kt 51 (NDFL paid).

An example of such a penalty is compensation to an individual under a shared construction agreement (letter of the Ministry of Finance of Russia dated September 15, 2017 No. 03-04-06/59629). Contributions for this type of penalty are not charged.

In both of these cases, personal income tax must be paid no later than the next day after the calculations are made (clause 6 of Article 226 of the Tax Code of the Russian Federation). Contributions, if any, are made, as usual, by the 15th day of the month following the date in which the payments were made.

Repayment of debts of accountable persons

Accountable persons are employees of the organization who received funds for expenses for the enterprise with the condition of subsequent reporting for them. The basis for transferring the amount to account is the order of the manager, or a certified statement by him of the person receiving the money on account.

An order must be issued for each issue of an amount for reporting. It must include the full name of the employee, the amount issued for the report, the date of its return and the order number.

If the amount is received by an employee upon application, then the manager will certainly put a note on paper about the amount, the period for which it is received, and put a date and signature.

Typically, amounts of money are reported for the following types of expenses:

- business trips;

- household security;

- payment for fuel and lubricants.

The employee to whom the funds were issued for accounting is obliged to report for them to the accounting department of the enterprise. This must be done using an advance report, to which documents confirming expenses are attached.

If not all amounts have been spent, then the remainder is returned to the company's cash desk. If the amount was overspent, and there is evidence that it was necessary, then the overspending is returned to the employee. The necessity of the expenses incurred is checked and certified by the company management.

If the employee received funds for travel expenses, then the advance report and the unspent amount should be submitted to the accounting department no later than 3 working days upon return.

The write-off of spent funds issued against the report is reflected in the credit of account 71, the basis is the employee’s advance report:

| Debit | Credit | Operation description |

| Dt 20 (26, 10, 08) | Kt 71 | Money issued on account |

| Dt 50 | Kt 71 | Return of unused amount to the cashier |

If an employee purchased inventory items at retail, then when checking by the tax office, you may have to present not only a sales receipt, but also a cash receipt. With the exception of the list of goods for the sale of which a cash register is not required.

If the employee has not returned the amount after the deadline, the following entries are made:

| Debit | Credit | Operation description |

| Dt 94 | Kt 71 | Reflection of the accountable amount |

| Dt 70 | Kt 94 | The unrefunded amount is withheld from the employee's salary. |

Such an action can be taken by the organization’s management no later than a month after the return date, and with the consent of the employee.

Penalty under an employment contract: how to take into account personal income tax and contributions?

If we are talking about the payment of a penalty to an individual under an employment contract (in the general case - in connection with a delay in wages), then other entries will be reflected in the accounting records:

- Dt 91 Kt 73 (the employer's penalties to the employee for wages have been accrued);

- Dt 73 Kt 51 or 50 (penalties paid).

The use of entries, which in turn are associated with the calculation of personal income tax and social contributions for penalties under employment contracts, is characterized by certain nuances.

A penalty under an employment contract is not subject to personal income tax if it is accrued within the limits established by the provisions of Art. 236 Labor Code of the Russian Federation. This is stated in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation and is confirmed by the Ministry of Finance of Russia in letter dated February 28, 2017 No. 03-04-05/11096.

Don't know your rights?

If a collective agreement or a specific employment contract establishes higher standards, then personal income tax is also not charged on interest. But if such standards are not established at the enterprise, then when a higher compensation is actually paid, personal income tax is charged on the difference between this compensation and the standards prescribed in the Labor Code of the Russian Federation (letter of the Ministry of Finance of Russia dated November 28, 2008 No. 03-04-05-01/450).

Contributions for penalties under an employment contract are generally always accrued (letter of the Ministry of Labor of Russia dated April 27, 2016 No. 17-4-OOG-701). Although in judicial practice there are also opposing positions (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13). But strictly speaking, according to the letter of the law, contributions must be calculated and, in order to avoid legal disputes, it is recommended.

If you need to reflect personal income tax on a contractual penalty, the following entries apply:

- Dt 73 Kt 68 (personal income tax withheld for a penalty);

- Dt 68 Kt 51 (NDFL paid).

Insurance premiums are reflected in the same entries as in the case of a civil contract.

Government duty

Almost every organization in the process of economic activity has to participate in litigation. Sometimes the business entity itself sues unscrupulous contractors, and sometimes it becomes necessary to act as a defendant. We must not forget about disputes with tax authorities, which very often end up in arbitration courts. When participating in a lawsuit, an organization incurs certain costs.

Leonid SOMOV Tax lawyer

In general, legal costs can be divided into state fees and costs associated with the consideration of the case. The Arbitration Procedure Code of the Russian Federation specifies the composition of the costs associated with the consideration of the case. Thus, in accordance with Article 106 of the Arbitration Procedure Code of the Russian Federation, such costs include:

• sums of money to be paid to experts, witnesses, translators;

• costs associated with on-site inspection of evidence;

• expenses for the services of lawyers and other persons providing legal assistance (representatives);

• other expenses incurred by persons participating in the case in connection with the consideration of the case in the arbitration court.

If the case is heard in courts of general jurisdiction, and this happens when the plaintiff or defendant is a citizen of the Russian Federation or a foreign person, then the costs associated with the consideration of the case, in accordance with Article 94 of the Civil Procedure Code of the Russian Federation, include:

• amounts to be paid to witnesses, experts, specialists and interpreters;

• expenses for translation services incurred by foreign citizens and stateless persons, unless otherwise provided by an international treaty of the Russian Federation;

• travel and accommodation expenses of the parties and third parties incurred by them in connection with their appearance in court;

• expenses for the services of representatives;

• costs of on-site inspection;

• compensation for actual loss of time;

• postal expenses incurred by the parties related to the consideration of the case;

• other expenses recognized by the court as necessary.

Regarding tax disputes, let us recall that the Constitutional Court of the Russian Federation, in its ruling dated February 20, 2002 No. 22-O on the complaint of the open joint-stock company "Bolshevik" about the violation of constitutional rights and freedoms by the provisions of Articles 15, 16 and 1069 of the Civil Code of the Russian Federation, noted that all losses, related to unlawful actions of the tax inspectorate, including the costs of paying lawyers, should be included in the damages reimbursed to the winning party. Before the definition of the Constitutional Court of the Russian Federation, arbitration courts considered these costs not losses, but legal costs that must be compensated in a special manner.

When filing a claim with an arbitration court, you must pay a state fee (Article 102 of the Arbitration Procedure Code of the Russian Federation). Its dimensions are established by the Law of the Russian Federation of December 9, 1991 No. 2005-1 “On State Duty”. The amount of the state duty depends on the nature of the claim and its price. The state fee for cases considered in arbitration courts, with claims of a property nature, is:

• 5% of the claim price, but not less than one minimum wage if the claim price is up to 10,000 rubles;

• 500 rub. + 4% of the amount over 10,000 rubles. with a claim price of 10,000 rubles. up to 50,000 rubles;

• 2100 rub. + 3% of the amount over 50,000 rubles. with a claim price of 50,000 rubles. up to 100,000 rubles;

• 3600 rub. + 2% of the amount over 100,000 rub. with a claim price of 100,000 rubles. up to 500,000 rubles;

• 11,600 rub. + 1% of the amount over 500,000 rubles. with a claim price of 500,000 rubles. up to RUB 1,000,000;

• 16,600 rub. + 0.5% of the amount over 1,000,000 rubles, but not more than 1,000 minimum wages if the claim price is over 1,000,000 rubles.

The state duty for other claims or applications considered in arbitration courts is set as a multiple of the minimum wage. Its maximum value - 20 minimum wages - is established for claims regarding disputes arising during the conclusion, amendment or termination of contracts, and for disputes regarding the recognition of transactions as invalid.

From appeals and cassation complaints against decisions and resolutions of the arbitration court, as well as against rulings on termination of proceedings in the case, on leaving the claim without consideration, on the imposition of court fines, on the issuance of a writ of execution for the forced execution of decisions of the arbitration court and on the refusal to issue a writ of execution The state fee is charged in the amount of 50% of the amount of the state fee collected when filing a claim of a non-property nature, and for disputes of a property nature - from the amount of the state fee calculated on the basis of the amount disputed by the applicant (clause 2 of Article 4 of Law No. 2005-1) .

The amount of the state fee when filing a claim in a court of general jurisdiction is established by paragraph 1 of Article 4 of the law on state fees.

How to take into account the penalty for the entitled party?

In turn, the party that receives the counterparty’s penalty under the contract will reflect the following entries in the accounting records:

- Dt 76 Kt 91.1 (the penalty was recognized by the court or the parties in accordance with the supporting document);

- Dt 51 Kt 76 (the penalty is credited to the company’s current account).

Note that according to account 76, it makes sense for the authorized party (by the way, as well as the obligated party) to use a separate sub-account to account for penalties and other penalties under civil contracts - 76.2.

Separate nuances characterize the establishment of the company’s obligation to charge VAT on the received penalty (if the taxpayer works under the OSN). This issue is highly controversial. It will be useful to familiarize yourself with the arguments for and against the calculation of VAT in legal relations involving the formation of a penalty.

Penalty and VAT: should tax be charged?

There are 2 opposing points of view regarding this issue:

- VAT must be charged because, in accordance with subparagraph. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is formed from any amounts that are associated with payment for goods sold (and there is no obvious reason to consider the amount of the penalty as an exception).

- There is no need to charge VAT, since the agreement on penalties in accordance with Art. 331 of the Civil Code of the Russian Federation is drawn up separately from the main agreement of the parties. Therefore, the penalty should not be associated with payment for goods (letter of the Ministry of Finance of Russia dated 06/08/2015 No. 03-07-11/33051).

If we talk about the type of penalty accrued on the basis of Art. 317.1 of the Civil Code of the Russian Federation (on interest for illegal withholding of funds), the Ministry of Finance allows VAT to be charged on the amount of such a penalty if there is a connection between it and payment for goods, without explaining the specific criteria for establishing the fact of such a connection (letter from the Ministry of Finance of Russia dated 03.08.2016 No. 03-03-06/1/45600).

Thus, the taxpayer determines whether or not to charge VAT. If there is objectively no reason to consider the penalty related to the receipt of payment for the goods, no tax is charged.

But if the company believes otherwise, then VAT transactions will be reflected (by the authorized party) in the accounting registers using the following entries:

- Dt 91.2 Kt 76 (sub-account “VAT”) - VAT is charged on the amount of the calculated penalty;

- Dt 76 Kt 68 - VAT is charged on the amount of the penalty received;

- Dt 68 Kt 51 - VAT on the penalty has been paid.

The penalty under the contract can be written off by the entitled party. Let's study which entries reflect this in accounting.

Basic entries in accounting for state duties - all about taxes

All companies have to face the need to pay state taxes. duties. In different cases, its size and payment terms are individual. In this article, we will look at how state fees are calculated and paid in accounting entries.

For legal entities, the most common reason why they have to pay a state fee is the commission of legal actions and state. registration. Also, some of the common reasons for paying a fee are: applying to a notary, acquiring property and rights, and legal proceedings.

Main types of state duty for a company

State duties for legal entities can be divided into three types:

- Acquisition of rights or property - state. a fee is paid for their registration.

- Operations related to the organization's activities - a very wide range: urgent issuance of an extract from the Unified State Register of Legal Entities, changes in constituent documents, issuance of permits and certificates, provision of licenses, etc.

- Litigation – state. fee for filing a statement of claim in court, complaints, initiation of legal proceedings, etc.

Accounting for state duties in accounting and tax accounting

In accounting, the state duty is reflected in the credit of account 68, and payment is reflected in the debit. For the first case mentioned above, state. the duty is taken into account as part of the acquired property or rights.

The postings will be as follows:

- Debit 08 (10.41...) Credit 68.10 - state duty for the acquisition of rights or property.

- Debit 20 (26.44...) Credit 68.10 - state duty on transactions related to the main activities of the company.

- Debit 91-2 Credit 68.10 - state duty on transactions unrelated to the main activities of the company.

- Debit 68.10 Credit 51 - transfer of state duty.

The state fee for notary services can be paid by the accountable person. Then the wiring will look like this:

- Debit 68.10 Credit 71 – state duty paid by the accountable person.

In tax accounting, this type of business transaction is taken into account as other expenses of the organization. The moment of recognition is the date of accrual. In this case, the following conditions must be met:

- State duty is paid in accordance with legal requirements.

- The state fee is expedient for the organization and incurs financial costs.

- The amount of the fee is determined and paid.

- When paying through accountable persons, there are documents confirming its transfer.

The only exception is the payment of state taxes. fees for company registration. It is not accepted as expenses.

Return of state duties

Refund of the state duty is not possible in all cases. The full list is given in Article 333.40 of the Tax Code of the Russian Federation. There you can also find cases where the return of the state. duties is not possible.

- Debit 51 Credit 68.10 - return of funds to the current account

Then you need to reverse the entries for writing off expenses for paying government expenses. duties.

Examples of calculation and payment of state duties in transactions

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 68.10 | 51 | Payment of the state fee for issuing the Unified State Register of Legal Entities | 400 | Payment order |

| 91.02 | 68.10 | State taken into account duty as part of other expenses | 400 | Accounting information |

| 71.01 | 50 | Money was given to the employee to pay state fees. notary fees | 180 | Account cash warrant |

| 68.10 | 71.01 | Payment of state notary fees | 180 | Receipt |

| 91.02 | 68.10 | State taken into account duty as part of other expenses | 180 | Advance report |

Source:

To what account should the state duty be attributed?

To account for state duty in accounting, you should use account 68, subaccount “State duty”. To select an expense account for the payment of state duty, you should refer to PBU 10/99 in accordance with the purpose of the expense group.

If costs are allocated to the expense item “Conducting current activities”, then they will relate to expenses for ordinary (core) activities:

When does an enterprise have expenses for paying state duty?

GP should be paid to the tax office to certify copies of documents, signatures of officials and translations. To obtain certificates of power of attorney from public or private notaries, you must pay a fee.