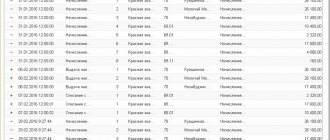

Payment

Position of the tax authority During the audit, the tax authority established that the invited consultant in the specialty

Providing entrepreneurs with the opportunity to reduce the amount of tax on UTII by the amount of expenses spent on the purchase,

The concept of a safe tax burden is familiar firsthand to most organizational leaders and practicing accountants. This

From July 1, 2021 and January 1, 2021, the Russian Federation will introduce

In modern business, situations arise when entrepreneurs provide each other with financial support in the form of

The uniqueness of the simplified taxation system lies, in particular, in the fact that the taxpayer applying this special regime

UTII, USN, PSN, OSNO. For some, these abbreviations mean nothing, but for the owners

Foreign exchange transactions can sometimes be a nightmare. Obviously, when one company trades with

What is tax accounting for and how to determine it? The main task of tax accounting in

a list of bonuses relevant for a particular company; a note on the frequency of issuance of specific bonuses, as well as