Tax registers for VAT: sample

The forms are accepted and compiled by the accounting department of the enterprise based on the provisions of the Tax Code of the Russian Federation, accounting standards and generally accepted recommendations for tax accounting . The sample tax registers for VAT contain the following mandatory components:

- Document's name;

- Analysis period;

- Units of measurement (in kind or monetary form);

- List of business transactions;

- FULL NAME. and the signature of the originator.

What are registers

Due to the fact that the most detailed description of the rules for maintaining tax registers is given in Chapter.

The Tax Code of the Russian Federation, dedicated to profit (Articles 313, 314 of the Tax Code of the Russian Federation), and a small article is devoted to VAT registers. 169 of the Tax Code of the Russian Federation, it would be logical to consider this issue using a set of provisions of the Tax Code of the Russian Federation and the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Registers used for tax purposes are designed to register and accumulate information contained in primary documents, accounting statements and analytical tables. At the same time, there are strict requirements for maintaining such registers: there should be no omissions or corrections in them, registration of imaginary or feigned accounting objects is not allowed, etc.

Registers in tax accounting are special forms for compiling and systematizing data for the reporting period. The data entered into the registers must be compiled in accordance with the requirements established by Chapter. 21 Tax Code of the Russian Federation. This information is grouped and registered without reflecting transactions, that is, a record is simply made for the taxable object. In this case, data entry into registers must be carried out continuously and in chronological order.

It is important for the taxpayer to ensure the creation of such an analytical accounting of incoming information that would reveal the procedure for forming the tax base. The registers accumulate and are subject to systematization of information contained in primary documents that are accepted for accounting.

There are registers for tax accounting and accounting. Based on formal characteristics, the following differences can be distinguished:

- accounting registers, which are drawn up in the form of books, contain records of primary documents;

- Only information from accountant’s certificates and calculation tables, which can also be equated to primary accounting documents, is entered into analytical registers for tax purposes.

How to maintain accounting and tax registers , learn from the materials :

- “Accounting registers (forms, samples)”;

- “How to maintain tax registers (sample).”

Tax accounting registers must be formed for all business transactions taken into account for tax purposes. And if, as mentioned above, the procedure for recording and systematizing taxable objects corresponds to the order of grouping and reflection in accounting, then accounting registers can also be declared as tax accounting registers. This means that all objects recorded in such registers will also be used to determine the tax base.

In this regard, the taxpayer, having analyzed his business operations, must choose for which accounting objects he should approve the forms of registers created for tax purposes. This must be done to ensure that all information that is required to correctly determine the tax return figures is reflected.

Registers are drawn up in the form of summary forms both on paper and in electronic format. Moreover, if the registers are maintained in the form of machine diagrams, in accordance with clause 19 of the Regulations on accounting and accounting in the Russian Federation, approved. By order of the Ministry of Finance dated July 29, 1998 No. 34n, it must be possible to print them on paper.

You are allowed to enter your details into the form of tax accounting registers if it is not possible to enter into the proposed standard ones all the information necessary to designate the tax base (Article 313 of the Tax Code of the Russian Federation). It is important that there is no duplication of records.

The need to make changes to the register form usually arises for the taxpayer if the accounting procedure differs from the tax accounting procedure. The format of these analytical reports, the method of maintaining them and reflecting the data are fixed in the accounting policy of the enterprise. Those officials who compile and sign them (responsible accounting employees) will be responsible for the correct reflection of taxable items in the registers.

Register data should be stored securely to protect it from unauthorized modifications. In this case, corrections can be made if an error was discovered and corrected in a timely manner by the person responsible for maintaining the registers. Each correction must not only be justified, but also confirmed by the signature of the person responsible for maintaining the registers, indicating the date.

Results

Despite the lack of a uniform concept of tax registers in the code, Art. 120 mentions the possibility of applying punishment to the payer in the complete absence of their knowledge. Based on a comprehensive assessment of Art. 169, 313 and 314 of the Tax Code of the Russian Federation in conjunction with Art. 10 of the Federal Law “On Accounting”, it is possible to formulate a list of rules on the basis of which accounting processes in the accounting and tax spheres should be built.

When the existing system of analytical accounts allows you to fully obtain data for tax calculations, there is no need to enter any additional forms: tax accounting will be built on the basis of existing data. It is also possible to enter auxiliary fields into standard forms in order to correctly calculate the tax base.

It is very important to consolidate the list of used registers in the company’s accounting policies, since this can become a decisive argument in a legal dispute. This is due to the fact that inspectorates do not have the right to insist on providing those tax forms that are not enshrined in company policy.

Specifying the topic of tax registers for VAT and being guided by the text of Art. 169 of the Tax Code of the Russian Federation, which states that these are the final forms for registering and grouping primary data, the following options for their practical implementation can be distinguished:

- Journal for recording invoices.

- Book of purchases.

- Sales book.

The entire set of rules, application forms and instructions for preparing these documents are approved in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. Using the information provided therein, the taxpayer has every opportunity to correctly fill out and make the necessary corrections to these documents. It is worth noting that the taxpayer himself is interested in the correct maintenance of registers, since they significantly simplify the process of preparing a VAT return.

Similar articles

- Development of tax registers for income tax

- Tax register for 6-NDFL sample

- List of accounting registers

- Tax accounting registers: what are they and how to prepare them correctly

- Rules for filling out tax accounting registers

Register requirements

In accordance with the requirements established by clause 4 of Art. 10 of Law No. 402-FZ for accounting and analytical registers prescribed in Art. 313–314 of the Tax Code of the Russian Federation, the mandatory attributes of any register are:

- its name;

- the period it covers;

- quantities in physical and monetary terms;

- the name of taxable transactions recorded in chronological order;

- signature of the responsible official.

Registers are necessary to systematize and collect information from primary documents, analytical and calculated summary data for their display when determining the tax base. Analytics of all collected tax accounting information should be organized in such a way that with its help it is possible to determine the entire progress of the formation of the tax base.

At the same time, fiscal authorities are strictly prohibited from establishing other forms of documents (Article 313 of the Tax Code of the Russian Federation), therefore the taxpayer should only take care of using the above details in the registers used.

If corrections need to be made to the register, they are made by the person responsible for its maintenance, indicating the date, initials and signature. In cases where the seizure of registers is expected, copies of the seized registers are included in the accounting documents.

Tax legislation defines only general points that taxpayers should adhere to when preparing tax registers. At the same time, the absence of registers is equated to a gross violation of the rules for accounting for taxable items; the fine for such a violation ranges from 10,000 to 40,000 rubles. (Article 120 of the Tax Code of the Russian Federation).

Registers for tax accounting are consolidated forms in which data is systematized without distribution among accounting accounts (Article 314 of the Tax Code of the Russian Federation), and the requirements regarding mandatory details coincide with the requirements for the preparation of accounting documents. Thus, it can be assumed that the documents used in accounting and tax accounting can also be classified as tax registers.

Only if some information is missing in the accounting register, you can add the corresponding details and use the modified version as a tax accounting register.

An enterprise can be held liable only for the absence of those registers that are specified in its accounting policy (Resolution of the Federal Antimonopoly Service of the North-Western District dated October 10, 2005 No. A42-7611/04-15). There is also judicial practice that is positive for taxpayers, according to which an enterprise itself can not only determine the form of registers, but also decide which lines it needs to fill out in them.

Purpose of the register

accumulation register presented is intermediate; it accumulates information about the status and amounts of incoming VAT:

- presented by suppliers and contractors;

- paid when importing goods into the territory of the Russian Federation;

- accrued by the organization when performing construction and installation work in an economic way;

- etc.

In accounting, incoming VAT is taken into account on account 19 “VAT on acquired values”, but despite this, it is by using the data in the VAT register that it is presented that one can determine whether the conditions for accepting VAT for deduction have been met in the program or not yet.

If the balance on account 19 does not coincide with the balances on the VAT register presented, then an error may arise regarding the “stuck” VAT.

What is required to be displayed in the accounting policy

Each enterprise, in its accounting policy approved for tax purposes, also needs to provide for the procedure for maintaining and compiling documents and registers for tax accounting, including VAT. It will be necessary to describe in detail the rules that must be followed when issuing invoices, maintaining books of purchases and sales, as well as log books and other registers.

In addition, VAT payers must provide in their accounting policies:

- frequency of updating the numbering of invoices;

- the procedure for maintaining separate VAT accounting if the taxpayer carries out taxable and non-taxable transactions or applies different VAT rates;

- scheme for maintaining separate accounting of input VAT.

For details, see the material “How separate accounting for VAT is maintained (principles and methods)” .

You should not neglect your right to establish in your accounting policy the list of registers used for tax accounting. This may be an additional argument in a dispute with the tax authority.

You will find step-by-step instructions for filling out accounting policies for tax purposes in ConsultantPlus. Get trial access to the system for free and upgrade to a ready-made solution.

Incomplete registers

Another common “nit-picking” of inspectors is the filling of lines in the registers themselves. This happens especially often if the taxpayer has decided to use the register forms recommended by the tax service, which we mentioned earlier. So, if inspectors find “empty” lines, they immediately declare the register invalid, since it does not ensure correct accounting. If there is no register, please pay a fine.

However, even here, a study of judicial practice suggests that there is no need to rush to pay fines. As we remember, the Tax Code contains a very limited list of mandatory tax register details. Accordingly, if these details are available, then failure to fill in any other data cannot be considered a violation. After all, registers are needed for the correct formation of the tax base. Therefore, the taxpayer can decide for himself which lines in which of the registers he needs to fill in to achieve this goal (see, for example, the already mentioned resolution of the Federal Antimonopoly Service of the Volga District dated July 14, 2009 No. A65-27027/2007).

*These recommendations are called “Tax accounting system recommended by the Ministry of Taxes of Russia for calculating profits in accordance with the norms of Chapter 25 of the Tax Code of the Russian Federation” and are not an official document with a date and number. But they are quite easy to find in any legal reference system.

What VAT registers are there?

Tax accounting registers for VAT include:

- invoice journal;

- sales book;

- shopping book.

Information from these registers is used when preparing a VAT return, namely to calculate the taxable base.

The log of received and issued invoices starting from 01/01/2015 reflects only documents drawn up as part of intermediary business activities, in the implementation of the developer’s tasks or on the basis of the following agreements: agency, commission or transport expedition. Both VAT taxpayers and those who are not VAT taxpayers (clause 3.1 of Article 169 of the Tax Code) must register invoices issued as part of the implementation of these business operations: firms or individual entrepreneurs exempt from the taxpayer’s obligation for value added tax in accordance with Art. 145 of the Tax Code of the Russian Federation, as well as special regime officers who issue (receive) invoices in the interests of other persons on the basis of intermediary agreements, transport expedition agreements or performing the functions of a developer.

The sales book records all outgoing invoices and data on the cost of sales and the amount of tax, broken down by tax rate:

- in columns 14,14a, 15,16 of the sales book, information is entered on the cost of sales taxed at rates of 20, 18, 10 or 0%;

- in columns 17, 17a and 18, the tax amount is broken down into 20, 18 or 10%.

All information for each column is summarized, and the resulting data is transferred to the corresponding lines of the declaration.

The purchase ledger records all incoming invoices in chronological order.

The amount of input VAT from the purchase book is reflected in the VAT tax return for the reporting period (clause 7 of the rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, hereinafter referred to as Decree No. 1137). The amounts of tax accepted for deduction at rates of 20 and 10% are reflected in line 120 of section 3 of the tax return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. MMB-7-3/ [email protected]

Important features are not only the correct execution of VAT registers, but also income tax registers. And ConsultantPlus experts talk about them in detail. Get free demo access to K+ and go to the ready-made solution to find out all the details of this procedure.

Requirements for registering received and issued invoices

The question of how to create and maintain a journal of incoming/outgoing invoices is also answered in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. For each flow of documents, the book has a separate section, that is, only issued invoices are recorded in one part - invoices, in the other - received from counterparties. The key requirements for its design are as follows:

- Mandatory presence of fields for recording intermediary transactions.

- Availability of a method and place on the form for registering adjusted (corrected) invoices.

- Since January 2015, when concluding an agency agreement or performing the functions of a developer, only invoices for intermediary transactions should be included in the journal. This obligation is assigned both to companies paying VAT and to companies exempt from this on the basis of clause 3.1 of Art. 169 NK.

It is possible to create a magazine on paper and in digital format.

Procedure for maintaining an invoice journal

The rules for maintaining a journal of issued/received invoices and the approved form of this register are also established by Resolution No. 1137. The journal itself consists of 2 parts, with the first part recording issued invoices, and the second - received ones. According to the current rules, in the invoice journal:

- it is possible to reflect information about intermediary activities in the first and second parts of the journal;

- It is possible to carry out separate registration of corrected invoices, including corrected adjustment documents.

See also the material “How to fill out an invoice journal.”

In accordance with paragraphs. 3, 3.1 and 9 art. 169 of the Tax Code of the Russian Federation, the journal of invoices can be kept not only on paper, but also in electronic format.

NOTE! Only the electronic form of the journal is submitted to the Federal Tax Service.

You should also take into account the norms of Resolution No. 1137 regarding the fact that all pages of purchase and sales books must be laced and numbered. The same resolution also contains requirements for the form of filling out and maintaining books. Let's look at them in more detail.

Finding errors in 1C for value added tax

The invoice “moved” 4 registers at once (in Fig. 9 we see 4 bookmarks). One of these 4 registers is the already familiar “VAT presented”. But unlike the entry made by the document “Receipt (act, invoice) 0000-000249 dated 08/01/2016 18:00:00”, the type of movement in this case is different (“expense”).

What does this mean? Firstly, the total sum of all similar movements with different signs matters. Let’s filter such movements in the “VAT presented” register using the “Invoice” column (Fig. 10) and sum up the “Amount without VAT” column, taking into account the sign in the “Type of movement” column. Please note that the “Invoice” column indicates the basis document.

Fig.10

As a result, we get zero. This is equivalent to a zero balance on account 19 (for this counterparty and agreement). It would seem, why duplicate in the register what can be seen in the postings?

The fact is that in life there are a wide variety of situations. For example, they forgot to register an invoice; then there will be no line with “expense”, the total amount will not be equal to 0, and the program, when analyzing, will show an error for this counterparty and agreement (Fig. 11)

Fig.11

Conclusion - registers are needed for operational analysis and reporting.

Procedure for maintaining a purchase book

The obligation to maintain a purchase book is established for buyers who are VAT payers (clause 3 of Article 169 of the Tax Code of the Russian Federation). You can keep a purchase book in both paper and electronic format. The rules for maintaining and the form of the book are fixed by Resolution No. 1137.

IMPORTANT! Tax authorities will not accept for deduction an invoice signed in facsimile. It will not be possible to defend the right to deduction even in court.

If you enter a corrected invoice into the purchase ledger, you should cancel the erroneous invoice with negative values and enter the corrective invoice with positive values. If an adjustment invoice is submitted at the end of the tax period, you should draw up an additional sheet of the purchase book and submit an updated declaration if the amount of tax claimed for deduction turned out to be overstated.

Learn how to fill out a purchase ledger.

How to create a tax accounting register

To use tax accounting registers, you will have to spend time developing their form, and then consolidate them in the annex to the accounting policy by issuing the appropriate order (paragraph 7 of article 314 of the Tax Code of the Russian Federation).

Read about the nuances of developing a tax accounting policy in the article “How to draw up an organization’s tax policy?”

The legislator does not limit taxpayers in choosing the type and form of these documents, so tax accounting registers may look different. The volume of information contained in them should give an idea of the basis on which documents and how the tax base is formed.

The only thing you cannot be proactive about when preparing tax registers is the required details. Their composition must comply with the Tax Code of the Russian Federation. For example, when calculating income tax, tax accounting registers containing the following information are used (paragraph 10, article 313 of the Tax Code of the Russian Federation):

- register name;

- date of compilation;

- natural (if possible) and monetary measures of the operation;

- name of accounting objects or business transactions;

- signature of the person responsible for compiling the register and its decoding.

Such registers can be maintained in any way convenient for the taxpayer: on paper or electronically.

Procedure for maintaining a sales book

The sales book records invoices, including adjustment ones, as well as other documents that are provided for by the rules for maintaining the sales book, approved by Decree No. 1137. The same resolution approved the form of this document. The format for maintaining the sales book in electronic form was approved by order of the Federal Tax Service of the Russian Federation dated 03/04/2015 No. ММВ-7-6/ [email protected] (as amended on 04/01/2019).

The obligation to maintain a sales book is assigned to both taxpayers and those who are exempt from paying tax (Articles 145 and 145.1 of the Tax Code of the Russian Federation, clause 3 of the rules for maintaining a sales book, approved by Resolution No. 1137). The obligation to maintain a sales book is also assigned to all enterprises and individual entrepreneurs that are not taxpayers, but perform the functions of tax agents in situations provided for in paragraphs. 1–5 tbsp. 161 Tax Code of the Russian Federation.

As for the procedure for making corrections in the sales book, the moment of their entry plays a big role here. So, if changes are made in the current reporting period, then only the deleted invoice with a negative value is reflected and the corrected document with a positive value is entered (clause 11 of the rules for maintaining a sales ledger). In cases where the tax period has ended, corrections can only be made by filling out an additional sheet of the book for the reporting period in which the erroneous document was registered.

Read about the nuances of filling out a sales book here.

An example of tax accounting for VAT from a supplier from an advance payment received

- April 21 – an advance payment is received on the account from the client in the amount of 118,000 rubles. (VAT 18,000 rub.);

- April 21 – the supplier’s accountant generates an invoice for the client indicating item number and registers it in the sales book;

- April 24 – goods worth 118,000 rubles are shipped. with the preparation of a delivery note for shipment;

- April 24 – the supplier’s accountant issues another invoice for 118,000 and records it in the sales ledger;

- April 24 – the supplier’s accountant offsets the client’s prepayment for the completed shipment and recovers VAT from the advance payment. The prepayment invoice is recorded in the purchase ledger.

To account for these transactions, an additional sub-account was opened in account 76.AB - advances received.

Postings:

| date | Sum | Debit | Credit | Operation |

| 21.04 | 118000 | 51 | 62.02 | Receiving money from a client |

| 21.04 | 18000 | 76.AB | 68.02 | Reflection of VAT payable (from prepayment) |

| 24.04 | 118000 | 62.01 | 90.01 | Reflection of the sale of goods |

| 24.04 | 18000 | 90.03 | 68.02 | Reflection of VAT on shipment payable |

| 24.04 | 118000 | 62.02 | 62.01 | Crediting prepayment upon shipment |

| 24.04 | 18000 | 68.02 | 76.AB | VAT recovery when offsetting prepayments |

VAT: recommendations for maintaining separate accounting

In accordance with the requirements of paragraph 4 of Art. 149 of the Tax Code of the Russian Federation, if a taxpayer carries out transactions that are subject to VAT and transactions that are not subject to such taxation (exempt from taxation), then in accordance with the provisions of the Tax Code of the Russian Federation, the taxpayer is obliged to keep separate records of such transactions. The principles of maintaining separate accounting by organizations are developed independently and are enshrined in the accounting policies.

Separately, it is necessary to take into account not only the proceeds from the sale of goods (works, services), but also the costs of producing these products.

The separate accounting system includes:

- description of business transactions in primary documents, which makes it possible to establish what type of activity they relate to. To do this, it is recommended that in primary documents (data, indicators) relating to transactions not subject to VAT, add the appropriate additional designation (for example, adding the designation “Not subject to VAT”);

- maintaining separate synthetic accounting registers to summarize primary documents for each type of activity;

- reflection of business transactions by type of activity in different subaccounts of the corresponding balance sheet accounts.

There are several methods for maintaining separate records.

Maintain detailed analytical records. At the same time, on the basis of primary accounting data, in which, as previously recommended, the relevant data should be separated, appropriate registers are compiled (for purchased goods (works, services), including, when necessary, for fixed assets, intangible assets, materials etc., in which the data of primary documents is summarized into sections - separately related to taxable VAT, separately related to non-taxable VAT.

Develop a system of subaccounts. For each account, where necessary, sub-accounts are opened, for example with numbers 1, 2, 3. Sub-account number 1 takes into account transactions that are carried out as part of activities subject to VAT, sub-account number 2 takes into account activities not subject to VAT. And on the subaccount number 3 there are transactions that cannot be attributed to one or another activity. All this should be reflected in the organization's working chart of accounts.

The following must be taken into account.

“Input” VAT on transactions that cannot be clearly attributed to any operation (this may apply to transactions on fixed assets, intangible assets, services) is subject to distribution (“division” in proportion) of VAT in accordance with clause 4 of Art. 170 Tax Code of the Russian Federation.

As for purchased materials, they can ultimately be used in only one activity (either subject to VAT or not subject to VAT). Therefore, there is no need to distribute (“divide” in proportion in accordance with clause 4 of Article 170 of the Tax Code of the Russian Federation) the “input” VAT paid to suppliers when purchasing materials between types of activities.

“Input” VAT related to a specific material, depending on the activity (taxable or not subject to VAT), is either deductible or included in the cost of the material. For example, if it is known in advance that the sale of goods (work, services) produced from purchased material is exempt from VAT, then the VAT paid to the supplier can be immediately charged to the corresponding subaccount of account 10 “Materials”, i.e. include in the cost of the material. In this case, there is no need to use Account 19 “VAT on purchased assets”.

Debit 10 (corresponding subaccount) Credit 19 (corresponding subaccount)).

It should be taken into account that in accordance with paragraph 4 of Art. 170 of the Tax Code of the Russian Federation, in cases where the share of total costs for the production of goods (work, services), sales transactions of which are not subject to VAT, does not exceed 5 percent of the total total costs for production in the tax period, then all amounts of VAT are subject to deduction.

To implement this requirement, it is necessary to maintain separate accounting of production costs, which can be maintained in a similar manner to the above procedure. At the same time, the organization distributes general business expenses between different types of activities in proportion to the salaries of production personnel, which is reflected in the accounting policies of the organization.

However, “input” VAT, which relates to these expenses, must be distributed in proportion to the share of revenue received from preferential and non-preferential activities in total revenue. To keep separate records of income, you must enter the appropriate subaccounts to account 90 “Sales”.

In accordance with the requirements of paragraph 6 of Art. 166 of the Tax Code of the Russian Federation, the amount of tax on transactions of sale of goods (work, services) taxed at a tax rate of 0 percent is calculated separately for each such transaction. In light of this, it is recommended that, in the same way as maintaining separate accounting for transactions subject to and not subject to VAT, separate accounting for transactions taxed at a tax rate of 0 percent is recommended.

- The total cost of shipped goods (work, services) is ... rub., including:

1a. The cost of shipped goods (works, services), sales transactions of which are subject to VAT - ... rub.

1b. Proportion (share) of the cost of shipped goods (work, services), sales transactions of which are subject to VAT, in the total cost of shipped goods (work, services)

/page 1a : page 1/ = ...

- The total value of total production costs is ... rub.

2a. Total costs for the production of goods (works, services), sales operations of which are not subject to VAT - ... rub.

2b. The share of total costs for the production of goods (works, services), operations for the sale of which are not subject to VAT, in the total amount of total production costs.

/page 2a: page 2/ x 100% = …%.

| Type of consumption | Amount of expense, rub. | Total VAT | Input VAT on transactions subject to VAT, rub. | Input VAT on transactions not subject to VAT, rub. |

In cases where the share of total costs for the production of goods (works, services), transactions for the sale of which are not subject to VAT, does not exceed 5 percent of the total total costs for production in the tax period, all amounts of VAT are subject to deduction.

In cases where goods (works, services) previously recorded as used to carry out transactions subject to VAT were accepted for deduction in accordance with Art. 172 of the Tax Code of the Russian Federation were used to carry out transactions not subject to VAT, then the previously deducted amounts of the corresponding VAT amounts are restored and they are taken into account in the cost of such goods (works, services) and reflected in the corresponding sub-accounts.

In addition to the “Analytical register of separate accounting of VAT amounts for expenses related to operations subject to and not subject to VAT for ________ 200__”, in order to carry out separate accounting of VAT, the “Register of VAT distribution on capitalized, paid material assets, works, services for ________ 200__ g.

When implementing the work specified in paragraphs. 5 p. 1 art. 164 of the Tax Code of the Russian Federation, carried out by an enterprise, to confirm the validity of VAT taxation at a rate of 0 percent and tax deductions, the following is submitted to the tax authorities: a separate tax return (clause 6 of Article 164 of the Tax Code of the Russian Federation) with a contract (copy) attached for the performance of the specified work (provision of services ), bank statements (copies) confirming the actual receipt of proceeds to the payer’s account, acts and other documents (copies) confirming the performance of work (provision of services) technologically determined and directly related to the performance of work (provision of services) in outer space (clause Clauses 7, 10, Article 165 of the Tax Code of the Russian Federation).

At the same time, accounting of operations related to the implementation of the above work is carried out in the corresponding sub-accounts (analytical registers) with the addition of the designation “Art. 0". The amount of tax on sales of goods (work, services) taxed at a rate of 0 percent is calculated separately for each such operation (clause 6, article 166 of the Tax Code of the Russian Federation).

E.P. Stolbov

Lead Auditor

How to take into account VAT in the 1C 8.3 Accounting program?

VAT accounting in 1C 8.3 Accounting is based on accumulation registers. The chart of accounts and the journal of postings, of course, remain, but the main information is stored in the registers. Let's try to understand their structure.

For example, they forgot to register an invoice; then there will be no line with “expense”, the total amount will not be equal to 0 and the program, when analyzing, will show an error for this counterparty and agreement (Fig. 11)

Fig.11

Conclusion - registers are needed for operational analysis and reporting.

It should be taken into account that in accordance with paragraph 4 of Art. 170 of the Tax Code of the Russian Federation, in cases where the share of total costs for the production of goods (work, services), sales transactions of which are not subject to VAT, does not exceed 5 percent of the total total costs for production in the tax period, then all amounts of VAT are subject to deduction.

To implement this requirement, it is necessary to maintain separate accounting of production costs, which can be maintained in a similar manner to the above procedure. At the same time, the organization distributes general business expenses between different types of activities in proportion to the salaries of production personnel, which is reflected in the accounting policies of the organization.

However, “input” VAT, which relates to these expenses, must be distributed in proportion to the share of revenue received from preferential and non-preferential activities in total revenue. To keep separate records of income, you must enter the appropriate subaccounts to account 90 “Sales”.

Help VAT tax accounting registers onliner

Ms excel templates for downloading all sections of the 2021 Ponds tax return into xml format. But this loss is taken into account for tax purposes in a special manner. To begin with, we will try to keep records in such a way that the methods of recording and writing off expenses in accounting are very close to tax accounting.

This register can represent a set of taxation objects in the context of tax rates and corresponding tax bases (sales turnover). Although there are several samples for internal tax forms, it is understood that they will exist in any case. Tax register for income tax for generating income standard .

To begin with, be sure to prepare a unitary enterprise in which the registers necessary for the organization’s work will be registered. At the same time, it is necessary to keep in mind that not all income and expense accounting transactions are taken into account in tax accounting, which means they are not entered into tax registers. Tax accounting registers are maintained by payers and other obligated persons in the form of special forms on cardboard and (or) electrical media.

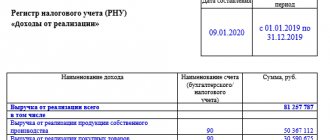

“Profitable” register of NU

Continuation of the example

The income of Ritm LLC in the reporting period consisted of the following components:

- revenue from sales of self-made products (RUB 50,367,000);

- revenue from sales of purchased products (RUB 30,590,000)

- proceeds from the sale of other property (RUB 300,000);

IMPORTANT! It is necessary to take into account in the “income” part the entire amount of products sold during the reporting period, with the exception of the income listed in Art. 251 Tax Code of the Russian Federation.

About what income is reflected in Art. 251 of the Tax Code of the Russian Federation, read the material “Art. 251 of the Tax Code of the Russian Federation (2018-2019): questions and answers.”

IMPORTANT! When drawing up the RNU “Income from sales”, one should not forget that revenue in the register and tax return must be indicated without taking into account VAT and excise taxes (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Information for filling out the “income” RNU is taken from accounting data (according to accounts 90 “Sales” and 91 “Other income and expenses”).

Reflection of acquired eds. 3.0

An organization purchases services that it uses in both taxable and non-taxable or VAT-exempt activities. Let's look at how to reflect purchased income, including distributing input VAT, registering invoices, and tracking the movement of registers used for tax accounting of VAT calculations using the following example.

Example 1

The organization ZAO TF-Mega applies a general taxation system and is a VAT payer. At the same time, CJSC TF-Mega carries out operations both subject to VAT and exempt from taxation in accordance with Article 149 of the Tax Code of the Russian Federation, as well as operations the place of implementation of which is not recognized as the territory of the Russian Federation. In addition, CJSC TF-Mega sells goods from the warehouse to individuals and pays UTII for this type of activity.

In the 4th quarter of 2013, the revenue of CJSC TF-Mega was distributed by type of activity as follows:

- sale of goods in wholesale trade in the amount of RUB 755,200.00. (including VAT 18% – RUB 115,200.00);

- sale of goods subject to UTII in the amount of RUB 110,000.00;

- provision of advertising services to a foreign company in the amount of EUR 5,000.00 (EUR exchange rate – RUB 43.0251).

In addition, the organization distributed goods (souvenirs) worth RUB 4,720.00 for advertising purposes.

In the same quarter, the following services received from third parties were reflected in the accounting of CJSC TF-Mega:

- 11/11/2013 – delivery of goods to the wholesale buyer by the carrier Transport Company LLC. The cost of services amounted to RUB 94,400.00. (including VAT 18% – RUB 14,400.00);

- 12/05/2013 – bank service for issuing a card with sample signatures costing 590.00 rubles. (including VAT 18% - 90.00 rub.);

- 12/31/2013 – rent of office space for the 4th quarter of 2013 in accordance with the agreement concluded with the lessor Delta LLC, in the amount of RUB 118,000.00. (including VAT 18% – RUB 18,000.00).

After setting up the accounting policy and accounting parameters** in the tabular part of the accounting system document Receipt of goods and services with the transaction type Services (as well as with the transaction type Goods, services, commission on the Services tab), it will be possible to indicate additional information about the selected VAT accounting method in in the Accounts column (Fig. 1). The VAT accounting method can take one of the following values:

- Accepted for deduction;

- Included in the price;

- For operations at 0%;

- Distributed.

Rice. 1. Selection of accounting accounts and method of accounting for VAT upon receipt of services

Let's analyze the nature of services provided by third parties:

- it is known that the service for the delivery of goods to wholesale customers is associated only with transactions subject to VAT, therefore in this case the VAT accounting method is indicated as Accepted for deduction;

- Bank services and office space rental are related to all activities carried out by the organization ZAO TF-Mega, therefore the VAT accounting method is indicated as Distributed.

If an organization regularly supplies the same type of services, then in order for the Account details, Cost Items and VAT Accounting Method to be filled in automatically in the Receipt of Goods and Services document, it is advisable to use the settings for the Item Account information register (Fig. 2). It is available from the Item and Warehouse section using the Invoices Item Accounting hyperlink. Let's consider the accounting entries that will be generated after posting the documents Receipt of goods and services in the 4th quarter of 2013.

Rice. 2. Setting up item accounting accounts

Debit 44.01 Credit 60.01

– the cost of transportation services excluding VAT;

Debit 19.04 Credit 60.01

– with the third subconto Accepted for deduction for the amount of VAT presented by the carrier.

Debit 91.02 Credit 60.01

– for the cost of the bank’s services for issuing a card with sample signatures without VAT;

– with the third subaccount Distributed according to the amount of VAT presented by the bank.

Debit 26 Credit 60.01

– the cost of rent excluding VAT;

– with the third subconto Distributed according to the amount of VAT claimed by the lessor.

For the purposes of tax accounting for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt and Amount NU Kt for those accounts where tax accounting is maintained (accounts with the NU attribute).

___________________________________________________________________

** Read more about the accounting policy settings in No. 4 “BUKH.1S” for 2014 on page 7.

You can change the information in the register from the registrar document.

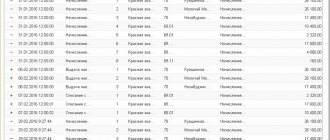

Let's consider how registers change depending on the posting of documents. We will conduct experiments with the “VAT presented” register.

Figure 4 shows the invoice. Let's check the postings of this document (Fig. 5).

We see two bookmarks, each of which corresponds to one register. The first displays accounting and tax accounting entries (generally speaking, entries are also stored in the register, but this is a register of a different format; the structure and purpose of the accounting register is not discussed in this article).

On the second tab (Fig. 6) there is data from the “VAT presented” register. This register is one of the 12 registers that relate to the VAT accounting system. Note that the type of movement is “Arriving”.

Now let's register the supplier invoice. For this, the receipt invoice below (Fig. 7) contains the necessary fields.

In the generated invoice, check the box “Reflect VAT deduction in the purchase book...” (Fig. 8) and check the movements of the document (Fig. 9).