The main task of tax accounting in 1C is the calculation of income tax, or rather the tax base for it.

Determining the income tax base is quite simple. This is the difference between income and expenses.

The difficulty lies in the fact that income and expenses are recognized differently in different types of accounting. Part of the income and expenses can be recognized only in one of the types of accounting. As a result, permanent and temporary differences appear.

The “friendship” of accounting and tax accounting is expressed by a formula consisting of four values:

BU = NU + PR + VR,

Where

- BU – accounting amount

- NU – tax accounting amount,

- PR – constant difference,

- TD – time difference.

Other calculations

The accumulation register “Other settlements” is intended to account for mutual settlements on wages, taxes and accountable persons for the purposes of the simplified tax system (Fig. 6). The occurrence of receivables in the register is reflected by incoming entries, and the repayment of receivables by expense entries. The occurrence of accounts payable in the register is reflected in expense entries, and the repayment of accounts payable is reflected in receipt entries.

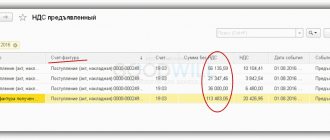

Figure 6.

Register entries are used to control payment and determine the amount of expenses taken into account when determining the tax base for the taxable object “income reduced by the amount of expenses.”

Entries in the accumulation registers of the simplified tax system subsystem are formed when posting documents that record the facts of the economic life of the organization.

Type of registers

According to their purpose, 1C tax accounting registers are divided into groups:

- Business transaction accounting registers are necessary to systematize information about the facts of the activities of an economic entity that lead to the emergence of an object of tax accounting;

- Registers for recording the status of a tax accounting unit exist to collect data on the presence and movement of a specific tax accounting object;

- Registers of intermediate settlements perform an auxiliary function: they are used at the stage of establishing the cost of an object, and also as a primary source of information for filling out registers for creating reporting data;

- Registers for creating reporting data exist to summarize data on recognized income and expenses of the reporting (tax) time, calculate the tax base and decipher some individual income and expenses in the income tax return.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

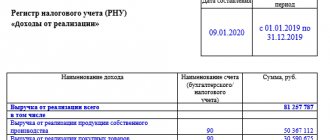

Figure 2. Example of a tax register. Author24 - online exchange of student work

Calculation of tax under the simplified tax system

In the information register “Calculation of tax under the simplified tax system,” the program, when performing the same-named regulatory operation of closing the month, saves information about the calculation of the amount of the advance payment for tax under the simplified tax system (for the corresponding reporting period), as well as the amount of tax under the simplified tax system (for the corresponding tax period) (Fig. . 8).

Figure 8.

Dear readers! You can get answers to questions about working with 1C software products on our 1C Consultation Line. We are waiting for your call!

Register requirements

In accordance with Article 313 of the Tax Code of the Russian Federation, taxpayers are required to calculate the tax base at the end of each (tax) reporting period of time on the basis of confirmed tax accounting data.

Note 1

Tax accounting is the systematization of accounting information to establish the tax base for a specific tax based on data from primary documentary acts.

The following are used to confirm the NU data:

- primary accounting documentation;

- analytical registers NU;

- calculation of the tax base.

Analytical registers of NU are consolidated formats for systematizing tax accounting information for each reporting period.

It is mandatory that these forms contain:

- register name;

- date of compilation;

- name of business transactions;

- measures of the operation itself in monetary and physical terms;

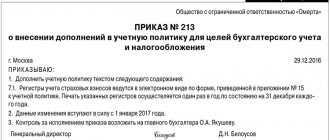

- signature and its transcript of the person responsible for drawing up the document. Taxpayers have the right to develop register forms and an algorithm for reflecting analytical tax accounting data in them independently, but must include them in addition to accounting policies for further tax purposes.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

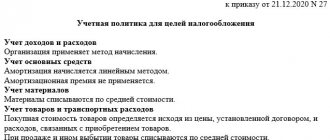

Figure 1. Location of tax registers in 1C. Author24 - online exchange of student work

Tab “Activities”

At first glance, this bookmark does not raise any questions. But it is precisely on it that a time bomb is laid.

However, let's take things in order. The tab clearly displays two types of activities.

- Flag “Production of products, performance of work, provision of services.”

- Flag "Retail".

Someone may be surprised, where is the wholesale trade?

There is no need to specifically set the presence of wholesale trade in the accounting parameters, and then in the accounting policy. This type of activity is already specified in the configuration by default. Therefore, regardless of the state of these flags, any organization of the enterprise can engage in wholesale trade. Flag “Production of products, performance of work, provision of services.”