UTII, USN, PSN, OSNO. For some, these abbreviations mean nothing, but for business owners and accountants they are a direct indication of how much and what taxes they will have to pay at the end of the year. In this article we will talk about the patent tax system (PTS), the general provisions and features of its application in 2021.

We have not previously written about this tax system, but the number of those who use PSN is growing, so it is necessary to talk about it in more detail. This will help make a more informed choice and reduce the tax burden, because a patent is especially convenient when analyzing the prospects for business development, since it can be taken out for a very short period of time (one or two months).

The target audience

The main audience (95%) are women aged 16 to 50 years. Basically, they work and visit the salon from 1 to 4 times a month (depending on needs and income level). A separate subgroup is the non-working population (mothers on maternity leave, housewives, students). 5% of the entire target audience are men.

To make it easier to create a set of services and tools for their promotion, we will draw up a portrait of the client. It is important to consider:

- life style;

- wage level;

- preferences;

- needs;

- values.

Conduct an in-depth analysis and collect the following information:

- Full name, contact details;

- date of first visit to the salon;

- total number of visits;

- optimal time to visit;

- the client’s opinion about the quality of services and the salon as a whole;

- what craftsmen served the client.

This is how the regular clientele is determined, the degree of their loyalty to the salon, and the quality of the employees’ work is monitored. This information is invaluable when developing a strategy to attract and retain your customer base.

Tax accounting

Tax reporting in the form of a declaration is not provided for PSN (Article 346.52 of the Tax Code of the Russian Federation). The accounting of income for each patent received is kept in a special book for the PSN. It is necessary to ensure that the total amount of actual income received (and not potentially possible income) for all patents does not exceed 60 million rubles per calendar year. The form and procedure for filling out the income accounting book were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

After registration, the individual entrepreneur is obliged to pay insurance premiums for himself (subparagraph 2 of paragraph 1 of Article 419, paragraph 1 of Article 423, paragraph 1 of Article 430 of the Tax Code of the Russian Federation). The amount of contributions depends on the amount of income received by the entrepreneur.

If an individual entrepreneur receives an income of up to 300 thousand rubles, then his insurance premiums will be:

- for pension insurance: RUB 26,545. for 2021; RUB 29,354 for 2021; RUB 32,448 for 2021;

- for health insurance: 5840 rub. for 2021; 6884 rub. for 2019; 8426 rub. for 2021.

If an individual entrepreneur receives an income of over 300 thousand rubles, then his insurance premiums will be:

- for pension insurance: RUB 26,545. for 2021; RUB 29,354 for 2021; RUB 32,448 for 2021 + 1% of the amount of income exceeding 300 thousand rubles, but not more than eight times the above fixed amount of insurance premiums for compulsory health insurance (212,360 rubles);

- for health insurance: 5840 rub. for 2021; 6884 rub. for 2019; 8426 rub. for 2021.

Disability and maternity contributions are optional. Individual entrepreneurs have the right to list them on a voluntary basis. The formula used for calculation is: minimum wage at the beginning of the year * tariff * 12.

From January 1, 2021, the minimum wage is 9,489 rubles, and the amount of contributions for disability and maternity is 3,300 rubles (9,489 rubles * 2.9% * 12 months).

As a general rule, an individual entrepreneur who employs employees must pay contributions to the following funds: medical, pension and social insurance. In 2021, individual entrepreneurs on PSN have preferential rates for these taxes: in the Pension Fund of the Russian Federation the rate is 20%, and in other funds - 0%. Individual entrepreneurs engaged in retail trade (subparagraphs 45, 46 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation) do not have such a benefit.

Individual entrepreneurs in the patent system do not have the right to reduce the tax under PSN by the amount of insurance premiums paid (neither from payments to employees nor for themselves). This is not provided for by the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated January 24, 2014 No. 03-11-12/2453). But if, for example, an individual entrepreneur combines PSN with UTII and does not have employees, then he can reduce UTII by the entire amount of contributions paid for himself (letter of the Ministry of Finance of Russia dated 04/07/2016 No. 03-11-11/19849).

Types of manicure business

At the planning stage, it is important to choose a format:

- Manicure salon. A room designed to accommodate a maximum of 2 craftsmen. Advantages: classic format, standard services, low start-up costs. Disadvantages - small area, difficulties with expansion.

- Studio. Beauty salon with all types of manicure and pedicure and qualified personnel. Advantages: above-average prices, wide-skilled specialists. Disadvantages: large investments, long payback period. In addition, it is not always possible to fill the salon with clients.

- Express manicure (nail bar). Open counters in shopping centers. The advantage is the location in a high traffic area. Disadvantages - expensive rent, psychological factor (many clients cannot relax when undergoing cosmetic procedures in front of everyone), reputation as a budget establishment (repels many). The business cannot be expanded.

- Manicure at home. Business with minimal investment. At the initial stage it will not even require registration. A good option for both a beginner who wants to have an independent source of income, and an experienced one with an established client base. A home studio has a lot of advantages - small investments, the ability to record at any convenient time. Disadvantage: lack of reputation. People don't trust home craftsmen - it's unknown what their skill level is.

Let's look at what it takes to open a manicure studio from scratch.

Documentation

Individual entrepreneurs and LLCs are suitable for registering a business. Typically, an individual entrepreneur is opened with a simplified taxation system or a single tax on imputed income. You will need an open bank account.

Package of documents:

- Certificate of registration of individual entrepreneur or LLC.

- License.

- Permission from the sanitary and epidemiological station.

- Fire inspection permit.

- Certificate of registration with the tax authorities.

- Registration with the Social Insurance Fund and the Pension Fund as an employer. Needed to hire workers according to Labor Code.

A manicure business does not require a large package of documents, but you need to be prepared for inspections by the sanitary and epidemiological station, control that employees undergo a medical examination (marks in the medical book are updated every 6 months), and maintain the conditions in the salon necessary for servicing clients.

If the owner of the premises has not entered into an agreement for the disposal of fluorescent lamps, solid waste, or garbage removal, the solution to these issues will fall on your shoulders.

Legal form

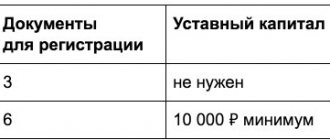

Depending on the plans of the future businessman and his capabilities, the nail salon is registered as an individual entrepreneur or as an LLC. The chosen form determines a number of rights and obligations for the businessman.

Individual entrepreneurship

Advantages:

- There is no need to keep records, you can immediately use the income received and at the same time pay a symbolic tax;

- An individual entrepreneur can be registered at the place of residence, without reference to registration;

- Small fines. Individual entrepreneurs are punished a little more severely than individuals, but much more loyally than legal entities;

- To close an individual entrepreneur, only an application is required and everything, as a rule, is done in one day;

Flaws

- It is registered only for one person, that is, it will not be possible to open a joint business and have it documented;

- IP cannot be sold or re-registered.

Entity

Advantages:

- The opportunity to open a joint business by registering several co-founders, there can be up to 50 people;

- The business can be sold;

Flaws:

- The fines are higher;

- Taxes are higher;

- Complicated liquidation procedure.

Room

The location and area of the room depend on the format. It is better to open a salon and manicure office in high traffic areas - in the central part of the city, near public transport stops and intersections in residential areas, in shopping centers.

The nail studio must meet sanitary requirements:

- availability of cold and hot water supply;

- the area of one workplace is not less than 4.5 m²;

- utility room;

- separate rooms or areas for manicure and pedicure;

- high-quality ventilation system;

- a room for cleaning and sterilizing instruments (instruments and furniture are disinfected after each client appointment).

You can study the requirements in more detail in Resolution No. 59 dated May 18, 2010 “On approval of SanPiN 2.1.2.2631–10.”

For 3 workplaces (2 for manicure work and one for pedicure work) you will need at least 30 m². The area is designed for work areas, utility rooms and a foyer where visitors will wait their turn. Our business plan for a manicure salon involves renting a one-room apartment on the ground floor. The average rental price in Russia is 25,000 rubles. Repairs will require 30,000 rubles.

Do you need a cash register?

In connection with the release of Federal Law 54 “On the use of cash register equipment,” entrepreneurs are wondering whether they need an online cash register. The timing of the transition, as well as the types of businesses exempt from immediate transition, is constantly changing.

Today, owners of nail salons and offices may not install an online cash register only in one case - if they do not have employees. After drawing up the first employment contract, the owner is given 30 calendar days to purchase and register the device.

From July 1, 2021, everyone who provides services or sells goods is required to switch to online cash registers. This rule is regulated by Federal Law dated July 3, 2016 No. 290-FZ.

Equipment

Table No. 1. Furniture for a manicure room:

| Furniture | Cost, rub.) |

| Chairs for craftsmen | 30 000 |

| Chairs for clients | 30 000 |

| Manicure table (height no lower than 70 cm) | 10 000 |

| Racks for storing tools and consumables | 8 000 |

| Reception desk | 5 000 |

| Sofa for visitors | 10 000 |

| TV for the hall | 6 000 |

| Pedicure chair | 30 000 |

| Cooler | 3 000 |

| Total amount: | 132 000 |

Table No. 2. Equipment for manicure salon:

| Equipment | Cost (Russian rubles) |

| UF lamps for building and drying gel polish | 2 000 |

| Sets for manicure and pedicure | 6 000 |

| Sterilization equipment | 3 000 |

| Milling cutter for manicure and pedicure | 6 000 |

| Baths, coasters and pillows | 8 000 |

| Paraffin furnace | 3 000 |

| Nail brushes | 1 000 |

| Lamp | 2 000 |

| Manicure hood | 4 000 |

| Total amount: | 35 000 |

Table No. 3. Materials for the manicure salon:

| Materials | Cost (Russian rubles) |

| Palettes of varnishes, gel polishes | 10 000 |

| Products for removing nail polish/shellac, softening cuticles, etc. | 10 000 |

| Care products | 6 000 |

| Napkins, gloves, etc. | 3 000 |

| Total amount: | 29 000 |

Staff

Customer loyalty—and therefore your income—depends on the level of service. Therefore, do not hire people on staff without making sure of their qualifications.

Criteria that the candidate must meet:

- education in the specialty, availability of a resume;

- availability of a health certificate with a completed medical examination;

- politeness, neat appearance;

- Diplomas from competitions, certificates of master classes will be advantages.

Table No. 4. A list of employees:

| Job title | Amount of workers | Salary (rub.) |

| Administrator (2 shifts) | 2 | 40 000 |

| Accountant (outsourced) | 1 | 6 000 |

| Master | 3 | 75 000 |

| Cleaning lady (several hours a day) | 1 | 5 000 |

| Total: | 126 000 |

conclusions

If you are looking for something as simple and understandable as possible, then you can become self-employed and pay NTD by installing the “My Tax” application. But it does not apply throughout the entire territory of the Russian Federation. For everyone who cannot use it, you can choose the simplified tax system, UTII or Patent, but then you must register an LLC or individual entrepreneur. We can calculate the tax burden and recommend a tax regime specifically for you - taking into account your number of employees, your region, and your expected income. With us you will definitely not overpay extra taxes.

Rate the article on a 5-point scale

5 out of 5 based on 12 ratings

In the beauty industry, word of mouth is considered the best advertising. A man got a beautiful manicure in your salon and attracted the attention of others. They also wanted to visit you. The business owner only needs to invest in the quality of services, and the client himself will become effective and free advertising.

But if you need to speed up business promotion (especially in areas with high competition), you can use marketing tools:

- Printable advertisement. Flyers, leaflets, booklets, announcements for posting. For design and printing - about 10,000 rubles.

- Business cards. We distribute at themed events and in any places with a potential audience. Expenses - 6,000 rubles.

- Website, groups on social networks, Instagram account. Most consumers prefer to search for a product or service of interest via the Internet. To underestimate this fact means to lose an impressive share of clients. When advertising services online, keep in mind that consumers want to see reviews, examples of work, prices and current promotions. You will spend from 15,000 rubles on advertising on the Internet.

- Participation in competitions, master classes, competitions.

- Implementation of client-oriented strategies. Having collected a database of telephone numbers, you can congratulate customers on the holidays, offer discounts, and lucrative special offers.

- Signboard. There must be an intriguing, attractive office sign. Its production and installation will require 15,000 rubles.

To attract attention, organize a grand opening of the salon - with decorations, gifts, raffles, master classes. Post photo reports on social networks or order an advertising block in the media. This method of advertising will require from 15,000 to 20,000 rubles.

Pay attention to the design of printed products. Bright, creative, stylish design of business cards, flyers, posters, advertisements will arouse trust and interest in the audience.

How much does it cost to open a manicure studio: business plan with calculations

Let's calculate the costs required to open a salon with 3 workplaces in a one-room apartment on the 1st floor:

- Registration of a business, payment of state duties and taxes – 10,000 rubles;

- Apartment rental – 25,000 rubles;

- Cosmetic repairs – 30,000 rubles;

- Furniture – 132,000 rubles;

- Equipment – 35,000 rubles;

- Materials – 29,000 rubles;

- Advertising – 40,000 rubles;

- Additional expenses (training of craftsmen, opening, transportation costs) – 50,000 rubles.

In total, you will need 351,000 rubles to start.

Monthly expenses:

- Taxes – 8,000 rubles;

- Apartment rental – 25,000 rubles;

- Utility bills – 10,000 rubles;

- Salary to employees – 126,000 rubles;

- Materials – 5,000 rubles;

- Advertising – 5,000 rubles.

Total monthly expenses: 179,000 rubles.

To calculate profit, you need to create a list of services.

There are many different procedures for nail care and treatment. The standard ones include manicure, pedicure, scrubs, masks, paraffin therapy, wraps, moisturizing, massage, modeling and strengthening of nails with gel, acrylic, as well as nail design itself (varnish coating, artistic painting). Additional services:

- SPA procedures;

- aroma peeling;

- aroma massage;

- healing coatings.

Offer only popular services at first to save on equipment and materials. According to statistics, manicures are in high demand. Its share among all procedures performed by manicure salons and salons is 30%. Nail extensions also account for 30%. For pedicure – 15%. Subsequently, you can expand the range of services - for example, eyelash extensions, eyebrow tinting.

Table No. 5. Manicure services and their cost.

| Services | Price (Russian rub.) |

| Manicure without coating | 400 |

| Hardware manicure | 700 |

| Varnish coating | 100 |

| Gel coating | 500 |

| Removing varnish | 200 |

| Gel extension | 1 300 |

| Design (art painting, rhinestones, etc.) | 300 |

| Correction | 650 |

| Paraffin therapy for hands | 250 |

| Massage | 200 |

| Pedicure | 1000 |

| Paraffin therapy for feet | 400 |

To set accurate prices, monitor prices of competitors in the region. To attract an audience at the opening stage, offer low prices.

The average profit of 3 masters per day will be 9,000 rubles.

This is about 252,000 rubles per month.

Net income: 252,000 – 179,000 = 73,000 rubles.

Payback period: 5 months.

Is it worth working on a franchise?

When opening an office under a franchising scheme, the franchisor takes on a huge share of the tasks. This includes developing a business plan, searching for premises, repair and design work, purchasing equipment and materials, and advertising. The franchisor has experience and a supplier base - therefore, you will save time, money and get rid of the risk of running into the pitfalls that await a newcomer on the path to creating a startup from scratch. Support is usually provided at all stages - from registration to organizing work processes. A ready-made, practice-tested model guarantees income.

The downside of a franchise is the need to give away part of the profit every month.

Basic Steps

All activities related to creating a business are conditionally combined into 4 main steps:

- Preparatory . More theoretical preparation for opening a salon. Includes analysis of basic business formats, choice of legal form and other organizational and theoretical issues;

- Searching for premises for a future salon;

- Collection of documents . Documentary preparation for registration of an entrepreneur, as well as obtaining the necessary permits and conclusions;

- Hiring . A conditionally obligatory step that is excluded when working independently without the involvement of employees.

What GOST R regulates for nail services

What is more profitable: a nail salon or a home business?

If you are a professional master and do not have the capital to open your own office, a home salon will be the best solution. What's good about it?

There is no need to take responsibility for the quality of work of other craftsmen, or waste time and money on organizing business processes. Some people are put off by the prospect of doing a manicure at someone’s home, but with high-quality service, you will have a base of regular and loyal customers. And with it a constant source of income. When it comes to profits, when running a home-based business, your profit margin will be limited by your time.

Is it possible to transfer money for a manicure to a card?

There are two ways to pay for the services of a specialist using a bank card:

- The first method is for the master to install a terminal for acquiring. This is a terminal with which clients pay for services. The money is debited from the client’s card and credited to the master’s bank account minus the bank commission.

- The second method is for the client to transfer payment from his card to the master’s personal card. The card is issued to the master as an individual. This method is not prohibited by the tax authorities. But the bank prohibits it - a personal card cannot be used for commercial purposes, so the bank can block it under Federal Law 115.

Business risks

- High competition. To attract a central office, you will have to introduce new technologies, promotions, special offers, and develop strategies for retaining your client base.

- It is necessary to constantly monitor the level of service. One dissatisfied customer will cause significant damage to your business.

- High qualification requirements. The field is becoming more complex, new standards are emerging - it is important to keep up with the latest trends. The professionalism of the master determines the loyalty of the audience.

- Difficulties with procurement. The niche is full of unscrupulous manufacturers and suppliers, so caution is required.