Author: Ivan Ivanov

Line 1190 displays information about other non-current assets with a circulation period of more than 12 months and not falling under other classifications. It can be:

- Expenses for the purchase of fixed assets for which the initial cost was not formed at the beginning of the period and they were not put into operation.

- Costs of purchasing equipment and facilities intended for installation in facilities under construction.

- The size of deviations in the cost of materials involved in the capital construction of buildings, as well as related equipment.

- Amounts of advance payments made in favor of capital construction of the enterprise's operating system.

The information from line 1190 can be deciphered and organized into groups in the text of the notes to the balance sheet or financial statement of results. Firms independently itemize expenses in accordance with balance sheet items.

Other non-current assets on the balance sheet are

Line 1190

reflects information about other assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet.

For example: [Debit balance on account 01 “Fixed assets”] (sub-account “Young plantings”)

[Debit balance on account 07 “Equipment for installation”] [Debit balance on account 08 “Investments in non-current assets”] [Debit balance on account 15 “Procurement and acquisition of material assets”]

(in the part related to equipment for the installation)

[Account balance 16 “Deviation in the cost of material assets”]

(in the part related to equipment for the installation)

[Debit balance in account 60 “Calculations with suppliers and contractors"]

(in terms of advances and prepayments for work, services related to the construction of fixed assets)

[Debit balance of account 97 “Deferred expenses"]

(in terms of expenses with a write-off period of more than 12 months)

Other non-current An organization's assets may include:

- equipment requiring installation, which is understood as equipment put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment;

- investments in non-current assets of the organization, accounted for in the corresponding subaccounts of account 08 “Investments in non-current assets”, in particular the organization’s costs in objects that will subsequently be taken into account as objects of intangible assets or fixed assets, as well as costs associated with the implementation of incomplete R&D;

- expenses related to future reporting periods and accounted for in account 97 “Future expenses” (for example, expenses for the development of natural resources, a one-time (lump-sum) payment for the right to use the results of intellectual activity and means of individualization);

- the cost of perennial plantings that have not reached operational age;

- the amount of transferred advances and advance payment for work and services related to the construction of fixed assets.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a positive factor

If the indicator decreases

Usually a negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- Tangible exploration assets 1140 Definition Tangible exploration assets 1140 - costs of searching, evaluating mineral deposits and exploring mineral resources in a certain subsoil area. As a result of their implementation...

- Fixed assets 1150 Definition Fixed assets 1150 are: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer technology, vehicles, tools, ...

- Research and development results 1120 Definition Research and development results 1120 are funds spent on research and development work that yielded a positive result. The works for which the results were obtained are taken into account:...

- Profitable investments in material assets 1160 Definition Profitable investments in material assets 1160 - investments of an organization in property, buildings, premises, equipment and other material assets provided by the organization for a fee for a temporary...

- Intangible assets 1110 Definition Intangible assets 1110 are: works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); commodity...

- Intangible exploration assets 1130 Definition Intangible exploration assets 1130 - costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area: the right to perform work...

- Financial investments 1170 Definition Financial investments 1170 are financial investments of an organization, the circulation (repayment) period of which exceeds 12 months from the moment on which the reporting was prepared (from the reporting date): state ...

- Asset structure (share in the total balance sheet), in percent Asset structure. The assets of the enterprise are divided into 2 large groups: non-current assets (immobilized funds), the service life of which is more than 12 months; current assets (mobile assets), service life...

- Balance sheet The balance sheet prepared for the financial analysis of the activity and condition of the enterprise for three years is as follows: Indicator Indicator code 2011 2012 2013 ASSETS OF THE ENTERPRISE I. NON-CURRENT…

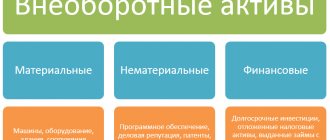

Composition and structure of non-current assets

The composition of the non-current assets of the enterprise is detailed in different ways by different documents of the Ministry of Finance of the Russian Federation:

- by order No. 43n dated 07/06/1999, which approved PBU 4/99, dedicated to the methodology for compiling accounting reports, non-current assets included intangible assets, fixed assets (with the inclusion of non-refundable assets), profitable investments in materiel and financial investments;

- by order No. 94n dated October 31, 2000, which approved the chart of accounts, non-current assets are divided into fixed assets (with the allocation of income-generating investments), intangible assets, depreciation of fixed assets and intangible assets, capital investments in them (with the allocation of equipment requiring installation) and ONA;

- By order No. 66n dated 07/02/2010, containing the latest form of balance sheet recommended for use, these assets are divided into 9 articles: intangible assets, R&D, intangible and tangible exploration assets, fixed assets, profitable investments in materiel, financial investments, non-current assets and other non-current assets .

There are no contradictions between them, but the concept of non-current assets for the purposes of its reflection in the balance sheet still needs to be clarified. Non-current assets on the balance sheet are the company’s own property, which for a long time (more than a year) is used in its main activities in order to generate income. The components of non-current assets are:

- NMA;

- OS;

- unfinished investments in their creation;

- financial investments;

- SHE.

ONA (account 09), which are temporary differences in income tax that arise due to a discrepancy between accounting and tax data, is a rather random phenomenon for non-current assets . They do not correspond to the meaning of a non-current asset either in essence (this is not property, but a certain estimated amount of tax), or in terms of duration of existence (they may not be long-term). Not all organizations use them, and they, as a rule, do not play a significant role in non-current assets , so we will not dwell on them.

Fixed Assets (Fixed Assets)

Regulates PBU 6/01 “Accounting for fixed assets”

Fixed assets are objects capable of generating income, used for a long time (over 12 months) and intended for use in the production of products, when performing work or providing services, for the management needs of the organization.

The main assets include:

- 3buildings, structures,

- working and power machines and equipment,

- measuring and control instruments and devices,

- Computer Engineering,

- vehicles,

- tools, production and household equipment and supplies,

- working, productive and breeding livestock,

- perennial plantings,

- on-farm roads and other relevant facilities,

- capital investments for radical improvement of land (drainage, irrigation and other reclamation works);

- capital investments in leased fixed assets;

- land,

- environmental management objects (water, subsoil and other natural resources).

What do intangible assets of organizations consist of?

Intangible assets, according to PBU 14/2007, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n, include documented rights to unique intangible objects, for example, rights to works, designs, technologies, brands (marks), reputation.

In the balance sheet they are divided:

- on NMA;

- R&D;

- intangible exploration assets that arise only in organizations engaged in the development of natural resources and can be depreciated during the process of their creation.

The cost of operated intangible assets in accordance with clause 35 of PBU 4/99 in the balance sheet is shown minus depreciation on them. Those. data on intangible assets in non-current assets consists of balances on accounts 04 and 08 (for intangible exploration assets) reduced by depreciation amounts (account 05). If the data on intangible assets listed on account 08 does not correspond to the analytics highlighted in the balance sheet, then they may be:

- added to the balances of used intangible assets when their amount is insignificant (up to 5%) compared to the residual value of intangible assets;

- allocated to an additionally entered separate line in non-current assets ;

- shown in the line “Other non-current assets ”.

In simplified reporting (Appendix 5 to Order No. 66n), it is allowed to reflect on 1 line both the residual value of operated intangible assets and existing unfinished investments in them.

This section provides information on current (more liquid than non-current) assets.

3.1.2.1. Line 1210 “Inventories”

This line of the Balance Sheet reflects information about the organization’s reserves, namely (clause 20 of PBU 4/99):

- about objects of labor intended for processing, processing or use in production or for economic needs;

— about the means of labor, which, in accordance with the established procedure, are included in the composition of funds in circulation;

— about costs in work in progress;

— about finished products (manufactured products);

— about goods;

- about future expenses, etc.

3.1.2.1.1. At what cost are inventories accounted for?

1. Raw materials

and other similar values are taken into account at actual cost, which is determined in the manner established by clauses 6 - 11, 13 PBU 5/01, clauses 16, 17, 63 - 71 of the Guidelines for accounting of material and production inventories (clause 5 of PBU 5/01, clauses 15, 62 of the Guidelines for the accounting of inventories, clause 11 of the Guidelines for the accounting of special tools, special devices, special equipment and special clothing).

The specified material assets, accounted for in separate subaccounts of account 10 “Materials,” can be listed on this account at actual cost or at accounting prices. In the latter case, the difference between the cost of these assets at accounting prices and their actual cost of acquisition (procurement) is reflected in account 16 “Deviation in the cost of materials” (clauses 80, 83, 85 of the Guidelines for accounting of inventories, p. 13 Guidelines for accounting of special tools, special devices, special equipment and special clothing, Instructions for using the Chart of Accounts).

If the receipt of materials is reflected using account 15 “Procurement and acquisition of material assets”, the balance of account 15 shows the availability of goods in transit at the end of the month (at the agreed value) (Instructions for using the Chart of Accounts, clause 26 of PBU 5/01, clause 85 of the Guidelines for accounting of inventories).

2. Finished products

is accepted for accounting at the actual production cost, which is determined in the manner established by clause 7 of PBU 5/01, para. 5 clause 16, clause 203 of the Guidelines for accounting of inventories. At the same time, the balances of finished products in the warehouse (other storage places) at the end (beginning) of the reporting period can be assessed in the analytical and synthetic accounting of the organization at accounting prices, in particular at standard (planned) cost (clause 5 of PBU 5/01, para. 2 clause 203, clause 204 of the Guidelines for accounting of inventories).

Information about the availability and movement of finished products is reflected in account 43 “Finished products”.

If accounting for finished products is carried out at accounting prices, then the difference between the actual cost and the cost of finished products at accounting prices is reflected in account 43 in a separate subaccount “Deviations of the actual cost of finished products from the accounting cost” (clause 206 of the Guidelines for accounting of material and production stocks).

When accounting for finished products at standard (planned) cost, to identify the difference between the actual cost and the cost of finished products at standard cost, account 40 “Production (work, Sales)” can be used and has no balance as of the reporting date.

Thus, if deviations from the accounting value of finished products are accounted for on account 43, then in the Balance Sheet finished products are reflected at actual cost, and if on account 40, then finished products are reflected at standard (planned) cost (clause 59 of the Regulations on maintaining accounting and financial statements, clause 24 PBU 5/01).

3. Products

are accepted for accounting at actual cost, which is determined in the manner established by clauses 6, 8 - 11 PBU 5/01 (clause 5 PBU 5/01). Organizations engaged in trading activities can account for goods at the cost of their acquisition. Organizations engaged in retail trade can account for goods at their sales price (clause 13 of PBU 5/01, clause 60 of the Regulations on Accounting and Financial Reporting).

Account 41 “Goods” is intended to summarize information about the availability and movement of goods.

In organizations engaged in retail trade and keeping records of goods at sales prices, information about trade margins (discounts, markups) on goods is reflected in account 42 “Trade margin”.

The receipt of goods and containers can be reflected using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets” or without their use in a manner similar to the procedure for accounting for relevant transactions with materials (Instructions for using the Chart of Accounts).

In general, the actual cost of inventories (including raw materials, materials, finished products and goods) is not subject to change (clause 12 of PBU 5/01). But for inventories, the market price of which has decreased or they have become obsolete or have completely or partially lost their original qualities, a reserve is accrued in accounting for a decrease in the value of material assets

. To account for such a reserve, account 14 “Reserves for reducing the value of material assets” is intended (clause 25 of PBU 5/01, clause 20 of the Methodological Guidelines for Accounting for Inventories, Instructions for the Application of the Chart of Accounts). Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

4. Goods shipped

are accounted for in account 45 “Goods shipped” at a cost consisting of the actual production cost (or standard (planned) cost) and costs of selling (selling) products (goods, work, services, etc.) (with partial write-off of costs) (Instructions for using the Chart of Accounts, clause 61 of the Regulations on Accounting and Financial Reporting).

Attention!

A reserve for a decrease in the value of goods listed as shipped goods on the reporting date is not created (Letters of the Ministry of Finance of Russia dated January 29, 2008 N 07-05-06/18, dated January 29, 2009 N 07-02-18/01).

5. Work in progress (WIP)

is taken into account in the assessment determined by one of the methods established by clause 64 of the Regulations on Accounting and Financial Reporting.

To reduce the value of work in progress, a reserve can be created, which is accounted for in account 14 “Reserves for reducing the value of material assets” (Instructions for using the Chart of Accounts). Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

6. Animals for growing and fattening

are taken into account on account 11 “Animals for growing and fattening” (on the corresponding sub-accounts). Animals purchased from other organizations and persons are accounted for at the actual cost of acquisition (actual costs) or accounting prices; transferred from the main herd - at residual value or initial (replacement) cost; offspring, weight gain and growth of animals - at the planned cost with adjustment at the end of the year to the actual cost of rearing (clauses 9, 10, 12, 13, 14 of the Methodological Recommendations for the accounting of animals for growing and fattening, Instructions for using the Chart of Accounts) .

The acquisition of animals from other organizations and persons can be reflected using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviations in the cost of material assets” (when using accounting prices) (paragraph 2 of clause 45 of the Methodological Recommendations for the Accounting of Farmed Animals and fattening, Methodological recommendations for the use of the Chart of Accounts of organizations of the agro-industrial complex, Instructions for the use of the Chart of Accounts, Methodological recommendations for the correspondence of accounts of agricultural organizations). Animals for growing and fattening, owned by the organization, but in transit, are taken into account in accounting in the assessment provided for in the contract, with subsequent clarification of the actual cost (clause 62 of the Methodological Recommendations for Accounting for Animals for Growing and Fattening).

7. Costs associated with the sale

products, goods, works, services, as well as expenses associated with the procurement of agricultural raw materials, livestock and poultry (if the organization’s accounting policy provides for their partial write-off from account 44 “Sales expenses”), are subject to distribution as follows (Instructions for application of the Chart of Accounts, Guidelines for the application of the Chart of Accounts of enterprises and organizations of the agro-industrial complex, paragraph 2 of paragraph 228 of the Guidelines for accounting of inventories):

1) in organizations engaged in industrial and other production activities - packaging and transportation costs (between individual types of shipped products on a monthly basis, based on their weight, volume, production cost or other relevant indicators);

2) in organizations engaged in trading and other intermediary activities - transportation costs (between the goods sold and the balance of goods at the end of each month);

3) in organizations that procure and process agricultural products - expenses for the procurement of agricultural raw materials and expenses for the procurement of livestock and poultry.

8. Deferred expenses

are taken into account in the amount of actual costs incurred minus their part attributed to expenses of expired periods (clause 65 of the Regulations on accounting and financial reporting, paragraph 2, paragraph 39 PBU 14/2007, paragraph 16 PBU 2/2008, paragraph 2 clause 8 PBU 15/2008).

FOR MORE on this issue see:

Section “Accounting for materials (including raw materials, purchased semi-finished products, spare parts, etc.) (accounts 10, 14, 15, 16)” of the Guide to Information Security “Correspondence of Invoices”

Section “Accounting for special equipment and clothing (subaccounts 10-10, 10-11)” of the Guide to Information Security “Correspondence of Accounts”

Section “Accounting for goods (accounts 41, 42, 14, 45)” of the Guide to Information Security “Correspondence of invoices”

Section “Accounting for Finished Products (Accounts 43, 40, 14, 45)” of the Guide to Information Security “Correspondence of Invoices”

Section “Accounting for animals for growing and fattening (account 11)” of the Guide to Information Security “Correspondence of accounts”

Section “Sales Expenses” of the Information Security Guide “Correspondence of Invoices”

Section “Accounting for production costs and sales expenses (accounts 20 - 29, 44)” of the Guide to Information Security “Correspondence of invoices”

3.1.2.1.2. What accounting data is used?

when filling out line 1210 “Inventories”

This line of the Balance Sheet indicates the cost of inventories, determined based on the methods used by the organization to evaluate inventories, minus the created reserve for reducing their value (clauses 58, 59, 61, 62, 64, 65 of the Regulations on Accounting and Financial Reporting , pp. 24, 25 PBU 5/01, pp. 60, 61 Methodological recommendations for accounting of animals for growing and fattening, pp. 20, 35 PBU 4/99).

Line 1210 “inventories” = Debit balance on account 10 + Debit balance on account 11 + Debit balance on account 41 – Credit balance on account 42 + Debit balance on account 43 + Debit balance on account 15 +- Balance on account 16 – Credit balance on account 14 + Debit balance on account 45 + Debit balance on accounts 20, 21, 23, 28, 29 + Debit balance on account 97 (analytical report of expense accounting with a write-off period not exceeding 12 months) + Debit balance on account 44

———————————

<*> In the part related to inventories (excluding amounts related to purchased equipment for installation).

Organizations independently determine the detail of the indicator on line 1210 “Inventories”. For example, the balance sheet may contain separate information on the cost of materials, finished products and goods, costs in work in progress, if such information is recognized by the organization as significant (paragraph 2 of clause 11 of PBU 4/99, clause 3 of Order of the Ministry of Finance of Russia N 66n). The organization’s decision on whether an indicator is significant depends on the assessment of the indicator, its nature, and the specific circumstances of its occurrence. That is, when preparing financial statements, materiality is determined by a combination of qualitative and quantitative factors (Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

The indicators in line 1210 “Inventories” as of December 31 of the previous year and as of December 31 of the year preceding the previous one are transferred from the Balance Sheets compiled as of the specified reporting dates. When preparing financial statements for the reporting period of 2011 in the columns “As of December 31, 2010” and "As of December 31, 2009" line 1210 “Inventories” of the Balance Sheet reflects the indicators in column 4 of line 210 “Inventories” of the Balance Sheets for 2010 and 2009.

EXAMPLE 2.1

Indicators for accounts 10, 14, 20, 23, 41, 43, 97 in accounting (indicators for accounts 15 and 16, 21, 28, 29, 42, 44, 45 are not included in accounting).

rub.

| At the reporting date | |

| 1 | 2 |

| 1. By debit of account 10 | 2 469 600 |

| 2. On the credit of account 14 (in terms of reserves for reduction in the cost of materials) | 48 000 |

| 3. On the debit of account 20 | 4 000 000 |

| 4. By debit of account 23 | 54 200 |

| 5. By debit of account 41 | 5 160 000 |

| 6. By debit of account 43 | 3 030 000 |

| 7. By debit of account 97 | 38 000 |

Balance Sheet Indicators for 2009 and 2010

thousand roubles.

| Index | Balance sheet for 2010 | Balance sheet for 2009 |

| Column 4 “At the end of the reporting period” on line 210 “Inventories” | 22 737 | 18 932 |

| Column 4 “At the end of the reporting period” for the line “raw materials, materials and other similar values” | 8 622 | 6 480 |

| Column 4 “At the end of the reporting period” for the line “costs in work in progress” | 9 634 | 8 200 |

| Column 4 “At the end of the reporting period” for the line “finished products and goods for resale” | 4 120 | 3 862 |

Due to the correction in 2011 of a significant error made in 2009 <*>, the indicators in the column “As of December 31, 2010” and "As of December 31, 2009" on line 1210 “Inventories” are adjusted (decreased) by RUB 300,000.

———————————

<*> The cost of materials supplied to carry out work, the revenue from which was recognized in 2009, was erroneously not written off as expenses and cost of sales.

Solution

The cost of the organization's inventory is:

as of the reporting date - 14,704 thousand rubles. (RUB 2,469,600 - RUB 48,000 + RUB 4,000,000 + RUB 54,200 + RUB 5,160,000 + RUB 3,030,000 + RUB 38,000);

as of December 31, 2010 - RUB 22,437 thousand. (22,737 thousand rubles - 300 thousand rubles);

as of December 31, 2009 - RUB 18,632 thousand. (18,932 thousand rubles - 300 thousand rubles).

Including:

the cost of materials for the organization is:

as of the reporting date - 2422 thousand rubles. (RUB 2,469,600 - RUB 48,000);

as of December 31, 2010 - 8322 thousand rubles. (8622 thousand rubles - 300 thousand rubles);

as of December 31, 2009 - 6180 thousand rubles. (6480 thousand rubles - 300 thousand rubles);

costs in work in progress are:

as of the reporting date - 4054 thousand rubles. (RUB 4,000,000 + RUB 54,200);

as of December 31, 2010 - 9634 thousand rubles;

as of December 31, 2009 - 8,200 thousand rubles;

The cost of finished products and goods for resale is:

as of the reporting date - 8190 thousand rubles. (RUB 5,160,000 + RUB 3,030,000);

as of December 31, 2010 - 4120 thousand rubles;

as of December 31, 2009 - 3862 thousand rubles.

A fragment of the Balance Sheet in Example 2.1 will look like this.

| Explanations | Indicator name | Code | On___ 20__ | As of December 31, 20__ | As of December 31, 20__ |

| 1 | 2 | 3 | 4 | 5 | 6 |

| II Current assets Reserves | 1210 | 14 704 | 22 437 | 18 632 | |

| Including raw materials and materials | 1211 | 2 422 | 8 322 | 6 180 | |

| Costs in work in progress | 1212 | 4 054 | 9 634 | 8 200 | |

| Finished products and goods for resale | 1213 | 8 190 | 4 120 | 3 862 |

3.1.2.2. Line 1220 “Value added tax

according to acquired values"

This line reflects the balance of the amounts of “input” VAT that counterparties presented to the organization for payment when it acquired goods (works, services), while the organization at the end of the reporting period did not accept them for deduction and did not include them in the cost of acquired assets or as expenses . This balance is taken into account on account 19 “Value added tax on acquired assets.”

3.1.2.2.1. What causes account balance 19

Currently, the possibility of deducting “input” VAT in the general case does not depend on the fact of payment for the purchased fixed assets, goods, works, and services.

However, the balance on account 19 at the end of the reporting period may arise:

— when performing export operations (clause 3 of Article 172 of the Tax Code of the Russian Federation);

— in the production of goods with a long production cycle (clause 7 of Article 172 of the Tax Code of the Russian Federation);

— when paying VAT by tax agents (clause 3 of Article 171 of the Tax Code of the Russian Federation);

- when making expenses normalized for profit tax purposes, when at the end of the reporting period they are not fully taken into account as expenses, but there is a possibility that before the end of the year the organization will have the right to recognize them for profit tax purposes and, accordingly, the right to deduct “input” VAT on them (clause 7 of Article 171 of the Tax Code of the Russian Federation);

— when importing goods into the territory of the Russian Federation and other territories under its jurisdiction (clause 1 of Article 172 of the Tax Code of the Russian Federation);

— when invoices containing errors are received from the counterparty, or in the absence of invoices (clauses 1, 2 of Article 169 of the Tax Code of the Russian Federation);

- when acquiring fixed assets and intangible assets (account 19 balance is possible before the fixed assets and intangible assets are accepted for accounting in accounts 01 “Fixed Assets” and 04 “Intangible Assets”, if the organization on this issue is guided by the opinion of the Ministry of Finance of Russia) (paragraph 3, paragraph 1 Article 172 of the Tax Code of the Russian Federation, see, for example, Letter of the Ministry of Finance of Russia dated September 21, 2007 N 03-07-10/20);

— when purchasing goods, works, services, including fixed assets and intangible assets, used in both taxable and non-VAT-taxable transactions. In this case, VAT is taken for deduction or taken into account in the cost of goods, works, services in the proportion in which they are used for the production and (or) sale of goods (works, services, property rights), transactions for the sale of which are subject to taxation (exempt from taxation). This proportion is determined based on the results of the tax period, which is currently a quarter (Article 163, paragraph 4 of Article 170 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated November 12, 2008 N 03-07-07/121, dated October 23, 2008 N 03 -03-05/136). It is impossible to distribute VAT before the end of the quarter, so it is taken into account in account 19 in the amount actually presented.

ADDITIONALLY on this issue, see the subsection “Value Added Tax (VAT)” of the Guide to IB “Correspondence of Invoices”.

3.1.2.2.2. What accounting data is used?

when filling out line 1220 “Value added tax

according to acquired values"

When filling out this line of the Balance Sheet, data on the balance of account 19 as of the reporting date is used.

Line 1220 “Value added tax on acquired assets” of the balance sheet = Debit balance of account 19

The indicators in line 1220 “Value added tax on acquired assets” as of December 31 of the previous year and as of December 31 of the year preceding the previous one are transferred from the balance sheets compiled as of the specified reporting dates.

When preparing financial statements for the reporting period of 2011 in the columns “As of December 31, 2010” and "As of December 31, 2009" line 1220 “Value added tax on acquired assets” of the Balance Sheet reflects the indicators in column 4 of line 220 of the Balance Sheets for 2010 and 2009.

EXAMPLE 2.2

Indicators for account 19 in accounting.

rub.

| At the reporting date | |

| 1 | 2 |

| 1. By debit of account 19 | 925 000 |

Balance Sheet Indicators for 2009 and 2010

thousand roubles.

| Column 4 “At the end of the reporting period” on line 220 “Value added tax on acquired assets” of the Balance Sheet for 2009. | 1582 |

| Column 4 “At the end of the reporting period” on line 220 “Value added tax on acquired assets” of the Balance Sheet for 2010. | 3953 |

Solution

The balance of the “input” VAT as of the reporting date is RUB 925,000.

A fragment of the Balance Sheet in Example 2.2 will look like this.

What applies to the enterprise OS

In accordance with PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, fixed assets represent a set of own property involved in the operation of the enterprise - from land and buildings to inventory. This also includes objects leased with the condition of being included on the balance sheet of the lessee.

In the balance sheet they are divided:

- on material exploration assets that arise only from organizations engaged in the development of natural resources and can be depreciated during the process of their creation;

- OS;

- profitable investments in materiel, which are fixed assets owned by the enterprise, but not exploited by it in its own production, but transferred for this purpose to the outside.

According to clause 35 of PBU 4/99, the cost of operating fixed assets is shown in the balance sheet minus depreciation on them. Those. fixed assets in consists of balances on accounts 01, 03 and 08 (for tangible exploration assets) reduced by depreciation amounts (account 02). If the fixed assets data listed on account 08 does not correspond to the analytics highlighted in the balance sheet, then they may be:

- attached to the balances of the fixed assets used when their amount is insignificant (up to 5%) compared to the residual value of the fixed assets;

- allocated to an additionally entered separate line in non-current assets ;

- shown in the line “Other non-current assets ”.

Together with the balances on account 08 for investments in fixed assets, the balances on account 07 are taken into account.

In simplified reporting (Appendix 5 to Order No. 66n), it is allowed to reflect on 1 line both the residual value of operating fixed assets and existing unfinished investments in them.

Research and development results

Regulates PBU 17/02 “Accounting for R&D expenses”

Research and development results - this item reflects the costs of completed research, development and technological work (R&D).

The following works are taken into account as part of R&D expenses:

- for which results were obtained that are subject to legal protection, but were not formalized in the manner prescribed by law;

- for which results were obtained that are not subject to legal protection in accordance with the norms of current legislation.

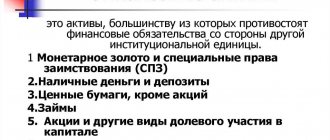

What is included in financial investments

The composition of financial investments is determined in PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n. These are securities, deposits in the management company, loans issued, deposits and receivables acquired under an assignment agreement.

Among financial investments, only those with a maturity period exceeding 1 year are classified as non-current assets Taking into account this requirement, balances on accounts 55, 58 and 73 are selected non-current assets.

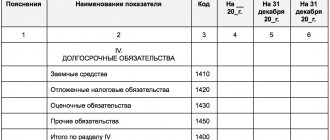

Decoding lines for balance sheet liabilities

| Index | Code | Which account data does it use? | Algorithm for calculating the indicator |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 “Authorized capital” | Kt 80 |

| Own shares purchased from shareholders | 1320 | 81 “Own shares (shares)” | Dt 81 (in parentheses) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | Kt 83 (regarding the amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | Kt 83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | Kt 82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or Kt 99 + Kt 84 Or Dt 99 + Dt 84 (the result is reflected in parentheses) Or Kt 84 - Dt 99 (if the value is negative, it is reflected in parentheses) Or Kt 99 - Dt 84 (same) |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | Kt 67 (regarding debts with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | Kt 77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | Kt 96 (regarding estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60, 62, 68, 69, 76, 86 “Targeted financing” | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 76 + K86 (all in terms of long-term debt) |

| Borrowed funds | 1510 | 66 “Calculations for short-term loans and borrowings”, 67 | Kt 66 + Kt 67 (in terms of debt with a repayment period of no more than 12 months as of the reporting date) |

| Accounts payable | 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75 + Kt 76 (in terms of short-term debt, minus VAT calculations reflected in the accounts on advances issued and received) |

| revenue of the future periods | 1530 | 98 “Deferred income” | Kt 98 |

| Estimated liabilities | 1540 | 96 | Kt 96 (regarding estimated liabilities with a maturity period of no more than 12 months after the reporting date) |

| Other obligations | 1550 | 86 | Kt 86 (regarding short-term liabilities) |

Read also

31.07.2018

Other non-current assets - what are they?

The line “Other non-current assets ” is intended to reflect data in one of 2 cases:

- For some reason, they cannot be included in any of the lines highlighted in non-current assets in the recommended form of the balance sheet.

- They are essential to be combined with one of the highlighted lines in the balance sheet. Most often it shows non-current assets formed by large balances in account 08 (for example, work in progress).

To learn how the section dedicated to non-current assets in the balance sheet will look like, read the article “Balance Sheet (Assets and Liabilities, Sections, Types)”

Financial investments

Regulates PBU 19/02 “Accounting for financial investments”

Please note that the article “Financial investments” is in both the “Non-current assets” section and the “Current assets” section. Previously, in the old balance sheet form they were indicated more clearly: “Long-term financial investments” and “Short-term financial investments”. The meaning of the articles remained the same, only the titles became shorter.

Financial investments are:

- state and municipal securities,

- securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills);

- contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies);

- loans provided to other organizations,

- deposits in credit institutions, d

- receivables acquired on the basis of assignment of the right of claim, etc.

- contributions of a partner organization under a simple partnership agreement.

Financial investments indicated in section I of the balance sheet are long-term, the circulation (repayment) period of which exceeds 12 months.

Other non-current assets (examples)

Other non-current assets in the balance sheet are property, information about which is not included in other lines of section 1 of the balance sheet. The cost of other non-current assets is reflected on line 1190 of the balance sheet.

Other non-current assets include:

- perennial plantings that have not yet reached the age of exploitation;

- equipment that requires installation;

- expenses of the organization in objects that will subsequently be accepted for accounting as fixed assets and intangible assets, as well as expenses associated with the implementation of unfinished R&D;

- advances and prepayments for work and services related to the construction of fixed assets;

- deferred expenses with a write-off period of more than 12 months.

Let us show in the table based on the data of which accounting accounts line 1190 of the balance sheet is formed (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n):

Why are they needed?

Functions of non-current assets:

- Receiving financial profit in the future.

- Ensuring that goods and services are supplied within specified time frames – without interruption.

- Maintenance and provision of the needs of the enterprise.

- Possibility to pay off credit institutions.

- Production and delivery of products.

- Improving the quality properties of manufactured goods.

Based on such data, the manager can assess the efficiency of the enterprise.