What is a bill of exchange and why is it needed?

This debt document is paid at the end of the term. A person can use such paper to pay for goods or transfer it to another.

Often bills of exchange are used for mutual settlements between subsidiaries of the same holding company, so as not to transfer money between their companies and not pay taxes. If a business cannot pay suppliers or employees (for example, when accounts are garnished), it can write a promissory note to continue operating.

There are 4 options for payment terms:

- to a specific date;

- by the time of compilation;

- when presented;

- by the time of presentation.

If the time of return is tied to the date of presentation, the issued financial document is sold at par upon issue, but it indicates interest that accrues until the return date. In other cases, when issued, such a receipt costs less than its face value, which is determined by the amount of interest.

Accounting efficiency

In the process of using bill of exchange accounting, a number of tasks can be solved:

- Creation of favorable conditions for the timely receipt of funds from the sale of goods offered, when performing a number of works and services provided. You can execute a transaction using a security, so it is not necessary to make an advance payment for the placed order. Trust between the customer and the supplier increases, and commodity-monetary communications are strengthened.

- Promoting the development of loans on a commercial basis. You can carry out transactions without using funds, and also set deadlines for payments made. Both parties independently come to a decision regarding the time frame for payment.

- A valid bill of exchange can be used as an alternative to monetary assets when paying for services of legal entities and individuals. In this case, the requirements of both parties must be taken into account.

- The paper can be sold and bought, and it can also act as collateral for obtaining a loan from a banking organization. It helps to get a discount, a loan, and conduct financial transactions.

This is an alternative means of helping to strengthen the relationship between two parties to a commodity transaction. Proper accounting of bills of exchange will help to establish order in document reporting at the enterprise, as well as control the status of debts and manage clients who purchase goods on credit.

Release Features

If all the necessary attributes are present, then the bill does not have to be drawn up on stamp paper. However, there are special forms that can be ordered from a printing house or purchased from the treasury.

When selling a financial instrument, a transfer and acceptance certificate is drawn up. It specifies the details and describes the transaction under which it was issued.

Accounting for own bills

They are commodity and financial. The first are given as confirmation that the buyer owes the supplier money for the goods. The second is when the subject of the transaction is the debt obligation itself. A financial promissory note can be either from the issuer (the legal entity that issued the promissory note) or from another company.

Typically, an organization issues such securities not at par value, but with a discount or interest. They are accounted for in the same way. The issuer's expenses (and the holder's income) of the discount variety will be the difference between the face value and the purchase price. If we are talking about an issued interest-bearing bill, the amount of interest.

Closing a bill of exchange

Useful articles

What is an endorsement on a bill of exchange and how to fill it out correctly

Often the maturity date is stated “at sight, but not before” a certain date. To pay off a debt, they draw up an act of presenting a promissory note and indicate all the details of the document, its denomination and the full amount that the drawer will pay. When the legal entity that issued the document has paid the debt, it transfers the receipt to the archive, along with the rest of the financial documentation.

Advance payment by bill of exchange

A loan letter is a convenient way to make an advance payment. Neither the supplier nor the buyer will fear that they will be deceived. An additional advantage is that the buyer will have time to make a profit, and the supplier can immediately sell the note and return the money for the goods.

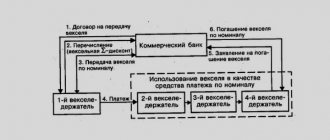

Redistribution of funds

If two companies belong to the same holding company, and one does not have enough funds, and the other has more than it needs, the first can issue a second financial bill. This method is also convenient for covering internal debts of one subsidiary to another. But it is better to add a small discount to the document so that the tax office does not consider this operation as a gratuitous loan.

How does accounting work?

A debenture gives the right to collect the amount of the debt. But besides this, the circulation of bills can take such forms as purchase by third parties or organizations. This process is called accounting.

Sometimes it is necessary to receive money before the expiration of the period specified in the document, then the securities can be sold to the bank. A credit institution buys debt obligations at a discount using the following formula:

- D—discount amount;

- B - the amount specified in the obligation;

- T is the number of days until the maturity date;

- I is the bank's discount rate.

A similar formula can be used as a cheat sheet to understand how profitable it is to sell a debt obligation to a bank.

Accounting for own debt obligations

Ownership is usually simple when there are two parties involved. For example, when one party cannot pay for goods or services with money, it issues a bill of exchange. In accounting entries they are indicated as collateral issued and received. When accounting, these papers will be written off from the accounts. Debt securities recorded at par are not subject to tax.

Accounting for other people's bills of exchange as part of financial investments

For borrowed securities to be considered financial investments, they must generate a profit. Discount or interest obligations meet these conditions. An example would be bills received as follows:

| Methods of obtaining | Lines in the ledger |

| Purchase | Dt 58-2 Kt 76 |

| Payment by third party bill | Dt 58-2 Kt 62 |

| Contribution to the authorized capital | Dt 58-2 Kt 75 |

| During property exchange transactions | Dt 58-2 Kt 91, Dt 91 Kt 10 |

| Gratuitous | Dt 58-2 Kt 91 |

The discount or interest received in such an acquisition scheme is taxable.

Accounting for other people's bills that are not financial investments

Those securities that do not generate income are not taken into account on the balance sheet as financial investments. These are, first of all, non-interest bearing obligations, as well as those purchased at par or above par. Receipt is reflected in account 76; when writing off securities, only their value is taken into account.

Accounting for commodity bills

In the case of accounting for goods, a discount card is issued, which takes into account the amount for the goods and the overpayment for the duration of the debt obligation. This data is recorded in different lines of the accounting books: main - in debit 51, credit 62, discount - in debit 51, credit 91-1.

Required details

This document is drawn up on a special form.

Its sample contains the following details:

- A bill of exchange can be simple or transferable. Its type is indicated in the name.

- The place and time of drawing up the document must be indicated.

- The amount that must be paid by the debtor. Its payment is not subject to additional obligations. The payment currency must be specified.

- Payment due date required. It can be expressed by a specific date, made upon presentation, or within some period from presentation to payment or preparation.

- The document may indicate the place where the payment should be made. This is usually the location of the debtor.

- The first purchaser of the security is indicated - the creditor.

- The debtor's signature is affixed.

Acceptance and endorsement

The concept of acceptance applies only to bills of exchange. In this case, the recipient of the money turns to the payer to confirm the latter’s obligation to pay the money.

If he has no objections, he puts an acceptance mark on the document. He has the right to accept only part of the amount or refuse it altogether.

Any inscription made by the drawee (drawer) on a bill of exchange is considered acceptance.

In the latter case, the owner of the security protests the bill. The court considers it and makes a decision. Usually the very existence of a bill of exchange is conclusive evidence of the existence of debt obligations.

There is a banker's acceptance, in which this institution guarantees the payment of money to the recipient.

An endorsement may be made on the reverse side of the bill of exchange. It means that the payee has ordered that the full payment be made to another person. Such an inscription is called an endorsement.

It must be made by the recipient himself, and it must indicate the full amount of the payment. There can be any number of such endorsements on a bill of exchange. If there is not enough space on the back of the form, an additional sheet is used for this purpose.

It is important to emphasize that after the endorsement is made, if the payer refuses to make payment, such responsibility falls on the first endorser. If he refuses, it will be for the next one.

That is, when this security is endorsed, the previous owner shares responsibility for paying the required amount.

There are various types of endorsement:

- Blank - in this case there is no indication of who gets the right to receive the money. In fact, such a security can be presented for payment by any person holding the document.

- The order specifies the details of the new recipient of the funds.

- endorsement is not actually the right to transfer ownership of a security. In this case, the former owner remains with him, and the new person must receive the money on his behalf.

- There is a pledge , in which an inscription is made on the bill stating that the security has been pledged.

- non-negotiable endorsement is used when the previous owner of the paper refuses to be held liable in the event of non-payment of the debt.

What problems does the bill solve?

It can be used like this:

- Allows you to pay for transactions without using cash.

- Makes it possible to use another method of payment for the received batch of goods.

- Can serve as collateral when obtaining a bank loan.

- It can be a convenient means of mutual settlements between enterprises for offsetting mutual claims.

- This security can be used as an independent object of purchase or sale.

Classification of bills by type

Their classification is as follows:

- financial;

- commercial (commodity);

- blank (filled out not immediately, but after specifying the necessary data);

- friendly (their issuance and repayment are conditioned by complete trust in the partner);

- bronze ones are also one of the examples of bills of exchange and express fictitious, fraudulent monetary relations;

- security (secure the loan);

- discount - purchased cheaper than face value to generate income for the holder;

- euro bills;

- treasury;

- recta bills (without the possibility of endorsement).

Payment on a bill

This payment has an important feature. In this case, it is not the debtor who looks for the creditor to pay, but the latter who looks for him. This follows from the nature of this security.

The payer may well not know who his creditor is, since the bill may be endorsed to a person unknown to him.

Execution is carried out against the bill of exchange document. Only its bearer has the right to receive payment.

The place of performance of the obligation is the one indicated in the bill, or where the debtor is located. In order to receive funds, the holder of the bill must come there at the time specified in the document.

The maturity date for this security can be determined in several ways:

- on a specific date specified in the document;

- upon presentation of a bill of exchange for payment;

- after a certain time after presentation or preparation.

If the wording indicates a period that must pass, then it is calculated based on the fact that the first day of the interval is the next day after the event occurred.

The payee can only be the one for whom the endorsement was made. Payment must be made on the day determined by the terms of provision of this security.

Difference from promissory note

Since a bill is a promissory note, it is often compared to a promissory note. But even here, upon closer examination, there are differences:

Sign | Bill of exchange | IOU |

| Decor | In strict accordance with the established form and details | Often free-form |

| Responsibility | Evasion from fulfillment of obligations under the bill entails financial liability. The issue and circulation of bills is regulated by a special federal law | Has no established legal force without notarization |

| Release conditions | The document is not tied to a specific transaction and can be transferred to a third party | A receipt is usually drawn up for a specific transaction, the essence and price of which is stated in the document |

| Status | It is a security and has international status | Not a security |

In general, we are talking only about similar, but mostly different types of loan processing. A bill of exchange is much more reliable.

Difference from bond

At first glance, a bill can be compared to a bond. Both are relatively reliable and have proven to be conservative investments. But they have a lot of differences, sometimes fundamental ones. The differences between a bill and a bond are presented in the table:

Sign | Bill of exchange | Bond |

| Release form | Always has a strictly defined documentary form, where all the details of the paper are written down (with the exception of treasury bills) | Can be in either documentary or non-documentary form, with the latter being more widespread |

| Release | Often produced in one single copy for a specific purpose | Bonds are always issued in large quantities with a certain frequency |

| Board shape | A bill of exchange is always paid only in cash in a single amount specified in the details of the paper | Can be repaid both in money and other monetary equivalents, for example, property and other valuables |

| Validity | Relatively short-term. Often issued for a period not exceeding a calendar year (although it can be significantly longer) | Long-term securities. Bonds are issued for a period of one year, most often 3 or 5 years |

| Income | Unless otherwise specified in the details, the bill is canceled strictly for the amount issued | In addition to its cost, which is paid off in shares, the bond implies additional income for holding the paper, called a “coupon” (analogous to interest on a bank deposit) |

| Who can release | An individual or legal entity, including financial institutions. Never - public authorities (exception - treasury bills) | State and municipal authorities regularly act as issuers of bonds |

| Use by individuals and investors | Can be used by large investors, but are more often used in professional and business circles | They are actively used by individuals who are not related to the paper-issuing business. Are an investment instrument |

| Walking on the stock market | Can be sold privately without the mediation of a broker | Available only on the stock market for registered exchange participants |

Thus, these seemingly similar instruments have more differences than similarities. In fact, the only thing they have in common is that both securities are debt and belong to the category of securities. Both the bill and the bonds can be resold, thus obtaining additional benefits.

How much will the bill cost if you buy it on the secondary market - for example, from some bank? Let's say you want to buy a bill of exchange that will pay 100,000 rubles in two years. How much should you pay for it today? Less than 100 thousand, because you can put it in the bank today at interest and get more in two years. Thus, the bill will be purchased at the present value, the calculation of which was discussed in this article.

How to issue your bill to a legal entity?

In addition to the Civil Code, the right of a legal entity to issue its bills of exchange is enshrined in Law No. 48-FZ of March 11, 1997 “On bills of exchange and promissory notes.”

The contents of the bill of exchange are stated in the Decree of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated 08/07/1937 N 104/1341 “On the entry into force of the Regulations on bills of exchange and promissory notes”. When you saw the date on this document, you probably thought we were lost in time. But no - the Regulation on the bill, adopted under Stalin, is in force!

In order for a company’s bill of exchange to become a bill of exchange, and not just a promissory note, it must contain certain conditions, the most obvious of which is the unconditional obligation to make payment within a certain period of time. In this case, the paper must have the name “bill”

The document must contain information about the payment deadline, the specific name of the person to whom the payment should be made, the date and place of drawing up the bill, and the signature of the drawer.

Despite the fact that a bill of exchange can be issued on plain paper, in practice, most often, they are made on special printing forms with protection against forgery. These forms can be purchased freely today.

Standard samples of bills recommended for issue by all companies are approved by Decree of the Government of the Russian Federation of September 26, 1994 No. 1094.

There are no restrictions on the issuance of their bills of exchange for legal entities, that is, any firm or company can at any time begin issuing their bills of exchange to counterparties.

Types of bills

A promissory note represents an unconditional obligation to pay the amount to its legal owner at a specified place at a specified time.

There are three sides to a bill of exchange. The payer (drawee or debtor) is the person who must pay the money.

The creditor is the drawer, and by his order the amount is paid to the remittor. The latter has the right to endorse the document to other citizens or organizations.

An avalized bill has a bank guarantee.

If the payer refuses to fulfill the obligations, the amount will be transferred to the recipient by the credit institution that provides the guarantee due to avalization.