BCC “Property tax for 2021 for legal entities” is the code indicated in the payment order to correctly identify the payment in the budget.

BCC “Property 2021 for legal entities” is one of the main details of the payment order for the payment of this obligation. Budget classification codes consist of 20 digits, which store information about the payment and its purpose. They are needed to correctly allocate transfer amounts to budget items. In order for a financial obligation to be considered fulfilled, you must correctly indicate the BCC for the property tax of legal entities; In 2021, there have been major changes in the scheme for paying this fee to the budget.

About the gas supply system and why it affects taxes

Order of the Ministry of Finance No. 132n dated 06/08/2018 on codes for the coming year provides for several property tax codes in 2021; codes are established for organizations, and its rates are determined by the constituent entities of the Russian Federation. However, they cannot be more than 2.2%. This is a general provision, and in Art. 380 of the Tax Code of the Russian Federation contains several exceptions to it.

In order to correctly transfer property tax, the KBK 2021 for legal entities is included in the payment order. But in order to choose the right code, you need to understand what the Unified Gas Supply System (UGSS) is, since a separate code is established for payments for objects included in it.

The concept of unified gas supply is contained in Federal Law-69 of March 31, 1999; The law is part of the system of regulatory acts on gas supply in the Russian Federation. The term UGSS is disclosed in Art. 6 laws. This is a whole production complex of interconnected things, which represents the basis of gas supply in the Russian Federation. The accounting department or management of the organization should know about the classification of fixed assets of the organization as a unified gas supply system. In any case, if the company is guided in its activities by the specified federal law, then, most likely, the fixed assets belonging to it are classified as UGSS, and you need to select code 182 1 0600 110. If the organization is not related to the gasification of the country, for example, it is a grocery store or a hairdresser, or a kindergarten, you need to use KBK 182 1 0600 110.

It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

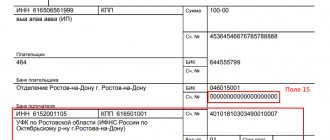

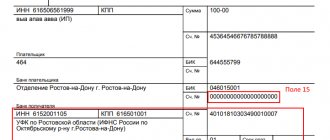

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2018-2019, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Budget classification code table

The BCC of property tax for 2021 for legal entities is given in the table.

| Payment for objects | Core Obligation | Penalty | Interest | Fines |

| Not included in the Unified State System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Included in the Unified State System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Please note that the BCC “Penalties on corporate property tax in 2020” is a separate value. Special indicators have also been established for penalties and interest.

Features of filling out property tax payments

Companies calculate property taxes independently. The Federal Tax Service calculates the property tax of citizens, and then sends out a notification to individuals with a ready-made form for payment.

All payment details for transferring taxes and the OKTMO code at the location of the property can be clarified on ]]>the website of the Federal Tax Service]]>. There, in the “]]>Pay taxes]]>” section, companies and citizens can fill out a document to transfer taxes online by entering the required information. In this case, when making a payment, an individual must indicate the UIN number - the index of the document indicated in the tax notice received from the Federal Tax Service.

For companies paying property tax, the payment form (2018 sample) is filled out as follows:

- The "Type of payment" field is left blank.

- In the “Payer status” field, enter “01” (legal entity-taxpayer).

- Next, you should indicate the amount of tax to be transferred (in words). All amounts are calculated and paid rounded to the nearest whole ruble.

- In the “Payer’s TIN” field, indicate the organization’s TIN; in the “KPP” field, enter the KPP assigned by the Federal Tax Service.

- In the “Payer” field – the name of the organization, then indicate the bank, BIC and current account number.

- After this, the TIN and KPP of the tax office are entered, to which the tax will be transferred (you can check the details on ]]>the website of the Federal Tax Service]]>).

- In the “Recipient” field you must indicate the name and number of the Federal Tax Service.

- In the “Type of transaction” field “01” is entered, in the “Payment order” field – “5”.

- In the “KBK” field, enter the KBK code, which corresponds to the tax paid.

- The “Base of payment” field is filled out as follows: if the taxpayer transferred the money on time, he indicates “TP”. When voluntarily repaying overdue taxes, “ZD” is prescribed. If the payment is transferred at the request of the tax authorities, you should indicate “TR”, if according to the audit report – “AP”.

- In the “Purpose of payment” field, you should write a brief explanation of the payment. For example, “Organizational property tax for 2021. The payment amount is RUB 70,000.00.”

- Filling out the “Document Number” field also has its own characteristics. If “TP” or “ZD” is indicated in the “Base of payment” field, the taxpayer enters “0” in the “Document Number” field; if “TR”, the number of the Federal Tax Service Inspectorate’s request for tax payment is indicated; if “AP”, the decision number is indicated, issued based on the results of the inspection.

Changes for 2021

From 2021, payments for movable property will not be transferred. But reporting for 2021 must be done according to the old rules.

Changes were made in 2021. Thus, the first and second depreciation groups were excluded from taxable assets for this property levy. Until 2021, fixed assets classified as 3-10 depreciation groups were recognized as objects of taxation.

Regions received the right to establish benefits, while some constituent entities of the Russian Federation immediately released payers from the obligation to transfer property taxes on movable fixed assets. Now this new provision has also been cancelled. Thus, only real estate becomes the object of taxation: federal legislation follows regional legislation. These changes were introduced by Federal Law No. 302-FZ of August 3, 2018.

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

See also: Sample and form of property tax.

Purpose of payment - what is it?

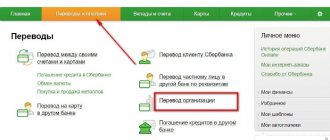

First, it’s worth understanding the question of what “Payment Purpose” is in Sberbank Online. Many companies can provide several types of different paid services for individuals. When payments are received from users, they need to identify the payment received in their checking account. This is where the information from the “Purpose of payment” item comes to the rescue. Thus, this term means any specific information that allows you to quickly identify the purpose of making a payment by the payer - agreement number, name of the service, personal account number, repayment of any debt, etc.

The need to indicate the purpose of the payment is not provided for all payment transactions. For example, if the purpose of payment for the selected service is initially clear, you will not find this field. For example, such operations include enumerations:

- for mobile communications;

- for housing and communal services, gas supply and electricity;

- when replenishing electronic wallets and transport cards;

- between your accounts in Sberbank;

- for traffic police fines;

- for Internet and TV;

- for many other transactions that do not require the user to enter the recipient's full payment details.

It is necessary to indicate information about the purpose of payment in the following cases:

- when selecting the item “Transfer to a private person to another bank using details”;

- when selecting “Organization transfer”;

- transfers to the accounts of charitable organizations;

- various social transfers;

- payment of taxes not according to the document index, but according to arbitrary details of the Federal Tax Service;

- repayment of loans from another bank.

Types of payments

In addition to the purpose of payments, there is the concept of “type of payment in Sberbank Online” - what it is and what role it plays, we will understand further. In the Sberbank Online user’s personal account, there are many different providers of certain services, so for the convenience of finding the right payee, they are clearly structured by type of payment. For example, all mobile telephone operators are presented in the “Mobile Communications” section. The title of the section in this case is also the type of payment.

In your personal account, inside the “Payments and Transfers” section, you will be able to see such types of transfers as payment for utilities, telephone services, Internet, TV, state duties, etc.

Types of payments to Sberbank online

Therefore, the term “Payment Type” is used only for convenience in locating the payee.

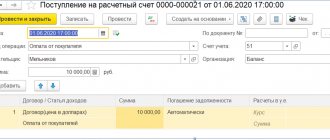

An example of filling out a payment order for transferring personal income tax from employee salaries to the Federal Tax Service

Let's say the amount was 102,302 rubles.

Let’s look at how to fill out the tax fields of a payment order in 2019 (sample), since this is what most often causes difficulties.

Field 4. Date of payment. The tax must be paid within the established deadlines. For benefits and vacations, create a payment slip no later than the last day of the month for which payments were made. When transferring wages or other income, set a date no later than the day following the day of payment of income to the employee (paragraphs 1 and 2 of paragraph 6 of Article 226 of the Tax Code of the Russian Federation).

We fill out fields 6 and 7 without kopecks, since the tax is calculated and transferred in rubles: 102,302.00 rubles.

KBK (detail 104) for personal income tax payment will be 182 1 0100 110.

Cell 105. OKTMO for your organization must be clarified with the tax office.

Cell 106 of the form. Reason for payment: TP (current period).

A fully completed personal income tax payment slip will look like this.

Service code

When logging into your personal account in the Sberbank Online system via a desktop PC using a browser, you have to manually search for the desired payee. You can use the quick search bar, but even in this case, among the names issued by the system, you will have to find the desired recipient yourself. When using the Sberbank Online mobile application, you have the opportunity to quickly find the recipient using a special square barcode for the service, which is often indicated on invoice receipts. You just need to scan this code and the application will automatically find the service provider.

How to fill out a payment order

Document number and date of preparation

Follow chronology when creating payment orders

Specify the type of payment transfer (by mail, electronically, telegraph) or leave the field blank if another type of data transfer is used

Amount (in words and numbers)

Write the amounts in words and numbers in the columns accordingly

Fill in the full name of the organization (maximum 160 characters)

Payer's personal account

Enter the twenty-digit number of a current personal account opened with a credit or financial institution

We fill in the full name of the banking, credit or financial organization in which the current personal account is opened

Indicate the bank's correspondent account number, if available.

Recipient information block

Fill in the same information about the recipient, his bank and personal account

Leave these fields blank; specific instructions from the bank are required to fill out this information.

We indicate the order in accordance with the norms approved by civil legislation (Article 855 of the Civil Code of the Russian Federation)

Here, indicate for what and on what basis (documentation) the payment is made. The accountant can indicate the deadlines for fulfilling obligations under the contract or the deadlines for paying tax obligations, if necessary. Or establish a legislative reference establishing the basic requirements for carrying out calculations

Enter the TIN of the payer (60) and recipient (61) in these fields

Specify the checkpoint of the payer organization (102) and the recipient organization (103)

The block of fields 104–110 is filled in ONLY when transferring payments to the budget system of the Russian Federation and extra-budgetary funds

We fill it out only when making payments to the budget or customs duties (fees). The rules for filling out this detail are given in Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n

Specify the code in accordance with the current OKTMO classifier. You can check the codes at the Federal Tax Service

The grounds are listed in paragraphs 7 and 8 of Appendix No. 2 of Order of the Ministry of Finance dated November 12, 2013 No. 107n, you need to enter the appropriate code:

Indicate the period in which the employee incurred taxable income. When transferring personal income tax on vacation and sick pay, in this field you must indicate the month on which the day of their payment falls.

Indicate the number of the claim or other document on the basis of which we make the payment, with a brief explanation of the type of document (TR - demand, RS - decision on installment plan, etc.)

Enter the number of the document that is the basis (for example, an agreement)

This field is not required. Exception: transfer of fees for 2014 and previous periods

The finished document must be certified by the signatures of the head and chief accountant, as well as the seal of the institution.

What to do if you haven’t received a receipt

According to Article 52 of the Tax Code of the Russian Federation, the tax service is obliged to notify you of the amount of tax deductions on property no later than 30 days before the deadline for payment. Taxes for the previous year are paid before December 1 of the current year, respectively, a notice and receipt for payment are sent before November 1.

If you have not received a letter from the tax office by mail within this period, and there are no electronic receipts in the taxpayer’s personal account on the Federal Tax Service website, then one of the unusual situations may have occurred. The receipt could have been lost in the mail, it could have been sent to someone else’s address, or there was a malfunction in the work of the Federal Tax Service. In any of these cases, the debt continues to hang, and you should not wait until tax officials realize their mistake and remember about you.

For taxes amounting to less than 100 rubles, notification will be received next year. In this case, penalties and fines are not charged.

There are two ways to pay tax if you don’t have a receipt:

- Fill out the receipt yourself at a Sberbank branch.

- Contact the tax office in person.

The first option is complicated, since to fill out the receipt yourself, you need to know the payment details and the amount of taxes, and without receiving a notification from the Federal Tax Service, it is quite problematic to find out. But if this information does not cause you any difficulties, then at any branch of Sberbank, at your request, they will issue a receipt in form No. PD-4 (tax). After filling out, contact the operator.

You will have to manually enter a lot of data, so in case of an error, it is better to immediately ask a bank employee for several receipts.

The second option is the simplest. In this situation, Federal Tax Service employees are obliged to provide you with all the necessary documents to pay taxes. Don’t forget your passport and TIN certificate. By the way, some branches of the Federal Tax Service have bank branches where you can immediately pay the tax using the issued receipt.