The receipt of an intangible asset (intangible asset) into an organization is naturally accompanied by its inclusion on the economic balance sheet.

In other words, any property acquired by an enterprise for one reason or another must be properly taken into account. The specifics of this procedure significantly depend on the method (reason) of the object coming into the possession of the copyright holder company. In addition, the fact of the appearance of an intangible asset in an enterprise must be documented, without which accounting of the corresponding object also cannot be carried out.

The legislative framework

The document was adopted by Resolution of the State Statistics Committee No. 71a of October 30, 1997. There is a footnote to this effect in the paper itself in the upper right corner (it also states that the card has been assigned the interindustry form NMA-1).

In 2013, all forms of primary documents became recommendations. For this reason, when creating a document, deviations from the given forms are allowed. Each such change must be justified and documented. The form remains in use due to the conservatism of the organizers of enterprises, as well as because of its informativeness and convenience.

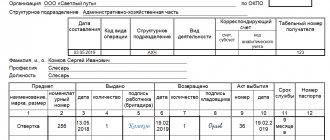

Components of the card

The paper is filled on both sides. On the title side there are:

- Title of the document;

- his number;

- OKUD code;

- OKPO

After this data, in the first lines of the card, you must write down the full name of the company itself, as well as the department in which the document is being filled out.

At the end of the introductory information there is a small table for filling in the date of compilation, transaction code, date and number of the described intangible asset.

Attention! In the vast majority of cases, the object of intangible assets is described in a single copy. This is indicated on the form itself; at the beginning there is space for one name.

Below are two tables to fill out. The first should provide data on:

- structural unit;

- the type of activity specified in the described intangible asset;

- account number;

- analytical accounting code;

- book value;

- period of use;

- volume of financial depreciation;

- estimated rate, percentage of depreciation rate;

- account code and the code of the accounting object itself;

- registration deadlines.

The second table is more extensive and includes columns such as:

- method of acquiring an intangible asset;

- description of the registration document;

- for what reasons, when and at what price it left.

At the very end, a separate line mentions the amount of depreciation of the intangible asset.

Sample order for registration of intangible assets

According to the Consignment Note, Consignment Note TORG-12.

If software is supplied to an organization, it is important to ensure that rights and licenses are provided, which must be attached to the documents.

If you are simply purchasing a license for a new working year, then you need to check with the responsible employee for how long the purchased license will be valid. Registration is complicated by the fact that the bulk of software and licenses for software, software for equipment and other intangible assets, as a rule, comes from abroad.

And, accordingly, the value of the asset is stated in the documentation in foreign currency, and this provokes exchange rate differences and revaluation of debt. Therefore, it is especially important to carefully study the contract and primary documentation from the foreign counterparty. It is important to remember that intangible assets must be registered in Russian currency. On what date the exchange rate should be taken must be specified in the agreement with the counterparty.

Accordingly, the initial cost of intangible assets established for registration should be exclusively in rubles.

What primary documents are used to record intangible assets?

The receipt of intangible assets into the organization is carried out using an acceptance certificate for intangible assets.

Reverse side of the intangible assets accounting card

There are no tables on the second page of the document. On it, the filler is provided with lines for a brief written description. Moreover, the purpose of the asset is not stated in it, since it should already be contained on the front side of the document.

You can specify here the specific parameters and capabilities of the computer program, terms, and rights. A list of functionality will also be useful. They often list the company whose intellectual property the product was. But too lengthy a description is not welcome.

Important! Information on the brief characteristics should not duplicate or quote technical documentation (instructions, operating rules) for the described object, which is located in the organization.

The final touch on the paper will be the indication of the position of the person filling it out, his personal signature and transcript. It is placed after a comprehensive analysis of the intangible asset.

Results

The movement of NFA between institutions of the budget system is certified by a special act, which was put into circulation by Order No. 52n. Information about the asset, sender, recipient, as well as persons representing the relevant organizations in one or another status is reflected here.

You can learn more about the specifics of NFA accounting in budgetary institutions from this article.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Subtleties of filling out the card

Responsibilities for filling out and maintaining all accounting cards in proper form rest with the accountant. In the vast majority of cases, it is this employee who signs the final part of the paper. Information to be filled out can come from acceptance certificates, various documents for the posting of the described assets.

Attention! A separate card is drawn up for each item of intangible assets.

Then they are all entered into the general register of cards, and a general statement is formed for all compiled documents.

Act of acceptance of intangible assets [p.158]

Let's consider the procedure for drawing up an act of acceptance of intangible assets using a conditional example. [p.158]

Drawing up an acceptance certificate for an intangible asset [p.161]

Filling out the reverse side of the acceptance certificate for intangible assets [p.163]

In the column “Total (initial cost)” the sum of the lines in column 5 is indicated. This amount must coincide with the value specified in column 11 of the intangible assets acceptance certificate. [p.170]

The organization OJSC Alpha received an intangible asset (see example on p. 158). The capitalization of the object of intangible assets was formalized by the act of acceptance of intangible assets No. 5 dated February 16, 1998 (see pp. 159-160). [p.170]

In column 7 “Amount of accrued depreciation, rub. cop." indicates the amount of depreciation, which is calculated monthly at rates calculated based on the original cost and useful life. The data for this column can be taken from column 14 of the acceptance certificate for intangible assets (see p. 159). [p.172]

The basis for entries in accounting registers are the acceptance certificate of intangible assets, invoice, invoice, payment and settlement documents. [p.177]

The basis for entries in the accounting registers are the constituent agreement, the act of acceptance and transfer, confirming the receipt of intangible assets from the founder, the act of acceptance of intangible assets, confirming their receipt in the organization, documents confirming the cost of services of third-party organizations [p.177]

The basis for entries in the accounting registers is an acceptance certificate confirming the receipt of intangible assets from a third-party organization or individual, an acceptance certificate for intangible assets confirming their receipt in the organization, documents confirming the cost of services of third-party organizations related to the acquisition of intangible assets received free of charge . [p.178]

The basis for entries in the accounting registers are an act confirming the creation of intangible assets in the organization, an act of acceptance of intangible assets confirming their recording as such in the organization itself, documents confirming the amount of costs incurred in creating intangible assets (similar documents confirming costs incurred during production of fixed assets). [p.179]

Accounting for receipt of intangible assets. The receipt of intangible assets by enterprises is formalized by an act of acceptance of intangible assets. The form of the act is similar to the act of acceptance of fixed assets f. No. OS-1. [p.237]

Options for determining depreciation rates for intangible assets should be reflected in the enterprise’s order on accounting policies for the current year; the standards are indicated in the acceptance certificate of the intangible asset; if necessary, the calculation of the rate of useful life and depreciation of the intangible asset, approved by the head of the enterprise, is attached to the act. [p.52]

Accounting for intangible assets is carried out by their types and individual objects on the basis of documents similar to documents on fixed assets (act of acceptance of intangible assets, act of transfer, etc.). The basis for drawing up an acceptance certificate are documents such as patents and certificates. [p.184]

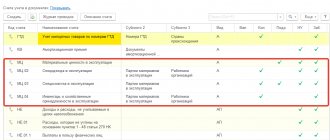

Acquisition of intangible assets. Intangible assets can be purchased for money on the basis of a copyright and licensing agreement, as well as an agreement for the use of a computer program or a database of agreements on the transfer of know-how, etc. The buyer's basis for making entries in the accounting registers is the acceptance certificate of intangible assets, invoice, invoice, payment and settlement documents. The acquisition and creation of intangible assets is reflected using account 08 Investments in non-current assets. [p.72]

In the “Date of Compilation” column, the date of drawing up the act is indicated, which must coincide with the date of acceptance of intangible assets (since, according to paragraph 4 of Article 9 of the Law on Accounting, the primary document must be drawn up on the day of the transaction). [p.161]

You have an act of acceptance of intangible assets, but this is not reflected in the accounting records. [p.180]

You have an entry in your accounting records, there is an act of acceptance of the intangible asset, but there is no agreement or other document signed by the transferring party confirming the conditions for granting you any rights, or this document is drawn up in violation of the established rules, which makes it invalid. [p.180]

When registering intangible assets, certificates of the right to use certain objects, patents, copyright and licensing agreements, acts of acceptance of software development work, etc. are used. [p.236]

The determination of the useful life of intangible assets is determined by an agreement, the basis for which are acceptance certificates, technological documentation and other primary registers that record the fact of acceptance of the object and its useful life, confirming the rights of the organization to the issued type of intangible assets. The service life of intangible assets may also be determined by the period during which the use of the object brings benefits to the legal entity (although conflicts with inspection authorities may arise here). [p.100]

The technical side of registration in the accounting of intangible assets is very important. Since this type of property does not have a material structure, in practice the problem of accounting control over the actual receipt and use of a particular object often arises. Based on the general principles of accounting, it is advisable to determine the object of intangible assets on the basis of the relevant primary documentation, which in content should correspond, for example, to the acceptance certificate of fixed assets. The main thing is that the document on acceptance of an intangible asset object must record the fact of the object’s receipt by the organization and its commissioning. Such a document must contain a detailed description of the object, its initial cost, cost code, service life, department in which the object will be used, and other necessary data. The document must be drawn up in accordance with the rules established by the Regulations on Documents and Document Flow in Accounting. (Since intangible assets are reflected in accounting and reporting in the amount of costs for acquisition, production and expenses for bringing them to a state in which they are suitable for use for the intended purposes, payment for licenses to engage in certain types of activities for a period of more than a year and expert opinions are included in them to costs associated with the acquisition of intangible assets. [p.101]

The costs of creating or acquiring them and the costs of bringing them to a state in which they are suitable for use for the intended purposes. As intangible assets are created or received by the enterprise and work is completed to bring them to a state in which they are suitable for use for the intended purposes, intangible assets are included on the basis of an acceptance certificate as part of intangible assets. The cost of intangible assets (patents, licenses, software products, rights to use land plots, natural resources, research and development, design and survey work, etc.) acquired by enterprises is reflected in the Capital investments account according to paid or sellers' invoices accepted for payment after they have been posted and registered [p.87]

Another option for the receipt of intangible assets by an enterprise is as a result of gratuitous receipt from legal entities and individuals. This operation is reflected in the debit of the account. 04 Intangible assets and credit account. 87 Additional capital, subaccount Freely received values. Donation transactions require very careful review using a counter-monitoring tool to determine whether the rights of voluntary investors have been violated. The receipt of intangible assets is documented in an acceptance certificate. [p.474]

Newly created, received and brought to a state suitable for use for the planned purposes, intangible assets are recorded at inventory value in account 04 Intangible assets on the basis of an acceptance certificate. [p.244]

The act of acceptance and transfer of intangible assets - a standard (unified) form has not been approved. [p.56]

The primary documents with the help of which the receipt of fixed assets and intangible assets are formalized are the act (invoice) of acceptance of the transfer of fixed assets OS-1, the inventory card for accounting for fixed assets OS-4a, the card for accounting for intangible assets NMA-1, the forms of which are approved by the resolution of the State Statistics Committee of the Russian Federation No. 71a of October 30, 1997 On approval of unified forms of primary accounting documentation for accounting for labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction. [p.507]

The disposal of fixed assets is formalized by the act of write-off of fixed assets OS-4 and the act (invoice) of acceptance and transfer of fixed assets OS-1 (forms approved by Decree of the State Statistics Committee of the Russian Federation No. 71a dated October 30, 1997 On approval of unified forms of primary accounting documentation for labor accounting and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction). [p.524]

The economic content and nature of intangible assets provides additional information for analyzing the potential capabilities of the client’s business and the quality of its management. When assessing the quality and movement of intangible assets, it is necessary to refer to Table 4 of Form No. 5 of the appendix to the enterprise’s balance sheet, which provides a breakdown of the enterprise’s cash flow, including intangible assets. As a rule, in terms of their economic content, the actual intangible assets of enterprises do not represent the intellectual potential of the enterprise, do not reflect the excess of the purchase price of the enterprise over the value of the enterprise's assets and are reflected in the balance sheet at their residual value. The main content of intangible assets is the right to use an apartment, the right to rent, brokerage positions, patented trademarks and service marks, organizational expenses, computer software, databases, original works of entertainment, literature or art, high-tech industrial technologies, other intangible fixed assets , which are objects of intellectual property, the use of which is limited by the rules of ownership established for them. Depreciation is not accrued on the rights to use an apartment (residential facilities), trademarks and service marks, organizational expenses (line code 111). Accounting for rights to intellectual property in an enterprise or organization without their actual use should be considered as their use in economic activity, that is, non-income-generating immobilization. Documents that indirectly confirm the fact of use of intellectual property are a balance sheet with form No. 5, reflecting the accounting and operations of these objects; patents and certificates belonging to the enterprise (employees); an agreement for the use of a specific object of intellectual property at a given enterprise; acts of acceptance and commissioning of objects at the enterprise. Analysis of the qualitative content of the client’s intangible assets is important when assessing possible partnerships between the client and the bank in order to create a joint business, since the economic content of intangible assets reflects the approach [p.140]

An act of acceptance and transfer of an intangible asset object for operation can be drawn up [p.264]

All intangible assets related to the object must be attached to the transfer and acceptance certificate [p.264]

Based on the act of acceptance and transfer (movement) of intangible assets and other [p.265]

The disposal of an object of intangible assets is formalized by an acceptance and transfer act of type OS-1 form [p.265]

Acceptance and transfer certificate (property rights to use a computer program, etc.) The supplier's invoice for the acquisition of an intangible asset was accepted for payment 08 60 76 [p.266]

Acceptance certificate for completed work Reflects the costs of bringing the intangible asset to a state suitable for use 08 60 76 [p.266]

Acceptance and transfer certificate Paid VAT is written off for settlements with the budget at the time of acceptance of the intangible asset for accounting 68 19 [p.266]

Acceptance and transfer certificate Reflects the capitalization of intangible assets contributed by the founders as a contribution to the authorized capital in the assessment agreed upon by the founders in the constituent documents 08 75 [p.266]

Acceptance and transfer certificate Intangible assets contributed by the founders as a contribution to the authorized capital 04 08 were accepted for accounting [p.266]

The operation of capitalizing this intangible asset was formalized by the acceptance certificate of intangible assets No. 5. According to the order of the General Director of Alfa OJSC Danilenko M.Yu. dated January 12, 1998 No. 6, registration of all operations is carried out by the commission consisting of the following: deputy. Ch. editor - Mitin A.V., editor - Volodina K.S., accountant - Larionova Yu.I. Chief accountant of OJSC "Alpha" - Korableva M.E. [p.158]

Basis for entries statement No. 17/1(06) of analytical accounting of costs for completed capital investments acts type. f. No. OS-1 acts of acceptance of intangible assets (in a form close to the standard form No. OS-1) and the corresponding supporting documents attached to them; accumulative statement of analytical accounting of the movement of intangible assets (in a form close to the standard form No. OS- 9) acts and certificates by type. f. No. KS-2, KS-3, KS-1 1, KS-12 (as appendices to the act type form. No. OS-1) acts of culling of animals when transferring young animals to the main herd and other specialized documents of agricultural production machine diagram-statement of completed capital investments machine diagram-statement Cost of completed capital investments. [p.96]

Another method of accounting for R&D is also possible after signing the acceptance certificate for the work performed and under the condition that the research results will be used in production, the organization acquiring the exclusive right (patent, license) for R&D must form the value of the intangible asset (determined equal to the costs incurred) and account for it as an intangible asset. Such intangible assets, according to the current provisions of the Tax Code of the Russian Federation, are not subject to property tax. These assets can be depreciated over the life of the patent (Article 257 of the Tax Code of the Russian Federation). If it is impossible to determine the useful life of an intangible asset, the period is set at 10 years. These assets may be subject to depreciation at standard rates that apply to tangible assets and depend on the nature of the asset in which the R&D will be implemented - equipment, materials, etc. The norms and rules of depreciation in this case will coincide with the rules for tangible assets. [p.21]

Possible mistakes

Loan costs should not be included in the initial cost of the asset. This may include:

- costs of attracting specialists (both internal and external);

- price of materials;

- depreciation of environmental protection;

- patent fees.

But not loans or credits.

If a company has acquired software, and its copyright holder is another organization, then such an asset cannot be registered in the intangible assets accounting card. This only occurs if the exclusive rights to that specific software product or license are transferred.

You should not issue an intangible registration certificate (NMA-1) for the rental service of any program. These cases are noted only on the off-balance sheet account according to the agreement number, which stipulates the relationship of the copyright holder with the user.

Important point! The useful life of the program or license must be reviewed annually.

The same applies to the calculation of depreciation (in particular, the method of carrying out this calculation). It is worth noting that there are intangible assets with an indefinite useful life. They require confirmation each year for factors that prevent these deadlines from being established.

Sample order for registration of intangible assets

PBU 14/2007, is an inventory object, that is, a set of rights arising from one patent, certificate, agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization.

A complex object that includes several protected results of intellectual activity, for example, a movie, a multimedia product, or a single technology, can be recognized as an inventory object.

Let us turn to part four of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) in order to consider the general provisions relating to exclusive rights to intellectual activity and means of individualization. The list of objects classified as intellectual property protected by law contains Art. 1225 of the Civil Code of the Russian Federation.

Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children).