INVENTORY AND HOUSEHOLD SUPPLIES

Inventory and household supplies are part of the organization’s material and production reserves, used as means of labor.

The list of property that relates to inventory and household supplies is not established by law.

In practice, inventory and household supplies are understood as:

– office furniture (tables, chairs, etc.);

– means of communication (telephone, fax);

– electronic equipment (cameras, voice recorders, video cameras, tablets, video recorders, etc.);

– kitchen household appliances (coolers, microwave ovens, refrigerators, coffee machines, coffee makers, etc.);

– equipment for cleaning territories, premises and workplaces (mops, brooms, brooms, etc.);

– fire extinguishing means (fire extinguishers, fire cabinets, etc.);

- lighting;

– toiletries (paper towels, air fresheners, soap, etc.);

– stationery;

— tools and devices;

– tableware and cutlery;

- table linen, sanitary clothing, uniform.

This list contains assets that meet all the characteristics of fixed assets - they last more than 12 months, but do not reach them in cost - 40,000 rubles. Furniture, telephones, electronic equipment, etc.

Such assets can be accounted for as part of inventories and depreciation is not charged on them.

Inventory and HP received at the warehouse is reflected in the debit of subaccount 10-9 Inventory and HP and the credit of account 60 Settlements with suppliers and contractors.

Accounting for inventory located in the warehouse is carried out by name in cards or warehouse accounting books, or in electronic form.

When issuing inventory from the warehouse, a demand invoice is drawn up in form No. M-11.

In this case, the following posting is made: Debit 25 (26, 44) Credit 10-9 – inventory was released from the warehouse, the cost of the inventory was written off as expenses.

Since at the time of transfer to operation the cost of inventory is completely transferred to expenses, these inventory items are no longer listed on the balance sheet. That is, they do not exist in accounting, but in fact they exist.

Since the legislation does not regulate the procedure for accounting for inventory transferred into operation, the organization must develop it independently. For example, in the 1C program, accounting of inventory transferred for operation is kept on an off-balance sheet account.

In order to ensure the safety of inventory and household supplies with a service life of more than 12 months, they are marked with paint, branding or attaching tokens.

To control the movement of inventory, for each materially responsible person, you can keep a record of inventory and household supplies in use.

Materially responsible persons maintain a statement f. OP-9 or magazine f. OP-19. They record the transfer, return, identification of losses and shortages of tableware and cutlery.

In accordance with the accounting law, enterprises are required to conduct an inventory of material assets at least once a year before drawing up an annual balance sheet.

The inventory of inventory and household supplies in the warehouse is carried out similarly to the inventory of other goods and materials.

Task 5.6. 1) Reflect the results of the soft inventory inventory in the Matching Statement. Comparison statements are compiled only for property, during the inventory of which deviations from the accounting data were revealed. 2) Identify shortages and surpluses. 3) Carry out offsets between shortages and surpluses. 4) Determine the amount of the final shortfall to be recovered from the financially responsible person.

Certificate of availability of inventory items according to accounting data as of the inventory date

| Inventory name | Price, r | Quantity, pcs. | Amount, r |

| 1. Waffle towel | |||

| 2. Chef's hat | |||

| 3. Waiter's apron | |||

| 4. Chef's jacket | |||

| 5. Chef's pants | |||

| 6. Linen-synthetic napkins | |||

| 7. Linen tablecloths | |||

| 8. Chef's jacket | |||

| 9. Linen napkins |

Extract from the inventory list on the actual availability of goods and materials in the warehouse

| Inventory name | Price, r | Quantity, pcs. | Amount, r |

| 1. |

Other legal methods of cashing out

Of course, the natural question will be: how to withdraw money from the company without additional costs? If we talk about legal methods that will not entail liability for tax evasion, they do not exist. In practice, other options for disposing of an enterprise’s cash are widely used, but they cannot be recognized as specifically withdrawing money from the business.

- Issuance of accounts. Cash from the cash register is issued only to employees, so the founder is registered as a member of the organization. He has the right to spend the received cash on business expenses, business trips, and the purchase of goods and materials. All expenses incurred must be documented and correspond to their intended purpose. That is, the founder manages the cash temporarily and must account for it or return the unspent amount.

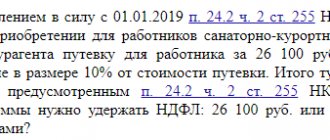

- Applying for an interest-free loan. The founder can receive an interest-free loan through the LLC. It will, of course, have to be returned within the period specified in the contract. In addition, the founder in this case receives a material benefit in the amount of the amount of interest that he would have paid if they had been charged. The material benefit is calculated as 2/3 of the refinancing rate of the Central Bank of the Russian Federation; personal income tax will be charged on this amount - 35%.

- Payment of entertainment expenses. The owner, if he is registered with the state, can receive money from the LLC for entertainment expenses: trips, restaurants, hotels and even expensive clothes. The main thing is to prove to the tax authorities that these expenses are indeed of a business and not an entertainment nature.

- Providing management services to your company. This method is not prohibited, but is under close attention of the tax authorities. Its essence lies in the fact that the founder of an LLC, having the status of an individual entrepreneur, enters into a civil contract for the provision of management services to his company. As a rule, such individual entrepreneurs work on the simplified tax system for income, so the manager pays only 6% tax on his remuneration, which is half the tax rate on dividends. Some founders do not see anything criminal in this scheme (after all, there is no direct prohibition in the law on this option), so they transfer all the company’s profits to themselves as a reward. This is a guaranteed way to find yourself under suspicion of tax evasion and substitution of labor relations for civil law ones. If you use this option, then you need to correctly draw up a management agreement and justify the amount of remuneration with real high financial indicators.

All other methods of withdrawing money from LLC accounts are considered illegal. We strongly advise against using them due to tax and criminal liability for illegal methods of withdrawing assets.

Household supplies

Waffle towel

2. Chef's hat3. Waiter's apron4. Chef's jacket5. Chef's trousers6. Linen-synthetic napkins7. Linen tablecloths8. Chef's jacket9. Linen napkinsCollation statement

| Name of materials | Unit. | Price, r | According to accounting data | Actually | Inventory result | ||

| Shortages | Surplus | ||||||

| Qty | Amount, r | Qty | Sum, | Qty | Amount, r | Qty | Amount, r |

| 1. Chef's hat | PC. | ||||||

| 2. Chef's jacket | PC. | ||||||

| 3. Linen-synthetic napkins | PC. | ||||||

| 5. Chef's jacket | PC. | ||||||

| 6. Linen napkins | PC. | ||||||

| Total | X | X |

Offsets: chef's jacket and chef's jacket; synthetic linen napkins and linen napkins. The final shortfall of 55 rubles is subject to recovery.

The procedure for spending funds for business needs

Enterprises (institutions) issue cash on account for business and operating expenses in amounts and for periods determined by the heads of the enterprises. Money issued on account can only be spent for those purposes that are provided for when it is issued.

Expenses for business and operational needs usually mean the expenses of an institution for the purchase of office or household goods, material assets, fuels and lubricants, for minor repairs, and entertainment expenses.

When an organization withdraws money from its current account for business needs, the following procedure must be followed:

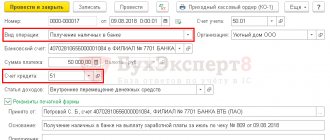

1. The withdrawn funds must be credited to the organization’s cash desk on the same day. Capitalization is done as follows: a cash receipt order is drawn up for the amount withdrawn from the account (receipt order form No. 0310001).

2. Then it is necessary to issue cash to the person who will purchase goods (work, services) for business needs for the organization.

The issuance of funds is formalized by the following documents (clause 4.4. Regulations):

- an application from the employee to issue him amounts on account, drawn up in any form, indicating the period for which the funds will be issued and their amount; The head of the company must sign and date this application.

- an expense cash order, which is drawn up according to form 0310002.

3. Entries are made in the Cash Book (form 0310004) about the receipt of funds from the bank under a receipt order and about their issuance under an outgoing cash order.

4. After spending the funds, but no later than 3 days from the end of the period for which the money was issued, the accountable person must draw up an advance report in Form No. AO-1.

The report must be accompanied by documents confirming the expenses incurred (for example, sales and cash receipts, clause 4.4 of the Regulations).

The advance report is presented to the chief accountant or accountant, and in their absence - to the manager. The person to whom the advance report is presented checks the intended use of funds, the availability of supporting documents, the correctness of their execution and the calculation of amounts.

After this, the expense report is approved by the manager. The period during which the verification of this report, its approval and final payment is carried out is established by the head (subclause 6.3, clause 6 of the Directive). After approval of the advance report, the accountable amounts are written off.

Unspent or undocumented amounts of money must be returned to the organization's cash desk.

If the employee spent less money than he received on the report: the chief accountant should draw up and sign a cash receipt order, which, in particular, reflects the amount of money being returned.

If the employee spent more money than he received on the report: after the advance report is approved by the head of the organization, the overexpenditure should be returned to the employee using a cash receipt order, the details of which are entered in the advance report.

If the advance report is not approved or the balance is not returned, then the money can be withheld from the salary (Article 137 of the Labor Code of the Russian Federation). To do this you should:

— obtain the employee’s consent to withhold the appropriate amount (if the employee does not agree to the withholding, the money can be recovered through the court);

- within a month from the date of expiration of the period established for the return of accountable funds, issue an order from the head of the organization to withhold (if you miss the deadline, you will have to recover the money in court);

— familiarize the employee with the order (letter of Rostrud dated 08/09/07 No. 3044-6-0).

The total amount of deductions cannot exceed 20% of the amount of wages due to the employee (Article 138 of the Labor Code of the Russian Federation). If the debt exceeds this limit, then deductions will need to be made from several payments.

Thus, the organization can spend cash only for its own needs. In addition, you need to confirm all out-of-pocket expenses with documents that must be kept.

In addition, if cash was issued to an individual without drawing up documents and an advance report, the tax authorities, during inspections, additionally charge this person personal income tax (NDFL), as well as penalties and fines for non-payment.

Example 1. Issuing money against a report from the cash register

Secretary of Vek LLC E.P. Kovaleva was given 5,000 rubles on March 24, 2021. for five days to buy stationery. The accountant issued E.P. Kovaleva money based on her application signed by the director.

On March 27, the secretary bought stationery worth 4,000 rubles. and brought the expense report and checks to the accounting department. Unused 1000 rub. The secretary handed it back to the cashier.

The accountant made the following entries:

March 24:

Debit 71 Credit 50 – 5000 rub. - money was issued against a report from the cash register.

March 27:

Debit 50 Credit 71 – 1000 rub. – the balance of unspent accountable funds is entered into the cash register;

Debit 10 Credit 71 – 4000 rub. – stationery items are accepted for accounting.

Example 2. Transfer of accountable amounts to an employee’s salary card

On November 6, 2014, Klyuchik LLC transferred 30,000 rubles to the salary card. accountable money for the purchase of stationery for O.R. Klyuchkin.

On November 7, Klyuchkin purchased the necessary inventory and materials in the amount of 27,350 rubles, paying for them with a bank card. On the same date, Klyuchkin provided the accounting department of Klyuchik LLC with an advance report with a cash register receipt, a receipt from PKO and a terminal slip, as well as a delivery note and an invoice in the name of the organization (since Klyuchkin was issued a power of attorney on behalf of the company). Also on November 7, Klyuchkin returned the remaining unspent amount in cash to the company’s cash desk.

The following entries will be made in accounting:

November 6, 2014:

Debit 71 Credit 51 – 30,000 rub. – the amount was issued for reporting,

November 7, 2014:

Debit 10 Credit 60 – 27,350 rub. - purchased stationery,

Debit 60 Credit 71 – 27,350 rub. – the debt to the stationery seller has been repaid,

Debit 50 Credit 71 – 2,650 rub. – the unused accountable amount is returned to the cash desk.

I. Administrative expenses

1. Costs for remuneration of administrative and economic personnel:

management staff (managers, specialists and other employees classified as employees);

line personnel: senior work producers (site managers), work producers, construction site foremen, local mechanics;

workers providing economic services to management staff (telephone operators, telegraph operators, radio operators, telecom operators, electronic computer operators, janitors, cleaners, cloakroom attendants, couriers).

2. Deductions for social needs (mandatory deductions according to the norms established by law: for state social and health insurance, pensions and the state employment fund) from the cost of remuneration of administrative and economic personnel.

3. Postal and telegraph expenses, expenses for the maintenance and operation of telephone exchanges, switches, teletypes, control room installations, radio and other types of communications used for management and listed on the organization’s balance sheet, expenses for renting the specified communication equipment or for paying for relevant services, provided by other organizations.

4. Costs for the maintenance and operation of computer equipment, which is used for management and is listed on the balance sheet of the organization, as well as the costs of paying for relevant work performed under contracts by computer centers, machine counting stations and bureaus that are not on the balance sheet of the construction organization.

5. Expenses for printing works, for the maintenance and operation of typewriting and other office equipment.

6. Costs for the maintenance and operation of buildings, structures, premises occupied and used by administrative and economic personnel (heating, lighting, energy supply, water supply, sewerage and cleanliness), as well as costs associated with payment for land.

7. Expenses for the purchase of office supplies, accounting forms, reporting and other documents, periodicals necessary for the purposes of production and management, for the purchase of technical literature, binding work.

8. Expenses for all types of repairs (contributions to the repair fund or reserve for repairs) of fixed assets used by administrative and economic personnel.

9. Expenses associated with official travel of administrative and economic personnel within the location of the organization.

10. Costs for the maintenance and operation of official passenger vehicles listed on the balance sheet of the construction organization and serving the management staff of this organization, including:

wages (with deductions for social needs) of workers servicing passenger vehicles;

the cost of fuel, lubricants and other materials, wear and repair of automobile tires, vehicle maintenance;

expenses for maintaining garages (energy supply, water supply, sewerage, etc.), rent for garages and parking lots, depreciation (depreciation) and expenses for all types of repairs (contributions to the repair fund or reserve for repairs) of cars and buildings garages.

11. Costs of compensation (within the limits established by law) for employees of administrative and economic personnel of a construction organization, whose production activities are associated with the need for systematic business trips, expenses for using personal passenger transport for these purposes.

12. Expenses for hiring company cars.

13. Expenses associated with the payment of relocation costs for administrative and business personnel, including employees servicing official passenger vehicles, and payment of allowances for them in accordance with the current legislation on compensation and guarantees for transfer, rehiring and sending to work in other areas.

14. Expenses for business trips related to the production activities of administrative and economic personnel, including employees servicing official passenger vehicles, based on the standards established by law.

15. Contributions made by structural units that are not legal entities for the maintenance of the management staff of a construction organization.

16. Depreciation deductions (rent) for fixed assets intended for servicing the management apparatus, depreciation and repair of wear-out equipment and other low-value items for administrative and managerial purposes.

17. Representation expenses related to the commercial activities of the organization, and expenses for holding meetings of the council (board) of the organization and the audit commission of the organization in accordance with the norms established by law.

18. Payment for consulting, information and audit services.

How can a participant legally make a profit from a business?

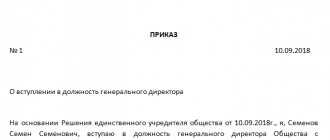

- Receiving dividends. This is the only answer to the question of how to withdraw money from a company legally. Dividends are paid from the company's net profit, which is distributed among participants no more than once a quarter. The tax rate on dividends for individuals in 2021 is the same as for salary payments - 13%. Dividends cannot be paid immediately from available cash proceeds, but can only be withdrawn from the account and received at the bank’s cash desk. It is easier to transfer this amount to an individual’s payment card than to issue it in cash.

- Receiving a salary. Most commercial organizations are managed by one of the participants. If the company operates successfully, then the salaries of top managers can be very high. Of course, we can’t do without taxes here either. 13% of personal income tax is withheld from the director’s salary and bonuses, plus insurance premiums are charged on the amounts of payments - in general, 30%. Salaries can be issued from the cash register, including from cash proceeds, or transferred to the director’s card.

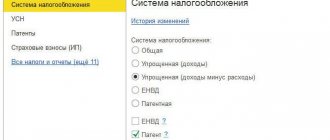

As you can see, both ways to get money from an LLC are associated with the payment of additional taxes by the founder: on dividends and wages. And before that, the organization’s income is taxed according to the chosen regime, for example, from a million rubles of revenue received, a company must pay 6% on the simplified tax system for income and only after that distribute the profit. However, this situation is not recognized as double taxation, because the tax on the simplified tax system is imposed on a legal entity, and not on its participant.

Inventory and household supplies

Payment for bank services, incl. for issuing wages to workers of a construction organization.

20. Other administrative and business expenses (payment for services provided by third-party organizations for production management, in cases where the staffing schedule of a construction organization does not provide for certain functional services, etc.).

Quick navigation: Catalog of articlesOther issues Material expenses in accounting and tax accounting (Panchenko T.M.)

Main types of expenses not related to production

- Expenses for administrative and management activities.

- Deductions related to expenses to eliminate problems with wear and tear of equipment.

- Expenses for repairs of non-production equipment, maintenance of general business personnel.

Expenses for business needs indicated in account 26 include the costs necessary to pay wages to employees, as well as money borrowed from funds allocated for production. This account also takes into account mutual settlements with third parties.

Costs reflected in account 26 are written off as costs for the main production, as well as related production if any third-party work was performed or services were provided. In addition, these costs can be written off against sales.

Material expenses in accounting and tax accounting (Panchenko T.M.)

Article posted date: 10/31/2015

Since January 1, 2015, organizations have been given the right to independently choose the procedure for writing off inventories as tax expenses. Legislative changes will help organizations bring tax and accounting closer together.

Write-off of inventory items as expenses

If the cost of property that an organization plans to use for more than a year does not exceed 40,000 rubles, it has the right to independently choose whether to reflect such property in accounting as part of fixed assets or as inventory (clauses 4, 5 of PBU 6/ 01). Accordingly, the cost of such property can be written off through depreciation over its useful life or at a time when registered. A similar procedure is provided for in tax accounting (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation). The organization has the right to write off expenses for the acquisition of inventory items, the cost of which is less than 40,000 rubles, intended for long-term use, either in a lump sum in full as they are put into operation, or over several reporting periods in the manner established independently in the accounting records. policy for tax purposes. Thus, organizations that write off property worth up to 40,000 rubles as expenses. not at once, but over a certain period of time; since 2015, it has become possible to bring tax and accounting accounting closer together in this area. A one-time write-off of costs for the acquisition of inventory will allow you to reflect a larger tax expense for the period (example 1). Uniform reflection of expenses is beneficial for organizations that do not want to declare a loss (example 2).

Example 1. An organization purchased an electric generator for 41,300 rubles. (including VAT - 6300 rubles). The accounting policy for both accounting and tax accounting purposes provides for a one-time write-off of an asset upon its transfer to operation. The following entries are made in accounting: D-t. 10 “Materials” Set of accounts. 60 “Settlements with suppliers and contractors” RUB 35,000. the electric generator was capitalized; Dt sch. 19 “Value added tax on acquired assets” Set of accounts. 60 “Settlements with suppliers and contractors” 6300 rub. VAT is reflected in the cost of the electric generator; Dt sch. 68 “Calculations for taxes and fees” Set of accounts. 19 “Value added tax on acquired assets” 6,300 rubles. VAT is claimed for deduction; Dt sch. 20 “Main production” (26, 44, 91) Set of accounts. 10 “Materials” 35,000 rub. The cost of the electric generator was written off as expenses when it was handed over to the installation team.

Example 2. We use the conditions of example 1. The accounting policy for both accounting and tax accounting purposes of the organization stipulates the write-off of an asset during its service life. The service life of the electric generator is set at two years. The following entries are made in accounting: D-t. 01 “Main production”, subaccount. “Inventory assets”, Set of accounts. 60 “Settlements with suppliers and contractors” RUB 35,000. the electric generator was capitalized; Dt sch. 19 “Value added tax on acquired assets” Set of accounts. 60 “Settlements with suppliers and contractors” 6300 rub. VAT is reflected in the cost of the electric generator; Dt sch. 20 “Main production” (26, 44, 91) Set of accounts. 02 “Depreciation of fixed assets” 1458 rub. (RUB 35,000: 24 months) monthly depreciation of the electric generator has been calculated.

Let us remind you that the LIFO method has not been used in accounting since 2008. From January 1, 2015, the possibility of using the LIFO method for tax purposes has been excluded. When determining the amount of material expenses when writing off raw materials and supplies used in the production (manufacturing) of goods (performing work, providing services), for tax purposes one of the methods for assessing raw materials and materials enshrined in the accounting policy for tax purposes is used (clause 8 of Art. 254 of the Tax Code of the Russian Federation). If an organization, when releasing raw materials into production, uses the same method for estimating the write-off of inventory and materials in accounting and tax accounting, then it will not have any differences (example 3).

Example 3. In June, a plant purchased 10 tons of copper rod, the cost of which is 236,000 rubles. (including VAT - 36,000 rubles). In July, 6 tons of copper rod were supplied to the drawing shop (for production). The plant's products, in the manufacture of which copper wire rod was used, were sold in August. The organization applies a general taxation system (accrual method). When releasing raw materials into production, the organization evaluates them both in accounting and tax accounting at the cost of a unit of inventory. Entries are made in accounting. In June: D-tsch. 10 “Materials” Set of accounts. 60 “Settlements with suppliers and contractors” RUB 200,000. 10 tons of copper rod were capitalized; Dt sch. 19 “Value added tax on acquired assets” Set of accounts. 60 “Settlements with suppliers and contractors” RUB 36,000. VAT is included in the cost of copper rod; Dt sch. 68 “Calculations for taxes and fees”, subaccount. “Calculations for VAT”, Set of accounts. 19 “Value added tax on acquired assets” RUB 36,000. VAT is accepted for deduction; Dt sch. 60 “Settlements with suppliers and contractors” Set of accounts. 51 “Current accounts” 236,000 rub. 10 tons of copper rod were paid to the supplier. In July: D-tsch. 20 “Main production” Set of accounts. 10 “Materials” 120,000 rub. (RUB 200,000: 10 t x 6 t) 6 t of copper wire rod was sent into production at the drawing shop. When calculating income tax, the accountant will take into account the cost of copper wire rod used in production in the amount of 120,000 rubles.

Estimating Material Costs

When calculating income tax, purchased materials are accounted for at their actual cost, which includes the purchase price under the contract; commissions paid to the intermediary; import customs duties and taxes; transportation costs; other costs associated with the acquisition of inventories (clause 2 of article 254 of the Tax Code of the Russian Federation). The actual cost of materials also takes into account the cost of non-returnable packaging. The cost of returnable packaging cannot be taken into account when calculating income tax, therefore, if the price of returnable packaging is included in the total cost of materials, it must be separated. The container must be assessed at the value that can be obtained from its possible use or sale. In documents (contract, delivery note, invoice), it is advisable to highlight the cost of returnable packaging as a separate line. This will avoid calculations for separating it from the total cost of purchased materials. When selling materials, they are assessed at the actual cost of acquisition (clause 2, clause 1, article 268 of the Tax Code of the Russian Federation). If an organization uses its own products as raw materials and other materials, they are assessed in the same way as finished products - based on direct costs. A similar procedure applies to the results of work and services of own production. The date of recognition of material expenses in tax accounting depends on the tax accounting method used by the organization. When using the accrual method, expenses are recognized in the period to which they relate (clause 1, article 272 of the Tax Code of the Russian Federation). With the cash method, expenses can be taken into account only after they have actually been paid (clause 3 of Article 273 of the Tax Code of the Russian Federation). Some material expenses are recognized in a special manner when calculating income tax. Thus, the purchase price of raw materials and materials can be written off as expenses only in the part released into production and used in it at the end of the month. The cost of non-depreciable property is included in expenses only after commissioning. In addition, when applying the accrual method, the organization can attribute part of the material costs to direct costs (clause 1 of Article 318 of the Tax Code of the Russian Federation). In this case, the cost of materials is taken into account in expenses as products are sold, in the cost of which they are taken into account. If an organization provides services, direct costs, as well as indirect ones, can be taken into account at the time they are accrued.

Reducing material costs

The amount of material expenses can be reduced by the value of the balances of inventories transferred to production, but not used in it at the end of the month; on the cost of returnable waste (clauses 5 and 6 of Article 254 of the Tax Code of the Russian Federation). You can determine the cost of leftover materials transferred to production, but not used in it at the end of the month, based on independent calculations. The valuation of balances must correspond to their valuation upon write-off. Returnable waste is taken into account at the time of its delivery to the warehouse. If an organization plans to use returnable waste in main or auxiliary production, it is valued at a reduced price of the source material (at the price of possible use). An organization can develop a cost calculation methodology independently and approve it as an annex to its accounting policies for tax purposes. If returnable waste is sold, in tax accounting it must be valued at the sales price, taking into account current market prices (example 4).

Example 4. An organization transferred 15 tons of copper wires to production at a price of 12,000 rubles/t for the amount of 180,000 rubles.

The account is used by 26 organizations. Typical wiring

Organizations that are not involved in the production of products (except for trading enterprises) use account 26 to account for expenses for the main activity. Costs are taken into account in the section of expenses for business needs, and then written off to sales.

Analysis of accounting for expenses for business needs in account 26 is carried out for each item of costs separately.

The list of transactions used when generating account 26 is as follows:

Debit

- 02. Involves the costs of depreciation of the organization’s main resources;

- 04. Intangible stocks;

- 05. Amortization of intangible assets;

- 10. Accounting for materials necessary to meet the needs of the enterprise;

- 16. Change in the price of material assets;

- 23. Additional productions;

- 29. Takes into account both production and economics of the enterprise;

- 43. Accounting for finished products;

- 60. Mutual settlements with organizations of suppliers and contractors;

- 68. Expenses for taxes and fees;

- 69. Accounting for the expenditure of funds for social insurance and security;

- 70. Employee salary expenses;

- 71. Settlements with accountable persons;

- 76. Settlements with debtors and credit institutions;

- 79. Expenses that are necessary for on-farm needs;

- 91. Other expenses and income.

- 94. Shortages and expenses from damage to valuables;

- 97. Expenses for future needs.

Credit

In credit entries, many items coincide with debit entries. These are accounts 10, 23, 29, 76, 79, 97. Which is quite logical, because such expenses cannot be predicted in advance. Even if you plan them, it will still not be possible to determine the exact amount.

The list of accounts corresponding to account 26 (excluding the above matches) will look like this:

- 20. Funds for main production;

- 28. Manufacturing defect;

- 86. Finance necessary for certain purposes;

- 90. Sales;

- 99. Profits and costs.

Household goods, assortment list

(RUB 12,000/t x 15 t). Returnable waste during production amounted to 300 kg. They will be used in auxiliary production for the production of New Year's garlands. Therefore, returnable waste in tax accounting is valued at the price of possible use. For copper wires it is 5 rubles/kg. The organization applies a general taxation system (accrual method). The accounting policy of the organization for the purposes of both accounting and tax accounting prescribes the procedure for assessing returnable waste at the price of its possible use. The following entries are made in accounting: Dt account. 20 “Main production” Set of accounts. 10 “Materials” 180,000 rub. raw materials were transferred to production; Dt sch. 10 “Materials”, subaccount. "Returnable waste", Kt. 20 “Main production” 1500 rub. (300 kg x 5 rubles/kg) returnable waste is capitalized. When calculating income tax, the organization will reduce material costs by the cost of returnable waste.

Increase in material costs

The organization can increase the amount of material expenses of the reporting (tax) period by the value of the surplus that was identified during the inventory; materials that were received in the process of liquidation (complete or partial), repair, modernization, reconstruction or technical re-equipment of fixed assets; materials received free of charge. The cost of surplus and materials received in the process of liquidation, repair, modernization, reconstruction, technical re-equipment of fixed assets is included in material costs at the time of their release into production (clause 2 of Article 272, clause 1 of clause 3 of Article 273 of the Tax Code RF). If the organization subsequently uses these materials when repairing fixed assets, their cost is recognized not in material costs, but in the costs of repairing fixed assets (example 5).

Example 5. The plant dismantled an obsolete drawing machine using its own resources. The market value of the materials remaining after dismantling was 9,000 rubles. These materials were used in the same month to repair other drawing machines. The organization applies a general taxation system (accrual method). The following entries are made in accounting: D-t. 10 “Materials” Set of accounts. 91 “Other income and expenses”, subaccount. 1 “Other income”, 9000 rub. materials remaining after dismantling the drawing machine are reflected at market value; Dt sch. 25 “Overall production costs” Invoice. 10 “Materials” 9000 rub. materials were written off for the cost of repairing other drawing machines. In tax accounting, the market value of materials is reflected in non-operating income - 9,000 rubles. Materials were written off at their full market value for the costs of repairing drawing machines.

Literature

1. Tax Code of the Russian Federation: part two // Reference and legal system “ConsultantPlus” /.

If you do not find the information you need on this page, try using the site search:

Return to previous page

Latest news March 27, 2018 Draft federal law No. 424632-7 “On amendments to parts one, two and four of the Civil Code of the Russian Federation”

The purpose of the bill is to consolidate in civil legislation certain provisions, based on which, the Russian legislator could regulate the market of new objects of economic relations existing in the information and telecommunications network (in everyday life - “tokens”, “cryptocurrency”, etc.), provide conditions for making and executing transactions in the digital environment, including transactions that allow the provision of arrays of information (information).

March 20, 2013 Draft Federal Law No. 419090-7 “On alternative ways to attract investment (crowdfunding)”

The bill regulates relations for attracting investments by commercial organizations or individual entrepreneurs using information technology, and also defines the legal basis for the activities of investment platform operators in organizing retail financing (crowdfunding). The activity of organizing retail financing (crowdfunding) consists of providing services to provide participants of the investment platform with access to its information resources.

March 12, 2013 Draft Federal Law No. 410960-7 “On Amendments to the Criminal Code of the Russian Federation and Art. 151 of the Criminal Procedure Code of the Russian Federation"

The bill is aimed at strengthening liability for violations in the field of procurement of goods, works, and services to meet state or municipal needs. Analysis of law enforcement indicates the presence of certain gaps in the legislative regulation of liability for abuses in the field of public procurement by persons representing the interests of state or municipal customers, as well as persons executing state or municipal contracts.

March 7, 2021 Draft Federal Law No. 408171-7 “On the specifics of the participation of socially oriented non-profit organizations in the privatization of leased state or municipal real estate and on amendments to certain legislative acts of the Russian Federation”

The purpose of this bill is to provide socially oriented non-profit organizations with preferences in the alienation of real estate leased by these organizations from state property of constituent entities of the Russian Federation or from municipal property.

March 1, 2021 Draft Federal Law No. 403657-7 “On Amendments to Article 18.1 of the Federal Law “On the Protection of Competition”

The purpose of this bill is to clarify the grounds for appealing to the antimonopoly authority violations of the procedure for implementing procedures in relation to legal entities and individual entrepreneurs who are subjects of urban planning relations, procedures included in the exhaustive lists of procedures in the areas of construction, including during bidding. The changes made will allow the antimonopoly authority to quickly restore the violated rights of legal entities and individual entrepreneurs who are subjects of urban planning relations out of court.

In the spotlight:

The administration of the municipal formation “Vsevolozhsk municipal district” of the Leningrad region (location: 188643, Leningrad region, Vsevolozhsk, Koltushskoe highway, 138, OGRN 1064703000911, INN 4703083640; hereinafter referred to as the administration) appealed to the Arbitration Court of the city of St. Petersburg and the Leningrad region with an application to challenge the decision of the Office of the Federal Antimonopoly Service for the Leningrad Region (location: 191124, St. Petersburg, Smolnogo St., 3, OGRN 1089847323026, INN 7840396953; hereinafter referred to as the department, OFAS) dated 01/19/2017 in case No. 64-03 -221-РЗ/17 and the order of the Federal Antimonopoly Service issued on the basis of this decision dated January 19, 2017 in the same case.

Article posted date: 03/13/2018

Development and legal regulation of the deposit insurance system using the example of Russia and the Czech Republic (Gorosh Yu.V., Shweigl J.)

Article posted date: 01/15/2018

Additional payments to the cost of a constructed apartment: disputes between the parties (Simić I.)

Article posted date: 11/15/2017

The dangers that digitalization poses (Moskaleva O.)

Article posted date: 11/15/2017

Problems of judicial proof of the customs value of goods (Mikulin A.)

Article posted date: 11/15/2017

Free legal consultation by phone:

- Moscow, Moscow region +7

- St. Petersburg, Leningrad region +7

- Federal number 8 ext. 141

Calls are free. We work seven days a week

How much does it cost to withdraw money from a current account?

Banks always charge a commission for operations to withdraw funds from the LLC current account. Its value depends on the amount and purpose of the expense. If an authorized person intends to withdraw funds for different purposes, then a single commission is charged as a percentage of the withdrawal amount.

At the same time, the percentage for each operation is different. If the bank provides different minimum commissions for such transactions, then the maximum of them is charged. The commission is expressed not only as a percentage, but also in ruble equivalent.

For example, the bank’s tariffs may indicate a value of 1.2% of the withdrawal amount, but a minimum of 200 rubles.

Do not forget that the commission for cash withdrawal is not always the final amount of the “extortions”. There are also taxes that are levied, for example, on wages or dividends.

Fee for withdrawing cash from a current account

What percentage the bank will charge for withdrawing cash from a current account can be found out in advance before opening the account itself. This information is contained in the tariffs, and you can find information on them on the official websites of banks or by contacting their branches.

Many banks set limits for clients on one-time or monthly withdrawals. For example, amounts up to 250,000 rubles can be withdrawn without any commissions or at a minimum rate. If this money limit does not suit you, and you need to withdraw a large amount, you will have to pay an increased commission. Depending on the bank’s policy, its value can reach up to 10%.

A minimum commission is provided for withdrawing funds for employee salaries. Typically it is 0.5% - 1%. However, deceiving the bank and withdrawing money for other purposes by indicating “for wages” in the purpose of the payment document is not allowed. This will lead to blocking of your accounts, and possibly to termination of the agreement with the credit institution.