An agency agreement is a consensual, mutual and remunerative act, according to which the agent undertakes to perform actions in favor of the principal, and the principal undertakes to pay for these actions.

Tax accounting of such agreements has its own distinctive properties. For tax purposes, it does not matter whether the agent acts on behalf of the principal or on his own. Under the terms of the contract, the principal undertakes to compensate the agent for all expenses. They are paid separately from the agency fee and have no relation to it (Article 1001 of the Civil Code). A party to an agency agreement can be either an individual or a legal entity.

General provisions

So what is an agency agreement concluded with an individual, and what are its features?

This is an accepted written agreement between two parties that does not require registration with government agencies. This document involves the performance of certain actions by an agent - an individual on the instructions of the principal - the employer . All important features, conditions and principles of interaction between these parties follow from civil legislation, Chapter 52 of Part Two of the Civil Code of the Russian Federation:

- Initially, it defines the concepts of an agent - the executor of the order and a principal - the customer, and establishes the principles of their relationship. According to Art. 1005 of the Civil Code, an agent can assume responsibility and work with a third party on his own behalf, but at the expense of the customer. Another option is on behalf of the latter and at his expense. In this option, the rights and obligations under the transaction will be borne by the principal, and the agent, in principle, will provide intermediary services. Therefore, a clause on the responsibility of the parties must be included in the document.

- In Art. 1006 of the Civil Code describes the principles of payment of agency fees. It must be borne in mind that if the document does not reflect the terms of payment, then the principal will be forced to pay the money a week from the date of the executor’s report. For the employer, of course, it will be beneficial to include a separate clause in the duration of the agreement in order to avoid unexpected consequences.

- In Art. 1007 of the Civil Code defines possible restrictions in relationships. So, for example, a restriction may be the employer’s obligation not to enter into other agreements (in this activity). The restriction for the agent is the impossibility of carrying out actions fixed by the contract with other principals. In addition, in the case of, for example, concluding an agency agreement with an individual. person to search for clients, you can establish a restriction on the employer’s right to search for clients independently.

- Given that in these relationships all the person’s expenses are borne by the customer, this person needs to periodically report on his work and expenses incurred. In Art. 1008 of the Civil Code stipulates that it is mandatory to attach the necessary primary expenditure documents to the report; the important point is the date of submission and the period for checking the documents - by default, within 30 days, the customer is obliged to check the documents and report any disagreements.

- In the course of work, the agent himself may enter into subagency contracts, the terms of which are established by Art. 1009 Civil Code. The parties must also agree on the subagency and reflect the outcome in writing.

- Termination of such a contract with an individual. person is possible on the basis of Art. 1010 GK:

- refusal of its execution by any of the parties, but only if the terms are not specified in it;

- death of the performer;

- declaring him incompetent or missing.

- Depending on whose name the agent acts, his relationship with the employer can be built on the principles of contractual terms of the assignment or commission (Article 1011 of the Civil Code).

When drawing up agency agreements with an individual, you should rely on the above information. If the agreement is drawn up correctly, taking into account all the nuances that arise, such a relationship is beneficial and convenient for both parties.

For a person, the main convenience will be the opportunity to earn money on their own, at a time convenient for themselves, and also with reimbursement of expenses.

For an employer, this is a convenient way to find a good specialist to perform non-core activities for the company (this could be the services of an auditor, marketer, accountant, lawyer, services aimed at selling goods, etc.) for a certain time and save on a permanent salary for a staff member and , of course, the cost of an additional workplace. Also, the employer will be able to terminate the contract or refuse payment (or possibly both) if it is not completed efficiently and on time. However, most likely this will not happen, because the performer in such a relationship is interested in showing his best side.

You can familiarize yourself with the proposed sample form of an agency agreement below.

Sample agency agreement with an individual.

It is imperative to take into account that in addition to all of the above, the document must have:

- full details of the Principal;

- Agent's passport details;

- a detailed list of those assigned;

- liability in case of possible non-compliance with obligations;

- the start and end period of the document (if desired, the possibility of extension);

- date of signing the document, signatures of the parties.

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

Taxation under an agency agreement with an individual

Having decided on the question of what an agency agreement with an individual is, you need to understand what taxes and contributions the principal will now have to pay on the remuneration to his agent.

In Russia, according to the law, when concluding GPC agreements with an individual, the role of the tax agent will be with the principal (clause 1 of Article 226 of the Tax Code of the Russian Federation). This means that personal income tax. he counts the persons himself and pays them to the budget. When applying for a job as an agent, a person should know this in order to avoid problems with taxes and conflicts with the customer - after all, he will receive an amount reduced by personal income tax.

The employer will determine the personal income tax rate based on whether his contractor is a resident or not. In the first case, the rate is 13%, but if you are not a resident of the Russian Federation (stayed in the Russian Federation for less than 183 days) - 30%.

However, personal income tax is not the only payment in this case.

In addition to payments to the resident agent, the principal is also required to pay insurance premiums to the Pension Fund of the Russian Federation and contributions to compulsory medical insurance (clause 1 of Article 420 of the Tax Code of the Russian Federation). For 2020, the Tax Code contains the following tariffs:

- for pension insurance 22%;

- for compulsory medical care - 5.1%.

It is important that disability contributions are not paid from these amounts (Article 422 of the Tax Code).

In turn, contributions for injuries are paid only when this condition is stated in the contract.

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal. By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

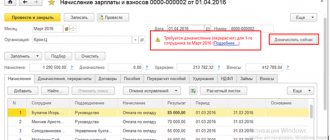

Example of calculating personal income tax and insurance premiums

For example, a tax resident employee fulfilled the conditions on time, reported for expenses and, as a result, received the 30 thousand rubles required under the contract. As a result, taxes under an agency agreement with an individual are 12,030 rubles, including:

- Personal income tax – 30 t. 13% = 3.9 t. rub.;

- contributions to compulsory pension insurance – 30 t. 22% = 6.6 t. rub.

- contributions for compulsory medical insurance – 30 t. 5.1% = 1.53 t. rub.

After calculating the amounts received, you must remember to indicate in your tax reporting and pay.

Agency agreements with an individual are a good solution especially for small businesses - simplified cooperation in accordance with the law. In these relations, the main thing for everyone is the correct execution of documents and further compliance with the agreed conditions. Only then will they be mutually beneficial and fruitful, without unnecessary legal and other unnecessary expenses.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

#14 03.03.2016 14:31:34

Re: Personal taxes person working under an agency agreement

Good afternoon, dear experts of this forum!

Firstly, I would like to thank you for the opportunity to receive your help and advice. Thank you for having such a service!

Secondly, a brief history of my question.

At the end of December 2014, an Agreement was signed between the Agent (me as an individual) and the Principal. To attract clients for the Principal (Internet Marketing Agency). The Agent (Regional Representative) acted on behalf of the Principal. During this period, the Agent bore all expenses (landline telephone, Internet, fuel and lubricants) to attract clients for the Principal. By April 2015, the amount of the Agent's remuneration was about 100,000 rubles - which the Principal kept on his "deposit" (literally) In order to minimize his salary deductions, the Principal several times made an offer to the Agent to organize a legal entity, or to take advantage of the Principal's opportunities with the help of companies " ephemera" (there are audio recordings of these Skype conferences) transfer the agent's commission to the Agent's physical account with a deduction of up to 15%

In May 2015, I registered as an individual entrepreneur (USN 6%) and went to a meeting with the Principal, the latter promised to compensate 6% of incoming funds. The contract was renegotiated on May 19, 2015 for 11 months. But throughout the year he walked away from his promises.

On February 10, 2021, the Agent(s) received a backdated termination notice from the Principal (December 31, 2015). If there is an existing debt in favor of the Agent (24,804) - according to the Principal’s Reconciliation Report dated January 19, 2021.

The agent wrote a complaint to the Principal regarding this matter. But there was no written response from the Principal. There was only a telephone call from the Principal in which he denied the fact that a notice of termination had been sent on his behalf, saying that this was possibly a mistake by Nadezhda’s accountant, expressing his desire to continue working.

At this point in time, I have decided not to further cooperate with the Principal due to numerous violations of contractual relations:

1) Two attempts to detain the agent’s remuneration on his deposit (which was contrary to the agreement) 2) Concealment of the facts of work performed by the Principal for clients attracted by the Agent. 3) Refusal to pay the premium agent part of the remuneration for the concluded contract by the Agent (on behalf of the Principal). The principal paid only the salary part, and it was three times less. 4) Notification of retroactive termination.

1) The principal refuses to pay the agency fee for January and February 2021. There is no written refusal - only by phone. 2) Refuses to compensate expenses for fuel and lubricants (January and February) in the amount of 4,000 rubles. Until this moment, he transferred money to a corporate fuel card (2,000 rubles per month) 3) Refuses to pay the premium agent part of the remuneration for the concluded agreement in July 2015 by the Agent (on behalf of the Principal). The principal paid only the salary part, and it was three times less.

Dear experts, I have several questions for you:

1) What legal actions need to be taken in order to get out of the current situation. 2) What effective tools do I have from the point of view of the law? 3) What should I do step by step? 4) Can I expect an additional payment in court for the unpaid part of the agency fee.

I will be very grateful for your effective recommendations!

What are the disadvantages of being an agent?

There are a lot of them too.

- No guaranteed salary.

- No right to leave.

- Lack of payment due to temporary disability (in other words, you have to get sick solely at your own expense).

- The risk of the principal not recognizing the transaction.

- In the event of termination of the contract, payments are made only for work actually performed; compensation for reduction is not provided.

- Contributions to the Social Insurance Fund for subsequent payments in connection with unemployment, accidents, and parental leave are mandatory if provided for by agreement of the parties.

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal. By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.