How to switch to a simplified tax system (STS) from OSN in 2021 and what it is

Simplified taxation is one of the most popular special tax regimes designed to simplify the procedure for calculating business taxes. In other words, simplified accounting greatly facilitates accounting, calculation and payment of taxes, and reduces the tax burden. The simplified tax system is mainly used among small businesses.

How to switch to the simplified tax system from the general taxation system from 2021? The Tax Code says that the transition to a simplified tax system is made voluntarily by initiating a notification and submitting it to the tax authority.

Before the transition, it is recommended to make a calculation of the tax burden, and for this it is necessary to make a forecast of income, expenses, take into account regional tax rates, and the possibility of reimbursement of paid insurance premiums.

Results

The transition from OSNO to the simplified tax system is strictly regulated: the law clearly defines the deadlines for submitting documents to change the tax regime and the criteria that taxpayers must meet to switch to the simplified system. Compliance with the requirements of the Tax Code of the Russian Federation will ensure an easy transition to this special regime.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

By what date do you need to submit an application to switch to the simplified tax system from 2021?

Application form for transition to the simplified tax system Official form for LLCs and individual entrepreneurs (single Federal Tax Service form)

Sample application for transition to the simplified tax system from January 1, 2021 Example of completion for LLC

Sample application for transition to the simplified tax system from mid-2021 Example of completion for an LLC

You can fill out the form online using the BukhSoft program. After which the program will check the application for errors and you can print it on a printer or save it as an Excel file.

To switch to a simplified taxation system, organizations and individual entrepreneurs need only inform the tax office of their intention by submitting a notice of transition (according to clause 1 of Article 346.13 of the Tax Code of the Russian Federation). A legal entity or individual businessman independently checks compliance with established standards and selects a system for calculating the tax burden. If inconsistencies are detected, the tax office may cancel the transition to the simplified tax system and collect taxes under the previous tax system.

You can switch to a simplified tax system from the beginning of the tax period, when registering a new legal entity (registering as an individual entrepreneur) or when terminating UTII.

To understand until what date you can submit an application to switch to the simplified tax system from 2021, let’s take a closer look at all the cases in the table.

| Transition to the simplified tax system when creating a new legal entity or registering a new individual entrepreneur | It is necessary to attach to the package of documents for registration of a legal entity or registration of an individual entrepreneur a completed notice of transition to the simplified tax system or submit it to the tax authority at the location of the legal entity or individual entrepreneur within 30 calendar days from the date of registration. The application should indicate the taxpayer's attribute "1" when submitting a notification to the simplified tax system at the time of registration or "2" when submitting after registration. In the second case, the application will need to include TIN, KPP, tax code). In the field about the transition to the simplified tax system, you need to put the value “2”, which means the transition to a special tax regime for the new legal entity. In the field about the object of taxation, enter “1” if the choice is made in favor of “Income” or “2” if in favor of “Income minus expenses”. Dash marks remain in empty cells. |

| Transition to simplification of an existing legal entity or individual entrepreneur | Notification of a change in the tax regime is submitted before the start of the new tax period, that is, before January 1 of the new year. Notification of the transition to the simplified tax system from 2021 is submitted to the tax authority until December 31, 2020 inclusive. In the fields Name, INN, KPP, tax code, enter the data of the organization or individual entrepreneur. The taxpayer's attribute must be indicated as "3". This means that an existing legal entity or individual entrepreneur switches to the simplified tax system from the beginning of the new period. In the field about the transition to the simplified tax system, you should indicate the number “1”, and below indicate from January 1 of which year the taxpayer switches to the new regime. In the field about the object of taxation, also indicate “1” or “2” depending on the selected type. In the field about the year of submission of the notification, indicate 2021 if you are submitting an application for 2021. In the field about income for 9 months, organizations indicate the income received for the 3rd quarter of the current year based on accounting data, and individual entrepreneurs put dashes in this section. In the field about the residual value of fixed assets, data from the organization’s accounting as of October 1 of the current year is similarly indicated. Individual entrepreneurs are also indicated in this section by dashes. |

| Transition to simplified tax upon termination of UTII | The transition to a simplified tax system from 2021 upon termination of UTII has a number of nuances, but is in many ways similar to the cases described above. The notification is submitted simultaneously with the application to remove the taxpayer from UTII. The name, INN, KPP, and tax code are also filled in. The taxpayer's attribute is indicated as "2". In the field about the transition to the simplified tax system, the value “3” is indicated, and below it is deciphered from the first day of which month and which year the transition is being made. Type of taxation object, indicate “1” or “2”. The year of filing the notification corresponds to the year of termination of UTII. The income received and the residual value of fixed assets are not indicated. Empty fields are filled with a dash. |

What is the simplified tax system

STS is a tax regime that stands for “simplified taxation system.”

It implies a special procedure for paying taxes and simplified reporting. Many enterprises and individual entrepreneurs prefer to use this particular system, because... it is one of the most economical in terms of paying taxes and is easy to account for, according to accountants who prepare reports and are responsible for reflecting all business transactions in accounting.

That is, simplification is a tax payment system that has more advantages than disadvantages.

Its advantages are:

- the ability to choose one of the existing objects - “income” (basic tax rate - 6%) and “income minus expenses” (basic rate 15%) (Article 346.14 of the Tax Code of the Russian Federation);

- exemption (with some exceptions) from other types of payments to the budget (VAT, profit, property, personal income tax on business activities);

- simplified reporting;

- submitting the declaration once a year.

It is impossible to unequivocally answer the question which of the objects of taxation under the simplified tax system is more profitable. Organizations and individual entrepreneurs must decide for themselves what to use, depending on the type of their activity and the income they receive.

However, if the amount of expenses is 60% or more, there are grounds to use a taxable object at a rate of 15%. What expenses can be taken into account in the costs of an enterprise are reflected in Art. 346.16 Tax Code of the Russian Federation.

We draw your attention to the fact that it is unacceptable to use both simplified taxation system objects together.

How to switch from OSNO to simplified tax system from 2021 with step-by-step instructions

Let's repeat all the information provided step by step:

- Before making a decision to transfer, check the compliance of the organization or individual entrepreneur with the criteria described in Art. 346.12 Tax Code of the Russian Federation.

- Select the object of taxation “Income” or “Income reduced by the amount of expenses”, making a calculation and assessing which type will be more profitable for the legal entity.

- Fill out an application to switch to the simplified tax system and submit it to the tax authority at the location of the legal entity or individual entrepreneur, strictly observing the deadline - until December 31, 2021. The notification form for the transition to a simplified taxation system can be downloaded from information and legal databases or on the tax website https://www.nalog.ru/html/sites/www.Rn08.Nalog.Ru/z_usn.Pdf.

- Completed forms are printed in duplicate. When submitted in person (or by proxy), the tax inspector will accept the notification and place a stamp on both copies with the date of acceptance of the notification. One copy is returned to the taxpayer and kept in accounting documents.

Who has the right not to connect the cash register after 2021

LLCs and individual entrepreneurs providing services can conduct payments without a cash register at all:

- shoe repair and painting

- for the production and repair of metal haberdashery and keys

- for the supervision and care of children and the sick

- for the production and sale of folk arts and crafts

- for plowing gardens and sawing firewood

- porters at railway stations, bus stations, air terminals, airports, sea and river ports

- ceremonial and ritual services

A complete list of persons is contained in Art. 2 of Law No. 54-FZ.

In this case, the seller does not have the right:

- use automatic devices to carry out calculations

- trade in excisable goods

Who can work on the simplified system

Not every company can switch to the simplified tax system. Below are the criteria that facilitate the use of the simplified tax system:

The number of employees of the company is no more than one hundred people;- The taxpayer cannot engage in certain types of activities (pawnshop

- mi, insurance and banking activities);

- Annual income should not exceed one hundred and fifty million rubles;

- The organization has no branches;

- The income received from the business over the next nine months should be no more than 112 million rubles;

- The balance of fixed assets should not exceed 150 million rubles.

The last condition applies only to organizations. Individual entrepreneurs did not comply with this requirement.

CCP reform

CCT reform is an integral part of the Federal Tax Service’s strategy for automated tax administration, which is aimed at creating the most convenient environment for citizens and businesses to communicate with tax authorities and ensuring an increase in revenues to budgets of all levels without increasing the tax burden.

This was reported in a report by tax officials prepared as part of recent public hearings.

The main objectives of the reform are:

— providing taxpayers who are users of cash registers with the opportunity to carry out all registration actions with cash registers and other legally significant document flow regarding the use of cash registers through the taxpayer’s personal account on the Federal Tax Service website;

— creation of modern tools for civil (popular) control in the field of CCP application;

— ensuring the transfer of information on calculations recorded and stored in the form of fiscal data in fiscal drives in electronic form to the tax authorities through the fiscal data operator (FDO) online and the creation of innovative tax administration tools.

Seminar “Reform of CCP. The Finish Line" will take place on December 13 in Moscow.

Experienced consultant M.A. Klimova will talk about changes in the law on cash registers and new requirements for the use of online cash registers.

Come!

Deadlines for submitting reports and paying taxes under the simplified tax system

The calculation of tax under the simplified tax system is carried out incrementally from the previous one and is taken into account in advance payments; the final payment will be calculated in the tax return. The timing of advance payments does not depend on the status of the taxpayer (legal entity or individual entrepreneur):

| Taxable period | Payment due date |

| First quarter | until April 25 |

| Half year | until July 25 |

| Nine month | until October 25 |

The deadline for submitting a tax return for the tax period and paying the finally calculated tax depends on the status of the taxpayer:

| Taxpayer | Deadline for filing returns and paying taxes |

| Individual entrepreneur | Until April 30 |

| Entity | Until March 31 |

The tax return is submitted after the end of the tax period, i.e. next calendar year.

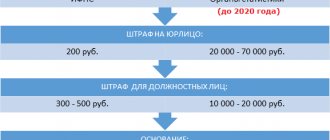

In case of violation of the deadlines for submitting a tax return and payment of the simplified tax system or violation of the deadlines for making advance payments, tax legislation provides for fines and penalties for negligent taxpayers.

Answers to frequently asked questions

Question N1: Hello! What benefits can be provided to entrepreneurs using the simplified taxation system?

Answer: Good afternoon! The simplified tax system, in its essence, is a preferential taxation system, since it frees the entrepreneur from the responsibility of accounting. Along with this, the simplified tax system gives lower tax rates than other systems - 6% and 15%. However, these rates can be lowered by local legislation to 1% and 5%, respectively. The simplified tax system also allows you to be freed from the tax burden in the form of taxes on property, income of individuals and profits of organizations.

Question N2: Good evening! Can the simplified tax system prove to be ineffective in an enterprise?

Answer: Good evening! Simplification can be effective in a number of cases. For example, when a simplifier is exempt from paying VAT, but his client is not exempt from such obligation. This situation can lead to the loss of customers, since the buyer will have to pay VAT for himself and for “that guy,” that is, for the supplier. Of course, there are risks, but you can try to avoid them by reducing the cost of the product. However, such a measure is not always possible.

Organizations that will definitely be denied application of the simplified tax system

The Russian Tax Code provides for the transition to “simplified taxation” only for certain types of activities.

Thus, the following organizations are guaranteed to be denied the transition to the simplified tax system: (click to expand)

- Non-state pension funds;

- Insurance organizations;

- Credit and microfinance organizations;

- Pawnshops;

- Notary and legal offices;

- Brokerage houses and private brokers;

- Investment funds and other organizations engaged in investment activities;

- Casinos and other organizations representing the gambling business;

- Organizations engaged in the production and sale of excisable goods

What is the price

The cost of filing an application to switch to the simplified tax system is not established by law.

This is due to the fact that upon registration the entrepreneur pays a state fee of 800 rubles. This amount includes, among other things, expenses related to the transition to the “simplified system”.

As for the cost of using the simplified tax system, it depends on the chosen option. Allows the use of simplified taxation system 6% or simplified taxation system 15%.

Preference for a type of simplified tax system is based on an assessment of the profitability of current or future activities.

For entrepreneurs working in the service sector, as well as those who do not incur significant expenses in the process of work, it seems more appropriate to use the simplified tax system of 6%.

If an individual entrepreneur works in the trade sector or the work involves high costs, then it is better to use the simplified tax system of 15%. In this situation, the scheme involves choosing a taxable object as “income minus expenses”, the tax rate will be floating.

When an entrepreneur cannot decide which type of simplified tax system is more suitable, an established formula can be used.

So, if in the future you plan to exceed expenses by more than 60% of income, then it is better to choose the simplified tax system of 15%. In the absence of such expenses, the simplified tax system of 6% is ideal.

Simply put, the simplified tax system of 6% should be chosen if for 100 rubles of profit there are 40 or more rubles of expenses. In all other cases, you need to apply the simplified tax system of 15%.