A number of amendments are being made to Law 54-FZ, which regulates the use of cash register systems, regarding individual entrepreneurs. Bill No. 682709-7 (LINK) was adopted by the Federation Council and signed by the President - Federal Law 129-FZ dated 06.06.2019 (LINK) provides for the introduction of a number of significant privileges regarding the use of cash register systems.

Next, we will consider who has canceled online cash registers until 2021 and under what conditions, as well as what can be considered goods of own production when they are sold by an individual entrepreneur.

Do you need an online cash register for individual entrepreneurs without employees?

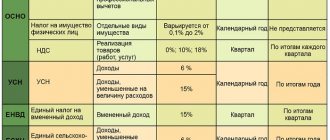

Recent changes in legislation have established the need to use online cash registers for all categories of business. With the introduction of Federal Law 54, it became clear that everyone was switching to online cash registers. So, online cash registers for individual entrepreneurs without employees, as established by law, are still needed. We'll have to switch to a new system anyway. The law says that individual entrepreneurs without employees need an online cash register, but does everyone need it? As we know, there are different taxation systems: UTII, PSN, OSN, simplified tax system. There is also a division of business into areas: trade, catering, services. Is there a difference for different business categories when it comes to switching to online cash registers? First, let's figure out why the state decided to introduce incomprehensible online cash registers and what consequences this transition has for business.

Results

So, the vast majority of business entities in 2021 are required to use online cash registers. For now, individual entrepreneurs from the service sector can do without CCP if they do not have employees.

In conclusion, we would like to remind you that failure to use cash register equipment is subject to a fine under paragraph 2 of Article 14.5 of the Code of Administrative Offences. The penalty for non-use of CCP in 2021 is as follows:

- for individual entrepreneurs - 25-50% of revenues processed without a cash register, but not less than 10 thousand rubles;

- for organizations - 75-100% of revenue, but not less than 30 thousand rubles.

If violations are detected again and if the amount of proceeds “bypass the cash register” is more than 1 million rubles, the punishment will be more severe. The business will be suspended for up to 90 days, and the official will be disqualified for 1-2 years.

Why do you need an online cash register for individual entrepreneurs without employees?

By introducing the sensational 54 Federal Law, the state set very clear and very specific goals. The transition to a new system is intended to help control financial flows and tax concealment, and identify illegal products. Thus, the new system will create a more modern and transparent business in Russia. A system of public control is being introduced. Now the buyer will be able to check receipts and report violations to the Federal Tax Service. Concealing income using online cash registers will be much easier to track than before. Also, the new type of receipts will indicate the product, i.e. It will be clear what, who sold and when. The state will be able to fully control what goods are sold and how they are sold, and control turnover. In addition to the standard paper check, an electronic format has appeared, which every client has the right to receive upon request in the form of an SMS message or an email.

Subjects from remote areas

Companies and entrepreneurs from remote settlements have the right not to use cash registers for any calculations. However, instead of a check, they are obliged, at the buyer’s request, to issue a document containing certain details, which are prescribed in Article 4.7 of Law 54-FZ (clause 1, paragraph 4-12). This document must have a serial number and be signed by the person who compiled it.

The list of areas to which this rule applies is approved by regional authorities and posted on their official website.

In addition to remote and hard-to-reach areas, there are areas remote from communication networks. Companies and entrepreneurs operating there need to use new technology. But it is not necessary to connect it to the Internet to transmit fiscal information.

The list of such settlements is also approved by regional authorities - they must meet certain criteria. The same rules apply to the territory of military facilities, FSB facilities, state security and foreign intelligence.

What are online cash registers and what is their difference?

The new type of online cash registers is different from the old cash registers. Now, at the time of selling a product, in addition to a regular paper receipt, the seller can create an electronic receipt. The cashier does not have the right to refuse the client if he asks him to send him an electronic version. To work with electronic checks, the cash register connects to the Internet. But that is not all. The main innovation is the fiscal registrar, into which a fiscal drive is inserted.

It doesn't sound very clear, but it's actually simple. The fiscal registrar receives information about the cash settlement transaction, records the data on the fiscal drive and sends the data to the OFD. OFD is a fiscal data operator who not only receives information, but checks it and then sends it to the tax service.

Another difference between many modern online cash registers is their similarity to tablets, computers and smartphones. What is it? Many cash registers run on modern Android and Windows operating systems, which makes their use more familiar and understandable. Some cash register equipment manufacturers provide cloud information systems for storing and exchanging data. This is very convenient, since all cash registers can be connected to one account, which facilitates analytics and reporting.

So, the distinctive features of online cash registers:

- availability of the Internet (the cash register must be online all working hours),

- fiscal drive (memory chip with encrypted information),

- connection to the OFD and transfer of data to the Tax and other information systems (for example, the Honest Sign marking system),

- two check formats,

- use of modern technologies.

Installing a cash register

After installing a new cash register or upgrading an old one, you need to select a FD operator and enter into a service agreement with him. A list of such companies is presented on the Federal Tax Service website. The functions of operators are to receive data about all operations performed on the cash register, their transmission, and storage. To conclude an agreement, a qualified electronic signature will be required. If necessary, it can be purchased from the same operator.

The installation proceeds as follows:

- An application for registering a cash register is generated in your personal account on the Federal Tax Service website.

- In the “My cash registers” tab, you indicate the address where the equipment will be located, the number of the device and drive, information about the FD operator, the model of the drive and the cash register itself, as well as the purpose of its use.

- The application must be signed and submitted.

- The results of the application consideration will be displayed in the corresponding section of the account.

Next, the necessary software is installed, data for fiscalization is entered: TIN, information about the OFD, the taxation system used by the individual entrepreneur, the serial number of the device and drive.

Important! If incorrect data is entered during the fiscalization process, the procedure will have to be repeated.

After completing fiscalization, you need to print the first check, which is considered a registration report. The document reflects the time and date of fiscalization, the number of the drive and the receipt.

The next stage is linking the cash register to the OFD and choosing a service tariff. This is done in your personal account on the operator’s resource. After generating the report, the information is entered into the account on the Federal Tax Service website, signed and sent. To complete the registration procedure, all that remains is to check the CCP registration card. The last step will be to verify the transfer of the check on the OFD website.

How it happened: transition time for individual entrepreneurs without employees

After changes in the legislation on cash registers, the phased introduction of online cash registers began. Individual entrepreneurs without employees in this case were no exception. In 2021, almost everyone uses online cash registers. Let us briefly tell you how the transition took place.

Individual entrepreneurs in trade, services and public catering without hired employees switched to online cash registers from July 1, 2021. Some individual entrepreneurs received a deferment until 2021, at which time the introduction of the “self-employed” category will be fully implemented.

The deferment for individual entrepreneurs without employees affected the trade and services sector, but there are several significant restrictions:

- Individual entrepreneur sells goods of his own making (not resale of other goods)

- Individual entrepreneur provides services or performs work

This category has the right not to use online cash registers until July 1, 2021. Next, you need to use the cash register or switch to the self-employed category.

Who else is exempt from CCT?

Another category of entrepreneurs who should not set up online cash registers are those who have switched to paying professional income tax (PIT). This is a new regime for individual entrepreneurs and self-employed persons. They generate a check through the My Tax application.

In addition, paragraph 2 of Article 2 of Law 54-FZ lists types of activities for which cash register equipment is not needed at all. Among other things, there are also certain types of retail trade, for example:

- sale of goods at markets, fairs, exhibitions - provided that it is carried out outside pavilions and other similar premises, vans and auto shops;

- hawking by hand, from baskets, trolleys and similar devices (including on a train, on an airplane);

- trade in kvass, milk and some other goods from tank trucks;

- seasonal trade in vegetables and fruits;

- sale of paper newspapers and magazines under certain conditions;

- sale of ice cream, bottled milk, water and soft drinks at kiosks.

In addition to these types of retail trade, it is possible not to use CCP when carrying out activities to provide food for children and workers in educational institutions, shoe repair, manufacturing metal haberdashery, caring for children and the elderly / sick people, and in some other cases. Also, businessmen from hard-to-reach settlements, the list of which is approved by the authorities of each region, may not install cash registers.

Finally, a cash register is not needed if the individual entrepreneur carries out only non-cash transactions through a current account with organizations and entrepreneurs.

Using online cash registers for individual entrepreneurs without employees: pros and cons

The transition to online cash registers is an additional cost for a business, and not all individual entrepreneurs without employees can afford such expenses. Also, for an online cash register you need to connect to the Internet, and this is not always convenient. It is necessary to connect the cash register to the OFD, which is also an expense. But, despite all this, there are legal requirements and significant undeniable advantages.

Advantages of online cash registers for individual entrepreneurs without employees

- Reducing tax audits. Now the Federal Tax Service receives all the necessary data for control through the OFD. The cash desk itself sends information to the OFD for further transmission to control services.

- Convenient revenue control, analytics and reporting thanks to special cash register software.

- Simplification of the cash register registration procedure.

To summarize, we can say that an online cash register for individual entrepreneurs without employees is needed and necessary.

Features of using online cash registers

Even before purchasing, be sure to check that your cash register and fiscal drive are in the Federal Tax Service register. What to do after purchasing online? You bought an online cash register - this is only the first step. Next, you need to conclude an agreement with the OFD and register your cash register. Connect to the Internet in a way convenient for you, depending on your conditions and CCP model. Set up your hardware and software. It is important to remember that you need to connect on time and carry out work at the checkout correctly, because for violations there will be fines, and if you violate again, your organization will be suspended.

| Read also: “How to register an online cash register” |

Can an individual entrepreneur work without a cash register in 2021?

An online cash register for individual entrepreneurs without employees is strictly required in 2021. There are no deferments or extensions, much less cancellation of online cash registers. To work legally and not receive fines, you must install equipment in accordance with the requirements of Federal Law 54.

Popular goods

In stock (Art. 100009)

Online cash register Evotor 7.2

- For small and medium businesses

- Touch screen

- Free cash register and app store

- Convenient adding of goods/services at the checkout or in your personal account

15.800 5.0 rating

More details

In stock (Art. 100010)

MTS 5 online cash register

- Up to 24 hours without recharging

- Built-in camera scanner

- 3G, WIFI, Bluetooth

- Fast receipt printing 75 mm/sec.

- Ability to maintain inventory records

14.700 5.0 rating

More details

In stock (Art. 100015)

Online cash register Viki Micro

- Suitable for sales of alcohol and branded goods

- Full functionality for working with EGAIS

- Fiscal registrar to choose from

- Personal management account

9.490 4.0 rating

More details

Need help choosing an online cash register?

Don’t waste time, we will provide a free consultation and select an online cash register that suits you for individual entrepreneurs without employees.