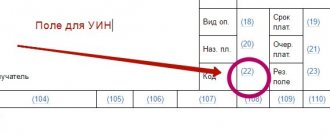

UIN and UIP are identifiers used in the payment order. It contains many fields, the purpose of which not all payers understand. A special place among them is occupied by the code in field 22, which must be indicated in the payment slip - it is important not to make mistakes when transferring funds to the budget, for example, taxes or insurance premiums.

First, you need to understand the meaning of abbreviations that differ by only one letter.

UIN is a unique accrual identifier: a set of numbers used when fulfilling the obligation to pay taxes, fees, etc. Used when making payments in favor of government agencies.

UIP is a unique payment identifier used for transferring money by a government-supported budgetary institution, and also if the counterparty - the recipient of the payment, on his own initiative, indicated this code.

The difference is that information about the UIN is provided by the recipient of the funds; this unique detail is assigned to the payment directly by the government agency to which the amounts will be transferred. The UIP helps to identify the payment among other similar transfers; it is precisely an identifier.

Such details as a unique payment identifier (UPI) are used if the recipient of the funds - usually budgetary organizations - has indicated such a code. It must be indicated in a special field of the payment order under code 22. How to understand what the UIP is in a payment order and where to get it? See whether the recipient of the funds has assigned the UIP to the payment. If yes, then leaving this field empty on the payment slip will not work: the bank (both Sberbank and any other) will consider the document to be filled out incorrectly and will not let it pass. Mandatory completion of field 22 with the UIP code is provided for by the rules approved by Bank of Russia Regulation N 383-P. If the counterparty has not specified the UIP, field 22 can be left blank.

Other rules apply for UIN, set out in Appendix No. 2 to Order of the Ministry of Finance No. 107n. In accordance with it, if the UIN is specified in the request for payment of penalties, it is transferred to field 22, if not specified, it is entered as 0.

Not all payers must indicate this value. The FSS of Russia gave detailed explanations on this matter back in 2014 in a letter dated 02/21/2014 N 17-03-11/14-2337. In addition, there are separate clarifications from the Federal Tax Service of Russia “On the procedure for indicating the UIN when filling out orders for the transfer of funds to pay taxes (duties) to the budget system of the Russian Federation.” Since then, nothing has changed in this matter.

Concept: what is UIP in a payment plan?

UIP is a unique payment identifier, which consists of 20 or 25 digits. It is used to quickly and correctly credit an incoming payment to your account. The numbers in this code indicate the payment administrator, the type of payment and the document that obliges it to be made. Therefore, each payment is assigned an individual identifier. But not always.

Unfortunately, the current legislation does not clearly explain where to get the UIP in a payment order starting from 2021. Although in certain cases, affixing this code to the payment document is formally mandatory. Therefore, it is necessary to have an idea of how to find out the UIP. At the same time, the legislation does not establish the obligation of the payer to independently determine the meaning of the UIP.

This code is assigned to the payment by the recipient of the funds and then communicates it to the payer on the basis of the agreement. The bank in which the obligated person has an account opens, when servicing it, checks the presence and correctness of the UIP value in the payment order. In some situations, if this information is filled out incorrectly, the payment may be rejected by the bank.

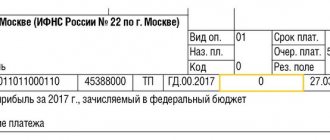

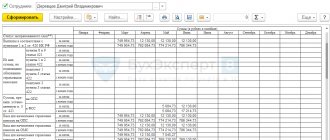

Example of a payment order

The private security company CheKa Private Security Company LLC transfers to the budget personal income tax withheld from employee salaries for January 2020. The amount of tax payable is 100,000 rubles.

Since the payment is current, the accountant should not fill out detail 22 “Code”, indicating the UIN. Instead, it will put a zero ("0") here.

If the company fulfilled the requirement to pay arrears, penalties or fines, the accountant would put the UIN code in the payment order 2021. He would duplicate the identifier value from the corresponding requirement.

Please note: errors when filling out tax invoices can be avoided if you generate invoices automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in one click based on data from the declaration (calculation) or the request for tax payment (contribution) sent by the inspectorates. All necessary details - UIN, KBK, recipient data, codes for payer status - are updated in the service automatically, without user participation. When filling out a payment slip, all current values are entered automatically.

When to specify a unique payment identifier

Cases when affixing the UIP code in a payment order is mandatory are listed in the aforementioned Regulation on the Rules of Money Transfers No. 383-P of the Bank of Russia. In accordance with this document, the UIP is included in the payment if it has already been assigned by the recipient of the funds. And the assignment of a UIP to a payment is possible in 2 cases:

- The identifier is assigned to the payment by the recipient of the funds, and he is obliged to provide this information to the payer in accordance with the agreement. In this case, the recipient’s bank, on the basis of a banking service agreement, can control the correctness of the reflection of the UIP in the order for the transfer of funds (for example, when paying for government services to the payer, including an individual, the UIP is reported to transfer funds).

- When an obligated person pays contributions to extra-budgetary funds and taxes on the basis of a demand for payment. The UIP code is reflected in the requirement and is required to be included in the payment order.

When transferring sums of money, the UIP is indicated on the payment slip only when it is known to the payer. If there is no information about this detail, then put “0” in field 22, since it is unacceptable to leave it blank. The bank will not accept payment orders with unfilled mandatory details.

For groups of taxpayers such as individual entrepreneurs, lawyers, notaries, farm managers, etc., there are some special features when filling out the details for 22 payments. When transferring funds to the budget in the payment order, they indicate:

- or your TIN in the “Payer TIN” field;

- or UIP in the “Code” field.

If the document contains a TIN, then a zero is entered in the “Code” detail. In such cases, banks do not have the right to require simultaneous completion of both details, as happens in some cases. Explanations on this issue are given in the letter of the Federal Tax Service No. ZN-4-1/6133 dated April 8, 2021.

Also see “UIN in payment orders: sample”.

What UIN code should organizations indicate in payment orders in 2021?

Organizations enter a UIN code only when they transfer to the budget the amount specified in the request for payment of a tax, fee, insurance premium, penalty or fine. Such a requirement may come from the tax office. Funds have the right to charge policyholders certain types of fines. For example, the Pension Fund may demand payment of a fine for failure to provide annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for failure to submit annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for violating the deadline or procedure for submitting 4-FSS.

Fill out and submit SZV-STAZH (SZV-ISKH, SZV-KORR) and EDV-1 via the Internet Submit for free

In such a situation, the accountant needs to take two simple steps.

- Determine which UIN is included in the request for payment of a tax, fee, insurance premium, penalty or fine.

- Duplicate it in field 22 of the payment slip, which is issued in connection with the fulfillment of the requirement.

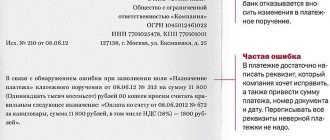

It is very important not to make mistakes when transferring the code from the request to the payment. An incorrect value will result in the payment not being identified. As a result, the organization’s debt will not be written off in a timely manner, which will lead to further accrual of penalties.

The situation is different if the organization calculates the payment amount independently. This is exactly what happens when paying current taxes, fees and contributions, the amount of which is indicated in the declaration, calculation or other document. For example, VAT at the end of the quarter, income tax at the end of the year, personal income tax for the month, etc. And in some cases, the organization itself calculates arrears for past periods and penalties. Then there is no need to specify a unique identifier.

ATTENTION. The bank is obliged to accept and execute a payment without a UIN if a legal entity transfers current payments for taxes or contributions, or repays arrears calculated on its own. The main thing is that the company does not forget to reflect its Taxpayer Identification Number.

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

There is another reason why the organization does not reflect the UIN. This is a situation where a payment request is received, but the unique accrual identifier is not there. Under such circumstances, the accountant is not able to indicate the UIN on the payment slip.

What to do if the UIP is indicated incorrectly

When the UIP is entered incorrectly on a payment slip, the bank is still obliged to fulfill the client’s payment order. The following cases are exceptions:

- when the accounts of the recipient and the payer are opened in the same bank;

- when the account to which the funds are transferred is opened for the purpose of identifying the payment.

In these situations, the bank of the obligated person, after checking all the details, will cancel the payment if there is no UIP in it.

If a payment order is executed but the code is entered incorrectly, a problem with payment identification may arise. And then the obligation to pay debts on taxes, contributions, as well as penalties and/or fines will be considered unfulfilled. The payer may need time to identify and clarify the payment. And this will lead to additional penalties.

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

Read also

02.12.2018

Did you enter your UIN incorrectly?

The UIN allows the GIS GMP (State Information System on State and Municipal Payments) system to automatically account for payments. If an error is made in it, then the payment is not correctly identified, and, accordingly, the organization will remain obligated to pay a fine, and a penalty may also be charged.

To resolve this error you will need:

- Contact the fiscal authority to clarify payment.

- It is possible to re-execute the payment order to eliminate the debt and accrue penalties.

Thus, actions with the UIN index are quite simple. If you pay any tax deductions as a result of independently calculating their amounts, then you simply have nowhere to get this code.

Therefore, put a zero in field “22”; do not leave it empty, otherwise the bank will refuse to complete the transaction. If payment occurs at the request of the fiscal authorities, then they are obliged to provide you with a UIN.

How is the ID used in the bank?

Every client who regularly uses banking services and transfers a payment must know that the unique payment number is Sberbank SUIP, that this is a designation whose main purpose is to help in recognizing the payment. UIP significantly facilitates the operation of the system, especially with the mass transition of citizens to remote payment methods.

With the help of SUIP, you can quickly and easily detect a previously made payment. This becomes most relevant if the money does not reach the recipient for some reason.

A unique identifier quickly identifies the cause of the failure and allows you to discover at what stage of the transaction the funds are stuck. It is thanks to SUIP that it becomes possible to return money to the sender if suddenly the transfer was sent using incorrectly specified details or a technical failure occurred . Therefore, all clients must save the receipt received during the transfer until the sent funds arrive at the account of the final recipient.

Using a unique identifier, you can return erroneously sent money and find a missing payment

Where to find an individual payment number

To find out how to check the unique payment number of Sberbank SUIP, you can use several methods. For example:

- Using self-service devices (ATMs/terminals). To do this, you need to authorize the card by specifying the PIN code and find the “Internet service” service from the list of the main menu. After completing any operation, the ATM will issue a receipt containing the required code.

- By calling the Sber contact center staff (8-800-555-55-50).

- You can also use Mobile Banking; the user should send an SMS message with the text “PASSWORD”. But you should understand that the personal encoding will be different in each case, this number is unique and is created for each new transaction.

What does the ID look like?

This encoding is indicated in the bank receipt for payments made (electronic check). This code is located in the central part of the document (near the designation of the amount of the shipment and the addressee’s details). It looks like this:

SUIP consists of numbers and English letters

SUIP is created from 16 characters. The initial 12 numbers of the combination are digital values, the final ones represent the capital numbers of the English alphabet.

Why is field 22 required?

The 22nd field appeared in 2014. The obligation to fill it out is imposed on all payers by the Russian Ministry of Finance. The purpose of introducing this requirement is to achieve the following:

- reducing the number of errors made when processing payments to the budget;

- improving the quality of work of government employees;

- optimization of the process of transferring funds and their accounting;

- acceleration of payments.

Identification data is also present in the TIN, which makes it possible in some cases to replace the UIN digits with 0.

How to find out the meaning of the unique code?

Sberbank clients can clarify their personal payment number in several ways:

- self-service devices - after entering the card and entering the PIN code, you should find the Internet services in the menu. At the end of the operation, the ATM will issue a receipt containing the required code;

- dial the number of a single contact center;

- use the Mobile Bank service - send an SMS with the word “PASSWORD”. The code will be a one-time use; you will not be able to use it a second time.

The concept of documents used for payment

Payment documents are used to confirm payment for products. They can be cash and sales receipts, strict reporting forms, payment requests and payment orders.

Cash receipts and sales receipts are issued to customers upon purchase of any product. A strict reporting form is issued to a client receiving a certain type of service instead of a cash receipt.

A payment order is used when you need to make a non-cash payment using a bank account. This document serves as confirmation to the person who made such payment.

Let's find out the UIP

How can I find out the UIP? This is not difficult.

In most cases, when making standard payments, specifying this detail is not required at all. The value “0” is entered in the field provided for it.

In the situations described above, when specifying the details is required, the payer will recognize it without difficulty. In the first case, it will be written on the request received from the tax authorities. You will simply need to copy this number into your payment slip.

In the second situation, the payer will also know the UIP. It will be reported by the recipient of funds who assigned this number to the payer.

What is it for?

It is needed so that the Federal Tax Service knows when and from which person the money was received into the account. There are millions of users registered in GIS; it is difficult to determine from whom and for what purposes money is transferred. That is why, by order of the Ministry of Finance No. 107n dated November 12, 2013, the rules were changed, according to which a unique identifier for accrual payments appeared separately for taxes.

The tax service needs it in order to more effectively implement fiscal policy and identify persistent defaulters. Legal entities and individuals need it as the most convenient and fastest way to pay taxes. As a result, the government can control the actions of tax officials and stop cases when their actions exceed the powers delegated to them, which often happened in the past. Businessmen are less dependent on the will of an individual tax inspector and suffer from illegal extortions. The number of inspections carried out has been reduced.

Payer ID - what is it?

There are individual entrepreneurs for legal entities, individuals and foreign organizations (IO). In this case, individual entrepreneurs are considered individuals.

For a legal entity, individual entrepreneur is the identification number of the payer (or taxpayer), that is, TIN. The TIN is usually indicated along with the reason code for registering the person with the tax authorities, i.e. KPP.

For an international organization, this is the KIO, that is, the code of the foreign organization, plus the checkpoint.

Payer ID of an individual

For individuals, the following can be used as identifiers:

- insurance number of a person insured by the Pension Fund of the Russian Federation (SNILS);

- series and number of passport or driver's license;

- series and number of the vehicle registration certificate received upon registration;

- other information permitted for use as personal identifiers, in accordance with the law (for example, military ID, sailor’s passport, etc.).

The individual ID code is a two-digit number. Allowed ID codes for individuals:

Abbreviation SUIP

Having found out that the UIP code serves to identify one specific payment in the total mass of the transfer flow, one can approach the deciphering of another similar concept, namely SUIP.

Decoding

This abbreviation denotes an electronic analogue of UIP, but relating only to Sberbank (“S” in abbreviation means “Sberbank”). This code is important for recognizing a bank payment within the electronic system of a particular institution.

How to check the unique SUIP payment number in a check? Each time a transfer is generated, this unique payment number is generated anew. It is reflected in any Sberbank check immediately below the payment amount. SUIP consists of 16 characters, including 4 Latin letters and 12 numbers.

Why is it needed?

If the recipient's details are filled in incorrectly, or there was a technical failure, the funds may be sent to the wrong account number, or the payment may not be processed. But using the SUIP number, you can return the money, subsequently redirecting it to the necessary details. That is why it is important to save the receipt until funds are credited to the recipient’s account.

UIP for individuals and entrepreneurs

If an individual has a tax debt, he will receive a receipt from the tax authority with the amount of the debt to be repaid. It will already contain the UIN. Citizens do not need to generate payment orders; they simply need to pay according to the received receipt.

Private businessmen, lawyers and notaries can indicate their choice of one of two details: their TIN or UIP. Credit institutions do not have the right to require such payers to indicate two details at once. Although, if they register both the TIN and UIP, this will not be an error.