Is it time to hire your first employee?

It is important to do everything within the allotted time frame, fill out the documents correctly, submit reports on time, make all deductions and pay salaries. For the slightest violation - fines and sanctions, including criminal liability and a ban on conducting any business activity. We reviewed all aspects of employing the first employee for an individual entrepreneur in one article. In it you will find step-by-step hiring instructions, forms of the necessary documents and an employment contract, relevant for 2021. Find out what reports need to be submitted, how to calculate an employee’s salary and what other deductions and contributions need to be made!

Let's briefly dwell on the main thing. To hire your first employee, an individual entrepreneur needs:

- Receive from him an application for employment and documents according to the list: passport, diploma, etc.

- Prepare an employment or civil law contract and personnel documents within the established time frame.

- Register with the Pension Fund and Social Insurance Fund on time.

Then all that remains is to pay salaries on time and correctly, make all the necessary deductions and submit reports.

You registered an individual entrepreneur, sorted out the taxes, exhaled and started working, but a new test lay ahead - employment of the first employee (hiring employees). It seems like nothing complicated: fill it out and don’t forget to make timely deductions from your salary, pay contributions and submit reports. But that is not all.

Example from practice: Sergey opened an individual entrepreneur, it came to hiring employees, and he signed the first employment contract. While I explained the essence of the tasks to the new employee and completed the paperwork, the month flew by. He went to find out how and where to pay contributions, and he was met at the Social Insurance Fund with a fine of 5,000 rubles.

It turned out that it was necessary to register as an employer - register with the Social Insurance Fund within 30 days from the date of concluding an agreement with an employee. It’s good that I came now - for being late for more than 90 days the fine is already 10,000 rubles!

To prevent this from happening to you, we decided to talk about how to hire an employee, where to go and in what time frame.

In the article you will find:

- rules for hiring employees for individual entrepreneurs and liability for their violation

- step-by-step employment of the first employee

- mandatory conditions that must be stated in the employment contract

- list of documents for registration of an employee

- reporting and employee contributions

- how to calculate and pay an employee's salary.

Don’t want to hire or figure it out yourself? A Finguru specialist will calculate your salary for you!

Submit your application

Rules for hiring employees and liability for their violation

indicates how an individual entrepreneur should register employees: it is necessary to draw up an official contract and make an entry in the work book within three days after the employee begins to perform his duties. If requirements or deadlines are violated, liability may be as follows:

| Administrative | Tax | Criminal |

| A fine of 5,000 to 20,000 rubles or suspension of activities for up to 90 days. Repeatedly: fine from 30,000 to 40,000 rubles. | Fine 20% of the amount of personal income tax and contributions not transferred. | A fine of 100,000 to 300,000 rubles or imprisonment for up to a year, a ban on conducting any business activity. |

| For unregistered or incorrectly registered employees. | For evasion of taxes and contributions. | For repeated violations, evasion of taxes and insurance premiums. |

No time to read? Check out the article summary.

Orders for individual entrepreneurs are mandatory - Question of law

The goal of entrepreneurs is to make a profit from the commercial activities they carry out. The composition of accounting and personnel documents for individual entrepreneurs in 2021 depends on the type of business and working conditions. Federal legislation obliges individual entrepreneurs to maintain all documentation correctly, since this is the subject of special attention from regulatory authorities.

Currently, individual entrepreneurs are equal in labor relations with enterprises, and therefore they need to maintain personnel documents in full and draw them up legally correctly.

If a businessman hires employees, he is obliged to keep personnel records and use an approved list of personnel documents for individual entrepreneurs.

This will allow you to properly build relationships with employees, minimize risks of labor disputes, and also eliminate difficulties associated with inspections by regulatory authorities.

The World of Business website team recommends that all readers take the Lazy Investor Course, where you will learn how to put things in order in your personal finances and learn how to earn passive income. No enticements, only high-quality information from a practicing investor (from real estate to cryptocurrency). The first week of training is free! Registration for a free week of training

Employment of the first employee: step-by-step instructions

To register (hire) a new employee you need:

- Receive a written application for employment from him.

- Draw up an agreement in two copies: one for you, the other for the employee. What such an agreement could be and what must be included in it will be discussed below.

- Familiarize the employee with the established rules and his responsibilities: job description, labor safety standards, labor regulations, etc.

- Issue an order for employment.

- Create a personal employee card.

- Make an entry in the work book.

- Register with the Social Insurance Fund and Pension Fund as an employer (register). This needs to be done once when hiring the first employee.

Then you simply pay the fees and submit reports.

Personnel records have been canceled for micro-enterprises and individual entrepreneurs

There is an opinion that the abolition of personnel records for small companies and individual entrepreneurs allows you to not think about it at all. However, this is not always true. Some entrepreneurs are required to draw up a number of documents. In this regard, it is important to carefully understand this issue.

When does an individual entrepreneur need to keep personnel records?

If an individual entrepreneur hires staff, he has the obligation to maintain personnel records. In cases where all activities are carried out solely by an individual entrepreneur, no additional documents will have to be completed.

When employees are hired, the relevant documents must be completed. In 2021, these do not necessarily have to be correctly completed work books. They can be replaced by an employment contract.

As soon as an employment contract is signed, small companies, as well as individual entrepreneurs, need to keep records. It is important to follow current legislation.

Failure to comply with its provisions, as well as the lack of necessary personnel documents, threatens the employer with prosecution, including criminal liability.

In this regard, the labor inspectorate has the right to conduct an appropriate inspection and request documents that must be maintained.

In the process of maintaining personnel records, an entrepreneur has rights and responsibilities. It is important for every entrepreneur to know which of them are the main ones. This will help avoid a number of problems and also make accounting easier.

Among the rights are the following:

- an entrepreneur can enter into both fixed-term employment contracts and for an indefinite period;

- issue orders that are based on signed agreements;

- conclude collective labor agreements;

- train employees in the basics of labor protection, and then monitor knowledge on this topic.

Despite the fact that today there is a law on simplifying personnel documents, the wording in it is quite vague. You should not count on a complete abolition of accounting, so it is important to accurately understand the responsibilities of an entrepreneur in this area:

- maintain work books and register them for those who got a job for the first time;

- provide employees with certificates confirming participation in pension insurance;

- adoption of local regulations containing information on relations with employees.

It is not enough for small organizations and individual entrepreneurs to know their rights and obligations. It is much more important to strictly comply with all conditions.

Mandatory HR documentation

Keeping records always involves drawing up primary documentation. Without this, it is impossible to competently conduct relations between an entrepreneur and his employees. Therefore, it is important to know what personnel documents an individual entrepreneur must have. You should not take this requirement lightly, because unpleasant consequences may occur.

To properly maintain personnel records for individual entrepreneurs, you will have to use three groups of documents:

- Internal regulations include work procedures, instructions, provisions on bonuses, work schedules, wages, and others. They help, if necessary, prove the employer is right in court.

- Organizational. These include all kinds of personnel records. Various documents are registered in them - orders, contracts, travel certificates, work books and others. This group also includes time sheets, vacation schedules, and staffing schedules.

- Accounting documents - employment contracts and books, employee cards, personnel orders, statements, explanatory notes and others.

On the one hand, accounting for individual entrepreneurs is carried out in a simplified form. On the other hand, personnel documents for micro-businesses have not been completely abolished. Other agreements may need to be formed.

Maintaining work books for individual entrepreneurs

If an entrepreneur hires a new employee, he, as an employer, is obliged to fill out the relevant documents: an employment order, as well as fill out a work book. Their registration is carried out on the basis of Russian legislation.

When employees are hired for a position by an individual entrepreneur, two situations may arise:

- When a future employee has a work book in hand, the entrepreneur must fill it out accordingly.

- If an employee is hired for the first time, the entrepreneur will have to provide him with such a document. Only after this can you make an appointment.

It is important to correctly reflect the relevant information in the work book: dismissal, hiring, transfer to another position must be indicated in it.

The introduction of simplified personnel records allowed individual entrepreneurs to use the standard form of an employment contract as an alternative to a traditional document. It turns out that in this case it is not necessary to keep work books; you can refuse to register them. However, such a substitution often leads to problems in the event of a lawsuit.

It is important to clearly determine which documents to use in accounting. After this, you should stick to the chosen strategy.

Entrepreneur's responsibility

It was discussed above that there are mandatory personnel documents for individual entrepreneurs. However, not everyone makes every effort to properly maintain personnel records.

Ultimately, the employer may face liability. For individual entrepreneurs in 2021, there are three groups of punishments: administrative, criminal, financial.

It is important for individual entrepreneurs to study all types.

Administrative liability is provided in several situations:

- In case of an unjustified refusal to conclude a collective agreement, the fine will be from three to five thousand rubles.

- Incorrect collection, storage, and use of information about an employee may result in a fine. You will have to pay from 500 to 1,000 rubles.

- Work without formalizing the employment relationship with an appropriate form of contract, as well as evading its conclusion, entails a fine of 5 to 20 thousand rubles. Repeated prosecution for such a violation will result in an increase in the monetary penalty. You will have to pay 30-40 thousand rubles.

- Illegal use of the labor of foreigners, refusal to notify the migration service about the employment of such citizens leads to the imposition of a fine. Its size depends on the qualifications of the foreign citizen and the place of activity.

Criminal liability may also arise in several cases:

- dismissal of a pregnant woman, as well as a woman with children under three years of age. In this case, you will have to pay a fine of up to two hundred thousand or work 180 hours;

- Delaying wages for more than two months for mercenary or personal purposes is punishable by a penalty of up to 500 thousand rubles.

Financial liability arises when wages are delayed. In this case, you will have to pay the employee overdue payments, calculated based on the refinancing rate - 1/300 for each day.

Outsourced HR accounting for individual entrepreneurs

Entrepreneurs often engage third-party organizations offering outsourcing services to maintain personnel records.

The reasons for this are:

- the high cost of hiring a competent staff member;

- lack of sufficient knowledge of office work among a full-time employee who is assigned additional responsibilities.

Involving an individual entrepreneur leads to cost optimization in combination with professional accounting. Thanks to the financial responsibility of third-party organizations, they guarantee that personnel documents will be maintained exclusively in accordance with the law.

Don't neglect the help of outsourcers. It is important to remember: despite the fact that full personnel records for micro-enterprises and individual entrepreneurs have been cancelled, some documents remain mandatory. Compiling them correctly will help you avoid facing serious liability.

Modern legislation contains provisions that entrepreneurs may not keep complete personnel records. However, it will not be possible to completely abandon it. Meanwhile, violation of accounting rules leads to serious liability. Therefore, it is important to understand what documents are needed and complete them correctly and in a timely manner.

Source: https://tvoeip.ru/kadry/otmena-ucheta

Necessary orders for the main type of activity for individual entrepreneurs

The activities of the enterprise are subject to strictly established rules and involve the maintenance of a large amount of documentation. Regarding the latter, many questions arise, since all kinds of forms for individual entrepreneurs and the requirements for their preparation often change: the most useful thing that can be offered for individual entrepreneurs are samples of documents that one encounters in the process of work.

Most internal processes at an enterprise are initiated by administrative documents, the main one of which is the order. In the activities of organizations or individual entrepreneurs, an order is used to convey the will of management to employees.

The preparation of such a document occurs in several stages: templates of orders are studied, and after drawing up the document, the order is signed and the executors familiarize themselves with it.

The activities of collegial and management bodies, commissions or councils are reflected in the minutes.

The peculiarity of such a document is the presentation of actions in strict sequence and the compilation of an event that is recorded directly in the process.

The task of transmitting information within the company and displaying information important for its functioning is performed by information and reference documents: memos, certificates, letters, acts.

The latter are most often used to document the results of significant actions and checks. Acts are most often drawn up according to standard forms. If there is no template, it is important to indicate all the information required for this document.

The sphere of entrepreneurship, no matter what direction it is represented, is always characterized by a variety of contracts and agreements. Some contracts have a strictly established form, others are drawn up in any form, but in compliance with certain rules.

The main purpose of the document is to regulate the rights and obligations of the parties so as not to leave room for illegal actions.

A separate section of office work is HR documents, presented in a wide variety. For them, norms and standards provide for separate procedures and periods of storage and registration. Many of the personnel documents are compiled according to standard templates.

The method of transmitting this or that information is notifications. Most often they are used by official organizations to notify the person mentioned in the document about the beginning or end of any actions in relation to him.

There are often cases when a notification is sent to an authorized authority by an individual or legal entity, for example, in order to inform about the termination of the company’s activities, as well as to provide other documents for liquidation. When citizens apply to official authorities, forms of petition such as statements are used - such an appeal usually concerns the exercise of certain rights and interests.

In addition, the statement serves as confirmation that the person actually applied to the authorized organization, and as a guarantee that the citizen’s request will not be forgotten.

Submission of an application may in some cases be carried out by proxy, if the personal presence of the applicant is not required.

No matter how hard some of us try to avoid paperwork, everyone has to sign a variety of contracts.

Sample contracts for individual entrepreneurs and agents need to be studied in connection with their professional activities, but find out what a particular agreement looks like.

Documentary recording of facts and events related to economic activities is carried out using acts. Despite the variety of areas of application of this document, there is a generally accepted model of the act. Its composition is typical.

An order is an administrative official document that is issued for the purpose of implementing management tasks and is its act.

Sample orders represent a documented decision of an individual entrepreneur or the head of a legal entity. Orders are mandatory: failure to comply is regarded as

An application is a document addressed to an authority or business entity, containing: a request for assistance in realizing legitimate interests; legally significant message; information about violations of the law; criticism of the activities of organizations or individual officials.

Unlike large companies, individual entrepreneurs are unjustifiably neglected. Characteristics are an official document expressing the opinion of the administration of an educational institution, employer or trade union about a student, student, or employee.

Issued at the request of a citizen for presentation at the place of demand. Contains a description of his business, moral and ethical qualities. Usually the document is prepared.

The law provides for the obligation of a business entity to notify the authorities, its counterparties or founders of the occurrence of certain circumstances.

Untimely requests, unsuccessful notification templates and methods of sending them can lead to negative consequences. Obligation to report legally significant matters.

A protocol is an official written document that, in a certain format, records actions that have already occurred or are ongoing, extending over time. There are different types of protocols, they depend on the essence of the event being displayed: meeting; meeting; administrative offense; interrogation Conditions for drawing up The only purpose of the protocol is to be complete and truthful.

A power of attorney is used by business entities to vest representatives with part of their own powers. There is no standard standard for a power of attorney.

The entrepreneur has the right to draw it up in any form. Concept The relations of commercial representation are regulated by Ch. X Civil Code. According to Art.

How many times a week does a person have to deal with documents - receipts, checks, charters?

Surely more than once. What then can we say about entrepreneurs, agents and other people closely associated with the business world? And every document from which.

Both beginners and experienced entrepreneurs have to go through moments of crisis, constantly fight for a place in the sun - and, unfortunately, not everyone manages to gain a foothold in their niche.

And then the time comes to liquidate the company -. Ask a Question. Register Login.

Go to section. Other samples. Documents for liquidation.

IP 2021: the most important changes

We are talking about local regulatory documents that reflect management decisions on issues of production and economic activity, planning, reporting, financing, lending, sales of goods, etc.

As a rule, a local regulatory act is prepared by the structural unit whose activities are related to its implementation.

In the article we will provide sample orders for the main activities of the enterprise, which can be used in everyday work.

Timely and competent reporting is a prerequisite for the long life of any small and medium-sized business. What documents should an individual entrepreneur have? What kind of reporting should he keep as an entrepreneur and as an employer?

On approval of Recommendations on the list of documents mandatory for individual entrepreneurs and micro-organizations when regulating labor relations with employees. In pursuance of the item on measures to implement the provisions of the Directive of the President of the Republic of Belarus of December 31

Approve the attached Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees. Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees.

Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees were developed in order to optimize and improve the work of conducting personnel records management by individual entrepreneurs and micro-organizations, simplify it, as well as create a more convenient system for maintaining personnel records records.

Mandatory list of personnel documents for each individual entrepreneur

Employment order form T-1 and T-1a. Staffing table form T Order on granting leave form T Vacation schedule form T Order on dismissal of an employee form T-8 and T-8a. Order for sending on a business trip, form T-9 and T-9a. Travel certificate form T. Official assignment for a business trip form Ta. Order on bonus payments to employees, form T and Ta.

What are orders for core activities

Personnel documentation of an individual entrepreneur. Labor relations are subject to documentation. Moreover, the responsibility for drawing up and maintaining documentation lies not only with employers-organizations, but also with employers - individual entrepreneurs.

In organizations, departments are created for this purpose, for example, a personnel department or a personnel department, or positions are simply introduced, for example, a personnel manager.

But individual entrepreneurs, for the most part, do not attach importance to the preparation of personnel documents or draw them up, but with significant violations of established requirements.

The activities of the enterprise are subject to strictly established rules and involve the maintenance of a large amount of documentation.

Evgeniy Sazhin Purchase book VAT examples of reflecting entries on invoices in the purchase book and sales book indicating the codes of types of transactions Sales book VAT Book of income and expenses and business transactions of an individual entrepreneur KUDiR Special tax regimes As a rule, the general tax reporting regime turns out to be simpler in understanding, but not always the most beneficial. Complete list of personnel documents Now you need to make a list of documents that must be in any organization.

How to register with the Social Insurance Fund: changes in legislation

Now the tax office controls only the calculation and payment of contributions for temporary disability and in connection with maternity (VNiM). Their expenditure on the payment of benefits to employees, as well as the payment and expenditure of contributions for injuries, is controlled by the Social Insurance Fund.

You must register with the Social Insurance Fund as a payer of contributions for injuries within 30 days from the date of conclusion:

- employment contract with the first employee

- a civil contract, which provides for the payment by the entrepreneur of contributions for injuries.

OR

The Fund will register the individual entrepreneur as an insurer for contributions for injuries and VNIM.

Registration of missing documents: SNILS and work book

If a person who is applying for a job for the first time does not have a work book and a pension certificate, then your task is to obtain them.

Pension certificate (SNILS)

SNILS is the insurance number of a citizen’s individual personal account in the compulsory pension insurance system. It is indicated on the pension certificate (green card issued by the Pension Fund). Every employee should have a SNILS number, as this number is needed for reporting. To issue a pension certificate for an employee, you need to take the following steps:

- Take a free-form application from the employee. For example, this.

- Fill out the form ADV-1. It must contain the employee's signature.

- Fill out the list of documents according to form ADV-6-1.

- Submit the questionnaire and inventory to the Pension Fund office at the place of registration of the individual entrepreneur on paper or electronically.

- After 5 working days, pick up the completed pension certificate and accompanying statement from the Pension Fund office.

- Give the employee a pension certificate and ask him to sign the statement.

- Return the accompanying statement with the employee’s signature to the Pension Fund.

Employment history

The work record book must be issued within a week from the date the employee is hired. The algorithm of actions is as follows:

- Take an application from the employee for the issuance of a work book. It must indicate the reason for the absence of a work book. For example, a person is applying for a job under an employment contract for the first time, or the previous work record book has been lost.

- Fill out the cover page of the work book.

- Sign up for the job.

Calculate your salary, contributions and personal income tax for free in the web service

Notification to the Social Insurance Fund about hiring the first employee

Starting from 2021, individual entrepreneurs are required to report the hiring of their first employee only to the Social Insurance Fund. This needs to be done in two cases:

- the employee is signed under an employment contract;

- the employee is registered under a civil contract, which provides for the payment of contributions “for injuries”.

You must register with the Social Insurance Fund within 30 calendar days after signing the contract with the employee. If you fail to do so in time, the individual entrepreneur faces a fine, the amount of which depends on the period of delay. A fine of 5,000 rubles will have to be paid if the delay is less than 90 days. If you are late in submitting documents for a longer period, the fine will increase to 10,000 rubles.

To register with the Social Insurance Fund as an insurer you will need:

- statement;

- copy of the individual entrepreneur's passport;

- employee's work record book;

- a civil contract with employees, if the contract provides for the transfer of contributions “for injuries”.

Until 2021, individual entrepreneurs reported hiring workers not only to the Social Insurance Fund, but also to the Pension Fund. But starting from 2021, the payment of insurance premiums is controlled by the tax service, so the Pension Fund has stopped registering individual entrepreneurs. The only type of insurance premiums that has not come under the control of the tax authorities are premiums for insurance against industrial accidents and occupational diseases (contributions for “injuries”). They still need to be transferred to the Social Insurance Fund. It is for this purpose that entrepreneurs must register with the Social Insurance Fund when hiring an employee.

What an employment contract must contain

In accordance with article, the contract must contain the following data:

- Full names of the parties;

- details of an individual entrepreneur;

- employee's passport details;

- schedule;

- terms of remuneration, bonuses;

- rights and obligations of the parties;

- place of work;

- date and signature;

- if the contract is concluded for a certain period, its validity period is indicated.

If you employ an employee part-time, remotely or part-time, the algorithm of actions will be the same, except that the application from the employee must indicate what schedule he will work on (number of hours worked). For example, part-time: 4 hours a day from 8:00 to 12:00 or part-time work week, working hours: four-day work week with three days off (Friday, Saturday, Sunday) with payment in proportion to the time worked. In the future, this will need to be specified in the contract and order.

The fact is that the law establishes a minimum wage. By working part-time or part-time, an employee may receive less. It is important to indicate this in the contract to avoid problems and explanations with the labor inspectorate. Typically, part-time workers have their main place of work. The work book remains there, so the individual entrepreneur does not make any notes.

The contract also usually indicates its subject (the labor relations of the parties), the circumstances under which it can be terminated, the actions of the parties in the event of force majeure circumstances and the procedure for resolving disputes.

Personnel and accounting documents of individual entrepreneurs in 2018, their storage period

The goal of entrepreneurs is to make a profit from the commercial activities they carry out. The composition of accounting and personnel documents for individual entrepreneurs in 2021 depends on the type of business and working conditions. Federal legislation obliges individual entrepreneurs to maintain all documentation correctly, since this is the subject of special attention from regulatory authorities.

Currently, individual entrepreneurs are equal in labor relations with enterprises, and therefore they need to maintain personnel documents in full and draw them up legally correctly.

If a businessman hires employees, he is obliged to keep personnel records and use an approved list of personnel documents for individual entrepreneurs.

This will allow you to properly build relationships with employees, minimize risks of labor disputes, and also eliminate difficulties associated with inspections by regulatory authorities.

The World of Business website team recommends that all readers take the Lazy Investor Course, where you will learn how to put things in order in your personal finances and learn how to earn passive income. No enticements, only high-quality information from a practicing investor (from real estate to cryptocurrency). The first week of training is free! Registration for a free week of training

List of personnel documents required by individual entrepreneurs

Many entrepreneurs want to know what personnel documents an individual entrepreneur should have, and what accounting registers need to be filled out based on the results of commercial activities? Mandatory personnel documents for individual entrepreneurs, regardless of the chosen form of taxation:

- instructions and provisions on payment for work, protection of individual data, financial incentives, and awarding bonuses;

- work time sheet;

- instructions on safety and labor protection;

- logs of medical examinations, issuance of orders, conducting briefings, issuing certificates to employees;

- routine rules;

- orders on personnel, on the conduct of work;

- personnel cards, work books;

- vacation distribution, staff schedule;

- book of movement of forms, issuance of work books;

- collective agreement;

- contracts describing labor relations and financial responsibility.

Important! Enterprises and individual entrepreneurs must properly store documents, taking into account the deadlines determined by federal laws and other acts of the Russian Federation.

Accounting documents of individual entrepreneurs

Individual entrepreneurs understand that they will be responsible for their actions with all their assets (not only goods, but also personal property). That is why it is necessary to carefully assess possible risks. Entrepreneurs are not forced to create accounting in its direct sense, but they are required to organize document flow and maintain tax records.

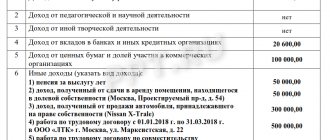

Tax accounting documents:

- tax returns;

- acquisition books;

- tax invoices;

- registers;

- certificates about the current state of accounts;

- implementation books;

- books of accounting of financial transactions;

- reconciliation acts.

Many managers understand that to run a successful business, it is not enough to have high-quality equipment and well-trained personnel. It is unacceptable to work without properly organized document flow. For this purpose, all primary documentation is collected and recorded in the appropriate accounting registers.

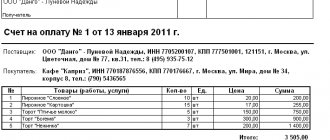

Accounting documents for individual entrepreneurs include:

- invoices;

- incoming and outgoing invoices;

- statements for accumulation;

- acts of acceptance and transfer;

- economic correspondence;

- accounting books;

- turnover statements;

- inventory lists;

- accounting policy;

- cash flow reports;

- sales receipts, bank statements;

- explanatory notes, etc.

The main accounting document of an individual entrepreneur is the accounting book, which must be filled out according to the rules established by the Ministry of Finance. It reflects not only the profit, but also the businessman’s expenses (can be filled out electronically). The forms of books and the procedure for maintaining them are approved by the Ministry of Finance.

They need to attach documents confirming financial transactions. Such documentation includes: checks, contracts, invoices. An entrepreneur can independently keep records of business transactions, hire an accountant, or use the services of outsourcing organizations.

Advice! Enter all data on business receipts into the book sequentially and fill out the columns provided for this in the appropriate order. The final data of the book of profits and expenses are the basis for the formation of tax returns.

When conducting commercial activities, businessmen often have a question: how long to store individual entrepreneur documents? In accordance with the law, legal entities and individuals are required to ensure the storage of their documents for the following periods:

| Documentation | Term |

| Documents subject to registration | Constantly |

| Financial statements for the quarter | 5 years |

| Primary documentation for accounting | 5 years |

| Tax returns | 5 years |

| Accounting policies, registers, chart of accounts, accounting correspondence | 5 years |

| statements to the Social Insurance Fund for the quarter | 5 years |

| Agreements on registration of labor relations | 75 years old |

| Books of personnel documentation, as well as magazines and cards | 75 years old |

| Personal documents of employees (originals) | until demand, or 75 years (if not demanded) |

| Book of accounting of profits and expenditures of funds for the simplified tax system | constantly |

| Certificates and licenses | 5 years |

| Monthly accounting reports | 1 year |

We recommend watching the video:

It is worth remembering that there is a penalty for incorrect documentation. Individual entrepreneurs may be subject to disciplinary, material, criminal, civil and administrative liability (depending on the nature of the violation).

Therefore, when starting commercial activities, individual entrepreneurs must comply with all the requirements of Federal legislation, in particular, timely register primary documents and distribute the data obtained from them to accounting registers.

Loading…

Source: https://mir-biz.ru/dokumenty/kadrovye-buxgalterskie-dokumenty/

Documents for employment

In order for an individual entrepreneur to hire a new employee, he will need:

- passport;

- employment history;

- SNILS;

- documents on military registration (for men and women with a military registration specialty);

- documents on education and qualifications (when applying for a job that requires special knowledge);

- certificates from the previous place of work (if any): 2-NDFL, 182-n.

Who can be an employer

Employers in labor relations can be both legal entities and individuals. Moreover, the Labor Code distinguishes between an ordinary individual and an individual entrepreneur, endowing them with different rights and responsibilities.

Thus, an ordinary individual can enter into an employment contract with domestic staff or with another performer for the purpose of personal service. However, such an employer does not have the right to enter a record of employment in the work book. Until 2006, entrepreneurs did not have this right, which is why the question arose: “Can an individual entrepreneur hire workers?”

In 2021, the answer to this question is, of course, yes. When hiring an employee for an individual entrepreneur, an entrepreneur bears the same responsibilities as an employer as an organization, with a few exceptions. For example, only legal entities are required to pay compensation for staff reduction.

Reporting and contributions: how much you will have to pay for employees

An individual entrepreneur must make the following contributions for his employees:

- Taxes.

Personal income tax, 13%. Transferred no later than the next day after the employee receives his salary. - Insurance premiums.

Payments are due by the 15th of each month. The contribution rate is 30% of the employee’s salary, where: 22% Pension Fund, 5.1% Compulsory Medical Insurance and 2.9% Social Insurance Fund. An individual entrepreneur can reduce the amount of taxes by the entire amount of fixed contributions (insurance premiums paid for employees, sick leave), unlike LLCs, which can only reduce the amount by 50%.

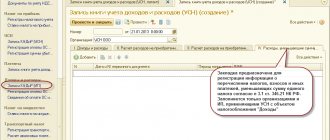

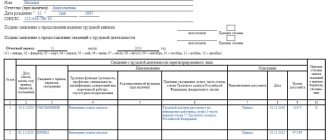

Individual entrepreneur reporting for employees

An individual entrepreneur submits reporting on employees to three authorities.

| Organ | Report type | For rent |

| Tax | Information on the average number of employees Help 2-NDFL Help 6-NDFL Calculation of insurance premiums | once a year: until January 20 of the following reporting year once a year: until April 1 (for each employee) quarterly: no later than the last day of the month following the reporting quarter quarterly: until the 30th day of the first month of the next quarter |

| Pension Fund | SZV-STAZH SZV-M | once a year: until March 1 of the next year monthly: until the 15th of the next month |

| Social Insurance Fund | 4 FSS | once a quarter: before the 25th day of the first month of the next quarter |

What salary should I pay to an individual entrepreneur?

The salary amount is set taking into account regional requirements. So in Moscow, starting from 2021, the minimum wage is 18,781 rubles. (Moscow GD dated September 19, 2018 No. 1114-PP).

For the Moscow region, the minimum wage is set at no lower than 14,200 rubles. (Article 1 of Law No. 82-FZ of June 19, 2000 on the minimum wage). Individual areas may have their own minimum wages. Thus, in the city of Mytishchi, Moscow region, the minimum salary in 2021 cannot be less than 18,460 rubles. This value is set for the period from 2018 to 2021. starting April 1, 2021. You can read about this in pp. 2.4.1 Mytishchi territorial tripartite agreement of the city of Mytishchi.

What salary should I pay if an individual entrepreneur is registered in Moscow and the employee works in the Moscow region?

The regional minimum wage should be applied, because the employee carries out his labor activity in the Moscow region. In this case, it does not matter where the employer is located (see Part 2 of Article 133.1 of the Labor Code of the Russian Federation).

Precautionary measures

Specialist contractors are not your subordinates. Contracts with them must be drawn up in such a way that they are not mistaken for labor contracts. There should be no regular fixed payments without reference to results, a work schedule and the obligation to obey internal rules. And even more so, such specialists should not constantly work in your office and work only for you. They must have other clients, otherwise you may be accused of having a hidden employment relationship.

You can find contract templates in our free contract database.

When paying for services, fill out certificates of completed work, which detail exactly what you are paying for. It is dangerous to simply write “with the total amount.” The report should show what specific work the specialist performed.

You will not be punished just because the contract is similar to an employment contract, there are no details in the act, or the person performed work in your office. All this will attract the attention of inspectors and give them a reason to dig deeper. But they will consider all the facts together and from them they will conclude whether there were hidden labor relations or not.

Working with the self-employed has its own peculiarities. You cannot order services from a self-employed person who works or previously worked in your state and less than two years have passed since then. If the former employee is not self-employed, but an individual entrepreneur, this may also raise questions, although there is no direct ban on working with such individual entrepreneurs.

Before each payment to a self-employed contractor, check that he or she currently has this status. You can check it in the free Federal Tax Service service. For each payment, ask for a receipt; without one, you will not be able to include this payment in expenses.

About remuneration

The TD must reflect the terms of remuneration. The size is discussed with the hired employee, but should not be less than the minimum wage. The procedure for calculating wages can be established in different ways - this is discussed by the parties. For example, you can set a fixed amount for the entire month of work or a fixed amount plus a bonus, and so on.

And again, points that IPs need to remember:

- When paying a salary to an employee, the individual entrepreneur as a tax agent will have to withhold and transfer 13% of this amount to the budget.

- Insurance premiums are calculated from the salary amount - these are already expenses of the individual entrepreneur, increasing his tax burden.

- Remuneration in special cases is regulated by Art. 152-154 Labor Code of the Russian Federation. Such situations include overtime work, going to work at night and on weekends.

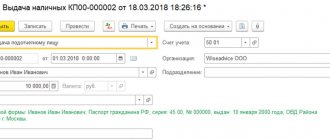

Payment of wages must be made to individual entrepreneurs in cash, namely in rubles. This must be done at least twice a month and on the day specified in the TD with the employee. It is possible to pay wages in another form - non-monetary, but for this the corresponding clause must be present in the TD. In addition, in this way it is possible to pay only part of the salary, and then only after obtaining the employee’s consent.

Restrictions on the number of employees

Any individual entrepreneur can hire employees by concluding an employment contract with them. This can be done at the initial stage or after some time. The only problem is the number of mercenaries. There is a “gradation” of the number of jobs, which is determined by the scale of the individual entrepreneur’s activities. In other words, the more serious the organization, the larger the staff:

- The smallest number of employees can have an individual entrepreneur working under a patent. 5 hired employees are allowed, regardless of full-time employment.

- Small organizations registered as individual entrepreneurs are allowed a staff of up to 100 units. An individual entrepreneur located on UTII has the same right. If you cross this threshold even by one unit, the individual entrepreneur is deprived of preferential conditions and the organization becomes a medium-sized enterprise (in accordance with the requirements of the Tax Code No. 346.29, paragraph 2).

- An average company may employ between 101 and 250 employees at any one time.

- Anything above 250 units is only relevant to large companies.

There is a “gradation” of the number of jobs, which is determined by the scale of the individual entrepreneur’s activities.

Before deciding to hire additional labor, it is worth considering how many employees you will need to grow your business.

Remember that the number of employees is the average number of people for the reporting period before the tax office. Even those employees who work part-time or part-time must be taken into account. The maximum quantity should not exceed certain parameters.

The procedure for recording orders and issuing them to employees

Each personnel order is assigned a registration number, which is recorded in internal logs. For individual entrepreneurs, maintaining such journals is not necessary, so the document number can be assigned in accordance with the order in which regular internal documentation is prepared. The original order is transferred to records management or for safekeeping to HR specialists.

The original is not given to the employee familiar with the contents of the document. However, Art. 68 of the Labor Code of the Russian Federation obliges the employer to issue a certified copy of the form if the employee submits a corresponding application. Certification of the copy occurs by affixing the signature of the responsible person, deciphering his position, and affixing the seal of the organization.

Upon dismissal, citizens can also request any documentation related to their employment. To do this, you need to submit an application indicating the list of forms and forms required by the dismissed specialist. The period for issuing certified copies of documents cannot exceed 3 days.

The procedure for dismissal by employees

Dismissal from an individual entrepreneur is not much different from the same procedure in another organization. The employee must write a corresponding statement. It can be in any form. Next, the manager draws up a dismissal order, reflecting the information of the employee, the employment contract and the reasons for termination of cooperation.

After this, the entrepreneur is obliged to give the employee a salary and other payments due to him. Among them may be compensation for vacation that was not used by the personnel. Those who have worked in this company for more than six months can apply for such a payment.

Important! If an employee is fired due to the cessation of the company's activities, he is entitled to severance pay. However, in the case of an individual entrepreneur, an employee can claim such compensation only if it was specified in the employment contract.

In addition to renting premises and other issues for running an effective business, individual entrepreneurs often need to hire staff. There are a lot of nuances in this matter. In particular, the manager is required to submit reports on his personnel. You need to report regularly. The main important points are hidden in the number of those who can be hired and the contributions that the employer must make. The entrepreneur also needs to compile and confirm the average number of personnel. After all, the number of employees may change over the course of a year. Someone new may appear, or there may be a reduction in staff. This information is necessary for the tax office to find out how best to interact with this individual entrepreneur. The staffing table helps with the preparation of such a document. It allows you to find out how many people work in the organization, with what salary, identify the difference between last year and this year, and so on.

How many employees can an entrepreneur have?

How many people are allowed to hire individual entrepreneurs with employees in 2021? You can get very different answers to this question, most often they say 100 people. In fact, restrictions on the number of employees are not related to the organizational and legal form of the employer (individual entrepreneur or LLC), but to the chosen tax regime.

If an entrepreneur works on the simplified tax system, then he can hire no more than 100 people. At PSN, the restrictions are even stricter - no more than 15 employees based on the average number. Fishing production facilities at the Unified Agricultural Sciences can accommodate up to 300 people. And for those who have chosen the general taxation system, there are no restrictions on personnel, so theoretically the average number of employees of an individual entrepreneur with employees can be anything.

In addition, if an entrepreneur applies for government support for small and medium-sized businesses, then the number of employees also matters. A micro-enterprise can have no more than 15 employees, a small enterprise - no more than 100 people, and a medium-sized enterprise must not exceed 250 employees.