Reorganization of a legal entity entails the creation of new legal entities or a change in the organizational and legal form of existing enterprises.

However, this process has its own subtleties. On the one hand, during reorganization, a legal entity is excluded from the state register - as during official liquidation, and it is extremely difficult for creditors and government agencies to cancel it. On the other hand, as a result of reorganization, a successor always appears who has to answer for all debts, and the procedure itself lasts at least 3.5 months.

General information

The reorganization procedure in the form of separation has been used in practice for quite a long time in various spheres of economic life. In this regard, the basic rules for its implementation are fixed in such regulations as the Civil Code, Tax Code and sectoral federal laws. A peculiarity of the process under consideration is the fact that the newly formed company is part of a previously existing one, but at the same time its founders act as owners of a separate structure. They have the opportunity to issue their own regulations and manage their current account.

Personal income tax reporting

When separating, as with other forms of reorganization, the personal income tax tax period is not interrupted. This is explained by the fact that the company is not a taxpayer, but a tax agent. In addition, labor relations with personnel continue, as stated in Article 75 of the Labor Code of the Russian Federation. This means that there is no need to submit any interim reporting on personal income tax upon allocation.

Let us note one feature: if an employee brings a notice for property deduction, where the “former” organization is indicated as the employer, the accounting department of the “new” company must refuse him. The employee will have to go to the tax office again and get another notice confirming the deduction related to the legal successor. Such clarifications are given in the letter of the Federal Tax Service of Russia dated September 23, 2008 No. 3-5-03 / [email protected] In practice, inspectors everywhere follow these clarifications and cancel the deduction provided under the “outdated” notification.

Characteristic

The reorganization procedure in the form of spin-off is considered the most difficult option for transforming an enterprise. As a result of the process, one or more new companies are formed. It should be said that this result is characteristic of almost all forms of transformation. A certain share of responsibilities and rights is transferred to the formed structures while continuing the functioning of the main enterprise. Reorganization in the form of separation is characterized by singular succession. It is impossible with other types of company transformation.

Classification

In accordance with legal provisions, such a change in the structure of the enterprise can be either forced or voluntary. In the first case, it occurs under the Federal Law regulating the protection of competition. For example, if an enterprise conducts business activities and has a monopoly on a particular service or product, the state can force it to reorganize in the form of a spin-off. This will ensure the creation of artificial competition. A similar situation may arise with a non-profit company. If its monopoly generates significant profits, it will be forced to transform. At the same time, reorganization of a legal entity in the form of a spin-off is permitted if a separate enterprise can exist on the market of goods or services alone. Such processes must be considered by the court. If the corresponding decision is made, the owner of the company or authorized bodies must carry out the transformation within the prescribed period. In accordance with the law, it must last at least six months.

Voluntary procedure

There are various factors under the influence of which the reorganization of an LLC in the form of a spin-off may become necessary. For example, one of the owners participating in the labor process decided to conduct business independently. The need for transformation may arise in order to optimize management in several structures. Often, to prevent liquidation, a reorganization of the company is carried out. The form of allocation is characterized by the provision of not only rights, but also responsibilities. Moreover, the latter may also be in debt. After this, the subsidiary can be declared bankrupt. In this case, the main enterprise will pay off small debts, thus continuing its functioning.

It is also worth saying that the newly formed company is not obliged under the Tax Code to pay duties, taxes and fees for the old enterprise. Reorganizing an LLC in the form of a spin-off can thus be used as a way to prevent debt from accumulating. Of course, there is a possibility that the court will oblige the company to pay it. However, this is only possible if it is proven that the purpose of its creation was precisely to evade payment.

When is it needed?

When is reorganization necessary by separating a new legal entity?

Spin-off is one of the forms of reorganization in which a new enterprise (one or more) appears on the basis of an independent organization, having part of its rights and obligations.

As a result of this procedure, an entry about one or more new economic entities appears in the state register. At the same time, the company from which they spun off continues to operate.

The most common situations in which reorganization through spinoff may be necessary:

- The company is engaged in different types of activities , one of which (or several) will be transferred to the new organization (and read about changing the types of activities of the LLC here).

In this case, the separation will optimize the taxation system and simplify the accounting of the activities of both companies. - The organization is seeking to restructure its debts . Since some rights and obligations of the previous one are transferred to the newly created enterprise, this also applies to debts - part of them can also be transferred to the selected entity.

- Unresolved disputes or conflicts have arisen between the owners of the company , as a result of which they cannot continue to work together. In this case, spin-off is the only way to solve the problem, which preserves the business and respects the rights of all participants.

- The company seeks to expand its rapidly growing activities by transferring part of its assets to another entity.

Regardless of the basis and form of ownership of companies, the reorganization procedure through spin-off must be carried out in compliance with all legal requirements.

If the tax authorities discover a clear attempt to evade taxes or other debts, the owners may incur serious liability.

The following is a reorganization by highlighting step-by-step instructions.

Reorganization in the form of separation: step-by-step instructions

The process under consideration has its own specifics. Enterprises that decide to reorganize often face a variety of problems. To avoid certain difficulties, it is advisable to use a practical guide to transforming an enterprise. The separation of an enterprise is carried out in several stages:

- Decision-making.

- Submitting an application.

- Notification of creditors.

- Publication about the upcoming procedure.

- Preparation of documentation.

- Drawing up a balance sheet.

- Notification from the Pension Fund about the absence of debt.

- Transfer of documentation to the registration service.

Let's look at each separately.

Decision-making

The issue of reorganization is discussed at a meeting of participants. The shareholders make a decision to carry out the transformation, and approve the procedure and conditions for the reorganization. Meanwhile, it is worth saying that this process must be preceded by the development of a plan. During the preparatory stage, the company's management must evaluate its assets and property and prepare documentation for examination. The plan will allow you to structure operations and reduce discussion time. The decision must be unanimous. This means that all meeting participants (if there are several of them) must vote for the reorganization. Problems usually do not arise if the company has only one founder. Minutes must be taken during the meeting.

Important points

When filling out the application, you must pay attention to points 1 and 4. In the first, you should indicate the number of persons participating in the allocation. Due to the fact that the new company has not yet been formed, only one economic entity is included. The fourth paragraph contains information about the number of tumors that are expected to form. This issue is resolved at the meeting.

Carry forward of losses and depreciation

The question of whether the spun-off organization has the right to take into account the losses of the predecessor company when taxing profits is controversial. There is no direct prohibition in the Tax Code. But officials have a different opinion. The fact is that, according to paragraph 5 of Article 283 of the Tax Code of the Russian Federation, losses can only be transferred in a situation where the reorganized legal entity has ceased to exist. And when separated, it continues to work, so it is unacceptable to inherit losses (letter of the Ministry of Finance of Russia dated June 24, 2010 No. 03-03-06/1/428). In our opinion, the conclusions of the financial department specialists are quite logical, and it is safer for taxpayers to follow them.

Another unclear point is related to the calculation of depreciation on real estate objects inherited by the legal successor according to the separation balance sheet. Is it possible to depreciate these objects, given that they are registered to a predecessor? We think it is possible. Although depreciation is not allowed to be calculated before submitting documents for state registration of property rights (clause 11 of Article 258 of the Tax Code of the Russian Federation), in this case the prohibition does not apply. This is due to the fact that during reorganization, ownership of real estate automatically passes to the successor (resolution of the Plenums of the RF Armed Forces and the Supreme Arbitration Court of the Russian Federation dated April 29, 2010 No. 10/22). Consequently, the spun-off organization does not have to register objects and prove the right to depreciation.

Preparation of documentation

The legislation requires the following documents to be available for an enterprise undergoing reorganization in the form of a spin-off:

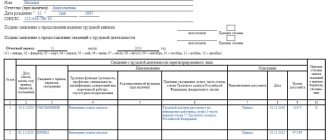

- Separation balance.

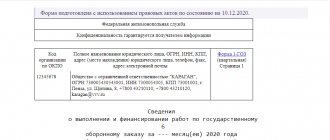

- Application according to f. p12001. In accordance with the unified form, it must contain information about the company that will be formed, the number of entities that will work in it, the number of persons who carried out the separation procedure, and so on.

- Local regulatory act of the established enterprise.

- Protocol or decision on allocation.

- An act approving a new body responsible for drawing up and implementing the charter.

- Receipt for payment of duty.

- Copies of the Herald pages. They are needed as proof of the existence of public notice of the upcoming process.

- Notification from the Pension Fund about the absence of debt. This certificate is not considered mandatory, however, as practice shows, its presence helps to significantly speed up the process.

Mutual settlements with the budget

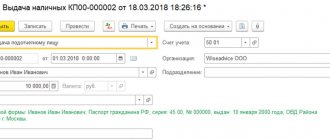

If the predecessor had an overpayment, which he transferred to the successor during the reorganization, then the spun-off company can return the money from the budget. There is one condition here: the predecessor should not have debts for other taxes, as well as penalties and fines. In this case, the legal successor should write a return application and attach a separation balance sheet, a statement of reconciliation with the budget (if available) and other documents confirming the payment of taxes. This is enough to receive money from the budget, according to the financial department (letter of the Ministry of Finance of Russia dated October 22, 2010 No. 03-02-07/1-485).

As for arrears, in the general case, upon separation, the legal successor does not inherit it. Also, he should not bear the tax liability to which the predecessor was involved. This is directly stated in paragraph 8 of Article 50 of the Tax Code of the Russian Federation, and this is confirmed by officials (letter of the Ministry of Finance of Russia dated April 26, 2011 No. 03-02-07/1-137).

Requirements

When carrying out reorganization in the form of a spin-off, it is necessary:

- Create a staffing schedule. It should indicate the number of employees who will work in the new company, as well as the distribution of responsibilities between them.

- Submit personnel documents. We are talking about papers for employees who are transferred to the newly formed company.

- Notifying employees about upcoming changes. In this case, those employees whose working conditions at the enterprise will be changed are subject to notification. If they agree to the transfer, appropriate entries are made in the work books and an annex to the contract is drawn up.

Tax base for VAT

In the event that, according to the separation balance sheet, receivables in the form of advances received from the buyer are transferred to the newly created company, the successor organization must include these amounts in the VAT base. In turn, the predecessor has the right to deduct the tax previously accrued for payment on advances (subclauses 1 and 2 of Article 162.1 of the Tax Code of the Russian Federation).

The “input” tax, which the predecessor paid to his suppliers (or at customs), but did not have time to deduct, can be deducted by the successor. To do this, standard conditions must be met. Namely: the presence of an invoice, a “primary” document and registration for use in transactions subject to VAT. There is an additional condition: the predecessor must transfer documents confirming payment (clause 5 of Article 162.1 of the Tax Code of the Russian Federation).

Particular attention should be paid to the date of the invoice issued in the name of the predecessor. If the document is dated after the allocation, then the tax authorities will most likely not allow the deduction to be accepted. In such a situation, the accountant can only contact the supplier and ask him to correct the document.

Let us add that conflicts with inspectors are likely in cases where the spun-off company received property from its predecessor and, after the reorganization, switched to a “simplified” system. The Ministry of Finance insists that the assignee is obliged to restore VAT on the received objects (letter dated July 30, 2010 No. 03-07-11/323). We believe that there is no need for restoration, because this case is not directly mentioned in paragraph 3 of Article 170 of the Tax Code of the Russian Federation. But this position will most likely have to be defended in court. The outcome of the dispute is difficult to predict.

Reorganization of the separation form: separation balance sheet (sample)

Drawing up this document is the responsibility of the enterprise carrying out the transformation. Its approval is carried out at the general meeting of participants. It contains information about the obligations and property of both the existing and the newly created company. The separation balance sheet is considered as a set of documentation reflecting data on the past, current and future work of the enterprise. In particular, it contains annual reporting, inventories, lists of obligations and material assets, and the procedure for their distribution.