There are special requirements for issuing an invoice, since it is necessary for VAT accounting. This means that not only the seller of goods, works or services with their buyer, but also the regulatory authorities will “deal” with him.

The invoice is issued by the seller within 5 days from the date of transfer of the subject of the contract to the buyer. He can do this both in paper and electronic form. In paper form, everything is simple - the document is generated in 2 copies, the first remains with the seller, and the second goes to the buyer, for example, by mail or courier. With electronic options, everything is somewhat more complicated, but it is in these “difficulties” that the main advantages of ESF lie.

What is an electronic invoice

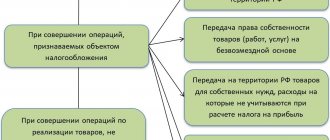

Let us remind you that an electronic invoice, just like its paper version, is the basis for deducting VAT amounts presented by the seller to the buyer (clause 1.2 of the Procedure).

The possibility of issuing electronic invoices is provided for in paragraph 1 of Article 169 of the Tax Code. This requires mutual consent of the parties to the transaction, as well as the availability of compatible technical means and capabilities. Electronic invoices can be issued not only by sellers, but also by commission agents, tax agents, as well as agents who sell or purchase goods on their behalf for the principal.

Firms must exchange invoices in accordance with the Procedure. In addition, such an exchange is possible subject to the following conditions provided for by the Tax Code (clause 1 of Article 169 of the Tax Code of the Russian Federation):

- there is mutual consent of the parties to the transaction;

- invoices are prepared in accordance with the established format;

- invoices are signed with an enhanced qualified signature;

- the parties have compatible technical means and capabilities to receive and process these invoices in the prescribed manner.

After the end of the magazine

After the end of the next quarter, the magazine must be printed. All its sheets are numbered, fastened with thick, strong thread (but not with a stapler), stamped (provided, of course, that the company uses stamps to endorse papers) and certified by the signature of the responsible employee.

Then the magazine must be signed by the head of the enterprise. The electronic version of the journal must be signed using an official electronic digital signature before being transferred to the tax service.

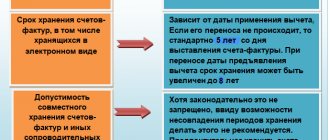

Invoice logs should be stored for the period established by law or the period prescribed in the internal regulations of the company (but not less than four years). After losing its relevance and expiration of the storage period, the form can be deleted from the computer or destroyed (paper version) in compliance with the procedure established by law.

Electronic signature and format

So, the exchange of electronic invoices is possible only via TKS through an electronic document management operator. How is this exchange carried out in practice?

According to paragraph 6 of Article 169 of the Tax Code, an electronic invoice must be signed with an enhanced qualified signature of the head of the organization or a person authorized by him to sign invoices.

The electronic signature of the chief accountant is not required for issuing electronic invoices.

From July 1, the electronic invoice format established by order of the Federal Tax Service of Russia dated March 24, 2021 No. ММВ-7-15/155 is used.

An electronic invoice, drawn up only in an approved format and signed with an enhanced qualified signature, can serve as the basis for the buyer to deduct input VAT. And only such electronic invoices can be sent to the Federal Tax Service at its request via TKS (letter of the Ministry of Finance of Russia dated November 13, 2015 No. 03-02-08/65721, Federal Tax Service of Russia dated February 09, 2021 No. ED-4-2/ [email protected] , dated September 7, 2015 No. ED-4-2/15669).

There is no need to print this electronic invoice. Moreover, neither for submission to the Federal Tax Service, nor for storage for a specified period (clause 1.13 of the Procedure, letter of the Ministry of Finance of Russia dated January 13, 2021 No. 03-03-06/1/259).

Electronic signature by proxy

According to the Ministry of Finance, an electronic invoice can be signed not only by the head of a company or an authorized employee, but also by any person to whom a power of attorney has been issued (letter dated November 8, 2021 No. 03-07-11/73385). This is due to the fact that the electronic invoice format contains elements that carry information about the signatories - the persons signing the invoice. These elements are formed depending on the powers of the signatories.

And if the power of attorney for the signatory is drawn up correctly, it does not matter whether he is an employee of the company or not. In any case, when signing an electronic invoice, he acts as an authorized person. And there is no need to enter information about his employer in the “Signer” element.

Therefore, an electronic invoice can be signed by any person who has been issued a power of attorney on behalf of the organization. Moreover, this person does not have to be an employee of the company.

Electronic document management operator

An operator of electronic document management of invoices is an organization that ensures the exchange of invoices drawn up electronically in an established format between the buyer and seller through an electronic document management system for invoices (EDI).

The electronic document management system (EDF) for invoices is an automated system (program, web interface) that allows you to create, send and receive invoices compiled electronically in an established format through an electronic document management system for invoices.

The register of trusted EDI operators can be found on the Federal Tax Service website www.nalog.ru (Taxation in the Russian Federation → Submission of tax and accounting reports → Electronic invoices → List of electronic document management operators).

An organization can choose any of them. And it is not at all necessary that the counterparty with whom electronic exchange of invoices is being introduced is serviced by the same operator. The only important thing is that in order to exchange electronic invoices, the parties to the transaction must have compatible technical means (clause 1.3 of the Procedure). This means that they must be compatible across their operators. Therefore, when choosing an EDF operator, you need to find out with which of the other operators it has the technical ability to exchange invoices.

In turn, when concluding an agreement with the operator, the organization must indicate whether it agrees or not to transfer information to another operator (clause “b”, clause 2.1 of the Procedure).

EDI invoice operators, as intermediaries, solve two problems at once.

Firstly, the organization does not need to independently worry about the technical development of tools for receiving and processing electronic invoices that are compatible with the facilities of the counterparty with which it is switching to electronic exchange of invoices. You just need to install the program (use the web interface) provided by the EDF operator.

Secondly, EDI operators generate technological documents that confirm the fact of exchange (dates of dispatch, receipt, etc.) of electronic invoices. And this is important to avoid disputes between the taxpayer and the Federal Tax Service. The tax authorities themselves point to this (letter of the Federal Tax Service of Russia dated April 30, 2015 No. BS-18-6 / [email protected] ).

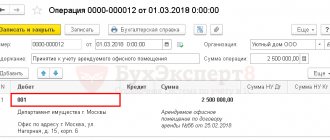

Integration of ESF IS with accounting systems

IS ESF provides an API for programmatic data exchange with taxpayer accounting systems. Users of 1C programs on the 1C:Enterprise 8 platform can use this opportunity to directly exchange data with the ESF IS.

Healthy

More details about the main points of working in the ESF IS for users of 1C programs:

- Setting up data exchange with IS ESF in 1C: Accounting 8 for Kazakhstan;

- PRO direct extract of ESF in “1C: Accounting 8 for Kazakhstan;

- PRO extract of ESF by exporting and importing XML files into 1C: Accounting 8 for Kazakhstan.

Seller's actions

To issue an electronic invoice, within five calendar days after shipment or receipt of an advance payment (clause 2.4 of the Procedure), the seller must:

- draw up an electronic invoice in the established format and sign it with an electronic signature;

- send the buyer an invoice file via TKS through an EDI operator.

Next, the seller will receive confirmation from the EDF operator indicating the date and time of receipt of the invoice file. In response to this confirmation, no later than the next business day, he must send a notice that the confirmation has been received.

According to the Procedure, after receiving this confirmation from the EDF operator, the invoice is already considered issued (clause 2.7 of the Procedure). Sending by the buyer a notice of receipt of an invoice via TKS through the EDI operator is only the subject of an agreement between the parties to the transaction (clause 2.9 of the Procedure). This is not required.

An electronic invoice issued to the buyer cannot be duplicated on paper. But if there is a need, for example, in case of a technical failure with the EDF operator, you can issue the buyer a paper invoice instead of an electronic invoice (clause 2.20 of the Procedure).

In the sales book, an electronic invoice is registered in the general manner in the quarter in which the date of shipment of goods or receipt of an advance payment falls (clause 2 of the Rules for maintaining a sales book (approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137), letter from the Federal Tax Service Russia dated June 17, 2013 No. ED-4-3/10769).

Numbering rules

The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time. It is imperative to reflect renewal periods in the company's accounting policies. The period may be as follows:

- Month.

- Quarter.

- Year.

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day. This will be considered a violation.

The frequency of updates depends on the document flow of a particular enterprise. The more papers are filled out, the more often the numbers are renewed.

Buyer actions

The buyer receives from the EDF operator a file with an electronic invoice and confirmation of its dispatch, indicating its date and time. No later than the next business day, he must send the operator a notice of receipt of confirmation.

This should be done only if there is such an agreement with the seller (clauses 2.9, 2.12 of the Procedure).

In the purchase book, an electronic invoice is also registered in accordance with the general procedure (clause 1.11 of the Procedure).

Electronic document flow when exchanging invoices is carried out for each invoice separately.

How to hand over a journal and what will happen if you don’t turn it in

By law, the journal can be kept in paper form and on a computer.

Note! Today, only electronic submission of the journal is provided to the tax authorities, through a company that is a special operator of an electronic document management system, and only officially approved document formats must be used.

If an organization does not provide a completed form on time, it may be subject to administrative punishment in the form of a fine (up to 10,000 rubles), and a fine may also be imposed on responsible officials (director and chief accountant).

How to fix an electronic invoice

To correct an electronic invoice, the buyer, through the EDF operator, sends a notification to the seller to clarify the invoice.

Having received the notification, the seller corrects the errors indicated in it and sends a corrected electronic invoice to the buyer through the EDI operator (clause 1.12 of the Procedure).

The procedure for further actions by the parties is similar to that used when sending the initial invoice.

By the way, according to the Ministry of Finance, if an electronic invoice is issued, an adjustment to it can be drawn up on paper (letter dated February 7, 2021 No. 03-07-09/7269).