In the latest issue of accounting education, Alexey Ivanov explains why a financial performance report is needed, what can be seen in it, and why it is important not only for an accountant to be able to read this report. At the end of the article there is an example of constructing a financial results report, which will be understandable even to a reader who is very far from accounting.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog on Klerke.ru I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Who must submit an income statement?

The legislation determines that accounting is the responsibility of every business entity that is registered with the Federal Tax Service as a legal entity.

In this case, no exceptions are made and the organizational form of the enterprise, the taxation system used, etc. are not taken into account. Accounting statements, and in their composition the report on financial results, must be sent to the Rostat and INFS bodies without fail.

Non-profit organizations and bar associations must also submit a profit and loss statement, Form 2, since this form is required to be completed by all entities.

Only citizens who have registered an individual entrepreneur as a legal form are exempt from this obligation. The same right exists for divisions of foreign companies. All these entities can prepare reports and send them to the authorities on a voluntary basis. Previously, reports did not have to be prepared and submitted to the relevant authorities only by companies using the simplified tax system.

The company may be classified as a small business. In this case, the provisions of the law provide for a simplified reporting procedure for such companies.

Attention! Even if you use this benefit, the company must prepare and submit accounting reporting forms, but in a simplified form. Companies must remember that this set of statements includes both a financial statement, Form 2, and a balance sheet, Form 1.

What are financial statements

A standard package of financial statements for a commercial organization includes a balance sheet, a statement of financial results, a statement of cash flows and changes in capital. These forms are based on accounting and are needed to analyze information about the organization’s activities and plan further development. They reflect information about the financial position of the company, the profitability or unprofitability of its activities, areas of expenses and sources of income, as well as capital flows.

Additionally, organizations prepare explanations and also submit an audit report along with the reporting if they are subject to a mandatory audit.

Which form to use – simplified or complete

An enterprise that does not meet the criteria for being classified as a small business must submit a balance sheet form 1 and a financial statement form 2 in full according to the provided reporting forms.

Organizations that have the right to use simplified reports are determined by the legislation “On Accounting”, these include:

- Companies classified as small businesses.

- Non-profit organizations.

- Participants in research and development projects on Skolkovo legislation.

Only these entities are given the right to prepare simplified accounting statements. Based on the prevailing circumstances and characteristics of the enterprise, they can independently decide on the use of reporting forms. They must consolidate this decision in the company’s accounting policies.

However, the use of simplified reporting is unacceptable for such business entities as:

- Firms whose reporting must be verified by statutory audit. They are determined by relevant legislation.

- Companies belonging to housing and housing-construction cooperatives.

- Credit consumer cooperatives.

- Microfinance companies.

- Government organizations.

- Parties and their branches in the regions.

- Bar associations, law offices, chambers of lawyers, legal consultations.

- Notaries.

- Non-profit enterprises.

Document structure

The general principle of structuring the report is to reflect indicators that allow you to get an idea of whether the company is unprofitable or profitable. Key information related to this is recorded at the very beginning of the document (this is revenue, sales data, expenses - including management).

After the basic information reflecting the efficiency of the enterprise is recorded in the document, additional indicators related to the formation of income or expenses are entered into the report - for example, interest on deposits (or, conversely, debt obligations), figures reflecting the results of business activities companies before taxes. Then the profitability of the company after paying the necessary fees to the budget is calculated and also recorded in the report. Thus, the final financial result is formed - net profit (or, conversely, loss) for the tax period.

Report submission deadlines

Financial statements, including balance sheet form 1, financial performance statement form 2, etc., must be sent to the tax authorities and Rosstat no later than March 31 of the following year. This temporary restriction exists only for the above listed bodies.

However, for statistics, it is possible that upon the occurrence of certain events it will be necessary to attach to the standard package an auditor’s report regarding the prepared annual report. The company must submit it to Rosstat within ten days from the date the auditors issued their report, but no later than December 31 of the following reporting year.

In addition, reports can be submitted to other competent authorities, as well as published due to the characteristics of the type of activity being carried out in accordance with legal norms. For example, companies that are tour operators must submit accounting forms to Rostourism within three months from the date of its approval.

The rules of law establish a different reporting procedure for companies registered on October 1. They can exercise their right and submit reports not until March 31 of the following year, but a year later.

For example, Rassvet LLC was registered with the Federal Tax Service on October 23. By decision of management, the company will submit its annual report by March 31, 2019, including information for the entire period of activity in one report.

Attention! Companies must file reports annually. Reporting, especially the financial performance report Form 2, can be presented not only annually, but also monthly or quarterly.

As a rule, in this case, its recipients are the owners who use it to make management decisions, credit institutions to process loans and credits, etc. Such accounting statements are called interim.

You might be interested in:

Reporting in 2021 for LLCs and individual entrepreneurs: deadlines, general table for LLCs, simplified tax system, UTII, unified agricultural tax

Reporting tools

To make working with reporting easier, many special services and programs have been created. They automate calculations, help optimize tasks and spend less time on reporting.

The most basic tool is an accounting program. Nowadays there are few companies left that keep records and generate reports manually. Large enterprises have long switched to special programs that allow several accountants to work together and perform all their tasks: keep records of primary documents, consolidate data by department, generate reports, prepare analytics based on any parameters, and much more. Such programs include Kontur.Accounting Asset.

Small businesses often choose online services that help them perform basic accounting operations and submit reports: Kontur.Accounting or Kontur.Elba.

Another indispensable tool is the Microsoft Office software package. For example, Excel is often used by financial directors and economists to generate internal analytics, non-standard calculations, and compilation of special tables. All this helps management make the right management decisions.

You can now submit financial statements only in electronic format. To do this, you can use the electronic service of the Federal Tax Service or connect a special system for online reporting - Kontur.Extern.

Where is it provided?

The laws establish that financial statements and the included form okud 0710002 profit and loss report are submitted to:

- To the relevant tax authorities - it must be submitted at the place of registration. In this regard, if an entity has separate divisions, it should not send its reports to the Federal Tax Service. Their information is included in the consolidated report of the parent company, which submits it to its legal address.

- It is mandatory to send reports to the territorial bodies of Rosstat if the company does not want to be fined on a fairly large scale.

- Owners and founders of the company - the annual report must be approved by them.

- To other government bodies, if this is directly stated in federal laws.

When concluding large contracts, partners can request financial statements from counterparties to confirm their reliability and financial solvency.

Management can decide to grant it or deny it. However, it must understand that this data can be obtained using special programs or partner verification services.

Attention! Also, quite often, reporting forms are requested by banks and other credit institutions when a company receives various loans. For example, if you need to get a loan to develop or start a business.

Rules for preparing financial statements

The reporting rules are approved in PBU 4/99. Of the basic requirements:

- Russian language;

- currency of the Russian Federation;

- data in thousands of rubles without decimal places;

- no erasures or blots;

- indicators with a negative value are indicated in brackets;

- missing indicators are replaced with a dash;

- the balance sheet includes indicators in net valuation, that is, minus regulatory values;

- reporting data for the reporting period must be comparable with reporting data for previous periods.

For each numerical reporting indicator, except for the report for the first year, data must be provided for at least two years - the reporting year and the previous one.

The reporting is considered completed after it is signed by the manager, chief accountant or other official responsible for signing it.

The annual reporting must be approved at the general meeting of participants (shareholders). The deadline for holding the meeting is determined in the charter. It must fall within the period:

- for LLC - from March 1 to April 30;

- for JSC - from March 1 to June 30.

The decision to approve the reporting is documented in the minutes of the general meeting. It must indicate the number, date, location, agenda, information about participants and voting results.

If the LLC has one participant, his decision, drawn up in any order, is sufficient to approve the reporting.

Since the period for approval of reporting is longer than the period for its preparation. You can also submit unapproved reports to the Federal Tax Service.

Delivery methods

The financial performance report Form 2, included in the annual report, can be sent to the competent authorities using the following methods:

- Come to the institutions and submit the financial statements to the responsible person in person on paper in two copies. Sometimes they may also ask you to provide an electronic file of it. This method is not available for companies with more than one hundred employees.

- Send a valuable letter through post offices or courier services. The post office will require an inventory of this letter.

- Using electronic document management, you can submit annual reports to all specified authorities if you have a qualified electronic digital signature (EDS). For this purpose, a specialized program, tax authorities website, etc. can be used.

Purpose

The income statement reports the amount of income and expenses of a company. This information is needed to:

- identify the causes of losses and find a solution to eliminate them;

- analyze profits and find ways to increase them;

- analyze gross and net income and distribute it correctly;

- compare data with other periods;

- evaluate the company’s performance and its prospects in the market;

- plan further economic development.

- identify credit potential.

The following specialists often study ODF:

- Stock analysts. If the owner of a company wants to list its shares on the stock exchange to attract small private investors, then he will have to put the financial report on public display. By analyzing this data, people will decide whether it is worth investing in a company or not.

- Investment analysts. If we are talking about one large shareholder, then he will need to provide all the data privately. The information obtained will help the investor determine how promising the organization is.

- Employees of credit institutions. If a company is planning an expansion or needs a loan from a bank for another purpose, its documents will be carefully examined before a decision is made.

- Counterparties. Before entering into a contractual relationship with an organization, they usually carefully study all the documentation.

However, companies are required to report financial results only to the tax authorities. There is no need to tell everyone else about the current state of affairs, since this is a private matter for a private organization.

Important! If an inaccuracy is found, the form must be filled out again.

Form and sample for filling out a financial performance report in Form 2 in 2021

Financial results report form 2021 free download in Word format.

Download the 2021 financial results report form in Excel format.

Download the profit and loss statement form 2 with line codes in Excel format.

Download a simplified form of the profit and loss report in Excel format.

Profit and loss report form 2 sample completed download for free in Pdf format.

Why do you need a net profit indicator?

In our country, it has long been customary to divide earnings into two types: “clean” and “dirty” money. The second type will be considered the official salary specified in the employment contract, and the first will be the amount that the specialist actually receives in person minus personal income tax and other contributions. This principle seems ambiguous, but it works with all financial business realities, including in our case.

Net profit is one of the key indicators indicating the success of a company. This is sales revenue and other income of the enterprise minus all expenses, including taxes. It is quite logical that any management wants to extract maximum benefit from the activities of their company. This result is needed both by owners and senior managers, and by ordinary specialists, because it is this indicator that most strongly affects the likelihood of issuing bonuses to staff.

Let us repeat that the size of this indicator is the most accurate evidence of the efficiency of the enterprise. If this amount increases compared to the previous period, we can talk about the high-quality work of the company, while its decrease indicates errors in the chosen management policy.

There are a number of people who use the net profit indicator for their needs, as well as a calculation formula with examples:

- Owners, shareholders.

The owner needs the data to understand how successful the company is and what results the chosen management system brings. In addition, this indicator is required when calculating dividends and the share of individuals as investors in the authorized capital. - Director.

The calculation formula allows this person to understand how stable the company is from a financial point of view, whether management decisions are being made correctly, and what new development strategies to introduce. This indicator directly affects profitability, so analysis of the balance of available funds plays an important role. - Suppliers.

The main question for them is whether the company is able to pay for raw materials. The indicator we are discussing allows us to answer it. If the company cannot boast of a high level of net profit, some suppliers will definitely not agree to sign the contract, fearing late payments. - Investors.

They evaluate the profitability of investing in an enterprise, so the higher the level of free income, the more attractive the company is from an investment point of view. After all, everyone, when investing money, strives to receive additional income from shares. - Creditors.

It is important for them to understand the solvency of the company. It is generally accepted that money has the highest liquidity. The more funds a company has after paying taxes and other charges, the faster it will pay off its debts. That is, this is a necessary condition for obtaining a loan from a bank.

There are several reasons for calculating net profit using the calculation formula:

- Profits from any business are distributed among all participants, but it is impossible to do this in the required shares without calculating using a formula.

- This indicator is calculated, for example, if it is necessary to calculate the amount of taxes payable for the reporting period.

- If a business suffers losses, it is important to know how much will have to be compensated.

- In this way, the results of business activities are assessed - this is required for further rationalization of processes, for example, reducing production costs.

- This is evidence of the profitability of sales and the effectiveness of the pricing policy chosen by the enterprise.

Thanks to the indicator under discussion, companies are able to develop their material base, invest in expanding production, improving technology and mastering the most modern methods in their work. As a result, firms enter new markets, increase sales volumes, and therefore increase income.

Top 3 articles that will be useful to every manager:

- Financial control at the enterprise

- Net profitability of the enterprise

- How to build a company's financial structure

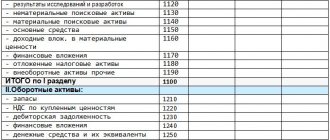

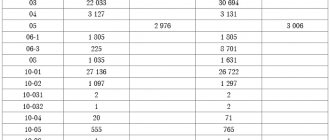

How to fill out a profit and loss statement form 2: full version

When filling out the financial results statement Form 2, you should follow a certain sequence.

The period under review is written under the title of the report. Further in the table, on the right, the date of compilation of the report is reflected. Below you need to write down the full or abbreviated name of the company, and in the tabular part - the registration code with Rosstat.

Then the TIN of the reporting company is reflected. Next, the name of the main type of activity carried out by the company is written down in words, and the OKVED code 2 is indicated in numbers.

The next line indicates the organizational form and form of ownership of the organization and puts the corresponding codes next to it. Next, the unit of measurement used is recorded.

The report itself is a table in which the company's performance indicators are reflected in terms, and in the columns - their value in the period of time under review and the previous one similar to it. Thus, a comparison of two periods of activity occurs.

Line 2110 should reflect the income received during the reporting period from all types of activities. This indicator is equal to the credit turnover on the account. 90.1. In this case, VAT should be removed from the revenue amount.

In the following lines of this subsection, you can decipher the amounts of income by type of activity. Small businesses may not do this.

Line 2210 reflects the amount of expenses incurred by the enterprise for the manufacture of products or the provision of services (work). The amount of the account turnover is reflected. 90.2.

At the same time, depending on the cost formation method used, the amount of expenses may include administrative expenses or not. If they are not included in the cost price, these amounts are reflected in line 2220.

If necessary, a breakdown of expenses by area of activity is also made here.

You might be interested in:

SZV-STAZH: who should take it, in what time frame, sample filling

Line 2100 determines the gross profit (loss), which is calculated as the difference between line 2120 and line 2210.

In line 2210, you should record the expenses incurred by the enterprise for the sale of products, goods, etc.

After this, in line 2200 the profit from sales is calculated, which is equal to the difference between lines 2100 and lines 2210, and line 2220.

Next, line 2310 indicates income received by the organization as dividends from other legal entities, other income from the participation of the company as a founder.

Line 2320 is used to reflect accrued interest on borrowed funds.

Line 2330 records the interest that the company must pay for the use of borrowed funds.

Line 2340 includes the amount of revenue received from non-core activities, including the sale of fixed assets, materials, etc.

Line 2350 reflects the amounts of expenses incurred for non-core activities, including the residual value of property sold and costs of materials sold.

Line 2300 calculates the enterprise's profit before tax. It is equal to the sum of lines 2200, 2310, 2340, from which the indicators of lines 2330,2350 are subtracted.

Line 2410 should reflect the income tax calculated on the basis of the relevant declarations. It is determined in profit declarations.

On line 2421 you should record the amount of the permanent tax liability or asset that affected accounting profit in the current year.

Lines 2430 and 2450 reflect discrepancies between the indicators of income and expenses for accounting and tax accounting, which are considered temporary, since their acceptance for accounting may occur in different periods. In this case, line 2430 reflects the amount of tax that will increase it in the future, and line 2450 will reduce it.

Line 2460 should reflect the amounts of indicators that were not considered and taken into account earlier, but nevertheless affect the company’s profit. For example, these could be various fines, a trading fee, etc. The indicator can take a positive value (turnover according to DT 99 is greater than turnover according to CT 99), or a negative value (vice versa).

Line 2400 is defined as the difference between line 2300 and line 2410, to which lines 2430, 2450, 2460 are added (subtracted).

Line 2510 records the change in the value of property based on revaluation, and line 2520 records other results that are not taken into account when determining profit.

Line 2500 reflects the adjusted profit indicator; it is equal to the sum of line 2400 plus lines 2510 and 2520.

Lines 2900 and 2910 are filled out as a guide and include information about basic and diluted earnings per share.

At the end, the document is signed by the manager and the date of approval of the document is set.

Definition of an indicator in the reference book “Structure of Goals”

The method for forming the value of the indicator itself is determined in the standard 1C:ERP reference book “Structure of Goals”.

Fig. 9 Directory “Structure of Goals”

Right there, by clicking the “Edit” button, you can make changes to the rules for generating this indicator.

Fig. 10 Editing an indicator

When clicked, a standard window of the 1C:ERP platform data composition system opens.

Fig. 11 Data composition system window

A 1C programmer, using the built-in capabilities of the 1C:Enterprise platform, will be able to configure any necessary financial ratio:

Fig. 12 Layout diagram designer

How to fill out a simplified income statement line by line

The simplified form for okud 0710002 differs from the main one in that in the tabular part it has a significantly reduced number of reflected performance indicators.

It states:

- Enterprise revenue (line 2000).

- Expenses of a company in its normal activities.

- Interest paid by the company for the use of borrowed funds (line 2330).

- Other income.

- Other expenses (2350).

- Income taxes taking into account all deferred and permanent assets and liabilities.

- Net profit (2400).

Attention! Indicators are calculated in the same order as in a standard report. It’s just that, as a rule, organizations using this form do not have all other information.

Option for implementing automated calculation of financial indicators in 1C:ERP

1C:ERP provides a Target Indicators mechanism, to use which you must enable the “Monitoring Target Indicators” option.

Fig.6 Mechanism of Target Indicators

A standard 1C:ERP configuration comes with a pre-configured model of financial indicators.

Fig.7 Table listing indicators

From the presented list of indicators, “Quick liquidity” most closely corresponds to the previously presented autonomy coefficient (or financial independence coefficient).

1C:ERP - an innovative solution for effective analysis of financial results

The quick liquidity ratio reflects the company's ability to pay off accounts payable using its own liquid assets.

Fig.8 Description of the indicator

In general, the formula for calculating urgent liquidity is as follows:

KLsr=(KrDZ+DSr+KrFVl)/(KrKr+KrKz+PrO)

Where:

- KLsr – quick liquidity ratio;

- KrDZ – short-term debt of debtors;

- ДСр – amount of funds;

- KrFVl – short-term financial investments;

- KrKr – the amount of short-term borrowed funds;

- KrKZ – short-term debt to creditors;

- PrO – other short-term liabilities.

On our website you can also find articles about other areas of financial analysis and the capabilities of 1C programs in terms of estimating sales volume, determining the relative weight of indicators, conducting structural analysis and trend analysis, as well as determining the liquidity of the report.

Common mistakes when filling out Form 2 of the balance sheet

Many errors when filling out this form are caused by arithmetic inaccuracies. Therefore, when filling out a report, it is best to use specialized complexes that perform all calculations automatically.

The most common mistakes made when filling out are:

- Quite often, when filling out the “Revenue” indicator, accountants forget to exclude the amount of accrued VAT from income.

- Another common mistake is to distribute income by type without taking into account the Accounting Regulations. Some professionals may include interest or income from participation in other organizations as other income.

- When determining the current tax, it is necessary to take into account the PBU “Accounting for income tax calculations”, which many do not do in practice.

- You also need to decipher some reporting indicators, which are given at the very end of the form in the form of a certificate. Experts quite often ignore this point.

Rules and procedure for filling out

The report is filled out according to a strict scheme and contains the following components:

- Gross profit. This parameter allows you to highlight the most promising areas of activity and rationalize financial flows. It is one of the main indicators characterizing the company’s performance.

- Income. This includes dividends from investments, interest from any kind of deposits and money in the account, which increase the budget. But the main item is revenue, which consists not only of income from sales, but also payments for the provision of services, rent payments, dividends and other types of profit.

- Expenses. This category includes losses from sales or incorrect economic decisions, interest payable, as well as expenses of any kind (rent of premises, expenses for materials, wages, etc.).

Calculation of net profit

Data for past periods should be taken from last year's reports. If the data is missing, then dashes must be placed in the corresponding lines.

Note! The report form has been approved by the Ministry of Finance, so it cannot be changed under any circumstances. You can only supplement with explanations that decipher the content of individual points.