It is important not only for the employees themselves to improve their qualifications and professionalism, but also for the company in which they work. Personnel are the face of the organization, and the quality of their work largely determines the success of the business. Investing money in training, education and retraining of personnel is beneficial in the long term if this money is managed wisely. To do this, you need to understand what the costs of employee training and how to account for them correctly.

Documenting

The employee must submit his request for payment for studies in a free form.

An agreement with an educational institution (organization carrying out educational activities) may be concluded by:

- the employee himself;

- the organization in which the student works.

In the first case, the organization compensates the employee for the cost of training. In the second case, the organization itself will conclude an agreement for the provision of educational services to the employee and pay their cost. In such a situation, the manager issues an order to pay for the employee’s education at the expense of the organization’s own funds.

All facts of the economic life of the organization must be confirmed by primary documents that contain the details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Such documents, for example, could be:

- agreement with an educational institution;

- act on the provision of educational services.

Accounting

In accounting, training costs not related to the production activities of the organization (in the interests of the employee) should be reflected as part of other expenses (clause 11 of PBU 10/99).

If the organization pays for the employee’s studies directly to the educational institution, reflect this with the following entries:

Debit 91-2 Credit 76

– employee training costs are reflected;

Debit 76 Credit 51

– payment for employee training is transferred.

Educational services of educational organizations are not subject to VAT (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation). Therefore, there is no input tax in the payment documents presented by such organizations.

Educational services of commercial organizations providing training are subject to VAT at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation). Reflect the tax amount allocated in the settlement documents by posting:

Debit 19 Credit 76

– VAT is taken into account on the cost of services of a commercial organization providing training.

If the organization deducts training costs (or part of them) from an employee’s salary, make the following entries in your accounting:

Debit 73 Credit 76

– expenses (part of the expenses) for training are attributed to the employee;

Debit 70 Credit 73

– part of the training costs is deducted from the employee’s salary.

The cost of training can be deducted from an employee’s salary only upon his written request. The list of cases when the administration of an organization, on its own initiative, can withhold amounts from an employee’s salary is given in Articles 137 and 238 of the Labor Code of the Russian Federation. There are no deductions for tuition fees.

An example of how employee training costs are reflected in accounting. The training is carried out in the interests of the employee under an agreement between the employer and the educational institution. The organization deducts part of the educational expenses from the employee’s salary.

Cashier of Alfa LLC A.V. Dezhneva is studying at the law faculty of the university. The agreement with the educational institution was concluded on behalf of Alpha. In August, the organization paid for Dezhneva’s tuition for the first semester. The cost of educational services is 6,000 rubles. The university is an educational organization, therefore its services are not subject to VAT.

According to the employee, 20 percent of the cost of study is withheld from her salary.

The following entries were made in the organization's records.

In August:

Debit 76 Credit 51 – 6000 rub. – Dezhneva’s tuition was paid for in the first semester;

Debit 73 Credit 76 – 1200 rub. (6000 rubles × 20%) - attributed to settlements with the monetary part of training costs;

Debit 70 Credit 73 – 1200 rub. – deducted from the salary The monetary portion of training expenses.

At the end of the first semester:

Debit 91-2 Credit 76 – 4800 rub. (6,000 rubles – 1,200 rubles) – Dezhneva’s training expenses are written off.

If an employee first paid for his studies himself, and the organization compensates him for expenses, then reflect this operation with the following entries:

Debit 91-2 Credit 73

– employee training costs are reflected;

Debit 73 Credit 50

– the employee is compensated for training expenses.

How to track employee training costs

Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation No. 33n. dated May 6, 1999 (specifically clauses 5, 6, 6.1, 7), classifies the enterprise’s expenses for employee training (in any form) as expenses for ordinary activities. Their amount must be reflected in the training contract.

Clause 16 of PBU 10/99 lists the following criteria under which a company’s expenses, including employee training costs, can be recognized in accounting:

- The basis for the expense is a contract, legal act or business customs.

- The amount is clearly defined.

- An expense is part of a transaction that clearly results in a reduction in the economic benefits of the enterprise (this is typical in cases where the company actually transfers its asset to someone or there is complete certainty that the asset will be transferred).

Expenses associated with training and retraining of company employees meet all these conditions and therefore can be counted in the period corresponding to the provision of educational services, namely, the date of signing the act of completion of work (regardless of when the payment for training was actually transferred) – see clause 18 of PBU 10/99.

The company's expenses for employee training are reflected in accounting:

- In the debit of account 60 (“Settlements with suppliers and contractors”).

- In the correspondence for account 50 (“Cashier”).

- On account 51 (“Current Account”), if the company pays for employee training by bank transfer.

- On account 71 (“Settlements with accountable persons”), if the payment was made in cash.

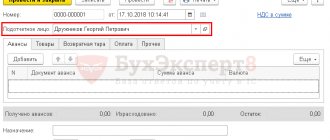

These costs are reflected in the form of accounts receivable if an advance payment was transferred to an educational institution for an employee’s training (see paragraphs 3, 16 of PBU 10/99). But this is no longer an expense, unlike the above cases. Data on prepayment must be present in the credit of account 50 (“Cash”), 51 or 71 (depending on whether the prepayment is made by cash or non-cash payment), as well as in the debit of account 60 (“Settlements with suppliers and contractors”) and analytical account 60-va (“Calculations for issued advances and prepayments”).

As soon as the document of acceptance and transfer of educational services has been received, expenses for employee training should be reflected in the debit of expense accounts 20, 25, 26, 44, in the credit of account 60 and, at the same time, offset the amount of the prepayment in the invoice for the provision of services, making an internal entry in analytical accounting on account 60 (debit 60, credit 60).

In more complex situations, when the company incurs the costs of training citizens with whom an employment contract has not been signed - children of full-time employees, etc. - these amounts are classified as other expenses (which is regulated by clauses 2, 11 of PBU 10/99 ). They must be entered in the debit of account 91 (“Other income and expenses”), subaccount 91.2 (“Other expenses”), as well as in correspondence with the credit of account 60.

Read the material on the topic: How to hire an employee

Personal income tax and insurance premiums

Situation: is it necessary to withhold personal income tax from the cost of training for an employee (employee’s children)? The training is carried out in the interests of the employee (his children), but at the expense of the organization.

The answer to this question depends on whether the conditions listed in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are met.

Namely, the educational institution (organization carrying out educational activities) in which the employee (his children) studied has a license for educational activities or the corresponding status for a foreign educational institution. If these conditions are met, do not withhold personal income tax (clause 21, article 217 of the Tax Code of the Russian Federation). Moreover, the fact that the training was in the interests of the employee (his children) does not matter. It also does not matter who pays for the studies (the organization itself or the employee, and the organization reimburses him for the costs). Please note that the organization must have documents confirming the expenses incurred (training agreement, which indicates the license number or status of the educational institution, type of study and payment procedure, payment documents).

If the conditions established in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are not met, study in the interests of the employee (his children) refers to income in kind, which is subject to personal income tax (subclause 1, paragraph 2, Article 211 of the Tax Code of the Russian Federation).

Similar conclusions follow from letters of the Ministry of Finance of Russia dated October 4, 2012 No. 03-04-06/6-295, dated April 2, 2012 No. 03-04-06/6-88.

Regardless of the taxation system applied, contributions to compulsory pension (social, medical) insurance, as well as contributions to insurance against accidents and occupational diseases, must be assessed on the cost of training in the interests of the employee.

This is explained by the fact that this payment is considered as payment for employee services. The employer makes such payments within the framework of the employment contract; in addition, they are not included in the closed list of amounts not subject to insurance premiums (including for accidents and occupational diseases). This conclusion can be drawn from Part 1 of Article 7 and Article 9 of the Law of July 24, 2009 No. 212-FZ, as well as Part 1 of Article 20.1 and Part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ.

The procedure for calculating other taxes depends on what taxation system the organization uses.

Study leave

Now consider the question: what is study leave and in what situations should it be granted? We have already identified several types of training, the costs of which can be taken into account when calculating income tax, namely: training carried out by the company, for example, in a personnel training center; training of employees in a licensed company; on-site training for employees on the employer’s premises. Study leave is additional leave granted, subject to certain conditions, to an employee combining work with education.

In order for a company to be able to provide study leave, certain conditions must be met (Articles 173, 174, 176, Part 1 of Article 177 of the Labor Code of the Russian Federation). Firstly, obtaining an education at the appropriate level should occur for the first time. It should be noted that study leave can be granted to an employee who has a professional education of a certain level and whom the organization sends to receive education in accordance with an employment contract or apprenticeship contract. Secondly, the educational organization must have state accreditation. Thirdly, successful completion of the educational program must be ensured, that is, the employee must not have any outstanding debts on exams or tests.

BASIC

Costs of study that are not related to basic or additional professional education or professional training of an employee and are carried out not in the interests of the organization, but in the interests of the employee, cannot be taken into account when calculating income tax (subclause 23, clause 1, article 264 and clause 1 Article 252 of the Tax Code of the Russian Federation).

Since employee training expenses do not reduce taxable profit, accrue a permanent tax liability in accounting (clauses 4 and 7 of PBU 18/02).

An example of how employee training expenses are reflected in accounting and tax purposes. The organization applies a general taxation system. The training is carried out in the interests of the employee under an agreement between the employer and the educational institution

Cashier of Alfa LLC A.V. Dezhneva is studying at the Faculty of Law of a university that has a license for educational activities. The agreement with the educational institution was concluded on behalf of Alpha. The organization calculates income tax monthly using the accrual method. The tariff for calculating insurance premiums for accidents and occupational diseases is 0.2 percent. The organization charges insurance premiums for compulsory pension (social, medical) insurance at general rates.

In August, the organization paid for Dezhneva’s studies in the first semester. The cost of educational services is 6,000 rubles. The university is an educational organization, therefore its services are not subject to VAT. Dezhneva’s salary is 12,000 rubles. The employee does not have rights to deductions for personal income tax.

According to the employee, 20 percent of the cost of training is withheld from her salary.

The act on the provision of educational services for the first semester was signed in January of the following year.

The following entries were made in the organization's records.

In August:

Debit 76 Credit 51 – 6000 rub. – Dezhneva’s tuition was paid for in the first semester;

Debit 26 Credit 70 – 12,000 rub. – Dezhneva’s salary for August was accrued;

Debit 73 Credit 76 – 1200 rub. (RUB 6,000 × 20%) - attributed to settlements with the monetary portion of training costs;

Debit 70 Credit 73 – 1200 rub. – the monetary portion of training expenses is withheld from the salary;

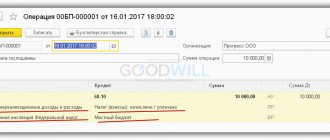

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1,560 rubles. (RUB 12,000 × 13%) – personal income tax is withheld from Dezhneva’s income;

Debit 26 Credit 69 subaccount “Settlements with the Pension Fund” – 3696 rubles. ((RUB 12,000 + RUB 4,800) × 22%) – pension contributions have been accrued (for the amount of the employee’s salary and the cost of training, paid for by the organization);

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 487.20 rubles. ((RUB 12,000 + RUB 4,800) × 2.9%) – social insurance contributions in the event of temporary disability and in connection with maternity are accrued in the Federal Social Insurance Fund of Russia (for the amount of the salary and the cost of training for the employee, paid at the expense of the organization);

Debit 26 Credit 69 subaccount “Settlements with FFOMS” – 856.80 rubles. ((RUB 12,000 + RUB 4,800) × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund (for the amount of the salary and the cost of training for the employee, paid for by the organization);

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 33.60 rubles. ((RUB 12,000 + RUB 4,800) × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated (for the amount of the salary and the cost of training for the employee, paid for by the organization).

In January:

Debit 91-2 Credit 76 – 4800 rub. (6,000 rubles – 1,200 rubles) – Dezhneva’s training expenses are written off.

The organization's expenses for Dezhneva's training do not affect the calculation of income tax. Therefore, accounting reflects a permanent tax liability:

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 960 rubles. (RUB 4,800 × 20%) – a permanent tax liability has been accrued on training expenses that do not reduce taxable profit.

Advice: it is possible to take into account the costs of training in the interests of the employee as expenses when calculating income tax, if they are classified as remuneration in kind.

Labor costs include any accruals to employees in cash and (or) in kind, provided for by Russian legislation, labor agreements (contracts) and (or) collective agreements. This is stated in Article 255 of the Tax Code of the Russian Federation.

In order to be able to attribute the cost of study in the interests of an employee to expenses under Article 255 of the Tax Code of the Russian Federation, it is clearly stated in the employment (collective) agreement that these payments are a form of remuneration in kind. In addition, it is necessary to take into account that the amount of payments in kind should not exceed 20 percent of the employee’s accrued monthly salary (Article 131 of the Labor Code of the Russian Federation).

Similar conclusions follow from paragraph 2 of the letter of the Ministry of Finance of Russia dated December 21, 2011 No. 03-03-06/1/835. Although this letter focuses on paying for the education of employees' children, the explanations provided in it can be applied to this situation.

It should be noted that if an organization qualifies study expenses in the interests of an employee as remuneration in kind, then personal income tax will have to be withheld from the specified amount (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation).

An employee’s studies in his interests are not related to the activities of the organization. Therefore, write off the VAT charged by commercial organizations providing training as expenses without reducing taxable profit (Clause 1, Article 170 of the Tax Code of the Russian Federation).

In accounting, make the following entry:

Debit 91-2 Credit 19

– VAT is written off at the expense of the organization’s own funds.

How are employee training expenses reimbursed?

Before sending an employee to study at the company’s expense, it is necessary to conclude an additional agreement with him (separate from the standard labor agreement), according to which the employee, having completed courses or an educational program, will have to work for some time in a company that compensated his training costs.

In such cases, a trained employee is immediately hired and does not need to undergo a probationary period. By paying for someone's training, the company hopes to get a trained and qualified specialist and make full use of his knowledge and skills. But the employee himself is not always interested in this. If he refuses to work for the company for a specified period, the employer has the right to demand that he reimburse training costs in proportion to the length of time that the employee had to work (this provision can be found in detail in Article 207 of the Labor Code of the Russian Federation). The procedure for making calculations is described in Art. 249 Labor Code of the Russian Federation.

Therefore, in the additional agreement containing all the conditions for paying the employee’s training costs, all the main points that may cause disputes between the employee and the employer must be clearly formulated:

- the duration of the period of compulsory service upon completion of training;

- educational institution where the employee will be trained;

- the amount of company expenses associated with his training;

- terms and procedure for reimbursement of funds spent in the event of an employee’s refusal to work or dismissal without good reason.

The legislation of the Russian Federation allows in such situations to recover only the cost of training from a failed employee. All associated expenses - travel expenses, expenses for study leave, etc. - which other employers also try to demand from the applicant, he is not obliged to pay.

When an employee has already left the organization, it is no longer useful to demand that he pay any money (including reimbursement of the company’s expenses for his education and training). This is obvious from a practical point of view and is reflected in the Labor Code, Art. 258. However, as long as the citizen continues to work in the organization, it is quite possible to recover a sum of money from him, provided that it falls within the amount of his monthly salary.

Before signing a collection order, the employer must obtain written consent from the employee to deduct from his salary when the final calculation of training expenses is made. This will give the accountant the right to deduct the required amount.

If the training costs of an employee who decides to suddenly quit without working work turn out to be more than his monthly earnings, then the required amount can only be recovered through the court (otherwise, the former student himself can sue and accuse the employer of violating the law). By agreement of the parties, large sums spent by the company on training an employee can be paid in installments. It is advisable that all such situations be taken into account in the training contract.

Read the material on the topic: Private accountant services

simplified tax system

The tax base of simplified organizations does not reduce the cost of training an employee in his interests.

For organizations that pay a single tax on income - because when calculating the tax, they do not take into account any expenses at all (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses - because when calculating the single tax, they can only take into account the costs of professional training and retraining of employees in the interests of the organization. Such organizations cannot take into account the cost of training an employee in his own interests. This follows from subparagraph 33 of paragraph 1 of Article 346.16, paragraph 3 of Article 264, paragraph 1 of Article 252 and paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation.

Advice: organizations that pay a single tax on the difference between income and expenses have the opportunity to take into account the costs of training an employee (in his interests) in expenses if they qualify them as remuneration in kind.

Simplified organizations that pay a single tax on the difference between income and expenses can include labor costs as part of their costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). At the same time, they take into account these expenses in the same manner as organizations on the general taxation system, that is, according to the rules of Article 255 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). According to this article, labor costs include any accruals to employees in cash and (or) in kind, provided for by the norms of Russian legislation, labor agreements (contracts) and (or) collective agreements.

In order to be able to include the cost of training in the interests of an employee as an expense when calculating the single tax, it is clearly stated in the employment (collective) agreement that these payments are a form of remuneration in kind. In addition, it is necessary to take into account that the amount of payments in kind should not exceed 20 percent of the employee’s accrued monthly salary (Article 131 of the Labor Code of the Russian Federation).

Similar conclusions follow from paragraph 2 of the letter of the Ministry of Finance of Russia dated December 21, 2011 No. 03-03-06/1/835. Despite the fact that this letter is dedicated to paying for the education of employees’ children and is addressed to income tax payers, the explanations given in it can also be applied to the situation under consideration.

It should be noted that if an organization qualifies the costs of training an employee in his interests as remuneration in kind, personal income tax will have to be withheld from the specified amount (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation).

What is included in employee training costs?

The most common expenses for training company employees are:

- Payment to employees for training in other professional skills.

- Learning foreign languages by employees.

- Reimbursement of training costs for employees in higher education institutions, including postgraduate and doctoral studies.

- Spending on periodic events to improve the skills of employees, which in some professions is a mandatory condition of work.

- Retraining of personnel, training of new employees within the organization or in special educational institutions.

In Art. 196 of the Labor Code of the Russian Federation states that the need for training - within the framework of both vocational education and additional education - is determined by the employer based on his business objectives and the specifics of the organization’s activities. The procedure and conditions for such training should be reflected in the collective agreement, employment contracts with employees and other agreements relating to the implementation of labor activities in the company.

However, when determining the necessary professions, specialties and methods of training personnel, the employer must not only rely on the needs of the business at the moment, but also take into account the opinion of the organization representing the interests of workers.

Federal laws and some other regulations oblige employers in a number of cases to provide training and provide the opportunity for employees to receive additional professional education (including compensating them for training costs), if without this training it is impossible for them to perform certain types of work activities.

In particular, Russian companies and individual entrepreneurs, whose activities include the operation of vehicles, must provide conditions for improving the qualifications of employees working on city or ground electric transport as drivers, or engaged in traffic regulation (Clause 1, Article 20 of the Federal Law “On Safety”) road traffic" No. 196-FZ dated December 10, 1995).

In addition to transport workers, medical workers have guarantees for training at the expense of the employer (vocational training, advanced training, retraining). This is reflected in Part 1 of Art. 72 of the Federal Law “On the Fundamentals of Protecting the Health of Citizens in the Russian Federation” No. 323-FZ of November 21, 2011. Training activities for doctors and medical staff must be provided by their medical institution, therefore for healthcare enterprises the costs of training employees are inevitable.

In addition to paying for professional training and education, the employer’s responsibilities include providing all other guarantees established by the Labor Code and internal regulations of the company, as well as creating conditions so that the employee can combine the performance of his work tasks with training.

The right of workers to receive additional professional education and training is also enshrined in Art. 197 Labor Code of the Russian Federation. To exercise this right, an employee can enter into an agreement with the employer, which will spell out all the conditions of training and the procedure for reimbursement of expenses.

Read the material on the topic: Payment for study leave

OSNO and UTII

Organizations that combine the general tax system and UTII must keep separate records of income and expenses received from various types of activities (clause 9 of Article 274 of the Tax Code of the Russian Federation).

However, the costs of training an employee in his interests cannot be taken into account when calculating income tax (subclause 23, clause 1, clause 3, article 264, clause 1, article 252 of the Tax Code of the Russian Federation). The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). The organization's expenses do not affect the calculation of the tax base.

Thus, for the purposes of calculating income tax and UTII, there is no need to distribute expenses associated with an employee’s studies in his interests between different types of activities.

On-site training

Now let's look at a situation where a company uses the services of a guest lecturer, so-called on-site training. Most likely, such a lecturer will not be a representative of an organization that has a license to provide educational services. This event usually takes place in the form of a lecture or seminar for employees, for example, in the accounting department. The costs of paying for the services of a lecturer should no longer be included in training costs, but taken into account as consulting fees on the basis of subclause 15 of clause 1 of Article 264 of the Tax Code of the Russian Federation. Then the package of supporting documents will be as follows: an agreement, a seminar plan, an act of services rendered for holding a lecture (letter of the Federal Tax Service of the Russian Federation for Moscow dated June 28, 2007 No. 20-12/060987). In addition, as some arbitrators note, this kind of expenses can be taken into account under subparagraph 14 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation - as expenses for information and consulting services, or on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation - as other expenses associated with production and implementation (Resolution 9 AAS dated February 2, 2011 No. 09AP-32031/2010-AK).