What is 81 accounts for?

81 accounts are used to summarize information about the availability and movement of the company’s own shares. Shares are purchased from shareholders, after which further transactions are carried out with them. Actions with shares will depend primarily on the decision of the owner, that is, the buyer. When repurchasing shares, an entry is made in the accounting debit of account 81 for the amount of money actually spent. When canceling securities, correspondence is carried out with the authorized capital. The difference that appears from 81 accounts is allocated to 91 accounts

Important! In agricultural structures, repurchase can be carried out for the amount of actual costs, both on the debit and credit of the accounts used when accounting for money.

Reflection of the sale of shares in accounting

Share repurchase activities take place at the request of shareholders. Shares subject to redemption become the property of the organization, after which they are resold, canceled or distributed among other shareholders. The features of using account 81 include the following:

- In practice, the account can be used not only by joint-stock companies, but also by limited liability companies (when purchasing shares in the authorized capital).

- Information on this account is reflected in the liability side of the balance sheet using parentheses (section 3, line 1320).

Important! The procedure for the repurchase and further sale of shares is established by the norms of the current legislation. It is common to all participants in this process and requires compliance with certain nuances.

Regulatory regulation

The legislative side is responsible for regulating aspects related to the disposal of shares. It includes representatives of government apparatuses at the federal and regional levels. For regulation, various orders, regulations, acts, standards, as well as local documentation developed by the management of joint-stock companies and other organizations dealing with shares are used.

Thus, account 81 is important and is involved in a large number of business transactions. In order to correctly compile records and operations on it, a detailed familiarization with the main nuances is required.

Which accounts does 81 accounts correspond to?

Important! When a company buys back shares owned by a shareholder from a shareholder, an entry is made in the debit of account 81 for the amount of expenses incurred. When canceling its own shares purchased by the company, accounting is carried out in the credit of account 81 and the debit of account 80 after the company has completed all the prescribed procedures. If there is a difference in 81 accounts between the costs incurred for the purchase of a share or share and their nominal value, it is allocated to 91 accounts.

81 accounts correspond with the following accounts:

| By debit | By loan |

| Account 50 "Cashier" Account 51 “Current accounts” Account 52 “Currency accounts” Account 55 “Special accounts” Account 91 “Other income and expenses” | Account 73 “Settlements with personnel for other operations” Account 80 “Authorized capital” Account 91 “Other income and expenses” |

Acceptance of shares for registration

Selena PJSC bought back 10 shares from shareholders at 950 rubles per share. The par value of the share is 1000 rubles.

| Dt | CT | Description of operations | Sum | Document |

| 81 | 75 | Capitalized property stock | 9500 | Accounting information |

| 75 | 51 | Paid for the purchase of shares | 9500 | Payment order ref. |

If payment for shares occurs within a month or quarter after submitting the application, you can get by with one transaction:

| Dt | CT | Operation description | Sum | Document |

| 81 | 51 | Share repurchase reflected | 9500 | Payment order ref. |

If the participant is an individual, personal income tax must be calculated:

| Dt | CT | Description of operations | Sum | Document |

| 75 | 68 | The amount of personal income tax has been accrued (9500*13%) | 1235 | Accounting information |

In this case, the transfer amount will look like this:

| Dt | CT | Operation description | Sum | Document |

| 75 | 51 | Transfer for shares (9500 - 1235) | 8265 | Payment order ref. |

| 68 | 51 | Transfer of personal income tax | 1235 | Payment order ref. |

An organization may have several reasons for repurchasing its own shares:

- calculation to provide more favorable conditions on the market;

- desire to increase earnings per share;

- preventing a hostile takeover attempt;

- obtaining at your own disposal additional shares for your own activities, etc.

The purchase of own shares is not considered an acquisition of an asset. In effect, this transaction reduces assets.

Purchased shares are not included in the calculation of book value because they are not outstanding.

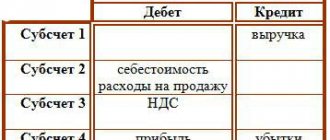

Sale of shares

After repurchasing the shares, the board of directors of Selena PJSC decided to sell 8 shares at 1,100 rubles per share.

| Dt | CT | Operation description | Sum | Document |

| 62(76) | 91.1 | Reflection of the sale price of shares (1100*8) | 8800 | Act, accounting certificate |

| 91.2 | 81 | Write-off of the book value of shares (950*8) | 7600 | Buh. reference |

| 51 | 62(76) | The receipt of DS from the sale of shares is reflected | 8800 | Bank statement |

| 91.9 | 99 | Financial result reflected (8800 - 7600) | 1200 | Buh. reference |

In the case of the sale (transfer) of shares to another participant within the organization, these transactions will only affect the analytics of account 81, but not the overall result.

Postings to account 81: resale of shares

In the case of repurchase and resale of securities, the following entries are applied:

- When repurchasing shares and accepting them for accounting, the same as in the previous scenario: Dt 81 Kt 51 (actual cost at the time of purchase).

- Shares sold: Dt 51 Kt 91 (actual value at the time of the transaction).

- When reflecting the financial result from the sale of shares, in the general case - profit: Dt 91 Kt 99.

In case of loss - Dt 99 Kt 91.

The wiring diagram we have considered is quite general. In practice, accounting for transactions on account 81 can have a huge number of nuances that require the inclusion of various additional entries in accounting.

For example, in the case when when repurchasing shares, not only their market and nominal prices are taken into account, but also the cost of the initial placement of securities on the stock exchange - IPO.

An initial public offering or IPO is the “first minute” of free circulation of securities issued by a business entity on the stock exchange. The price of shares at the IPO is close to the nominal value and, as a rule, slightly more than it (the difference is usually within 10%).

Reduction of the authorized capital due to repurchased shares

PJSC "Berezovaya Roshcha" bought back 500 shares at a price of 20 rubles per share, the cost of shares at par is 25 rubles.

Since the shares were sold to a third party, the board of founders decided to reduce the authorized capital by this amount.

| Dt | CT | Description of operations | Sum | Document |

| 80 | 81 | Reduction of authorized capital (500*25) | 12500 | Accounting information |

| 81 | 91.1 | Reflection of the difference between the purchase price and the denomination (25*500 - 20*500) | 2500 | Accounting information |

The amount in excess of the nominal value over the purchase price (2,500 rubles) is reflected in the income account and is taken into account as part of non-operating income when calculating income tax.

Line 1150 of the balance sheet: explanation

→ → Current as of: December 11, 2021

We talked about the composition, as well as requirements for it, in our consultations. You can read more about the content and structure of the balance sheet. How is line 1150 of the balance sheet filled out? In the balance sheet form approved, line 1150 is called “Fixed Assets”.

As the name suggests, line 1150 as of the reporting date reflects the amount of the organization’s fixed assets.

But here it is necessary to take into account several features.

Firstly, line 1150 does not take into account all fixed assets, but only those reflected in account 01 “Fixed assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Let us recall that fixed assets that are intended exclusively for provision by an organization for a fee for temporary possession or use for the purpose of generating income are accounted for in account 03 “Income-generating investments in tangible assets” (,).

And they are reflected in the balance sheet on line 1160 “Profitable investments in material assets” (). Secondly, fixed assets on the balance sheet, like all other indicators, are reflected in the net valuation ().

In relation to fixed assets, this means that they are shown on line 1150. As for accounting accounts, to fill out line 1150 you need to subtract from the debit balance of account 01 the credit balance of account 02 “Depreciation of fixed assets” for the same reporting date. Naturally, depreciation needs to be deducted only that which relates to fixed assets recorded in account 01.

After all, for profitable investments in material assets accounted for on account 03, depreciation is also accrued on account 02. And since the debit balance of account 03 is not included in line 1150, then the depreciation related to them should also be excluded from the balance of account 02.

We talked about decoding all the lines of the balance sheet in this.

Current as of: October 20, 2021

We considered the accounting of equity capital in our consultation and noted that the accounting of the organization’s authorized capital is kept in passive account 80 “Authorized capital”.

But sometimes a situation is possible when an organization buys back its own shares or a share in its authorized capital owned by another person. How can an organization take into account the acquired part of its own authorized capital? The chart of accounts and the Instructions for its application are intended for these purposes to include active account 81 “Own shares (shares)” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Typical transactions for account 81

| Debit | Credit | Contents of a business transaction |

| On the debit of account 81 | ||

| 81 | 50,51,52,55 | Payment for own shares purchased from shareholders |

| 81 | 91.1 | Income from the sale of shares |

| On account credit 81 | ||

| 73 | 81 | The organization's own shares were purchased by its employees |

| 80 | 81 | Own shares purchased from shareholders were canceled |

| 91.2 | 81 | Expense from sale of shares |

Example No. 1. Repurchase of shares and their further sale

Let’s say, at the request of a shareholder who is an employee of the organization, a PJSC buys back 1,500 shares with a par value of 1 ruble and a redemption price of 2,300 rubles. Next, the PJSC sells shares to individuals at a price of 2,400 rubles. The register of shareholders is maintained by the depository.

Postings to 81 accounts made in the organization:

| Dt | CT | Amount (rub.) | Contents of a business transaction | Document |

| 81 | 73* | 3 450 000 | Share repurchase. At the depository, shares are debited from the shareholder's account and credited to the organization's account at par | Extract from the register of shareholders |

| 73 | 51 | 3 450 000 | Payment for shares | Bank statement |

| Further sale of shares | ||||

| 51 | 75 | 3 600 000 | Receipt of money for sold shares. At the depository, shares are debited from the organization’s account and credited to the account of the individual shareholder at par | Bank statement |

| 75 | 81 | 3 450 000 | Shares are written off from accounting | Extract from the register of shareholders |

| 75 | 91 | 150 000 | Income from the sale of shares | Accounting certificate-calculation |

Example 2. Redemption of a share using the organization’s property

Let’s say that an LLC participant, an individual, wrote a letter of resignation from the company in April 2021. The share was acquired in February 2011. By mutual agreement, the purchase of the share is carried out by transferring the office space of the administrative building with an area of 19 sq.m. Organization on the simplified tax system with taxation “income minus expenses”.

Table of indicators for reflecting business transactions on accounting accounts:

| № | Indicators | Amount (rub.) |

| 1. | Nominal value of participant's share | 5 000 |

| 2. | The actual value of the participant's share, calculated from the value of the organization's net assets for the last reporting period preceding the day of filing the application to leave the company | 800 000 |

| 3. | Market price of office space according to an independent appraiser | 830 000 |

| 4. | Book value of an administrative building with an area of 2000 m2 | 86 000 000 |

| 5. | Accrued depreciation for the administrative building | 9 684 211 |

| 6. | Book value of office premises, (RUB 86,000,000/2000m2*19m2) | 817 000 |

| 7. | Accrued depreciation for office premises (9684211/2000*19) | 92 000 |

Postings made in an organization where account 01/в is disposal of fixed assets:

| Dt | CT | Amount (rub.) | Contents of a business transaction | Document |

| 81 | 75 | 800 000 | LLC debt | Participant's statement |

| 75 | 91 | 800 000 | Debt written off | Certificate of acceptance and transfer of an OS object |

| 01/v | 01 | 817 000 | The book value of the office space was written off | Certificate of acceptance and transfer of an OS object |

| 02 | 01/v | 92 000 | Depreciation of office premises written off | Certificate of acceptance and transfer of an OS object |

| 91 | 01/v | 725 000 | The residual value of the office premises has been written off | Certificate of acceptance and transfer of fixed assets, certificate of calculation: 817 000-92 000=725 000 |

| Personal income tax | ||||

| An individual, in our case, does not pay personal income tax. Since on January 1, 2011, a norm was introduced (clause 17.2 of Article 217 of the Tax Code of the Russian Federation), according to which income received from the sale of a share is exempt from taxes if, on the date of the transaction, the rights to them belonged to the owner continuously for more than 5 years. This rule also applies to shares in the management company acquired from January 1, 2011. | ||||

| If the share had been acquired earlier than 2011, then the tax base for personal income tax would have been 825,000 rubles in our example. (830,000-5,000) | ||||

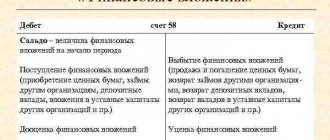

Accounting on account 81

As stated in the Instructions for using the Chart of Accounts, account 81 is used to account for the presence and movement of its own shares, which the JSC purchased from its shareholders for subsequent resale or cancellation. LLCs, for example, use this account to account for the share of a participant that was acquired by such LLC for transfer to other participants or third parties (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

The repurchase of shares (shares) is reflected in the debit of account 81 and the credit of cash accounting accounts for the actual cost of acquisition as follows:

Debit account 81 – Credit accounts 50, 51, 52

If the JSC subsequently cancels the purchased own shares, and, accordingly, the authorized capital is re-registered in a new amount, the decrease in capital as a result of the cancellation of shares will be reflected in the accounting as follows:

Debit account 80 – Credit account 81

It must be taken into account that the specified entry is made for the nominal value of the shares. At the same time, it is quite possible that the cost of purchasing shares does not correspond to their nominal value. For example, the par value of a share is 1,000 rubles, and the redemption price is 1,500 rubles. The resulting difference between the nominal value and the acquisition cost in the amount of 500 rubles (1,500 - 1,000) is included in the financial results of the organization as other expenses. The above means that the entries for the redemption and cancellation of shares will be as follows (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit account 81 – Credit accounts 50, 51, 52 – 1,500

Debit account 80 – Credit account 81 – 1,000

Debit of account 91 “Other income and expenses” - Credit of account 81 - 500

If, instead of canceling shares (shares), the organization resells these shares or shares, the transactions will also be reflected through account 91:

Debit accounts 51, 52, etc. – Credit account 91

Debit account 91 – Credit account 81

Account correspondence

In the course of a company’s activities, situations may arise in which companies buy back their own shares or shares in the authorized capital. This raises the question of how to account for the acquired part of the equity capital.

In accordance with the chart of accounts, as well as instructions for using accounts, account 81 is used. It is used to account for the availability and movement of company securities purchased by the company from shareholders. The LLC uses this account to account for the share of a participant purchased by him for the purpose of transfer to third parties. This norm is provided for by Order of the Ministry of Finance 94n. Accordingly, in practice it is possible to carry out several business transactions and document this with the appropriate entries.

| Business transaction | D | TO |

| Share repurchase | 81 | 50 (51,52) |

| Reduction of authorized capital | 80 | 81 |

| Income received from the sale of shares purchased from a shareholder | 91 | 81 |