| A busy schedule prevents you from attending professional development events? We found a way out! |

Consultation provided on June 10, 2015.

A contract was concluded with the organization (contractor) in September 2014 to carry out work on the development of working documentation and construction and installation work on the territory of a residential building. Work on the development of working documentation was completed in October 2014. From November 2014 to the present day, no work has been carried out under this agreement.

Also in October 2014, an agreement on the assignment of the right of claim was concluded, according to which a third organization transfers to the organization (contractor) a two-room apartment located in the building of the above-mentioned residential building (it is understood that in payment for the upcoming work under the above-mentioned contract). The amount specified in the agreement for the assignment of the right of claim does not contain VAT. The apartment will be sold later. It follows from the agreement that the organization will be obliged to pay in cash within the period specified in the agreement. The assignment agreement was registered in October 2014, the state duty for state registration of rights, restrictions (encumbrances) of rights to real estate and transactions with it was paid from the current account.

How should an organization reflect the received right of claim to an apartment in its accounting? How should an organization reflect in its tax records the acquired right of claim to an apartment (also provided that VAT will be charged by the seller of the property right)?

Having considered the issue, we came to the following conclusion:

In accounting, the value of acquired property rights to an apartment should be reflected in account 76 “Settlements with various debtors and creditors” and then included in the cost of the purchased apartment.

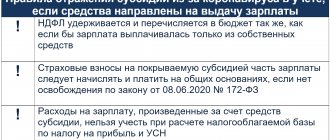

In tax accounting, the organization has the right to take into account the costs of acquiring property rights when calculating income tax either after the sale of the acquired apartment, or in the period when they were actually incurred, depending on what type of expenses (direct or indirect) are included in the accounting records. policy for tax purposes, the organization has acquired property rights.

If the amount of VAT is presented upon assignment of property rights, then this amount is not accepted for deduction, since in the future the acquired apartment will not be used in activities subject to VAT. VAT not accepted for deduction is taken into account in the value of acquired property rights in both accounting and tax accounting.

Rationale for the conclusion:

Real estate accounting

Real estate accounting is carried out in accordance with these acts:

- Accounting regulations established by Order of the Ministry of Finance No. 26 n dated March 30, 2001.

- Guidelines for accounting for OS No. 91.

the write-off of buildings and other real estate in accounting ?

Accounting should not contradict general rules. There are conditions for real estate to be included in the list of fixed assets (hereinafter referred to as fixed assets):

- Real estate is necessary for conducting the main activities of the company (sale of products, provision of services).

- The facility will be in operation for longer than a year.

- The company does not plan to resell.

- The facility is expected to provide financial benefits. In this case, its acquisition will be considered justified.

The list of these conditions is given in paragraph 4 of PBU 6/01. These rules apply to all fixed assets to which real estate belongs. Accounting is carried out based on the cost of the object. This cost is formed based on the company’s actual expenses for purchase, assembly, and production. All taxes and government fees are deducted from this amount. However, registration fees may be included as expenses because they are associated with the purchase. That is, expenses for state registration of real estate will be written off as current expenses. Write-offs are carried out in accordance with general accounting rules.

Question: In 2021, an organization acquired and registered a property that is used in transactions subject to and exempt from VAT. VAT was accepted for deduction in 2021. In what order should VAT be restored for periods of use of the property in VAT-free transactions in 2019? View answer

Purchasing objects taking into account the new rules is not considered a capital investment.

They are recognized as OS objects on the date of appearance of documents confirming their readiness for operation.

These may be documents such as a transfer and acceptance certificate, permission to put the facility into operation. Depreciation will be calculated on a general basis from the first day of the month following the month in which the property was accepted for accounting. In 2011, the procedure for accounting for objects was changed. In particular, new regulations abolished these conditions:

- Documents on registration of the object are optional.

- Actual operation is not necessary.

- Depreciation is not charged if the property remains on account 08.

How to reflect in accounting transactions for the acquisition of real estate (industrial building) ?

Since 2011, property has been accepted for accounting as fixed assets if it meets these requirements:

- Compliance with the provisions of paragraph 4.5 of PBU 6/01.

- Capital investments are completed.

- There are documents confirming readiness for use.

Registration for inclusion of property in the OS is optional. Depreciation of property will depend on when it is recorded. The month of acceptance for accounting is the month in which investments were completed and the object began to meet the characteristics specified in paragraph 4 of PBU 6/01. For depreciation, it is not necessary to transfer papers for registration. The object can be accepted into the OS on the date of signing the transfer and acceptance certificate.

Assignment of claims under a contract

The assignment by a participant in shared construction of the rights of claims under the contract is allowed only after he has paid the contract price or simultaneously with the transfer of the debt to a new participant in shared construction in the manner established by the Civil Code of the Russian Federation (Part 1 of Article 11 of Law No. 214-FZ).

According to Part 2 of Art. 11 of Law N 214-FZ, assignment by a participant in shared construction of rights of claim under an agreement is allowed from the moment of state registration of the agreement until the parties sign a transfer deed or other document on the transfer of the shared construction object.

In this case, the right (claim) to the developer belonging to the participant in shared construction (the original creditor) is transferred by him to the organization (new creditor) under the transaction, that is, on the basis of clause 1 of Art. 382, paragraph 1, art. 388 of the Civil Code of the Russian Federation there is an assignment of property rights (claims) under an agreement for participation in shared construction.

The assignment of a right (claim) arising from an agreement on shared participation in construction, as well as the agreement itself, are drawn up in appropriate written form and are subject to state registration (clause 2 of article 389 of the Civil Code of the Russian Federation, part 3 of article 4, article 17 of Law No. 214 -FZ, Article 25.1 of the Federal Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it”).

In accordance with paragraph five, paragraph. 30 clause 1 art. 333.33 of the Tax Code of the Russian Federation (as amended in 2014), for state registration of the assignment of rights of claim under an agreement for participation in shared construction, the state fee was paid in the amount of 200 rubles from 01/01/2015. (from 01/01/2015 this amount is 350 rubles - a change was made to this norm by Federal Law dated 07/21/2014 N 221-FZ).

If, during the registration of each of the agreements for the assignment of the right of claim, both parties to the transaction simultaneously apply for the commission of a legally significant action, not having the right to the benefits established by Chapter. 25.3 of the Tax Code of the Russian Federation, then the state duty is paid by the parties to the transaction in equal shares (clause 1, clause 1, article 333.17, paragraph two, clause 2, article 333.18 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 20, 2010 N 03-05-04-03 /98, dated 04/01/2009 N 03-05-05-03/03, dated 12/09/2008 N 03-05-05-03/54).

Acceptance of real estate for registration

The initial cost of the object will include these components:

- If the object is purchased: the cost of the property set by the supplier, as well as the costs of bringing the objects into a condition suitable for use.

- If the company is building real estate: funds paid to the contractor.

Other costs may be included in the expenses associated with the activities of the company. These expenses must be taken into account in the period in which they arose. Let's look at the transactions that are relevant when accepting a property:

- DT08 KT60. Accounting for expenses for the acquisition or construction of objects. It is assumed that these costs are included in the original cost.

- DT01 KT08. Acceptance of objects for accounting.

Postings are made on the basis of documents. For example, this is an act of acceptance and transfer of real estate.

Income tax

The object of taxation for income tax for Russian organizations that are not members of a consolidated group of taxpayers is profit, defined as the difference between the income received and the amount of expenses incurred, which are determined in accordance with Chapter 25 of the Tax Code of the Russian Federation (Article 247 of the Tax Code of the Russian Federation).

The acquisition of a right (claim) arising from an agreement for participation in shared construction is regarded in tax accounting as the acquisition of a property right.

According to paragraph 1 of Art. 268 of the Tax Code of the Russian Federation, the value of property rights is taken into account by the taxpayer when implementing the specified property rights.

However, the repayment of the right of claim as a result of receiving an apartment from the developer is not considered as a sale.

At the same time, we believe that accounting for expenses in the form of the acquisition of property rights is possible taking into account the general norms of Chapter 25 of the Tax Code of the Russian Federation.

As a general rule, in accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the income received by the amount of expenses incurred by him.

In this case, expenses that reduce the base for calculating income tax are recognized as justified and documented expenses incurred by the taxpayer. Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

According to paragraph 2 of Art. 252 of the Tax Code of the Russian Federation, expenses, depending on their nature, as well as the conditions for implementation and areas of activity of the taxpayer, are divided into expenses that are associated with production and sales, and non-operating expenses.

In turn, costs associated with production and sales are divided into direct and indirect costs (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Direct costs may include, in particular:

— material costs determined in accordance with paragraphs. 1 and paragraphs. 4 paragraphs 1 art. 254 Tax Code of the Russian Federation;

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as the amount of the unified social tax and expenses for compulsory pension insurance, used to finance the insurance and funded part of the labor pension, accrued on the specified amounts of labor expenses ;

— the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Art. 265 of the Tax Code of the Russian Federation, carried out by the taxpayer during the reporting (tax) period.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by the Tax Code of the Russian Federation. Non-operating expenses are included in the expenses of the current period in a similar manner.

Direct expenses refer to the expenses of the current reporting (tax) period as products, works, and services are sold, the cost of which they are taken into account in accordance with Art. 319 of the Tax Code of the Russian Federation (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Note! The list of expenses that, in accordance with Art. 318 of the Tax Code of the Russian Federation can be classified as direct expenses; it is advisory in nature.

When classifying costs as direct or indirect, it should be taken into account that, first of all, the tax accounting of any organization must be reliable (Article 313 of the Tax Code of the Russian Federation).

Accordingly, attributing to indirect expenses costs associated only with the production and sale of products can be regarded by the tax inspector as an action aimed at reducing tax liabilities in the reporting (tax) period.

If in the accounting policy of your organization the costs of acquiring property rights are included in indirect costs, then you can take into account the costs of their acquisition in the period when such costs were actually incurred. If in the accounting policy the costs of acquiring property rights are classified as direct, then you can take them into account only after the sale (sale) of the apartment.

Accounting for property reconstruction under the simplified tax system

Real estate reconstruction is an improvement of the property. Reconstruction costs are included as expenses. They are recognized as expenses from the date of operation of the facility. Expenses should be written off evenly until the end of the reporting period. Only those expenses that were actually paid are taken into account.

Formation of initial cost under OSNO

If the company uses OSNO, the initial cost includes these costs:

- The cost of constructed or acquired property.

- Interest on a loan taken for purchase or construction.

- Expenses to improve an object so that it becomes suitable for use.

- Other expenses associated with the acquisition (for example, commissions).

If a company uses OSNO, it is also not necessary to send documents for state registration for accounting and depreciation.

Features of accounting for objects from the seller

If the property has been sold, its value is written off. Sales revenue is recognized in these cases:

- The company has ownership of the object, confirmed by documents.

- The amount of proceeds from the sale is known.

- There are indications that the firm will benefit economically from the sale.

- The buyer received ownership of the object.

- The costs of the operation can be clearly established.

Income and expenses from write-offs will be credited to profit and loss.

Accounting entries

The selling company makes the following transactions:

- DT02 KT01. Write-off of depreciation accrued on an object.

- DT45 KT01. Write-off of residual value.

- DT62 KT91.1. Proceeds from sale.

- DT91.2 KT68. VAT accrual.

- DT91.2 KT45. Write-off of residual value.

- DT91.9. KT99. Fixation of profit.

Tax documentation must reflect sales income, expenses, and profit from the sale.

Computer for sale at market value with VAT debit credit account

– News – Computer for sale at market value with VAT debit credit account

Its initial cost was RUB 430,000.00. Service Center LLC bought a loader for RUB 141,600.00. The acceptance certificate was signed on December 1, 2021, payment was received on December 10, 2021.

During the sales preparation, spare parts were removed from the loader, which can be used to repair other equipment. Their market price was determined to be 12,000.00 rubles. The sale of a fixed asset should be reflected by the following postings: September 10, 2016.

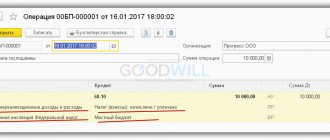

Debit 01 “Disposal of fixed assets” - Credit 01 – 430,000 rubles. – the initial cost of the loader was written off Debit 02 – Credit 01 “Disposal of fixed assets” – RUB 430,000. – the accrued depreciation of the loader was written off on December 1, 2021.

Debit 62 - Credit 91-1 “Other income” - 141,600 rubles. – revenue from the sale of the loader is reflected Debit 91-2 - Credit 68 “VAT calculations” - 21,600 rubles.

The amount of VAT on such an intangible asset paid by the transferring party is not claimed for tax deduction by the receiving party. It increases its actual cost. The transferring party draws up a single copy of the invoice.

Reflect the receipt of an intangible asset with the following entries: DEBIT 08-5 CREDIT 98-2 – the intangible asset was received free of charge; DEBIT 19 CREDIT 98-2 – VAT on an intangible asset is taken into account (if there is an invoice from the transferring party); DEBIT 08-5 CREDIT 19 – VAT is taken into account in the cost of the intangible asset; DEBIT 04 CREDIT 08-5 – intangible asset accepted for accounting. Let's look at an example. Example On December 25 of the reporting year, Aktiv JSC received free of charge from the non-profit organization Agroservice the exclusive right to a selection achievement. The market value of the selection achievement is 236,000 rubles.

Typical accounting entries for VAT: tax accounting

Tax Code of the Russian Federation). In 2012, Alpha acquired production equipment. This equipment was used in the main activity of the organization - the sale of folk arts and crafts of recognized artistic merit. Therefore, the input VAT paid to the supplier was included in the original cost of the equipment.

Features of accounting for fixed assets in connection with the transition to a new chart of accounts

Debit 91-2 Credit 68 subaccount “Calculations for VAT” – 2136 rubles. – VAT payable to the budget has been accrued; Debit 51 Credit 76–190,000 rub. – money received from the buyer.

Situation: is it necessary to pay VAT on the sale of property that is recorded at cost including input tax, if the purchase price of the property exceeds the sales price? Answer: no, it is not necessary.

If the purchase price of the property exceeds its sale price, the tax base calculated in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation is taken equal to zero.

Important

This conclusion follows from the letter of the Ministry of Taxes and Taxes of Russia dated May 13, 2004 No. 03-1-08/1191/15. Therefore, there is no need to pay VAT on the sale of such property (accounted for at cost including input tax). This conclusion is also confirmed by arbitration practice (see, for example, the resolution of the FAS Moscow District dated November 9, 2005 No.

No. KA-A40/10790-05).

Accounting entries upon receipt of fixed assets

An example of determining the tax base for VAT when selling property that was recorded at cost, taking into account input tax. In February 2014, Alfa CJSC purchased equipment for the production of prosthetic and orthopedic products for 236,000 rubles. (including VAT – 36,000 rubles).

The equipment was put into operation in the same month. When selling prosthetic and orthopedic products, the organization took advantage of the exemption from VAT provided for in Article 149 of the Tax Code of the Russian Federation.

Therefore, the VAT paid to the supplier was taken into account in the original cost of the equipment. In both accounting and tax accounting, the useful life of the equipment was set at five years, and depreciation was calculated using the straight-line method. No revaluation of equipment was carried out.

In February 2015, it was decided to sell the equipment.

Attention

By this time, the amount of accrued depreciation on equipment in both accounting and tax accounting amounted to 40,000 rubles. Based on the results of the revaluation, the equipment was valued by an independent appraiser at RUB 220,000. (excluding depreciation). To adjust the depreciation accrued in accounting, the Alpha accountant calculated the revaluation coefficient: 220,000 rubles.

: 200,000 rub. = 1.1. The amount of depreciation (according to accounting data) of revalued equipment was: RUB 40,000. × 1.1 = 44,000 rub. In the working Chart of Accounts "Alpha" (approved as an appendix to the accounting policy) to account 83 "Additional capital" for the results of revaluation accounting, a subaccount "Revaluation of fixed assets" is provided. The Alpha accountant made the following entries in accounting: Debit 01 Credit 83 subaccount “Revaluation of fixed assets” - 20,000 rubles. (RUB 220,000

Sale of fixed assets. accounting and tax accounting

Tax Code of the Russian Federation); - company cars and minibuses purchased before January 1, 2001 (such vehicles were taken into account when purchasing including input tax); — other property accounted for with input VAT. Calculate VAT on the sale of such property as follows.

If the property being sold is subject to VAT at a rate of 18 percent, use the formula: VAT = Sales price – Purchase (residual) value of the property × 18/118 If the property being sold is subject to VAT at a rate of 10 percent, use the formula: VAT = Sales price – Purchase (residual) value cost of property × 10/110 This procedure is established by paragraph 3 of Article 154 and paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

How to reflect the sale of a fixed asset in accounting based on

According to the expert assessment of the appraisal organization, the market value of the equipment, taking into account its condition, amounted to 200,600 rubles. The equipment was sold for this price (including VAT). The residual value of the equipment at the time of sale was RUB 188,800.

When selling equipment, the accountant charged VAT in the amount of: (200,600 rubles – 188,800 rubles) × 18/118 = 1,800 rubles.

If property was acquired from an organization that is not a VAT payer, the provisions of paragraph 3 of Article 154 of the Tax Code of the Russian Federation are not applied when determining the tax base.

That is, if the seller of the property was an organization that applies a special tax regime or uses an exemption from VAT under Article 145 of the Tax Code of the Russian Federation, when reselling this property, VAT must be charged on the entire cost (clause

1 tbsp. 154 of the Tax Code of the Russian Federation). This is explained by the fact that VAT was not included in the cost of the acquired property. Tax Code of the Russian Federation, subject to the following conditions:

- the sale of fixed assets was made to a related party;

- less than five years have passed from the date of putting the OS object into operation until the date of implementation;

- Previously, depreciation bonus was included in expenses in tax accounting

In addition, the restored depreciation bonus increases the residual value of the sold fixed asset (subclause 1, clause 1, article 268 of the Tax Code of the Russian Federation). 6. Accounting for loss from the sale of a fixed asset If the amount of expenses exceeds the amount of proceeds from the sale of depreciable property, then a loss arises. Such a loss is taken into account differently in tax and accounting.

- In accounting, the entire amount of loss from the sale of fixed assets is reflected as an expense at a time. According to clause

Source: https://11-2.ru/prodaetsya-kompyuter-po-rynochnoj-stoimosti-s-nds-debet-kredit-scheta/

Accounting for the purchase of objects

The company that purchased the property takes it into account regardless of whether the property is registered. Real estate is included in fixed assets, and therefore is included in a special depreciation group. From the first day of the month following the month of acquisition, depreciation begins to accrue. For tax accounting of objects, these conditions must be met:

- Papers have been sent for registration.

- The property has been put into operation.

As a rule, enterprises use the straight-line method of calculating depreciation. The rate is based on the useful life period. The time during which the property was used by the previous owner is deducted from this period. The useful life period can be determined by these methods:

- Based on total useful life.

- Remaining term.

If the second method is used, the company must have a document confirming the period of operation of the object by the previous owner. In the first option, the company sets the deadline independently. When purchasing real estate, the buyer must make these entries:

- DT08 KT60. Receipt of object.

- DT01 KT08. Acceptance of real estate for accounting as fixed assets.

- DT19 KT60. Allocation of VAT amount.

- DT68 KT19. Acceptance of VAT deduction.

Opposite each posting should be the date on which the accounting was completed.

conclusions

Real estate owned by the company is depreciable property, so the company must calculate deductions monthly.

For accounting and tax accounting, it is convenient to use the linear calculation method, in which the cost of the premises is written off evenly over the entire period established for it.

Discrepancies for taxation and accounting will be minimal if you establish the same SPI, based on the depreciation group from the OS Classification, as well as the same method of depreciation.