Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Trade tax (TC) is a local tax established for organizations and individual entrepreneurs that trade using movable and immovable property. To pay it, you need to fill out a payment order, the important details of which are KBK. In this article we will tell you who pays the trading fee, in what time frame and which BCCs to use when paying the trading fee in 2021.

When to pay in 2021: deadlines

The trading fee must be determined and paid every quarter. There are no reporting periods for the trade fee, just as there are no reporting forms (Article 414 of the Tax Code of the Russian Federation). Pay the calculated amount of the trading fee to the budget no later than the 25th day of the month following the taxable period (quarter). In 2021 these are the following dates:

| Trade tax payment deadlines in 2021 | |

| For the fourth quarter of 2021 | No later than 01/25/2021 |

| For the first quarter of 2021 | No later than 04/26/2021 |

| For the second quarter of 2021 | No later than 07/26/2021 |

| For the third quarter of 2021 | No later than October 25, 2021 |

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2021 exempted those affected by coronavirus from paying the trade tax for the 2nd quarter of 2021. Read more about this in the article “To whom and what taxes will be written off: list.”

This might also be useful:

- Changes in the field of insurance premiums in 2021

- Deadline for submitting 2-NDFL in 2021 for 2021

- Fixed payments for individual entrepreneurs in 2021 for themselves

- Tax calendar for 2021

- How much taxes does an individual entrepreneur pay in 2021?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payment order in 2021: KBK

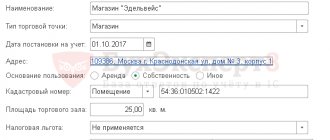

Transfer the amount of the trade tax in 2021 according to the details of the tax inspectorates in which the organization is registered as a payer of the trade tax (clause 7 of Article 416 of the Tax Code of the Russian Federation).

Make a payment for the payment of the trade tax in 2021 in accordance with the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P and appendices 1 and to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

If you pay a trade fee for a property, then in the payment slip indicate the details of the Federal Tax Service at the place of registration as a payer of the trade fee, and the OKTMO code - at the place of trading activity. If you pay the fee at the location of the organization (residence of the individual entrepreneur), then indicate the details of the tax office with which you are registered as a payer of the trade fee. And the code according to OKTMO is at the place of trading activity, which is indicated in the notice of registration as a payer of the trade tax.

In field 104 of the payment, indicate the KBK, which in 2021 is valid for the purpose of paying the trade fee. You may also be required to pay penalties and interest associated with the payment of the trade fee. Special budget classification codes have been approved for them. At the same time, we note that compared to 2021, the BCC for 2021 has not changed and no new codes have been approved. Here is a table with current codes for paying the trade tax in 2021.

| Purpose | Trade fee amount | Penalty | Fine |

| Trade tax paid in the territories of federal cities (Moscow) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Read also

23.04.2020

How to calculate trading fee

To pay the vehicle, you need to calculate its amount for the quarter yourself. Fee rates are established by district and territory; for Moscow, the rates are contained in Article 2 of Law No. 62. The amount of the fee depends on the number of retail facilities and their area. This is a physical indicator.

Vehicle amount = Rate (Article 2 of Moscow Law No. 62) × FP

Income from trading does not affect the amount of the fee. Let us note once again: even if you traded at the facility at least one day per quarter, you will have to pay the fee in full. Therefore, it is not at all profitable to start an activity at the end of the tax quarter, as well as to finish it at the beginning.

Calculation example. IP Demidov sells farm products in Moscow. It has a shopping pavilion with an area of 60 sq.m. in the Tverskoy district, two kiosks in Cheryomushki and one van.

The vehicle rate in the Tver region for an object over 50 sq.m. is 1080 rubles for each sq.m. within 50 sq.m. and 60 rubles for each full and incomplete sq.m. over 50 sq.m. In Cheryomushki, the cost of one kiosk will be 40.5 thousand rubles. The fee for the van is 40.5 thousand rubles. Let's calculate the total trading fee:

50 × 1080 + (60 − 50) × 60 = 54,600 rubles - fee for a trade pavilion 40,500 × 2 = 81,000 rubles - fee for two kiosks 54,600 + 81,000 + 40,500 = 176,100 rubles - total trade fee

Demidov will pay a trading fee of 176,100 rubles per quarter.

Do not forget that the amount of the fee depends on the area of the sales floor; when calculating it, do not take into account warehouses and utility rooms. We recommend that you separately highlight retail space in the plan or lease agreement so that inspectors do not impose fines.

Question 1 13. Fee for the right to trade

- •A common part

- •3. The method of legal regulation is a method of legal influence on the behavior and will of the participants in regulated relations.

- •Question 2.

- •Question 3. Tax law as a science

- •Question 4.

- •Question 5

- •Question 6

- •2.The main functions of taxation are:

- •Question7.

- •Question 8. Tax regulations

- •Question9. Structure of tax law

- •1.Structure of the tax legal norm 2. General characteristics of the elements of the structure of the tax legal norm

- •Question 10, implementation of tax regulations

- •Question 11. Types of tax regulations

- •1. The grounds (criteria) for classifying tax law norms by type are:

- •3. According to their content, tax and legal norms are grouped into certain legal institutions.

- •Question 12. Characteristics of sources of tax law

- •Question 13. The Constitution of the Russian Federation as a source of tax law

- •2. The sources of tax law are the provisions of the Constitution of the Russian Federation:

- •14. Legislation of the Russian Federation on taxes and fees as a source of tax law

- •5. Regional legislation” on taxes and fees as a source of tax law.

- •6. Regulatory legal acts on taxes and fees adopted by representative bodies

- •1. Russian legislation on taxes and fees includes:

- •Chapter 21 “Value Added Tax”;

- •Question 15. General tax legislation as a source of tax law

- •1. The concept of general tax legislation of the Russian Federation

- •16. Subordinate regulatory legal acts on taxation issues as a source of tax law

- •2. Subordinate regulatory legal acts containing tax law norms are divided into two groups:

- •3. Acts of bodies of general competence include:

- •Question 17. Decisions of the Constitutional Court of the Russian Federation as a source of tax law

- •1. General provisions

- •2. Legal positions of the Constitutional Court of the Russian Federation regarding taxation problems

- •5, The Tax Legislation Act of the Russian Federation is repealed:

- •3. Recognition of a normative legal act as not corresponding to the Tax Code of the Russian Federation

- •Question 22. Tax system of the Russian Federation

- •1. Tax system concept

- •2. The tax system of the Russian Federation is a combination of:

- •3. The basic principles of the tax system include the following organizational and functional principles:

- •Question 23. System of taxes and fees of the Russian Federation

- •4. Legal regulation of the composition of federal, regional and local taxes and fees

- •Question 24. Federal taxes and fees

- •3. In Art. 19 of the Law of the Russian Federation “On the Fundamentals of the Tax System

- •Question 25. Regional taxes and fees

- •2. In Art. 14 of the Tax Code of the Russian Federation provides the following list of regional taxes and fees:

- •3. In Art. 20 of the Law of the Russian Federation “On the Fundamentals of the Tax System in the Russian Federation” contains the following list of taxes and fees of the constituent entities of the Federation (regional taxes):

- •Question 26. Local taxes and fees

- •27 Tax legal relations

- •1. The concept of the composition of tax legal relations.

- •Question 28. Representation

- •2. Legal representative of the taxpayer organization

- •29. Payers of taxes (fees) as participants in tax legal relations

- •1.' Concept and types of taxpayers

- •4. — Responsibility of taxpayers

- •Question 30. Tax agents as participation in tax legal relations Rights of tax agents

- •Question 31. Collectors of taxes and fees as participants in tax legal relations

- •5. Tax officials are obliged to:

- •6. Tax authorities are liable for unlawful actions or inaction:

- •Question 33. Financial authorities

- •Question 34. Customs authorities as participants in tax legal relations

- •3. Responsibilities of customs authorities and their officials.

- •4 Responsibility of customs authorities

- •2. The main functions of the customs authorities of the Russian Federation include:

- •Question 35. Bodies of state extra-budgetary funds as participants in tax legal relations

- •Question 36. Tax police authorities as participants in tax legal relations

- •1, Tax police authorities as participants in tax legal relations

- •2. Legal basis for the activities of bodies

- •5. The tax police authorities are granted a number of rights to fulfill their duties:

- •Question 37. Registration authorities

- •Entrepreneurs,

- •1. General Provisions

- •2. The role and importance of registration authorities as participants in tax legal relations.

- •38. Bodies authorized to perform notarial acts and notaries as participants in tax legal relations

- •1. General provisions

- •2. The role and importance of organs

- •3. Responsibility of authorities

- •Question 39.

- •Question 40.

- •Question 41. Credit organizations (banks) as participants in tax legal relations

- •1. The concept of a credit organization (bank).

- •3. Responsibility of the participating bank

- •2. The Tax Code of the Russian Federation assigns the following responsibilities to the bank as a participant in tax legal relations:

- •Question 42. Emergence, suspension and termination of the obligation to pay taxes and fees

- •1. Contents of the obligation to pay taxes

- •43. Characteristics of certain types of taxation objects

- •1. Property as an object of taxation

- •Question 44. Principles for determining price for tax purposes

- •Question 45.

- •Question 46. Changing the deadline for paying taxes (fees)

- •1. Forms (types) of changing the deadline for payment to us

- •2. Deferment or installment payment of tax.

- •Question 47.

- •2. Methods of paying tax (fee)

- •3. Grounds for non-recognition of the obligation to pay

- •3. There are three main methodological methods of paying tax:

- •4. The obligation to pay taxes (fees) is fulfilled in the currency of Russia – Russian rubles.

- •6 Tax (fee) is not considered paid in the following cases:

- •48. Payment of taxes and fees during the reorganization of a legal entity

- •1. General – provisions, reorganization of a legal entity

- •Question 49. Payment of taxes and fees upon liquidation of a legal entity

- •Question 50.

- •1. General provisions.

- •2. Features of payment of taxes and fees of a missing person.

- •51. Enforcement of the obligation to pay taxes and fees

- •2. The following types of payment requirements are distinguished:

- •4.As a general rule, tax collection from an organization is carried out in an indisputable manner.

- •Question 52.

- •1. The concept of ways to ensure obligations

- •2. Types of provision methods

- •3. Suspension of transactions on » bank accounts

- •Question 53. Credits and refunds are unnecessary

- •1. I apply the rules for offset and refund of tax (fee) and penalties* in relation to:

- •Question 54. Tax control

- •2. Tax control in the Russian Federation is carried out by the following authorities:

- •3. The immediate goals of tax control measures are:

- •8. In addition to the bodies exercising tax control, supervision of compliance with tax legislation of the Russian Federation has the right to carry out:

- •Question 55. Tax audits

- •2. There are the following types of tax audits:

- •Question 56. Taxpayer accounting

- •1. General provisions

- •Question 57. Tax return

- •1. Concept of a tax return 2. Procedure and methods for submitting a tax return

- •58. Collection of tax sanctions

- •1. The concept of tax sanctions.

- •2. The procedure for collecting tax penalties.

- •Question 59. Compliance control

- •1. Cost Control Objectives

- •Question 60. Tax secrecy

- •Question 61,

- •Question 62. Tax offenses for which liability is established by the Tax Code of the Russian Federation

- •2. The elements of a tax offense are:

- •3. The range of entities that can be held liable for:

- •63. Types of tax offenses

- •Question 64. Violation of the deadline for registration with the tax authority

- •Question 65. Evasion of statement

- •1. General provisions

- •2. Characteristics of the composition of the tax

- •66. Evasion of registration

- •1. General provisions of the offense

- •2. The object of the offense is the procedure for recording bank accounts of taxpayers established for tax control purposes.

- •Question 67. Failure to file a tax return

- •Question 68. Gross violation of the rules for accounting for income and expenses and objects of taxation

- •Question 69. Non-payment or incomplete payment of tax amounts

- •Question 70. Failure to retain and/or

- •1.General position.

- •2.Characteristics of the composition of the tax

- •Question 71. Illegal obstruction of access of an official of a tax or other body to the territory or premises

- •1. General provisions

- •72.. Failure to comply with the procedure for possession, use and (or) disposal of seized property

- •Question 73. Failure to provide information required for tax control

- •2. Characteristics of tax composition

- •74. Failure of a witness to appear, unlawful refusal to testify, or giving knowingly false testimony

- •1. General provisions.

- •2. Characteristics of the composition of the tax

- •75. Refusal of an expert, translator or specialist to participate in a tax audit, giving a knowingly false opinion, translation

- •1. General situation.

- •2. Characteristics of compositions, offenses

- •1. Responsibility for refusal of an expert, translator or specialist from;

- •Question 76.

- •1. General provisions

- •2. Characteristics of the composition of the tax

- •Question 77.

- •Question 78. Violation of the deadline for the execution of an order to transfer a tax or fee

- •1. General position

- •2. Characteristics of the composition of a tax offense.

- •79. Failure by the bank to comply with the decision of the tax authority to suspend transactions on accounts

- •Question 80.

- •1. General provisions

- •2. Characteristics of the composition of a tax offense

- •81. Failure to provide information on the financial and economic activities of bank clients

- •Question 82. Administrative

- •Question 83. Violation of the deadline for registration with the tax authority

- •Question 85.

- •Question 86.

- •87. Violation of account opening procedures by credit institutions

- •1. General situation.

- •88. Violation of the deadline by a credit institution for the execution of an order to transfer a tax or fee

- •Question 89. Failure of a credit institution to comply with a decision to suspend transactions on accounts

- •Question 90. Tax crimes (criminal crimes in the field of taxation) and liability for their commission

- •9.1. Tax disputes and protection of taxpayers' rights

- •Question 95. Foreign element

- •Question 97. Value added tax (VAT)

- •Question 98. Excise taxes

- •5. Taxable period

- •2. Taxpayers of corporate income tax are:

- •6% (Applies to income received in the form of dividends from Russian organizations by Russian organizations and individuals who are tax residents of the Russian Federation);

- •Question 100. Personal income tax

- •5.-Tax period

- •2. Taxpayers of personal income tax are:

- •101, Unified social tax (UST)

- •2, Unified Taxpayers are:

- •Question 102 mineral extraction tax (MET)

- •8, Procedure for calculation and payment* of tax

- •103. Transport tax

- •104. Organizational property tax

- •1. Taxpayers tz.

- •Question 105. Sales tax (SPT)

- •Question 106. Gambling tax

- •107. Land tax

- •Question 108. Property tax for individuals

- •1. General provisions

- •109. Advertising tax

- •110. Inheritance and gift tax

- •Question 111. Registration fee for individuals carrying out entrepreneurial activities

- •Question 112. Resort fee

- •Question 1 13. Fee for the right to trade

- •Question 114. Concept and types of special tax regimes

- •2. Currently, the Tax Code of the Russian Federation provides for the establishment of the following special tax regimes:

- •Question 115. Unified agricultural tax

- •Question 116. Simplified taxation system

- •1.General provisions.

- •117. Single tax on imputed income for certain types of activities

- •1.General provisions.

Many organizations pay a special fee for the right to trade. However, local laws establishing requirements for its payment cannot always be interpreted unambiguously. Therefore, organizations have to prove their case in court.

Ivanov S.A., expert of AG "RADA"

Most often, the subject of disputes is the question of which types of trading activities are subject to a fee and which are not. It all depends on how exactly this is established by local authorities. Many of them use in their work the joint letter of the Ministry of Finance dated 04/02/92 No. 4-5-20, the State Tax Service dated 04/02/92 No. IL-6-04/176, the Commission of the Council of the Republic of the Supreme Council of the Russian Federation on the budget, plans, taxes and fees dated 04.06.92 No. 5-1/693 “Approximate provisions (recommendations) for certain types of local taxes and fees.” This document recommends that everyone and everything be included in the list of payers of the fee for the right to trade, including trade from hand (with some, of course, nuances).

Federal legislation does not establish any requirements for the subject of taxation and the payer of the fee. This is the prerogative of local authorities.

Solution

The court of first instance satisfied the entrepreneur's demands. This decision was confirmed by the cassation instance (resolution of the Federal Arbitration Court of the East Siberian District dated June 26, 2003 NА33-15760/02-С3н-Ф02-1877/03-С1).

The judges justified their decision as follows. In the above-mentioned Model Provisions (Recommendations) on certain types of local taxes and fees, a permanent outlet refers to shops, canteens, cafes, kiosks, etc. Consequently, a warehouse is not a permanent outlet. Due to the fact that the entrepreneur did not trade “in permanent retail outlets,” he did not have to pay a fee for the right to trade.