Who is required to submit a declaration

All legal entities and entrepreneurs working on a simplified basis are required to submit a final declaration under the simplified tax system for 2021, regardless of the object they choose: 1. Tax only on income.

2. Tax on income minus expenses.

Moreover, even those payers who did not conduct any activity in 2021 must submit a zero declaration under the simplified tax system for 2021. Simply put, when the business was “frozen”, it stood idle. In particular, there were no transactions on the accounts.

The deadline for submitting the simplified tax system declaration for 2021 is regulated by clause. 1 and 2 paragraphs 1 art. 346.23 Tax Code of the Russian Federation. And let’s say right away that there are no changes to these standards in 2021 or 2021. That is, the old rules apply.

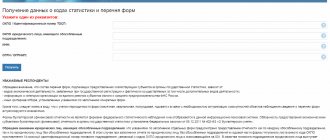

Tax return under the simplified tax system in 2021

Individual entrepreneurs and organizations that are payers of the trade tax, in addition to section 2.1.1, will also have to additionally fill out this section 2.1.2. Please note that it consists of two sheets, with the first sheet being filled out almost identically to section 2.1.1.

First sheet of section 2.1.2

Lines 110 – 113. The amount of income on an accrual basis from the type of activity of the simplified tax system for which a trade fee is established

. If you are engaged only in trading activities, then duplicate the income indicated in section 2.1.1.

Line "110"

. Enter the amount of income for the first quarter.

Line "111"

. Indicate the amount of income for the six months (the amount for the first and second quarters).

Line "112"

. Enter the amount of income for 9 months (amount for the first, second and third quarters).

Line "113"

. Enter the amount of income for the year (amount for the first, second, third and fourth quarters).

Lines 130 – 133. The product of the amount of income and the tax rate from section 2.1.1 for the corresponding period is calculated and indicated.

Line "130"

.

Calculate and indicate the advance payment for the first quarter: line 110 x line 120 section 2.1.1 / 100

.

Line "131"

.

Calculate and indicate the advance payment for the half-year: line 111 x line 121 of section 2.1.1 / 100

.

Line "132"

.

Calculate and indicate the advance payment for 9 months: line 112 x line 122 of section 2.1.1 / 100

.

Line "133"

.

Calculate and indicate the tax for the year: line 113 x line 123 of section 2.1.1 / 100

.

Lines 140 – 143. The amounts of tax deductions are indicated on an accrual basis, reducing the advance payments and tax calculated above.

Line "140"

. Enter the tax deduction amount for the first quarter.

Line "141"

. Indicate the amount of tax deduction for the half-year (amount for the first and second quarters).

Line "142"

.

Enter the amount of tax deduction for 9 months (amount for the first, second and third quarters). Line "143"

. Enter the amount of tax deduction for the year (amount for the first, second, third and fourth quarters).

Please note that if you made payments to individuals (in line 102 you indicated “1”), then by law you cannot reduce advance payments and the simplified tax system by more than half. Therefore, in this case you will have to ensure that:

- line 140 was not larger than line 130 / 2;

- line 141 was not larger than line 131/2;

- line 142 was not larger than line 132 / 2;

- line 143 was not larger than line 133/2.

Individual entrepreneurs who have not made payments to individuals (indicated “2” in line 102) can reduce advance payments and tax completely. Therefore, lines 140–143 can be equal to (but not exceed) lines 130–133, respectively (if the deduction amount is sufficient).

Second sheet of section 2.1.2

Lines 150 – 153. Indicated as a cumulative total of the amount of actually paid trading fee for the corresponding period.

Line "150"

. Enter the amount of trading fee paid for the first quarter (the sum of the first and second quarters).

Line "151"

. Enter the amount of trading fee paid for the half year (amount for the first, second and third quarters).

Line "152"

. Enter the amount of trading fee paid for 9 months (amount for the first, second and third quarters).

Line "153"

. Enter the amount of trading fee paid for the year (amount for the first, second, third and fourth quarters).

Lines 160 – 163. The amounts of the paid trade fee are indicated, which reduce the advance payments and tax calculated above.

Line "160"

.

Check if the condition is true: the result of line 130

(of this section) -

line 140

(of this section) must be less than

line 150

, and also must be less than or equal to the result of

line 130

(from section 2.1.1) -

line 140

(from section 2.1. 1).

If the condition is true, then specify the result of line 130

(of this section) -

line 140

(of this section), otherwise just specify

line 150

.

Line "161"

.

Check if the condition is true: the result of line 131

(of this section) -

line 141

(of this section) must be less than

line 151

, and also must be less than or equal to the result of

line 131

(from section 2.1.1) -

line 141

(from section 2.1. 1).

If the condition is true, then specify the result of line 131

(of this section) -

line 141

(of this section), otherwise just specify

line 151

.

Line "162"

.

Check if the condition is true: the result of line 132

(of this section) -

line 142

(of this section) must be less than

line 152

, and also must be less than or equal to the result of

line 132

(from section 2.1.1) -

line 142

(from section 2.1. 1).

If the condition is true, then specify the result of line 132

(of this section) -

line 142

(of this section), otherwise just specify

line 152

.

Line "163"

.

Check if the condition is true: the result of line 133

(of this section) -

line 143

(of this section) must be less than

line 153

, and also must be less than or equal to the result of

line 133

(from section 2.1.1) -

line 143

(from section 2.1. 1).

If the condition is true, then specify the result of line 133

(of this section) -

line 143

(of this section), otherwise just specify

line 153

.

When do organizations hand over

As a general rule, the deadline for filing a simplified taxation system declaration for 2021 by organizations (legal entities) is no later than March 31 (subclause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation). However, March 31, 2021 falls on a Saturday - a day off. Therefore, according to the rules of the Tax Code of the Russian Federation, if the deadline falls on an official weekend or non-working day, then it is automatically subject to postponement. This is stated in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation.

Thus, in 2021, the deadline for filing a tax return under the simplified tax system for 2021 by legal entities is April 2, 2021 inclusive. It will be Monday:

As you can see, simplified organizations have one extra day in 2021 to prepare and submit their simplified tax return for 2021 on time.

The declaration form under the simplified tax system, its electronic format and rules for filling out are fixed by order of the Federal Tax Service of Russia dated February 26, 2021 No. ММВ-7-3/99 (see “Declaration under the simplified tax system”).

Also see “Deadline for submitting a declaration under the simplified tax system for 2021: legal entities.”

Reporting to the Social Insurance Fund

Starting this year, the 4-FSS form has been simplified. This is due to the fact that the fund only manages contributions for injuries and occupational diseases. Small companies choose the type of report (electronic or paper) independently. But if a company employs more than 25 people, then it has no choice - in this case, the report is submitted electronically.

Depending on the type of report, the deadlines are as follows: first quarter - electronic report until April 25 and paper report until April 20, second quarter - electronic report until July 25 and paper report until July 20, third quarter - electronic report until October 25 and paper report until October 20.

When is the IP submitted?

As for individual entrepreneurs, the deadline for submitting a declaration under the simplified tax system for 2021 has been shifted exactly 1 month later (subclause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation) - until April 30, 2021 inclusive. Although it will be Monday, it will be an official non-working day due to the following first May holidays.

Also see 2021 Production Calendar.

As a result, the deadline for filing an individual entrepreneur’s declaration of the simplified tax system for 2021 is also subject to the rule of the Tax Code of the Russian Federation on postponing the deadline. It falls on May 03 – Thursday. This will be the first working day after the extended May weekend:

Thus, entrepreneurs on a simplified basis in 2021 have two additional days to prepare and submit their declaration for 2021. Let us remember that merchants do this at their place of residence.

The deadlines for submitting declarations under the simplified tax system for legal entities and individual entrepreneurs differ. The law gives simplified entrepreneurs exactly 1 month more to fill out and submit this annual report. And interim declarations - based on quarterly results - are not submitted by individual entrepreneurs under the simplified tax system.

Typical errors when filling out

Mistake #1. Refusal to submit an updated return if more than 3 years have passed since the mistake was made when filling out the tax return.

Submission of “clarification” is not limited to three years. If an error is discovered, it is better to immediately submit an updated declaration, especially if you sent a smaller amount to the budget than you were supposed to transfer.

Mistake #2. A legal entity hires employees unofficially, without registration, and then sends a tax return as a “company without employees.”

Unlike entrepreneurs, organizations cannot exist without employees; for the tax authorities they are considered inactive.

Mistake #3. Failure to submit tax returns for the reporting period in which the enterprise did not operate.

In such cases, a zero declaration is submitted; this is a mandatory requirement.

What is the penalty for missing a deadline?

If the above deadlines for submitting the simplified tax system declaration for 2021 are not met, then you will face a fine under clause 1 of Art. 119 of the Tax Code of the Russian Federation. This is at least 1000 rubles, even if you pay the tax in full to the budget. And in general, the inspection will collect from 5 to 30% of the amount of tax not transferred to the treasury according to the simplified tax system according to the declaration for each full or partial month starting from:

- from April 3, 2021 – in relation to legal entities;

- from May 4, 2021 – for entrepreneurs.

Another extremely undesirable measure that the leadership of the Federal Tax Service may take is freezing bank accounts, including the movement of electronic payments (clause 3 of Article 76 of the Tax Code of the Russian Federation). There is a reason when the delay in filing a declaration is at least 10 working days. That is, the inspectors never saw her:

- by April 17, 2021 – from the organization;

- by May 21, 2021 – from the individual entrepreneur.

The Federal Tax Service must cancel the suspension of transactions on accounts no later than one business day following the day when the simplifier finally submitted the declaration (paragraph 2, paragraph 3, paragraph 11, article 76 of the Tax Code of the Russian Federation).

According to clarifications of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108, an administrative fine for individual entrepreneurs under Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, the simplified tax system is not imposed for late submission of a declaration. It threatens only officials of the organization - the manager, accountant, etc.

Also see “Changes to the simplified tax system in 2021”.

Read also

30.01.2018

VAT, income and property tax

In accordance with paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation, organizations that have chosen the simplified tax system are exempt from paying VAT, income tax and property tax. However, in cases established by law, they must also pay these taxes and report on them. For example, when a company using the simplified tax system, at the request of a counterparty, has issued an invoice with an allocated amount of VAT, it must pay the tax to the budget and submit a declaration. The law also establishes other cases when “simplified workers” must fulfill the duties of a VAT payer. As for property and profit taxes, the same paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation lists cases in which companies using the simplified tax system are not exempt from these taxes.

Answers to common questions

Question No. 1. What should you do if your accountant entered the wrong date on your tax return?

This error is corrected by filing an amended return, since there was no underpayment of tax.

Question No. 2. The accountant mistakenly entered into the declaration a smaller amount of tax according to the simplified tax system than was necessary. So what's now?

An employee’s mistake led to a shortfall in funds to the budget, which means that you will have to submit an updated declaration and pay the shortfall. This needs to be done as quickly as possible, because when the tax authorities discover the missing amount, you will be fined.

Question No. 3. The employee responsible for filing the tax return made a mistake, resulting in an overpayment of taxes. How to get back extra money?

First, determine why the error occurred. If you understate your tax base by overstating income or understating expenses, you will be subject to an on-site audit. If you decide to submit an amended return, be sure to document that an overpayment occurred.

Employee tax for individual entrepreneurs

Individual entrepreneurs with employees are recognized as tax agents and are required to withhold personal income tax from all income paid (including under civil law contracts).

| Employee tax | |

| How is it calculated? | Tax = (employee's monthly income - tax deductions) × tax rate. A certificate in form 2-NDFL is drawn up for each employee and submitted to the tax office before April 1 of the year following the reporting year. |

| How to report? | From January 1, 2021, tax agents are required to transfer the calculated and withheld personal income tax no later than the day following the day of payment of wages. Personal income tax on sick leave, benefits for caring for a sick child and vacation pay must be transferred to the budget no later than the last day of the month in which they were paid. |

| How to pay? | 3% – for citizens of the Russian Federation, 30% – for foreigners. |