What is meant by accounting policy

The accounting policy is prepared in the form of a document containing detailed instructions on how the organization will conduct accounting and tax reporting.

According to fixed standards, records of income, expenses and other actions are kept.

The development of an accounting policy is mandatory, although there is no single template for its preparation.

The list of data contained in the document can include:

- tax payment regime;

- tax benefits;

- information about accounting accounts;

- other information related to accounting.

For an enterprise, accounting rules are traditionally divided into two components: one of them is accounting, the second is tax.

The accounting department includes organizational, technological and methodological parts.

The accounting component contains rules for systematizing data on business activities, using accounts, receiving and sending documents, and taking inventory.

In accordance with established standards, primary forms are accepted, a method for calculating depreciation is selected, income is distributed and profits are calculated.

The purpose of tax accounting policy is to formulate a model according to which:

- information about completed business transactions is collected;

- based on the data received, the tax base is calculated;

- tax contributions are calculated.

An organization's tax accounting policy shows how taxes on profits and on added value will be calculated. Using the same rules, the cost of the enterprise’s resources and the probability of forming reserves are derived.

back to menu ↑

“Accounting policies of the organization” PBU 1/2008: changes

From 08/06/2017, amendments to PBU 1/2008 “Accounting Policy of the Organization” came into force (Order of the Ministry of Finance of the Russian Federation dated 04/28/2017 No. 69n). Its provisions include, in particular, the following innovations:

- PBU “Accounting Policies” now applies to all legal entities, except credit and government organizations,

- a rule has been introduced on independent choice of the accounting method, regardless of the choice of other organizations, and subsidiaries choose from the standards approved by the main company (clause 5.1),

- the concept of rational accounting has been clarified - accounting information must be useful enough to justify the costs of its formation (clause 6),

- in cases where there is no specific method of accounting in federal standards, the organization develops it itself, based on paragraphs. 5 and 6 PBU 1/2008 and accounting recommendations, consistently referring to IFRS standards, federal (PBU) and industry accounting standards (clause 7.1), and to companies conducting simplified accounting (small enterprises, non-profit organizations, Skolkovo participants) , when forming an accounting policy, it is enough to be guided by the requirements of rationality (clause 7.2),

How to draw up accounting rules for accounting

The legislation does not stipulate specific requirements for the design of accounting rules, nor does it provide a single template. Basically the document is divided into two parts:

- accounting;

- tax

The first may contain two indicators. The organizational and technical description describes how the accounting department functions, in what form the reporting is prepared (automated accounting or journal-order), how the inventory is taken.

The following applications can be added in this part:

- instructions for employees of the accounting department;

- forms for compiling primary accounting;

- forms for how tax registers will be presented;

- regulations on the work of the department;

- the schedule according to which reporting documents are accepted and sent;

- persons who have the right to sign accounting documents.

The next section, which includes the accounting part, is methodological. Accounting methods are prescribed here.

As an appendix to the section, lists of enterprise funds, objects for which depreciation is calculated, and a list of designations for cost accounting may be indicated.

back to menu ↑

How is the second part formatted?

The purpose of the tax accounting policy determines which sections will be included in it. Typically there are three points:

- principle of tax accounting;

- methods used to calculate tax contributions;

- tax registers.

The purpose of tax accounting policy differs from the purpose of the accounting part.

There are also differences in accounting methods, which leads to increased reporting costs. However, these differences can be significantly reduced.

To do this, when preparing a document, the rules for maintaining two types of accounting are brought together as closely as possible.

Important: as an example, they use a single method for determining the cost of goods and compile a similar list of direct costs.

back to menu ↑

When accounting rules are formed

Tax accounting policy and its accounting part are developed in most cases by the chief accountant.

For the document to come into force, a corresponding decree of the head (for example, the general director of an LLC) is issued. It is drawn up in any form; no official form or sample is provided.

Important: accounting policies are prepared and approved when the organization is created. This is done only once.

With the arrival of the next financial year, the rules established for the enterprise are revised.

The purpose of tax accounting policy is compliance with current legislation in tax matters. It is not necessary to update the entire text of the document annually. However, amendments are made to the sample in the following cases:

- If inconsistencies with current legislation are found.

- If changes have occurred in the activities of the organization or new directions have emerged.

Changes to the list of accounting requirements are planned at the end of the year and approved from January 1 of the next year.

In order for the adjustments to take effect from the beginning of 2021, the corresponding order is signed in December 2015.

back to menu ↑

Ready-made accounting policy samples

Accounting policies are drawn up separately for accounting and tax accounting

02/14/2019Russian tax portal

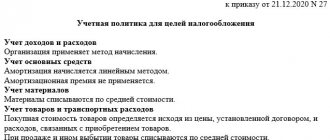

For tax purposes

The accounting policy is approved by order or order of the head (director) of the enterprise in the year preceding the year of its application. For example, on December 26, 2021, an accounting policy was approved, but it should only be applied from January 1, 2021.

When creating an organization, it selects methods for determining income and expenses, tax accounting registers and enshrines them in the order on accounting policies. There is no need to draw up a new accounting policy every year or “repeat” an order from last year. The accounting policy is drawn up once. But, it is possible to make changes to it. Only when many changes to the Tax Code have been adopted, is it more advisable to adopt and approve a new accounting policy. In this case, it is necessary to make references to the Federal laws that have entered into force (on the basis of which amendments were made to the Tax Code of the Russian Federation).

Changes in accounting policies

Changes to the accounting policy are made in the following cases:

– the legislation introduced amendments to the Tax Code of the Russian Federation (minor changes). In this situation, changes are made no earlier than the date of entry into force of the relevant laws;

– the organization decided to change the methods of accounting for income and expenses. Changes are accepted from the beginning of the tax period (mandatory);

– emergence of new types of activities for the company. You can adopt accounting policies and make changes at any time in the reporting year.

Main sections of accounting policies

When drawing up an accounting policy, an enterprise should pay attention to the fact that it is advisable to divide the accounting policy into two parts:

- organizational;

– on methodological.

First, you need to indicate how the responsibilities of accountants (accounting employees) will be distributed and assign certain employees to be responsible. Next, it is important to disclose what analytical registers the company will use. The third stage is accounting methods.

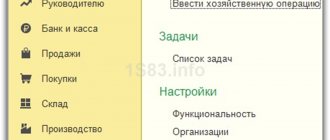

Sample accounting policy for tax accounting

For accounting

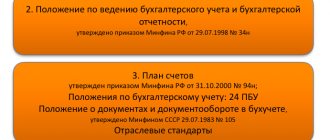

The accounting policy for accounting purposes must be formed on the basis of the Accounting Regulations “Accounting Policy of the Organization” (PBU No. 1/2008).

Accounting policy approval period

The accounting policy must be approved in December of the year preceding the year in which the accounting policy provisions are applied. For example, you can date the order to December 30 last year. Then the accounting policies will be applied from January 1 of the following year. If the company has been newly established, then it approves the accounting policies for accounting purposes until the presentation of financial statements.

Changes in accounting policies for accounting purposes

Changes to the previously approved accounting policies for accounting purposes are made in the following cases:

– in case of changes in legislation;

– when the essential conditions of the organization’s activities change;

– when developing new methods of accounting.

The company must reflect any changes in its accounting policies in the explanatory note to the financial statements.

Independent approval of forms of primary documents

The organization has the right to independently approve the forms of documents. The company must formalize the forms of “independent” documents in its accounting policies.

Sample accounting policy for accounting purposes

Downloads

- Accounting policies for tax accounting.docx (26Kb)

- Accounting policy accounting.docx (28Kb)

Post:

Comments

How is the accounting component formed?

The main basis for the formation of regulations is Federal Law No. 402-FZ of December 6, 2011. On November 16, 2014, amendments were made to it regarding the scope of application of simplified accounting systems.

Now such reporting methods cannot be used by small businesses, which must undergo a mandatory audit.

Important: the definition of which organizations are classified as SMP is contained in Art. 4 of Federal Law No. 209-FZ of July 24, 2007. Situations when a mandatory audit is carried out are reflected in clause 1 of Art. 5 of Federal Law No. 307-FZ of December 30, 2008.

Therefore, if an enterprise previously operated under a simplified accounting system, changes will be made to the rules when these requirements come into force. In accordance with them, other accounting methods are used.

back to menu ↑

Development of the second component

Tax accounting policy is developed within the framework of the requirements of the Tax Code of the Russian Federation. In 2021, a number of provisions were amended. They should be reflected in the organization's regulations.

- In accordance with paragraph 1 of Art. 256 and paragraph 1 of Art. 257 of the Tax Code, property whose original cost exceeds 100 thousand rubles is considered depreciable. If earlier in the list of organization rules this amount was indicated as 40 thousand, this item needs to be replaced. The order applies only to property put into operation after January 1, 2021.

- Another change concerns businesses making only advance quarterly income tax payments. Previously, enterprises whose sales income for four reporting quarters did not exceed 10 million rubles could use this procedure. Now the limit has been increased to 15 million, therefore, as the purpose of the tax accounting policy implies, changes are being made to its text.

Important: amendments to the company’s regulations cannot be made during the year. This is possible only in exceptional cases related to changes in legislation, the introduction of new accounting methods, or significant changes in relation to business transactions.

back to menu ↑

Complex accounting issues for 2016

1. Application of new accounting legislation when preparing reports for 2021 . Specifics of updated simplified accounting when preparing annual reports for 2016.

2. Composition of reporting and ensuring compliance of the forms of accounting reports adopted by the organization with the nature and conditions of its activities . Requirements for adapting forms and detailing indicators in reporting. Features of simplified reporting.

3. Disclosure of deferred expenses: how to avoid mistakes.

4. Reflection of estimated reserves and estimated liabilities in the balance sheet . Avoiding the creation of hidden reserves

5. Disclosure of information about:

- doubtful debts;

- unfinished capital investments and fixed assets subject to state registration;

- OS overhaul;

- financial investments of the organization;

- MPZ.

Accounting policies: key issues

1. The role of accounting policies in the context of the Law “On Accounting” . The draft amendments to PBU 1/2008 “Accounting Policies of the Organization” proposed by the Ministry of Finance. New requirements for accounting standards for an economic entity in 2021. Principles of construction and approval, changes in accounting policies. The protective function of the accounting policy for the chief accountant in the context of increasing his responsibility for the reliability of accounting.

2. Inventory Regulations - the meaning of this section of the accounting policy in 2021.

3. Basic provisions of accounting policies:

3.1. Approval of forms of primary accounting documents and registers;

3.2. Accounting for fixed assets:

- application of the new OKOF and new provisions of PBU 6/01 - what needs to be included in the accounting. politics?

- fixed assets and objects that can be accounted for as inventories;

- inventory object: enlarge or divide;

- determination of approaches to the formation of the initial cost of the operating system;

- provisions on depreciation of fixed assets in the accounting policy;

3.3. Inventory accounting:

- formation of the actual cost of purchasing materials;

- determining the estimated value of uninvoiced supplies;

- assessment of inventories when released into production and other disposals;

3.4. Production cost accounting:

- composition of direct costs of production and sales;

- accounting and distribution of indirect costs;

3.5. Other mandatory and optional accounting policies.

Accounting policies for tax purposes: key issues

1. New developments in tax accounting policy in 2017 due to changes in tax legislation.

2. VAT accounting policy: optimization.

3. Accounting policy for profit tax purposes:

3.1. Recognition of income and expenses:

- distribution of expenses;

- accounting of direct and indirect costs.

3.2. Accounting for depreciable property:

- application of the new tax classification of fixed assets by depreciation groups and the new OKOF;

- determining the composition of the initial cost of fixed assets and intangible assets;

- determination of the approach to establishing useful lives.

3.3. Accounting for material costs:

- the border between the MPZ and the OS;

- cost distribution;

- setting up accounting of technological losses;

3.4. Evaluation of work in progress , finished products and shipped goods.

3.5. Creation of tax reserves : decision on formation, approach to assessment.

Answers on questions

On what principles are accounting rules drawn up?

In order for the goal of tax accounting policy to be achieved, the following points are taken into account:

- continuity of reporting;

- documentary evidence of all business transactions;

- property independence;

- rationality of accounting;

- consistency.

In order for the goal of tax accounting policy to be achieved, the above economic principles must be observed. The organization is obliged to follow these regulations, so they must be rationally drafted.

In accordance with what the tax accounting policy indicates, the tax base is determined and tax contributions are calculated. The accounting component, among other things, regulates the acceptance of primary documents and the form in which tax registers are provided.

Tax accounting policies are drawn up by an accountant and then approved by the head of the enterprise.

Its presence is mandatory for reporting organizations. This document is built on the basis of general reporting principles and is adjusted in accordance with current legislation.

back to menu ↑

UP 01 Requirements for Accounting Policies

Accounting policies and changes to the Tax Code in 2021

The accounting policy in the organization is very important for the work of the accounting department and interaction with the Federal Tax Service. It determines the main areas of accounting and, in some way, influences the results of tax audits, since with a competent policy the number of errors is minimal. The policy itself is affected by changes in tax laws. What new did VAT and income tax bring to accounting policy issues for 2017? Find out from this article.

VAT in accounting policy

The next tax we are interested in is VAT. No particularly serious changes in terms of features to be disclosed in the organization’s accounting policies were adopted in 2021. Unless paragraph 10 of Article 165 of the Tax Code of the Russian Federation was supplemented with an additional proposal (changes were made by subparagraph “d” of paragraph 1 of Article 1 of the Federal Law of May 30, 2016 No. 150-FZ “On Amendments to Chapter 21 of Part Two of the Tax Code of the Russian Federation”), requiring disclosure in the accounting policy, the procedure for determining the amount of tax related to goods (work, services), property rights acquired for the production and (or) sale of goods (work, services), transactions for the sale of which are taxed at a tax rate of 0%.

It is determined that the specified procedure is approved only for goods not specified in subparagraph 1 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation (goods exported under the customs procedure for export, as well as goods placed under the customs procedure of a free customs zone, with the exception of raw materials) and in subparagraph 6 paragraph 1 of Article 164 of the Tax Code of the Russian Federation (precious metals by taxpayers who mine or produce them from scrap and waste containing precious metals, the State Fund of Precious Metals and Precious Stones of the Russian Federation, funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation , banks).

Accordingly, “input” VAT is allocated from the total amount of “input” VAT on taxable transactions in proportion to the cost of shipped goods (work, services), the sale of which is taxed at a rate of 0% (except for those indicated above), in the total cost of shipped goods (work, services) ), property rights, the sale of which is subject to VAT, for the quarter and is determined by the following formula:

VAT 0 = VAT (ras) x SOT 0 / SOT total,

where VAT 0 is the amount of “input” VAT on transactions taxed at a rate of 0% (except for transactions for the sale of goods specified in subclause 1 of clause 1 (except for raw materials) and in subclause 6 of clause 1 of Article 164 of the Tax Code of the Russian Federation), for the quarter;

VAT (ras) - the amount of “input” VAT, which is subject to distribution among VAT amounts related to transactions taxed at a rate of 0% (except for transactions for the sale of goods specified in subparagraph 1 of paragraph 1 (except for raw materials) and in subparagraph 6 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation), and VAT amounts related to other VAT-taxable transactions for the quarter;

COT 0 - the cost of shipped goods (work performed, services rendered), the sale of which is taxed at a rate of 0% (except for transactions for the sale of goods specified in subparagraph 1 of paragraph 1 (except for raw materials) and in subparagraph 6 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation) , for the quarter;

COT total - the total cost of shipped goods (work performed, services rendered), realized property rights, the sale of which is subject to VAT, for the quarter.

It is obvious that the additions made to paragraph 10 of Article 165 of the Tax Code of the Russian Federation by Law No. 150-FZ are rather of an informative nature. In the sense that only those organizations that have the corresponding turnover of goods (works, services) taxed at a rate of 0% will enter the relevant information into the accounting policy (in addition to those that are expressly excluded in the text of this paragraph). This point will be of little interest to others.

Income tax in accounting policies

Now let's turn to income tax. During 2021, several federal laws were adopted, which amended Chapter 25 of the Tax Code of the Russian Federation and which, in turn, directly affected the volume of information disclosure in accounting policies.

The first and simplest change concerned terminology. What was previously called “financial elements of forward transactions” (FISS) in the text of the Tax Code of the Russian Federation is now called “derivative financial instruments” (DFI). This change was introduced by Federal Law No. 242-FZ dated July 3, 2016 “On amendments to Article 105.15 of the Tax Code of the Russian Federation and part two of the Tax Code of the Russian Federation and the recognition as invalid of certain provisions of legislative acts of the Russian Federation.” The change is purely cosmetic and was made solely to clarify the terminology.

It is clear that organizations that, by the nature of their activities, were related to FISS, must make cosmetic changes to the text of their accounting policies. To keep up with the flow of changing life. And for nothing else.

Depreciation of fixed assets

Now let's talk about depreciation. Federal Law No. 144-FZ of May 23, 2016 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” supplemented paragraph 1 of Article 259.3 of the Tax Code of the Russian Federation, which lists cases when organizations have the right to apply an increasing factor of no more than 2, subparagraph 6. And now, from January 1, 2017, organizations will have the right to apply such an “accelerated coefficient” in relation to depreciable fixed assets included in the first to seventh depreciation groups and produced in accordance with the terms of a special investment contract. What is a “special investment contract”? This is stated in paragraph 2 of Article 25.9 of the Tax Code of the Russian Federation. This is a contract concluded on behalf of the Russian Federation by a federal executive body designated by the Government of the Russian Federation in the field of industrial policy or another federal executive body authorized by the Government of the Russian Federation to conclude special investment contracts in industries, in accordance with Federal Law No. 488-FZ “On industrial policy in the Russian Federation”.

As we can see, the declared tax break regarding the use of accelerated depreciation on fixed assets with a useful life of no more than 20 years concerns an extremely narrow group of organizations carrying out investment activities within the framework of government programs for the development of industrial production. This point does not apply to mere mortals (in the sense of ordinary organizations), who may also have the specified fixed assets and even invest in production. So they can sleep peacefully and not change anything in their accounting policies.

The change regarding the procedure for creating a reserve for doubtful debts for the purposes of calculating the taxable base for income tax applies to a much larger number of organizations. After all, in order to form this reserve, an organization does not need to enter into an investment contract with the state - it is enough to simply want to create a reserve (if there is an urgent need for it).

So, from January 1, 2021, Federal Law No. 405-FZ dated November 30, 2016 “On Amendments to Article 266 of Part Two of the Tax Code of the Russian Federation” amended paragraphs 4 and 5 of this article of the Tax Code of the Russian Federation. According to its new version, the amount of the created reserve for doubtful debts, calculated based on the results of the tax period, cannot exceed 10% of the revenue for the specified tax period, determined in accordance with Article 249 of the Tax Code of the Russian Federation. When calculating the reserve for doubtful debts during the tax period based on the results of the reporting periods, its amount cannot exceed the greater of the values - 10% of the revenue for the previous tax period or 10% of the revenue for the current reporting period. Currently, the amount of the reserve created at the end of the reporting period should not exceed 10% of revenue for the current reporting period.

Often, revenue for the previous tax period is higher than for the current reporting period. This means that the reserve will become larger. This will allow you to take into account a larger amount in income tax expenses compared to what can be taken into account now. The innovation will be especially relevant when creating a reserve for the first reporting period of the year. Please note that these changes are not mandatory. Therefore, the organization itself chooses which of the ten standard percentages is more profitable for it - those calculated for the previous year, or for the current one. Here it is impossible to do without indicating the relevant information in the accounting policy.

That seems to be it. As we can see, this time legislators have not been very generous with changes that lead to variability in tax accounting methods. Well, that's good. Sometimes stability also has its advantages.

ppt.ru

Share link:

- Click here to share content on Facebook. (Opens in a new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Twitter (Opens in new window)