Advantages of the simplified tax system

The most important benefit of the simplified taxation system is the low tax rate. It depends on the chosen object of taxation:

- 6% for simplified taxation system Income;

- from 5% to 15% for simplified taxation system Income minus expenses.

This is significantly lower than the rates in force in the general taxation system:

- up to 20% on income tax for organizations or 13% personal income tax for individual entrepreneurs;

- up to 18% (and from 2021 to 20%) for value added tax.

In addition, if the tax object “Income” is selected, then the calculated tax is reduced by the amount of insurance premiums paid. Moreover, individual entrepreneurs without employees can take into account the entire amount of contributions for themselves, and employers can reduce the tax payment by no more than 50%.

You can find specific examples of how advance tax payments and the single tax on the simplified tax system are reduced here.

Another special feature of the simplified taxation system is that only one annual declaration is submitted. And if the object of taxation is “Income”, then you can handle the accounting yourself, without an accountant.

Naturally, the state does not provide such preferential conditions to all taxpayers, but only to those who can be classified as small businesses. The conditions established for the transition to the simplified tax system in 2021 are indicated in the article of the Tax Code of the Russian Federation.

Tax base of the transition period

Before starting to apply the simplified taxation system, a company must create a tax base for the transition period. The procedure for determining it depends on how the organization calculated income tax:

- accrual method;

- cash method.

Special rules for the formation of the tax base of the transition period are established only for organizations that determined their income and expenses by accrual. This follows from the provisions of paragraph 1 of Art. 346.25 of the Tax Code of the Russian Federation.

1. Income

In such “transitional” income, companies must include unclosed advances received during the period of application of the general taxation system. This is explained by the fact that under the accrual method, income must be reflected on the date of sale of goods (work, services). The date of payment does not affect the amount of income (clause 3 of Article 271 of the Tax Code of the Russian Federation). When simplified, the cash method is used. With it, income is generated as payment is received, regardless of the date of sale of goods (work, services) on account of which it was received. Such rules are provided for in paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation.

Advances received for upcoming deliveries during the period of application of the SST are included in the single tax base as of January 1 of the year in which the organization begins to apply the simplified regime (subclause 1, clause 1, article 346.25 of the Tax Code of the Russian Federation). At the same time, take into account the specifics of calculating and paying VAT received as part of advances.

In the future, advances received before the transition to the simplified tax system must be taken into account when determining the maximum amount of revenue that limits the use of the special regime. This follows from the provisions of clause 4.1 of Article 346.13 and clause 1 of clause 1 of Article 346.25 of the Tax Code of the Russian Federation.

In 2021, the maximum amount of revenue that allows you to apply the “simplified tax” is 150,000,000 rubles. (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

Buyers' receivables accumulated during the application of the OSN do not increase the tax base of the transition period. With the accrual method, revenue is included in income as it is shipped (Clause 1, Article 271 of the Tax Code of the Russian Federation). This means that it has already been taken into account for tax purposes. Amounts received to pay off the organization’s receivables after the transition to the simplified tax system do not need to be re-included in the tax base. This is indicated by paragraph 3 of paragraph 1 of Art. 346.25 of the Tax Code of the Russian Federation.

2. Expenses

Those organizations that used the accrual method should include here unrecognized expenses that were paid during the period when the general tax system was applied. This is explained by the fact that with the accrual method, expenses are taken into account on the date of their implementation (clause 1 of Article 272 of the Tax Code of the Russian Federation). The date of payment does not affect the date of recognition of expenses. When “simplified”, the cash method applies (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). With it, expenses are formed as they are paid. Moreover, additional conditions have been established for the recognition of certain types of costs.

Advances issued during the period of application of the general taxation system against future deliveries (excluding VAT) should be included in the single tax base on the date of receipt of goods (work, services). At the same time, take into account the restrictions associated with the write-off of purchased goods and fixed assets. Include paid but unrecognized expenses as expenses as the conditions under which they reduce the tax base for the single tax are met. These rules are provided for in subparagraph 4 of paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation.

The organization's accounts payable for expenses that were taken into account when calculating income tax do not reduce the tax base for the single tax. Amounts paid to repay accounts payable after the transition to the simplified tax system cannot be re-included in expenses. For example, if unpaid goods were sold before the transition to the simplified regime, then there is no need to take their cost into account when calculating the single tax after payment. This is indicated by subparagraph 5 of paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation.

3. Cash method

For organizations that have already used the cash method, a special procedure for generating income and expenses when switching to a simplified system has not been developed. This is due to the fact that such organizations previously recognized their income and expenses as they were paid (clauses 2, 3 of Article 273 of the Tax Code of the Russian Federation). For them, when switching to the simplified tax system, nothing will change.

Here you should pay attention to the procedure for determining the residual value of depreciable property acquired before the transition to the special regime.

If the organization paid for such property and put it into operation before the transition to the simplified tax system, then determine its residual value in the following way. From the purchase price (construction, manufacturing, creation), subtract the amount of depreciation accrued during the period of application of the general taxation system. In this case, use tax accounting data (clause 2.1 of Article 346.25 of the Tax Code of the Russian Federation).

If, before the transition to the “simplified” system, fixed assets or intangible assets were created (purchased, constructed, manufactured), but not paid for, then reflect their residual value in accounting later, starting from the reporting period in which the payment occurred. The residual value must be determined as the difference between the purchase price (construction, manufacturing, creation) and the amount of depreciation accrued during the period of application of the general taxation system.

However, for organizations that calculated income tax using the cash method, the residual value of such property will coincide with the original one. This is due to the fact that under the cash method, only fully paid-for property is depreciated (clause 2, clause 3, article 273 of the Tax Code of the Russian Federation).

Who can work on the simplified system

Conditions and new criteria for choosing a simplified taxation system are established annually. True, in the last couple of years a certain stability has been established in this sense, i.e. The requirements for simplified taxation system payers do not change fundamentally.

The criteria for applying simplified taxation are specified in Chapter 26.2 of the Tax Code:

- the average number of employees is no more than 100 people;

- the taxpayer does not have the right to engage in certain types of activities (for example, banking and insurance, pawnshops, mining, except for common ones, etc.);

- annual income should not exceed 150 million rubles (a few years ago the limit was only 60 million rubles);

- the organization has no branches;

- income received by an existing business for 9 months of the current year when switching from OSNO to simplified tax system from 2021 cannot exceed 112.5 million rubles;

- the residual value of fixed assets does not exceed 150 million rubles (until 2021, the limit was set at 100 million rubles).

Regarding the latter condition, the Federal Tax Service recently expressed an ambiguous opinion. The fact is that in subclause 16 of clause 3 of Article 346.12 of the Tax Code of the Russian Federation, the limit on the residual value of fixed assets is indicated only for organizations. Accordingly, individual entrepreneurs did not comply with this limit and made the transition from the OSNO to the simplified tax system, even having fixed assets for a large amount.

However, in a letter dated October 19, 2021 No. SD-3-3 / [email protected] , the Federal Tax Service noted that in order to be able to switch from OSNO to the simplified tax system, the limit on fixed assets must be observed not only by organizations, but also by individual entrepreneurs. Moreover, this conclusion of the tax authorities is supported by judicial acts, including decisions of the Supreme Court.

In addition, the Ministry of Finance has established new income and employee limits for simplified tax payers from 2021. However, those who will earn more than 150 million rubles and employ more than 100 people will be required to pay tax at a higher rate: 8% for the simplified tax system for Income and 20% for the simplified tax system for Income minus expenses.

But, of course, the majority of newly registered LLCs easily fit into the simplified limits on income and number of employees. This means they have the right to switch to a preferential regime and pay taxes at a minimum.

Combination of special modes

It is possible to be in two modes at the same time only in one case: the first of these modes is PSN, and the second is UST, “simplified” or OSNO. Any other combinations are prohibited (see Table 2).

table 2

What tax regimes are allowed (not allowed) to be combined with each other?

| Tax regimes | Can / can't be combined | |

| OSNO and simplified tax system OSNO and Unified Agricultural Tax OSNO and NPD | it is forbidden | |

| USN and NPD USN and Unified Agricultural Tax | it is forbidden | |

| PSN for certain types of business and | simplified tax system | Can |

| Unified agricultural tax | ||

| BASIC | ||

| NPD and PSN NPD and Unified Agricultural Tax | it is forbidden | |

REFERENCE

When combining modes, separate accounting of income and expenses is required. Costs that relate to the two tax systems should be distributed in proportion to the revenue received under each system.

Maintain separate accounting when combining simplified taxation system and PSN and prepare reports Try for free

When can you switch to simplified work?

Many aspiring businessmen know that small businesses in Russia have the right to operate at reduced tax rates. And the choice of a preferential tax system often occurs even before documents for business registration are submitted to the Federal Tax Service.

If you have not yet decided on the tax system or are in doubt about your choice, we recommend that you contact us for a free consultation.

Free tax consultation

So, if you have already decided that you want to work on a simplified system, but have not yet submitted documents for registration of an individual entrepreneur or LLC, then together with them you can submit an application for the simplified tax system. And even if registration with the Federal Tax Service has already taken place, but no more than 30 days have passed since that date, then you still have time for the transition.

How to switch to the simplified tax system if you did not know about this possibility, so you ended up on the general taxation system (OSNO)? Unfortunately, the opportunity to transfer for an existing business is only available once a year.

To formalize the transition from OSNO to simplified tax system, you must submit a notification before December 31. Then you will be able to apply the simplified version from January 1, 2022. But, of course, provided that you comply with the limits of income, employees, fixed assets and do not violate other established requirements.

Create an application for the simplified tax system for free

And another procedure for switching to a simplified tax regime was provided for UTII payers. If in the middle of the year they stop the type of activity for which they pay tax on imputed income, then they have the right to switch to the simplified tax system in another line of business without waiting for January 1. In this case, the application can be submitted within 30 days from the date of deregistration as a UTII payer. However, you cannot simply switch from imputation to the simplified tax system for the same type of activity in the middle of the year.

For clarity, we have collected the timing of the transition to the simplified tax system in different situations in a table.

| Taxpayer category | Notice deadline |

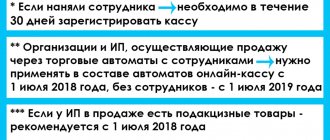

| Newly registered individual entrepreneurs and LLCs | Simultaneously when submitting documents for business registration or within 30 days after it |

| Existing individual entrepreneurs and LLCs operating in other modes | No later than December 31 of the current year for the transition to the simplified tax system from January 1 of the new year |

| Payers of UTII | After the cancellation of UTII for registration on the simplified tax system from 01/01/2021, the application can be submitted until January 31, 2021 |

This might also be useful:

- Deflator coefficients for 2021

- VAT accounting for individual entrepreneurs using the simplified tax system in 2021

- Individual entrepreneur reporting on the simplified tax system without employees

- How to work on the simplified tax system income 6%

- Pros and cons of the simplified tax system and UTII in comparison

- Minimum tax under the simplified tax system in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to report the transition to a simplified mode

The transition to the simplified tax system is of a notification nature. This means that if you meet the conditions listed above, then you simply need to notify the Federal Tax Service of your choice of a simplified regime. To do this, an application in form 26.2-1 is submitted to the tax office where the individual entrepreneur or LLC is registered with the tax authorities. We have already discussed the deadlines for submitting notifications in the table.

Form 26.2-1 was approved by Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3/ [email protected] , but continues to be valid now. Filling out the application is very simple, and if you fill out documents for registering an individual entrepreneur or LLC in our service, it will be prepared automatically.

We also advise you to read the detailed instructions for filling out an application for a simplified regime.

The tax office does not document the transition to a simplified regime. Typically, proof of this is the Federal Tax Service stamp on the second copy of the notification. But for greater confidence, you can request an information letter from the tax authorities in form 26.2-7. This document confirms that the taxpayer actually submitted a notice of transfer and submits returns under the simplified tax system.