Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

Sample of filling out the title page

Let's talk about the procedure for filling out the UTII declaration for the 3rd quarter of 2018 using an example.

Individual entrepreneur Nadezhda Arkadyevna Kuleshova provides hairdressing services (OKVED 96.02). In the hairdressing salon of N.A. Kuleshova. 4 employees work under employment contracts (total number ─ 5 people including individual entrepreneurs). In July 2021, she registered a cash register with the tax authorities. The cost of purchasing a new generation cash register (online cash register), setting it up and connecting it amounted to RUB 12,480.

To prepare a declaration for UTII Kuleshova N.A. I used the form recommended by the Federal Tax Service.

She filled out the main block of the title page as follows:

Filling out the title page of the updated UTII declaration form follows the usual rules - there have been no changes to it (except for the barcode). The sections are formatted according to the following scheme:

- First, the amount of UTII for the quarter is calculated (Section 2).

- Then the amount of expenses included in the cash register deduction is determined (Section 4).

- The amount of tax to be transferred to the budget is determined, taking into account the contributions paid and the amount of cash deduction (Section 3).

- The final data is transferred to Section 1.

You can also use another approach: first make all the necessary calculations (prepare the initial data), and then sequentially fill out all sections of the declaration with them.

Restrictions on the use of UTII

A businessman who wishes to apply UTII must make sure that he meets all the requirements for applying the regime:

- no more than 100 personnel;

- participation of organizations in the management company is no more than 25%;

- compliance of the type of activity with the list of household services;

- provision of services to individuals for a fee;

- regional legislation includes this type of activity.

A salon can use UTII only if the territory of the municipality where it is located allows the use of this special regime. For example, Moscow salons cannot switch to imputation.

Beauty salons cannot operate on UTII from January 1, 2021. Choose the most favorable tax system for your salon using our online calculator. Kontur experts held a webinar and talked about the transition from UTII, we collected the most interesting explanations in the article. If you don’t find the answer to your question, ask it in the comments, we will definitely answer.

For this special regime, the final consumer of cosmetic services can only be an individual. If a salon provides cosmetic services to a legal entity under a corporate agreement, imputation cannot be applied. Such services are subject to taxes according to OSNO or simplified tax system.

Requirements for hairdressers

SanPiN 2.1.2.2631-10 regulates the sanitary and epidemiological requirements for the location, design, equipment, maintenance and operating hours of public utility organizations providing hairdressing and cosmetic services.

So, hairdressing salons can be located either in a free-standing building or in an attached one, built-in or attached to residential and public buildings. That is, as part of consumer service enterprises and public shopping centers, beauty and health centers, baths, hotels and other public buildings.

At the same time, the legislation does not provide for any specific criteria for classifying business entities operating in the field of providing hairdressing and cosmetic services as this type of organization.

Thus, companies and merchants providing hairdressing and cosmetic services, regardless of whether such business entities belong to public utility organizations or not, can switch to the “imputed” regime.

How to register a beauty salon with UTII

The owner who opened a beauty salon is registered at the place where services are provided. Having opened several salons within the same district, it is enough to register with one of the inspectorates. And businessmen who open salons in several municipalities at once are registered in each of them. This means that you need to file a return and pay tax separately in each entity.

To register, submit a tax application in the form of UTII-1 for organizations and UTII-2 for individual entrepreneurs. From the day you started applying the imputation, you have 5 working days to submit your application. The day of transition to UTII is considered to be the date you indicated in the application.

How to calculate UTII tax for individual entrepreneurs in 2021

Payment period. The tax amount you calculate must be paid by the 25th of the first month after the end of the tax period. If the last day of payment falls on a weekend, transfer the money to the budget on the next closest working day. Payment deadlines in 2021:

- 1st quarter - until April 27;

- 2nd quarter - until July 27;

- 3rd quarter - until October 26.

At the end of 2021, UTII must be paid by January 25, 2021.

Payment details. You can pay tax only using the details of the tax service of the region where you operate. In this case, you must be registered as an imputation taxpayer. There are types of activities to which these standards do not apply:

- delivery and distribution trade;

- advertising in transport;

- passenger and cargo transportation.

Individual entrepreneurs engaged in these types of activities pay tax from the place where the main office of the enterprise is located, since the exact address of the activity is impossible to determine.

Liability for non-payment. If the tax was not paid on time, the individual entrepreneur will be held accountable. It could be:

- collection of tax shortfalls;

- a fine of 20% of the debt amount if the payment was not made by the payer unintentionally;

- a fine of 40% of the debt amount if non-payment of tax was intentional;

- For each day of delay, a penalty is charged.

Types of services that a salon can provide on UTII

Calculate UTII in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

The taxpayer himself chooses and indicates the code of the type of activity that he intends to carry out. Personal services to the population, as a rule, fall into the category of household services, since they are received by individuals on a reimbursable basis. But not all services provided by beauty salons fall under the list of household services approved by Decree of the Government of the Russian Federation dated November 24, 2016 N 2496-r. UTII includes:

- hairdressing services for men, women and children;

- make-up and make-up;

- eyebrow correction and tinting, eyelash extensions;

- face and neck skin care;

- hygienic massage of the face and neck;

- hygienic facial cleansing;

- piercing and tattooing;

- manicure and pedicure;

- SPA care;

- body care, hair removal.

To provide cosmetology or medical services, you must obtain a license. To do this, specialists must have diplomas and certificates, the equipment must be registered, and the premises must be checked by the SES and approved by the fire department.

Dog grooming

Recently, many owners of four-legged pets have been spending money on grooming their dogs. Therefore, special beauty salons for animals are opening everywhere. Such services are called professional grooming, that is, a haircut. This business is currently gaining momentum. However, it is not clear what tax regime should be applied in this case? Is it legal in such a situation to apply the “imputation” for the type of activity “providing other personal services” (code 93.05 OKVED) - the provision of pet care services, such as providing accommodation, care, supervision and training of pets, without the provision of veterinary services?

Let us immediately note that when running this business, OKVED will be different.

The all-Russian classifier of services to the population OK 002-93, approved by Decree of the State Standard of Russia dated June 28, 1993 N 163, classifies household services under code 018300, including “Pet grooming” under code 018317.

Thus, business activities related to the provision of dog grooming services are classified as household services. In relation to income received from this business, the taxpayer has the right to pay a single tax on imputed income. Such clarifications were given by the Russian Ministry of Finance in Letter dated February 28, 2013 N 03-11-11/84.

Calculation of UTII for a beauty salon

Calculate UTII in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

The reporting and tax period for UTII is quarterly, so you need to pay tax at the end of each quarter by the 25th of the next month. The single tax is calculated based on several indicators using the formula: UTII = (FP × BD × K1 × K2) × 3 × 15%.

Physical indicator (PI) depends on the type of activity. Beauty industry services are classified as household services. According to Art. 346.29 of the Tax Code FP for personal services - number of employees. If you're an individual entrepreneur, don't forget to count yourself.

Basic profitability (BR) is also determined taking into account the type of activity. For household services, it is 7,500 rubles per FP unit, that is, per employee. For calculating UTII, actual income does not matter.

K1 – calculated every year by the Ministry of Economic Development and depends on inflation. In 2021, the coefficient is 2.005.

K2 – reduction factor established by the constituent entities of the Russian Federation. To find out, study regional legislation in the “Features of regional legislation” section on the official website of the Federal Tax Service.

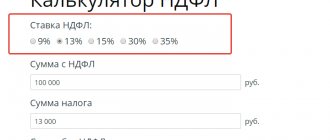

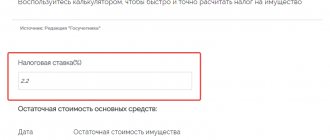

The tax rate in general is 15%, but regional authorities can set differentiated reduced rates from 7.5 to 15%.

An important advantage of imputation is the ability to reduce tax on insurance premiums. Individual entrepreneurs who work as one person and pay contributions only for themselves can reduce the tax by 100% and not pay it at all. Organizations and individual entrepreneurs with employees are limited in this; they reduce the tax by no more than ½.

Taxation of a hair salon

Established annually by the Ministry of Finance of the Russian Federation.

Important point: The amount of calculated tax on imputed income is reduced by the amount of social contributions made to extra-budgetary funds, but not more than 50% of the calculated tax value received.

An entrepreneur who is on UTII is required to submit a quarterly declaration to the Tax authorities at the place of registration for calculating imputed income.

An example of calculating UTII for a beauty salon

The staff of the Aelita salon includes 4 people, including individual entrepreneurs. The salary of each employee is 20,000 rubles, the annual wage fund is 720,000 rubles. Insurance premiums for employees per year are 216,000 rubles. The individual entrepreneur will make contributions for himself in the amount of 40,874 rubles per year, since the basic profitability does not exceed 300,000 rubles. Let's calculate the tax amount:

- UTII (month) = 4 × 7,500 × 2.005 × 0.65 × 15% = 5,864.6 rubles;

- UTII (year) = 5,864.6 × 12 = 70,375.2 rubles;

- Half of this amount can be deducted from insurance premiums paid, then UTII will be 35,187.6 rubles per year.

Calculation procedure

You can calculate the amount of UTII tax yourself. To do this you will need a formula:

UTII = DB × FP × K1 × K2 × tax rate , where

- BD - basic profitability, established by the Government and differs for each type of activity;

- FP is a physical indicator; the number of workers, the number of vehicles, etc. are taken into account;

- K1 - coefficient established at the federal level and in 2020 equal to 2.005;

- K2 - coefficient, established by local authorities;

- The tax rate is 15%, 10% or 7.5% depending on the region, activity and municipality.

The physical indicator for each type of activity and the basic profitability per unit are indicated in Art. 346.29 Tax Code of the Russian Federation. If you want to calculate the tax for the quarter, multiply the resulting value by 3.