Transfer deadlines for 2021: table

Transfer the calculated UTII amount to the budget no later than the 25th day of the first month following the expired tax period (quarter). This is stated in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation.

The deadline for paying UTII may fall on a non-working day. In this case, the tax must be transferred to the budget on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation). Below in the table we summarize the deadlines for paying UTII in 2021:

| Deadlines for paying UTII in 2021 | |

| For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 |

| For the second quarter of 2021 | No later than July 25, 2018 |

| For the third quarter of 2021 | No later than October 25, 2018 |

Definition of special mode

The single tax on imputed income is intended for a specific list of business transactions and is calculated on the basis of a legally established amount of revenue that is not interconnected with actual receipts from the sale of goods (works, services).

An entrepreneur carrying out activities falling under UTII in 2021 is not required to choose this particular regime.

To optimize taxation, it is necessary to make preliminary calculations for each system:

- general;

- simplified;

- patent;

- imputed;

- Unified Agricultural Sciences.

In addition to the financial aspect, the following criteria for applying UTII in 2021 are important:

- The individual entrepreneur's staff does not exceed 100 people.

- Types of activities are fixed by local legislation.

- In the region where the entrepreneur works, the imputed system is allowed.

- Individual entrepreneur is not a payer of the Unified Agricultural Tax.

- The businessman does not enter into transactions under simple partnership and trust management agreements.

- The entrepreneur does not rent out gas stations and gas stations.

- The activity is not subject to sales tax.

UTII provides an opportunity for a businessman not to pay personal income tax, VAT and property tax in relation to objects falling under the imputed regime.

Where to send payments for imputation

In 2021, pay UTII according to the details of the Federal Tax Service, which has jurisdiction over the territory where the “imputed” activity is carried out. In this case, the organization must be registered by the Federal Tax Service as a payer of UTII (clause 2 of Article 346.28, clause 3 of Article 346.32 of the Tax Code of the Russian Federation). However, if there are certain types of business that these rules do not apply to, namely:

- delivery and distribution trade;

- advertising on vehicles;

- provision of services for the transportation of passengers and cargo.

For these types of businesses, organizations do not register as UTII payers at the place of business. Therefore, UTII will be listed at the location of the head office.

Payers

Business entities that meet the criteria specified in the legislation have the right to choose a special taxation system.

All types of activities on UTII in 2021 for individual entrepreneurs are specified in the Tax Code of the Russian Federation and are adjusted by decisions of regional authorities:

- Satisfying the household needs of the population.

- Treatment of animals.

- Car repair services, including cleaning.

- Transportation of people and goods.

- Piece sales of goods in premises up to 150 square meters. m.

- Retail trade in permanent and mobile networks.

- Renting out parking areas. This includes ensuring machine safety.

- Catering services with a department for visitors up to 150 sq. m. or without a special room.

- Outdoor advertising on devices and vehicles.

- Hotel activities and rental housing up to 500 square meters. m.

- Rent of retail outlets and land plots for retail and catering.

Each item has a detailed description in accordance with the OKVED and OKP codes. In addition, there are codes for the types of entrepreneurial activities of UTII, which are used when filling out the imputed regime payer registration form, deregistration and drawing up a tax return.

When receiving individual entrepreneur status, the applicant correlates his type of business transactions with information from the classifier. If these numbers are in the permit list of local legislation, and all other necessary conditions are met, then the payer has the right to UTII.

The capital of Russia has established a ban on the operation of the imputed regime in the city since 2014.

Responsibility in 2021

For failure to pay UTII in 2021, the payer may be held liable in the following ways:

- collection of arrears under UTII (clause 2 of Article 45 of the Tax Code of the Russian Federation);

- application of a fine in the amount of 20 percent of the unpaid UTII tax, if this happened without the intent of the payer (clause 1 of Article 122 of the Tax Code of the Russian Federation), or a fine in the amount of 40 percent of the unpaid tax, if non-payment was the result of intent (clause 3 of Article 122 of the Tax Code of the Russian Federation ).

For payment of UTII late (for example, if you accidentally transfer UTII later for the 1st quarter of 2021), the damage caused to the budget is compensated by calculating and paying a penalty for each day of delay (clause 2 of Article 57, clauses 1, 3 of Article 75 of the Tax Code of the Russian Federation) .

Read also

14.12.2017

The nuances of filling out payment slips for paying UTII

When filling out a payment order for payment of UTII, you need to pay attention to the following points:

- In field “104” the KBK is entered. It should be noted that the imputation codes remain the same. You can view the KBK for UTII for indicating taxes, penalties, fines or interest on the payment in this and this materials.

- In field “105” the OKTMO code is recorded, which corresponds to the type of activity of the “imputed person”.

In the “110” field there is no need to indicate the characters “NS” or “PE”, as well as other previously provided abbreviations for this field. The need to cancel filling out this detail is due to the fact that this information can be seen from the KBK. For a sample of filling out a payment order for the payment of UTII, see here.

Which individual entrepreneurs cannot use UTII

Article 346.26, paragraph 2.2 of the Tax Code of the Russian Federation defines cases when an individual entrepreneur cannot apply UTII:

- With a staff of more than 100 people, except for cooperatives founded by the decision of the consumer union (society).

- Having 25% of shares owned by another legal entity.

- Those who have received the status of a partnership or community using property on the basis of a trust agreement.

- Rental cars, gas stations...

- Operating in other regions of Russia or having branches.

- Engaged in insurance activities, personnel selection, purchase of valuables, production of excisable products, extraction, and sale of valuable minerals.

- Providing notary and financial services.

- Introduced a single agricultural tax.

- Developing and implementing computer programs.

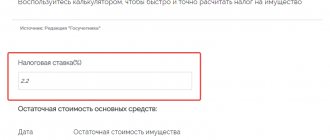

- With a residual value of fixed assets over 150 million rubles.

- Those who did not notify the tax service about the transition to UTII within the time limits established by law (Article 346.13 P.P. 1-2 of the Tax Code).

If at least one payment was made under other tax systems such as the simplified tax system or OSNO, UTII cannot be applied without their cancellation.

How to reduce UTII

To reduce taxes, you should analyze the performance of employees and the use of production (trade) space. Increasing the efficiency of these indicators affects the reduction of the base tax rate.

Exceeding social payments of the tax amount will also reduce its size by a maximum of 50%.

The use of cash registers reduces the amount of the single annual payment by 18,000 rubles. The period for mandatory use of cash registers has been extended until July 1 of this year.

Definition of a single tax

Calculating the amount of UTII for individual entrepreneurs in 2021 directly depends on the nature of business transactions. Each type of activity is assigned a fixed level of monthly profitability by law, which relieves entrepreneurs from controlling the amount of revenue.

The second parameter that affects the single tax and is directly related to the type of business is the physical criterion.

The imputed tax for individual entrepreneurs with any type of activity in 2021 is calculated as follows:

EN = Fixed income x Indicator x Coefficient. 1 x Coefficient 2 x 15%

The first coefficient is used to take into account inflation processes, is set annually, and in 2021 it is adopted as 1.868. The second adjustment factor is used by municipalities to reduce the burden on certain categories of payers; the value ranges from 0.005 to 1.

Example.

An individual entrepreneur rents out an apartment with a living area of 25 sq. m. m. Coeff. 2 = 1.

UTII for a full month is: 1000 x 25 x 1.868 x 1 x 0.15 = 7005 rubles.

If the pay period is interrupted, the payment is reduced in proportion to the time worked. For example, an individual entrepreneur registered UTII status on the 11th. Then the tax is multiplied by 20 days of activity and divided by 30 total days in the month: 7005 x 20: 30 = 4903.50 rubles.

KBK for UTII for paying taxes, penalties and fines for individual entrepreneurs 2019-2020

The budget organization code depends on the purpose of payment. The data is presented in the following table:

| UTII in 2021 for individual entrepreneur KBK (tax code itself) | 182 1 05 02010 02 1000 110 |

| Penalty code | 182 1 05 02010 02 3000 110 |

| KBK penalty UTII | 182 1 05 02010 02 2100 110 |

Penalty is a sanction that is accrued daily for late payment of an obligation. Unlike a penalty, a fine is imposed for a specific violation. Despite the direct relationship of sanctions to “imputation”, the Code of Criminal Code of fines and penalties differs from the code of the tax itself. It is recommended to save the data so as not to confuse the direction of the money.

Imputation: how to calculate tax

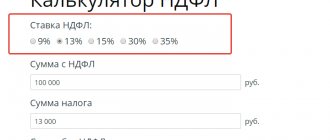

Important! Imputation tax is calculated at a rate of 15% of the taxable base - this rate is standard by law. But starting from 2021, authorities of municipalities, city districts and federal cities have been given the right to reduce it. The tax rate can be set from 7.5 to 15%.

This may be a big plus for some taxpayers. Why is this so? It is beneficial to use UTII when the actual income is greater than the imputed one, since the tax is calculated from the latter. Plus, there is also the possibility of using a reduced rate - the tax burden for some will be reduced.

Imputation tax is calculated at a rate of 15% of the taxable base. For UTII, the base is imputed income - that which can be received by an individual entrepreneur whose business has certain physical characteristics. It is considered as the product of the basic profitability and the actual expression of a particular physical characteristic and is adjusted by special coefficients.

For simpler and more convenient accounting and tax accounting for UTII, we recommend using the “My Business” service.

The algorithm looks like this:

VD (base) = DB * (F1+F2+F3) * K1 * K2, where

VD – imputed income,

DB – basic profitability,

F – physical indicator of a business for a specific month (3 values = 3 months in a quarter),

K1 – deflator installed for UTII;

K2 – coefficient for database adjustment.

Let's look at each element of the formula.

Basic profitability is the potential amount of income, that is, the amount that an individual entrepreneur can receive as a result of work at the end of the month. Indicated in the Tax Code as a value per unit of physical indicator. Both of these values are approved by the Tax Code for all types of activities corresponding to UTII (Article 346.29).

Example: the imputed income of an individual entrepreneur providing household services, without taking into account adjustments for the month, will be the product of the number of employees and the basic income of 7,500 rubles. Let's say there are only 5 people working, their number did not change in the first quarter.

VD (month) = 7,500 * 5 = 37,500 rubles

VD (1st quarter) = 7,500 * (5+5+5) = 112,500 rubles

Deflator (2019) = 1.915, and let the value of K2 be 0.8. Let's calculate the adjusted value of the individual entrepreneur's imputed income for the quarter:

- VD (1 quarter) = 7,500 * (5+5+5) * 1,915 * 0.8 = 172,350 rubles

- UTII = 172,350 * 15% = 25,853 rubles

Physical indicators. This is some characteristic of an individual entrepreneur’s business. Each activity has its own indicator.

Example: for cargo transportation, the number of vehicles is taken into account; for passenger transportation, the number of boarding places is taken into account.

The individual entrepreneur is obliged to organize the recording of such indicators; a journal in free form is sufficient, which will reflect the change in its value by month. For LLCs on UTII, such accounting is regulated, since they are entrusted with the responsibility for maintaining accounting records.

Odds. These are adjustment parameters. K1 is set by the Ministry of Economic Development; in fact, it is a deflator. Its validity period is one year. In 2021, the K1 value was 1.868, and from January 1, 2021 – 1.915.

K2 is approved by the authorities of the constituent entity of the Russian Federation, taking into account the specifics of doing business in the territory of the region / territory / republic. Not only the coefficients between subjects of the Russian Federation may differ, but also the coefficients between regional territories within the same region.

It is possible to set K2 within the range from 0.005 to 1.

It is also possible that it is not the coefficient itself that is set, but its parts—subcoefficients.

Example: on the territory of a certain city it is established that the value of K2 is calculated as the product of the coefficients K2.1 and K2.2. For your activity K2.1 = 0.4, K2.2 = 0.9.

When calculating UTII you must use the K2 value:

K2 = 0.4 * 0.9 = 0.36

K2 is set for a year; if a new law has not been adopted on the territory of a constituent entity of the Russian Federation, then the K2 values of the previous year apply in the new year. If there is no such regulatory act on the territory of a subject of the Russian Federation, then K2 = 1 is used by default.

When calculating UTII tax payable, it is important to take into account insurance premiums. So, what fees are generally paid:

- Individual entrepreneurs without employees pay insurance premiums for themselves;

- Individual entrepreneurs with employees pay insurance premiums for their employees at current rates and for themselves.

When applying UTII, insurance premiums can be deducted at the time of tax calculation. Since the tax period for imputation is a quarter, only contributions transferred for the same period can be deducted from the tax amount to be transferred in a particular quarter.

Individual entrepreneurs are required to transfer contributions in a fixed amount for themselves strictly before December 31 of the reporting year. The amount of these contributions for 2021 is 36,238 rubles (29,354 rubles for pension insurance and 6,884 rubles for medical insurance).

You can pay as before: you can divide this amount into four parts and pay quarterly, or you can pay once.

If the annual income of an individual entrepreneur exceeds 300 thousand rubles, then the difference in excess must also be paid 1% to the Pension Fund. The deadline for paying 1% in the Pension Fund is July 1 of the next year, but it is not prohibited to transfer money in the current year.

Important! In 2021, the total amount of pension insurance contributions (29,354 rubles + 1% of the excess) cannot be more than 234,832 rubles.

An individual entrepreneur can deduct:

- all insurance premiums are borne by himself if he does not hire employees;

- insurance premiums for yourself and for employees, if any (but the tax can be reduced only by 50% of its amount) - this is also one of the changes, starting in 2021; previously, individual entrepreneurs with employees could only deduct contributions for employees.

Is it possible to combine imputed tax with other tax regimes?

The current Tax Code allows for the combination of imputation with other tax systems, since UTII is used only for a limited number of types of activities.

The combination can be carried out with a general regime, a simplified regime, as well as an agricultural tax. But it must be remembered that in order to correctly calculate the amounts of taxes for each system, it is necessary to keep records of property, income and expenses for each of them separately.

If the general regime and imputation are combined, there is a nuance in calculating property tax. The subject, when determining this tax for the purposes of the general system, must exclude from the calculation all property that is used for activities on UTII.

Cash transactions

Although the size of UTII does not depend on the actual income of the business, to protect consumer rights, the law obliges entrepreneurs to issue checks or BSO.

From July 1, 2018, individual entrepreneurs on UTII with hired employees, conducting retail trade or providing catering services, are required to use the new cash register system. From July 1, 2019, all other categories of imputed tax payers will have to purchase online cash registers.

To take advantage of the opportunity provided by law to take into account the costs of purchasing cash register equipment when reducing UTII, the following conditions must be met:

- For retail trade and catering services, for individual entrepreneurs with employees, register an online cash register before 07/01/18.

- For the same types of activities without hired staff, register a new cash register before July 1, 2019.

- For all other individual entrepreneurs on UTII - mark the cash register in the Federal Tax Service until July 1, 2019.

The amount for applying the deduction is limited to 18,000 rubles. for each piece of equipment. This also includes the costs of the fiscal drive, software, installation and commissioning of equipment.

Advantages of UTII for individual entrepreneurs

- Exemption from paying taxes on value added (VAT), profit, property.

- Replacement of income used as the basis for calculating the amount with other values specified in Article 346.29 of the Tax Code.

- Possibility of quarterly transfer of taxes and insurance contributions.

- Accounting for the amount of all previously made payments.

- Adjustment of the base amount by eliminating the cost of cash registers, the costs of their installation, configuration, and maintenance.

The use of a single tax does not exempt individual entrepreneurs from paying income tax, transfers to the pension fund, or health insurance fund.

In case of suspension of his activities, the entrepreneur does not have the right to independently stop the deduction of UTII. This requires permission from the tax service.