Participants in property and tax relations sometimes have to go to court to resolve controversial issues, resolve contradictions that have arisen, and hold violators of the rules accountable and properly fulfill their obligations.

For the losing party, such cases and proceedings can have serious financial consequences.

A typical situation is when the court makes a reasoned decision that obliges the defendant to make certain payments in favor of the plaintiff.

Such a court verdict often becomes the basis for bailiffs to open enforcement proceedings to collect the corresponding debt from the obligated person.

In order to make the necessary payments under the writ of execution of the Federal Bailiff Service (FSSP), the payer must form an order to the servicing bank to transfer the required amount of money to the provided details.

It is necessary to find out how such an order is drawn up.

Standard

The new rules are due to the adoption of several regulations.

- Federal Law No. 12-FZ of February 21, 2019 “On Amendments to the Federal Law “On Enforcement Proceedings”;

- Directive of the Central Bank No. 5286-U dated October 14, 2019 “On the procedure for indicating the type of income code in orders for the transfer of funds,” registered with the Ministry of Justice on January 14, 2020;

- Letter of the Central Bank No. 45-1-2-OE/8224 dated 06/08/2020.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

For a person who loses a case with financial consequences in a court hearing, the Federal Bailiff Service opens its own proceedings, and further financial settlement for payments ordered by the court will be made exclusively through this enforcement structure.

Codes

Law 12-FZ establishes that persons paying a citizen a salary or other income, in respect of which Article 99 FZ-229 (on enforcement proceedings) establishes restrictions or for which, in accordance with Article 101 229-FZ, cannot be levied, are required to indicate in the payment documents the corresponding code for the type of income.

What is it for? The fact is that the bank needs this information in order to understand whether it is possible to write off funds from the amount received on the card according to the executive document or not.

Central Bank Directive No. 5286-U regulates the procedure for indicating the code in the payment order. The code of the type of income is indicated in detail 20 “Name. pl." payment order.

List of codes and cases of their use:

When transferring funds that are not income, for which restrictions are established by Articles 99, 101 of Federal Law No. 229-FZ, the type of income code is not indicated.

When is a payment made to the FSSP?

To ensure the collection of certain payments ordered by the court, the bailiffs send the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details.

In essence, this order is a writ of execution, which gives it the necessary legal force.

A document demanding repayment of obligations under a court decision can be sent to the payer either at the place of his employment (in this case, the debt will be officially deducted from the payer’s earnings), or to the address of his actual residence (if the obligated person is not employed).

In the practice of bailiffs, it is customary to divide writs of execution into the following types:

- collection of tax debts;

- repayment of non-tax debt (loan obligations, housing and communal services payments, penalties, alimony payments, other penalties).

If, for example, a sum of money ordered by the court for payment is withheld according to a writ of execution from the salary of the obligated person (payer), the accountant of the employing organization draws up and sends a special payment to the bailiffs to the servicing bank.

As a rule, an authorized FSSP employee who supervises (conducts) a specific enforcement proceeding officially provides the employing organization with a sample of such an order, already containing all the necessary details.

Thus, the financial institution carries out the designated payment transactions according to these orders, transferring the money directly to the FSSP authorities.

Bailiffs accept the appropriate payment, register it in the prescribed manner, and then forward it to the actual (target) recipient, who is the beneficiary of the enforcement proceedings.

The funds from this payment can be sent to a budgetary structure, an economic entity, another organization or a specific individual.

Purpose of payment

Federal Law 12-FZ introduced another innovation for accountants.

Persons paying wages or other income to the debtor by transferring them to the debtor’s bank account, from June 1, 2021, were required to indicate in the payment order the amount collected under the writ of execution.

The Central Bank explained how to do this in letter No. IN-05-45/10 dated February 27, 2020.

When transferring income from which amounts were withheld under executive documents, in the “Purpose of payment” details you must indicate:

- symbol "//";

- combination of letters “VZS”, that is, the amount collected;

- symbol "//";

- the amount collected in numbers (rubles from kopecks must be separated by a dash sign “-„, if the collected amount is expressed in whole rubles, then after the dash sign “-” “00” is indicated);

- symbol "//".

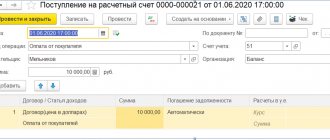

For example, when withholding alimony in the amount of 10,000 rubles, the following is indicated: //VZS//10000-00//.

What is it for? The fact is that executive documents also come to banks where employees have accounts. And it turns out that the bank does not know that some income has already been withheld within the amount established by law.

conclusions

The payment, through which tax/non-tax debts are collected by bailiffs, is drawn up according to the typical form of an order to transfer money from a bank account.

However, when filling it out, you should always follow certain rules. It is recommended that the details required to be reflected in such a payment order be clarified in advance with the FSSP authorities.

This will avoid problems with the correct formation and timely execution of the payment document.

Example 3

Child benefit was transferred to the employee

By the way, the payment card for transferring child care benefits has one more feature. The Central Bank indicated this in a letter dated August 14, 2019 No. 45-1-2-07/22917.

The fact is that some benefits, including child care benefits up to 1.5 years old, must be transferred to a bank account attached to the Mir card. This applies to payments assigned after May 1, 2021.

In this case, the payment slip must indicate code 1 in the “110” field.

Sample of filling out a payment order to bailiffs

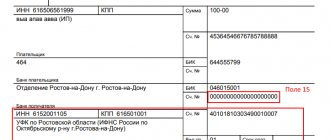

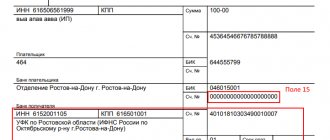

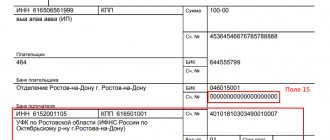

For clarity, let’s look at filling out a payment slip to the FSSP using a conditional example.

Let’s say that ICS LLC, on the basis of writ of execution dated August 19, 2019 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

The organization will fill out the payment order as follows:

- will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer;

- will indicate 19 as the payer status;

- the individual’s identifier will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

- the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

- instead of UIN will put 0;

- payment order 4th;

- OKTMO - the one that is installed at the location of the FSSP management;

- fields 104, 106, 107 and 109 will contain 0.

You can view and download a completed sample payment order to bailiffs on our website.

If you need to fill out a payment order for the transfer of alimony from an employee’s income, then a ready-made solution from ConsultantPlus experts will help you. Get trial online access to K+ for free and proceed to the sample.

Do you have any unresolved questions regarding filling out payments to bailiffs? You can find the answers to them in the Ready-made solution from ConsultantPlus. Follow the link and get trial online access to K+ for free.

How to transfer insurance premiums

After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:

- compulsory pension insurance,

- compulsory health insurance,

- social insurance in case of temporary disability and in connection with maternity,

are paid to the tax authorities. Previously, they were transferred directly to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund, respectively.

The rules for processing payment orders for tax payments are established by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

All employers who hire employees pay contributions from the amount of wages paid. The transfer deadline is until the 15th day of the month following the billing month.

Features of filling out a payment order for payment of insurance premiums

| Field | Field name | Specified value |

| 101 | Payer status | 01 |

| 104 | KBK | OPS: 18210202010061010160. Compulsory medical insurance: 18210202101081013160. SS in case of VNiM: 18210202090071010160. |

| 105 | OKTMO | 8-digit code according to the classifier |

| 106 | Basis of payment | TP - transfers of the current year. ZD - voluntary repayment of debt. TR - repayment of debt on demand. AP - repayment of debt according to the inspection report. |

| 107 | Taxable period | In MS.month.year format. For example, when paying for May 2021, you should indicate: MS.05.2018. |

| 108 | Document Number | For current payments, “0” is entered. If payment is made on demand, then the request number. |

| 109 | Document date | For current payments, “0” is entered. If payment is made on demand, then the date of demand. |

| 24 | Purpose of payment | Information about the type of payment and payment period. |

Samples of filling out payment orders for payment of insurance premiums:

- for compulsory pension insurance;

- for compulsory health insurance;

- for social insurance in case of VNiM.

KBK 3220000000000000180

Often citizens receive payment orders in which bailiffs indicate the details. KBK 3220000000000000180, the decoding of which is incomprehensible to most citizens, means that the citizen missed a payment under the writ of execution. Missing payments ordered by a court hearing will result in a fine, which is coded by this number. A receipt with this code must be paid within five working days, otherwise a further fine will be assessed.

Sep 10, 2019adminlawsexp

voice

Article rating

What you shouldn't forget

The executor of the bailiff's claim, regardless of whether he is directly the debtor or the entity holding the debt and transferring it to the FSSP, should remember two important aspects of liability for failure to comply with the bailiff's decision.

The debtor, or a business entity that ignored the request of the bailiff service for forced repayment of the debt, bears liability, the limits of which are established by Article 17.14 of the Code of Administrative Offenses of the Russian Federation.

If the employer maliciously evades the execution of the order, his actions may be interpreted as a criminal offense under Art. 315 of the Criminal Code of the Russian Federation.

Payment order for a writ of execution, sample for bailiffs:

Grounds for collection

For the payer, the basis for collection is the payment order for the enforcement fee issued by the bailiff service. Such a request can be sent by bailiffs:

- at the payer’s place of work, to pay off the debt by deducting from wages;

- at the payer’s place of residence (for unemployed persons).

The bailiff issues a financial claim as part of enforcement proceedings, on the basis of a court decision on the repayment of tax or non-tax (alimony, fines, utility bills, loans, etc.) debts. Such an order has the force of a writ of execution.

When deducting the claim amount from the payer's salary, the accountant fills out a payment slip to the bailiffs, a sample of which, indicating the recipient's details, must be provided to the employer by the responsible representative of the FSSP in charge of the proceedings. A transfer is made in favor of the bailiffs, who, in turn, having registered the payment, send it to the address of the individual, government agency or organization in whose favor the enforcement proceedings have been opened.

Why are budget classification codes changing?

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

There are 4 types of KBK:

- relating to government revenues;

- related to expenses;

- indicating the sources from which the budget deficit is financed;

- reflecting government operations.

- organize financial reporting;

- provide a unified form of budget financial information;

- help regulate financial flows at the state level;

- with their help, the municipal and federal budget is drawn up and implemented;

- allow you to compare the dynamics of income and expenses in the desired period;

- inform about the current situation in the state treasury.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods.

There are various versions put forward by entrepreneurs and the Ministry of Finance and the Ministry of Justice do not comment in any way.

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

FOR YOUR INFORMATION! There are opinions that since this coding is an internal matter of the Treasury, it should be done by them, and not by taxpayers. The KBK code can be assigned by bank employees based on the specified data about the recipient and purpose of the payment, or by treasury employees upon receipt of it.