There are several options for deregistering a cash register: when contacting the tax office or through your personal account on the Federal Tax Service website. But tax authorities can do this forcibly. Let's take a closer look, how to deregister an online cash register.

The owner can do this on his own initiative if:

- transfers the cash register to another user,

- equipment was stolen or lost,

- the device is broken.

You must submit an application to the tax office to deregister the cash register (KND form 1110062) no later than one business day after the transfer or discovery of the theft. Take the document in person or send it online. Below on the page is an application template and instructions on how to deregister an online cash register through your personal account on the Federal Tax Service website.

Causes

The online cash register must be deregistered from the tax office directly by its owner. That is, to the person to whom it is documented and who was involved in registering the device. But in some cases, the Federal Tax Service handles the procedure without the participation of the businessman.

The owner deregisters the cash register on the following grounds:

- the cash register becomes the property of another person, which often happens in the case of sale, lease or other similar consequences;

- the online cash register is lost or stolen;

- The CCP has lost its functionality as a result of a breakdown and cannot be repaired.

Situations forcing tax authorities to deregister a cash register without the participation of a businessman:

- non-compliance of the device with established requirements, as a result of which its use is contrary to legal norms;

- the period of validity of the FN ended more than a month ago, and the owner of the cash register did not replace the drive in a timely manner;

- the business entity ceased its activities, which was recorded in the state registers of individual entrepreneurs or legal entities.

When a cash register is deregistered unilaterally, the owner is notified of this by mail or online (a notification is sent through the user's personal account on the Federal Tax Service website).

If the fiscal drive fails, while the functionality of the cash register is maintained, as evidenced by the normal operation of another FN installed in the device, deregistration of the cash register is not expected. A damaged drive must be replaced, followed by re-registration of the cash register.

Reasons

So, let's look at what situations can lead to such a decision. It is worth understanding that entrepreneurial activity is a purely voluntary matter, and its termination is possible at any time. So, in fact, explaining something to the Federal Tax Service when closing the operation of cash registers is a whim. But if this is not done, then additional questions may arise. Therefore, in most cases it is logical to choose the lesser evil.

How to deregister an online cash register with the tax authorities yourself, voluntary closure

The manager is free to simply get rid of the current equipment at the enterprise and acquire new ones. But in most cases, no one will throw away properly working devices. This is simply an unprofitable move. It’s another matter when the requirements of new legal norms forced a complete change in cash discipline.

Of course, upon termination of activity and liquidation of a legal entity, everything will also have to be closed. Ordinary cases of a business entity:

- Breaking. This implies a level of malfunction that makes further operation virtually impossible. For example, if the equipment has external damage that, in principle, does not prevent it from working normally, but spoils its visual appeal, this does not apply to this case. Of course, the device will be replaced; no one wants to spoil their reputation by showing external damage to the client at the point of sale. It looks unflattering. But there will be no actual breakdown. And if the machine simply cannot perform its functions, then this is our case.

- Sale or transfer. Even if the owner has not changed, the closing procedure is still implied. Deregistration of a cash register with the tax office is necessary if the device has been transferred to another branch, city, or even another point of sale, and the same is necessary if the owner has changed after the transfer, that is, a donation has occurred.

- Theft. The rarest case. Considering modern security measures, constant video surveillance at product distribution points, security, it is difficult to pull off such a maneuver. However, rarely does not mean never. And in this case, the fact of theft will still need to be proven. Without evidence, an audit will clearly be triggered to reveal intent to conceal or evade taxes. This is the procedure according to which the inspection works.

Forced deregistration of a cash register with the tax office

Let's move on to the moments when the service itself, without the consent of the owner of the equipment, blocks the reporting of the device. There are also few such options.

- Upon liquidation of a legal entity. Moreover, regardless of whether it was a voluntary termination of activity or, for example, bankruptcy. As we clarified, you can submit an application yourself. But according to the general rules, the Federal Tax Service organizes the procedure on its own. The start will coincide with the date the record is deleted from the corresponding database. Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, depends on whether the company operated on the basis of individual entrepreneurship or as an LLC.

- In case of violations. If the performance and functional properties do not meet the requirements of current legislation. This usually implies the fact of using outdated technology. After all, all new products on the market are produced taking into account current rules and regulations.

- When the service life of the drive is exceeded. Moreover, even if the machine works completely properly, there are no failures or malfunctions. The period allotted by the manufacturer has expired; the service must be notified immediately. However, she herself will react even without a statement.

Deadlines

A very strict limit is set. Exactly one day is given for everything. That is, we are talking about a voluntary basis. If there is a breakdown, theft, loss, sale, etc. It is noteworthy that during this time it is also necessary to collect evidence if we are talking about theft. And only then forward the data. If you didn’t manage to complete it in one day, get ready for fines. Therefore, it is important to act quickly and also quickly receive and process information. And for this it is necessary that the entire structure operates on modern software and is managed by a competent person who personally accepts responsibility.

For the best and most customized software, it is recommended to contact. It specializes in programs intended for the Russian market, taking into account local legislation and all its nuances that have appeared recently or are just planning to be implemented.

As for the question of how to deregister a cash register with the tax office - if violations have occurred or the service life has expired, then time does not matter. After all, this is already the competence of the Federal Tax Service. So, they decide for themselves how quickly to react. But to the credit of the organs, it must be admitted that they usually also fit in just one day.

How to deregister an online cash register owner

Let's look at how to deregister an online cash register. The action algorithm is as follows:

- 1. Formation of the corresponding application for the purpose of sending it to the Federal Tax Service. The application is submitted in paper or electronic form. The regulatory authority has not established strict rules regarding the form of this document.

- 2. Creating a report on closing a financial fund. The drive is not used at another cash register, so it is considered already “used material”. Data from the report on closing the FN archive is submitted to the tax office along with the application. Exceptions are cases when it is impossible to remove the report (the drive is lost or out of order).

- 3. Receiving a card about deregistration of the device.

Each stage is discussed in more detail below.

How to understand that the procedure is completed

Having figured out how to deregister an online cash register with the tax office, you also need to find out in time that the process was successful. After all, in case of refusal, if we missed something, made a mistake, then time becomes a very important indicator. After all, we remember the short time frames allotted to us by the service. Many managers, after sending, simply close the page and do not appear there until the next need. Without even suspecting that at the moment they may already be breaking the law. And serious fines are increasingly looming on the horizon. And it’s good if only they are, and not accusations of criminal intent.

And the verification procedure itself is simple to the point of primitiveness. Just go to the same menu and see the fate of the application. If everything went well, we will see a confirmation with a green checkmark. Or a refusal with a red cross. In principle, you can also rely on the card that the service will send within five days. Again, if there was approval.

Filing an application

The first stage of deregistration of a cash register is the formation of a corresponding application. As mentioned above, it can be in electronic or paper form.

The application can be submitted:

- through your personal account on the Federal Tax Service website;

- upon a personal visit to the nearest branch of the Federal Tax Service;

- in your OFD personal account.

To certify an electronic document, an electronic digital signature is used, which was issued to the owner of the cash register or his authorized representative.

Submitting an application in your personal account on the Federal Tax Service website

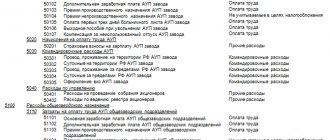

Since May 29, 2017, Federal Tax Service Order No. ММВ-7-20/ [email protected] , approving the application form.

The application shall indicate the following information:

- name of the company (as in the constituent documents) or full name. Individual entrepreneur, if he is the owner of the cash register;

- TIN;

- CCT model;

- number assigned to the equipment at the manufacturer’s plant;

- reason for deregistration of equipment.

The application includes a section where data from the report on closing the financial fund is indicated. It is filled in after the corresponding procedure has been completed.

Paper application form

Applications for deregistration of the cash register with the tax office can be found here (KND form 1110062).

If the reason for deregistration of the cash register is its transfer to another owner, the application is generated within 1 business day from the moment the transaction is concluded. The same period is given if the fact of theft or loss of the device is discovered. If there is a breakdown of the cash register or financial register, an application for deregistration is submitted within the next 5 working days.

Contents of the statement

Compilation instructions vary depending on the form. While we will sort out the paper one, the transfer is implied in person when visiting the department. Although, in most cases it is more logical and convenient to send a request remotely.

Remember about the application deadline so as not to provoke the service into penalties. You must use a standard form, which can be easily found online. For example, on the website of the same tax authorities.

The following points must be indicated in the application:

- Taxpayer details. This refers to the TIN of the legal entity. Necessary for both individual entrepreneurs and LLCs.

- Information about the organization. Indicate the name, legal and physical address.

- The reason why technology should, in principle, be eliminated from monitoring. In most cases, if this is a voluntary decision, then this is not the most important point and can even be omitted. But if theft is implied, then it is strictly necessary to voice this point.

- Information about who submits the application. This can be either a directly authorized third party, that is, a representative, or a director, founder, or owner of the company.

Also, to the question of how to close an online cash register at the tax office, something else should be added. Namely, what needs to be supplemented with the application.

Generating a report on closing a financial fund

Before deregistering the cash register, the user generates a report on the closure of the financial fund. The data contained in it is transferred to the Federal Tax Service along with the application.

If it is impossible to generate a report on closing a financial fund because it is out of order or the cash register was stolen (lost), providing such data is not required. Also, the reason for the lack of performance of the drive may be a manufacturing defect. In this case, it is also not always possible to read data from it.

Confirmation of the loss of functionality of the FN is a document from the manufacturer, to whom the device is sent for examination. Its results must be ready no later than 30 working days from the date of receipt of the drive by the manufacturer. He transfers them both to the user himself and to the tax authorities through the cash register office.

If the ability to read data from the device’s memory is confirmed, the user must transfer it to the Federal Tax Service within 60 days from the date of generating an application to deregister the cash register. The examination is carried out by the manufacturer free of charge if the cause is defective products.

If the fiscal drive is operating normally, a report on its closure is generated according to the following scheme:

- 1. Make sure that the OFD of all checks based on the results of cash transactions is sent. If not all data is transferred to the operator, an error will be displayed when archiving information on the FN. You can view the number of untransmitted fiscal documents in the shift closing report or in the cash register service settings (depending on the model). The number should be “0”.

- 2. Generate a report by selecting the close archive command (detailed instructions can be found in the user manual developed for a specific model).

- 3. Extract the FN after generating the check.

Additional documents

The first of these is a report - taking the latest data from the registrar, which is necessary to complete the procedure. If the equipment itself functions, then there will be no problems with this. The situation is much more complicated if it is damaged. Moreover, the nature of the breakdown also matters. In case of any malfunctions associated with cash register equipment that did not affect the fiscal registrar itself, it can simply be removed. But if it has become unusable and it is no longer possible to obtain data from it, the nature of the task changes.

You will need to submit a request directly to the manufacturer. Explain the situation, point out the need for reporting. According to the law, he cannot refuse in this case. A technician will arrive and either take the equipment with him or solve the problem on site. In this option, additional time is allocated during which information must be retrieved. This is up to 60 calendar days from the date of application.

But if a theft has occurred, then it will no longer be possible to provide any results, and the Federal Tax Service, by law, cannot even demand them. But at the same time, it is able to initiate a check, which is designed to identify the presence or absence of theft. Employees will be guided by evidence of appeals to the authorities. Therefore, as soon as the responsible person suspects a crime, theft of an object, you must immediately submit an application to law enforcement agencies. There, receive a coupon stating that the application has been accepted, and save it together with a copy of the application itself, and then present it during verification. You can also act preventively. That is, when the fiscal drive is deregistered, attach all the documents received from the police to the shipping documents.

Card on deregistration of cash registers

The cash register is considered deregistered from the day the tax authority generates a deregistration card certified by an enhanced CEP. It is sent to the device owner electronically within 10 days from the date of application.

It contains the following information:

- name of the organization, and if the user of the cash register is an individual entrepreneur, then his full name. fully;

- TIN;

- model name;

- number assigned to the equipment at the manufacturer's factory;

- date of deregistration of the cash register.

Upon request, the Federal Tax Service is obliged to provide the card in electronic form, and if the entrepreneur expresses a desire, then on paper.

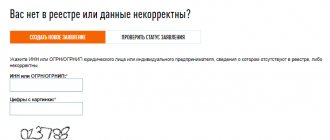

We work through your personal account

Let's move on to the remote form. It is more convenient, modern, reliable. And in the lion's share of cases, it is logical to use it. Moreover, if you take into account the short time frame that the law allows for the implementation of this action, namely a day, in the usual form you simply may not have time.

To work, we will need an account on the Federal Tax Service website. It is necessary to create a profile in advance; this is not currently required by law, but in principle, without your own account, many procedures will be greatly complicated.

Next, we follow a simple algorithm:

- We log in to the site or go through the registration process if we have not previously created our taxpayer profile.

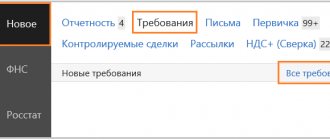

- You will need the CCP section, which can be found in the top vertical menu. It is designated by symbols of a technical device, it is difficult to confuse it.

- In the menu that opens, go to deregistration by clicking on the corresponding box.

- Now we need to fill out a short questionnaire. In fact, you will have to provide all the information as in the application in the usual form. Just in a virtual version. We fill it out scrupulously; a mistake may be a reason for refusal.

- We use our electronic signature.

- Next, your request is sent for development. Employees carefully study it and soon report the progress of the inspection and the decision. You should check your personal profile on the site often to stay informed about the situation.

Removing the cash register from tax registration

If a cash register is deregistered without the participation of its owner, the application is not submitted. The Federal Tax Service sends a notification to the user, and he, in turn, generates a report on the closure of the financial fund. The data is transmitted to the supervisory authority within 60 working days from receipt of the notification. An exception is the situation with the detection of inconsistencies in CCP FZ-54. In this case, the businessman will have to seize and present the drive itself after 30 days. Federal Tax Service specialists will independently read the information.

The cash register is considered deregistered from the day the corresponding card is generated. The owner of the cash register receives it no later than 5 working days from the date of creation.

If the CCP operates offline

If an entrepreneur works in a village, town or other area (with a population of no more than 10 thousand people) remote from communication networks, he can use the cash register in an offline mode. The list of such settlements is approved by the regional authorities and published on its website.

The essence of the offline mode is that the device records all transactions on the fiscal drive, but does not transfer them to the tax service, since it is not connected to the Internet. How to close an individual entrepreneur with an autonomous cash register? When the fiscal drive is closed, the data from it should be transferred to the Federal Tax Service. This can be done in several ways:

- physically transfer the FN to the Federal Tax Service. The data is read by connecting the drive to the computer and then returned;

- read the data at the technical service center and record it on a digital medium and send it through the Federal Tax Service website in electronic form.

Removing a cash register from registration in Multikas

Thanks to the specialists of the Multikas company, you can remove the cash register from the tax office in 1 day without visiting the Federal Tax Service.

Comprehensive service includes:

- closing the drive archive;

- filing a corresponding application with the Federal Tax Service;

- generating a report on closing the financial fund;

- clearing registration information from the cash register memory.

If you do not have an electronic signature, you can also obtain it using the Multikas company. Qualified specialists with extensive experience will perform their work efficiently and quickly.

The FN must be kept by the user for 5 years, starting from the date of completion of use. This requirement does not apply to cases of loss or theft of the device along with the fiscal drive.

Need help deregistering your cash register?

Don’t waste time, we will provide a free consultation and deregister your online cash register with the Federal Tax Service.

What to do after the process is completed

It all depends on how exactly you pose the question. In fact, you don't need to do anything. If we talk about the cessation of activity of this equipment. But to return it to duty, you will have to try. If a breakdown occurs, we contact technical specialists and get their conclusion. And if restoration is possible, we repair it. If the fiscal registrar has failed or its service life has expired, all that remains is to purchase a new unit. And then continue working.

In case of theft, we contact the police. Of course, the chance that the lost item will be returned to the owner’s hands is not the greatest, especially in good condition, but it is there.

It is important to understand that as soon as the device becomes functional again, it will have to be registered again. You can’t just put it into work. The same applies if there is a sale. The new owner is required to register. By the way, let him know about this just in case. It might even be a good idea to have a little consultation.

In fact, as we have figured out, deregistering a cash register with the tax authorities on your own is not so difficult.

Especially if you use the remote method. This takes about half an hour. Including collection of documents. Of course, when we do not need to receive papers from third parties. Therefore, it’s easy to manage in one day. Another thing is that many simply do not understand the strict deadlines, they postpone solving the problem until later, receiving fair criticism and fines in response. Number of impressions: 17781

At the initiative of the Tax Service, withdrawal can be carried out in the following cases:

- violation by the taxpayer of the procedure for using equipment;

- expiration of the service life of the fiscal storage device;

In the first case, no documents are required. After eliminating violations and paying fines, you must re-register the device.

In the second case , the taxpayer will have to send all data from the device to the Federal Tax Service. This procedure is similar to that which is carried out when deregistering a device if it is located in hard-to-reach regions. The service life of a fiscal storage device is generally 13 months from the date of registration with the Federal Tax Service. For payers on UTII, simplified tax system, PSN and unified agricultural tax – 36 months.

The fifth method is forced cancellation of registration of a cash register

In some cases, tax authorities themselves terminate the registration of cash register equipment. In general, there is one reason - various violations by the entrepreneur of the current legislation in the field of registration, application and use of cash register equipment. The list of violations for which an online cash register can be deregistered without your knowledge:

- The validity period of the fiscal accumulator has expired. FNs are available in several types: for 13, 15, 36 months and so on. After this period has expired, the device must be replaced with a new one. Strictly speaking, a month is given for this: the fiscal officer will store the information in memory for 30 days without transferring the receipts to the OFD. If the drive is not replaced after a month, the tax office will see that the checks are being damaged and the information is not being transmitted. First, they will send you a warning, and if you do not respond, the cash register registration will be canceled unilaterally;

- The online cash register does not meet the requirements of the law on the procedure for using cash register systems (Federal Law No. 54). There can be many reasons for this: you did not change the firmware of the cash register on time, the model is not in the register of cash register equipment, you do not transfer fiscal documents in the prescribed manner or transfer them with violations. In any of these cases, registration will be stopped, but not immediately: usually the tax office notifies of the violation and gives a deadline for elimination.

Types of fiscal drives

After forced deregistration, registration must be restored . If the arrest is imposed for violation of the law, then it will not even be possible to sell such a cash register. Or rather, it will come out, but the new owner will not be able to register it. Therefore, before selling, the violation must be eliminated and then the registration must be restored. But even with cancellation due to the expiration of the FN, not everything is so simple. Within a month after this, you are required to provide the tax office with all the information that was on the device until the moment of closure, namely from the date when its validity period expired until the registration was terminated. This is understandable: you could easily conduct sales, but not transmit the OFD data. And this already leads to tax evasion. Therefore, it is better to close all these issues and only then remove the cash register from the register.

Important! All work on deregistration of cash register equipment must be carried out BEFORE you close the individual entrepreneur or liquidate the LLC. Many people make the mistake of starting to liquidate their business by closing the individual entrepreneur. The logic is clear: this needs to be done as quickly as possible so that the accrual of mandatory payments stops. But there's no need to rush. First you need to remove all the “tails”, and only then close the individual entrepreneur or LLC. As soon as you do this, you will not have access to your personal accounts, and the status of an individual will change. After this, it will be much more difficult to do anything: you will have to go to the tax office, write a bunch of unnecessary papers and statements.

The third way is to contact a specialized organization

It’s best to go to the one that registered your cash register. Everyone there knows about you and your cash register equipment. True, here, too, you cannot do without an electronic digital signature, and if you don’t have one, you will have to buy it. But the organization’s specialists will do this for you. You are only required to pay the invoice for the work.

If, for some reason, you cannot contact the company that carried out the initial registration, any office in a similar direction , for example, ECAM, will do. The only thing you need to do is provide specialists with access to accounts on the tax website and with the fiscal data operator - OFD.

Trade management system - ECAM

Who is required to use KKM

According to Federal Law No. 54, individual entrepreneurs and legal entities that carry out settlements with buyers and sellers both in cash and non-cash have obligations to use cash registers (CCM). In particular, business entities are required to have a cash register when:

- sales of goods (works, services) to organizations and the population;

- payment of funds in favor of the population and/or legal entities when purchasing goods/services;

- refund to the buyer if the goods are rejected;

- receiving money from the seller for the returned goods.

A complete list of situations obliging business entities to use cash register equipment (CCT) is described in Federal Law No. 54. Read also the article: → “Procedure for registration of cash registers, required documents”

The fourth method is to deregister the cash register through a legal representative

You can entrust the work to a third party - your legal representative. To do this, you need to issue a notarized power of attorney . This can be done by any notary. The cost of the service is from 1200 rubles and above. Please note: issuing a power of attorney on behalf of a legal entity is more expensive than writing it on behalf of an individual entrepreneur. To contact a notary, prepare the following documents:

For individual entrepreneurs:

- IP certificate;

- certificate of registration with the Federal Tax Service;

- taxpayer identification number - TIN;

- IP passport;

- extract from the Unified State Register of Individual Entrepreneurs;

- seal of an individual entrepreneur, if it exists. According to the law, individual entrepreneurs have the right to work without a seal, but if they have one, they need to present it to a notary and have the power of attorney certified.

For legal entities:

- certificate of registration of a legal entity;

- TIN;

- extract from the Unified State Register of Legal Entities;

- certificate of registration with the tax authority;

- constituent documents: charter, agreement, etc.;

- minutes of the meeting of founders on the appointment of proxies;

- an extract from the minutes of the meeting on the appointment of proxies;

- order;

- Stamp of the company.

One of the options for a power of attorney form

In addition to these documents, the notary will need a personal passport of the person for whom the power of attorney is issued. The procedure takes from half an hour to several hours and depends on the workload of the notary’s office. The document can be issued for a period of up to 3 years.