Sometimes the work of company employees involves constant travel. However, transport for this is not always provided by the company management, since maintaining your own fleet of vehicles is expensive. In this regard, there is such a thing as compensation for fuel and lubricants to an employee when using personal transport. Most often, couriers, personal drivers of management, delivery service personnel, sales representatives, agents, directors apply for this payment. The right to compensation to an employee for fuel and lubricants for the use of personal transport is regulated by Article 188 of the Labor Code of the Russian Federation and may arise even in the case of a one-time business trip.

Personal car for business purposes

The current legislation does not contain separate provisions on how the use of a personal car for business purposes is regulated. But this possibility is enshrined in Art. 188 Labor Code of the Russian Federation. Currently, there are several ways to write off gasoline for the director’s personal car. These include the following:

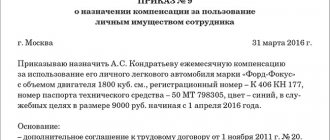

- Compensation. The use of vehicles in this case is recorded in local acts. This may also be specified in the employment contract or collective agreement. At the same time, procedural procedures are brought to a minimum, and the employer can flexibly regulate the labor process. However, paying compensation to the director for the use of a personal car makes him less protected.

- Rent. To reduce actual costs, as well as optimize the accounting of all expenses, rent can be used. In this case, the company essentially rents a vehicle without a driver, and the employee already drives a company car, that is, one that is on the company’s balance sheet. The contract may provide for a full reimbursement scheme for the cost of the vehicle. But this method also has disadvantages.

- Loan. With a gratuitous loan, it is also possible to use a personal car for business purposes. In this case, the employee does not receive direct remuneration for providing the vehicle, but the overall tax burden, as well as rental deductions, will be reduced. In this case, the car is registered on the company’s balance sheet.

- GPC agreement. Sometimes it is advisable to enter into a GPC agreement with the driver for the provision of services for the transportation of goods or passengers. This method has a number of both advantages and disadvantages.

Pros and cons of an additional agreement

Compensation of employee expenses under an employment contract is primarily beneficial to the employer. After all, you can always limit it to the amount provided for by Government Decree No. 92 of 02/08/2002: 1200 rubles - for cars with an engine capacity of less than 2000 cm3 and 1500 rubles - for cars with an engine capacity of more than 2000 cm3.

However, such compensation is unlikely to satisfy the employee - at current gasoline prices it is almost impossible to meet it. Accordingly, the employer has to compromise and enter into a lease agreement or an agreement for the provision of transport services, or pay out of his own pocket - it will not be possible to offset compensation by reducing taxes.

Car rent

Renting out a personal car in order to later use it for business purposes is a common practice. This method provides the employee with a high level of guarantee of the safety of his car, provides additional remuneration and puts the vehicle on the company’s balance sheet, which significantly simplifies reporting.

But directors also note disadvantages in using a personal car rental. These include the following:

- You will have to pay personal income tax on rent.

- It is necessary to issue an insurance contract again.

- Additionally, you need to sign a lease agreement.

This issue is discussed in detail in Art. 643 Civil Code.

Challenging the amount of accrued compensation payments

Compensation payments for the operation of a personal car are of a civil contract nature and are regulated by the Civil Code of the Russian Federation. Therefore, challenging the accrued compensation is possible only in cases where the amount contradicts the agreement between the employer and employee. Usually, all controversial issues can be easily clarified in the accounting department of the enterprise. If the employer violates the terms of the contract intentionally. According to the rules of civil law, the amount of accrued compensation can only be challenged in court.

Director's personal car

Other methods may also be used to write off gasoline for the director’s personal car. He is not relieved of the obligation to issue DPs, as well as to properly arrange business trips and other business trips. But in practice this requirement is not always met.

If any problems arise, the director can always explain the trips as personal goals, not work ones. Then, in order to accuse him of violating the law, the investigative authorities will have to prove that the trip was carried out directly as work functions.

The director of the LLC, being at the same time the founder, has the right to use all the methods described above to register the car. This is possible due to the fact that he also acts as an individual - that is, he is a director, an employee, and a representative of a legal entity.

Let's take a closer look at how to write off gasoline for the director's personal car. In this case, we will assume that it is on the balance sheet of the enterprise.

The concept of a waybill

It (in short - PL) refers to the primary document where the mileage is recorded. Based on this, fuel consumption is determined. Companies for which the use of transport is the main activity use the form of a waybill with the details specified in section 2 of Order No. 152 of the Ministry of Transport. If the company needs a car to perform management and production functions, then the sheet can be developed in accordance with the Law “On Accounting accounting" No. 402-FZ.

Companies often use the PL, approved by Resolution of the State Statistics Committee of the Russian Federation No. 78 back in 1997. It contains different forms of PL based on the type of car, for example, form 3 is intended for a passenger car, and form 4 is for a truck.

Submarines are registered in a special journal. Their accounting is interconnected with the accounting of fuels and lubricants. If the company is not a motor transport company, then sheets are drawn up when it is necessary to confirm the validity of expenses, for example, once a week or once a month. This can be judged based on the letter of the Ministry of Finance of the Russian Federation No. 03-03-04/1/327 or the Resolution of the Federal Antimonopoly Service No. A38-4082/2008-17-282-17-282.

If the director uses a personal car for business purposes or, conversely, a company car for personal purposes, then it is especially important to correctly register the license. This determines whether expenses for fuels and lubricants will be taken into account when calculating income tax. To insure yourself in case of inspections and avoid mistakes, you need to take into account various nuances.

Convenient document option

The write-off of gasoline at an enterprise is not carried out immediately in tax accounting. The cost of purchased fuel is not included in expenses either when paying in advance or during refueling with gasoline and the corresponding debiting of money from the fuel card. The fact is that refueling using a gas station terminal receipt only confirms its purchase, but does not serve as proof of intended use. The main document that confirms the consumption of fuels and lubricants is the waybill. With its help, the operation of transport and the work of the driver are taken into account and monitored. Without it, transportation of people, luggage and cargo is prohibited.

It should contain the following information:

- Name and number.

- Validity period information.

- Information about the owner of the vehicle.

- Vehicle data.

- Driver information.

Unified forms of documents, which are approved by the State Statistics Committee of Russia, should be used only by companies whose main activities are related to motor transport. At other enterprises, you can use a form developed independently. In this case, the form is approved by attaching it to the company’s accounting policies and includes all the details listed above.

How to write off gasoline using waybills? It is not necessary to enter the route of the vehicle in them. This is especially important when the car is used for both business and personal purposes. These conclusions are confirmed by practice in court.

Example No. 1: about the absence of certain data in the PL

The reader may be interested in one of the decisions of the Federal Antimonopoly Service NWO, taken in favor of the enterprise. The point is this.

The tax inspectorate pointed out that in the plans and reports on the consumption of fuels and lubricants, which the company compiled every month, there was no data on the route of official passenger cars, as well as on the number of flights and drivers’ license numbers. Nothing was said about the period of leaving and returning the car to the garage, speedometer data, remaining gasoline and its consumption for each day.

To justify the costs, the company presented the following documents: instructions for operating company cars, orders on the procedure for their use, statements of gasoline coupons, accounting registers, PL. Having considered the case materials and the evidence presented, the court decided that any evidence, including indirect evidence, is accepted to determine the income tax basis. The information contained in the PL (in particular, car mileage, gasoline consumption, gasoline residues in the tank) together with other documents confirm the economic justification of the expenses.

Example No. 2: about the absence of a route to the submarine

A similar decision was made by the Federal Antimonopoly Service of the Moscow Region, when the tax authorities wanted to prove that if the PL did not contain information about the route, then the document did not confirm the costs of purchasing fuel and lubricants. The circumstances of the case were as follows.

When justifying expenses, the company provided initial documents confirming that fuel was received from suppliers and the volume of car refueling. In addition, payment orders were presented, as well as expense norms, which were approved by order of the authorities, PL, which contained all the necessary details (confirming mileage), information on fuel consumption, documents for the write-off of gasoline, properly executed.

Having examined the case materials, the court came to the conclusion that the tax authorities did not prove the unreasonableness of the expenses. Lack of information about the route does not serve as a basis for refusal to confirm expenses.

Thus, companies may well include gasoline costs as part of tax expenses based on papers that confirm the purchase of gasoline, as well as a self-developed PL form, even if it does not contain the route. In addition, the PL can be issued for any period – from 1 day to 1 month.

If it does not follow from other documents that the trip was of a non-production nature (for example, based on the director’s instructions made in writing), then the company can take these expenses into account when calculating income tax, even if the trips were made for personal purposes.

Disadvantages of a unified submarine

When using the unified form, the DP must fill out the “Place of departure and destination” item, as well as the remaining details of this form, since any details cannot be deleted. Therefore, it will be necessary to additionally check that among the destinations and departures there are no addresses that will allow the tax authorities to believe that the director’s use of the company car was for personal purposes.

If route information is not provided or the origin or destination indicates a non-business trip, the company will not be able to accept gasoline expenses. Moreover, in this situation, the employee receives income in kind (the cost of gasoline), from which the enterprise must calculate and transfer personal income tax to the budget, as well as pay insurance premiums. The adopted VAT may also be considered unreasonable by tax authorities.

An example of how an individual entrepreneur increases income from car rental

Let’s imagine that Ivan rented out his car to Romashka LLC, of which he is an employee, for 100,000 rubles a month. In this case, the company undertakes current and major repairs of the machine, as well as payment for fuel and lubricants and other consumables.

Without registering as an individual entrepreneur, the employee would receive only 1,044,000 rubles per year. The employer, acting as Ivan’s tax agent, would independently withhold 13% of personal income tax from this amount. At the same time, having registered an individual entrepreneur using the simplified tax system “Income”, Ivan would have paid the following taxes:

- insurance contributions to the Pension Fund: 32385 + 1% × (100,000 × 12 - 300,000) = 41,385 rubles;

- insurance premiums for health insurance: 5840 rubles;

- STS 6%: 100,000 × 12 × 6% - 41385 - 5840 = 24775 rubles.

Accordingly, his net income was 100,000 × 12 - 41385 - 5840 - 24775 = 1,128,000 rubles. Moreover, 41,385 rubles would go to Ivan’s future pension, and not to the state treasury. Thus, the tax savings would be 125,385 rubles per year. Or a little more than 10,000 rubles per month.

In addition, in the first case, Ivan pays personal income tax immediately. In fact, he doesn’t even see this money - the employer pays the tax for him. In the second, Ivan receives the entire amount in his hands. And only then does he pay taxes. Moreover, he can distribute them as he pleases throughout the year - the main thing is to pay everything no later than December 31.

The ability to manage tax payment deadlines provides a significant advantage. Let’s say Ivan decided to evenly distribute the tax burden and pay the due amount every quarter.

In this way he can additionally release the following amounts:

- January – 100,000 × 13% = 13,000 rubles;

- February – 100,000 × 13% +13,000 = 26,000 rubles;

- March – 100,000 × 13% + 13,000 + 13,000 = 39,000 rubles.

Until the end of March, he can use this money at his discretion. And only then pay the appropriate payment for insurance premiums, thereby reducing the advance payment under the simplified tax system “Income”.

At first glance, the amounts seem small. But as soon as Ivan increases his income 10 times - rent out several cars or choose leasing instead of renting, the savings will become impressive.

Fuel write-off according to the norm

It is also important to take into account that fuel costs are standardized. Despite the fact that the Tax Code of the Russian Federation does not provide for restrictions on taking into account gasoline costs when calculating taxes, the corresponding norms are indicated in the Methodological Recommendations “Norms for the consumption of fuel and lubricants in motor vehicles.” They should be used not only by trucking companies, but also by those that operate vehicles. They are taken into account for tax purposes.

Therefore, in order to avoid claims regarding the amount of fuel consumed, when writing off gasoline without waybills, you need to take into account the actual expenses with the established standards and try not to exceed them. For those vehicles for which the corresponding costs are not approved, the company must be guided by technical documents or information provided by the vehicle manufacturer.

At the same time, the company has the right to set its own gasoline consumption standards, taking into account seasonal surcharges. The period and amount of accrual of allowances is carried out on the basis of the relevant order of local authorities, and in its absence - by personal order of the head. In the latter case, a reference is made to the order of the Ministry of Transport, car brands are registered and restrictions are calculated. This takes into account transport conditions, the technical condition of the vehicle, as well as the degree of its load.

How does everything work in practice?

Often an employee is given a choice: either travel 300 km to another city in the heat by bus, or drive your own car. It doesn’t even occur to him that expenses for paying for fuel and lubricants and other things can and should be compensated to him. Enterprises take advantage of workers' legal illiteracy. Most people do not know what payment for fuel and lubricants at work and reimbursement of costs are.

By the way, this applies not only to the car, but also to any other personal property that the employee uses in the performance of his official duties. It’s just that personal transport is used most often. Accordingly, payment of fuel and lubricants to employees at the expense of the employer is the norm. Although not all employers agree to pay.

Writing off gasoline for business trips

In accordance with Art. 166 of the Labor Code, a business trip is understood as a trip by an employee by order of management for the required period for the purpose of fulfilling an official assignment outside of regular work. Traveling work is not considered business trips. Thus, business trips do not include trips by drivers who carry out freight transportation.

When traveling on a business trip, including when the director uses a personal car for business purposes, he is compensated for travel expenses, rental housing and additional expenses (per diems and other expenses that are carried out with the permission of the employer). This is stated in Art. 168 Labor Code of the Russian Federation. Reimbursement is made on the basis of the Instruction of the USSR, the State Committee for Labor and the All-Union Central Council of Trade Unions No. 62 “On official business trips within the USSR.” However, this document does not provide for payment for fuel. But its cost can be included in travel expenses for travel.

Confirmation of the purchase of gasoline during the director’s business trip in a personal car is the PL. Based on its data, the cost and amount of gasoline that was consumed during the business trip is determined. Upon his return, the employee must submit documents on the purchase of fuel along with an advance report. These are cash receipts and gas station reports on gasoline filled. According to paragraphs. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, in tax accounting fuel costs are recognized on the day when the report is approved.

The director uses fuel and lubricants, what documents need to be drawn up and what taxes arise?

» Question to an expert » Frequently asked questions » The director uses fuel and lubricants, what documents should he submit and what taxes arise? Answer:

An employee who, with the consent of the employer, uses his car for business needs must be paid compensation for its use and wear and tear (depreciation). In addition, you must reimburse the employee for costs associated with operating the car (for example, costs for fuel and lubricants), if he confirms them with documents (Article 188 of the Labor Code of the Russian Federation).

Compensation and reimbursement of expenses in the amount provided for in a written agreement with the employee are not subject to personal income tax and insurance contributions (Letter of the Ministry of Finance dated January 23, 2018 N 03-04-05/3235).

Both under the OSN and under the simplified tax system, both compensation and reimbursement of costs are taken into account in expenses on the date of their payment in the amount provided for in the agreement with the employee (clause 4, clause 7, article 272 of the Tax Code of the Russian Federation). When using a passenger car, these costs can only be taken into account in an amount not exceeding the standard, which depends on the engine size (clause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation, clause 1 of Government Resolution No. 92 dated 08.02.2002, Letter of the Ministry of Finance dated 23.03 .2018 N 03-03-06/1/18366):

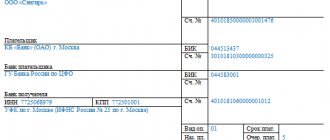

| Passenger car engine size | Standard (rub/month) |

| up to 2,000 cubic meters cm inclusive | 1 200 |

| over 2,000 cubic meters cm | 1 500 |

There is no legal limit on the amount that can be taken into account when using an employee's truck.

The type of car (passenger car or truck) is determined by the vehicle registration certificate or PTS.

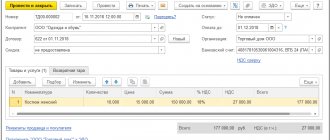

Postings for payment of compensation

| D 26 (20, 44) - K 73 | Compensation awarded for the use of a personal car |

| D 73 - K 51 (50) | Compensation paid for the use of a personal car |

When an employee uses a personal car for business purposes, the company must compensate for wear and tear of the car and maintenance costs. For example, gasoline, repairs and parking. This requirement is stated in Article 188 of the Labor Code of the Russian Federation. There are three options: pay compensation according to the Labor Code of the Russian Federation, enter into a lease agreement with an employee, or apply for loans (free use of a car).

We will talk about how to take into account compensation more profitably, and choose an option in which the company’s expenses and tax risks are minimal, and the employee will receive benefits.

Let's say goodbye to the loan agreement right away. This option is the least beneficial for both the company and the employee. After all, income will have to be recognized from the gratuitous use of property. This is a requirement from paragraph 8 of Article 250 of the Tax Code of the Russian Federation. To calculate income, you need to focus on the market rental price of similar property. In addition, the employee will not receive money from the company. He can only count on compensation for car expenses. This is not beneficial for him.

Income tax (single tax under the simplified tax system). When an employee uses a passenger car, tax expenses do not take into account the entire amount of compensation, but only within the standard limits. This rule is valid for both simplified and general system companies (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation, subclause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation). Most organizations, in order not to count the difference, set compensation in the amount in which it can be included in expenses.

Monthly compensation standards depend on engine size. They are indicated in paragraph 1 of the Decree of the Government of the Russian Federation of February 8, 2002 No. 92:

1200 rub. – for passenger cars with engine capacity up to 2000 cc. cm inclusive;

1500 rub., if the engine capacity is more than 2000 cc. cm;

600 rub. – for motorcycles.

When an employee drives a truck, the entire amount can be included in expenses.

Compensation for expenses is possible only after payment (subclause 4, clause 7, article 272 of the Tax Code of the Russian Federation). Simply charging the amount is not enough.

Let's move on to compensation for fuel costs. Officials believe that the standards already take into account the cost of fuel and lubricants and other costs of maintaining the machine. The Russian Ministry of Finance speaks about this in letters dated September 23, 2013 No. 03-03-06/1/39239 and dated May 16, 2005 No. 03-03-01-02/140. Therefore, the simultaneous write-off of compensation and the cost of fuel and lubricants will lead to disputes with the Federal Tax Service. Let’s say compensation for the use of an employee’s personal car in an organization is 1,200 rubles. monthly. And on top of this, they reimburse fuel and lubricants - 4,000 rubles. and is spent on repairs. So, only 1200 rubles can be taken into account in tax expenses.

There is no need to withhold personal income tax from compensation. It is exempted from tax by paragraph 3 of Article 217 of the Tax Code of the Russian Federation. Moreover, personal income tax does not have to be withheld even from the amount that exceeds the profit standard. The main thing is to indicate the required value in the additional agreement to the employment contract (letters of the Ministry of Finance of Russia dated August 27, 2013 No. 03-04-06/35076, dated June 27, 2013 No. 03-04-05/24421).

Insurance premiums are also not charged. The amount that is agreed upon in the agreement with the employee is exempt from them. The funds are of the same opinion. The Pension Fund reported this in paragraph 2 of letter No. 30-21/10260 dated September 29, 2010, and the FSS reported this in letter dated November 17, 2011 No. 14-03-11/08-13985.

How to use an employee's car under a rental agreement

Lease contract. Let's consider the following option with which you can register a car - conclude a rental agreement with an employee. There are two types of vehicle rental agreements: with and without a crew. A rental agreement with a crew assumes that the employee not only transfers the vehicle, but also provides management and maintenance services on his own. In a bareboat rental agreement, the employee only provides the car without any services.

But you can only enter into a bareboat rental agreement with a company employee. The fact is that the lessor enters into a lease agreement with the crew only if he has driver employees (paragraph 2, paragraph 2, article 635 of the Civil Code of the Russian Federation). And when the lessor is an individual employee, this condition is not met.

To confirm the costs of rental payments, issue a vehicle acceptance certificate. You can draw up the form yourself or take the unified form No. OS-1. In the act, describe in detail the characteristics of the car: make, color, license plate number, year of manufacture, engine and body numbers. Indicate in the act the approximate cost of the car. It is needed in order to reflect the car on off-balance sheet account 001 as a leased fixed asset. Attach copies of PTS, OSAGO and certificate of state registration to the act.

The rent is set by agreement of the parties (employee and employer). As a rule, the amount depends on the technical characteristics of the car, the degree of wear, etc. You can focus on the average rental cost in the region. We recommend that the rent be established in the contract not as a fixed payment, but rather tied to the time of work, mileage or number of trips. After all, an employee may go on vacation or get sick. If only he uses the car, then the car will be idle. Suspending the contract during an employee’s vacation or illness in order to adjust the rent is risky. The Civil Code of the Russian Federation does not provide for such a procedure.

Income tax (single tax under the simplified tax system). The rent can be fully taken into account in tax expenses by both companies on the general system and simplified companies (subclause 10, clause 1, article 264, subclause 4, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Under a bareboat rental agreement, the company bears all costs associated with operating the vehicle: gasoline, maintenance, repairs, insurance, washing, parking (Articles 644 and 646 of the Civil Code of the Russian Federation). Unless, of course, the parties provide otherwise in the contract. Fuel, repairs and other expenses for maintaining a rented vehicle can be written off as expenses without any problems.

Personal income tax. The lease agreement has one drawback. Personal income tax will have to be withheld from the rent. The Ministry of Finance regularly reminds that a company that rents property from an individual becomes a tax agent. Here is one of such letters - dated August 16, 2013 No. 03-04-06/33598.

Insurance premiums. If you have entered into a bareboat rental agreement, you do not need to pay insurance premiums. In a letter dated March 12, 2010 No. 550-19, specialists from the Ministry of Health and Social Development explained that the essence of the lease agreement is the transfer of property. And payments under such agreements are exempt from contributions by Part 3 of Article 7 of the Federal Law of July 24, 2009 No. 212-FZ. Rent is also not subject to injury charges. The exemption is provided for by Part 1 of Article 5 of the Federal Law of July 24, 1998 No. 125-FZ.

A practical situation.

Question:

The director of an organization (LLC) drives a company car and drives it himself. Fills up the car on weekends. The director's work schedule is a five-day work week, working hours from 10.00 to 18.30, working hours are irregular. Waybills are compiled once a month in a form developed by the organization. The consumption standards for fuel and lubricants were approved by order of the manager for winter and summer. In addition, the director uses a toll road (on the way to work and home).

For tax accounting purposes, is the cost of fuel and lubricants based on gas station receipts issued on weekends (i.e., outside the working hours specified in the employment contract with the director), as well as the cost of travel on a toll road, accepted?

Answer:

Tax accounting of the cost of fuel and lubricants based on gas station receipts

In accordance with paragraphs. 5 p. 1 art. 254 of the Tax Code of the Russian Federation, material expenses include the taxpayer’s expenses for the purchase of fuel, water, energy of all types spent for technological purposes, production (including by the taxpayer himself for production needs) of all types of energy, heating of buildings, as well as expenses for production and (or ) acquisition of power, transformation and transmission of energy.

According to paragraphs. 11 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales are, in particular, the taxpayer’s expenses for the maintenance of official transport (road, rail, air and other types of transport).

Based on paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for profit tax purposes, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Justified expenses are economically justified expenses, the assessment of which is expressed in monetary form. Documented expenses are expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

In order to recognize for tax purposes expenses on fuels and lubricants for a car driven and used by the director, in addition to confirming these expenses with primary documents that indicate the fact of purchasing fuels and lubricants (for example, gas station receipts), it is necessary to document the economic justification and production orientation of these expenses .

On January 1, 2013, the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ) came into force, according to which the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation, are not mandatory for use (Article 9 of Law No. 402-FZ). In this case, the primary accounting document must contain the mandatory details listed in Part 2 of Art. 9 of Law No. 402-FZ.

At the same time, as explained in Information of the Ministry of Finance of Russia N PZ-10/2012 “On the entry into force on January 1, 2013 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Information N PZ -10/2012), forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory for use.

Accordingly, the form of waybill independently developed by the organization must contain the required details, as provided for in Part 2 of Art. 9 of Law N 402-FZ, and those specified in section. II “Mandatory details of the waybill” of Order of the Ministry of Transport of Russia dated September 18, 2008 N 152 “On approval of the mandatory details and procedure for filling out waybills” (hereinafter referred to as Order N 152), since this Order was issued in pursuance of the requirements of the Federal Law of November 8, 2007 N 259-FZ “Charter of road transport and urban ground electric transport” (Article 6).

Organizations also have the right to use a unified form of waybill for a passenger car (Form No. 3), approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78, if necessary adding or removing some of the details.

We remind you that based on the requirements of Part 4 of Art. 9 of Law N 402-FZ, all forms of primary accounting documents used by the organization, including those developed on the basis of unified forms, must be approved by the head of the organization either by a separate administrative document or as part of the accounting policy for accounting purposes.

According to paragraph 10 of section. III “Procedure for filling out a waybill” of Order of the Ministry of Transport of Russia N 152, a waybill is issued for one day or a period not exceeding one month. Accordingly, organizations have the right to provide any period for issuing waybills, but not more than one month.

It should be noted that the mentioned Order of the Ministry of Transport of Russia does not indicate the route as a mandatory detail of the waybill. At the same time, according to the explanations of the official bodies, information about the route of the car makes it possible to confirm the fact of the use of the car in the activities of the taxpayer and, accordingly, serves as evidence of the economic justification of expenses for fuel and lubricants and their connection with activities aimed at generating income, based on the requirements of Art. 252 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated 02/20/2006 N 03-03-04/1/129, Federal Tax Service of Russia for Moscow dated 07/07/2008 N 20-12/064123.2, dated 04/13/2007 N 20-12/035154, dated 11/14/2006 N 20-12/100253, dated 06/19/2006 N 20-12/ [email protected] ).

In judicial acts, which supported the position of the tax authorities on the issue of the correct filling out of waybills, it is clarified that a waybill that does not contain in its details information about the specific route of the car, indicating the name of the organization and address, cannot confirm the expenses incurred by the taxpayer for the purchase of fuel and lubricants for official purposes and demonstrate the validity of these expenses.

Such conclusions are given in the Resolutions:

— FAS Povolzhsky District dated May 21, 2013 N A55-23291/2012 (Determination of the Supreme Arbitration Court of the Russian Federation dated August 30, 2013 N VAS-11880/13 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation);

— FAS Volga District dated June 20, 2013 N A55-26509/2012 (Determination of the Supreme Arbitration Court of the Russian Federation dated October 7, 2013 N VAS-13642/13 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation), FAS East Siberian District dated October 21, 2009 N A33 -13602/08 and dated 08/06/2008 N A78-3068/07-F02-3517/08, A78-3068/07-F02-3652/08;

- FAS East Siberian District dated July 16, 2010 N A33-10451/2009 (Determination of the Supreme Arbitration Court of the Russian Federation dated October 11, 2010 N VAS-13567/10 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated October 21, 2009 N A33-13602/ 08.

At the same time, there are examples of judicial acts confirming that the lack of information about the route of a vehicle cannot serve as a basis for non-recognition of expenses for fuel and lubricants. According to the conclusions of the courts, the absence of information about the routes in the waybills does not give grounds to believe that the organization actually used the car for other than official purposes, since such information is not mentioned among the mandatory details of the waybill in Order of the Ministry of Transport of Russia N 152 (Resolution of the Federal Antimonopoly Service of the Volga Region dated 05.03. 2013 N A55-19369/2012, FAS of the North Caucasus District dated 05/14/2012 N A25-1314/2011, dated 08/31/2011 N A53-26379/2010, FAS Moscow District dated 02/29/2012 N A40-63465/11-116 -182, dated 08/26/2010 N KA-A41/9668-10, dated 07/20/2010 N KA-A40/7436-10, dated 01/26/2010 N KA-A40/15099-09, dated 12/08/2009 N KA-A40 /13500-09, Federal Antimonopoly Service of the North-Western District dated November 23, 2009 N A56-4991/2009, etc.).

The presence of a fairly extensive arbitration practice indicates that the absence of indication in the waybill of the route of a company car, including the name of the organization and address, may entail the emergence of tax risks in relation to expenses for fuel and lubricants.

Thus, it seems appropriate to include in the details of the waybill form, including those to be filled out by the manager, in addition to the address of the destination, the name of the organization (institution) where the official vehicle was sent.

Regarding the issue of recognition for tax purposes of expenses for the director’s purchase of fuel and lubricants based on gas station receipts issued on weekends, in our opinion, what matters is not the fact of purchasing fuel and lubricants on weekends, but the time (period) of using these fuels and lubricants. For example, fuels and lubricants were purchased on Sunday evening for their further use from the beginning of the work week during the working hours of the manager established by the employment contract, which will be confirmed by waybills, which are drawn up taking into account the above requirements.

The Resolution of the Federal Antimonopoly Service of the Moscow District dated February 3, 2009 N KA-A40/96-09 considered a similar situation.

Having established that the cars driven by some drivers, according to waybills, left the garage no earlier than 9.00 and returned no later than 18.00, while according to cash receipts in a number of cases gasoline was purchased at gas stations either before 9.00 or after 18.00, the tax inspectorate considered that that the named persons received income to be taken into account when calculating personal income tax. However, the organization explained that, on the basis of orders, the cars were transferred to persons authorized to drive for safekeeping at their place of residence due to the lack of parking at the enterprise. These orders stipulate that these employees are reimbursed for expenses based on advance reports related to the purchase of fuel and lubricants during non-working hours. It was established that the purchase of fuel and lubricants outside working hours is justified by the goal of unhindered travel to the line the next day.

Since servicing a vehicle after returning from the line (work) or before going to the line (work), including refueling with fuel and lubricants, is an objectively necessary action to ensure the continuity of the production process, the court indicated that the fact of moving the vehicle from the location of the plant to the driver’s place of residence who accepted the vehicle for safekeeping does not indicate the use of the specified vehicle and fuels and lubricants purchased with the funds issued under the report for personal purposes.

In the Resolution of the Federal Antimonopoly Service of the Moscow District dated 04.02.2008 N KA-A40/13427-07-2, in which the court also supported the taxpayer, it was noted that the amount and connection of expenses for fuel and lubricants, including those purchased on weekends, with the production activities of the company are confirmed by cash register receipts, advance reports of drivers, orders for shift work of drivers.

At the same time, we draw attention to the Resolution of the Federal Antimonopoly Service of the Moscow District dated December 3, 2012 N A41-20691/11. According to the taxpayer, taking into account the traveling nature of the work of the director and his deputy, expenses for gasoline, auto parts and car washing, as well as travel expenses are included in the cost of maintaining official vehicles. It does not matter that the expenses were incurred on weekends and holidays, since this does not prove that the car was used for non-production purposes.

As the court pointed out, recognizing the taxpayer’s position as unlawful, the taxpayer’s accountable persons paid for car washing services and purchased fuel and lubricants in cash. Since the inspection established that the expenses were not incurred in the region of the company’s activities on days when employees were not sent on business trips (including on weekends and holidays), and the documents submitted do not allow the identification of cars, these expenses do not meet the requirements of Art. 252 of the Tax Code of the Russian Federation as not confirming their production orientation.

In addition, the court agreed with the inspectorate’s classification of the disputed amounts as material benefits received by the director of the company and his deputy in the form of reimbursement of expenses for fuels and lubricants and car wash services and subject to personal income tax.

Therefore, if fuel and lubricants are used by the director for business trips on weekends, which must be confirmed by properly completed travel sheets, the following must also be taken into account.

The director, on the one hand, is the leader - the sole executive body of the organization, which resolves all economic, managerial and financial issues, and on the other hand, he is an employee of the organization who works under an employment contract and complies with labor regulations. Relations between the company (employer) and the director as an employee are regulated by the norms of labor law in their entirety (Articles 16, 20, 56, 273 of the Labor Code of the Russian Federation, Article 40 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” liability”, hereinafter referred to as the Law on Limited Liability Companies).

The employer in relation to the manager is the general meeting of participants of the LLC or the sole participant (clause 4, clause 2, article 33 of the Law on Limited Liability Companies).

Provisions of Art. 100 of the Labor Code of the Russian Federation provide for the possibility of using various working hours, including work with irregular working hours for certain categories of workers.

According to Art. 101 of the Labor Code of the Russian Federation, an irregular working day is a special work regime, according to which, by order of the employer, if necessary, individual employees may occasionally be involved in the performance of their labor functions outside the established working hours.

Thus, for an employee working on a five-day workweek schedule, the condition of irregular working hours means only an occasional increase in the duration of his working hours and cannot serve as a basis for his involvement in work on weekends.

A similar conclusion follows from Letter of Rostrud dated 06/07/2008 N 1316-6-1: the introduction of irregular working hours for employees does not mean that they are not subject to the rules defining the start and end times of work, the procedure for recording working hours, etc. These workers are generally exempt from work on weekly rest days and holidays.

Involvement of employees who have an irregular working day to work on their days off must be carried out using the provisions of Art. Art. 113 and 153 of the Labor Code of the Russian Federation.

It should be remembered that working under irregular working hours (Article 101 of the Labor Code of the Russian Federation), on weekends and holidays (Articles 113 and 153 of the Labor Code of the Russian Federation), overtime work (Articles 99, 152 of the Labor Code of the Russian Federation) is independent work regimes in conditions deviating from normal (Article 149 of the Labor Code of the Russian Federation, Letter of Rostrud dated December 2, 2009 N 3567-6-1). Therefore, if a company car driven by a director will be used for production purposes on weekends, the established procedure for attracting the manager to work on weekends and paying him must be followed (Articles 113 and 153 of the Labor Code of the Russian Federation).

Failure to comply with the requirements of the mentioned norms of the Labor Code of the Russian Federation is a violation of labor legislation, for which the organization can be brought to administrative responsibility in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

In addition, compliance with the specified requirements of labor legislation in relation to the manager, along with the proper completion of travel sheets, will make it possible to recognize expenses for fuel and lubricants purchased and used on weekends for business trips as justified for tax purposes.

Thus, the Federal Tax Service of Russia for the city of Moscow in Letter dated June 19, 2006 N 20-12/ [email protected] reported that in order to recognize expenses for the purchase of fuel and lubricants during the period of operation of motor transport in excess of the normal working day (working hours) for profit tax purposes, it is necessary the presence of internal regulations approved by the head of the organization, providing for work on weekends and ensuring accurate accounting of overtime work performed by car drivers.

For example, in Resolution No. KA-A40/13427-07-2 dated 02/04/2008, the Federal Antimonopoly Service of the Moscow District indicated that the cost of fuel purchased on weekends also meets the cost criteria established by clause 1 of Art. 252 of the Tax Code of the Russian Federation, since the organization presented orders from the manager on shift work of drivers.

However, taking into account the fact that the manager is an employee with a special status, his involvement in work on weekends, in our opinion, should be provided for by a decision of the company's participants, or the latter, on the basis of the minutes of the general meeting of participants, grant the manager the right to independently make a decision on working on weekends and/or include a corresponding provision in the employment contract concluded with the director.

Question: The organization pays compensation to its employees for the use of personal cars for business purposes in the amounts established by law. Does she have the right, along with compensation, to take into account in tax expenses the amounts of fuel and lubricants reimbursed to employees?

Answer : No, he has no right, since the amounts of the above compensations established by law take into account reimbursement of costs arising during the operation of vehicles, including the cost of fuels and lubricants.

Rationale: Based on paragraphs. 11 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include, in particular, expenses for compensation for the use of personal cars and motorcycles for business trips within the limits established by the Government of the Russian Federation.

These standards were approved by Decree of the Government of the Russian Federation dated 02/08/2002 N 92 and today are: for passenger cars with an engine capacity of up to 2,000 cubic meters. cm inclusive - 1,200 rub. per month; over 2,000 cubic meters cm - 1,500 rub. per month.

Thus, the taxpayer has the right to include in expenses for the purpose of calculating income tax compensation to an employee for the use of a personal passenger car for business trips within the established norms, and also subject to compliance with the criteria of Art. 252 of the Tax Code of the Russian Federation.

Since the amounts of the above compensations provided for by law take into account the reimbursement of costs arising during the operation of vehicles (wear, fuels and lubricants, repairs), the cost of fuels and lubricants reimbursed by the organization to employees using a personal car for business purposes cannot be re-included in expenses, then There are, in addition to the amounts of compensation mentioned above, paid to employees for the use of personal cars for business purposes. The Ministry of Finance of Russia has repeatedly come to this conclusion in its letters, responding to similar requests from taxpayers (see Letters dated 04/10/2017 N 03-03-06/1/21050, dated 08/19/2016 N 03-03-06/1/48789, dated 12/04/2015 N 03-03-06/70852).

In this regard, we believe that it is much more profitable for the taxpayer to enter into a lease agreement with an employee for a vehicle with a crew (Article 632 of the Civil Code of the Russian Federation) or without a crew (Article 642 of the Civil Code of the Russian Federation). In this case, he will be able to recognize for tax purposes a large amount of costs associated with using the car for business purposes (subject to the conditions of Article 252 of the Tax Code of the Russian Federation).

A selection of materials on this issue.

Typical situation: How to pay and account for compensation for the use of an employee’s personal car for business purposes (Glavnaya Kniga Publishing House, 2018) {ConsultantPlus}

Question: The organization pays compensation to its employees for the use of personal cars for business purposes in the amounts established by law. Does she have the right, along with compensation, to take into account in tax expenses the amounts of fuel and lubricants reimbursed to employees? (“Income tax: accounting for income and expenses”, 2021, N 7) {ConsultantPlus}

Explanation prepared by: accountant-consultant Kim Olga Valerievna

The answer was prepared using materials from SPS Consultant Plus contained in the following information banks:

— SPS ConsultantPlus: Prof version;

— SS Consultant Financier.