In the process of functioning, an economic entity carries out many operations in various areas relating to financial, production, economic, social and other areas of activity. All operations represent a single system that reflects the activity of the subject and is the subject of accounting, which can be defined as the financial and economic activities of an organization, regardless of its form of ownership.

The objects of accounting are economic categories that are directly used in the implementation of activities by an economic entity. Article 5 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ specifies a specific list of those categories that are the object of accounting. In accordance with this legal norm, accounting objects include:

- assets and liabilities,

- facts of economic life,

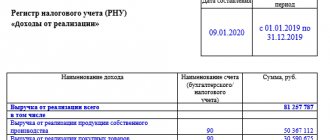

- income and expenses,

- sources of financing the entity's activities.

The subject and objects of accounting can be briefly described as:

- subject – financial and economic activity of the subject;

- objects – categories included in the financial and economic activities of the subject.

Accounting methods are the techniques by which a subject is studied. In other words, these are the methods used to study the activities of an economic entity. In this case, the methods can be quantitative and qualitative, allowing for recording, analysis and research of objects.

The essence of accounting objects: definition by the Ministry of Finance

There are quite a few interpretations of the term “accounting objects”. Let's consider its official definition given in paragraph 4 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998.

According to this document, accounting objects should be understood as the property of enterprises, their obligations, as well as business operations carried out in the process of economic activity.

A specific list of accounting objects at the legislative level is determined by the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Property and assets

So, the 1996 Law, defining the list of accounting objects, spoke about property, liabilities and business transactions, that is, facts that change the composition and/or volume of property and liabilities of organizations. Neither the Law “On Accounting” nor any other regulatory legal acts on accounting defined the concepts of “property” and “liabilities”.

From the point of view of civil legislation (clause 1 of Article 2 of the Civil Code of the Russian Federation), “entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services by persons registered in this capacity in in accordance with the procedure established by law." In other words, from the standpoint of civil law, the source of “earning” profit for economic entities is property and, accordingly, operations carried out with it. The Civil Code of the Russian Federation does not name other sources of profit besides the “use of property.” It is characteristic that the Civil Code of the Russian Federation speaks specifically about the use of property, which may not imply the existence of ownership rights to it. This means that if we consider the accounting definition of assets from the point of view of the Civil Code of the Russian Federation, then we can put an equal sign between the concepts of “assets” and “property”. This is what was prescribed by the 1996 Law.

Whether because the 1996 Law dealt specifically with property as an object of accounting, or for some other reason, the concept of “asset” was not defined in domestic accounting regulations until the 2011 Law was issued. And it is not defined in this law. Assets are only named among other accounting objects, but this term is not defined in the Law.

Unlike domestic regulations, IFRS define the concept of “assets”. The IFRS Principles define assets as resources controlled by an entity that arise as a result of past events from which the entity expects future economic benefit. Thus, International Financial Reporting Standards, following the general concept of the priority of economic content over legal form, speak not about property, but about the company’s resources. It is no longer possible to put an equal sign between these concepts.

Resources (from the French ressource) are a set of capabilities of an economic entity to generate income. A firm's resources may include elements that are not property, and conversely, a firm's property may not be its resource. So, for example, we are talking about labor resources, which are by no means the property of the company. On the other hand, a painting hanging in the office of the head of a company may please him, perhaps scares off clients - it is the property of the company, but it is unlikely to be its economic resource; it can become such from the moment the decision is made to sell it.

At the same time, the concept of “resources” is not identical to the accounting concept of “asset”. On the one hand, the same labor resources or human (intellectual) capital are not currently shown as assets, and IFRS is no exception here. On the other hand, an element of the assets of the balance sheet may be positions that are not related to either the company’s property or its resources as economists understand this term. So, for example, deferred expenses reflected in the asset are not property or a resource of the company, but it is an asset formed on the basis of the accounting principles of continuity and correspondence of income and expenses. Some time ago, domestic regulations prescribed that the company's losses should be reflected as assets. Soviet accounting knew such an asset as diverted funds. Hence, assets are what firms must show in the assets of their balance sheets according to the regulations in force in practice. This purely accounting category only partially correlates with the legal concept of “property” and the economic category of “resource”. This relationship can be represented as the following diagram (Fig. 1):

Rice. 1. The relationship between the categories “property”, “resources” and “assets” in modern accounting practice

Thus, by defining assets as an object of accounting, the 2011 Law does something extremely important: it gives accounting the right to generate information about the financial position of organizations, based solely on accounting methodology, in certain cases completely independent from purely legal and/or purely political economic interpretation of economic facts. This provision of the 2011 Law contains enormous opportunities for the development of accounting methodology.

What are the objects of accounting?

In accordance with the provisions of Art. 5 of Law No. 402-FZ, accounting objects are :

- facts of the economic life of the enterprise;

- assets and liabilities of the enterprise;

- sources of financing;

- income and expenses of the company;

- other objects specified by federal legislation.

A fact of economic life should be understood as any transaction, operation or other significant event that has or could potentially have an impact on the financial condition of the enterprise, the results of its activities or the flow of capital (Article 3 of Law No. 402-FZ).

A company's assets and liabilities can be presented in a wide range of varieties: their correct classification can be important when drawing up a balance sheet - one of the key sources of financial statements.

This classification can be studied in detail by reading the provisions of Section IV of Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n (PBU 4/99).

Sources of financing the company's activities can be represented by:

- authorized capital;

- income (including revenue);

- credit funds;

- investments;

- budget revenues.

In accordance with paragraph 2 of PBU 9/99, income should be understood as an increase in the economic benefits of the enterprise not caused by the actions of the founders (owners):

- receipt of assets (in the form of cash or other property);

- repayment of obligations, as a result of which the capital of the enterprise increases.

In accordance with paragraph 2 of PBU 10/99, expenses should be understood as a reduction in the economic benefits of the enterprise not caused by the actions of the founders (owners):

- disposal of assets;

- the emergence of obligations that lead to a decrease in the capital of the enterprise.

Sources of resource formation

All sources available in an LLC can be divided between two groups - equity and borrowed capital. Own capital includes:

- The authorized capital of the company, formed at the initial stage of formation of the LLC, this capital is made up of the founders;

- Reserve capital - is formed by the LLC by deducting a share of retained earnings, the created reserve allows you to cover the annual losses of the LLC;

- Additional capital - is formed based on the results of revaluation by increasing the value of the assets being valued;

- Profit not distributed at the end of the year, or loss not covered.

Borrowed capital includes:

- Borrowed funds – long-term and short-term loans taken by the LLC to carry out its activities;

- Accounts payable are funds that an LLC owes to its counterparties, employees, budget, and funds.

Valuation of accounting objects as a necessary condition for accounting procedures

The most important operation performed within the framework of accounting with accounting objects is their evaluation. It is a procedure, the result of which is the reflection of the cost of an object in rubles (Article 12 of Law 402-FZ).

The need for assessment arises due to the fact that all information about the noted accounting objects is reflected in accounting documents, as well as in reporting, in monetary terms.

The basic principles by which the value of accounting objects should be assessed are enshrined in clause 23 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998, as well as in PBUs regulating the features of accounting for certain accounting objects.

Business processes

Business processes:

- Process of acquisition, procurement. Enterprises buy material assets, fixed assets that they do not produce on their farm.

- Production process. Enterprises make certain expenses and receive finished products.

- Sales process. Businesses sell products through various channels and generate revenue.

Results

Accounting, like any other areas of activity related to the management of an organization, has objects. Their essence is defined at the legislative level - in Law No. 402-FZ, as well as in the provisions of Order No. 34n of the Ministry of Finance.

You can find other useful information about accounting in the following articles:

- “Accounting in 2015–2016 (chart of accounts and principles)”;

- "Accounting in budgetary institutions."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Obligations and sources of financing activities

Just as in the case of property, the 1996 Law, without giving a special definition of this concept, named the organization’s obligations as the second object of accounting. And, similarly, the absence of such a special definition of the term “liabilities” in accounting regulations “tied” the definitions of the subject of accounting and the methodology for accounting for the company’s obligations as part of its liabilities precisely to the civil law interpretation of the concept of “obligation”. According to paragraph 1 of Article 307 of the Civil Code of the Russian Federation, “by virtue of an obligation, one person (debtor) is obliged to perform a certain action in favor of another person (creditor), such as: transfer property, perform work, pay money, etc., or refrain from a certain actions, and the creditor has the right to demand that the debtor fulfill his obligation.”

The appearance of the term “liabilities” in the 1996 Law is most likely associated not with the legislator’s attempt to harmonize the content of accounting regulations with the provisions of civil legislation, but with the process of convergence with IFRS and the borrowing of such a basic category as liabilities. IFRS define liabilities as a present obligation of an entity, arising from past events, the fulfillment of which will result in an outflow of resources embodying economic benefits from the entity. In other words, here liabilities are accounts payable, reflected in the liability side of the balance sheet.

However, unlike the category of “property”, the civil law concept of “obligation” is much broader than “accounts payable” and does not coincide with the accounting concept of “liabilities”.

First of all, it should be noted that a very significant part of the obligations of any organization is not reflected at all in modern financial statements. Thus, these are obligations arising from contracts that have not yet begun to be fulfilled at the time of drawing up the balance sheet.

On the other hand, the obligations reflected in the financial statements form not only a liability, but also an asset of the balance sheet - this is the organization's receivables.

You should also pay attention to the fact that as part of accounts payable, liabilities may include not only the company’s obligations in their purely legal understanding. For example, the amount of so-called reserves for future expenses can be shown by the organization as part of short-term liabilities in the liabilities side of the balance sheet.

Based on the above, we, by analogy with property, resources and assets, can present the relationship between the categories of liabilities, assets and liabilities as follows (Fig. 2):

Rice. 2. The relationship between the categories of “liabilities”, “assets” and “liabilities” in modern accounting practice

At the same time, as in the case of the definition of assets as objects of accounting, the definition of liabilities we are considering by the 2011 Law also contains serious potential for the development of financial accounting methodology in practice. In some cases, information about an organization's liabilities included in its financial statements may be considered insufficient to make a judgment about its actual financial position. Today, this is partly solved by maintaining off-balance sheet accounting of obligations, but the future may require the search for methods of presenting a more complete picture of the obligations of companies, and here the norm of the Law in question precisely determines the opportunities for the development of domestic accounting in this direction.

The company's liabilities presented in the balance sheet as accounts payable are part of its liabilities, that is, the sources of the company's funds. Liabilities are only part of the company's sources of funds - attracted sources of funds. The second part of the company’s sources of assets is represented by the so-called own sources of funds of the economic entity, currently reflected in the “Capital and Reserves” section of the balance sheet. And if the 1996 Law, defining the objects of accounting, was limited only to obligations, then the norm of the 2011 Law we are considering includes “sources of financing activities” to the list of accounting objects.

Sources of financing the activities of an economic entity are represented as liabilities on the balance sheet. Consequently, having defined liabilities as an object of accounting, the 2011 Law has already affected the category of sources of financing. It is as a source of financing for the company’s work that the methodology for constructing and analyzing financial statements considers the company’s accounts payable reflected in the balance sheet. From the standpoint of assessing the structure of the company’s funding sources, its obligations to creditors reflected in the balance sheet are nothing more than a loan that provides the company with the amount of funds reflected in the asset corresponding to their monetary value. However, the category “sources of financing activities” is broader and, in addition to accounts payable and equivalent liabilities, includes the so-called own sources of financing activities - capital and reserves.

This category also has not received a special definition in domestic regulations, and, apparently, to reveal its meaning that corresponds to the content of the norm of the 2011 Law we are considering, we must also turn to the provisions of IFRS.

Disclosing the content of the elements of financial statements, IFRS define capital as net assets, namely as “the residual interest in the assets of an organization after deducting all its liabilities.” Therefore, the section of the balance sheet that reveals the “own sources of funds” of the organization in English is called “equity”, which in one of the translations means “share”, and in meaning - “the share of owners in the capital of the organization”. In most sources in Russian, this term is translated as “capital”. This definition corresponds to the balance sheet equation, in which “Assets” - “Liabilities” = “Capital”. Thus, in the most general form, capital (and its value) is determined by the difference between the amounts of accounting estimates of assets and liabilities.

This approach, as defined today by IFRS, allows the balance sheet to be viewed not as solely a consequence of the account entries during the reporting period, but as a result of measuring the elements of the picture of the entity's financial position (assets and liabilities) at the reporting date. Capital is thus viewed primarily as the result of estimates representing the current state of the company's assets and liabilities. It is this idea that underlies and justifies the use of measuring balance sheet elements at fair value and at the discounted value of future cash flows (that is, demonstrating in the statements the estimates of assets and liabilities that are most relevant at the time of reporting). Thus, the amount of the company’s capital is formed, on the one hand, by reflecting the facts of economic life during the reporting period, and on the other, as a result of assessments of balance sheet items as components of the financial position of the organization as of the reporting date.

Along with the above, it is very important to note that the definition of sources of financing activities by the 2011 Law represents another case of legislative definition of a purely accounting category, which potentially makes it possible to develop reporting, the formation and assessment of elements of which may be methodologically unrelated to the presentation of the state of affairs companies in any branch of legislation. This is another “legalized” step towards methodological freedom in financial accounting practice in Russia.