The transition to a new standardization system, the features of which depend on the category of the object that has a negative impact on the environment (hereinafter referred to as NVOS), raises related questions about the procedure for calculating fees for NVOS.

Looking ahead, we note that starting from 2021 (when calculating fees based on the results of 2021), business entities will have to restructure somewhat and get used to the new features of calculating payments.

At the same time, with regard to calculating the fee for NVOS for 2018, it can be said that legislative changes in the field of regulation should not affect the amount of the fee for NVOS determined by 03/01/2019. To make sure of this, let's talk about the applicable standards.

The procedure for determining the amount of advances according to the tax assessment

The main document defining the key points of calculation and procedure for making payments for pollution is the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ.

It provides for the obligation for legal entities that are not classified as small and medium-sized businesses to pay advance payments for negative environmental impact (NEI) during the current year. At the end of the year, the amount of these payments will reduce the total amount of fees accrued for the year in the tax return. Who should pay for the negative impact on the environment in 2020-2021, and who should not, see ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

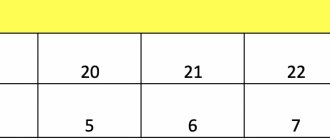

Advance payments are required to be accrued and paid 3 times a year, at the end of the 1st, 2nd and 3rd quarters, before the 20th day of each month occurring after the end of the corresponding quarter (Clause 3, Article 16.4 of Law No. 7-FZ).

How to determine the amount of advance payment? From 2021 there are three such methods. The advance can be determined as:

- ¼ of the fee for the tax assessment payable for the previous year;

- ¼ fee calculated based on the volume or mass of emissions (discharges) of pollutants within the limits of standards, temporarily permitted emissions (discharges) or limits on the disposal of production and consumption waste;

- the product of the payment base, which is determined on the basis of industrial environmental control data on the volume or mass of emissions (discharges) or on the mass of disposed production and consumption waste in the previous quarter, and the corresponding payment rates for environmental waste using the coefficients provided by law.

Sanctions for failure to submit environmental reports or violation of their deadlines

The legislator motivates organizations and individual entrepreneurs to submit reports on time using the whip method - threatening penalties if the order is violated.

The regulatory authorities have enough leverage:

- Art. 13.19 Code of Administrative Offenses of the Russian Federation. Failure to provide information or its submission after the expiration of the established period is regarded as a violation of the procedure for submitting statistical reporting and is punishable by penalties for legal entities of up to 70 thousand rubles, for officials - up to 20 thousand rubles;

- Art. 8.5 Code of Administrative Offenses of the Russian Federation. According to this norm, a violation is regarded as a deliberate concealment or distortion of environmental information. Fine - up to 6 thousand rubles for the responsible person in the organization and up to 80 thousand rubles - for the enterprise itself;

- P. 8.2 Code of Administrative Offenses of the Russian Federation. Affects SMEs whose operations generate waste. Sanctions - up to 30 thousand rubles for a responsible employee, up to 250 thousand rubles or administrative suspension of activities for a period of up to ninety days - for an organization, up to 50 thousand rubles or administrative suspension of activities for a period of up to ninety days - for individual entrepreneurs;

- P. 19.7 Code of Administrative Offenses of the Russian Federation. If the inspector regards it as failure to provide information, if its submission is required by law, then the violator will face the most “mild” punishment - up to 500 rubles for an official, up to 5 thousand rubles for a legal entity.

The Regional Code of Administrative Offenses of the Nizhny Novgorod Region provides for liability under Art. for violation of the procedure for submitting environmental reports to the Ministry of Ecology. 5.17. It provides for a fine of up to 10 thousand rubles per employee of the enterprise. In relation to the organization, the regional legislator is more severe than the federal one - the fine can reach 100 thousand rubles with a minimum threshold of 50 thousand rubles.

How to calculate fees for 2021

The calculation of the pollution fee for the year is made in the declaration, which includes:

- title page;

- a section with summary results of calculations, in which accrued amounts are reduced due to expenses that reduce the negative effect of polluting impacts, and due to advances paid during the year;

- 3 special sections (according to the number of main types of pollution sources), each of which is a table with the parameters necessary to calculate the payment for the corresponding pollution source, and is filled out only if the payer has such a source.

Calculation in special sections occurs according to the rules described in detail in the order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 (in the notes to the declaration form) and in the Decree of the Government of the Russian Federation dated 03/03/2017 No. 255. Both of these documents also contain the necessary values used in the calculations coefficients

For more information about the parameters involved in the calculations, read the article “Calculation of fees for environmental pollution - 2021 - 2021”.

Feeding method

The declaration is submitted to the executive body in one of two options:

- electronic;

- on paper.

At the same time, we note that according to the recommendations of the Ministry of Natural Resources of the Russian Federation, an electronic version of the document is preferable. A paper form is permitted only under the following circumstances:

- there is no possibility of connecting to the Internet;

- lack of electronic signature;

- the amount of payment based on the results of the year does not exceed 25,000 rubles (but even in this case it is recommended to additionally submit an electronic version of the document).

Deadlines for pollution charges

Legal entities obligated to make such payments make advance payments 3 times a year. Calculations for the year are completed with one more payment - payment of the total amount received in the section of the declaration allocated to summary data, as a result of arithmetic operations performed on the amount calculated in special sections.

Thus, there are two types of deadlines for payment.

- For advance payments - in 2021 they will expire on April 20, July 20 and October 20.

IMPORTANT! If the due date for payment for the tax assessment coincides with a weekend, the payment must be transferred the day before, since Law No. 7-FZ does not provide for the transfer of deadlines to the next working day (as in the Tax Code of the Russian Federation).

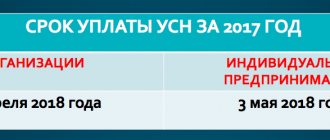

- For the final payment for the year, the deadline for this period corresponds to March 1 of the year following the reporting year, i.e. payment for 2021 will need to be made no later than 03/01/2021.

ConsultantPlus experts explained what will happen if you don’t pay the fee for the tax assessment on time. Get free demo access to K+ and go to the Ready Solution to find out all the consequences.

Those organizations that are not required to pay advances transfer payments to the NVOS once (at the end of the year), i.e., there is only one deadline for them (March 1).

Overpayments under the Tax Assessment can be offset or refunded. Since 09/07/2019, the procedure for credit/refund has been established by law.

Common to all legal entities, regardless of the scale of their business, is the deadline established for submitting a declaration on the NVOS, which expires on March 10 of the year following the reporting year.

For information on possible ways to submit a declaration on the NEE, read the material “How to submit a declaration on payment for negative environmental impact?”.

How to reflect in accounting the fee for negative environmental impact paid in the current reporting year in the form of advance payments? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In what form should I report to the RPN?

Payers whose payment amount for the previous reporting period was 25 thousand rubles or less can report for the NVOS on paper or electronically (clause 6 of Order of the Ministry of Natural Resources dated December 10, 2020 No. 1043). If a company reports on paper, it must attach an electronic version of the declaration to the printout.

All others must submit declarations for the IEE only in electronic format. This can be done through your personal account on the RPN portal or through an electronic document management (EDF) operator.

Experts advise all companies to switch to the electronic reporting format in the RPN, since this greatly simplifies the process of preparing and submitting the declaration.

| What to pay attention to when preparing a declaration for the NVOS | Report submission form | ||

| on paper | in electronic format | ||

| through the personal account of the RPN service | through the EDF operator | ||

| Decide in advance in what format you will submit the report in order to take into account all the nuances | By mail or in person to the supervisory authority. Only for SMEs, if their annual fee for the previous reporting period is ≤ 25 thousand rubles | Purchase an electronic signature certificate (ES). If the report is not signed with an electronic signature, it will need to be duplicated on paper | An electronic signature certificate is already included in the price of the service; the EDF operator is responsible for the document flow process with the department |

| Learn on your own the features of environmental legislation and the technical nuances of sending reports to the RPN | Video instructions and consultations on working in the service, filling out forms, legislation for subscribers | ||

| Keep track of the relevance of declaration forms and other changes in legislation | Declaration forms for NVOS are always up to date | ||

| Check the declaration for possible errors, verify all the data in it to minimize the likelihood of sending an incorrect report | The built-in error checking system will highlight possible shortcomings in color | ||

| The declaration is submitted by March 10 of the year following the reporting year. Try to submit the declaration in advance to avoid possible difficulties with sending and subsequent sanctions (Article 8.5 of the Code of Administrative Offenses of the Russian Federation) | Send reports in one click. You can send a report literally at the last minute - and it will be submitted | ||

| There may be queues at post offices or at offices of supervisory authorities when submitting a report on paper | On the last day of reporting, there may be overloads of the portal and failures in sending reports | ||

| Track the status of your report: is the report accepted, are there any error notifications? | Control the document flow process with the on-load tap-changer so you don’t miss notifications | Track document status online. If you have problems with the report status, contact the service technical support | |

| Respond promptly to error notifications sent by the RPN | Find out what errors need to be corrected in accordance with the notification, and send a response by mail or through your personal account | Technical support specialists will help you understand the notification, correct the error, prepare and send a response in the service | |

Where and how to pay advances for NVOS

Regarding the place of payment, the pollution fee is linked as follows (Clause 1, Article 16.4 of Law No. 7-FZ):

- for emissions and discharges it is paid to the budget at the location of the source of pollution;

- for disposed waste it is paid where the waste is disposed of.

That is, OKTMO for payment carried out for different types of polluting objects may turn out to be different. And this must be taken into account not only when drawing up the declaration, but also when making advance payments.

Depending on the type of pollution source, the values of the BCC indicated in the payment document will also differ.

For information on the BCC values used for payments for new environmental impact materials, see the article “BCC for negative environmental impact.”

A new tax will be introduced in Russia. Payment procedure

Rosprirodnadzor administers fees for environmental pollution. Details for payment must be obtained from the territorial office of the department. If sources of pollution are located in several regions, funds must be transferred to the budget of each of them. It is worth remembering that not only the details of territorial authorities differ, but also the CSC, depending on the type of pollution. You can familiarize yourself with them in Appendix 1.1 to Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n.

Be careful: starting from 2021, the fee for the NVOS may be replaced by an environmental fee - such an initiative is being discussed.

What distinguishes payments under NVOS from environmental payments?

In addition to payments under the NVOS, there is another payment of an environmental nature, which has the official name “environmental fee”. It is regulated by another regulatory act - the Law “On Industrial and Consumption Waste” dated June 24, 1998 No. 89-FZ.

It has many differences from pollution charges:

- the circle of payers represented by persons producing or importing products that require their disposal upon completion of use;

- tax base, defined as the volume of recycled goods, adjusted to the recycling standard;

- rate depending on the type of product being disposed of;

- the deadline established for payment and being the only one, coincides with the deadline for submitting collection reports and corresponds to the date of April 15 of the year following the reporting one.

The legislation does not provide for advance payment of environmental fees. Thus, there is no need to make advance environmental payments in 2021.

Read more about the environmental fee in the material “Who must pay the environmental fee in 2021 - 2021?”

How to register an object for hazardous production

The following indicators depend on which category the operating facility is given:

- Determination of the fee that must be paid within the framework of current standards for environmental pollution.

- Plans for environmental programs.

- Standards for permissible impacts that are allowed during its operation.

- If it was decided to classify an object as category 1, the procedure for introducing modern environmental efficiency technologies is relevant for it.

The register of objects is maintained by the state

If the impact on the environment is negative, the objects must be entered into the state register. This mechanism is valid for both legal entities and individuals who have received the status of individual entrepreneurs.

Registration of an object hazardous to nature must be carried out no later than 6 months after the start of its work - this is stated by federal law.

The algorithm of actions is as follows:

Stage 1. Enterprise specialists or a private entrepreneur determine the category of the object within the framework of Government Decree No. 1029. If the specified compliance is not identified, it does not need to be registered. Otherwise, go to the second point of the algorithm.

Stage 2. Users go to the Rosprirodnadzor portal and, having selected a category, fill out the necessary elements of the application form for registration.

If, based on the level of impact, an object can be classified into several groups, the level of danger is established based on the maximum.

The application is sent through access to your personal account. If the owner or tenant of the property does not have the ability to sign electronic documents, the application must be duplicated in documentary form. It contains the report identifier that was issued when transferring data in the RPN portal format. Documentary support is provided for the paper version. The date of the application is the date of receipt of information by the regulatory authority.

Table 1. Who is responsible for accepting applications

| Characteristics of activities | The structure that is authorized to oversee the timely submission of reports |

| The enterprise's activities are under federal environmental control | Regional division of RPN |

| Some of the facilities are under the control of the federation, some are under the jurisdiction of regional environmental units | Regional division of RPN |

| The activity of the facility is monitored at the regional level | Territorial executive structure (one option is the Ministry of Environment) |

| NVOS facilities are located in different regions | An independent application is generated for each region |

Stage 3. In the personal account of the natural resource user, you can find out the answer to the application - positive, with receipt of a certificate, or negative, indicating errors and asking for their correction.

Also, at the stage of contacting specialists, you can update current information, declare the liquidation of an object or suspension of activities.

When accounting information changes, the category assigned to the object may also change. Data updating is necessary in the following cases:

- A different production technology is being introduced.

- The object moves to another location.

- Environmental technologies and equipment are being improved, thereby reducing the burden on the environment.

To receive a certificate of the assigned category of an object, taking into account the new data, you need to transfer it to an employee of the department. The further mechanism is identical to the primary algorithm - they have 10 days to study the documents, after which an official document is issued.

If an object is frozen or undergoes a liquidation process, it is removed from the register - the state registration procedure is confirmed by an act, after which, after 10 days, the enterprise receives a certificate.

If the object remains without a registration number, the fine for legal entities in this case will be from 30 to 100 thousand rubles, and officials may receive a monetary penalty in the amount of 5 to 20 thousand rubles - this information is contained in the Code of Administrative Offenses. Similar penalties await managers and business owners when data is not provided in full.

It is necessary to register with the state in order to receive payment.

The service for providing a state certificate is free. There are also some points to keep in mind when collecting the information presented below.

If several facilities are involved at one production site, a register is created for each of them. When operating facilities are located in different constituent entities of the Russian Federation, the user of natural resources independently determines which territorial body of Rosprirodnadzor to send the application. In the case of a lease, it is submitted by the person who entered into the agreement. Conducting activities at a facility under construction assumes that the register is updated with new data after it is put into operation.

When the department receives data about an object or complex that causes damage to the environment, its specialists have 10 days to make a decision (provided that a complete set of information has been collected on these objects). They may refuse due to the absence of certain documents or incorrect completion, of which the applicant is notified within 5 days from the date of application. In case of a positive outcome, Rosprirodnadzor issues a corresponding certificate.

Detailed information about the categories is contained in the official document of the Russian Federation Decree. To assess the scale of pollution for different objects, you should consider examples:

- Objects of the 1st category include a pig farm, the livestock of which exceeds 2000 units, and a mining enterprise.

- The second group of facilities includes an airport, which is equipped with a runway more than 2,100 meters long, and a facility for breeding and keeping cows with a population of more than 400 heads.

- Category 3 facility – this group includes a bakery with a full production cycle, including flour procurement, product production and packaging.

Results

Advances on payments for NVOS must be paid by legal entities that are not classified as small or medium-sized businesses.

Such payments are made three times a year, upon completion of the 1st, 2nd and 3rd quarters, no later than the 20th day of the month following the end of the corresponding quarter. The amount of each advance is determined in one of three ways specified in Law No. 7-FZ. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to form an application

You can fill out an application online through your personal account and software module.

Regardless of the method of registration and transmission of information, the data about the object will include:

- General information with name, contacts, details, etc.

- Location information.

- Date of commissioning of the facility and technical characteristics, including its design capacity.

- Hazard category according to established criteria and standards.

- The presence of environmental technologies and measures in the organization or individual entrepreneur, as well as their compliance with modern requirements.

- The nature of reporting to government agencies.

- Detailed information about the types and volumes of pollution and sources of formation.

- Permits that allow the discharge of harmful substances.

The specified set of information can be obtained from the departments that are responsible for compliance of the facility’s activities with the regulatory requirements of Rosprirodnadzor - in particular, they can be requested from the engineering service.

Up-to-date information is required to be included in the register.

Organizations and individual entrepreneurs should know an approximate list of documents that they have the right to demand from government authorities.

Are additional documents required for calculating payments?

Current legislation does not provide for the provision of related information for calculations in the NVOS declaration. In this case, Rosprirodnadzor may request, in order to verify the correctness of payment calculations, copies of documents such as:

- Agreement on lease or ownership of objects (this group may include premises, buildings, land plots for commercial and industrial purposes).

- Regulatory information for a specific organization.

- Waste transfer agreement.

- Documents that record the direct use of waste, etc.

This condition especially applies to large payers.

In some cases, representatives of Rosprirodnadzor may limit themselves to a certificate of production activity. Much depends on the territorial location of the units and specific local requirements. It is advisable to clarify additional information in the accounting department where the certificate of the type of pollution facility was obtained.