Grounds for calculating payments for the maintenance of children and other persons

Withholding may be made on the basis of:

- a writ of execution, which is sent to the payer’s new place of work by bailiffs;

- statements of the employee, if he decided to transfer them voluntarily.

Upon receipt of a writ of execution, the organization must familiarize the employee with this fact and begin making deductions. Moreover, she is obliged to do this regardless of the employee’s wishes.

If the employee himself wrote an application to withhold part of the income and transfer it to support children, then at any time he can, by writing a new application, stop voluntarily transferring money to support children or other persons.

Also, often a newly hired employee notifies the company of the need for deductions before receiving a writ of execution. This will help the payer avoid accumulating arrears of alimony payments.

In the application, the employee must indicate:

- the reason and amount of the withholding;

- Full name, passport details of the recipient;

- FULL NAME. and dates of birth of children;

- details for transfer.

Withholding alimony from wages - the procedure for posting deductions with examples

The agreement determines the amount of alimony as agreed between the parties, but not less than the amount specified in Art. 81 SK, clause 1. One child is paid ⅟4 of the income, two – ⅟3, three or more – half. It happens that an employee pays alimony to different families according to different documents. If in total more than 50% must be paid, a deduction is made on the basis of Art. 110 SK.

Mandatory deductions cannot exceed 50% of income. In some cases, it is possible to withhold 70%, for example, when deducting under several executive documents. This includes child support deductions, compensation after injury to health or death of the breadwinner, and compensation for intentional damage.

How to make payments under a writ of execution

Withholding of alimony is made from all payments made to the payer: wages, vacation pay, bonuses, financial assistance (Government Decree No. 841 of July 18, 1996). You should also include payment for sick leave in the database.

Only a small list of payments are not subject to penalties (Article 101 229-FZ of October 2, 2007):

- compensation payments established by labor legislation (for example, for the use of personal vehicles);

- travel expenses;

- in connection with birth, death, and marriage registration.

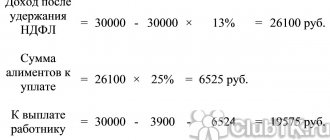

The amounts withheld are calculated from income after deducting personal income tax. The court determines the following amount of deductions:

- for one child - one quarter of income;

- for two children - one third;

- for three or more children - half the income.

At the same time, the writ of execution may order the collection of debt for previously unpaid alimony. The maximum amount of alimony deductions under a writ of execution is 70% (Article 138 of the Labor Code of the Russian Federation).

The withheld alimony must be transferred or paid from the cash register within three days after the payment of wages. All transfers are made at the expense of the debtor. That is, if the bank charges a commission for a transfer, the organization has the right to recover its amount from the employee’s income.

How does the accounting department pay child support?

Withholding child support must have a legal basis. That is, a potential payer cannot come to the accounting department and say: “I want you to transfer a quarter of my salary to my ex-wife/husband.” For the process to proceed, you need an agreement certified by a notary, a court order or a writ of execution. Of course, the first option is more preferable, because litigation is not very pleasant and lasts quite a long time. However, the accounting department doesn’t care, and this service will accept any document confirming the legal grounds for deduction of alimony in favor of the former spouse. Let's look at the features of this operation through the eyes of an accountant:

- From what payments are deductions made? Contributions in favor of the child are transferred not only from the basic salary. The Government of the Russian Federation has decided to pay alimony from many types of citizen’s income. So the payer will not be able to cheat on the premium. What can I say, even remuneration in kind is subject to mandatory division. Alimony is withheld from wages at the main place of work and from any additional earnings, as well as from most payments provided for by the legislation of the Russian Federation. This includes compensation for meals, income from rental property, income from copyrights, and dividends. In general, a single parent will be forced to share almost all income imaginable with their children. This is not true in all cases, since often after deducting taxes and alimony the payer is left with a very modest amount. But you can’t argue with the law, and you have to get out of it like crazy until your son turns 18.

- Payment terms. Since alimony is directly related to the payer’s income, the date of their transfer usually coincides with the arrival of fixed assets to his account. That is, on the day of the alimony provider’s salary, funds for the maintenance of the child are received by the recipient, a maximum of three days later. Usually, accountants monitor the timely payment of alimony, since they are the ones who face punishment for late payments. How many times a month are funds collected for the maintenance of a minor child? After all, according to the law, salaries are paid in installments twice a month, that is, workers receive an advance and the bulk of the funds. Most often, alimony is paid once a month, deducted from the total amount of income, but there are exceptions. It is clear that the first option is more convenient for accountants, but sometimes a single parent requires double payment. By the way, you can receive alimony in three ways: by mail, at the cash desk of the organization where the payer works, and by bank transfer using the account number. Needless to say, the last method is the most convenient and popular. In one moment, the funds appear on your bank card, and you don’t need to go anywhere to get your legitimate money.

- Personal income tax and alimony. Is alimony transferred by the accounting department before personal income tax is deducted or after? This issue justifiably worries payers, because funds for child support are most often paid as a percentage of income. And before deducting personal income tax, the figure would have looked much more impressive. However, the amount of child benefits is calculated after taxes are paid, from the “net” salary. If the employee is entitled to benefits and personal income tax is not withheld from him, then alimony is calculated from total income without tax deduction.

- What income cannot be withheld? Are there any funds that will go to the child support provider’s account in pure form, and they do not need to be shared with the children? Yes, there are some. This may include payments on the occasion of the birth of another child, marriage registration, compensation in connection with the death of close relatives, business trips, therapeutic and preventive nutrition, moving to a remote area, and wear and tear of working tools. Also, alimony is not charged for financial assistance in the event of a serious illness or work injury. The survivor's pension remains entirely with the recipient. If an employer reimburses an employee for the cost of trips to a sanatorium, then it is also impossible to collect funds for child support from these payments.

This is important to know: Which court considers the collection of alimony

Child support is paid until the child reaches 18 years of age. The procedure for their payments does not change if the employee continues to work in the same organization. If the payer has changed his place of work, then the recipient of alimony must forward all the necessary documents (agreement, writ of execution, court order) to the accounting department of this enterprise.

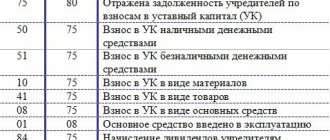

Alimony: entries in accounting

Let's look at accounting using an example.

Manager Altufiev S.N. According to the writ of execution, he pays alimony for two children in the amount of 1/3 of his earnings. The employee's salary for January 2021 was 30,000 rubles. The employee did not write an application for a personal income tax deduction.

| Sum | Debit | Credit | |

| Salary accrued | 30 000 | 44 | 70 |

| Personal income tax withheld 30 000 × 13 % | 3900 | 70 | 68 |

| Maintenance payments are withheld from the employee's income (30 000 – 3900) × 1/3 | 8700 | 70 | 76 |

| The withheld amounts are transferred to the recipient's current account | 8700 | 76 | 51 |

| Bank commission paid for transfer (0.1%) 8700 × 0,1 % | 8,70 | 73 | 51 |

| Bank commission for transfer is withheld | 8,70 | 70 | 73 |

| Employee's salary transferred 30 000 – 3900 – 8700 – 8,70 | 17 391,30 | 70 | 51 |

The recipient can also choose to receive the payment in cash.

Alimony payments were issued from the cash register, posting Dt 76 Kt 50.

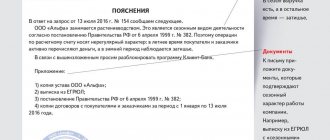

Registration of transfer of alimony through accounting

If the spouses were able to agree with each other on the payment of alimony without bringing the matter to court, then all they have to do is confirm the terms of their agreement with a notary. When peace negotiations do not lead to anything, the potential recipient of child support brings an application to the court. If the defendant agrees to pay alimony under the specified conditions, the court will issue an order. If there are serious disagreements between the former spouses, the single parent will be forced to file a statement of claim in court, after which the verdict will be a writ of execution. In order for an employer to begin transferring alimony, he must provide documents confirming the legal basis for the payments. Such papers include notarized agreements between spouses, court orders and writs of execution.

Articles on the topic (click to view)

- Assignment of the right to claim under alimony obligations is possible

- Formula for calculating penalties and fines for alimony: sample

- What are the consequences of non-payment of alimony in 2021?

- Find out the debt by name from the bailiffs for alimony

- Reducing alimony debt over the past period

- Payment of alimony voluntarily without agreement

- Criminal liability for non-payment of alimony under Art. 157 of the Criminal Code of the Russian Federation

All these documents must indicate the conditions for the transfer of alimony, as well as the details for their transfer (mailing address of the defendant or bank account). The claimant must himself send the original papers to the organization where the future payer works. If the alimony worker works at several enterprises at once, then it is necessary to deliver documents to each of them. Duplicates, photocopies and scanned electronic versions are not accepted.

Agreements on the payment of alimony, writs of execution and court orders are documents of strict accountability. Therefore, the employer appoints a responsible accounting employee to record, store and process them. These papers are handed over against signature and are stored not in a general pile of documents, but in specially designated places: safes or metal locked cabinets.

If documents on the assignment of alimony are lost, the responsible person may be punished with a fine of up to 2,500 rubles.

The entire procedure for withholding and paying alimony is specified in the Family Code of the Russian Federation. Upon receipt of writs of execution, orders and agreements, the accountant is obliged to record their appearance in the reporting journal. Then the responsible employee determines from what date the funds must be withheld. The date must be indicated on the documents received. Sometimes the papers arrive much later than the start date of collection stated in them. In this case, the accountant is obliged to borrow the debt for the previous days or months from the employee of the enterprise. If all the necessary documents arrive on time, then the accounting department begins to calculate payments for child support from the employee’s next salary according to the specified percentage or a fixed amount after deducting personal income tax. Alimony is not paid in advance, so the recipient can expect it no earlier than the day the former spouse “pays”, but no later than three days after this event.

According to the law, alimony cannot amount to more than 50% of a citizen’s income. If, in addition to the basic monthly contribution, a child support debt is withheld, then the total amount of payments should not exceed 70% of the salary. Before making payments, the accounting department checks whether these conditions are met.

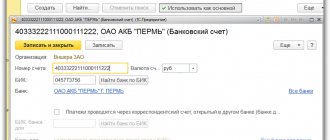

Postings for the transfer of alimony reflect quantitative changes in the payer’s salary and are usually characterized by the debit and credit of the accounting item. So, the debit part will always have account No. 76, and the credit part will depend on the method of paying alimony. That is, account No. 50 is a cash payment, No. 51 is for payment by bank transfer, No. 71 is for a postal transfer. And the posting of alimony through the eyes of an accountant always looks like this: Dt 76 Kt 50 (51, 71).

When transferring alimony, the organization does not undertake additional expenses associated with the delivery of funds to the recipient. That is, the costs for bank commissions and postal transfers are paid by the employee.

Also, payers often have a reasonable question: is it necessary to pay alimony from the refund of tax deductions? For example, if an employee gets sick, studies or buys a home, he can get some of the funds back by filing an application with the tax office. In fact, these payments are not listed in the list of income from which alimony is collected. Therefore, the payer can be calm in the event of receiving a tax refund.

This is important to know: Statement of claim for the recovery of alimony for spousal support: sample