Accounting

In 2011, there were changes to the BCC for taxes paid in connection with the use of special tax regimes (simplified taxation, UTII, unified agricultural tax).

The rest of the KBK remained the same. For a list of new CBCs, see the link.

For the nuances of transferring payments to the budget system of the Russian Federation, see Letter of the Ministry of Finance of Russia dated 02.02.2011 No. 02-04-09/402.

BCC, which are used in 2010 , were approved by order of the Ministry of Finance of Russia dated December 30, 2009 No. 150n.

Here is the list of BCC for 2010, as well as the list of BCC for insurance premiums for 2010.

KBK, which operated in 2009 , were approved by order of the Ministry of Finance of Russia dated August 24, 2007 N74n.

The list of budget classification codes for 2009 is presented below:

| Tax name | KBK for 2007 |

| VAT | 18210301000011000110 |

| Personal income tax | |

| From all income (at a rate of 13%) | 18210102021011000110 |

| From dividends (at a rate of 9%) | 18210102010011000110 |

| From the income of individuals who are not tax residents (at a rate of 30%) | 18210102030011000110 |

| From winnings and prizes for advertising purposes, material gain (at a rate of 35%) | 18210102040011000110 |

| For entrepreneurs | 18210102022011000110 |

| UST | |

| To the federal budget | 18210201010011000110 |

| To the Social Insurance Fund of the Russian Federation | 18210201020071000110 |

| To the Federal Compulsory Medical Insurance Fund of the Russian Federation | 18210201030081000110 |

| To the territorial compulsory health insurance funds of the Russian Federation | 18210201040091000110 |

| Insurance contributions credited to the Pension Fund of the Russian Federation | |

| To pay the insurance part of the labor pension | 18210202010061000160 |

| To pay the insurance part of the labor pension (fixed payment for entrepreneurs | 18210202030061000160 |

| To pay the funded part of the labor pension | 18210202020061000160 |

| For payment of the funded part of the labor pension (fixed payment for entrepreneurs | 18210202040061000160 |

| Corporate income tax | |

| To the federal budget | 18210101011011000110 |

| To the budgets of the constituent entities of the Russian Federation | 18210101012021000110 |

| A single tax levied under a simplified taxation system (except for the minimum tax credited to extra-budgetary funds) | |

| Tax calculated on the amount of income | 18210501010011000110 |

| Tax calculated on the difference between income and expenses | 18210501020011000110 |

| Minimum tax credited to extra-budgetary funds | 18210501030011000110 |

| Simplified tax under the patent system | 18210501040021000110 |

| UTII | 18210502000021000110 |

| Tax on property of organizations if the property is not included in the Unified Gas Supply System | 18210602010021000110 |

| Transport tax | |

| For organizations | 18210604011021000110 |

| For individuals | 18210604012021000110 |

| Gambling tax | 18210605000021000110 |

| Water tax | 18210703000011000110 |

| Land tax | |

| For lands taxed at a rate of 0.3 percent: tax for lands in Moscow and St. Petersburg | 18210606011031000110 |

| tax on lands of urban districts | 18210606012041000110 |

| tax on lands of inter-settlement territories | 18210606013051000110 |

| tax on settlement lands | 18210606013101000110 |

| For lands taxed at a rate of 1.5 percent: tax for lands of Moscow and St. Petersburg | 18210606021031000110 |

| tax on lands of urban districts | 18210606022041000110 |

| tax on lands of inter-settlement territories | 18210606023051000110 |

| tax on settlement lands | 18210606023101000110 |

| Mineral extraction tax | |

| Oil | 18210701011011000110 |

| Natural gas | 18210701012011000110 |

| Gas condensate | 18210701013011000110 |

| Common minerals | 18210701020011000110 |

| Other minerals | 18210701030011000110 |

| Fee for the use of fauna and aquatic biological resources | |

| Fee for the use of fauna objects | 18210704010011000110 |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 18210704020011000110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 18210704030011000110 |

| Unified agricultural tax | 18210503000011000110 |

| Contributions for compulsory social insurance against accidents at work and occupational diseases | 39310202050071000160 |

Budget classification codes - 2010

Codes for classification of income of budgets of the Russian Federation administered by the Federal Tax Service for 2010

Budget classification codes have been determined for which insurance premiums for compulsory pension insurance and compulsory health insurance will be paid from January 1, 2010.

Amendments to Russian legislation approving these codes were adopted by the State Duma of the Russian Federation in the first reading. If the budget classification codes presented below are changed, the Pension Fund of the Russian Federation will provide additional notification.

Let us recall that in connection with the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” that came into force On January 1, 2010, control over the correct calculation and payment of insurance contributions for compulsory pension insurance and compulsory health insurance will be carried out by the Pension Fund and its territorial bodies.

Payers of insurance premiums should take into account that insurance premiums for 2010 should be paid to budget classification codes, where the income administrator will be the Pension Fund of Russia, that is, to budget classification codes, where the first three digits are 392.

If the payer has arrears in insurance premiums for previous periods, as well as insurance premiums for 2009, they should be paid to budget classification codes where the revenue administrator is the Federal Tax Service, that is, to budget classification codes where the first three digits are 182.

The declaration on insurance premiums for 2009 should be sent to the tax authorities, since in 2009 control over the correct calculation and payment of insurance premiums was carried out by the tax authorities.

Individual entrepreneurs, lawyers, notaries and other categories of persons who independently provide themselves with work must pay insurance premiums for 2009 to the budget classification codes, which take into account insurance premiums in the form of a fixed payment.

Since from January 1, 2010, the concept of “insurance premiums in the form of a fixed payment” will be absent from the legislation, insurance premiums are paid for 2010 according to budget classification codes, which take into account insurance premiums paid based on the cost of the insurance year.

| 182 | 1 0900 140 | Arrears, penalties and fines on contributions to the Pension Fund of the Russian Federation |

| 182 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 182 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 | Pension Fund of the Russian Federation | |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 | 1 0200 160 | Insurance contributions in the form of a fixed payment credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 | 1 0200 160 | Insurance contributions in the form of a fixed payment, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 | 1 0200 160 | Additional insurance contributions for the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation |

| 392 | 1 0200 160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation to pay the insurance part of the labor pension |

| 392 | 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 | 1 1600 140 | Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) |

| 392 | 1 1600 140 | Monetary penalties (fines) imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48 - 51 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical funds insurance" |

| 392 | 1 0200 160 | Insurance premiums for compulsory health insurance, credited to the budget of the Federal Compulsory Health Insurance Fund |

| 392 | 1 0200 160 | Insurance premiums for compulsory health insurance, credited to the budgets of territorial compulsory health insurance funds |

KBK Archive

- KBK for 2021

- KBK for 2021

- KBK for 2021

- KBK for 2021

- KBK for 2021

- KBK for 2021

- KBK for 2015

- KBK for 2014

- KBK for 2013

- KBK for 2012

- KBK for 2011

- KBK for 2010

- KBK for 2009

- KBK for 2008

- KBK for 2007

- KBK for 2006

- KBK for 2005

- KBK for 2003

KBC for insurance premiums. For 2009 and 2010

(Federal laws of the Russian Federation dated November 28, 2009 No. 292-FZ

“On the budget of the Social Insurance Fund of the Russian Federation for 2010 and for the planning period of 2011 and 2012”

,

dated November 28, 2009 No. 294-FZ

“On the budget of the Federal Compulsory Medical Insurance Fund for 2010 and for the planning period of 2011 and 2012”

,

dated November 30, 2009 No. 307-FZ

“On the budget of the Pension Fund of the Russian Federation for 2010 and for the planning period of 2011 and 2012”

)

In accordance with the Federal Law of the Russian Federation dated July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation Federation, Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds" from January 1, 2010

the amount of insurance premiums is calculated and paid by insurance premium payers

separately to each state extra-budgetary fund

.

Payers of insurance premiums making payments to individuals

, during the billing period, pay insurance premiums in the form of monthly mandatory payments.

Monthly required payment

must be paid

no later than the 15th day

of the calendar month following the calendar month for which the monthly obligatory payment is calculated.

Payment of insurance premiums is carried out in separate settlement documents sent to the funds to the appropriate accounts of the Federal Treasury.

Payers of insurance premiums (individual entrepreneurs, lawyers, notaries engaged in private practice) calculate insurance premiums “for themselves” independently

and pay them for the billing period (that is, for the year)

no later than December 31 of the current calendar year

.

In this case, the amount of insurance premiums is calculated separately

in relation to the Pension Fund, FFOMS and TFOMS.

Payment

insurance premiums are carried out

in separate settlement documents

sent to the funds to the appropriate accounts of the Federal Treasury.

No later than January 15, 2010

you will need to pay insurance premiums for compulsory pension insurance for December 2009, as well as advance payments under the unified social tax for December 2009, credited to the Federal Social Insurance Fund of the Russian Federation, FFOMS and TFOMS.

In applications number 1

Federal Laws No. 292-FZ, 294-FZ, 307-FZ contain lists of the main administrators of budget revenues of the Federal Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Pension Fund of the Russian Federation, which

indicate the BCC for insurance premiums

.

For convenience, we have summarized all the codes in a table.

| Budget classification code of the Russian Federation | Contributions |

| For 2009 contributions paid in 2010 | |

| 182 1 0900 110 | Unified social tax credited to the Federal Social Insurance Fund of the Russian Federation |

| 182 1 0900 140 | Arrears, penalties and fines on contributions to the Social Insurance Fund of the Russian Federation |

| 182 1 0900 110 | Unified social tax credited to the Federal Compulsory Medical Insurance Fund |

| 182 1 0900 140 | Arrears, penalties and fines on contributions to the FFOMS |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the funded part of the labor pension |

| 182 1 0900 140 | Arrears, penalties and fines on contributions to the Pension Fund |

| 392 1 0200 160 | Additional insurance contributions for the funded part of the labor pension and employer contributions in favor of insured persons who pay additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund. |

| Based on contributions for 2010 | |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity |

| 392 1 0200 160 | Insurance premiums for compulsory health insurance, credited to the FFOMS budget |

| 392 1 1600 140 | Monetary penalties (fines) imposed by the Pension Fund of Russia and its territorial bodies |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the funded part of the labor pension |

| 392 1 0200 160 | Additional insurance contributions for the funded part of the labor pension and employer contributions in favor of insured persons who pay additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund. |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of the funded part of the labor pension |

| 392 1 1600 140 | Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the Pension Fund budget) |

| 392 1 1600 140 | Monetary penalties (fines) imposed by the Pension Fund of Russia and its territorial bodies for failure to provide documents and information |

In connection with the adoption of Order of the Ministry of Finance dated December 21, 2012 No. 171n “On approval of the Instructions on the procedure for applying the budget classification of the Russian Federation for 2013 and for the planning period of 2014 and 2015,” we inform payers about changes in budget classification codes (BCC) for payment of insurance premiums, credited to the Pension Fund budget from January 1, 2013.

| Since January 1, 2013, the bodies of the Pension Fund of Russia have been administering the receipt of insurance contributions for compulsory pension insurance for billing periods from 2002 to 2009 inclusive, the administrator of which was previously the bodies of the Federal Tax Service. | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance premiums for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance premiums for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods from 2002 to 2009 inclusive) |

| BCC for insurance premiums for compulsory pension insurance in the amount determined based on the cost of the insurance year is used by individual entrepreneurs only to pay arrears for billing periods expired before January 1, 2013 | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013 |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013) |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) |

| From January 1, 2013, individual entrepreneurs must pay insurance contributions for compulsory pension insurance in a fixed amount for the following BCCs | |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

| 392 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

| 392 1 0200 160 | Penalties on insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension |

Budget classification codes for insurance contributions for compulsory pension insurance and compulsory health insurance, applied in 2011 and not specified above, continue to be applied in 2013.

Dear payers! The Pension Fund branch draws your attention to the fact that accounting for receipts of insurance contributions to the budget of the Federal Compulsory Medical Insurance Fund, according to the budget income classification code 392 1 02 02 101 08 0000 160 “Insurance contributions for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Fund insurance" will be carried out according to the following codes of subtypes of income: 392 1 02 02 101 08 1011 160 - insurance contributions to the Federal Compulsory Medical Insurance Fund for compulsory medical insurance of the working population , received from payers;

392 1 02 02 101 08 1012 160 - insurance premiums for compulsory health insurance of the working population , previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012);

392 1 02 02 101 08 2011 160 - penalties on insurance premiums for compulsory health insurance of the working population , received from payers;

392 1 02 02 101 08 2012 160 - penalties on insurance premiums for compulsory health insurance of the working population , previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012);

392 1 02 02 101 08 3011 160 - amounts of monetary penalties (fines) for insurance premiums for compulsory health insurance of the working population received from payers;

392 1 02 02 101 08 3 012 160 - amounts of monetary penalties (fines) for insurance premiums for compulsory health insurance of the working population , previously credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012).

KBK

KBK

is a budget classification code or, more simply, a tax code.

BCC is indicated when preparing reports and paying taxes.

If you enter the wrong tax code when paying, the payment will be lost. Efforts will have to be made to find it on uncleared payments and further determine it.

KBK consists of twenty characters. The structure of the 20-digit code is shown in the figure.

| Structure of the budget income classification code | |||||||||||||||||||

| Code of the chief budget revenue administrator | Budget income type code | Budget income subtype code | Classification code for general government sector operations related to budget revenues | ||||||||||||||||

| Group | Subgroup | Article | Sub-article | Element | |||||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

The structure of the BCC can be explained as follows.

In 1-3 KBK characters

the code of the main administrator is indicated:

- 182 – FTS (Federal Tax Service),

- 392 – PFR (Pension Fund),

- 393 – FSS (Social Insurance Fund), etc.

In 14-17 characters

As a general rule, the budget classification code indicates the type of payment:

- 1000 – tax,

- 2100 – penalty,

- 3000 – fine.

For example, KBK for paying tax according to the simplified tax system (income):

| tax: | 182 1 05 01011 01 1000 110, |

| penalties: | 182 1 05 01011 01 2100 110, |

| fine: | 182 1 05 01011 01 3000 110. |

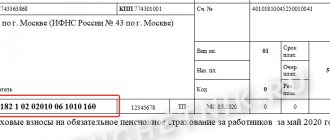

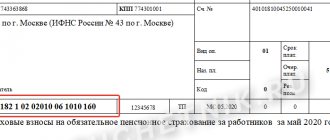

KBK when paying taxes

When filling out a payment document, the BCC is indicated in field (104). This is stated in the order of the Ministry of Finance dated November 12, 2013 No. 107n.

The figures show the fields where the BCC is indicated.

Where to get KBK

BCCs are approved by order of the Ministry of Finance, then further clarified by orders of chief administrators.

These documents are quite specific and take up hundreds of pages.

It is convenient to fill out a payment document using a special service on the Federal Tax Service portal

The table shows the main BCCs

on taxes and contributions for

2021

.

| Name of tax (contribution) | KBK | |

| Income tax | to the federal budget | 182 1 0100 110 |

| to the regional budget | 182 1 0100 110 | |

| Personal income tax | employer | 182 1 0100 110 |

| from the income of individual entrepreneurs | 182 1 0100 110 | |

| from an individual's income | 182 1 0100 110 | |

| from income taxed at 15% | 182 1 0100 110 | |

| VAT | (except imported) | 182 1 0300 110 |

| Contributions to OPS | employer | 182 1 0210 160 |

| Individual Entrepreneur (fixed payment) | 182 1 0210 160 | |

| Contributions to compulsory medical insurance | employer | 182 1 0213 160 |

| Individual Entrepreneur (fixed payment) | 182 1 0213 160 | |

| Contributions to VNiM | 182 1 0210 160 | |

| Contributions for injuries | 393 1 0200 160 | |

| simplified tax system | income | 182 1 0500 110 |

| income and expenses, including minimum tax | 182 1 0500 110 | |

| Unified agricultural tax | 182 1 0500 110 | |

| Patent | (urban district without intra-city division) | 182 1 0500 110 |

| Property tax | organization | 182 1 0600 110 |

| individual (urban district without intra-city division) | 182 1 0600 110 | |

| Land tax | organization (urban district without intra-city division) | 182 1 0600110 |

| individual (urban district without intra-city division) | 182 1 0600 110 | |

| Transport tax | organization | 182 1 0600 110 |

| individual | 182 1 0600 110 | |

| Tax penalty | must be indicated in 14-15 digits of the KBK - “21” | |

| Fine for non-payment of tax | VAT | 182 1 0300 110 |

| Other | must be indicated in 14-15 digits of the KBK - “30” | |

| Fine for failure to submit a declaration or DAM | (Article 119 of the Tax Code) | 182 1 1602 140 |

| Fine for failure to submit documents to the Federal Tax Service | (Article 126 of the Tax Code) | 182 1 1607 140 |

| Fine to the Pension Fund for failure to submit SZV-M or SZV-STAZH | 392 1 1600 140 | |