Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

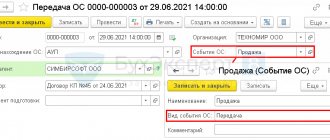

Let's look at the actions in 1C using the following example.

The organization produces women's shoes.

On January 29, the product “Megan” women’s sandals (500 pairs) was produced, for which the following was used:

- eco-leather “Lazur” - 250 linear meters;

- insoles - 500 pairs;

- shoe decorations with rhinestones - 1,000 pcs.

In addition, the Organization entered into an agreement with Zolushka LLC for the supply of women's shoes.

On January 30, the first batch of women's shoes worth RUB 177,000 was shipped. (incl. VAT 18%):

- Women's sandals “Megan” – 150 pcs. at a price of RUB 1,180.

How to set up an accounting policy

For a successful start, you need to configure the “Main-Accounting Policy” menu.

The main account for cost accounting is account 26 “General business expenses”

This requires replacement with 20.01 “Main production”. When you activate the checkbox in the “Product Output” line, you can include general expenses in the cost of sales or attribute them to the cost of production.

We select methods for distributing indirect costs by clicking on the appropriate line in this section.

A number of cost sharing alternatives are available at this stage.

Click “Create” and see the following window:

Select the period from which the current method and distribution base, account and cost item are entered. By clicking on the “Expense Account” button, we see a window where you can select these two accounts.

Account 25 “General production expenses” is selected. The next line of choice is much broader, where you can focus on depreciation, workers' compensation, write-off of materials, etc.

Establishing the allocation of indirect costs occurs in a similar way

The choice of direct cost account 20.01 “Main production” or 23 “Auxiliary production” occurs here. There is the possibility of accounting for cost according to plan. There is a checkbox for this.

Accounting for costs of production and release of finished products in 1C 8.3

Document production output with the document Production Report for a Shift in the section Production – Product Output – Production Reports for a Shift – Create button.

Reflect material costs for production on the Materials or in the document Requirement invoice .

Postings according to the document

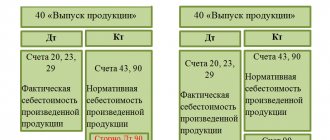

The document generates transactions:

- Dt Kt 20.01 - release of finished products only in quantitative terms, because Planned cost is not used.

- Dt 20.01 Dt 10.01 - release of materials into production.

Production costs

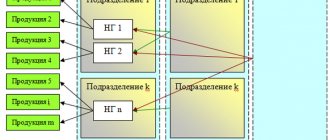

Accounting for production costs in the 1C: Accounting 8 program is carried out in the context of item groups (types of activity). They must first be entered into the directory “Nomenclature Groups” (menu: “Enterprise – Goods (materials, products, services)”). Example:

Direct production costs are recorded in accounts 20 “Main production” and 23 “Auxiliary production”. This includes everything that can be attributed to specific types of manufactured products (semi-finished products, production services): raw materials written off for production, depreciation of capital equipment, wages and payroll taxes of production workers, as well as some services.

During the month, direct costs are reflected in the program using documents such as “Request invoice”, “Receipt of goods”, “Advance report” (tab “Other”), “Payroll”, as well as routine operations “Depreciation and depreciation of fixed assets” funds”, “Calculation of taxes (contributions) from the payroll” and some others. You should pay attention to the correct indication of the nomenclature group both in documents and in the methods of reflecting depreciation expenses and reflecting wages in accounting.