Meaning of 40 accounts for accounting

40 account is intended to summarize information about the goods released during the reporting period, as well as to assess the emerging deviations between the standard and actual cost of goods produced.

In order to estimate the real value of the cost, the following information is used:

- information about the semi-finished products and materials used;

- data on costs for services or work of third-party enterprises;

- data on wage costs for workers engaged in production;

- information on fuel costs;

- indicators on the costs of maintaining premises allocated for production activities.

The planned cost of manufactured products for a future period can be calculated using average consumption indicators or data on a similar product produced in the previous period as a basis.

When is the account used? 40

Accounting for finished products without account 40 is carried out on account 43 at actual costs. The count of 40 can be used in different ways: consider four cases.

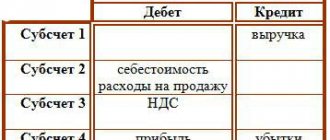

First case. To reflect product output at planned cost

On the account 40 summarizes information about manufactured products, completed works, and services provided for the month. The actual cost (c/st) of production is reflected as a debit, and the standard (planned) cost is reflected as a credit. By comparing debit and credit turnover at the end of each month, you will determine the deviation of the fact from the plan. If we receive a debit balance, this means that actual costs exceeded the planned ones, such excess is written off by posting Dt 90 Kt 40. If the plan exceeded the actual figures, the credit balance of the account is written off with a reversal entry Dt 90 Kt 40. Closing is carried out monthly, the balance at the beginning of each month is zero.

Example:

Dt 20 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 20 Kt 23, 25, 26 - expenses of other departments

Dt 43 Kt 40 - shows the planned cost Dt 62 Kt 90 - for the sales amount

Dt 90 Kt 43 - the planned cost is written off as expenses

Dt 40 Kt 20 - shows the fact of costs

Dt 90 Kt 40 - written off as a decrease in sales, excess of the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from plan written off to increase sales

An example of accounting for finished products without account 40:

Dt 20 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 20 Kt 23, 25, 26 - expenses of other departments

Dt 43 Kt 20 - expenses were written off for the cost of the GP

It is not entirely convenient to reflect production output without using account 40, since with WIP balances on the account. 20 writing off the cost of GP requires additional calculations and/or developed methods. Otherwise, write-off of the account. 20 in the total balance at the end of the month on the account. 43 may lead to an overestimation of the cost of production and the costs of its sales.

Second case: to account for GP produced not by the main one, but by auxiliary or servicing industries, which can also be involved in its production

The accounting entries are similar to those given in the first case, except for the use of the account. 20:

Dt 23 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 43 Kt 40 - the planned cost is shown

Dt 62 Kt 90 - for the sales amount

Dt 90 Kt 43 - the planned cost is written off as expenses

Dt 40 Kt 23 - shows the fact of costs

Dt 90 Kt 40 - written off as a decrease in sales, excess of the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from plan written off to increase sales

GP issued by service industries is taken into account in a similar way.

Third case: the processing of semi-finished products and the production of products from them is reflected

This accounting option is applicable when semi-finished products are an independent accounting object in terms of quantity and cost. In this case, an account is used to reflect “unfinished” products. 21.

Accounting for account 40 in this case involves reflecting

- according to his loan, the standard assessment of semi-finished products: Dt 21 Kt 40;

- according to its debit, the actual s/st: Dt 40 Kt 20.

Fourth case: to reflect work performed, services provided in planned indicators

It is advisable to use this option if, at the time of implementation of such work or services, accounting does not have time to collect information on actual costs, and also if there are no documents confirming expenses, and financial indicators need to be generated for reporting. And again the planned indicator and account 40 are applied:

As of the date of implementation:

Dt 62 Kt 90 - reflects the implementation of works and services

Dt 90 Kt 40 - we show the planned cost of completed work and services

As of the date the accounting department received documents confirming expenses:

Dt 20 Kt 10, 60, 69, 70, 76 - actual production costs are reflected

Dt 40 Kt 20 - actual s/st is shown

Dt 90 Kt 40 - written off as a decrease in sales exceeding the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from the plan are written off

Standard accounting entries

Standard accounting entries for item 40 look like this:

— Dt 40

Kt 20 – write-off of actual costs to the initial cost of the finished product;

— Dt 40

Kt 20 – transfer of finished goods to the warehouse at standard or actual cost;

— Dt 40

Kt 23 – write-off of the actual cost of finished products;

— Dt 40

Kt 79 – production of finished products;

— Dt 43

Kt 40 – accounting of manufactured products at standard initial cost.

Postings for accounting for the release of finished products using account 40

The main entries in account 40 “Output of products (works, services)” are reflected in the table:

| Dt | CT | Wiring Description | A document base |

| 40 | 20/23/29 | Reflection of actual production costs | Costing |

| 43 | 40 | Reflection of standard (planned) cost | Certificate of release of finished products |

| 40 | 79.01 | Write-off of products transferred to structural divisions on a separate balance sheet (at actual cost) | Transfer and acceptance certificate, invoice |

| 10/43 | 40 | Finished products (products) are accepted for accounting at planned cost | Limit card/calculation certificate, Finished product release certificate |

| 79.01 | 40 | Write-off of products (works or services) transferred to structural divisions on a separate balance sheet (at standard cost) | Transfer and acceptance certificate, invoice |

| 28 | 40 | Reflection of identified defects | Write-off act |

| 90.02 | 40 | Savings reflected | Accounting statement-calculation (closing the month) |

| 90.02 | 40 | Overexpenditure reflected (reversal method) |

Analytical monitoring

The main purpose of using the 40th account in accounting is to evaluate data on the normative and actual SS, which is necessary for making appropriate management decisions designed to ensure the efficient use of the resources of any company.

Saved resources, when a credit balance remains on account 40 at the end of the reporting period, must be reversed by Dt 90 position. If there is a debit balance, i.e. there is an overexpenditure of resources, it is written off to the debit part 90 of the account.

Such a comparison of data is observed, as a rule, in those companies where there are a huge number of product groups, and therefore the assessment of indicators is carried out in the context of structural divisions or product names.

Account 40 when accounting for product costs

At the end of January 2021, Syndicate JSC sold 124 sets of crystal tableware:

- sales price – 1040 rub./unit, VAT 159 rub.;

- PlanSS set of dishes - 825 rubles;

- FactSS set of dishes - 843 rubles.

According to the accounting policy, Syndicate JSC keeps records of finished products according to PlanSS.

The accountant of Syndicate JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 43 | 40 | Sets of crystal glassware were received at the warehouse of Syndicate JSC (RUB 825 * 124 units) | 102,300 rub. | Certificate of release of finished products |

| 40 | 20 | The fact of the dishes is taken into account (843 rubles * 124 units) | RUR 104,532 | Costing |

| 62 | 90.1 | Revenue from the sale of tableware is taken into account (RUB 1,040 * 124 units) | RUR 128,960 | Packing list |

| 90.2 | 43 | PlanSS of sold crystal sets is reflected in expenses | 102,300 rub. | Costing |

| 90.3 | 68 VAT | VAT charged on sales (RUB 159 * 124 units) | RUR 19,716 | Invoice |

| 51 | Funds from the buyer are credited as payment for sold sets of dishes | RUR 128,960 | Bank statement | |

| 90.2 | 40 | The difference between FactSS and PlanSS of sold utensils is reflected in expenses (RUB 104,532 – RUB 102,300) | RUB 2,232 | Accounting certificate-calculation |

| 90.9 | The received profit was taken into account based on the results of January 2021 (RUB 128,960 – RUB 19,716 – RUB 102,300 – RUB 2,232) | RUB 4,712 | Turnover balance sheet |

***

The need to use account 40 in accounting depends on the specifics of the company’s activities. If a large number of items are produced, and the production cycle is short, then it is difficult to organize accounting immediately at actual cost. Therefore, the use of account 40 when releasing products in this case is necessary. In case of piece production with a long cycle, you can do without it and take into account costs only in fact after the end of the reporting period.

The purpose of the account is to collect the planned cost of manufactured products (by credit) and compare it with the actual cost (by debit). The difference between debit and credit turnover reflects savings or overspending compared to the plan. At the end of the month, this difference is subject to write-off to the cost of products sold, defects or stock balances.

Is count 40 active or passive? General characteristics of account 40 according to the chart of accounts

The answer to the question whether account 40 is active or passive will be somewhat unexpected: account 40 in the chart of accounts is active-passive. Depending on the situation, there may be an excess of debit turnover over credit, and vice versa.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's consider the general characteristics of account 40.

In terms of economic content, this account is regulatory. As mentioned above, it is used to account for planned and actual costs. The difference between debit and credit turnover corresponds to the deviation between plan and actual. The specified difference is subject to write-off at the close of the period. Therefore, the account should not have a balance of 40 at the end of the month.

Requirements for account 40

Control over reporting on account 40 is carried out on the basis of the Chart of Accounts and the Instructions thereto approved by the Ministry of Finance of the Russian Federation.

It should be noted that summing up the planned cost of production, that is, using account 40 in financial statements, is a separate method called Standard-cost. The indicated approach indicates cost overruns or savings based on the results of annual work. All operations in this case are carried out in the same order, but the period under consideration changes from month to year. As mentioned above, operations with account 40 are optional and even if the Standard-cost method is used, it can be replaced with account 43.

Thus, the use of account 40 makes it possible to realistically assess the costs of producing products, providing services and performing work by the company in the short term, and also allows them to be adjusted if there is such a need. This is an important indicator for a commercial organization, which is why working with a score of 40 most often turns out to be justified.

Closing account 40: postings

For account 40 the regulatory framework provides for mandatory summing up and closing of the month, as a result of which the presence of a final account balance is unacceptable.

Closing account 40 is accompanied by the preparation of accounting entries depending on what production result the organization has reached at the end of the month. In each case, closure is carried out using account 90 “Sales”. When carrying out this operation, two scenarios are possible: the actual cost exceeds the planned one and, conversely, the planned cost turns out to be higher than the actual one. In both the first and second cases, the same accounting entry Dt 90 Kr 40 will be made in business accounting. However, when there is a saving of resources (the plan is greater than the fact), the posting is reversed.

40 account in the economic accounting of production organizations has an important purpose. Mainly, it is used in cases where, in order to make managerial decisions, it is necessary to compare the actual and planned costs of manufacturing products. Analytical accounting for this account is carried out according to product groups of manufactured goods.

Without using account 40 “Output of products (works, services)”;

Accounting for the production, shipment and sale of finished products Read more: Other sales expenses (costs of storage, processing, sub-sorting, etc.)

1. without using account 40 “Output of products (works, services)”;

2. using account 40 “Output of products (works, services)”.

In the first option, which is traditional for domestic accounting practice, finished products are accounted for in synthetic account 43 “Finished products” at actual production costs.

The total cost is calculated by dividing costs into direct and indirect. First, all actual costs are taken into account on the debit of account 20 “Main production”. These can be materials used in the manufacturing process (account 10), wage payments to employees (account 70) and related social contributions (account 69), depreciation charges (account 02), settlements with suppliers and contractors (account 60), calculations with different debtors and creditors (account 76).

D20 – K10,70,69,02,60,76

You can also take into account semi-finished products of your own production (account 21), products, works and services of auxiliary production (account 23), shop expenses (account 25), general business expenses (account 26), accounting for defects in production (account 28), expenses for maintenance of production and economy (account 29). In all these areas, actual costs are incurred, which are written off first to these accounts.

D21,23,25,26,28,29 – K10,70,69,02,60,76

And then all these costs at the end of the month are written off from these accounts to the cost of finished products in the debit of account 20.

D20 – K21,23,25,26,28,29

Cost is included in finished goods (account 43), shipped goods (account 45), and sales (account 90), so it is written off to these accounts.

D43,45,90 – K20

Account balance 20 is unfinished production.

Analytical accounting of certain types of finished products is carried out at accounting prices (planned cost, wholesale prices, etc.), highlighting deviations of the actual cost of finished products from the cost at accounting prices of individual products and taken into account in a separate analytical account.

The capitalization of finished products at accounting prices is recorded as an accounting entry to the debit of account 43 “Finished products” and the credit of account 20 “Main production”.

D43 – K20 (GP at discount prices)

At the end of the month, calculate the actual cost of capitalized finished products, determine the deviation of the actual cost of products from their cost at accounting prices and write off this deviation from the credit of account 20 “Main production” to the debit of account 43 “Finished products” using the additional accounting entry method or the “red reversal” method "

| D43 – K20 |

D43 - K20 (additional posting if the actual cost exceeds the cost of the GP at accounting prices)

(posting - red reversal if the cost of the GP at accounting prices

prices exceed the cost of GP at actual cost)

If the finished product is fully used in the organization itself, then it can be credited to the debit of account 10 “Materials” and other similar accounts from the credit of account 20 “Main production”.

D10 – K20

Agricultural organizations take into account the movement of agricultural products during the year at the planned cost, and at the end of the year it is brought to the actual cost.

Finished products shipped or delivered locally, depending on the delivery conditions specified in the contract for the supply of products, are written off at accounting prices from the credit of account 43 “Finished Products” to the debit of accounts 45 “Goods Shipped” or 90 “Sales”. At the end of the month, the deviation of the actual cost of shipped (sold) products from its cost at accounting prices is determined and written off from the credit of account 43 by additional posting or the “red reversal” method and the debit of accounts 45 or 90.

D45.90 – K43

| D45.90 – K43 |

D45.90 – K43 (additional posting if the actual cost exceeds the cost at accounting prices)

(the deviation is reversed when the cost at accounting prices is greater than the cost at actual cost)

Finished products transferred to other organizations for sale on a commission basis are written off from the credit of account 43 to the debit of account 45 “Goods shipped”.

D45 – K43

In the second option, when using account 40 “Output of products (works, services)”, synthetic accounting of finished products is carried out on account 43 “Finished products” at standard or planned cost.

The debit side of account 40 reflects the actual cost of products (works, services), and the credit side reflects the standard or planned cost.

The actual production cost of products (works, services) is written off from the credit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities” to the debit of account 40.

D40 – K20,23,29

The standard or planned cost of products (works, services) is written off from the credit of account 40 to the debit of accounts 43 “Finished products” and 90 “Sales”.

D43.90 – K40

By comparing debit and credit turnover on account 40 on the 1st day of the month, the deviation of the actual cost of production from the standard or planned cost is determined and written off from the credit of account 40 to the debit of account 90 “Sales”. In this case, the excess of the actual cost of production over the standard or planned one is written off by additional posting, and the savings are written off using the “red reversal” method. Account 40 is closed monthly and has no balance at the reporting date.

D90 – K40 (additional wiring if the actual cost exceeds the planned cost)

| (posting “red reversal” if the planned cost exceeds the actual cost) When using account 40, there is no need to make separate calculations of deviations of the actual cost of products from their cost at accounting prices for finished, shipped and sold products, since the identified deviation for finished products is immediately written off to account 90 “Sales”. In the balance sheet, finished products are reflected: 1. at actual production cost (if account 40 is not used); 2. at standard or planned cost (if account 40 is used); 3. at a reduced actual cost (for direct expense items), when indirect expenses are written off from account 26 “General expenses” to the debit of account 90 “Sales”; 4. at incomplete standard or planned cost (when using account 40 and writing off general business expenses from account 26 to account 90). Product sales accounting Sales of products are carried out in accordance with concluded contracts or through free sale through retail trade. Contracts for the supply of finished products indicate the supplier and buyer, the necessary indicators for products, prices, discounts, markups, payment procedures, the amount of value added tax and other details. In international practice, it is customary to additionally indicate insurmountable circumstances (force majeure), a guarantee, guarantees for the fulfillment of contractual terms, the procedure for compensation of losses, a clause on jurisdiction and arbitration and other information. Sales of products (works, services) are carried out by organizations at the following prices: 1. at free (market) prices and tariffs, increased by the amount of VAT; 2. at state regulated wholesale prices and tariffs, increased by the amount of VAT (products of the fuel and energy complex and services for industrial and technical purposes); 3. at state regulated retail prices (minus, in appropriate cases, trade discounts, sales and wholesale discounts) and tariffs, including VAT (for the sale of goods to the population and the provision of services to them). Settlements for inter-republican supplies of goods (works, services) with states that have signed an agreement on economic cooperation are carried out at prices and tariffs increased by the amount of VAT. When setting selling prices, it is indicated ex-franco, that is, at whose expense the costs of delivering products from the supplier to the buyer are paid. Free station of destination means that the costs of delivering the product to the buyer are paid by the supplier and are included in the selling price. Shipper's free station means that the supplier pays costs only before loading the finished product into the wagons. All other costs for transporting finished products (payment of railway tariffs, water freight, etc.) must be paid by the buyer. The basis for shipping finished products to customers or releasing them from the warehouse are usually orders from the sales (marketing) department of the organization. Based on invoices, freight-transport railway invoices and other documents for the release of products to third parties, the financial department or, in its absence, the accounting department issues payment requests in several copies for settlements with customers through the bank. The payment request indicates the name and place - location of the supplier and buyer, supply agreement number, type of shipment, amount of payment under the agreement, cost of additionally paid containers and packaging, transport tariffs subject to reimbursement to buyers (if provided for by the agreement), amount of value added tax , highlighted on a separate line. When shipping goods, providing services, or performing work that is not subject to VAT, settlement documents and registers are issued without allocating VAT amounts and they are inscribed or stamped “Without tax (VAT).” Payment requests must be issued by the supplier and submitted to the bank for collection (i.e., with an instruction to receive payment from the buyer) no later than the next day after shipment or delivery of the finished product to the consignee. A second copy of the payment request is sent to the buyer for payment. The data of payment requests is recorded daily in the statement of accounting and sales of products (works, services) (form No. 16 or 16a). The statement indicates the date and number of the payment request, the name of the supplier, the quantity of products shipped by type, the amounts submitted for invoices, and a note on payment of invoices. The statement is a form of analytical accounting of goods shipped. Finished products are reflected in the statement at accounting and selling prices. Statement f. No. 16 is used when determining shipment revenue, and f. No. 16a – when determining payment revenue. Operational records of shipments are kept in the marketing (sales) department in special cards, books or magazines, and when using a computer - in daily machine reports for product shipment. To export finished products from the territory of the organization, representatives of the consignee are issued trade passes for the export of inventory items from the territory of the enterprise. The passes are signed by the head and chief accountant of the organization or persons authorized by him. The pass can be copies of waybills or invoices on which special permitting inscriptions are made. If finished products are released to the buyer directly from the supplier’s warehouse or other storage location for finished products, then the recipient is required to present a power of attorney for the right to receive the cargo. The procedure for synthetic accounting of product sales depends on the chosen method of accounting for product sales. Organizations are allowed to determine revenue from the sale of products for tax purposes, either at the time of payment for shipped products, work performed and services rendered, or at the time of shipment of products and presentation of payment documents to the buyer (customer) or transport organization. In accounting, products are considered sold at the time of their shipment (due to the transfer of ownership of the product to the buyer). Accounting for product sales is carried out on account 90 “Sales”, it is intended to summarize information on income and expenses and determine financial results for them. 2. Determination of revenue, its recognition and disclosure of information about revenue in the financial statements 2.1. Determination of revenue In accordance with PBU 9/99, revenue is accepted for accounting in an amount calculated in monetary terms equal to the amount of receipt of cash and other property and (or) the amount of accounts receivable. If the amount of receipt covers only part of the revenue, the revenue accepted for accounting is determined as the sum of receipt and receivables (in the part not covered by receipt). PBU 9/99 provides specifics for determining revenue depending on the terms of the contract: 1. the price is established by the contract; 2. the price is not provided for in the contract and cannot be established based on the terms of the contract; 3. commercial loan is provided; 4. provision is made for the fulfillment of obligations (payment) in non-monetary means; 5. obligations under the contract change; 6. discounts (capes) are provided; 7. a monetary obligation is payable in rubles in an amount equivalent to a certain amount in foreign currency, or in conventional monetary units. The amount of receipts and (or) receivables is determined based on the price established by the agreement between the organization and the buyer or user of the organization’s assets. If the price is not provided for in the contract and cannot be established based on the terms of the contract, then to determine the amount of receipts and (or) receivables, the price at which, in comparable circumstances, the organization usually determines revenue in relation to similar products (goods, works, services) is accepted. or providing similar assets for temporary use. When selling products and goods, performing work, providing services on the terms of a commercial loan provided in the form of deferred and installment payment, the proceeds are accepted for accounting in the full amount of receivables. This means that the amount of interest on a commercial loan should be reflected in the revenue from the sale of products (works, services) and interest on a commercial loan will be included in the turnover subject to tax on road users and tax on the maintenance of housing stock and social and cultural facilities . That is, the entire amount of revenue, together with the amount of interest on a commercial loan, will be reflected in one entry, in the debit of account 62 “Settlements with buyers and customers”, the subaccount “Bills received” and the credit of account 90 “Sales”. D62 – K90 The amount of receipts and (or) receivables under contracts providing for the fulfillment of obligations other than cash is accepted for accounting at the cost of assets received or to be received by the organization. The value of these assets is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. If it is impossible to establish the value of the valuables received by the organization, the amount of receipts and receivables is determined by the cost of the products transferred or to be transferred by the organization, which is established based on the price. This price is usually used by the entity to determine revenue for similar products in comparable circumstances. If the obligations under the contract have changed, then the initial amount of receipts and receivables is adjusted based on the value of the asset to be received by the organization. The amount of receipts and receivables is determined taking into account all discounts (discounts) provided to the organization in accordance with the agreement. It should be noted that the moment the right to a discount or markup arises often does not coincide with the moment the product is shipped, and often these moments occur in different reporting periods. This circumstance gives rise to a number of problems in accounting for discounts and capes. In international practice, this problem is solved by creating a reserve to cover the return of goods and discounts, which allows you to adjust the amount of revenue so as not to distort the net profit. Russian legislation does not yet provide for the possibility of creating such a reserve. The amount of revenue is also determined taking into account the amount difference that arises in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units). The total difference is the difference between the ruble valuation of an asset actually received as revenue, expressed in foreign currency, calculated at the rate on the date of acceptance for accounting, and the ruble valuation of this asset, at the rate on the date of recognition of revenue in accounting. When creating, in accordance with accounting rules, reserves for doubtful debts, the amount of revenue does not change. 2.2. Revenue recognition In accordance with PBU 9/99, revenue is recognized in accounting under the following conditions: 1. the organization has the right to receive this revenue arising from a specific agreement or confirmed in another appropriate manner; 2. the amount of revenue can be determined; 3. there is confidence that as a result of a specific transaction there will be an increase in the economic benefits of the organization (when the organization received an asset in payment or there is no uncertainty regarding the receipt of the asset); 4. ownership (possession, use and disposal) of the product has passed from the organization to the buyer or the work has been accepted by the customer (service provided); 5. the expenses that have been incurred or will be incurred in connection with this operation can be determined. If at least one of the above conditions is not met in relation to cash and other assets received by the organization as payment, then the organization’s accounting records recognize accounts payable, not revenue. An organization may recognize in its accounting revenues from the performance of work, provision of services, sale of products with a long manufacturing cycle as the work, service, product is ready or upon completion of the work, provision of service, or production of products in general. Now this rule applies only to organizations performing long-term work (construction, scientific, design, geological, etc.), which in account 46 “Completed stages of work in progress” reflect information about completed stages of work that have independent significance. PBU 9/99, this rule applies to products and services with a long execution and manufacturing cycle. In this case, revenue from performing specific work, providing a specific service, or selling a specific product is recognized in accounting as it is ready, if it is possible to determine the readiness of the work, service, or product. In relation to work performed, services provided, or products manufactured that are different in nature and conditions, organizations may simultaneously apply different methods of revenue recognition in one reporting period. If the amount of revenue from the sale of products, performance of work, provision of services cannot be determined, then it is accepted for accounting in the amount of recognized and accounting expenses for the manufacture of these products, performance of this work, provision of this service, which will subsequently be reimbursed to the organization. 2.3. Disclosure of information in financial statements As part of the information about the accounting policies of the organization in the financial statements, at least the following information is subject to disclosure: 1. on the procedure for recognizing the organization’s revenue; 2. on the method of determining the readiness of work, services, products, revenue from the implementation, provision, sale of which is recognized as readiness. With respect to revenue received as a result of the execution of contracts providing for the fulfillment of obligations other than cash, at least the following information is subject to disclosure: 1. the total number of organizations with which the specified contracts are carried out, indicating the organizations that account for the bulk of such revenue; 2. share of revenue received under the specified agreements with related organizations; 3. a method for determining the cost of products (goods) transferred by the organization. 3. Accounting for commercial (non-production expenses) Selling expenses include sales costs paid by the supplier. Selling expenses together with production costs form the total cost of production. Business expenses include: 1. costs of containers and packaging of products in finished product warehouses (the cost of services of its auxiliary workshops engaged in the manufacture of containers and packaging, the cost of containers purchased externally, payment for packaging and packaging of products by third-party organizations); 2. costs of transporting products (costs of delivering products to the station or pier of departure, loading into wagons, ships, cars, etc., payment for the services of specialized freight forwarding offices); 3. commission fees and deductions paid to sales enterprises and organizations in accordance with contracts; 4. advertising costs, including costs for advertisements in print and on television, prospectuses, catalogs, booklets, for participation in exhibitions, fairs, the cost of samples of goods transferred in accordance with contracts, agreements and other documents to buyers or intermediary organizations free of charge, and other similar costs; Accounting for the production, shipment and sale of finished products Read more: Other sales expenses (costs of storage, processing, sub-sorting, etc.) Information about the work “Accounting for the release, shipment and sale of finished products” Section: Accounting and Auditing Number of characters with spaces: 47371 Number of tables: 14 Number of images: 0 Similar worksAudit of production, shipment and sale of finished products 40560 2 0 ... ; • invoice; • waybill; • agreement; • invoice for tax purposes. Analytical and synthetic accounting registers: • list of finished products; • statement of shipment and sale of finished products. The financial statements, which reflect the section (section, accounting account), must include a balance sheet (form No. 1) and, ... Audit of production and sales of finished products 64367 10 0 ... and compliance with established limits; — monitoring compliance with the plan for selling products and timely payment for products sold; — identifying the profitability of all products and their individual types. Accounting for the production and sale of finished products at Stroykeramika OJSC in accordance with the accounting policy is carried out using account 43 “Finished products”. Among the documents subject to verification are... Revision and audit of accounting for shipment and sale of finished products 129193 9 0 ... evaluates the system of internal control and accounting, assesses audit risk and establishes an acceptable level of materiality. The auditor begins to plan an audit of accounting for the shipment and sale of finished products before writing a letter of commitment and before concluding an agreement with an economic entity to conduct an audit. Planning, being the initial stage of the audit, ... Accounting and audit of finished products 74472 15 0 ... finished products are reflected in the accounting and reporting of the month in which the inventory was completed, and the annual inventory is reflected in the annual accounting report.2. Audit of finished products. 2.1 Audit of finished product accounting operations. In a market economy, the issues of correctness and timeliness of recording the receipt of finished products and ensuring their provision are of particular relevance... |

Finished products in 1C with examples

Standard documents in 1C 8.3 for reflecting production operations are available in the “Production” section (see the “Product Release” subsection).

Product output is reflected in the “Shift Production Report”. Despite the name, this program object is not a report, but a standard document.

It is first necessary to enter the manufactured products into the “Nomenclature” directory, indicating the type of nomenclature for them – Products. If an organization uses different nomenclature groups to record its activities, you must also fill out the “Nomenclature group” field (by selecting an item from the directory).

An example of accounting for finished products in 1C without account 40

Example 1. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy prescribes accounting for manufactured products on account 43, without account 40.

- Output. In order to reflect output, we will create a standard document “Production Report for a Shift”. In the “header” details we will indicate the warehouse (if the organization maintains warehouse records) and the cost account. On the “Products” tab, in the rows of the table, we indicate the manufactured products and manually enter their planned price. By default, the accounting account is filled in - 43.

Document 1C will generate accounting entries for accounts Dt 43 Kt 20 for the amount of the planned cost of production.

- Sales of finished products. Registered in the program in a standard way using the standard “Implementation” document.

- Closing the month and adjusting costs. At the end of the period (month), we will perform routine automatic processing “Closing the month” in the program. It will calculate the cost of production based on the amount of actual costs posted to the debit of account 20 for the item group of products (if item groups are not used, costs are calculated as a whole for account 20). Costs usually include the cost of raw materials, wages of production workers, etc. Then the program will adjust the cost of production. To view the postings of this operation, you need to click on the link “Closing accounts 20, 23, 25, 26” in the month closing form and select “Show postings”:

We see that in 1C an accounting entry has been generated that adjusts the cost of production: Dt 43 Kt 20. Moreover, the amount of the entry can be negative, depending on which cost is greater - planned or actual.

If the manufactured products were sold, then during the closing of the period the program also adjusts the cost of its write-off, creating a debit entry in accounting account 90.02 “Cost of sales”:

The program allows you to generate convenient analytical reports and calculations “Calculation of cost” and “Cost of manufactured products”. They are also available in the month closing form (after the closing has been completed) using the link “Closing accounts 20, 23, 25, 26”.

The “Cost Cost Calculation” reflects the costs incurred for each unit of production:

Another calculation certificate - “Cost of manufactured products” - shows the value of the actual cost, the planned one, as well as the deviation of the “fact” from the “plan”:

Without a trace

After the actual cost is reflected in the debit section of account 40, and in the credit line of this account the planned total cost, credit and debit turnovers are compared to identify deviations between the two indicated costs. The identified deviation coefficient is calculated every month relative to its end date.

Consequently, the excess of the debit turnover of the 40 account in relation to the credit account is the excess of the actual cost to the planned one, as a result of which the resulting excess is reflected by the posting Dt 90 Kt 40.

When debit turnover is lower than credit turnover, financial savings result. In this case, the total cost exceeding the standard is corrected using credit 40 of the account. This wiring looks like this: Dt 90 Kt 40.

According to the monthly write-off comparing the turnover of the specified account at the end of each month, the 40th account is reset to zero and will not have a balance.

So, the 40th account of manufactured products, work performed and services rendered in the balance sheet is used to record the amount of the established total cost of goods manufactured at the enterprise and reflect transactions related to their actual cost.

Example of an operation using account 20

The Integra enterprise produces oil and related products. The following costs were incurred as a result of the production process for Batch No. 400:

- 1000 rubles – purchase of milk;

- 300 rubles – purchase of sourdough;

- 2000 rubles – labor costs;

- 500 rubles – electricity costs;

- 200 rubles – taxes;

- 400 rubles – packaging;

- 100 rubles – delivery.

Total: 4500 rubles – production cost. 90 packs of butter were received for 50 rubles, which were transferred to the finished products warehouse. The accountant used the following entries:

- Dt. 20 – Kt. 60 - 1000 rubles – purchase of milk;

- Dt. 20 – Kt. 60 – 300 rubles – purchase of sourdough;

- Dt. 20 – Kt. 70 – 2000 rubles – salary;

- Dt. 20 – Kt. 76 – 500 rubles – electricity;

- Dt. 20 – Kt. 68 (69) – 200 rubles – taxes;

- Dt. 20 – Kt. 76 – 400 rubles – packaging;

- Dt. 20 – Kt. 76 – 100 rubles – transportation.

All production costs are combined and formed on one account.

- Dt. 45 – Kt. 20 – 4500 rubles – transfer of goods to the warehouse with subsequent write-off.

Summary : I produced oil for 4,500 rubles (cost), and then the expenses were written off due to the transfer of the products to the warehouse.

Characteristics and description

Finished products are reflected in accounting using account 40.

This is an active-passive account, where the debit line indicates the actual costs of the enterprise for the production of products or the implementation of work, and where the credit record information on the estimated costs of producing the finished product. The organization has the right to make an independent decision regarding the use of account 40 for business accounting or refusal from it, because the legislation does not establish certain rules for its accounting.

At the end of each month, employees of the accounting department compare debit and credit turnover on account 40 in order to identify the difference between the estimated cost and the real one.

In most cases, the size of the organization's planned costs for the production of goods can be determined by information from previous periods regarding similar goods or by identifying the average values of the required coefficients.

The actual cost is the amount of costs associated with materials, raw materials, services of contracting companies, personnel wages, taxes, and other expenses.

Examples of correspondence

By loan:

- 20 - main production;

- 23 - auxiliary production;

- 29 - servicing industries and farms;

- 79—on-farm calculations.

By debit:

- 10 - materials;

- 20 - main production;

- 21- semi-finished products of the company produced by it;

- 23 - auxiliary production;

- 28 - defects during production;

- 43 - finished goods;

- 79 — on-farm calculations;

- 90 – product sales.

Interaction with other accounts

By debit, account 40 corresponds with accounts 20, 23, 29, and by credit - with account 43. The positive balance at the end of the month is written off to accounts 20, 23, 29. The income of account 43 is written off to the costs of account 40. The write-off of the planned cost of production is transferred from the debit of account 90 “Sales” to the costs of account 40.

At the end of the month, the account balance reflects the real picture of profit from production. At the same time, the account is active-passive, and if the balance is positive, this indicates that the actual cost exceeded the planned one (and vice versa).

Account 40 when reflecting the cost of contract work performed

JSC “Advertising Project” is engaged in the installation and installation of advertising structures. Based on the results of July 2015, Advertising Project JSC:

- provided installation work to Modelier LLC in the amount of 54,200 rubles, VAT 8,268 rubles;

- The plan for installation work amounted to 33,250 rubles;

- Fact SS of completed installation work – RUB 36,420.

When recording transactions, the accountant of Advertising Project JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 62 | 90.1 | Revenue from installation work provided by Modeller LLC is taken into account | 54,200 rub. | Certificate of completion |

| 90.2 | 40 | PlanSS of installation work is reflected in expenses | RUB 33,250 | Costing |

| 90.3 | 68 VAT | The amount of VAT calculated on the cost of installation work carried out | RUR 8,268 | Invoice |

| 51 | Funds have been credited from “Modelier” LLC as payment for installation work performed | 54,200 rub. | Bank statement | |

| 40 | 20 | The amount of FactSS work on the installation of advertising structures is taken into account | RUR 36,420 | Costing |

| 90.2 | 40 | The difference between the actual and standard cost of installation work is reflected in expenses (RUB 36,420 – RUB 33,250) | 3,170 rub. | Accounting certificate-calculation |

| 90.9 | The profit received based on the results of July 2015 is taken into account (RUB 54,200 – RUB 8,268 – RUB 33,250 – RUB 3,170) | RUR 9,512 | Turnover balance sheet |