Home — Documents

- Fill in column 2

- Fill in column 3

- Fill out column 7

- Fill in column 10

The question of how to fill out a particular document (declaration lines) is perhaps the most discussed in accounting forums. Therefore, from time to time we pay attention to it on the pages of our magazine. Today we’ll talk about the algorithm for filling out the purchase book for organizations importing goods from EAEU member countries.

Note. Countries participating in the Eurasian Economic Union (EAEU): Russia, Belarus, Kazakhstan, Armenia and Kyrgyzstan.

The rules for maintaining a purchase book used in calculations of value added tax (hereinafter referred to as the Rules) were approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (Appendix 4). Despite the fact that the procedure for filling out each of the lines (columns) is spelled out in detail, accountants have reasonable questions.

Invoice updated: finding out the details

The absence of line 8 in the invoice can be attributed to errors that do not prevent the identification of the information listed above. Therefore, if the old invoice meets the requirements of paragraphs.

5 and 6 tbsp. 169 of the Tax Code of the Russian Federation, the tax authority does not have the right to refuse deductions on an invoice issued using an invalid form.

— Let’s assume that the buyer wants to play it safe and asks the seller to issue an invoice in the current form. Is the seller obligated to fulfill the buyer's request? And how exactly should the seller correct his mistake?

— If the buyer receives an invoice that is not in accordance with the established requirements, he has the right to contact his seller (supplier, contractor, performer, etc.) with a request to make appropriate corrections. And the seller must fulfill the buyer's request.

Changes in the purchase ledger and sales ledger since October

To do this, in the book settings, select “Generate additional sheets” and set the desired period.

The seller makes corrections to invoices by drawing up new copies of invoices.

Important changes have also been made to adjustment invoices. Previously, the law did not regulate the issue of whether the buyer was notified that an adjustment document was being drawn up. Now the book needs to reflect information about the document, which will confirm that the buyer was informed about the changes.

The purchase book should reflect the above changes in a similar way. 2 new columns were added to the sales book: “3a” – “Registration number of the customs declaration” and “3b” – “Product type code”. These changes will affect a few taxpayers: only those who either sell goods released for sale within the country, after passing the customs control procedure in the territory of the free customs zone of the special economic zone of the Kaliningrad region, or export goods to the countries of the EAEU.

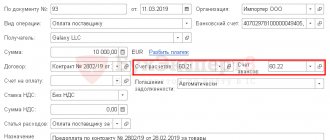

Setting up the program

In order to start taking into account imported goods, you need to go to the “Main” menu, then follow the “Functionality” link to go to settings. We are interested in the “Inventory” tab, go to it and check the “Imported goods” checkbox:

Please note that once you start using this functionality, you will no longer be able to disable it.

What has changed in the purchase and sales books since October 1, 2021?

It is worth noting that the Ministry of Finance previously allowed the possibility of registering a primary business (letter dated November 19, 2015 No. 03-07-09/66869), but there was no official rule. In cases where an advance payment has been received, but an invoice has not been issued, information about the payment order must be entered into the register. In addition, it is permissible to indicate the details of the consolidated advance document received from the buyer.

New columns have been added to the updated form of the sales book: 3a “Registration number of the customs declaration” and 3b “Product type code”.

Column 3a needs to be filled in with data from the declaration; customs officers put the corresponding number in the first line of Column A of the main and additional sheets of the document.

We recommend reading: Procedure for transferring to shift work

Information about counterparties (seller, intermediary)

In this block we have included columns that are intended to indicate the names and TIN/KPP of the seller (columns 9 and 10) and the intermediary.

In column 9 you must indicate the name of the foreign supplier. Some importers indicate here, for example, the name of the customs office or customs broker. It is not right. But not critical. Information from column 9 of the purchase book about the name of the seller is not transferred to section 8 of the declaration. Therefore, even if you filled out column 9 incorrectly, this will not affect the verification of the declaration in any way.

Column 10 should remain blank. 7 Rules for maintaining a purchase book. Here you can only indicate your tax identification number and checkpoint. And UNP and other foreign tax numbers of suppliers are not INN/KPP from the point of view of Russian tax legislation. And you shouldn’t try to fit them into the TIN format by adding zeros at the beginning. The program will not allow such a pseudo-TIN.

Columns 11 and 12 do not need to be filled out. Even if you used an intermediary. The Ministry of Finance confirmed this to us.

FROM AUTHENTIC SOURCES

“Since we are talking about deducting VAT on imported goods, regardless of the fact that the goods are imported with the participation of an intermediary, information about him in columns 11 and 12 of the purchase book does not need to be indicated. And in column 2 of the purchase book you should indicate code 19 or 20.”

LOZOVAYA Anna Nikolaevna Ministry of Finance of Russia

Indeed, information about the intermediary comes from the purchase ledger into the VAT return for the purpose of matching data coming from intermediaries, sellers and buyers. In the case of an intermediary importing goods from abroad, there is essentially nothing to control, since there is no supplier invoice that the commission agent (agent) would reissue to the principal (principal).

Registration number of the customs declaration

It has the following format (, approved.

The code in column 3b corresponds to the code of the type of goods imported from the EAEU states. If the company does not purchase such goods, this field is not required. The new provisions have changed the procedure for registering adjustment invoices, in particular, uniform adjustment documents.

By decision of the Customs Union Commission dated May 20, 2010 No. 257): XXXXXXXX/ XXXXXX/ XXXXXXX Element 1 Element 2 Element 3 Element 1 - code of the customs authority that registered the DT, in accordance with the classifiers of customs authorities used in the CU member states.

So, for example, the code of the Moscow customs is 10129000, and the Nakhodka customs code is 10714000. Element 2 is the registration date of the DT (day, month, last two digits of the year). Element 3 is the serial number of the DT, assigned according to the DT registration log by the customs authority that registered the DT. All elements of the registration number are indicated using the delimiter character “/” without spaces.

The above means that for the registration number of the customs declaration assigned by the Customs post of the Vostochny Seaport of Nakhodka customs, the sample may look like this: 10714040/140917/0090376 Until 10/01/2021 in addition to the registration

Information from documents

You can apply a deduction for import VAT if the goods are registered, are subject to use in taxable activities and you have documents in your hands confirming the payment of VAT and the actual import of goods. 2 tbsp. 171, paragraph 1, art. 172 of the Tax Code of the Russian Federation. We included the columns of the purchase book, where you need to indicate the details of the documents necessary to reflect the VAT deduction, in the first block. Depending on which country the goods are imported from, you will need a different set of such documents.

SITUATION 1. Goods were imported from countries outside the EAEU

In this case, to apply the VAT deduction and correctly fill out columns 3 and 7 of the purchase book, you will need para. 2 subp. "e", para. 2 subp. “k” clause 6 of the Rules for maintaining a purchase book:

- declaration of goods. When declaring goods in electronic form, you will need to receive a paper copy of the declaration Letter of the Ministry of Finance dated No. 03-07-15/31200 (Letter of the Federal Tax Service dated No. GD-4-3/ sent for information and use by inspectors);

- a document confirming the actual payment of VAT to the customs authority. What is it about? About the payment. But there are a number of nuances here.

ATTENTION

To reflect the deduction of “customs” VAT, the importer does not have to indicate the goods declaration number in column 13 of the purchase book.

Typically, VAT is transferred to the customs authority in advance (or to the advance BCC as part of other advance payments, or to a special BCC for VAT). However, such an advance in itself is not considered payment of tax. And only from the moment of submitting a declaration for goods to the customs authority, which will become your order to send the transferred amounts to pay tax on specific imported goods, will it be possible to talk about the actual payment of VAT. 1, 3 tbsp. 73 TK TS; pp. 1, 3 tbsp. 121 of Law No. 311-FZ (hereinafter referred to as Law No. 311-FZ).

Data on which payment order was used to transfer the amount used to pay VAT is in column B “Calculation details” of the goods declaration, sub. 46 p. 15 Instructions, approved. By decision of the CU commission dated No. 257. You will need to indicate the details of this payment order (and possibly also payment slips if, say, you had balances of unspent advances) in column 7 of the purchase book.

The Ministry of Finance, however, has repeatedly indicated that the document confirming the actual payment of VAT, as referred to in the Rules for maintaining a purchase ledger, is a confirmation issued by customs for the payment of customs duties and taxes, Appendix No. 1 to the FCS Order No. 2554; Letters from the Ministry of Finance from No. 03-07-08/33992, from No. 03-07-08/44735, from No. 03-07-08/252. Moreover, once financiers even noted that the deduction can be claimed only after receiving this document Letter from the Ministry of Finance dated No. 03-07-08/29571. The customs office issues a confirmation at the request of the payer of customs duties. 4 tbsp. 117 of Law No. 311-FZ.

The confirmation contains information as of a certain date, in particular, on which declarations, in what amount and by which payment method VAT was paid for the period of time specified in your application (not exceeding 3 years). That is, this document may contain data on the payment of VAT not only in relation to the declaration you are currently interested in. And it would be at least uninformative to enter the details of the confirmation itself in column 7. Here you need to reflect the number and date of the payment, which are indicated in the confirmation in relation to the declaration of goods you are interested in.

Here are the recommendations for filling out column 7 of the purchase book we received from the Ministry of Finance.

FROM AUTHENTIC SOURCES

LOZOVAYA Anna Nikolaevna Head of the Indirect Taxes Department of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

“In column 7 of the purchase book, the importer has the right to indicate the details of the payment order confirming the transfer of funds to pay VAT to the customs authority. At the same time, in order to avoid disagreements with the tax authorities about the legality of applying a tax deduction on imported goods, the importer should obtain confirmation from the customs authority about the payment of customs duties in writing.”

ADVICE

If you are sure that your data matches the customs data, as they say, a penny is a penny, then fill out the purchase book based on the goods declaration. But in parallel, just in case, ask the customs office for confirmation of payment of customs duties and taxes. By the way, if you transferred an advance payment to the customs authority, then we advise you to ask at the same time for a report on the expenditure of funds contributed as advance payments, Appendix No. 2 to FCS Order No. 2554. The customs must provide a report within 30 days after receiving your application. 5 tbsp. 121 of Law No. 311-FZ.

Another subtle point is the payment of VAT by the customs representative (the so-called broker). The customs representative may pay the duties and taxes provided for by the customs procedure instead of the declarant, if this is provided for by the terms of the agreement concluded between the declarant and the customs representative. 5 tbsp. 60 Law No. 311-FZ; clause 3 art. 12 TK TS.

A customs representative is an organization included in a special register that carries out customs operations on behalf and on behalf of the declarant (or other interested party) subclause. 34 clause 1 art. 4, Art. 12 TK TS.

In this case, the declarant, as a rule, first transfers money to the broker to pay customs duties. The agreement with the customs representative also often provides that in the event of a shortage of the listed payments, the broker pays additional customs duties (including VAT) at his own expense, with subsequent compensation for these amounts by the importer. What payment details should the importer indicate in the purchase book: his own (to transfer money to the broker) or the broker’s (to pay “customs” VAT)?

The Rules for Maintaining a Purchase Book speak of a document confirming the actual payment of VAT to the customs authority. A payment to the customs representative is not suitable for this role. Therefore, in column 7 of the purchase book, you need to indicate the details of the document with which the broker transferred the money used to pay VAT. This data will be in column B “Calculation details” of the goods declaration, and in confirmation of payment of customs duties and taxes. The broker will probably provide you with a copy of this payment slip when reporting for the work performed.

FROM AUTHENTIC SOURCES

“If VAT on imported goods was paid by the customs representative, then the importer has the right to indicate in column 7 of the purchase book the details of the payment order confirming the transfer by the customs representative of funds to the customs authority for the payment of VAT. Payment documents for the transfer of funds by the importer to the customs representative for payment of customs duties do not need to be reflected in the purchase book. But if necessary, the importer will have to provide such documents to the tax authority.”

LOZOVAYA Anna Nikolaevna Ministry of Finance of Russia

Another difficult situation is the import of goods with the participation of an intermediary acting on his own behalf.

In this case, it is the commission agent (agent) who will file a declaration for the goods and pay VAT to the customs authority. But the deduction will be due to the importer - the principal (principal).

The Ministry of Finance, considering the situation with the payment of VAT at customs by an agent, explained that in this case, a VAT deduction can be applied on goods accepted for registration on the basis of:

- documents confirming payment of tax by the agent;

- customs declaration (its copy) for imported goods, received from the agent Letter of the Ministry of Finance dated No. 03-07-08/68143.

The details of these documents must be indicated in columns 3 and 7 of the purchase book.

In addition, financiers believe that an agreement is also necessary providing for the payment of tax by an intermediary with subsequent compensation for these amounts. Letter from the Ministry of Finance dated No. 03-07-08/297. At the same time, the Ministry of Finance does not speak about the fact of compensation of expenses as a necessary condition for deduction.

And even if by the time import VAT is reflected in the purchase book you already have a payment in hand to reimburse the intermediary’s expenses for paying VAT to the customs authority, indicating its details in column 7 will be unnecessary.

ADVICE

Ask the intermediary to request proof of payment of duties and taxes from customs. At your request, customs will not provide this document, because it was the intermediary who was the payer of customs duties.

SITUATION 2. Goods were imported from the EAEU countries - Belarus, Kazakhstan, Armenia and Kyrgyzstan

In this case, columns 3 and 7 of the purchase book must be filled out on the basis of para. 3 subp. "e", para. 3 subp. “k” clause 6 of the Rules for maintaining a purchase book:

- statements on the import of goods and payment of indirect taxes with a tax mark on payment of VAT, Appendix 1 to the Protocol on the exchange of information dated. If the application was submitted electronically, the tax office will also send an electronic message confirming the payment of VAT. In this case, there is no need to apply for a “paper” payment stamp. Letter from the Federal Tax Service dated No. ZN-4-17/;

- bills for payment of import VAT.

If you have an overpayment, you can offset it against the payment of import VAT. 2 clause 20 of Appendix No. 18 to the Treaty on the Eurasian Economic Union (signed in Astana). In this case, in the purchase book, register the decision to offset the amount of overpaid (collected) tax.

VAT amendments from October 1, 2021

Who fills it out?

N.Ch.: This column will be filled in only by residents of the SEZ in the Kaliningrad region when selling goods in respect of which they were exempt from paying “import” VAT upon completion of the customs procedure of the free customs zone or paid it in a special manner. It is for such cases that, starting with the declaration for the 1st quarter of 2021, a new line 035 has already appeared in Section 9 “Information from the sales book...”, which reflects the numbers of customs declarations. Now the indicators of the sales book and the declaration are brought into line.

Not to be confused with the information reflected in column 11 “Registration number of the customs declaration” of the invoice. When selling imported goods on the domestic market, the registration numbers of customs declarations from group 11 of the invoice in the sales book are not filled in. 2. From October 1, 2021, the provision that corrected invoices are registered in the purchase book as the right to tax deductions arises is excluded from the purchase book.

Registration for separate VAT accounting

Registration for separate VAT accounting

For some transactions for which invoices (other documents) are issued, the law provides for a special procedure for their registration in the purchase ledger.

If an organization maintains separate VAT accounting, then register invoices in the purchase ledger only for the amount of VAT that is subject to deduction. That is, in column 15 of the purchase book, indicate the full cost of goods (work, services), which is reflected in column 9 of the presented invoice. And in column 16, indicate only the amount of VAT to which the organization has the right to deduct in the current quarter. This procedure is provided for by subparagraphs “t” and “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Similar explanations are contained in the letter of the Ministry of Finance of Russia dated March 2, 2015 No. 03-07-09/ 10695.

An organization can transfer an advance (partial payment) towards future deliveries of goods (work, services, property rights), which will be used in both taxable and non-VAT-taxable transactions. In this case, the invoice received from the supplier (contractor) for advance payment (partial payment) must be registered in the purchase book for the entire amount (paragraph 5, subparagraph “y”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If a product is purchased that the organization will use in tax-exempt transactions, there is no need to register such an invoice in the purchase ledger. After all, the buyer will not have the right to deduct on such an invoice. This follows from the provisions of subparagraph 1 of paragraph 3 of Article 169 and paragraph 2 of Article 171 of the Tax Code of the Russian Federation.

An example of filling out a purchase book. The organization carries out taxable and VAT-exempt transactions

The organization carries out taxable and tax-exempt transactions. The organization calculates the proportion for the distribution of input VAT on goods (works, services) for general economic purposes for the current quarter.

In October, the organization was provided with waste removal services in the amount of 59,000 rubles, including VAT - 9,000 rubles. On October 29, the contractor (Proizvodstvennaya JSC) issued invoice No. 2569 to the organization for the entire amount of services provided.

These services are of a general business nature. It is impossible to determine what specific type of activity they relate to. Therefore, part of the input VAT amount is deducted, the remaining tax amount is included in the cost of services.

To distribute input VAT, the organization's accountant determined the share of tax-exempt transactions for the fourth quarter.

The volume of sales of goods during this period amounted to 1,000,000 rubles. excluding VAT, including:

- 800,000 rub. – from the sale of goods subject to VAT;

- 200,000 rub. – from the sale of goods exempt from taxation.

The share of transactions exempt from taxation was 0.2 (200,000 rubles: 1,000,000 rubles). Accordingly, the amount of tax included in the cost of garbage removal services is equal to: 9000 × 0.2 = 1800 rubles.

VAT is accepted for deduction in the amount of: 9,000 rubles. – 1800 rub. = 7200 rub.

The Master's invoice for this amount was recorded in the purchase book.

Situation: is it possible to register an invoice for the entire amount of VAT in the purchase book if an organization purchased materials intended for use in taxable and non-VAT transactions? The supplier has issued one invoice.

No you can not.

This is due to the fact that VAT is deductible only on those goods (works, services) that are used in activities subject to VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation). The amount of VAT that can be deducted is determined based on the separate accounting of input VAT. In the purchase book, register an invoice for exactly this amount. The Russian Ministry of Finance made a similar conclusion in letter dated September 11, 2007 No. 03-07-11/394.

Situation: how to keep a purchase book if an organization conducts taxable and non-VAT activities? The tax amounts subject to deduction are determined at the end of the quarter as a percentage based on the cost of goods (work, services) shipped.

Register invoices issued by suppliers (performers) when shipping goods (performing work, providing services, transferring property rights) at the time of determining the amount of VAT to be deducted. That is, on the last day of the quarter. In this case, in column 16 of the purchase book, indicate the amount of tax that can be deducted in accordance with the calculation. Column 15 - the total cost of goods accepted for registration (including VAT).

This procedure follows from subparagraph “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: how to register an invoice in foreign currency in the purchase book?

If the obligation under the terms of the transaction is expressed and paid in foreign currency, the supplier organization has the right to issue an invoice in foreign currency (clause 7 of Article 169 of the Tax Code of the Russian Federation). In the purchase ledger, such an invoice must be registered in the invoice currency. In this case, in column 14 you should indicate the name and code of the currency according to the All-Russian Classifier of Currencies, and in column 15 - the total cost of purchases (including VAT) in the invoice currency. Column 16 indicates the amount of VAT in rubles and kopecks. To do this, recalculate the amounts indicated in the invoice into rubles at the official rate in effect at the time of registration of goods (work, services) and property rights. This procedure follows from the provisions of paragraph 4 of paragraph 1 of Article 172, paragraph 5 of Article 45 of the Tax Code of the Russian Federation.

Customs declaration in the purchase book 2021

If previously they were transferred to the report as an accumulated total, then from 2015 they need to be duplicated line by line, for this there is an eighth section. The purchase book consists of two parts - the title page, which reflects data about the taxpayer organization, and a table in which information is recorded about invoices. The following information is written on the title page and in the “header” of each page:

- number of the quarter for which the data is reflected.

- TIN, KKP;

- name of the company or individual entrepreneur (full and abbreviated according to the Charter);

The purchase book form must include the following information about the “primary” item: Column No. Contents 1 No. of the registered document in order. 2 Code of the type of transaction. This field indicates current data that should be selected based on the explanations of the Federal Tax Service and existing accounting practices. 3 No. and date of the “primary” reflected. 4-6 These fields are intended for entering

We recommend reading: Power of attorney for participation in tenders and procurements

Column 15 of the purchase book: clarifications of the Ministry of Finance for importers

But at the same time, it is impossible not to fill out this column (column 15 of the purchase book is a mandatory element of the VAT declaration file).

Software developers have solved this problem in different ways.

Some, for example, provided for the reflection in column 15 of the amount payable to the supplier of imported goods, increased by customs VAT.

Others set up their programs so that column 15 indicated the customs value of goods, increased by the amount of customs duties, excise taxes and VAT. The Ministry of Finance sees the following solution to this problem - importers can indicate in column 15 the amount calculated using the following formula: (1) Tax base for calculating VAT.

Let us recall that this is the method of filling out column 15 of the purchase book that was previously recommended to us by the Federal Tax Service specialists (see explanations by O.S. Duminskaya in

, ). Importers can find all the data necessary to fill out column 15 in the goods declaration.

Import of goods

Situation: how to fill out a purchase book when importing goods?

When importing goods, you need to fill out the purchase book in a special way. This is due to the fact that the foreign supplier does not issue an invoice, and the importer pays the tax at customs (tax office). Therefore, in the purchase book, instead of an invoice, the importer registers the details of a customs declaration or application for the import of goods and payment of indirect taxes (paragraphs 2–3, subitem “e”, paragraph 6 of section II of Appendix 4 to the Procedure approved by the Decree of the Government of the Russian Federation of December 26 2011 No. 1137). In this case, how to fill out each column of the purchase book, see the table below.

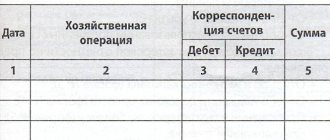

| Purchase ledger column | How to fill out | |

| Box 1 | Operation sequence number | |

| Column 2 | Transaction type code 19 (import from the countries of the Customs Union) or 20 (import from other states) (attachment to the letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/794) | |

| Column 3 | In the column indicate: – number and date of the application for the import of goods and payment of indirect taxes - when importing goods from the countries of the Customs Union (letter of the Federal Tax Service of Russia dated March 21, 2021 No. ED-4-15/4611); – number and date of the customs declaration – when importing goods from other countries | |

| Columns 4–6 | Not filled in | |

| Column 7 | Details of the payment order confirming payment of VAT at customs (at the tax office - if goods are imported from a country participating in the Customs Union) | |

| Column 8 | Date of receipt of goods | |

| Column 9 | Seller's name. There are no exceptions for filling out the purchase book when importing subparagraph “m” of paragraph 6 of Section II of Appendix 4 to the Procedure approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Therefore, in column 9 you need to indicate the name of the foreign supplier | |

| Box 10 | Not filled in | |

| Columns 11 and 12 | Not filled in | |

| Box 13 | Not filled in | |

| Box 14 | You don't have to fill it out. Information from the purchase book is needed to be reflected in section 8 of the VAT return. At the same time, in the exchange file, the element “Currency Code” from the purchase book is optional (Appendix 4 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558). The absence of optional elements does not affect the declaration's passage of format and logical control. Therefore, if the “Currency Code” is not indicated in the purchase book when registering a customs declaration, then this is not an error. According to some representatives of the tax service, the currency code must be indicated when registering customs declarations. Such clarifications are based on the literal interpretation of Section II of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (letter of the Federal Tax Service of Russia for Moscow dated November 13, 2015 No. 24-15/121141). If the importer shares this item, column 14 can be completed. Since the amount of VAT at customs is determined in rubles, enter code 643 | |

| Box 15 | The specific procedure for filling out column 15 when importing goods is not specified in Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Typically, this column duplicates the cost of goods indicated in column 9 in the “Total payable” line of the invoice (subparagraph “t”, paragraph 6 of Section II of Appendix 4 to the Procedure approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 ). But when importing goods, the foreign supplier does not issue an invoice. Instead of an invoice - a customs declaration (statement on the import of goods and payment of indirect taxes). To generate the indicator in column 15, you need to take the customs value of the goods and add to it the amount of customs duties, excise taxes (on excisable goods) and VAT. Define this indicator as follows: | |

| The cost of goods indicated in column 42 “Price of goods” of the declaration approved by decision of the Customs Union Commission dated May 20, 2010 No. 257 | + | Customs duties, excise taxes (when importing excisable goods), VAT paid at customs |

This procedure is confirmed by the letter of the Ministry of Finance of Russia dated February 8, 2016 No. 03-07-08/6235.

In this case, the cost of goods indicated in column 42 must be recalculated at the exchange rate on the date of registration of the customs declaration. This course can be taken in column 23 of the declaration, approved by decision of the Customs Union Commission dated May 20, 2010 No. 257.

If the accounting program does not allow you to form this indicator based on the customs value, you can take the contract value of the goods and add to it the VAT paid at customs. In private explanations, representatives of regulatory agencies allow this option.

If an organization imports goods from the countries of the Customs Union, take the indicator for filling out column 15 from the Application for the import of goods and payment of indirect taxes

Column 16 Amount of VAT paid when importing goodsAn example of filling out a purchase book when importing goods. Registration of customs declaration

The Alpha organization imported a batch of full-fat cocoa paste from Germany in April.

The cost of the goods is 7000 euros.

Full-fat cocoa paste is included in the Unified Customs Tariff of the Customs Union with the HS code 1803 10 000 0. The import customs duty rate is 3% of the customs value of the goods.

The date of registration of the customs declaration is April 17, 2015. The euro exchange rate on the date of import of goods is 52.9087 rubles. per euro.

The customs value of goods on the date of import was 370,360.90 rubles. (7000 euros × 52.9087 rubles).

The customs duty amounted to 11,110.83 rubles. (RUB 370,360.90 × 3%).

The tax base for calculating VAT was RUB 381,471.73. (RUB 370,360.90 + RUB 11,110.83).

The amount of VAT payable at customs was RUB 68,664.91. (RUB 381,471.73 × 18%).

VAT was paid on April 17 (payment order No. 1501 dated April 17, 2015).

The goods were received on April 21.

The accountant recorded data on imported goods in the purchase ledger.

An example of filling out a purchase book when importing goods. Registration of an application for the import of goods and payment of indirect taxes

The Alpha organization imported a consignment of goods from the Republic of Belarus in April. Supplier – Hermes LLC. The cost of the goods is 7000 euros. The VAT rate on imported goods is 18 percent.

The date of acceptance of goods for accounting is April 17. The euro exchange rate on this date is 52.9087 rubles. per euro. The cost of goods on the date of their acceptance for accounting (tax base for calculating VAT) amounted to 370,360.90 rubles. (7000 euros × 52.9087 rubles).

The amount of VAT payable is RUB 66,664.96. (RUB 370,360.90 × 18%). VAT was paid on April 17 (payment order dated April 17, 2021 No. 1501).

The accountant registered an application for the import of goods and payment of indirect taxes dated April 17, 2021 No. 548 in the purchase book.

How the rules for maintaining a purchase book and a sales book have changed since October 2021

In previous articles, we discussed changes regarding invoices and journals (see.

“How the form of the invoice and the rules for filling it out will change from October 2021” and “How the rules for filling out the log of received and issued invoices have changed since October 2021”). Today's material is devoted to the most significant amendments related to the purchase ledger and the sales ledger. Innovation for buyers registering corrected invoices. A very important amendment is dedicated to buyers who register corrected invoices (including adjustment) in the purchase ledger.

The previous version of paragraph 9 of the rules for maintaining a purchase ledger stated that corrected invoices are registered in the period when the buyer has the right to deduct VAT. And since, according to tax authorities, this right arises at the time of receipt of the corrected invoice, it should have been registered during the period of receipt of this document.

The procedure for drawing up an additional sheet

When compiling an additional sheet of the purchase book, use the following algorithm.

1. In the tabular part of the additional sheet, in the “Total” line, transfer the data in column 16 from the purchase book for the quarter in which the invoice (adjustment invoice) was registered before corrections were made to it.

2. On the lines following the “Total” line, reflect the data of invoices that are canceled (i.e., data on the invoice (adjustment invoice) before changes are made to it). Indicate indicators in columns 15–16 with a minus sign.

3. In the “Total” line, summarize the total in column 16. To do this, from the indicators in column 16 in the “Total” line, you must subtract the indicators in column 16 in the line of invoices (adjustment invoices) to be cancelled.

If several corrections are made relating to one quarter, then reflect the data in columns 2–16 on the “Total” line of the previous additional sheet on the “Total” line of the subsequent sheet.

Use the “Total” line data to make corrections to the declaration.

This follows from Section IV of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Example of designing an additional sheet for a purchase book

In August, the accountant of Alpha LLC discovered that errors were made in the purchase book for the second quarter:

1. Incorrectly registered invoice dated June 30, 2021 No. 1200 from Master LLC in the amount of RUB 236,000. (including VAT – 36,000 rubles).

2. Invoice dated June 15, 2021 No. 560 from Hermes LLC in the amount of RUB 118,000 was not registered. (including VAT – 18,000 rubles).

On August 10, the accountant issued an additional sheet to the purchase book, in which he canceled the invoice dated June 30, 2021 No. 1200 in the amount of RUB 236,000. and registered an invoice dated June 15, 2021 No. 560 in the amount of RUB 118,000.

Shopping Book 2021

It should be noted that the changes made to the Rules from October 1, 2021 provide for the following: - when reflecting in the purchase book the cost of goods imported into the territory of the Russian Federation from the territory of states that are not member states of the EAEU, column 15 indicates the cost of goods reflected in accounting (previously, this could be the cost of goods stipulated by the contract, and if there was no value in the contract, the cost indicated in the shipping documents); — when registering invoices for partial prepayment in the purchase book, there is no need to mark “partial payment”; — now in the purchase book you can reflect advance invoices for non-cash payments (previously this was prohibited).