Account 99 “Profits and losses” is intended to summarize information on the formation of the final financial result of the organization’s activities in the reporting year.

The final financial result (net profit or net loss) is made up of the financial result from ordinary activities, as well as other income and expenses. The debit of account 99 “Profits and Losses” reflects losses (losses, expenses), and the credit shows the profits (income) of the organization. A comparison of debit and credit turnover for the reporting period shows the final financial result of the reporting period.

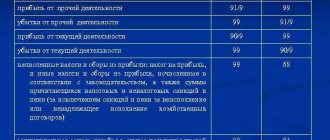

Account 99 “Profits and losses” during the reporting year reflects:

the balance of other income and expenses for the reporting month - in correspondence with account 91 “Other income and expenses”;

the amount of accrued contingent income tax expense, permanent liabilities and payments for recalculation of this tax from actual profit, as well as the amount of tax penalties due - in correspondence with account 68 “Calculations for taxes and fees”.

At the end of the reporting year, when preparing annual financial statements, account 99 “Profits and losses” is closed. In this case, by the final entry of December, the amount of net profit (loss) of the reporting year is written off from account 99 “Profits and losses” to the credit (debit) of account 84 “Retained earnings (uncovered loss)”.

The construction of analytical accounting for account 99 “Profits and losses” should ensure the generation of data necessary for drawing up a profit and loss statement.

Account 99 “Profits and losses” corresponds with the accounts

| by debit | on loan |

| 01 Fixed assets 03 Profitable investments in material assets 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 16 Deviation in the value of material assets 19 Value added tax on acquired assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business 28 Defects in production 29 Servicing 41 Goods 43 Finished products 44 Selling expenses 45 Goods shipped 50 Cash register 51 Current accounts 52 Currency accounts 58 Financial investments 68 Calculations for taxes and duties 69 Social calculations 70 Calculations with personnel 71 Settlements with accountables 73 Settlements with personnel 76 Settlements with various 79 On-company 84 Retained earnings 90 Sales 91 Other income and expenses 97 Deferred expenses | 10 Materials 50 Cash 51 Current accounts 52 Currency accounts 55 Special bank accounts 60 Settlements with suppliers and contractors 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 79 On-farm settlements 84 Retained earnings (uncovered loss) 90 Sales 91 Other income and expenses 94 Shortages and losses from damage to valuables 96 Reserves for future expenses production and economic expenses insurance and provision of wages to persons other transactions debtors and creditors settlements (uncovered loss) |

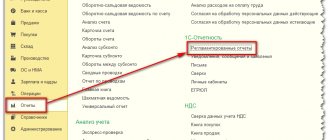

Application of the chart of accounts: account 99

- How to reflect penalties and fines for late payment of insurance premiums in accounting?

Account 99 “Profits and losses” during the reporting year are reflected along with profit and losses... statements of the annual report are reflected in account 99 “Profits and losses” in correspondence with... account 69. Moreover, in accordance with paragraph... with Regulation No. 34n and Instructions - on account 99 “Profits and losses”, either in accordance with the Recommendation, or on account 91 ... - In which account (91 or 99) should sanctions for violation of tax laws be reflected?

Account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and ... account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and ... minus those due from profits established in accordance with ... application (hereinafter - Chart of accounts and Instructions), approved by order of the Ministry of Finance... account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and... accounting procedure (on account 91 or account 99) for economic entities... - The deferred tax asset from the loss of the consolidated group of taxpayers of the

Relevant Group of Taxpayers on account 99 “Profits and losses” in correspondence with account 78 “Settlements with...) and is taken into account when determining the net profit (loss) of the organization (without participating in the formation of profit (loss) of the organization... before tax). 5. Information on account balances 78... the tax base of the consolidated group of taxpayers, is written off to account 99 “Profits and losses” in the reporting period preceding the period... - Advance payments for income tax.

Examples of the Result is reflected in account 99 “Profits and losses”. The specified account also reflects the amounts... from the amount of accounting profit received for the reporting period and the current tax rate...). Further, regardless of the amount of taxable profit (loss), the organization’s accounting records reflect... profit determined on the basis of accounting profit (loss) and recognized for the purposes of PBU 18... in accounting as a debit to account 99 “Profits and losses” (subaccount for accounting... - Reflection in accounting of fines for violation of tax laws

in Account 99 “Profits and Losses” in correspondence with account 68 “Calculations for taxes and... period, minus those due from profits established in accordance with the legislation... for its application (hereinafter referred to as the Chart of Accounts and Instructions), approved by order of the Ministry of Finance of Russia... account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and... a specific accounting procedure (on account 91 or account 99) is recommended for economic entities independently... - Reporting for 2021: on how to correctly take into account the annual clarifications of the Ministry of Finance

Profit, it is reflected in the debit of account 99 “Profits and losses” and credit 96 “Reserves for future expenses... etc.), as well as tax sanctions on them are reflected in the debit of the account 99 “Profits and losses...”. Fines and penalties paid by the taxpayer or... are reflected in expense accounts, account 99 is not used. Accordingly, in the report on... profits for social purposes, production development, etc. does not change the account balance... - The procedure for transferring an organization from a JSC to an LLC in a simplified manner: the nuances of accounting and taxation.

A separate) book of accounting for income and expenses of organizations and individual entrepreneurs using the simplified tax system... profit and loss accounts and distribution (direction) based on the decision of the founders of the amount of net profit... . That is, the JSC closes account 99 “Profit and Loss”, ... distributes, based on the decision of the founders, the amount of net profit and ... in the book of income and expenses of organizations and individual entrepreneurs using ... - Accounting for factoring companies that attract external financing

Providing financing services to Clients at the expense of Investors. OSNO - classic... on the date of accounting for goods and receipt of invoice 68/VAT (... order Turnover balance sheet Account/subaccount Debit Credit Balance... expenses) 99 (profits and losses) 0 Recognition of income, expenses from auxiliary activities 99 (profits and losses) 68/ ... on the date of accounting for the goods and receiving the invoice 68/VAT (... on the date of accounting for the goods and receiving the invoice 68/VAT (... - Correction of significant errors

The account in the records is the account for retained earnings (uncovered loss), that is, account 84 “Retained earnings ... “Cost of sales” account 90; Debit account 99 “Profit and loss”, Credit account 90 “Sales”, ... “Profit and loss”; Debit of account 84 “Retained profit (uncovered loss)”, Credit of account 99 “Profit and losses” - ... 500,000 rubles. – the amount of net profit has been adjusted. In... based on basic and diluted earnings (loss) per share (if... - Separate accounting of expenses and revenues for the supply of products within the framework of the execution of state defense orders

... (hereinafter referred to as PBU 9/99) and PBU 10/99 “Expenses of the organization” ... (hereinafter referred to as PBU 10/99). A specific methodology for maintaining separate accounting...hereinafter - Chart of Accounts)). Based on the Chart of Accounts, overhead and commercial expenses of the trade... (clause 21 of PBU 4/99 “Accounting statements of an organization”... (hereinafter referred to as PBU 4/99)). The organization's income and expenses are reflected in... PBU 4/99). A more detailed specification of income and expenses is carried out ... a different procedure for accounting for profit and loss from the general one. For example, maintaining a separate... - Accounting rules for “kids” and non-profit organizations are simplified

Period 99 “Profits or losses” (90 “Sales” - when using such an account) 20 (other accounts) Please note... directly related to the acquisition, construction and manufacture of fixed assets are included... an enterprise can charge depreciation of production and business equipment at a time in... account 20 (other accounts for recording production costs - when used) and credit accounts... settlements with contractors, payroll personnel, etc... - Imported goods have deteriorated: how to take into account customs VAT, disposal costs and insurance compensation

. Non-operating income taken into account when taxing profits, the Ministry of Finance of Russia recognizes the possibility of simultaneous... with clause 2 of PBU 9/99 “Income of the organization”... (hereinafter referred to as PBU 9/99) the organization’s income is recognized as an increase in economic... (clause 8 of PBU 9/99), which are accepted for accounting... of the organization" (hereinafter referred to as PBU 10/99); the organization’s expenses are recognized as a decrease in economic... production inventories, which presupposes the attribution of losses to the account of the guilty parties and only in volume… - Pledge.

Accounting and taxation Particularly interest, penalties, compensation for losses caused by delay in performance, and... losses caused as a result of this event in the insured property (to pay... the pledged property when taxing profits. Therefore, there is a risk that... the pledged property when taxing profits in full. ... in particular interest, penalties, compensation for losses caused by delay in performance, and... 99). The cost of materials specified in the pledge agreement and previously reflected in the off-balance sheet account... - Accounting for expenses by their nature and purpose

Accounting for expenses is regulated by PBU 10/99 “Expenses of the organization.” According to paragraph…. Clause 8 of PBU 10/99 defines the grouping of expenses according to ordinary... a direct instruction in PBU 10/99 to attribute depreciation deductions to... expenses disclosed expenses financed by state aid. True, these are not... rules for classifying expenses. According to paragraphs 99 - 105 IAS 1 “... vary in frequency, potential for profit or loss and predictability. This analysis appears... - Additional capital: formation, use and accounting procedure

Additional valuation of the property to account for the retained earnings (uncovered loss) of the organization upon disposal... a possible markdown will have to be carried out at the expense of retained earnings. Moreover, it may turn out to be... an accounting entry to the debit of account 83 and the credit of account 02 “Depreciation of fixed assets... sales as part of final turnover 99 91-9 4,139.91... at the expense of the authorized capital or profit. According to the author, replenishment and spending operations...

This allows you to create a preliminary working balance that reflects the real financial position of the organization. Knowing all the distinctive features that the 99 “Profit and Loss” account has, young professionals will be able to understand all the features of accounting. Do not forget about PBU, as well as reference and legal systems, without which the legal activities of enterprises are impossible. 18 Superfoods for a Healthy Heart Today we're going to talk about foods that should be in your diet on a regular basis. All of them will make the heart work without interruption... Healthy eating How to look younger: the best haircuts for those over 30, 40, 50, 60 Girls in their 20s don’t worry about the shape and length of their hair. It seems that youth is created for experiments with appearance and daring curls. However, already after...

Debit 99

To form the final financial result, account 99 “Profits and losses” is used, the debit of account 99 shows losses, the credit shows profits. The final results of activity for the year are shown in the balance sheet - detailed completion of the balance sheet and a completed sample. At the end of each month, the financial result from the activities for the past month is formed on accounts 90 and 91, the resulting final profit or loss is written off from these accounts to accounting account 99 with the following entries:

- D90/9 K99 – profit from ordinary activities is reflected,

- D99 K90/9 – losses from ordinary activities are reflected,

- D91/9 K99 – profit from other income and expenses is reflected,

- D99 K91/9 – losses from other income and expenses are reflected.

During the calendar year, profits and losses accumulate on account 99 from month to month.

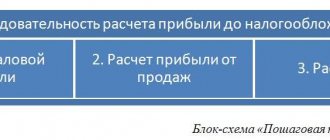

Determination of profit before tax

There are several types of profit, the determination of which uses different data.

Table 1. What they include

| Name | Description |

| Gross (VP) | Difference between revenue and cost excluding VAT |

| From sales (PP) | Gross minus selling and administrative expenses |

| Before tax (PDN) | Profit from sales plus interest and other cash receipts and expenses |

| Clean | Financial result of the enterprise |

Schematic explanations in the video:

Net profit is considered a significant coefficient for any entrepreneur, but each line of the balance sheet is subject to analysis. With the help of competent accounting, it is determined which factors positively or negatively affect the result.

Characteristics of account 99 in accounting

Accounting accounts are designed to record all monetary transactions. This review will examine in detail account 99 “Profit and Loss”. The reader will learn about what functions it performs, whether it can have its own categories, how to work with it and close it. The information is accompanied by examples to help better explain the topic. Purpose of account 99 Every enterprise works to achieve the main goal - increasing profits. Financial result is the sum of all income from each type of activity.

To sell goods or services, you will need to invest money, but how profitable this will be in the reporting period will become known after summarizing all the information about cash costs and receipts.

Balance sheet profit of the enterprise in reporting

Accounting statements reflect all performance indicators of companies. It allows you to assess the degree of success of a business project, calculate its profitability and prospects. The line in the balance sheet for book profit is not highlighted. The report shows the value of the profit remaining after deducting from it all types of costs and tax liabilities.

The reason for the impossibility of identifying the value of balance sheet profit according to the balance sheet reporting form is the different approach to reflecting the results of operations. The balance sheet is compiled on the basis of the ending account balances. Balance sheet profit must be calculated based on information generated cumulatively. The calculation can be made based on the balance and data from accounting registers. To do this, the amount of income tax paid during the year must be added to the retained earnings from the balance sheet line under code 1370.

Balance sheet profit is a line in Form 2, corresponding to the code designation 2300. If the company has a loss instead of a profit, then in the column with code 2300 its value is indicated without a minus, but the number is taken in parentheses.

Balance sheet profit (damage) is the final result (amount) of income (damage) of the company for the period of time under consideration from various types of work of a production and non-production nature, displayed on the balance sheet accounts of the enterprise.

The income structure on the balance sheet consists of 3 main elements:

- profit (damage) from the sale of industrial products;

- profit (damage) from other sales;

- profit (loss) on non-operating transactions;

Let's look at the composition of each of them.

Account 99 “profit and loss”

Attention

Postings for closing account 99 at the end of the year:

- D84 K99 – final financial result for the year – loss;

- D99 K84 – final financial result for the year – profit.

Reformation of the balance sheet Reformation of the balance sheet is the closure of accounts related to the formation of the financial result of the company. Closing accounts means resetting their final balance to zero. The reform concerns the following accounts: 90 “Sales”, 91 “Other income and expenses”, 99 “Profits and losses”.

Based on the results of the reformation of the balance sheet on account 99, the final profit or loss is identified and transferred to account 84 by the transactions indicated above. The Reformation allows you to end the year, reset your accounts and start accounting in the new year with a “clean slate.”

Book profit: formula

Update: August 16, 2021

The purpose of doing business is to derive profit from the enterprise’s activities, both as stated in the organization’s charter and those accompanying its conduct. The amount of profit as a result of an enterprise’s activities can be assessed differently for tax, accounting and management purposes. One of the indicators that determines the size of the final profit of an economic entity is balance sheet profit; the formula for calculating balance sheet profit is based on the accounting data of the enterprise.

Formation of the final financial result

This is exactly what the 99 account is intended for, which can reflect:

- increase or decrease in income from the main activity (D90 K99);

- the balance of other expenses and income for the reporting period (D91 K99);

- the impact of emergency situations on economic activities (force majeure, accidents);

- accrual of amounts intended for calculating taxes (interaction with account 68).

Is it possible to open new subaccounts? According to the instructions, the account in question has no categories. An accountant can create them independently, taking into account the requirements of the enterprise (analysis, control, reporting).

Other types of enterprise profit

The operating profit of an enterprise can be the result of different types of activities. Each of them depends on certain conditions. Such profit indicators are formed from the following criteria:

[1]. The type of calculation used in the company. The profit of a trading enterprise can be marginal, net or gross.

[2]. By type of application. The use of profits in an enterprise is carried out through capitalization, where funds are accumulated in the company’s accounts, and through distribution, where the proceeds are used to develop the business itself.

[3]. On the analysis of economic activity. Profit and loss statements are prepared for each specified period. A comparative analysis of past years shows the growth or decline of the company's overall efficiency.

[4]. By type of tax deductions. The profit of a manufacturing enterprise is divided into taxable based on the regime established in the company and non-taxable, which is included in the list in accordance with current legislation.

Enterprise profit planning methods allow, based on these criteria, to generate the volume of funds subject to further distribution or accumulation, as well as to compare the efficiency of production and accounting policies for past periods.

Formation of financial results for the year

The same entry will reflect the accrual of fines and penalties to the budget for income tax, VAT and other taxes. Sanctions to extra-budgetary funds (for example, the Pension Fund) should be calculated as follows: Debit 99 – Credit 69 “Calculations for social insurance and security”. If accounting for profit calculations is carried out in accordance with PBU 18/02, then debit account 99 can also correspond, in particular, with account 09 “Deferred tax assets”. Thus, accounting entry D99 K09 is made when writing off a deferred tax asset in the event of disposal of the object for which it was accrued. Closing account 99 At the end of the year, account 99 is reset with the difference being assigned to account 84 “Retained earnings (uncovered loss)”: the so-called “balance sheet reformation” occurs.

Calculation of enterprise profit using a specific example

The initial data is as follows. Klyuch LLC produces chains for chainsaws. Material reporting for the past two years is reflected in the table:

Table 3. Initial data for calculating the profit of a hypothetical enterprise

| Indicator name | Line code | For 2021 | For 2021 |

| Revenue | 2110 | 160000 | 60000 |

| Production cost | 2120 | 40000 | 20000 |

| Business expenses | 2210 | 5000 | 3000 |

| Management costs | 2220 | 16000 | 11000 |

| Other income | 2340 | 1500 | 1000 |

| Other costs | 2350 | 2500 | 2000 |

| Percentage to be paid | 2330 | 5000 | 3000 |

| Income tax | 2410 | 10000 | 3560 |

Using tabular data, we calculate the company’s profit in 2017:

Pmarj. = B - Let's stop. = 60,000 rub. – 20,000 rub. = 40,000 rub.

Pvalov. = B – Prod. = 60,000 rub. – 20,000 rub. = 40,000 rub.

Prereal. = B – Full. = 60,000 rub. – (20,000 rub. + 3,000 rub. + 11,000 rub.) = 26,000 rub.

Balance. = Psales – Rprot. + Other = 26,000 rub. – 2000 rub. + 1000 rub. = 25,000 rub.

Poper. = Pbalance. + PRvyp. = 25,000 rub. + 3000 rub. = 28,000 rub.

Pchist. = Pop. - Nprib. = 28,000 rub. – 28,000 rub. * 0.2 (or – 20%) = 22,400 rub.

In the same way, we calculate the profit values for 2021:

Pmarj. = B - Let's stop. = 160,000 rub. – 40,000 rub. = 120,000 rub.

Pvalov. = B – Prod. = 160,000 rub. – 40,000 rub. = 120,000 rub.

Prereal. = B – Full. = 160,000 rub. – (40,000 rub. + 5,000 rub. + 16,000 rub.) = 99,000 rub.

Balance. = Psales – Rprot. + Other = 99,000 rub. – 2500 rub. + 1500 rub. = 98,000 rub.

Poper. = Pbalance. + PRvyp. = 98,000 rub. + 5000 rub. = 103,000 rub.

Pchist. = Pop. - Nprib. = 103,000 rub. – 103,000 rub. * 0.2 (or – 20%) = 82,400 rub.

As can be seen from the examples given, the company’s profit for the year increased significantly due to the natural increase in significant parameters. But there are also artificial ways to increase profits.

The main goal of the company's management is to increase income from all types of activities.

To achieve this goal, it is necessary to carry out a number of measures to increase profits and reduce costs.

Account 99 “profit and loss”

Correspondence on the loan Account 99 “Profits and losses” interacts on the loan with the following categories:

- "Materials" (10).

- “Financial transactions with suppliers and contractors” (60).

- “Currency and current accounts” (52, 51).

- “Retained earnings” (84).

- “Sales of goods” (90).

- “Shortages and damage from damaged valuables” (94).

- “Reserves for future expenses” (96).

- “Special bank accounts” (55).

- “Intra-household calculations” (79).

- “Financial transactions with creditors and debtors” (76).

- “Other expenses and income” (91).

- “Settlements with employees for various operations” (73).

Loan transactions The table provides some examples to help you understand what kind of loan entry account 99 may have, reflecting the profit (income) of the company. D10 K99 Identification of excess materials.

How to calculate book profit?

The unconditional performance of a company's production is determined by its final economic indicators. The most important of these is the profit indicator.

Balance sheet profit is the most important determining financial result of the economic activity of an enterprise. Based on its results, the organization's income can be calculated.

To calculate balance sheet profit, use the algebraic sum of its three elements (indicators): profit from the sale of industrial goods (Pр), the amount of income and damage from non-sales operations (Pvp) and income and damage from other sales (Ppr).

As a result, the calculation formula for balance sheet profit can be written as follows:

Pb = Pr + Pvp + Ppr

Let's consider the calculation of each of the constituent elements of balance sheet profit.

The formula for income from the sale of production products is:

Pр = Np - Sp - Pnds - Ra, where

Np - income from sales,

Sp – production costs for the production of goods,

Rnds – VAT,

Ra – excise tax.

The formula for the amount of income and damage for non-operating transactions (Pvp) takes into account the values:

- income part (dividends) of securities;

- payments from the rental of premises;

- income from joint venture;

- sanctions, fines and penalties for low-quality goods;

- violations in logistics operations;

Profit from other sales (Ppr) includes income (damage) from the sale of work, products, and services. In addition, this type of profit includes non-production work, excluding the income from the sale of industrial goods.

Such work may include repairs, capital construction, transportation services, and sales of heat energy.

Closing debit balance on account 99 profit and loss

During the reporting year, account 99 “Profits and losses” reflects: - profit or loss from ordinary activities - in correspondence with account 90 “Sales”; - balance of other income and expenses for the reporting month - in correspondence with account 91 “Other income and expenses”; - losses, expenses and income due to emergency circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.) - in correspondence with accounts of material assets, settlements with personnel for wages, cash, etc. . Extraordinary income is considered to be income arising as a consequence of extraordinary circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.): insurance compensation, the cost of material assets remaining from the write-off of assets unsuitable for restoration and further use, etc. . Similarly, profit and loss are identified for other types of activities, income and expenses from which are recorded in account 91: Debit 91 – Credit 99 means that profit was generated for other activities at the end of the month. Debit 99 – Credit 91 means that there was a loss for other income and expenses for the month. Account 99 - for calculations of income tax Account 99 during the year also reflects the amounts of accrued conditional expenses and income for income tax, permanent tax liabilities and assets and payments for recalculation of this tax from actual profit, as well as amounts due for payment tax sanctions.

Thus, the accrual of a conditional income tax expense in accordance with PBU 18/02, as well as simply income tax on the basis of a declaration, if calculations are not kept in accordance with PBU 18/02, will look like this: Debit 99 – Credit 68.

Each enterprise has the most important and most important goal of its activities - a systematic increase in profits. The financial result of a work process can only be assessed by summing up the income of each area of the organization. This is an important point, since only on the basis of this information should you make an investment decision. Acting at random is fraught with serious risks and unpleasant consequences. This is why it is so important to track information about cash costs and receipts. This is exactly the kind of reporting available on account 99.

Throughout the entire working year, data on the organization’s profits and losses is stored in this account. Operations are taken into account not only in the main activity of the company, but also in all other areas. At the very end of the working year, a report is generated that compares credit and debit data. Account 99 is eventually closed by writing off the remaining funds on account 84.

The count 99 itself is considered active-passive. In its debit you can see the loss resulting from financial transactions, and in its credit you can see the profit. All basic characteristics of account 99 can be viewed in the Chart of Accounts, which was established by order of the Ministry of Finance under number 94n dated October 31, 2000.

According to the above-mentioned order, throughout the entire working year, information on the following aspects of the organization’s activities is accumulated and stored on account 99:

1. Increase and decrease in income from the main activity of the organization. This can be seen in the wiring of the Dt90 Kt99.

2. The balance of all other income and expenses incurred during the reporting period. Wiring Dt91 Kt99.

3. The impact of unexpected and unplanned situations on the business activities of the company. We are talking about all kinds of force majeure, industrial accidents, etc.

4. Amounts intended for calculating tax payments. Both fixed income tax liabilities, penalties and other charges are taken into account. Wiring Dt68 Kt99.

If an organization is engaged in the field of agriculture, then, according to the above-mentioned Chart of Accounts, when comparing debit and credit turnover on account 99, the following results of financial activities appear:

1. Force majeure related to sudden natural disasters, fire, etc. In this case, the transactions selected are those on which the corresponding expenses are noted.

2. Based on the first point, it is possible to receive income in the event of unplanned situations. For example, insurance claims related to compensation for destruction caused by natural disasters. Income from the sale of materials obtained during the dismantling of unfit for use buildings and structures is also possible.

Calculation example

For example, a company sells office chairs of its own production. Within one month, the organization sold 123 chairs, receiving revenue of 984 thousand rubles for the goods. 657 thousand rubles were spent to produce these goods, so this value is represented by the cost price.

The company additionally has its own workshop, which is not used for production, but is leased to a partner. The organization receives 18 thousand rubles monthly. in the form of rent. At the same time, there are no other cash receipts during the month.

The director of the company decided to improve the engineer’s qualifications by sending him to the appropriate paid courses. 9 thousand rubles were paid for training. Using the available data, significant indicators are determined:

VP is equal to: 984,000 – 657,000 = 327 thousand rubles.

PP is determined: 327,000 – 9,000 = 318 thousand rubles.

PDN is equal to: 318,000 + 18,000 = 336 thousand rubles.

The calculation is simplified due to the absence of numerous other expenses or income. The resulting indicator is not always used to determine tax, since it is determined whether all cash receipts and expenses can be taken into account for tax accounting. They must be documented and related to the work of the company.

How to calculate the balance sheet, watch the video:

Basic postings

According to Order of the Ministry of Finance No. 94n, the following correspondence from account 99 can be distinguished:

Dt 99 Kt 01, 03, 07, 08, 10, 11, 16, 19, 20, 21, 23, 25, 26, 28, 29, 41, 43-45, 50-52, 58, 68-71, 73 , 76, 79, 84, 90, 91, 97.

Dt 10, 50-52, 55, 60, 73, 76, 79, 84, 90, 91, 94, 96 Kt 99.

The debit shows expenses, and the credit shows income. Comparison of turnover for the required reporting period allows you to see the final financial result and understand whether the company’s activities are profitable.

Debit 99 - penalties

Account 99 allows you to see all tax debts accrued to the organization, as well as write-offs of the necessary amounts to pay off outstanding debts. Moreover, it is worth considering that when transferring fines to the state budget, the posting Dt68 Kt51 is used. And when calculating tax sanctions - Dt99 Kt68.

It is necessary to distinguish between fines and penalties, since these are completely different concepts, and information on them is reflected in different accounts. A fine is accrued immediately when one or more reasons arise (an accounting report not submitted on time, unpaid tax or insurance premium, deliberate reduction of tax liability). Its size is strictly determined by law. Penalty is a penalty payment that is calculated for each day of overdue payment. The percentage ratio is 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

99 accounting account shows only fines, but not penalties, which is regulated by Article 114 of the Tax Code of the Russian Federation. Penalties can be seen on the wiring Dt91.2 Kt68.

The profit that remains after taxes have been paid and has not yet been spent on paying dividends to shareholders, has not been distributed to replenish the authorized capital or has not been used as funds to pay off uncovered losses is called undistributed (NRP)

.

An uncovered loss is a financial loss of an organization of a negative nature incurred during the reporting year or previous years.

Enterprise profit factors

Factors affecting the profit of an enterprise are (1) internal and (2) external.

External factors do not directly affect the economic development of the company, but they should be taken into account when forecasting the company’s profit. These factors include:

- social and economic development in the country and in the region; location of the company;

- features of the market to which the manufactured products are supplied;

- economic reforms carried out by the state aimed at stimulating entrepreneurship;

- inflation indicators;

- tax systems;

- the location of raw materials needed to produce products and their prices.

Internal factors are further classified into (1) production and (2) non-production.

Production factors include factors that directly affect the costs and profits of an enterprise. These include:

- volumes of products produced;

- technologies used in production;

- product quality;

- employee qualifications;

- production workload;

- production speed.

Non-productive factors include factors that are only indirectly involved in the main process of creation, production and sale of products. It can be:

- relations in the work team;

- speed of employee response when production conditions change;

- work of logistics departments;

- effectiveness of management personnel at different levels.

When accounting for profit at an enterprise, internal and external factors are taken into account. This will make it possible to give a more accurate forecast and identify less efficient elements in production at an early stage.

List of subaccounts and features

Account 84 is used to display the financial results of the company's activities

from the moment of its creation to the time of liquidation. It is replenished during the period when the balance sheet changes - at the end of the reporting year.

The decision on the disposal of funds can only be made by the owners of the enterprise, most often through a meeting and voting, after which everything is certified by a specially drawn up protocol and certified by each shareholder or participant.

The amount of net profit received is shown as a credit, and the amount of uncovered losses is shown as a debit. Count 84 is active-passive

.

List of subaccounts

:

- 84.01

– profit to be distributed; - 84.02

– the amount of loss to be covered; - 84.03

– profit of undistributed type, which is in circulation; - 84.04

- displays the amount of spent retained income that has gone through the process of being converted into goods or, conversely, through depreciation deductions.

Funds transferred to special funds and spent on expenses such as privileged expenses, corporatization, payments and other material incentives for employees - they must be displayed and accounted for in the balance sheet in the amount of the authorized capital.

Accounting for account 84 is necessary to combine data on profits received that have not yet been capitalized and losses that have not been received.

Compilation

:

Reflection of balance sheet profit in statutory reporting

If the term “balance sheet profit” itself is present, there is no line in the balance sheet with this name, which has its own justification and logic.

The organization's balance sheet presents aggregated indicators of the organization's assets and liabilities as of a specific reporting date according to the accounting registers. An organization's balance sheet profit is an indicator that accumulates on an accrual basis throughout the year, but is completely exhausted at the reporting date, being, according to accounting rules, allocated to accounts for taxes payable and accounts for net (retained) profit.

Consequently, on the reporting date in the balance sheet of the enterprise in an expanded sense (if we present it as a list of all accounts indicating the balances on them), the balance sheet profit will already be distributed and equal to zero, as will be the zero line with the same name in the balance sheet as a reporting form, if that was used.

The indicator “balance sheet profit” can be calculated using the formula from both the interim and final balance sheet data, and from accounting data using the formula:

Postings

Display of NRP by on-farm reserves and funds:

- D 80 Kt 84

– a decrease in the volume of the authorized capital (AC) to the amount of its net assets is displayed. - D 84 Kt 80

- the reverse process - an increase in the amount of funds of the management company. - D 82 Kt 84

- reduction or full coverage of losses through deductions from the capital. - D 83 Kt 84

– writing off the amount of loss using additional capital (AC). - D 75 Kt 84

- repayment of financial losses of the organization through contributions collected from shareholders or owners of the enterprise. - D 84 Kt 83

– use of research and development funds to increase the amount of additional capital. - D 84 Kt 84

- movement of funds within an account - reserving finances for an upcoming purchase or organizing a fund for accumulation.

In analytical accounting, account 84 is formed in such a way that it will ensure the organization of data in accordance with the purposes of using its resources. Also, when displaying information about the use of retained earnings as a financial instrument for the acquisition of new tools and other means for the production development of the company, this data may be subject to differentiation

.

How is profit different from income?

The company's income reflects the volume of cash and other material receipts to the accounts of the enterprise. It can be classified as an external indicator.

Profit is primarily an internal indicator. In the classical presentation, it is formed from the total amount of income received, for example, for a quarter or half a year, minus all expenses, which will include:

- costs of producing goods or organizing services;

- management costs;

- business expenses;

- tax deductions;

- payment of salaries to employees;

- costs of selling products;

- costs of promoting goods;

- payment of fines based on court decisions;

- interest payments on borrowed funds.

The economic essence of profit lies in the allocation of net funds that remain after all of the above deductions.

These funds remain on the company’s balance sheet and can be capitalized and used to develop the production process itself.

How to close

If an organization operates on the simplified tax system, it happens in the same way as with other enterprises - at the end of the reporting year. However, there are peculiarities when closing. At the beginning of the process, the subaccounts of account 90 are closed. After this, the company can begin to reset the account. 90, and 99.

In writing this is shown as follows

:

- D 90, 91 Kt 99

or

D 99 Kt 90, 91

- this means that income accounts have been closed. - D 99 Kt 84

or

D 84 Kt 99

– written off net profit or incurred loss is taken into account.

At the end of the reporting year

Every month, the accountant generates the entries necessary to write off the results of the company’s activities. This is done like this:

- D 90.9 Kt 99

or

D 99 Kt 90.9

– data on income or losses from the main activities of the organization is generated. - D 99 Kt 84

– the write-off of net profit (NP) is displayed; if in posting 84 it is formed by debit, then this means a write-off of the company’s losses.

At the end of the year, the balance sheet is reformed

. During this process, the corresponding accounts are reset. Postings are compiled depending on the intended purpose:

- D 84 Kt 75

- contains information on the accrual of funds for settlements generated at the end of the year. - D 84 Kt 80

– deductions for increasing the volume of the capital. - D 84 Kt 82

- drawing up a reserve capital base. - D 84.3 Kt 84.2

– use of part of the NRP to cover losses accumulated during the reporting year.

Debit and credit

Account 84 corresponds to both debit and credit.

By debit:

- - checking account. Its function is to display information about the movement of funds in a current account opened with a banking organization.

- 52

– accounts in foreign currency. Contains information about existing accounts in which funds in foreign equivalents are stored. - 55

– accounts in special purpose banks. Needed to display data on accounts held by the company, the funds in which are in rubles or other currencies within the Russian Federation or other countries. The basis may be a checkbook, payment documentation, with the exception of bills of exchange, special and special accounts - 70

- remuneration of employees. All payments between the employee and the company are displayed here. - 75

– settlement with the founders. All payments made by the founders of the company are taken into account. - 79

– calculations of intra-farm type. - 80

– authorized capital (AC) - 82

– contains information about the size and changes in the company’s reserve funds (RC). - 83

– capital of additional type. Using it you can find out the volume of total additional capital (AC). - 84

– profit that has not yet been distributed. - 99

– profit and loss.

By loan

:

- – settlement actions in front of company employees that do not relate to wages;

- 75

– settlements with founders; - 79

– on-farm calculations; - 80

– UK; - 82

– RK; - 83

– DK; - 84

– uncovered loss or retained earnings; - 99

– income received from the activities of the organization and losses arising in the process of its functioning.