As you know, demand for a product creates its supply. However, for a manufacturer’s products to become popular, they must be of high quality.

Quality is a set of characteristics and properties of a product that determine its suitability for its intended use. This definition is present in GOST 15467-79. According to GOST R ISO 9001-2015, quality is the degree of compliance of a set of product characteristics with established requirements.

However, no matter how the manufacturer strives to meet standards, some products are produced with defects. Such products are called defective. The reasons for its occurrence are very different: human factor, equipment failure, etc. In any case, defective products should not reach the consumer.

Types of marriage

Depending on the location of detection of the defect and the nature of the detected defects, the defect is divided into the following categories:

- external: correctable and incorrigible;

- internal: correctable and incorrigible.

The reasons for defects (both internal and external) for a trade organization are:

- receipt of defective goods from the supplier (manufacturer);

- defects made during pre-sale preparation of goods (for example, during packaging and packing). In this case, goods actually become damaged. For more information about accounting for damaged goods, see How to record shortages (damage) of goods.

If a defective product was sold to a buyer, then the organization suffers losses from external defects. Accounting for losses from external defects depends on what kind of defect is identified - correctable or irreparable.

Profit tax

When writing off defects, as stated above, they are included in other costs associated with the production and sale of products. There are no special restrictions in the Tax Code regarding the accounting of these costs. Consequently, subject to the general principles of cost recognition for tax purposes in accordance with Chapter 25 of the Tax Code, documentary evidence, economic feasibility, and non-reimbursable losses from defective products can be taken into account by the manufacturer as expenses. Control agencies also adhere to this position.

Depending on the rules of the enterprise's accounting policy, for taxation purposes, costs associated with the production and sale of products can be classified as both indirect and direct costs. The relevant provisions are enshrined in paragraphs 1, 2 318 of Article NK.

Indirect costs are included in full in the costs of the current period. Direct expenses form the tax base for the sale of products in the cost of which they are already taken into account.

Accordingly, in the accounting policy of an enterprise for tax purposes, it is necessary to fix the rules for accounting for defective costs. In particular, it is advisable to develop a methodology for determining the cost of defective products.

External correctable marriage

If a correctable defect is discovered, the buyer has the right:

- demand a proportionate reduction in the price of a low-quality product (i.e., discount it);

- return the goods to the seller;

- demand elimination of defects;

- independently eliminate the defects, while demanding compensation from the seller for the costs of eliminating the defect.

This follows from Articles 475 and 482 of the Civil Code of the Russian Federation, Law of February 7, 1992 No. 2300-1.

If the buyer demands that the defect be corrected, the seller can:

- transfer the goods for correction to the organization from which such goods were previously purchased;

- correct the defect on your own (with or without compensation from the supplier for low-quality goods);

- correct the defect with the involvement of service centers (third party organizations).

"1C": write-off

If defective products are found in the warehouse, it is necessary to issue a “Demand-invoice”. If an irreparable defect is identified, the document for write-off indicates the cost item: “Defect in production.” The system enters the 28th account automatically. The tabular part of the scrap write-off act indicates the nomenclature group for which analytical accounting will be carried out.

In the system, you can indicate which product the defect is attributed to, accurate to the batch.

If a correctable defect is identified, the product can be sent for revision. For this purpose, a “Request-invoice” document is drawn up for the cost item.

Elimination of defects by the manufacturer

If an organization transfers the goods to its supplier (manufacturer of goods) for correction, then it will not incur losses from defects. This is because all costs for correction will be borne by the supplier (manufacturer).

Situation: how to reflect in accounting the goods accepted from the buyer to correct a defect (defect)? The organization transfers these goods for repair (elimination of defects) to its supplier (manufacturer).

Goods accepted from the buyer and transferred to the supplier (manufacturer) to eliminate defects are reflected in off-balance sheet account 002.

This is explained as follows. Firstly, the buyer, when transferring the goods to the seller to eliminate defects, remains the owner of this product (Article 218 of the Civil Code of the Russian Federation). Secondly, the purchase and sale agreement was concluded between the trading organization and the buyer (Article 454 of the Civil Code of the Russian Federation). The trading organization that accepted the goods from the buyer remains responsible to the buyer for eliminating defects, as well as for the safety of the goods. A trading organization, as a seller, is obliged to deliver goods of proper quality (Article 469 of the Civil Code of the Russian Federation). In case of transfer of a low-quality product, it is responsible for its shortcomings (it must eliminate, reimburse the buyer’s expenses for elimination, replace the product, etc.) (Articles 475 and 476 of the Civil Code of the Russian Federation).

The supplier (manufacturer) and the trading organization are bound by another supply agreement. If the buyer of a trade organization transfers the goods for correction to this organization, and not to the manufacturer, then the manufacturer does not bear any obligations to the buyer of the trade organization. He is responsible only to the trading organization (since the contract is concluded between them). This follows from Article 476 of the Civil Code of the Russian Federation.

Therefore, reflect the goods transferred to the supplier (manufacturer) to correct the defect on account 002. Documentary confirmation of the fact of transfer of the goods to the supplier (manufacturer) can be an acceptance certificate. It will be possible to write off such goods from off-balance sheet account 002 only at the moment when the organization returns the goods to its buyer (Instructions for the chart of accounts).

For the convenience of maintaining analytical accounting and reflecting the movement of goods received to account 002, you can open additional sub-accounts:

- “Goods accepted for elimination of defects in warehouse”;

- “Goods transferred to the supplier (manufacturer, service center) to eliminate defects.”

Mistakes in quality management

Basically, trade organizations sell goods to customers on the basis of a sales contract, the legal basis of which is regulated by Chapter. 30 “Purchase and sale” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

If, when concluding a purchase and sale agreement, the parties provided for the procedure for accepting and returning goods of inadequate quality, then the return is carried out in accordance with the terms of the agreement. For example, the parties may stipulate in an agreement that when accepting goods the following applies:

- Instructions on the procedure for accepting production and technical products and consumer goods for quality, approved by Resolution of the USSR State Arbitration Court of April 25, 1966 N P-7;

- Regulations on the supply of products for industrial and technical purposes, Regulations on the supply of consumer goods and the Basic conditions for regulating contractual relations when carrying out export-import operations, approved by Resolution of the USSR Council of Ministers of July 25, 1988 N 888.

If the contract does not provide for the acceptance procedure, then in this case both the buyer and the seller must be guided by the norms of the Civil Code of the Russian Federation.

Requirements for the quality of goods are set out in Art. 469 of the Civil Code of the Russian Federation, according to which the seller is obliged to transfer to the buyer goods, the quality of which corresponds to the purchase and sale agreement.

If the purchase and sale agreement does not contain conditions on the quality of the goods, then the proper fulfillment by the seller of the conditions on the quality of the goods depends on whether the seller knows the purpose of its use or not.

If the seller does not know the purpose for which the goods are purchased, then he is obliged to transfer to the buyer the goods, suitable for any purposes for which they are usually used. If the buyer notifies the seller of the purpose of using the goods, then the seller is obliged to transfer the goods suitable for use precisely in accordance with these purposes.

If a product is purchased based on a sample and (or) description, then the seller’s responsibility is to transfer the product that fully corresponds to the sample and (or) description.

If the law or the procedure established by it provides for mandatory requirements for the quality of the goods being sold, the seller is obliged to transfer to the buyer goods that meet these mandatory requirements. Note that usually the quality of a product is confirmed by a certificate (declaration) of conformity, the validity period of which is determined by the relevant technical regulations.

The procedure for certification of products (works, services) is regulated by the Federal Law of December 27, 2002 N 184-FZ “On Technical Regulation”, according to which certification can be either mandatory or voluntary. Today, only products released into circulation on the territory of the Russian Federation are subject to mandatory certification.

The consequences of transferring goods of inadequate quality are discussed in Art. 475 of the Civil Code of the Russian Federation, according to which the buyer to whom the seller has transferred goods of inadequate quality has the right, at his own discretion, to demand from the seller:

- proportionate reduction in the purchase price of the goods;

- free elimination of product defects within a reasonable time;

- reimbursement of their expenses for eliminating defects in the goods.

If violations of product quality requirements are significant, then the buyer has the right:

- refuse to fulfill the purchase and sale agreement and demand the return of the amount of money paid for the goods;

- demand replacement of goods of inadequate quality with goods that comply with the contract.

A significant violation of product quality requirements means the discovery of irreparable defects, defects that cannot be eliminated without disproportionate costs or time, or are identified repeatedly or appear again after their elimination, and other similar defects (Clause 2 of Article 475 of the Civil Code of the Russian Federation).

Thus, only low-quality goods that have significant defects in quality can be returned to the seller. The period during which the buyer can return a defective product to the seller depends on whether or not the product has a warranty period or expiration date.

Clause 2 of Art. 477 of the Civil Code of the Russian Federation determines that in the absence of a warranty period or expiration date for a product, the buyer may make claims related to defects in the product within a reasonable period of time, not exceeding two years from the date of transfer of the product. If a longer period is specified by law or the purchase and sale agreement, then the period during which the buyer has the right to make claims increases.

The period for identifying defects in goods to be transported or sent by mail is calculated from the day the goods are delivered to their destination.

If a warranty period has been established for the product, the buyer has the right to make claims related to the defect of the product if defects are discovered during the warranty period. If the warranty period provided for in the contract is less than two years and defects in the goods are discovered by the buyer after the expiration of the warranty period, but within two years from the date of transfer of the goods to the buyer, the seller is liable if the buyer proves that the defects in the goods arose before the transfer of the goods to the buyer or for reasons that have arisen up to this point.

In relation to a product for which an expiration date has been established, the buyer has the right to make claims related to defects in the product if they are discovered during the expiration date.

Having discovered a defective product, the buyer must notify the seller about this, and this must be done within the time period provided for by law, other legal acts or contract. If such a period is not specified, then the buyer must notify the seller within a reasonable time after the violation of the terms of the contract on the quality of the goods should have been discovered based on the nature and purpose of the goods.

Some manufacturers are not entirely clear about the purpose of accounting for manufacturing defects. They believe that the occurrence of defective products is a natural process, without which production activities cannot occur.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

Meanwhile, the creation of a competent accounting system makes it possible to timely identify the circumstances causing the appearance of defects in goods. Accordingly, based on the available data, the manager can take measures to reduce the number of defective products.

Quite often, shop managers complain about the obsolescence of equipment. This explains the appearance of defects and believes that the purchase of modern machines can improve the situation. However, not every enterprise has the funds for this. Of course, you can’t work on old equipment either. The best way out of the situation may be to modernize or rent machines.

Managers and technologists often say that identifying the causes of defects can be difficult. Of course, various situations may arise at an enterprise in which it is really problematic to determine the circumstances of the occurrence of defects. But in most cases, it is possible to identify the reasons for the production of products with defects by grouping them according to common characteristics. Usually the causes of defects are violations of technology, negligence, or oversight of responsible persons.

When grouping signs of low-quality products, correct accounting of products is of particular importance.

Eliminating defects on your own

If the organization eliminates the defect on its own (for example, the contract does not provide for the elimination of the defect by the supplier), then losses from the defect will be equal to the amount of expenses associated with eliminating the defect. Namely:

- the cost of materials used to correct the defect;

- salaries of employees involved in eliminating defects;

- accruals on the salaries of employees involved in repairing marriages (contributions to compulsory pension (social, medical) insurance, as well as insurance against accidents and occupational diseases);

- costs of shipping defective goods for correction from the buyer and back;

- other expenses for correcting the defect.

Reflect these expenses in the debit of account 44 “Sales expenses”. This is due to the fact that in sales organizations all costs can be taken into account as part of sales expenses. When reflecting expenses associated with eliminating defects, make the following entry in accounting:

Debit 44 Credit 10 (60, 69, 70…)

– the costs of correcting the defect are reflected.

Goods accepted from the buyer for correction of defects during the entire period of work to eliminate defects are recorded in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” This is explained by the fact that the goods transferred for correction are the property of the buyer and remain so even when they are with the trade organization to eliminate defects (Clause 1 of Article 223 of the Civil Code of the Russian Federation).

Capitalize the goods received to correct a defect on the basis of the documents issued by the buyer when transferring the goods for correction. This could be, for example, an invoice drawn up by the buyer in any form (or an invoice in form No. TORG-12). The use in this case of an independently developed primary document is explained by the fact that there is no unified form for reflecting such an operation. This procedure follows from Article 9 of the Law of December 6, 2011 No. 402-FZ.

In accounting, reflect the receipt of defective goods for correction and its return to the buyer after eliminating the defects with the following entries:

Debit 002

– goods were received from the buyer to correct the defect;

Credit 002

– the product is returned to the buyer, the defects of which have been eliminated.

This procedure follows from the Instructions for the chart of accounts.

Compensation for damage

When deciding on compensation for harm, the fact of identifying the perpetrators will be of significant importance. They can be not only employees of the enterprise, but also third parties. For example, equipment was stopped due to a power outage, low-quality materials were received from the supplier, etc.

Claims to third parties are sent in the manner established by the Civil Code. Compensation for damage by employees of the enterprise is carried out according to the rules established by the Labor Code. As Article 241 of the Code establishes, if an agreement on swearing was not concluded with the employee. liability, you can recover from him an amount that does not exceed the average monthly salary.

Retention is carried out on the basis of an order from the head of the enterprise. The order is issued within a month from the moment the final amount of property damage is determined. If this deadline is missed, as well as if the employee evades compensation for damage, the employer has the right to go to court.

Elimination of defects by a third party

If an organization eliminates defects with the involvement of service centers (other third-party organizations), then reflect the cost of their services in expenses using the following entry:

Debit 44 Credit 60

– expenses for the services of the service center (other third-party organizations) are reflected.

This procedure follows from paragraph 1 of Article 475, Article 477 of the Civil Code of the Russian Federation and the Instructions for the chart of accounts.

In accounting, reflect the movement of goods received from the buyer and transferred to a service center (third-party organization) to eliminate defects in the same way as in the case of transfer of goods to the supplier (manufacturer).

The defect was eliminated by the buyer

The buyer, having purchased a defective product, can independently eliminate the defects so that the product is suitable for use. In this case, he has the right to demand compensation from the seller organization for the costs of correcting the defect. This is provided for by paragraph 1 of Article 475 of the Civil Code of the Russian Federation and paragraphs 1 and 2 of Article 18 of Law No. 2300-1 of February 7, 1992. It is these costs that will be taken into account by the seller as expenses for eliminating defects (i.e., increasing losses from defects). To take into account such costs, require the buyer to provide documents confirming the presence of a defect and the costs of eliminating it. For example it could be:

- marriage certificate;

- conclusion of the service center;

- calculation of expenses incurred.

As a rule, the buyer attaches such documents to the claim that he submits to the organization when a defect is discovered and corrected.

In this case, when reflecting the costs of eliminating defects in accounting, make the following entry:

Debit 44 Credit 76 subaccount “Calculations for claims”

– reflects the amount of compensation for the costs of eliminating the defect presented by the buyer.

In all cases, make entries in account 44 related to the reflection of expenses for correcting defects on the basis of:

- primary documents confirming the detected defect. These documents must be drawn up by the buyer at the time of discovery of the defect (damage) and then handed over to the trading organization;

- documents confirming the costs incurred to eliminate defects (damage) and compensation for damage from the perpetrators (suppliers, manufacturer) (invoices, pay slips, work completion certificates, etc.).

This procedure is provided for in Article 9 of the Law of December 6, 2011 No. 402-FZ.

Manufacturing defect: a good thing won’t be called that

In the field of production, a defect is a product or its element (it can be a semi-finished product, part, assembly), the quality of which does not fit into the norms, standards, technical conditions adopted at the enterprise, and which is impossible to use for its intended purpose or is only permissible with additional adjustments that require costs. .

FOR YOUR INFORMATION! The definition of manufacturing defects, used in modern legal acts, repeats clause 38 of the Basic Provisions for Planning, Accounting and Calculation of Costs at Industrial Enterprises, approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR and the Central Statistical Office of the USSR on July 20, 1970.

What is included in financial losses as a result of marriage:

- irreparable costs for the cost of a defective product (money for raw materials, salaries to employees, payment of energy for equipment operation, etc.);

- expenses for corrective actions to bring the product to acceptable quality (this includes remuneration for workers’ labor and funds for equipment maintenance);

- funds for identifying and formulating defects (for example, creating a list of typos);

- reimbursement to the consumer of low-quality products for the expenses incurred by him (these include the cost of replacing or correcting a product whose quality did not suit the consumer, including transportation costs for its delivery).

The following are not considered a manufacturing defect:

- products for which at a particular enterprise there are special requirements that differ from the standard ones for similar products, although the quality meets the standard requirements, but does not fit into the increased ones;

- losses associated with downward transition to another type of product.

The acceptable percentage of defects is the minimum acceptable level of non-compliance with quality. Depends on the nature of production and established quality criteria. At developed enterprises it should not exceed 2-3%, up to a maximum of 5%. Excess is a reason to worry about finding the causes and influencing the detected problems.

The supplier reimburses the costs

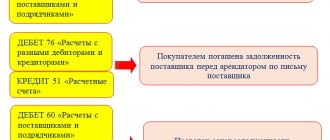

If the buyer returns a defective product, the trade organization may file a claim with its supplier for reimbursement of the costs of eliminating the defect (unless otherwise provided by the contract). This is explained by the fact that in relation to its supplier, the trading organization is the buyer. This means that she can present to the seller all claims related to inadequate quality of the goods, provided that the supplier is responsible for the defect, that is, the defect occurred before the goods were transferred to the trading organization. Such rules are established by Articles 475 and 476, paragraph 2 of Article 518 of the Civil Code of the Russian Federation. In this case, the trading organization does not experience losses from defects. The costs of eliminating defects reimbursed by the supplier (manufacturer of the goods) should be reflected by posting:

Debit 76 subaccount “Settlements on claims” Credit 44

– a claim was made to the supplier for compensation for losses due to defects.

VAT

In paragraph 3 of Article 170 of the Tax Code there is an exhaustive list of situations in which the “input” tax, legally accepted for deduction, must be restored.

It is worth noting that this norm does not contain such a basis as writing off a defect that is not suitable for subsequent use (without identifying the perpetrators). At the same time, according to the control agencies, the “input” tax in the case under consideration should be restored during the period of write-off of products. After all, they will not be used to carry out transactions that are recognized as subject to taxation in the Tax Code.

As for judicial practice, it is developing in favor of enterprises. As stated, in accordance with Article 23 of the Tax Code, the payer is obliged to pay established taxes to the budget. Accordingly, the obligation to pay VAT previously legally accepted for deduction should be enshrined in legislation.

Meanwhile, taking into account the explanations of the Ministry of Finance, some experts believe that the decision not to restore the tax when writing off a marriage may lead to disagreements with the Federal Tax Service.

Losses from external irreparable marriage

If the buyer returns a product with an irreparable defect, the organization, in turn, can also return it to its supplier (manufacturer of the product). This is explained by the fact that in relation to its supplier, the organization is a buyer. This means that he has the right to make demands related to low-quality goods (Article 475 of the Civil Code of the Russian Federation). In this case, the organization does not experience losses from defects.

If the organization cannot return it to its supplier (Article 477 of the Civil Code of the Russian Federation), it has the right:

- discount this product and resell it in the future;

- use in your activities;

- write off (if the goods are not subject to further sale or use).

When calculating losses from external irreparable defects, determine the cost of the defective product as the cost at which the buyer returns it. It will be equal to the purchase price of the goods excluding VAT. This is explained by the fact that, as a rule, at the time of return the goods are already the property of the buyer, and therefore, when they are returned, a “reverse sale” occurs, where the buyer is the seller, and the seller is the buyer (Article 218, paragraph 1 of Article 223 Civil Code of the Russian Federation).

The cost of the returned (defective (damaged)) goods should be recorded on account 10 “Materials” or on account 41 “Goods”, depending on further use. So, if an organization wants to use defective goods in its own activities (for example, office supplies), then use count 10.

How to document a manufacturing defect

A detected defect, both final and subject to correction, must be documented by a special act. It is compiled by a commission that carries out quality control. The form of the act is developed by the organization independently; there are no strict requirements in this regard, except for the mandatory presence of basic office details. In addition to them, in such an act they usually cite:

- the name of the products that turned out to be defective;

- description of the identified defect, determination of the type (possibility of adjustment);

- assumption or statement of reasons;

- the place where the defect was discovered;

- quantity that does not correspond to quality (in the agreed units of measurement);

- cost of losses;

- identification of the person responsible for the marriage;

- conclusion regarding write-off or correction.

IMPORTANT! If an employee is found to be guilty of a detected defect, as reflected in the report, he must be familiarized with the report and signed.

The act serves as the basis for calculating the final amount of the marriage (calculation), which includes:

- amounts to be recovered from the perpetrators;

- irreparable financial losses;

- material claims against suppliers.

The person bearing financial responsibility delivers the registered defective products to the warehouse upon request-invoice. Subsequently, another act is formulated - for destruction (write-off) or correction of the detected defect.

Markdown of goods

If you return a defective product, reflect it on account 41 (10) depending on further use.

Debit 41 (10) Credit 60 (76)

– defective goods were capitalized as part of the goods.

This procedure follows from the Instructions for the chart of accounts (accounts 10 and 41).

In this case, estimate the cost of the defective product as the cost at which the buyer returns it. It will be equal to the purchase price of the goods excluding VAT.

In the future, the organization can use the returned goods at its discretion (for example, sell or use in activities). If necessary, it is necessary to mark down (for example, for further sale) the cost of the returned goods due to defects.

Features of drawing up an act

The act of identifying a marriage must contain the following details:

- Name of the enterprise.

- Location address.

- Contact details.

- Title of the document.

https://www.youtube.com/watch?v=ytdevru

The text contains information about the product in which the defect was detected, the reasons for the defect, and the persons responsible.

The document must be prepared in 3 copies. The first is transferred to the accounting department, the second - to the department where the low-quality product was produced, the third is received by the financially responsible employee. If an external defect is detected, a consumer claim is attached to the report.

Confirmation of the fact of detection of defects is carried out by a special commission.

We invite you to familiarize yourself with the Spousal share in the inheritance: how to allocate fairly

Reimbursement of other expenses

If the organization, in addition to the cost of the defective (damaged) product, reimburses the buyer for other expenses (for example, transport), they should also be attributed to:

- to increase the actual cost of materials accepted for accounting if the returned goods will be used in the organization’s activities (clause 6 of PBU 5/01);

- sales expenses if the returned goods are resold after markdown (Instructions for the chart of accounts, clause 13 of PBU 5/01).

In all cases, make entries in the accounting accounts (accounts 10, 41, 44) based on:

- primary documents confirming the detected defect (damage) and the buyer’s costs, which are reimbursed by the organization (for example, invoices, claim certificate, etc.);

- primary documents confirming the attribution of losses from defects to the perpetrators (supplier, manufacturer) or the organization’s use of part of the defective goods (for example, a write-off act, an internal movement act, etc.).

These documents must contain the mandatory details specified in paragraph 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

BASIC

When calculating income tax, losses from marriage are taken into account in full as part of other expenses (subclause 47, clause 1, article 264 of the Tax Code of the Russian Federation).

It does not matter at whose expense the defect is written off - the supplier (manufacturer) or the organization. Losses from a correctable defect will be equal to the cost of eliminating it, from an irreparable defect - the amount of the returned payment (excluding VAT), as well as the buyer's costs, which the organization reimburses in case of returning the goods.

If an organization uses the accrual method, take such losses into account in full when calculating income tax in the period to which they relate (Articles 272 and 318 of the Tax Code of the Russian Federation). For example, take into account the cost of materials transferred to eliminate repairable defects at the time of their transfer from the warehouse (i.e., at the time of filling out the demand invoice in Form No. M-11).

If an organization uses the cash method, all losses for which the conditions for their recognition during taxation are met will reduce the tax base for income tax (clause 3 of Article 273 of the Tax Code of the Russian Federation). For example, losses from a correctable defect, equal to the cost of purchased materials spent on its elimination, should be included in the tax base in the period in which these materials were used (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation). At the same time, they must be paid to the supplier (clause 3 of Article 273 of the Tax Code of the Russian Federation).

The cost of the goods returned by the buyer should be taken into account in the income of the period in which the return occurs (Article 250 of the Tax Code of the Russian Federation). Include in income the cost of the product at which it was accounted for on the date of sale (i.e., the amount of actual costs associated with its acquisition or creation). Accept the goods returned by the buyer for tax accounting at the same cost. In the future, the organization can use the returned goods at its own discretion (for example, sell or use in activities).

To learn how to take into account the costs of selling a product when calculating income tax if it was sold at a price significantly lower than the purchase price (for example, as a result of a defect), see How to record shortages (damage) of goods.

Amounts received from suppliers (manufacturers) through whose fault the defect occurred should be included in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Under the cash method, recognize non-operating income at the time of receipt of money (to the cash register, to the current account) for damages (clause 2 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, determine income as the amount of compensation for damage on the date it was recognized by the guilty party (for example, at the time when the supplier signed the claim made against him). If the organization seeks compensation for damage through the court, the date of recognition of income is the day the court decision enters into force. This is stated in subparagraph 4 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation.

When returning a defective product, VAT previously charged to the buyer can be deducted.

An example of how losses from external correctable defects are reflected in accounting and when calculating income tax

LLC "Torgovaya" is engaged in the sale of furniture. The organization applies a general taxation system (accrual method). The organization pays income tax quarterly. The organization maintains accounting for purchased goods at purchase prices.

In March, Hermes sold a furniture set to a citizen in the amount of 236,000 rubles. (including VAT – 36,000 rubles). The cost of goods sold was 150,000 rubles. In April, the buyer discovered that some of the goods were defective (the covering of the wooden tables was uneven). The purchase price of the defective goods was RUB 70,800. (including VAT – 10,800 rubles). The buyer handed over the defective goods to Hermes to eliminate the defects (polishing and varnishing).

In the same month (April), the defect was eliminated by Hermes and the product was returned to the buyer. The cost of correcting it amounted to 25,300 rubles, including:

- cost of materials used (excluding VAT) – 8,000 rubles;

- salary (including salary accruals) of the employee who corrected the defect - 17,300 rubles.

In April, Hermes submitted demands to its supplier for reimbursement of costs to eliminate deficiencies. In the same month, the “Master” fully compensated for the losses from the marriage.

Postings were made in accounting.

In March:

Debit 62 Credit 90-1 – 236,000 rubles. – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 150,000 rub. – the cost of goods sold is taken into account in expenses;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 36,000 rubles. – VAT has been charged.

In April:

Debit 002 – 70,800 rub. – goods were received from the buyer to correct the defect;

Debit 44 Credit 10 – 8000 rub. – the cost of materials used to correct the defect has been written off;

Debit 44 Credit 70 (69) – 17,300 rub. – the salary (including salary accruals) was accrued to the employee who corrected the marriage;

Debit 76 subaccount “Calculations for claims” Credit 44 – 25,300 rub. – expenses for correcting defects are attributed to the manufacturer of the goods;

Debit 51 Credit 76 subaccount “Settlements on claims” – 25,300 rubles. – losses from the marriage are compensated by the “Master”;

Loan 002 – 70,800 rub. – the corrected product is returned to the buyer.

When calculating income tax for the first half of the year, the accountant included in other expenses the cost of the correctable defect - 25,300 rubles, and reflected the amount of compensation in income - 25,300 rubles.

The concept of commodity losses

At all stages of the promotion of a product from its manufacturer to the final consumer, loss of part of the product may occur due to the following reasons:

- natural origin, due to the peculiarities of the properties of the product itself, arising despite compliance with the conditions of its storage, transportation, pre-sale preparation and the sales process;

- resulting from damage caused by the intentional or careless actions of any person(s): violation of requirements for storage and transportation conditions or pre-sale preparation technology, use of faulty technological equipment or failure to comply with the rules of its operation, theft;

- emergency nature.

https://www.youtube.com/watch?v=ytaboutru

All these losses GOST R 51303-2013 “Trade. Terms and definitions”, approved by order of Rosstandart dated August 28, 2013 No. 582-st, classifies them as commodity. According to their nature, losses caused by causes of each group are distinguished:

- quantitative, in which the quantity of a product is reduced while maintaining its quality;

- qualitative, leading to a change in its properties while maintaining quantity.

Qualitative changes can lead to either complete or partial loss of the original commercial properties. In case of partial loss, the goods may be marked down to the possible selling price.

Losses that depend on the properties of the product, but arise due to the peculiarities of the technology of the applied process of its transportation or processing, should not be considered commodity losses. They are classified as technological and are taken into account in costs in full, while commodity losses have 3 write-off options with attribution:

- on costs;

- perpetrators;

- net profit.

Among natural losses, quantitative ones predominate, which are divided into:

- due to the nature of the product, which can manifest itself at all stages of interaction with it;

- related to pre-sale preparation.

Product losses caused by the properties of the product itself may occur:

- during drying and weathering, and non-food products can also be subject to drying;

- cracking and sputtering that occur when reloading or weighing goods consisting of small fractions;

- volatilization, which is typical for alcohol-containing materials;

- absorption of water and fat components into the packaging;

- crumbling that occurs when a product is divided into parts;

- leakage during defrosting;

- bottling during pumping due to adhesion to the walls of the container;

- breathing, which distinguishes fruits and vegetables;

- release from primary packaging before sale in slices;

- breakage of fragile material.

Losses during pre-sale preparation can be of the following types:

- liquid, when low-value parts are separated from the product to be either sold at a lower price or sent for processing;

- illiquid, associated with weight loss due to the removal of liquid containing the product, packaging, parts with irreparable defects.

Natural quality losses include the expiration of the shelf life of unsold goods.

Since the process of reduction of goods for natural reasons is considered normal, losses occurring due to it can be taken into account in costs for tax purposes, but only on condition that their volumes fall within the standards approved in the manner determined by the Government of the Russian Federation (subclause 2 p. 7 Article 254 of the Tax Code of the Russian Federation).

Norms of natural loss are developed for specific goods, taking into account the conditions under which they are stored, transported and prepared for sale, and must be reviewed at least once every 5 years (clause 1 of the Government of the Russian Federation of November 12, 2002 No. 814). Their development was entrusted to:

- Ministry of Health;

- Ministry of Industry and Trade;

- Ministry of Construction;

- Ministry of Agriculture;

- Ministry of Energy.

Standards that meet the requirements established by the Government of the Russian Federation exist for many types of both food and non-food products. However, for a number of goods those that were introduced back in the USSR still continue to apply. Their use before the development of more modern standards is permitted by Art. 7 of the Law “On Amendments to Part Two of the Tax Code of the Russian Federation...” dated 06.06.2005 No. 58-FZ.

https://www.youtube.com/watch?v=ytcopyrightru

The standards apply to all types of inventory items classified as material expenses for the purpose of calculating income tax (methodological recommendations approved by order of the Ministry of Economic Development of the Russian Federation dated March 31, 2003 No. 95).

We suggest you read: How to find out who caused the damage and how to get it back

The rules are not applicable:

- to piece and packaged goods subject to drying out;

- quality losses.

The loss of quality is always documented in an act and written off against net profit, unless such loss is revealed to be the fault of the person from whom the damage caused can be withheld.

Loss rates are set as percentages and, according to general rules, are applied to the quantitative volume:

- a batch of the corresponding goods received from the supplier, if the loss is detected at the time of its acceptance;

- sales of a certain product for a period if its loss is established during the sales process or during inventory.

For specific types of goods, the specific application of standards may be established by industry recommendations.

Determining the value of losses for a particular product, which can be included in costs, is done by multiplying the missing quantity by the price (methodological instructions approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n):

- supplier specified in the accompanying documents for the goods, excluding VAT (clause 58);

- for which the goods were registered for the period used to calculate losses, including transportation and procurement costs attributable to the cost of the goods, if they are accounted for separately (clause 29).

When a shortage of goods is detected at the time of acceptance, the amount of VAT allocated in the supplier’s documents is reduced by an amount corresponding to the amount of the shortage. The amount of tax attributable to the shortage is divided into parts corresponding to losses at the norm and above the norm.

The part that corresponds to losses that fall within the norm can be deducted in the same way as VAT on capital goods, based on the same invoice. And that part of the tax that falls on excess losses cannot be deducted, but the volume of the claim presented to the supplier or carrier must be increased for it.

Requirements for the restoration of VAT for shortages identified during inventory, clause 3 of Art. 170 of the Tax Code of the Russian Federation (which provides possible grounds for such a procedure) does not contain. Therefore, there is no need to restore it, and the employee will pay off the damage caused in an amount not including VAT.

For more information on VAT issues that arise when writing off losses, read the material “Should VAT be restored upon disposal of fixed assets and inventory as a result of their write-off, theft, damage, shortage, loss, wear and tear, etc.?”

simplified tax system

If an organization applies a simplification and pays a single tax on the difference between income and expenses, expenses in the form of amounts of damage from an external irreparable defect do not reduce the tax base for the single tax. This is explained by the fact that such costs are not in the list of expenses that can be taken into account when calculating the single tax (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). But take into account the costs of eliminating a correctable defect (material costs, salaries of employees involved in correcting the defect, etc.) when calculating the single tax in the general manner (clause 2 of Article 346.16 and Article 346.17 of the Tax Code of the Russian Federation). But only if they are provided for in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (Clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

If a simplified organization has chosen income as the object of taxation, do not take into account expenses in the form of losses from marriage when calculating the single tax. This is due to the fact that organizations that pay tax on income do not take into account any expenses at all when calculating the single tax. This follows from paragraph 1 of Article 346.18 of the Tax Code of the Russian Federation.

Regardless of the chosen object of taxation, take into account the cost of the goods returned by the buyer in the income of the period in which the return occurs (clause 1 of Article 346.15, Article 250 of the Tax Code of the Russian Federation). Include in income the cost of the product at which it was accounted for on the date of sale (i.e., the amount of actual costs associated with its acquisition or creation). Accept the goods returned by the buyer for accounting at the same cost. In the future, the organization can use the returned goods at its own discretion (for example, sell or use in activities).

The tax base of the single tax also increases the cost of defects, which are repaid by the supplier (manufacturer) (clause 1 of Article 346.15, clause 3 of Article 250 of the Tax Code of the Russian Federation).

In this case, include the amount of compensation for damage as income at the time the debt is repaid by the guilty party (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Reflection in accounting

Accounting for defects in accounting is carried out on account 28. The debit concentrates all costs associated with defects identified before sending products for sale and after sale. The credit reflects the amounts to be paid by those at fault. Typically, a deduction is made from the salaries of these individuals, the subjects are deprived of bonuses, and other penalties are made.

The loan also reflects other amounts allocated to reduce losses. These include, in particular, the cost of defective products at the price of their possible use.

When forming credit and debit turnover, the total amount of losses is determined. Write-off of defects is carried out at the cost of low-quality products from invoice 28 in the account. 20. The cost of goods of proper quality of the corresponding type is included in the losses.

Analytical accounting is carried out for individual workshops (divisions) of the enterprise, types of goods, consumable items, circumstances under which the defect occurred, and the entities responsible for this.

OSNO and UTII

As a rule, it is always possible to determine which type of activity the losses from marriage relate to. Therefore, if an organization applies a general taxation system and pays UTII, losses from defective products used in activities transferred to UTII and activities on the general taxation system must be taken into account separately for income tax and VAT (clause 9, article 274, clause 4 Article 170 of the Tax Code of the Russian Federation).

Losses from marriage, which relate to activities on the general taxation system, will increase other income tax expenses (subclause 47, clause 1, article 264 of the Tax Code of the Russian Federation). Do not take into account losses from marriage that relate to activities on UTII for tax purposes (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Return operations

Their accounting can be carried out in different ways. For example, an enterprise can recalculate the profit tax base for the period in which the defective product was sold. Since the contract between the seller and the buyer will be terminated, the payer has the right to reduce the amount of profit by the amount of income from the sale of the defect. The amount of costs can be reduced by the cost of the product returned by the buyer.

The second option is to attribute costs in the form of product costs to losses from the identified defect. In this case, the cost will be the amount that must be returned to the buyer of the defective product.

As the Ministry of Finance explains, the company has already taken into account the costs of producing defective goods during sales. Therefore, the price of the returned product is recognized as zero.