The formation of shipping documents for primary documentation is an important stage in commodity-money relations. An agreement and an act of acceptance and transfer are not all that is required when transferring property assets from one person to another (under Article 223 of the Civil Code of the Russian Federation). During the signing of agreements, the participants have the right to determine how, where and to whom the transfer of property will be carried out. A third party may also participate in this process as an intermediate link, transferring objects to the final point (the buyer). All legal entities or individuals participating in the transaction must receive official papers to deliver the cargo and carry out its shipment on the spot. The absence of one of them may be detrimental to one of the parties when controversial issues arise and a claim is filed in court. Filling out such forms requires compliance with the law, since many of these forms are unified at the state level. Moreover, the principles of transfer of inventory items according to the documents discussed here are relevant both within the Russian Federation and during international transportation.

Shipping documents - what are they?

When organizing transportation, an important aspect is the formation of the necessary documentation. The main types of such papers include financial, transport and permitting. The chain of key events is as follows: the conclusion of an agreement between the two parties to the transaction, its execution (that is, delivery of the ordered item on time and to the right place). But at the arrival address it is necessary to carry out delivery and unloading actions, which also requires the availability of specific documents. According to Article 506 of the Civil Code, the supplier is obliged to ship the goods to the buyer or a third party. Therefore, signed agreements and an acceptance certificate will not be enough. Shipping documents required.

Financial papers

This includes invoices and commercial invoices. The formulation and execution of such shipping papers falls on the seller (shipper).

Comaccount or “CI”

The type of goods, their quality and quantity, as well as the unit of measurement and general prices are indicated here. The names and addresses of participants are also included here. Such documents prove that the sale and purchase has been completed. It determines the taxable amount for customs and creates receivables.

Proforma invoice

This is the so-called proforma invoice - a preliminary documented calculation of the transferred items and services provided. It is sent from the seller to the buyer according to the terms of the transaction and does not require payments. It is also used in world practice (in the exchange of goods between countries). It does not have a form standardized by law and does not contain information about prices.

Difference between platforms and commercial accounts

The first ones are usually used when the delivery itself and payment for it have not yet been made. This is not a “check” for payment, since the exporter does not enter a credit in his accounting department, and the importer does not enter a debit. But such forms describe the product and its value, which is similar to the second type of document. The latter are issued to give customs officers maximum information on applicable import duties and rights to import goods and materials abroad. They have legal legitimacy and are significant for tax accounting. Accordingly, they serve as an actual account for making payments.

Consular invoice

Consular invoice is commercial and is registered by the sender (foreign exporter) with mandatory certification from the consulate of the state where the buyer is located. The purpose of the compilation is to provide the competent government agencies in the country of arrival with data on the customs value of delivered products, as well as dumping. And thus implement currency control.

Shipping documents

Not all documentation discussed below is standard. The purpose of their compilation is to identify the product (for all product categories with their properties and number of units). This also includes information about the participants involved, the specifics of the transportation process and payment for delivery. The documentary set is assembled with adjustment for specific inventory and materials products. Additional documents are included at the request of the parties.

Check packing list

The shipment is accompanied by a Packing list, attached to the invoice. This contains the entire list of supplied goods and materials, indicating storage space for everything (boxes, crates, pallets, etc.). There is no standardized form here, so each organization develops its own. So the seller’s form may differ from the copies used by the buyer. But the second one usually accepts the paper sent to him in any form. Logistics companies also need it. It is also required by customs authorities when crossing the border.

Consignment note

Or rather, on the product itself. This means that this is TORG12 for release and transfer. Using this document, the purchaser checks the shipped products (by quantity, volume, quality, etc.) with the information contained in it. The seller and sender, in turn, take into account the property remaining in the warehouse.

Commodity transport

When the issuance of inventory items occurs through pick-up, the documentation discussed here will not be required. They are only needed during transportation to the customer. If a transport and logistics company is involved in this, then the documentary originals are provided to it. They always indicate the details of the carrier, vehicle and forwarder.

Usually delivery is made using road transport. Then two types of forms are used: 1-T and the form attached to PP No. 272 of April 15, 2011 on the rules of transportation by road (Appendix 4k). For air and railway transportation, other unified forms are used: GU-27 / GU-29-O and AWB, respectively.

Waybill

This is a T-bill (different from the TT-bill discussed earlier). It is required according to PP No. 272 dated 11. Often it is issued by the shipper (but it also happens otherwise if this is provided for in the agreements of the parties). It is usually compiled for one batch. For several, if transportation is carried out at the same time by one transport. It differs from the previous one in the absence of a product section.

What shipping documents are used to document the shipment of goods to the buyer’s warehouse using air travel? This is the so-called AWB waybill. But it only describes the property being transported, and does not legitimize this process.

Through bill of lading

Through bill of lading is required when participating in the supply of sea vessels. There may be two or more shipping lines here. That is, transshipment from one vessel to another is often carried out. The document confirms ownership of the shipped goods and materials.

Paper functionality:

- the carrier signs here for receipt of the shipment, describing the visual condition of the goods upon arrival;

- this confirms the fulfillment of the terms of the contract;

- a commodity distribution function is also performed.

Multimodal transport connaissement

In world practice, this is usually called multimodal cargo transportation by several modes of transport. Not only aquatic, but also terrestrial. That is, transportation by sea is only part of the overall journey.

International waybill

CMR is the main document for road freight delivery across the border of another state. It represents an agreement between the sender, the transport company (with ground transport) and the consignee. The CMR invoice is universal in nature, since it contains information that is understandable to a representative of any country. It confirms the legality of the transportation. In the absence of digital materials, law enforcement agencies may seize transported goods and materials. Each stage that occurs with the cargo is noted here. Whether it is transferring it to the forwarder or the final recipient. Accordingly, the financial responsibility of persons at a certain point in time is determined in this way.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Certificate of origin

This is a document about the certification of a product, which also reflects the place of its production. The relevant government agencies enter here notes about production on the territory of a particular state. A description of product characteristics is also included. In the Russian Federation it is issued by the Chamber of Commerce and Industry. Depending on the country of purchase, the marking is affixed here. There is also a general format for some territories.

Certificate Form A

Certificate of Origin form A is a universal international document quoted in many countries. At customs it is used to identify the place of origin of the goods. The acquiring party receives benefits and bonuses during customs clearance.

Several concepts should be distinguished here:

- the country where the goods and materials were manufactured;

- preferential production - if they were produced at different foreign factories (the advantage is determined by who made the largest contribution to the cost of the products - usually more than 50%);

- delivery point means where the order was delivered to the recipient (may differ from the first two).

Destination Control Statement

The Destination control statement is made by the sender and is noted on commercial invoices, bills of lading, air waybills and other export documents. It is necessary to accompany the delivery process to the final destination. It does not have any special form and is compiled to ensure arrival at a specific geological point.

What documents are needed when shipping goods to the buyer regarding its quality?

This documentation is required not only to list the characteristics of the product, but also for reconciliation with what is actually received.

Third Party Acceptance Certificate

Some acquirers want to see a certificate of inspection by a disinterested party. The costs of such procedures are often borne by them (unless otherwise specified in the contract).

Four types of such operations:

- pre-production control to determine the quality parameters of raw materials and individual components that the manufacturer will use in the process;

- taking samples or samples from the production line (helps to find defects before shipment or before the actual receipt of defects);

- control of material assets when loading containers for delivery;

- inspection at the port upon arrival (visually and using instruments).

Certificate of testing or quality of materials

For certain product categories (chemical products and raw materials), their supplier provides chemical certificates indicating indicators of composition, acidity, viscosity, etc. This information is obtained with the assistance of an independent laboratory chosen independently by the parties (before shipment or after). Metal objects are delivered subject to certification of the properties of these materials.

General rules for creating primary documentation

What documents are needed when shipping goods for the buyer is not the only important question. It is also important to follow the principles of their completion and circulation. From the point of view of legislation, it is necessary to take into account Art. 9 Federal Law 402 on accounting from 11th year.

Here are the required sections included in the document:

- Name.

- Date of writing.

- Mention of the person who compiled the specific paper.

- The presence and nature of economic life.

- The size of natural and financial measurements (indicating measurement units).

- Listing the positions of those people who make the transaction and are responsible for its execution and correct execution.

At the end, people’s signatures are placed as standard (from the sixth point). To do this, their surnames and initials or other details identifying them are written down.

Writing Instructions

This document is usually provided by the supplier. Accordingly, their own forms are used for this. If we talk about trade turnover between two traders, the options they use may differ. For example, when it comes to supplying equipment and software to another entrepreneur to organize his activities (product accounting and debugging the sales process). Such documentation is often not sent for approval. It is the supplier (“sales person”) who is primarily interested in it. That's why he offers to sign the paper he sends. The form of the act of acceptance and transfer of goods from the buyer is not common. Although no one forbids discussing these nuances in advance.

Information about the parties

As a rule, the formation of such documents is relevant when interacting between two companies or branches. When making a purchase (especially of a “small-caliber” kind) by individuals, they usually make do with simple checks. Accordingly, when indicating officials, you will have to enter the full name of the organization, bank details and contacts. This is a standard procedure and every lawyer or chief accountant of an enterprise knows what exactly should be indicated here. In principle, you can take a variation available in other documentation.

Conditions and product list

Depending on what category of product we are talking about and the specific quantity, it is allowed to take it alone or in a group. It is not prohibited to take an expert or a person who understands the details with you to the inspection. He can evaluate for you whether what you received matches the description or not.

It is allowed to include several classes of products, indicating the quantity of such products in the supply. That is, there is no need to create a separate document for all types of products. There is no need to write down factory codes and articles. The main thing is to list all property units, assigning each a serial number and specifying the name (and then other characteristics).

Signatures of the parties

A completed sample certificate of acceptance and transfer of goods for sale and to the warehouse requires signing. The person responsible for this issue often holds a leadership position in the organization. An employee with such rights must have the appropriate power of attorney. Do this based on agreement to bear financial responsibility. Otherwise, the validity of this documentation may be questioned. A person becomes financially responsible to the manager, accepting and dealing with goods distribution, accounting and turnover.

Who takes part in transport transportation

The main two parties are the shipper and the recipient. But in order to deliver the goods to their destination, full-time drivers or transport companies are involved here. And they, in turn, are also presented with the same original documents as the parties to the transaction. The third party carrier may deliver the goods by sea, air or land. In the first two cases, delivery on your own is usually difficult in principle.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

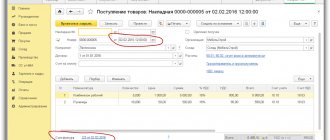

Postings for the sale of goods and services in 1C

Let's see what sales transactions the document generated for us in 1C. To do this, click the button at the top of the document. A window with generated transactions will open:

The following types of postings have been generated:

- Debit 90.02.1 Credit 41 (43) - reflection of the cost of goods (or finished products);

- Debit 62.02 Credit 62.01 - since the buyer previously made an advance payment, the 1C program reads the advance;

- Debit 62.01 Credit 90.01.1 - reflection of revenue;

- Debit 90.03 Credit 68.02 - VAT accounting;

Postings can be edited manually; for this, there is a “Manual adjustment” checkbox at the top of the window. But this is not recommended.

Our video on selling goods in the 1s 8.3 program:

TORG-12: filling rules

This form was approved by Decree of the State Statistics Committee of 1998 No. 132. It is drawn up by the seller to reflect the fact of write-off and sale of inventory items. For the purchaser, this is a form confirming the purchase, which means it serves as the basis for the future receipt of goods in their warehouses.

Preparation and execution of shipping documents of this type requires the inclusion of sections:

- Data about the participants in the transaction: names, addresses, telephone numbers, bank accounts and codes (OKPO and OKVED).

- Details from the contract and delivery note.

- Number and dating of the T-waybill.

- Information about material assets: name, unit of measurement, quantity, amount of money due for it (including VAT).

- List of applications.

At the end, the signatures of those involved in commodity-money relations are affixed. From the seller, this is the employee who approved the release of the goods, the employee who released it from the warehouse, and the chief accountant. Persons representing the interests of the buyer and consignee also sign here. For this purpose, information on powers of attorney, on the basis of which acceptance is made, can be used. The document is dated. Stamps are also placed on both sides, although according to Art. 9 Federal Law No. 402 is a completely optional initiative.

Is sample TORG-12 required?

It is necessary to take into account the necessary information blocks that are used by the majority of participants in commodity-money relations. In principle, they have the right, by agreement, to add their own sections reflecting some of the specifics of the transaction. In general, a standardized form was available to organizations until 2013. Then the unification was cancelled. That is, now those involved in trade turnover have the right to take the old format for convenience or create their own.

What is important to remember

- The document must be drawn up in 2 copies. One of them is left at the organization’s point of sale. The other is sent to the accounting department. There, the products are written off from financially responsible employees and reported to the head of the store, sales tent or other point.

- The act in form SP-36 must be kept for 5 years.

- Factual errors often occur when filling out the form. To correct them, you need to: cross out the erroneous information, write the correct version next to or on top, write in the margins “Believe the corrected information” and sign. Other signatories must be notified of changes.

Design features

Shipping documents from the supplier are papers when shipping goods from the warehouse, respectively. The information provided is used to confirm delivery transactions, performed services and transfer of property rights. They need to be prepared in several copies. At a minimum for the shipper, recipient and driver. Plus one copy will be required for the transport company (if hired).

Who is responsible for generating the documentation discussed above? This is a seller or a transport company that works with the former under a transportation agreement. The date stamped corresponds to the day of shipment (Clause 3, Article 9 of Law No. 402-FZ). Invoices are issued at the time of delivery of goods and materials to the customer or the carrier organization. The date in the UPD and in the T-waybill is entered no earlier than the one registered in the TT-waybills. If these conditions are not met, the supervisory authorities will consider the procedure to be fictitious. Then the purchaser is not entitled to deduct VAT. All data in them must also match.

Since the risk of loss and damage to products due to theft, shaking and weather changes is high, it is necessary to determine in advance the person responsible for this.

Registration and issuance of a package of primary documents for the shipment of goods when transferring them to the buyer are needed as evidence of the transaction. All points and important nuances must be documented, including so that there is someone to ask for compensation for losses. Software from Cleverence will help simplify all routine procedures with documents. We offer solutions of various types: both individual offers that are personalized specifically for the type of business activity, and packaged solutions for any company. Number of impressions: 2678

Create a shipment

As in the case of creating an invoice for payment, a new shipment is created from the order editor or from the Documents tree. If you use a tree, open the “Counterparties” directory, select the client who needs to create an act or invoice and click the Document Flow button. In the tree, find or create an agreement, open it, find or create an order, expand the “Shipments” branch and click on the +Add shipment link.

If you are more accustomed to performing all operations from tables, open the client card from the “Counterparties” directory for editing, go to the “Agreements” tab, create or select an existing agreement, open it for editing. In the contract editor, create or select an existing order and open it for editing. In the order editor, go to the “Shipments” tab and click the Add button.

The interface for creating a shipment does not depend on the method of calling the dialog; the input fields will be different only for different types of frequency of the contract type. Read more about this in the documentation section Agreements with counterparties.

If the frequency is “One-time”, specified in the form of an agreement, it is possible to change the fields:

- “Document date” - date of implementation;

- “Document No.” - is not displayed during creation, since it is assigned automatically. In the future, if you need to edit this field, simply change the saved entry;

- “Signed, returned” - a switch signaling the return of a signed document (this sign is changed by the Post/Distribute action);

- “Date of signing” - a field that is not editable - is filled in automatically when the “Signed, returned” switch is changed to the “On” position;

- “Comment”—an arbitrary comment on the shipment: the field can be used when filling out the template.

If the contract allows you to create monthly shipments, in addition to the fields described above, you must fill in:

- “Month” is the period for which the act is issued. To select a month, click on the ... button and select the year and month.

Unlike accounts, where you can select an arbitrary period, you can only close 1 calendar month with a shipment!

When creating a monthly shipment, the system will find the last month in which the order was sold and automatically insert the next calendar month into the “Month” field. Also, the “Document Date” field is automatically assigned the last day of this month.

Invoice for advance payment

In the journal of issued invoices, invoices for advance payments are also generated.

Fig. 17 Invoice - invoices for advance payment

However, before generating this type of invoices, it is necessary to make settings in the company’s tax accounting policy for accounting for invoices for advances received.

Fig. 18 VAT accrual on shipment without transfer of ownership

The following setting options are possible:

- Always register invoices upon receipt of an advance. Invoices will always be recorded upon receipt of an advance;

- Do not register invoices for advances offset within 5 calendar days. If advances received were offset within 5 calendar days, invoices for the advance are not generated;

- Do not register invoices for advances cleared before the end of the month. If advances received were offset before the end of the month, invoices for the advance are not generated;

- Do not register invoices for advances offset until the end of the tax period. If advances received were offset before the end of the tax period, invoices for the advance are not generated;

- Do not register invoices for advances (Clause 13, Article 167 of the Tax Code of the Russian Federation). Advance invoices are not recorded.

After this procedure, we begin to generate an invoice for the advance payment, opening it in the journal of issued invoices.

Fig. 19 Journal of issued invoices

Let's go straight to the line documents - grounds. The system automatically accesses receipts to the company's current account or cash register. In our case, funds in the amount of 100.00 thousand rubles were credited to the current account.

Fig. 20 Receipts to the current account

Click the “Select” button, then “Write”, the remaining account details - invoices for advance payments are filled in automatically.

Fig. 21 Generated invoice for advance payment

Journal of registration of issued invoices

Created and posted invoices automatically enter the sales book of the corresponding tax period. The program independently calculates the amount of VAT in the sales book based on the entered entries in the journal of issued invoices. To do this, in the “Sales” menu, go to the sales book.

Fig. 22 Logbook of issued invoices

Select the tax period we need and click the “Generate” button.

If you still have questions about working with invoices, contact our 1C systems support specialists, we will be happy to help you.